Академический Документы

Профессиональный Документы

Культура Документы

Sharekhan Top Picks: November 30, 2012

Загружено:

didwaniasОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sharekhan Top Picks: November 30, 2012

Загружено:

didwaniasАвторское право:

Доступные форматы

Visit us at www.sharekhan.

com

November 30, 2012

Sharekhan Top Picks

The Top Picks basket has appreciated by 4.2% since our last update on October 26, 2012. The performance is largely in line with the appreciation of 3.8% each in the Sensex and the Nifty, and that of close to 4.4% in the CNX Mid-cap Index in the same period. On a year-till-date basis (for the eleven months of CY2012), the Top Picks basket has generated returns of 31.5%, which is ahead of the returns given by the Sensex (24.7%), the Nifty (27.4%) and the CNX Midcap Index (28.7%). This month we are making only one change in the Top Picks basket. We are inducting Federal Bank in place of Persistent Software. This will enable us to increase the baskets exposure to the banking sector. Federal Bank is among the better managed old private sector banks and its recent underperformance offers an attractive opportunity for investors to enter the stock. On the other hand, we are replacing Persistent Software due to our constructive view on the rupee in the near term.

Absolute outperformance (returns in %)

180.0% 150.0% 120.0%

Constantly beating Nifty and Sensex (cumulative returns in %)

280.0 250.0 220.0 in % 190.0 160.0 130.0 May-09 Jul-09 Sep-09 Nov-09 Jan-10 Mar-10 May-10 Jul-10 Sep-10 Nov-10 Jan-11 Mar-11 May-11 Jul-11 Sep-11 Nov-11 Jan-12 Mar-12 May-12 Jul-12 Sep-12 Nov-12 Sharekhan Sensex Nifty

90.0% 60.0% 30.0% 0.0% -30.0% -60.0% YTD CY2012 CY2011 CY2010 CY2009 Since Jan 2009 Nifty

100.0

Sharekhan (Top Picks)

Sensex

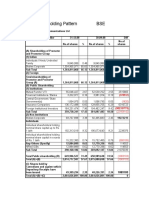

Name Axis Bank BHEL Cadila Healthcare Dishman Pharma Federal Bank GCPL ICICI Bank Larsen & Toubro M&M Relaxo Footwear Reliance Industries

* CMP as on November 30, 2012

CMP* (Rs) 1,316 233 835 115 484 735 1,099 1,667 945 801 794

FY12 12.8 8.1 22.2 16.5 4.7 43.8 19.6 24.0 21.0 24.1 13.0

PER (x) FY13E 11.5 8.6 19.0 10.8 4.2 31.7 16.3 21.2 18.2 18.5 12.9

FY14E 9.6 9.3 14.2 6.7 3.5 25.4 14.6 18.9 19.0 13.7 12.2

FY12 20.3 27.7 25.4 6.1 14.4 26.3 11.2 18.1 22.8 20.3 11.2

RoE (%) FY13E 19.2 22.2 26.2 8.7 14.4 26.8 12.3 17.7 22.1 20.4 9.9

FY14E 19.5 17.9 27.2 12.4 15.5 27.5 12.7 17.3 18.4 20.6 9.7

Price target 1,370 250 1,000 135 550 796 1,230 1,788 949 885 915

Upside (%) 4 7 20 17 14 8 12 7 0 10 15

For Private Circulation only

Sharekhan Ltd, Regd Add: 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East), Mumbai 400 042, Maharashtra. Tel: 022 - 61150000. BSE Cash-INB011073351; F&OINF011073351; NSE INB/INF231073330; CD - INE231073330; MCX Stock Exchange: CD - INE261073330 DP: NSDL-IN-DP-NSDL233-2003; CDSL-IN-DP-CDSL-271-2004; PMS INP000000662; Mutual Fund: ARN 20669. Sharekhan Commodities Pvt. Ltd.: MCX10080; (MCX/TCM/CORP/0425); NCDEX -00132; (NCDEX/TCM/CORP/0142)

sharekhan top picks Name CMP (Rs) Axis Bank Remarks: 1,316 FY12 12.8 PER (x) FY13E 11.5 FY14E 9.6 FY12 20.3 RoE (%) FY13E 19.2 FY14E 19.5 Price target 1,370 Upside (%) 4

