Академический Документы

Профессиональный Документы

Культура Документы

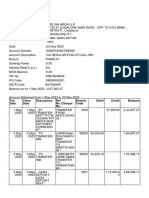

Union Bank

Загружено:

heinzteinАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Union Bank

Загружено:

heinzteinАвторское право:

Доступные форматы

Justo Ortiz's Grand Plan

UnionBank aims to be in the top three in the banking industry by 20J0. And e-

business and the Internet will help get it there.

Story by Heinz Bulos

June 2002

t`s ree to dream. \hy not It

doesn`t cost a cent. So let them

dream.`

In 1995, a small uniersal bank announced

that it would be in the top ie in the

banking industry by the turn o the

century. No one took the relatiely

obscure Union Bank o the Philippines

seriously. In act, people oten conused it

with the troubled Urban Bank.

UnionBank`s Chairman and CLO Justo A.

Ortiz iidly recalls the arrogant and

cynical remarks o critics and competitors,

Let them try, it`s okay, it`s ree to

dream.`

A year beore the target date, UnionBank

ranked in the top ie. Suddenly, people

started to sit up and notice. During the

dot-com boom o 1999 and 2000,

UnionBank was being heralded as tbe

technology leader, making the Bank o the

Philippines - long proud o its tradition o

technological innoation - appear to be

playing catch-up.

But it was more than just riding the tech

bubble. UnionBank was hitting its

numbers. By the end o 2001, it was

number one in return on assets, number

two in return on equity, top three in net

proits, and number six in market

capitalization.

It also garnered its share o awards and

citations. 1o wit: 1he Banker lists

UnionBank as one o the world`s 25

soundest bank or our consecutie years,

1he Asian Banker awarded it Best Retail

Bank in the Philippines, linance Asia

named it among the top ie corporations

in e-commerce strategy, and the

Philippine \eb Awards honored its

unionbankph.com site with three key

awards.

1he CLO as celebrity

nionBank`s success didn`t happen

oernight. Ortiz says it`s been

eight years in the making. 1o

better understand UnionBank`s

achieements, we hae to set back the

clock to circa 1982 when it became a

commercial bank. Union Bank o the

Philippines was the product o a merger

o a saings bank and a troubled

inestment house. 1en years ago, it was

just another generic bank indistinguishable

rom the rest. In 1993, it acquired

International Corporate Bank ,Interbank,.

In the same year, the Aboitiz group, the

bank`s majority stockholders, was inally

able to conince a young Citibank

eteran, ellow Cebuano 1ito Ortiz, to

head the bank as Chairman and CLO.

Ortiz, reerred oten as JAO by

UnionBankers, was then in his mid-

thirties already a high-lying Managing

Partner or Global linance and Country

Lxecutie or Inestment Banking or

Citibank, N.A.

Ortiz joined Citibank right ater college, a

magna cum laude graduate o Ateneo de

Manila Uniersity`s AB Lconomics,

lonors Program, and went up the

corporate ladder in a little more than a

decade.

At 45, he`s probably the youngest CLO in

the banking industry. Among the old

oggies o the banking club, he looks like

I

U

a rookie. One can say that he was clean-

shaen in 1999 and 2000 to portray

UnionBank as a company o young and

dynamic employees, at the time when the

public adored twenty-something, dot-com

millionaires, and ully bearded in 2001 and

2002 to project a mature, experienced

persona or the bank when the tech

bubble burst. It may sound silly, but or a

bank ond o slogans such as \e make

da di!` and or someone who once

turned up at a company party as Neo

rom the moie 1be Matri to create the

right image, one can`t help but speculate.

As an aside, it`s interesting to note that

UnionBank has since cut back on the

Internet sloganeering and symbolism ater

the dot-com crash. Its annual reports o

1999 and 2000 were a blatant display o its

tech-sainess. Its 2001 annual report

coer is a bit subtle, but the symbols are

still there: a computer mouse on ire,

UnionBank20`, and e-xcellence`. It

also has played down the dot-com

rhetoric, re-emphasizing their traditional

corporate products and inancial

soundness.

1all and lean, Ortiz cuts a striking and

towering igure. \e irst interiewed him

in late 2000 or 1be !eb magazine`s

Moers and Shakers list. Len back then,

he exudes an aura o someone destined

or greatness. \hen he answers questions,

he speaks in a deliberate pace,

accentuating his points oten. le likes to

use the word clearly`, giing the

impression o assuredness.

le seems to be patient with people, at

least outsiders. During the photo shoot, a

ew minutes beore their stockholders`

meeting, he gamely poses, calmly

reminding us that he has to go. At the

stockholders` meeting, he keeps his cool

as he answers inane remarks rom a

couple o small inestors who neer ail to

speak up year ater year. One old-timer, a

certain Mrs. Marasigan, chides Ortiz and

entire board or bragging about the bank`s

achieements without giing glory to

God, perhaps rightly so. She then

demands quarterly stock and cash

diidends like what`s gien by their

generous rials`. Another inestor, a Mr.

Dulalia, commends them in broken

Lnglish or a job well done ,Our country

will become prosperity!`,, recommending

a bonus or the directors and oicers ,and

will they please gie een just a

transportation allowance or the

stockholders present in the meeting while

they`re at it,.

