Академический Документы

Профессиональный Документы

Культура Документы

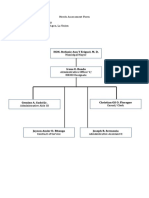

Collection Executives

Загружено:

lulughoshАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Collection Executives

Загружено:

lulughoshАвторское право:

Доступные форматы

1.

AKBAR

3 years of experience as collection executive. t-board default more-indica on board-maruthi alto for goods-mahindra defaults more Reasons: Ususl reason given by t board customer is didnt get payment . FI not done properly(especially just check the pass book for address proof) Proper education of business executives not done-they concentrate more on getting business and forgets verification properly CIBIL check make it strict. Mode of collection causes non intentional defaulters Especially ECS:because the business executives doesnt educate the customers about it. Hw to avoid defaulters? FI done properly Try to collect full PDC rather than ecs.its useful for the company and the customer. Customer doesnt have to go through the difficulties caused by the ecs transaction.

Ecs customers should be educated more. CIBIL check made strict. Give more to on board customers If ageing occurs try to collect before 30th and do not allow to go beyond 4th ageing. Try to avoid giving personal loan to existing car loan customer they tend to default in any one(especially t board) Legal action should be taken. 2.A.C.Balaji Two and half years of exp Both on board and t board defaults On board:maruti alto T board:indica,sumo Reasons maximum given:payment is not given by the customers company. On board customers:intentional defaulters because of lack of awareness.executive problem is also there because proper follow up is not there. Mode of Repayment problem Usually in ECS:proper updation is not done by the dexecutives so ecs bounce even though money is available in bank.business executive doest do proper follow up.they check only till the disbursement of the amount and will not check

whether ecs is updated or not.collection executives will get to know tht the default has occurred only after 1 month. Hw to avoid this? Proper FI Legal action In MMFSL 2 or 3 ageing is not taken as a problem as in banks.prper awareness should be given to the customers about the legal procedure. Repossession should be done when customer cross soft bucket itself so tht intentional defaulters will understand the risk of non payment. 3.K CHANDRAN Two and half years Defaulters:T-board and On board T board:indica On board:bolero Reason given:t board:didnt get the money. Avoid ECS:business executive processing is not correct Collection executives have to keep a close watch on the customer in age 1 itself get in touch with the customer some field executive leave it if the customer is not taking up the call.

For t board customer keep a comfortable due date that is 25.they get money from the company they work only at that time but the computer doesnt accept it if the customer data is entered on 5th the computer automatically keep the due date as 10th that is 5 days after the entering of due date. Educate the customer about the due dates and collection etc. If during the FI alayse the customer and based on the income reduce the amount given. In the fi for on board try to identify the intentional defaulters and try to reduce it.ie avoid politicians. 4.Sathyamurthy 9 months of service Default T board:major(indica) Major reason said:customer not getting money. On board to a great extend(maruthi 800) How to reduce default For t board customer regular follow up will reduce thedefault. Educate the customer in the starting itself about the defaults that will happen and about the due date. ECS The updation is not properly done by the executives.

If the Fi is made stricter then we can reduce the default.that is reduce the amout given to low income customers. 5.velmurugan 7 months Both T board and on board go into default T board mainly:maruthi omni,tata indica,Mahindra xylo On board Swift,ford fiesta Hw to eliminate default Follow up with the customer and the executives will have an idea about the whether the customer will default or not if they knoe that the customer will default then they can warn or remind the customer earlier itself, Business executives can get in touch with the customers and educate them about what happens if the customer defaults. Like their name would come in CIBIL and they will not be able to get any more loan etc. If at all the customer sell the vehicle to a third person the details of the third person should be collected and kept. Most of the customers of mmfsl are uneducated they should be educated about the process of ecs. 6:vijay 5 months

Default:t board and on board Hw to reduce Proper legal action should be there when cuatomer reaches age three if we reposses the vehicle the t board customer will pay back even though this might not work with on board. The collection executives should follow up regularly. Getting pdc through collection executives should be made stricter rather than calling and telling customer to bring pdc coz they may forget. FI should be made stricter the executives lack in it. Regular intimation of pdc should be made regular.and intimation to the collection executives regarding the default payers. Business executives should keep in touch with the customers for minimum of three months.the customers might be unaware of the due date and all so if business executive is in touch they might be able to show them the rope. 7:swaminathan 3 months Reduce default by reducing amount in FI Check FI thoroughly becoz there are cases when customer of mmfsl act as guarantor for another customer and vice versa.this should be avoided because this will cause default for both customers.