Axis Banks net interest margin (NIM) improved to 3.46% in Q2FY2013 due to a decline in the cost of deposits. The banks strong growth in the retail segment is likely to support the margin in the coming period. Going ahead, the management expects to maintain the margin in the 3.3-3.5% range. The bank aims to expand its loan book by 3-5% higher than the industry rate (~20% for FY2013). Moreover, the bank has shifted its focus towards the retail segment (currently corporate loans form ~55% of the book) and aims to expand the retail mix to 30% of the book by FY2015. Axis Bank continues to maintain a strong liability base (the current and savings account [CASA] ratio is 40.5%) and expects a healthy growth in deposits. The average CASA balance remains healthy, which will give stability to the margins. While the asset quality scenario remains challenging, the banks non-performing asset (NPA) ratio (gross NPAs at 1.1%, net NPAs at 0.33%) is better than that of its comparable peers. Going ahead, any asset quality deterioration will be within manageable levels (ie gross stressed loan additions at ~Rs1,000 crore per quarter) and the management has guided for a credit cost of 75-80 basis points of advances. Further, the higher provision coverage (~80%) adds comfort on the asset quality front. Axis Bank is attractively valued as it trades at 1.7x FY2014 book value against a five-year mean valuation of 2.2x. We expect the bank to deliver return on equity (RoE) of ~19% and return on asset (RoA) of 1.5% by FY2014. We recommend a Buy on Axis Bank with a price target of Rs1,370.

BHEL Remarks:

233

8.1

8.6

9.3

27.7

22.2

17.9

250

Bharat Heavy Electricals Ltd (BHEL) is a premier power generation equipment manufacturer and a leading engineering, procurement and construction company. BHEL has witnessed a severe downgrade in its valuation multiples in the last couple of years on account of policy inaction-driven slowdown in the demand environment. However, the proposed initiatives to restructure the debt on the books of the state electricity boards would kick-start the reforms in the power sector. In terms of the existing order book, we believe that the concern over the cancellation of the orders from the private power developers seems overplayed as the Inter Ministerial Group hasn't de-allocated any coal mine of BHELs private clients after scrutinising 29 coal mines. The company is also focusing on the non-BTG segments, like railways, logistics, and transmission and distribution (T&D), that have a significant growth potential. The relatively lower order intake in recent years would reflect on its revenue growth and result in a marginal decline in the earnings over the next two years. However, a lot of negatives are reflected in the serious de-rating of the stock over the last two years. Therefore, we have included BHEL in our Top Picks basket.

sharekhan top picks Name CMP (Rs) Cadila Healthcare Remarks: 835 FY12 22.2 PER (x) FY13E 19.0 FY14E 14.2 FY12 25.4 RoE (%) FY13E 26.2 FY14E 27.2 Price target 1,000 Upside (%) 20

A weak performance in the recent quarter due to temporary supply disruptions in Brazil had spawned the negative sentiment, widening the valuation discount. However, the valuation discount is set to shrink on new product launches in the USA (got five approvals from USFDA towards the end of Q2FY2013) and a strong growth in the domestic market. The management is confident of achieving 25% plus revenue growth in the next two to three years Thus, maintaining its aims of reaching US$3 billion revenue mark by the end of FY2016. There are multiple factors that should lead to a pick-up in the revenue and profit growth during FY2013 and FY2014 Better synergies from newly acquired entities and a favourable change in the product mix due to the focus on niche segments are set to lead the margin expansion by 212 basis points and 160 basis points to 22.7% and 24.3% in FY2013 and FY2014 respectively. However, patent litigation, forex and competition remain the key risks for the company. We expect revenue compounded annual growth rate (CAGR) of 20% and profit CAGR of 25% over FY2012-14. The stock is currently trading at 14.2x FY2014E earning per share (EPS), which is a 17% discount to Lupin. We believe the valuation discount should narrow further. We value the stock at 17x FY2014E EPS to arrive at a price target of Rs1,000.