But certainly, when it comes to his bank,

he`s impatient or results. le`s a man in a

hurry. le likes to remind his top

lieutenants their end-date is just eight

years away, and the ultimate goal to be

number one will then be just within their

grasp. Don`t you want it to happen in

our lietime`

Ortiz`s media exposure has helped

perpetuate the public perception o

UnionBank as dierent, innoatie, and

tech-say. And it has turned him

somewhat into a celebrity. le narrates,

apparently amused, Once in Ayala,

somebody asked me to autograph their

LON |pack|. And I told him, well this

does not gie you beneits just because I

signed it.``

Despite the media attention and public

accolade, Ortiz doesn`t gie the

impression o a CLO with a huge ego.

\hen we asked i he liked their new

annual report coer, he said he did but

preerred past coers, which had

UnionBankers on them. In the end, it`s

all about people,` he says.

le doesn`t think o himsel as a celebrity

CLO or business hero, and doesn`t seem

to be inluenced by one, I`m not sure,

what I read are academic in nature rather

than personalities or biographies. I read

articles about people - Bill Gates, Jack

\elch, Roberto Gozuieta, and all these

guys - but there`s nothing in those articles

that are actionable. It`s all a lot o

motherhoods and philosophies. I cannot

honestly say that any one o them has an

inluence, I guess it`s all o the aboe.`

\hile he acknowledges the role o

leadership, he doesn`t think he`s any

dierent. Most leaders think big, it`s a

normal leadership quality. 1he dierence

is how you translate that rom merely a

dream, which can ery well turn out into a

nightmare, into reality.`

And he`s quick to pass credit to his team.

It`s more a question o listening with

each other. Maybe I start the ball rolling

with a particular idea but at the end o the

day, I think we hae a unique

management team with enough openness

to be able to deelop our own path that`s

unique to our skills, philosophy, and

market place.`

1urning point

hen Ortiz took oer as

Chairman and CLO, he

recognized the need to identiy

the disciplines he wanted the bank to

excel in: technology, product

management, risk management, and sales

capability.

1he turning point happened in 1994.

1eodoro Panganiban, Lxecutie Vice

President and head o Channel

Management and Process & Quality

Management, narrates, \hat they did, in

the merger o UnionBank and Interbank,

was that they junked the banking system

o both and bought a new system called

Systematics, which is the same system

used by BPI, Metrobank, and Citibank.`

1he system was so expensie that the

bank had to sell the building o Interbank

to be able to aord the new Systematics

CASA system. 1hat was a major bet. But

it placed us at the same leel as the

others.`

Just as important, the new system allowed

the bank to align its internal processes to

irst-world standards, in contrast to what

older banks did, which was to tinker with

Systematics, in eect contaminating` it

with third-world processes, as Panganiban

describes it.

It was this backend capability that made

UnionBank capitalize on technology as a

competitie adantage. Larly on, Ortiz`s

imperatie was to come up with

technology-leeraged products.

L-brands

he breakthrough technology-based

product was LON. Ldwin

Bautista, Lxecutie Vice President

and head o Retail Product Banking, is

largely responsible or the success o

LON, an Internet-based deposit account.

I anything, it established UnionBank as

the leader in Internet banking in the eyes

o the media, inestment analysts, and the

general public.

UnionBank was hailed as a pioneer,

claiming to be the irst in Internet

banking, een though Urban Bank

introduced \eb-based banking earlier in

199, which turned out to be a dud.

Neertheless, the association has stuck.

Len as competitors belatedly launched

better Internet banking acilities, online

banking remains synonymous with

UnionBank.

1he high-proile marketing campaign,

which came straight rom the consumer

marketing handbook, positioned LON as

\

1

the new way o banking. It screamed non-

traditional! young! cutting-edge!

1he result: around 185 thousand new

depositors. \ith a single product, it has

doubled its retail deposit base in a ew

years. 1o put that in perspectie, beore it

launched its Internet initiaties, it had

about 185 thousand regular accounts and

120 branches. LON, in other words, is

roughly the equialent o putting up 120

branches.

1hat`s the good news. 1he bad news is it`s

not proitable. Bautista explains that LON

account holders are generally Internet

early adopters o two arieties: those in

I1-related industries and, to a larger

extent, college kids. Unortunately, a

large part o that does not hae the

money. \e hae 185 thousand customers

in LON, which is the same size as our

regular accounts in terms o number, but

way, way below in terms o the balances

that they keep. But they are the market o

the uture.`

UnionBank is making a gamble that these

college kids, short on cash but rich in tech

skills ,and preerring to do business

through electronic channels,, will grow up

to become high-income generating

proessionals, staying loyal to UnionBank,

which understands their needs. Ortiz is

also betting that 10 or 20 years rom now,

the Internet would hae become more

perasie and online banking, more

mainstream. le`s willing to wait because,

as Bautista quips, that`s the adantage o

haing a CLO who knows he`s going to

be around in the next 20 years.`

In the year 2020, when Ortiz has reached

retirement age, it may not be ar-etched

to think that Internet banking in whateer

orm or name will be the norm.

Panganiban says, In the uture, money

will not be in the paper bills you see and

the coins. It will be just a number in your

account or an entry in your smart card.

\ou`re just moing alues rather than

physical coins and paper. 1he medium o

exchange will be electronic, no longer

physical. \hen you get to that, you hae

to be ready.`

Ortiz talks about the rationale behind

their strategy, Banking is a ery inelastic

business. It`s irst come, irst sered. 1he

minute you open an account with a bank,

it`s highly unlikely that you`re going to

change it.` le tells a aorite anecdote

about, o all things, the toothpaste

business, Close Up made a 15-year

inestment and they targeted the youth.