Check whether they have commitments to any other bank. Ecs:educate. 8.Ramesh 1 year T Board:Indica Educate customer Collection executives tend to leave the collection executives if they are not responding to phone for age one customer.go and talk to the customer directly rather than leaving it. Ecs problem occurs because of both executives and customers Executives should check it properly Pdc finished should be regularly informed Personal loan and car loan together causes default this should be avoided Educate the customer abouth wqhat will cause because of the non payment. Put due date for the customers as different as possible. 9.David 10 months Dont give personal loan for default customers. Reduce the amount based on the FI of the customer

When Age 3 occurs reposses the vehichle it will reduce the default to an extend especially for T board customers 10.Vinayakam T board:PIndica,tavera,Sumo Bussiness executives should educate the customers about the fine which will get accumulate at the end Proper follow up by the customer Get the money within the correct ageing dont allow it to grow Family relatives should not be kept as guarantor.wspecially for the t board customer avoid it to the maximum.try to put a non relative as the guarantor. Communication should be correct that is if the ciustomer wants you to go and collect the money at a particular time go at that time rather than any time you like and when you are with the customer give him you full attention rather than take phone in between. Use proper language when you are talking to the customer. Show thta you are giving importance to the customer. Tell them about the AFC charges.when they come for full payment reduce the afc charges so that we have more customers by word of the mouth marketing. Repayment schedule should be correctly given to the customers that is this document contains details about how

many dues they have to pay and the amount and due date is also mentioned. Due dates should be mentioned to the customer. Afc should be reduced on due date clearance. Pdc finished info should be given Wavier in the afc charges and all should be given for early settlement it will improve the business. 11.Lakshmana Bharathi 2&1/2 years Insurance should be taken with the emi rather than with thaking fully at one time.then the customer will concentrate on giving the insurance that month and default on the due payment. Pl given person should be veified properly and given. Schedule about their due date is not given properly which should be given accordingly. Business executives rather than leaving the customers after business should keep in touch with them Many ppl dont trust the collection executives during the first stage so it will be better if the business executive is dealing with them. Tele calling should be there

Collection executives will leave the soft bucket if they are not taking the call and concentrate on the hard bucket becoz the company gives them target certain amount which they have tp take care of. Atleast message the customer about their due date. Remainder letter about the due and default should be given Becoz of the pressurisation the collection executives leave the soft bucket and concentrate more on the npa customer When ecs form is given its not properly filled business executives should check that before updating Business executives should be given an area as collection executives.most of the executives doesnt knw wht they have done If business executive is in touch with the collection executives then the non starters can be avoided.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Mass Effect 5e - The HomebreweryДокумент253 страницыMass Effect 5e - The HomebreweryRony Do CarmoОценок пока нет

- Starbucks Delivering Customer Service Case Solution PDFДокумент2 страницыStarbucks Delivering Customer Service Case Solution PDFRavia SharmaОценок пока нет

- Internship PresentationДокумент22 страницыInternship PresentationCalvin WongОценок пока нет

- 11 11 13Документ3 страницы11 11 13lulughoshОценок пока нет

- Srishti Rana of India Was Crowned Miss Asia Pacific World 2013Документ5 страницSrishti Rana of India Was Crowned Miss Asia Pacific World 2013lulughoshОценок пока нет

- 9 11 13Документ3 страницы9 11 13lulughoshОценок пока нет

- 8 11 13Документ2 страницы8 11 13lulughoshОценок пока нет

- India and Vietnam Signed Treaty On The Transfer of Sentenced PrisonersДокумент5 страницIndia and Vietnam Signed Treaty On The Transfer of Sentenced PrisonerslulughoshОценок пока нет

- 3 MarchДокумент1 страница3 MarchlulughoshОценок пока нет

- Paralympic Committee (IPC) Asian Open Championships With A World-Record Lift. Ali LiftedДокумент1 страницаParalympic Committee (IPC) Asian Open Championships With A World-Record Lift. Ali LiftedlulughoshОценок пока нет

- 5 11 13Документ1 страница5 11 13lulughoshОценок пока нет

- Jan 22Документ1 страницаJan 22lulughoshОценок пока нет

- Jan 21Документ1 страницаJan 21lulughoshОценок пока нет

- Feb 27Документ1 страницаFeb 27lulughoshОценок пока нет

- Renaud Lavillenie Broke 21-Year Pole Vault Record of Sergey BubkaДокумент1 страницаRenaud Lavillenie Broke 21-Year Pole Vault Record of Sergey BubkalulughoshОценок пока нет

- Jan 29Документ1 страницаJan 29lulughoshОценок пока нет

- Jan 28Документ1 страницаJan 28lulughoshОценок пока нет

- Jan 4Документ1 страницаJan 4lulughoshОценок пока нет

- Jan 3Документ1 страницаJan 3lulughoshОценок пока нет

- Jan 7Документ1 страницаJan 7lulughoshОценок пока нет

- Jan 13Документ1 страницаJan 13lulughoshОценок пока нет

- Jan 8Документ1 страницаJan 8lulughoshОценок пока нет

- Jan 6Документ1 страницаJan 6lulughoshОценок пока нет

- General Knowledge TodayДокумент4 страницыGeneral Knowledge TodayAnonymous y3hYf50mTОценок пока нет

- Jan 2Документ1 страницаJan 2lulughoshОценок пока нет

- General Knowledge TodayДокумент3 страницыGeneral Knowledge TodayAnonymous y3hYf50mTОценок пока нет