Dishman Pharma Remarks:

115

16.5

10.8

6.7

6.1

8.7

12.4

135

17

After four years of lull, Dishman is all set to capitalise on its capabilities in the contract, manufacturing and research services (CRAMS) space and the marketable molecules (MM) business, thanks to its enhanced capacities and the up cycle in the CRAMS business. In H1FY2013, the net revenues of Dishman jumped by 19.4% YoY to Rs604.5 crore on the back of a 17.6% Y-o-Y rise in the CRAMS business and a 22.5% jump in the MM business (which includes the vitamin-D business). The oprating profit margin (OPM) improved by 925 basis points YoY to 23.5% which led the net profit to turnaround to Rs65.3 crore during H1FY2013. The up cycle in the CRAMS business and the enhanced capacities (it commercialised three new units in Q3FY2012) will help achieve a 16% revenue CAGR over FY2012-14. We expect an improvement in the operating profit margin and a reduction in the fixed costs during this period, which should lead the profit after tax (PAT) to grow at a CAGR of 55% over FY2012-14. Strong cash flows are likely to help reduce its debts significantly. We expect the debt/equity ratio to reduce to 0.5x in FY2014 from 0.9x in FY2012. Being an export-oriented player and having a substantial portion of foreign debts on its balance sheet Dishman is vulnerable to foreign exchange fluctuations. The chequered past performance and the managements inability to meet the stated guidance in the past are also causes for concern in the prevailing market where management quality and transparency carry a premium. The stock is currently trading at 6.7x FY2014E EPS, which is a 58% discount to its five-year average P/E multiple and close to a 65% discount to Divis Laboratories. We expect the valuation gap to narrow on a strong operating performance and an improved financial health. We recommend a Buy on the stock with a price target of Rs135 (8x FY2014E EPS).

Sharekhan

November 2012

sharekhan top picks Name CMP (Rs) Federal Bank Remarks: 484 FY12 4.7 PER (x) FY13E 4.2 FY14E 3.5 FY12 14.4 RoE (%) FY13E 14.4 FY14E 15.5 Price target 550 Upside (%) 14

Federal Bank is an old private bank with a network of 1,010 branches and a dominant presence in south India. Under a new management the bank is working on a strategy to gain pan-Indian presence, shift the loan book to better-rated corporates, increase the fee income, become more efficient and improve the asset quality. The asset quality of the bank has remained steady after showing some strain initially. The slippages from the SME and retail accounts have declined substantially while the slippages from the corporate accounts remain stable. Going forward, with the initiatives undertaken the recoveries could pick up and the NPAs may decline. Federal Banks loan growth has slowed over the past few quarters as the bank is cautious in view of the weakness in the economy. However, the loan growth is likely to be in line with the industry while risk adjusted margins may improve, thereby driving the operating performance. The banks return ratios are likely to go up led by an increase in the profits. We expect an RoE of ~15.5% and an RoA of around 1.2% by FY2014 led by a 16% CAGR in the earnings. Currently the stock is trading at an attractive valuation of 1.2x FY2014 book value. We recommend Buy with a price target of Rs550.

GCPL Remarks:

735

43.8

31.7

25.4

26.3

26.8

27.5

796

Godrej Consumer Products Ltd (GCPL) is a major player in the Indian fast-moving consumer goods (FMCG) market with a strong presence in the personal care, hair care and home care segments in India. The recent acquisitions (in line with the 3x3 strategy) have immensely improved the long-term growth prospects of the company. On the back of strong distribution network, and advertising and promotional support, we expect GCPL to sustain the market share in its core categories of soap and hair colour in the domestic market. On the other hand, continuing its strong growth momentum, the household insecticide business is expected to grow by ~20% YoY. In the international markets, the Indonesian and Argentine businesses are expected to achieve a CAGR of around 20% and 35% respectively over FY2012-14. This along with the recently acquired Darling Group would help GCPL to post a top-line CAGR of ~23% over FY2012-14. Due to the recent domestic and international acquisitions, the companys business has transformed from a commodities soap business into the business of value-added personal care and home care products. Therefore, we expect its OPM to be in the range of 16-18% in the coming years. Overall, we expect GCPLs bottom line to grow at a CAGR of above 30% over FY2012-14. We believe the increased competitive activity in the personal care and hair care segments and the impact of high food inflation on the demand for its products are the key risks to the companys profitability. At the current market price, the stock trades at 31.7x its FY2013E EPS of Rs23.2 and 25.4x its FY2014E EPS of Rs29.0.