1his was a Colgate market, that was the

taste. An adult at that time will neer

dream o using Close Up, because it

would taste unny. But they appealed to

the youth. 1he youth got used to that

taste, and when they became adults, that`s

what they bought. It took a whole

generation. 1hat`s the same situation in

terms o our customer ranchise.`

Bautista clariies that the bank is willing to

inest in the uture, proided carrying

them into the uture does not entail

tremendous costs. It has since dropped its

ree ISP model when it launched LON

or instance. But LON itsel is a cost-

eectie way o getting and maintaining

customers. 1he estimate cost per online

transaction is >0.10 compared to >0.2 or

A1M and >0.81 or oer-the-counter

transactions. 1he signiicant saings rom

not giing out passbooks and bank

statements as part o the appeal o LON

is a marketing coup.

1he inancial portal, unionbankph.com,

was award-winning and highly isited but

it also was airly successul as a sales

channel. Bautista says that it was neer

eyeball-oriented, \hat`s important to us

was what we could sell. \e look at it as a

channel. \e sold a lot o LONs on the

Net, a lot o credit cards.` Panganiban

adds, \e een sold ROPOA, oreclosed

properties, on the Internet. 1his is a

reelation, bati/ba,av. saw this rom

abroad and told their amilies to join our

auctions.` Last year, UnionBank sold

P500 million worth o oreclosed

properties, and the Internet was

instrumental in the entire process.

1op management was so serious about its

Internet banking site, and its loss to IDS

linance at the 2000 Philippine \eb

Awards in the Banking and linance

category, to the point o pirating IDS`

\eb programmers. 1he moe, apparently,

paid o.

On the other hand, the Visa Llectron, a

debit card designed or online purchases,

and 1he Port, a payment gateway or e-

commerce sites, were both launched at

the time when the Internet hype has died

down, and it seems it will be some time

beore the market is ready or them.

It`s in corporate banking, howeer, where

e-business has translated to real and

immediate, not just uture and potential,

reenues, particularly in the area o cash

management and settlement, with

products such as Union el1,

BusinessCheck, LIPP, and Checkwriter.

1hat one is real money today and it`s an

innoation in the sense that customers,

mostly multinational companies, neer

een considered UnionBank as an

alternatie banker,` says Ortiz. Now,

clearly a lot o that innoation come rom

listening to customers and be willing to

customize or create products that are

unique to their particular needs.`

lrom customizing products or large

clients, UnionBank was able to mass

produce products with lesser

customization but distills the essence o

what a customer needs. Ortiz explains, A

good example is our BusinessCheck,

something we sell to small and medium

enterprises. It doesn`t hae all the eatures

o the product we`re doing or Procter &

Gamble but the basics are there.`

1hrough technologically innoatie

products, UnionBank was able to

penetrate new market segments. \hereas

beore, its retail customers were rom the

upper C class, now it has been able to

attract the A and B markets. On the

corporate side, rom small and medium

sized companies, it now counts many

large corporations as clients.

But perhaps the greatest impact the

Internet and e-business has on

UnionBank is in brand equity. Ortiz

himsel admits, I don`t know i it`s by

design or by luke, the UnionBank brand

will be nothing, it will be lost in the crowd

i it weren`t or this shine that we hae on

technology initiaties. \hat`s UnionBank

in your head Is it about lending money, is

it about depositing money No, it`s about

e-business. It might be small, we`ll be

lucky i we hae 1 o banking reenues

but we hae been able to ind a

positioning that`s unique to UnionBank by

being irst.` le quips, UnionBank, it`s

not een an exciting, sexy name.

Somehow it`s in the minds o people.`

\hat we`e achieed is we`e been able

to brand ourseles and it`s ery clear. It`s

not obuscated, it`s not diused. It`s ery

precise. It`s not cluttered. \hen you think

o UnionBank, or better or or worse, the

next word you think o is technology, not

car loans or credit cards. lopeully we

can leerage that.`

Putting the e in efficiency

nionBank is also leeraging

technology in streamlining its

processes, what Ortiz calls e-

management. lor a lot o these e-

solutions, one thing is clear, that it is

demanding. It`s demanding as to time, it

must be aailable 24x. It`s demanding as

to response. It`s not like waiting in line 15

minutes in a branch and that`s okay, you

won`t wait or 15 minutes in your

computer, so we`re talking seconds here.

It`s more demanding in terms o content.

I it`s the same thing you see once a day,

pretty soon it`s stale, boring. \hat does

that imply to the institution \hat it tells

me is i I can align my operating processes

to the most demanding channel rather

than hae a dierentiated process or my

call center, or my branch, or the A1M,

or the Internet, or whateer, then I

would hae created, by deinition, a

hugely cost-eectie process low.`

1hat requires a radical rethink. It dries

me to digitize all my inormation to begin

with because you don`t know where the

customer is going to hit you. It requires

me to hae a central customer databases,

all sorts o security controls, and

identiication methodology. It requires a

certain attitude o the people behind this,

a certain rame o mind, or urgency and

accuracy. 1hat`s the challenge and

technology can make it possible. And

that`s the process we`re doing now.`

As part o the Bayan1rade consortium,

the bank has also beneited rom saings

in online procurement and auctions. Says

Panganiban, Inside the bank, the saings

rom procurement is not that big, as we`re

not a manuacturing company. But or our

new building, all our contracts are now

bidded out through Bayan1rade. And

these are huge numbers, that building is

worth P1.8 billion. 1he last one we had,

P14 million went down to P9 million.