- General Knowledge TodayДокумент3 страницыGeneral Knowledge TodayAnonymous y3hYf50mTОценок пока нет

- Feb 27Документ1 страницаFeb 27lulughoshОценок пока нет

- General Knowledge TodayДокумент4 страницыGeneral Knowledge TodayAnonymous y3hYf50mTОценок пока нет

- Feb 14Документ1 страницаFeb 14lulughoshОценок пока нет

- General Knowledge TodayДокумент3 страницыGeneral Knowledge TodayAnonymous y3hYf50mTОценок пока нет

- Feb 25Документ1 страницаFeb 25lulughoshОценок пока нет

- Union Cabinet On 20 February 2014 Gave Its Nod For Classifying Odia As A Classical LanguageДокумент1 страницаUnion Cabinet On 20 February 2014 Gave Its Nod For Classifying Odia As A Classical LanguagelulughoshОценок пока нет

- XJ600SJ 1997Документ65 страницXJ600SJ 1997astracatОценок пока нет

- Research On Restaurant DesignДокумент20 страницResearch On Restaurant DesignCrizalene Caballero100% (1)

- Moral IssuesДокумент34 страницыMoral IssuesDaryll Jade PoscabloОценок пока нет

- HRDM 21 Midnotes - TwoДокумент51 страницаHRDM 21 Midnotes - TwoTimОценок пока нет

- SAM3-P256 Development Board Users Manual: This Datasheet Has Been Downloaded From at ThisДокумент21 страницаSAM3-P256 Development Board Users Manual: This Datasheet Has Been Downloaded From at ThissunnguyenОценок пока нет

- JDCF-66 220 VTДокумент13 страницJDCF-66 220 VTHusein OkhonovОценок пока нет

- Appendix 24 - QUARTERLY REPORT OF REVENUE AND OTHER RECEIPTSДокумент1 страницаAppendix 24 - QUARTERLY REPORT OF REVENUE AND OTHER RECEIPTSPau PerezОценок пока нет

- Nagpur Company List 2Документ10 страницNagpur Company List 2Kaushik BachanОценок пока нет

- CV WorkbookДокумент28 страницCV WorkbookRobin LaforêtОценок пока нет

- 1580823068890043Документ6 страниц1580823068890043Cristopher Dave CabañasОценок пока нет

- GNDДокумент16 страницGNDDEAN TENDEKAI CHIKOWOОценок пока нет

- Electricity at Work - Safe Working Practices HSG85Документ27 страницElectricity at Work - Safe Working Practices HSG85Sivakumar NatarajanОценок пока нет

- Agricultural Extension System in Sudan FinalДокумент52 страницыAgricultural Extension System in Sudan FinalMohamed Saad AliОценок пока нет

- Toyota PDFДокумент3 страницыToyota PDFPushp ToshniwalОценок пока нет

- Labor Case Digest MidtermsДокумент219 страницLabor Case Digest MidtermsMvapsОценок пока нет

- Silverio Nuanez Verified ComplaintДокумент10 страницSilverio Nuanez Verified ComplaintMichael_Lee_RobertsОценок пока нет

- 70 Fernando Medical Enterprise Vs Wesleyan University PDFДокумент2 страницы70 Fernando Medical Enterprise Vs Wesleyan University PDFTon Ton CananeaОценок пока нет

- Bilal CVДокумент3 страницыBilal CVShergul KhanОценок пока нет

- Efqm Success-Story-Book LRДокумент34 страницыEfqm Success-Story-Book LRabdelmutalabОценок пока нет

- Reinforcement Project Examples: Monopole - Self Supporter - Guyed TowerДокумент76 страницReinforcement Project Examples: Monopole - Self Supporter - Guyed TowerBoris KovačevićОценок пока нет

- Encryption LessonДокумент2 страницыEncryption LessonKelly LougheedОценок пока нет

- SLA707xM Series: 2-Phase Unipolar Stepper Motor DriverДокумент20 страницSLA707xM Series: 2-Phase Unipolar Stepper Motor DriverKatherine EsperillaОценок пока нет

- Accounting Graded AssignmentsДокумент19 страницAccounting Graded AssignmentsAnnela EasyОценок пока нет

- Needs Assessment Form Company Name: HRMO Address: Sta. Barbara Agoo, La UnionДокумент2 страницыNeeds Assessment Form Company Name: HRMO Address: Sta. Barbara Agoo, La UnionAlvin LaroyaОценок пока нет

- 12-24VDC Powered Ignition System: N N N N N N NДокумент2 страницы12-24VDC Powered Ignition System: N N N N N N NLeinner RamirezОценок пока нет

- Decisions Made by The DecisionДокумент2 страницыDecisions Made by The Decisionneil arellano mutiaОценок пока нет

- Reversible Motors: Additional InformationДокумент36 страницReversible Motors: Additional InformationAung Naing OoОценок пока нет