Sharekhan

November 2012

sharekhan top picks Name CMP (Rs) ICICI Bank Remarks: 1,099 FY12 19.6 PER (x) FY13E 16.3 FY14E 14.6 FY12 11.2 RoE (%) FY13E 12.3 FY14E 12.7 Price target 1,230 Upside (%) 12

ICICI Bank continues to report strong growth in advances (up 17.6% YoY in Q2FY2013) with stable margins of 3.0%. We expect the advances of the bank to grow by 20% CAGR over FY2012-14. This should lead to a 13% CAGR growth in the net interest income in the same period. ICICI Banks asset quality has shown a turnaround as its NPAs have continued to decline over the last eight quarters led by contraction in slippages. This has led to a sharp reduction in the provisions and an increase in the profitability. Going forward, we expect the NPAs to decline further which will lead to lower NPA provisions and hence aid the profit growth. Led by a pick-up in the business growth and an improvement in the margins the RoEs are likely to expand to about 13% over the by 13% in FY14 (consolidated RoE ~15%) while the RoA would improve to 1.5%. This would be driven by a 16% CAGR in profits over FY2012-14. The stock trades at 1.8x FY2014E book value. We expect the stock to re-rate, given the improvement in the profitability led by lower NPA provisions, a healthy growth in the core income and improved operating metrics. We recommend Buy with a price target of Rs1,230.

Larsen & Toubro Remarks:

1,667

24.0

21.2

18.9

18.1

17.7

17.3

1,788

Larsen & Toubro (L&T), the largest engineering and construction company in India, is a direct beneficiary of the strong domestic infrastructure development and industrial capital expenditure (capex) boom. L&T continues to impress us with its good execution skills, reporting decent numbers throughout this year despite the slowdown in the industrial capex cycle. While there has been a growth of 11% YoY in its order backlog to Rs158,528 crore, the order inflow remained rather muted (excluding spill-over orders) in Q2FY2013. Despite challenges like deferral of award decisions and stiff competition, the company has given robust guidance of 15-20% in revenue and order inflow for FY2013. While this seems an uphill task, it instills confidence amongst the investors. Though the company reported overall decent results for the quarter, but the order inflow guidance would be highly subjective to an uptick in the infrastructure development activities in the country and in the Middle East region. Sound execution track record, bulging order book and strong performance of its subsidiaries reinforce our faith in L&T. With the company entering new verticals, namely solar and nuclear power, railways, and defence, there appears a huge scope for growth. At the current market price, the stock is trading at 18.9x its FY2014E stand-alone earnings and at an EV/EBIDTA of 11x.

Sharekhan

November 2012

sharekhan top picks Name CMP (Rs) M&M Remarks: 945 FY12 21.0 PER (x) FY13E 18.2 FY14E 19.0 FY12 22.8 RoE (%) FY13E 22.1 FY14E 18.4 Price target 949 Upside (%) 0

Mahindra & Mahindra (M&M) is a strong rural India story benefiting from the rising agriculture incomes. The farm equipment sector is estimated to grow by 8% in H2FY2013 as compared with a decline in H1FY2013. Continued farm mechanisation following labour shortages and increasing non-agri uses would support the demand for tractors in the long term. The automotive sector is expected to grow by 10-12% in FY2013. The new launches, such as Qunato and Rexton, have expanded the existing UV portfolio. The pick-ups portfolio has benefited from the shift towards large pickups where M&M has a higher market share. The companys pricing power is better compared with the other OEMs because of its strong brand equity. It took price hikes aggressively to maintain the margins in both the automotive and the farm equipment division. The company is expected to launch Reva electric NXR and sub-four meter Verito in H2FY2013. Our SOTP-based price target for M&M is Rs949 per share as we value the core business at Rs721 a share and the subsidiaries at Rs228 a share. We recommend Buy on the stock.