\hen you talk o construction, that`s

about 15 to 30 saings.`

1he latest initiatie is the corporate

intranet, myunionbankph.com, which

eatures product team updates and reports

as well as corporate circulars and orms.

lresh rom the success o

unionbankph.com, the bank decided to

apply the concept internally. \e didn`t

realize that we were already doing what

you now call knowledge management.

\hen we started this we were just saying

let`s start a \eb site that eeryone can

access`,` Panganiban notes.

1he intranet gies senior executies like

Ortiz instant access rom anywhere on

what`s happening in the company. lor

example, i he wants to check how the

credit card operations is doing rom a

serice standpoint, he can simply log on

een i he`s at home, and iew the

progress charts. It cuts down on the need

or meetings and rees up people or more

productie work. lRonline, what Bautista

calls in jest their intranet`s killer app,

contains memos, orms, and most

importantly, payroll details. By distributing

irtual pay slips, all UnionBankers are

orced to use the company intranet. At the

same time, it saes the company the cost

o paper and printing. By going paperless

using CommerceOne, it has been able to

sae P15 million in continuous orms and

the like. 1he lR department also

becomes more productie. Panganiban

explains, On loan applications, eeryone

calls up lR. low much can I borrow

\hat`s my cash adance My acation

leaes It rees them up to do more

productie actiities instead o answering

routine questions.`

Making the da diff

e asked Ortiz why UnionBank`s

competitors hae been slow to

adopt, or conused about, e-

U

\

business strategies. I think it`s because

they didn`t hae to. 1hey owned the

market, they occupied the space. 1here

was no challenge and you add to that the

low |Internet| penetration, they couldn`t

een make a business case or it. In our

case we hae to ind something that

would dierentiate us. And that was the

obious thing. \e committed ourseles

into transorming not into an Internet

bank but to a bank that was releant to

the Internet age.`

le adds, \ou know ery well that

motiation is a ery powerul orce. \e

hae the motiation, the others didn`t, to

the extent that it created a challenge or

us, but I don`t know i they see it as a

challenge. It`s more like, we just need to

hae it, eerybody has it, so let`s hae it

too`.`

Bautista agrees, 1he reason we are

successul is we beliee in it

wholeheartedly. 1he way I understand it,

the other banks treat it as insurance, they

just want to be there in case it becomes a

big thing. As opposed to us, we want to

lead.`

1he aorite line here is guys, we don`t

hae 150 years`. Because we`re a bank in a

hurry, rom a strategy standpoint, you

cannot simply copy what they`re doing

because you will just grow at the same

pace as them. 1he question is how to

execute it and the answer is, whateer it is

it`s got to be dierent rom the big boys.

1hat orces people to think dierently.

1echnology happens to be one o those

areas which we think we can make a

dierent approach.`

Culture of experimentation

ne key element to UnionBank`s

success in e-business is its

culture o innoation and risk-

taking. It helps that the aerage age o

UnionBankers is 2 ,a deliberate eort by

the way,, making the bank more lexible

and open to resh ideas. Ortiz has recently

organized the bank into product teams,

combining a unctional organization with

a network structure that promotes

cooperation and collaboration. \e do a

lot o experimentation where we just do

things. \e can`t justiy it, there`s no

analysis, acts, data, it`s purely instinctie

and we do it. Most o the time it ails but

once in a while it works. \ou just need a

ew o those successes. As a philosophy,

we experiment a lot but within ery

deined limits, so we can neer break the

bank.`

le adds, \e do a lot o things on a

hunch. \e spend about roughly 20 o

our regular capital expenditures on

experimentation rom a resource

allocation point o iew. Now that we

hae this product team concept, there`ll

be a lot o more o that going on.

lopeully the outcome o that are insights

that you couldn`t possibly igure out in a

acuum or some sort o analysis with

ocus groups, sureys, what not.`

It`s like LON. low do you explain

LON \hat is it \e hae as many LON

account holders as our regular accounts.

low \hy Is there an explanation I

cannot understand what buttons we

pushed. I you asked me how to replicate

it, I don`t hae an answer. Maybe nobody

does. It`s an experiment that worked.

\hat`s LON It`s a stripped down A1M

account. In act I would complain about

it. \ou mean I don`t get statements, I

don`t hae passbooks, you mean I can`t

withdraw oer the counter \hat kind o

lousy account is that` \et i you look at

our ads, that`s precisely what LON is all

about. No passbook, no lines, no

statements.`

O

|And it says|, \ou`re dierent, you`re no

dinosaur who needs all these stu. 1hese

are or the old olks. \e`re young, we`re

modern, we want to do our banking while

drinking coee, we want to do our

banking at home.` And that struck a

chord. \ou tell me, what is it It`s not a

great moneymaker but certainly in terms

o 200 thousand cardholders, where did

that come rom It`s hard to beliee, it`s

hard to explain.`

Still, UnionBank is quick to emphasize

that being dierent doesn`t mean eering

away rom its core business. Bautista

dismisses the possibility o spinning o a

tech subsidiary, It`s not a question o

spinning it o. Banking itsel is going to

be transormed. \e`re changing the way

we do banking but at the end o the day

we`re still a bank.`

le adds, Our tools are new economy but

our objecties are still old economy. \e`re

talking customer acquisition, ees. \e

cannot lose sight o the act that we`re a

bank, two we need to make money. \e`re

ery tough on making money. \e`re

obsessed on return on equity o our

shareholders.`

1echnology has made a tremendous

impact to UnionBank`s bottom line. Net

income or 2001 was P1.1 billion, 32

higher than the year beore. Net income

margin is 22. Return on equity was

9.2, way aboe the industry aerage o

2.6. In terms o reenues, the

contribution o e-business products is

both direct and indirect. Serice ees in

act are insigniicant in proportion to total

reenues. But by oering technologically

adanced and \eb-accessible solutions

particularly or the corporate market,

which is becoming more demanding and

increasingly inclined towards technology-

based products, it has been able to capture

a bigger pie. Len as multinational

corporations consolidate their cash

management on a global or regional basis,

they make an exception or the

Philippines, due to UnionBank`s

innoatie solutions. Its corporate cash

management business, which already

contributes 21 to net income, allows the

bank to take adantage o the unds low

to earn interest.

A key reason or UnionBank`s healthy

proitability is that it`s one o the most

eicient banks around. 1his is where

technology is making the most impact. Its

cost to income o 0.60 makes it the lowest

in the industry. Since its merger with

Interbank, it has ceased expanding its

branch network. Instead, it relocated

branches to more strategic locations,

lowered rental cost, and downsized them

so that just ie people can operate a

branch. Its strategy or customer

acquisition and market reach may be

limited geographically, but the use o

innoatie products is working to gain

more corporate clients. Its inancial portal

is key in getting retail inance customers,

especially or its ast-growing business in

credit cards, auto loans, and mortgage

loans. Using the Internet as a distribution

channel as a low-cost deposit generation

tool is certainly helping.

Still, a major concern among inestment

analysts is UnionBank`s weak deposit

ranchise, or a medium-sized bank at

that. It ranks in the high teens in total

deposit accounts o about P28 billion, a

mere 10 o the top bank. Neertheless,

that represents an increase o 15 rom

2000, and 23 beore that. UnionBank

wants to proe that size and scale do not

matter. LON and unionbankph.com are

helping increase accounts in terms o

numbers, and its cash management

business is proiding the increase in alue.

1he combination o innoatie products

and distribution channels enhanced by

technology has been an important actor.

Its innoation ratio - reenues rom new

products and businesses introduced in the

last three years - is now at 32, rom

15 in 1999.

It is also outsourcing more o its backend

operations to its Cebu-based subsidiary

Union Data Corporation to take

adantage o lower production costs. Its

break-een leel or its credit card

operations is the lowest in the industry

largely because o this. In addition, it has

employed automated credit scoring,

eliminating the need to hire more credit

analysts. 1echnology enables this kind o

automation and internal communication.

1he bank also hired its linance Controller

rom Procter & Gamble, bringing the cost

discipline o a manuacturer. Its

Operations Controller is rom Intel,

adding a quality discipline to operations.

Its Project Delta continues to drie down

costs and improe productiity. Its total

manpower is now around 1,600, rom

2,400 in 1994. All those saings and

productiity rom the use o e-business,

rom online procurement to knowledge

management, add up.

IOCUS 20J0

n January 2002, UnionBank

celebrated its 20

th

anniersary. And

appropriately, it cooked up a new

slogan: Drien with passion, powered by

e-xcellence.` UnionBank is ired up to

meet its new challenge - to be one o the

top three most aluable banks by 2010. Its

target is to hae 1.5 million retail

customers and 3,000 corporate clients. Its

battle cry is lOCUS 2010, which stands

or inancial alue, operational excellence,

customer ranchise, UnionBank

brand,experience, and speed o

innoation.

Ortiz explains, 1he consensus is our own

people need to make da di`. In order to

achiee those goals, you got to do things

dierently. I you do exactly the same

thing, you`ll be in the exactly same relatie

place. \e`re not going to catch up with

BPI by doing what they do. 1he odds are

stacked up against us because they`re the

leader. 1hat means taking a risk. Because

we`re not ollowing the herd, which is the

sae way, there`s no guarantee o success.

Lither through luck or skill, or a

combination o both, we chose to be

dierent, we`e taken the risk, and we can

now speak about it with some measure o

success. Now we got to carry it on urther

and see i we can continue with the

success.`

It will be at most eight years beore we see

i UnionBank`s strategy will work. But i

the past ew years and the irst quarter o

2002 are any indication, it appears it`s on

the right track. Already, its net income or

the quarter one is P506 million, hal o

what it earned the entire 2001, and double

that o the same period last year. And it`s

due to robust earnings rom its electronic

banking, cash management, treasury-

related businesses, priate banking,

consumer banking, and other ee-based

businesses.

O course, there are other key

perormance measures or the banking

industry aside rom earnings. Capital

adequacy and liquidity, or example,

though UnionBank has no problem here.

Asset quality is another, though it`s

soling its problems with non-perorming

loans ,NPLs,. And one can`t dismiss the

giants like BPI and Metrobank, they aren`t

big or anything. 1here are no guarantees.

Ortiz acknowledges this, 1his is sort o a

work in progress, it`s not a ormula. Are

we ensured o success It`s hard to say.`

I

Neertheless, aiming or top three or een

number one doesn`t seem as daunting, or

een impossible, as beore. Ortiz airms,

UnionBankers beliee. \hen I said top 5

beore, I don`t think een they belieed.`

1op 3 now seems more achieable or

them, their rationale being beore, the

bank came rom something like number

20, and now it`s just two steps away.

low about the outside world I don`t

think they will be as cynical as they were 5

years ago. 1his time they might think it`s

diicult, but maybe. 1he response beore

was ery arrogant. 1here`s now a healthy

respect. Certainly there`s more

credibility.`

Justo Ortiz dared to dream and took the

risk. No one`s laughing now.

Вам также может понравиться

- Managing A Consumer Lending Business - David Lawrence - Z Lib - OrgДокумент386 страницManaging A Consumer Lending Business - David Lawrence - Z Lib - OrgSebas 24Оценок пока нет

- Banks rely on branches to drive future growthДокумент6 страницBanks rely on branches to drive future growthHien Bui100% (1)

- Unlocking Unicorns: Ten Startup Stories from Diverse Billion-dollar Founders in Africa, Asia, and the Middle EastОт EverandUnlocking Unicorns: Ten Startup Stories from Diverse Billion-dollar Founders in Africa, Asia, and the Middle EastОценок пока нет

- Digital Transformation in Banking and Finance PDFДокумент29 страницDigital Transformation in Banking and Finance PDF2guntanОценок пока нет

- Mit Digital Bank Manifesto ReportДокумент19 страницMit Digital Bank Manifesto ReportChun KitОценок пока нет

- Bitcoin and Blockchain B094G62PPMДокумент289 страницBitcoin and Blockchain B094G62PPMDương Nguyễn BìnhОценок пока нет

- DCF and Trading Multiple Valuation of Acquisition OpportunitiesДокумент4 страницыDCF and Trading Multiple Valuation of Acquisition Opportunitiesfranky1000Оценок пока нет

- Hsu - Sara - Li - Jianjun China - S Fintech Explosion - Disruption - Innovation - and Survival Columbia UnivДокумент361 страницаHsu - Sara - Li - Jianjun China - S Fintech Explosion - Disruption - Innovation - and Survival Columbia UnivNguyễn Đức Tuấn100% (1)

- Annual Bank Statement SummaryДокумент4 страницыAnnual Bank Statement Summarydebroy8282Оценок пока нет

- Plan B: How to Hatch a Second Plan That's Always Better Than Your FirstОт EverandPlan B: How to Hatch a Second Plan That's Always Better Than Your FirstРейтинг: 3 из 5 звезд3/5 (2)

- ICONIC: How Organizations and Leaders Attain, Sustain, and Regain the Highest Level of DistinctionОт EverandICONIC: How Organizations and Leaders Attain, Sustain, and Regain the Highest Level of DistinctionОценок пока нет

- Bancom - Memoirs - by DR Sixto K Roxas - Ebook PDFДокумент305 страницBancom - Memoirs - by DR Sixto K Roxas - Ebook PDFVinci RoxasОценок пока нет

- Breaking Banks: The Innovators, Rogues, and Strategists Rebooting BankingОт EverandBreaking Banks: The Innovators, Rogues, and Strategists Rebooting BankingОценок пока нет

- The Digital Banking Revolution: How financial technology companies are rapidly transforming the traditional retail banking industry through disruptive innovation.От EverandThe Digital Banking Revolution: How financial technology companies are rapidly transforming the traditional retail banking industry through disruptive innovation.Оценок пока нет

- Bitcoin A Primer For PolicymakersДокумент111 страницBitcoin A Primer For PolicymakersVictor Hugo LaurindoОценок пока нет

- Supertrends: Winning Investment Strategies for the Coming DecadesОт EverandSupertrends: Winning Investment Strategies for the Coming DecadesОценок пока нет

- Citibank Japan EntryДокумент5 страницCitibank Japan Entrypriyajuneja89Оценок пока нет

- Case Study For BINTДокумент4 страницыCase Study For BINTMicah CarpioОценок пока нет

- Introduction To The Business of Banking and Financial-ServicesДокумент30 страницIntroduction To The Business of Banking and Financial-ServicesWan ThengОценок пока нет

- National Commercial Banking in Trinidad and Tobago: A Positive Step in ConsciousnessОт EverandNational Commercial Banking in Trinidad and Tobago: A Positive Step in ConsciousnessОценок пока нет

- Julio Nalundasan Member of The FromДокумент7 страницJulio Nalundasan Member of The FromAva BarramedaОценок пока нет

- Jesus TambuntingДокумент5 страницJesus TambuntingheinzteinОценок пока нет

- Financial Technology in Monzo Bank: Student Name: Institute Name: Course Code: Instructor Name: DateДокумент8 страницFinancial Technology in Monzo Bank: Student Name: Institute Name: Course Code: Instructor Name: DateRabnawazОценок пока нет

- Social Media Guide For Filipino Entreps by Carlo OpleДокумент114 страницSocial Media Guide For Filipino Entreps by Carlo OpleMichael LuОценок пока нет

- A to B: How to Move from Adversity to Breakthrough With Powerful StorytellingОт EverandA to B: How to Move from Adversity to Breakthrough With Powerful StorytellingОценок пока нет

- Reimagining Payments: The Business Case for Digital CurrenciesОт EverandReimagining Payments: The Business Case for Digital CurrenciesОценок пока нет

- Your Money 2014Документ21 страницаYour Money 2014The Myanmar Times50% (2)

- Battle For Soul of MF-Optional Reading - ObaidullahДокумент7 страницBattle For Soul of MF-Optional Reading - ObaidullahfswardhanaОценок пока нет

- Issues That Affect The Global Banking IndustryДокумент3 страницыIssues That Affect The Global Banking Industryem-tech100% (1)

- FDIC Chairman McWilliams The Future of BankingДокумент13 страницFDIC Chairman McWilliams The Future of BankingRishrisОценок пока нет

- Metrobank's History and Growth as the 2nd Largest Bank in the PhilippinesДокумент2 страницыMetrobank's History and Growth as the 2nd Largest Bank in the PhilippinesAndrea Gale Dela CruzОценок пока нет

- Reaction - Analysis Paper - Elaina Joy YwanДокумент4 страницыReaction - Analysis Paper - Elaina Joy YwanElaina JoyОценок пока нет

- Wooha - China International BusinessДокумент2 страницыWooha - China International BusinessTom SpenderОценок пока нет

- The back story behind the UBA & STB MergerДокумент18 страницThe back story behind the UBA & STB MergerverosОценок пока нет

- INTERVIEWERДокумент10 страницINTERVIEWERPromkes GontaОценок пока нет

- PixelSutra Insight - Banking SectorДокумент13 страницPixelSutra Insight - Banking Sectoreswar jОценок пока нет

- Referat EnglezaДокумент7 страницReferat EnglezaBobescu AlinaОценок пока нет

- The Future of Banking: A Discussion with Capitec CEOДокумент5 страницThe Future of Banking: A Discussion with Capitec CEOMpho SeutloaliОценок пока нет

- Emotional Banking: Fixing Culture, Leveraging FinTech, and Transforming Retail Banks into BrandsОт EverandEmotional Banking: Fixing Culture, Leveraging FinTech, and Transforming Retail Banks into BrandsОценок пока нет

- Thriving in A Digital AgeДокумент9 страницThriving in A Digital AgeThavam RatnaОценок пока нет

- FinTech Revolution: Universal Inclusion in the New Financial EcosystemОт EverandFinTech Revolution: Universal Inclusion in the New Financial EcosystemОценок пока нет

- In Languages, Economies and Institutions of Asia and North AfricaДокумент114 страницIn Languages, Economies and Institutions of Asia and North AfricaRoll MarollОценок пока нет

- Hyperconnected Economy - Informilo Swift Sibos Magazine October 2012Документ11 страницHyperconnected Economy - Informilo Swift Sibos Magazine October 2012anthemisgroupОценок пока нет

- Festival of EconomicsДокумент89 страницFestival of EconomicsalbusprimusОценок пока нет

- MSJ 121013Документ15 страницMSJ 121013geeyookОценок пока нет

- Lu en Future of Banking 2017Документ57 страницLu en Future of Banking 2017Dhiraj MagadeОценок пока нет

- Metrobank A Filipino Global CorporationДокумент2 страницыMetrobank A Filipino Global CorporationG'well Maika LongcopОценок пока нет

- Wake-Up Call: Economic, Political, Social, and Psychological Factors That Can Erode Your WealthОт EverandWake-Up Call: Economic, Political, Social, and Psychological Factors That Can Erode Your WealthОценок пока нет

- (Babson) - Investment PerformanceДокумент4 страницы(Babson) - Investment PerformancecogitatorОценок пока нет

- Banking Sector Analysis: History, Trends, Technologies and PoliciesДокумент48 страницBanking Sector Analysis: History, Trends, Technologies and PoliciesDeepak_Kesharw_688Оценок пока нет

- 50 Key Youth Trends 2011Документ74 страницы50 Key Youth Trends 2011ononujubОценок пока нет

- Banking CareersДокумент29 страницBanking Careers3chelonОценок пока нет

- Banking Industry OverviewДокумент27 страницBanking Industry OverviewNicole JoanОценок пока нет

- Selling to China: A Guide for Small and Medium-Sized BusinessesОт EverandSelling to China: A Guide for Small and Medium-Sized BusinessesОценок пока нет

- Component CompaДокумент7 страницComponent CompaRena Jocelle NalzaroОценок пока нет

- Weaving The WebДокумент15 страницWeaving The WebheinzteinОценок пока нет

- What Can You Do With One Billion PesosДокумент17 страницWhat Can You Do With One Billion PesosheinzteinОценок пока нет

- Wall of ShameДокумент3 страницыWall of ShameheinzteinОценок пока нет

- Audio VocaДокумент2 страницыAudio VocaheinzteinОценок пока нет

- The Web Movers and ShakersДокумент13 страницThe Web Movers and ShakersheinzteinОценок пока нет

- Take 5Документ7 страницTake 5heinzteinОценок пока нет

- CДокумент5 страницCheinzteinОценок пока нет

- The Right Mutual Funds For YouДокумент2 страницыThe Right Mutual Funds For YouheinzteinОценок пока нет

- SurvivorДокумент9 страницSurvivorheinzteinОценок пока нет

- Walk The PlankДокумент15 страницWalk The PlankheinzteinОценок пока нет

- The First Million Is Always The HardestДокумент8 страницThe First Million Is Always The HardestheinzteinОценок пока нет

- The Race For The Last MileДокумент19 страницThe Race For The Last MileheinzteinОценок пока нет

- StarbucksДокумент6 страницStarbucksheinzteinОценок пока нет

- Ship AhoyДокумент7 страницShip AhoyheinzteinОценок пока нет

- SiemensДокумент3 страницыSiemensheinzteinОценок пока нет

- ShakeysДокумент4 страницыShakeysheinzteinОценок пока нет

- Sony Cybershot Dsc-p100Документ2 страницыSony Cybershot Dsc-p100heinzteinОценок пока нет

- SapДокумент6 страницSapheinzteinОценок пока нет

- September Capital Home Financing 101Документ5 страницSeptember Capital Home Financing 101heinzteinОценок пока нет

- Sex SellsДокумент7 страницSex Sellsheinztein100% (1)

- Pirates of Digital ValleyДокумент10 страницPirates of Digital ValleyheinzteinОценок пока нет

- PalДокумент10 страницPalheinzteinОценок пока нет

- SchwarzwalderДокумент2 страницыSchwarzwalderheinzteinОценок пока нет

- Rediscovering BaguioДокумент4 страницыRediscovering BaguioheinzteinОценок пока нет

- Ramon MagsaysayДокумент4 страницыRamon MagsaysayheinzteinОценок пока нет

- Rate Shopping For A Housing LoanДокумент4 страницыRate Shopping For A Housing LoanheinzteinОценок пока нет

- OperaДокумент5 страницOperaheinzteinОценок пока нет

- Olympus Camedia c5060Документ2 страницыOlympus Camedia c5060heinzteinОценок пока нет

- Glory GFS 120Документ4 страницыGlory GFS 120especialistas mantenimientoОценок пока нет

- Future Money and Payments PDFДокумент7 страницFuture Money and Payments PDFForkLogОценок пока нет

- Challan Form PDFДокумент2 страницыChallan Form PDFHaroon Fazal MeoОценок пока нет

- Digital Financial InclusionДокумент14 страницDigital Financial InclusionANONYMOUS PeopleОценок пока нет

- BASIC-ACCOUNTING-WORKBOOK-final-version-1Документ50 страницBASIC-ACCOUNTING-WORKBOOK-final-version-1ynarchive00Оценок пока нет

- Excercise - TBДокумент2 страницыExcercise - TBammadey21@gmail.comОценок пока нет

- Chapter 7 Internal Control Over CashДокумент39 страницChapter 7 Internal Control Over Cashtrangalc123Оценок пока нет

- Requirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20AДокумент4 страницыRequirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20AGvm Joy MagalingОценок пока нет

- Sbi May 23Документ17 страницSbi May 23Arun MotorsОценок пока нет

- Cash account audit of Makati CorporationДокумент8 страницCash account audit of Makati CorporationGlizette SamaniegoОценок пока нет

- Ch2-3 Cash & Cash Equivalent and Bank Recon TablesДокумент1 страницаCh2-3 Cash & Cash Equivalent and Bank Recon TablesEUNICE NATASHA CABARABAN LIMОценок пока нет

- W14494 PDF EngДокумент6 страницW14494 PDF EngJason RoyОценок пока нет

- Audit of Cash and Bank BalancesДокумент14 страницAudit of Cash and Bank BalancessninaricaОценок пока нет

- History of CryptocurrencyДокумент3 страницыHistory of CryptocurrencyBunda DungaОценок пока нет

- Solved CAT 1990 Paper With Solutions PDFДокумент75 страницSolved CAT 1990 Paper With Solutions PDFPrem Nath YadavОценок пока нет

- Venezuela's Adoption of a CBDC to Combat Inflation and DollarizationДокумент40 страницVenezuela's Adoption of a CBDC to Combat Inflation and DollarizationLibia OvaldoОценок пока нет

- Accounting Practice SetДокумент25 страницAccounting Practice SetBeverly EroyОценок пока нет

- Governtment AccountingДокумент2 страницыGoverntment Accountingjessica amorosoОценок пока нет

- IAS 21 - Foreign Currency TransactionsДокумент1 страницаIAS 21 - Foreign Currency TransactionsDawar Hussain (WT)Оценок пока нет

- Tally BIZ PresentationДокумент10 страницTally BIZ PresentationTurner TuringОценок пока нет

- Accounting Chapter 22 Test: True/FalseДокумент3 страницыAccounting Chapter 22 Test: True/FalseZayli Morales100% (1)

- Internship Report On Askari BankДокумент167 страницInternship Report On Askari BankAiliya Rizvi67% (3)

- 2012 Dec 30-41 - Himanshu - BarotДокумент12 страниц2012 Dec 30-41 - Himanshu - BarotSunil PatelОценок пока нет

- Key Fact Statement CorporateДокумент7 страницKey Fact Statement CorporateRAM MAURYAОценок пока нет

- Cimb Petronas Visa Infinite I TNC EngДокумент3 страницыCimb Petronas Visa Infinite I TNC EngMuhammad KhudriОценок пока нет

- Mahila Samman Savings Certificate FormДокумент5 страницMahila Samman Savings Certificate FormanuОценок пока нет

- Journal Chapter Explained in DetailДокумент17 страницJournal Chapter Explained in DetailKartikey swamiОценок пока нет