Relaxo Footwear Remarks:

801

24.1

18.5

13.7

20.3

20.4

20.6

885

10

Relaxo Footwear is present in the Indian organised footwear market and is involved in the manufacturing and trading of footwear through its retail and wholesale networks. The companys top brands, namely Hawaii, Sparx, Flite and Schoolmate, have an established presence among their respective segments. The company has displayed an impressive growth rate in its top line and bottom line in the last couple of years and is expected to maintain the performance going forward. With an established distribution set-up and aggressive plans of opening own retail outlets called Relaxo Retail Shoppe, the company should be able to gain market share in the coming years. The softening rubber prices should provide a boost to the companys margins and profitability. We believe a rise in the raw material prices and a continuous slowdown in the discretionary spending remain the key risks to our volume and profitability estimates. At the current market price, the stock trades at 18.5x its FY2013E EPS of Rs43.2 and 13.7x its FY2014E EPS of Rs58.3.

Sharekhan

November 2012

sharekhan top picks Name CMP (Rs) Reliance Industries Remarks: 794 FY12 13.0 PER (x) FY13E 12.9 FY14E 12.2 FY12 11.2 RoE (%) FY13E 9.9 FY14E 9.7 Price target 915 Upside (%) 15

Reliance Industries Ltd (RIL) has a strong presence in the refining, petrochemical and upstream exploration business. The refining division of the company is the highest contributor to the companys earnings and is operating efficiently with a better gross refining margin (GRM) compared with its peers in the domestic market due to the ability of its plant to refine more of heavier crude. However, the gas production from the Krishna-Godavari-D6 field has fallen significantly in the past one year. With the government approval for additional capex, we believe production will improve going ahead. In case of refining, the GRM, which had improved sharply in Q2FY2013, showed signs of correction in recent times. We believe the GRM is likely to be stable in the coming quarters. In the petrochemical business, the companys margins are close to bottoming out (with a sharp correction in Q1FY2013). In H2FY2013, we could see an improvement in the margin that will support the overall profitability of the company. In case of the upstream exploration business, the company has recently got the nod for further investments in exploration at the Krishna-Godavari basin, which augurs well for the company and could address the issue of falling gas output. The key concern remains in terms of a lower than expected GRM, profitability of the petrochemical division and the companys inability to address the issue of falling gas output in the near term. At the current market price the stock is trading at PE of 12.2x its FY2014E EPS.

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

Disclaimer This document has been prepared by Sharekhan Ltd.(SHAREKHAN) This Document is subject to changes without prior notice and is intended only for the person or entity to which it is addressed to and may contain confidential and/or privileged material and is not for any type of circulation. Any review, retransmission, or any other use is prohibited. Kindly note that this document does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report. The information contained herein is from publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies, their directors and employees (SHAREKHAN and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. We do not represent that information contained herein is accurate or complete and it should not be relied upon as such. This document is prepared for assistance only and is not intended to be and must not alone betaken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. SHAREKHAN & affiliates may have used the information set forth herein before publication and may have positions in, may from time to time purchase or sell or may be materially interested in any of the securities mentioned or related securities. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. Any comments or statements 2012 November made herein are those of the analyst and do not necessarily reflect those of SHAREKHAN.

Sharekhan

Вам также может понравиться

- Freeman Status PapersДокумент18 страницFreeman Status PapersDavid BrysonОценок пока нет

- Elliott Wave Crib SheetДокумент5 страницElliott Wave Crib SheetKKenobi100% (7)

- This Study Resource Was: Case: San Miguel in The New MillenniumДокумент2 страницыThis Study Resource Was: Case: San Miguel in The New MillenniumBaby BabeОценок пока нет

- Man Company investment income from Kind CorpДокумент12 страницMan Company investment income from Kind Corpbobo kaОценок пока нет

- Clean and Dirty PriceДокумент4 страницыClean and Dirty PriceAnkur GargОценок пока нет

- Audit Materiality and TolerancesДокумент8 страницAudit Materiality and TolerancesAlrac GarciaОценок пока нет

- Sharekhan Top Picks: January 01, 2013Документ7 страницSharekhan Top Picks: January 01, 2013Rajiv MahajanОценок пока нет

- Sharekhan recommends Axis Bank, BHEL, Cadila Healthcare in October 2012 Top PicksДокумент7 страницSharekhan recommends Axis Bank, BHEL, Cadila Healthcare in October 2012 Top PicksSoumik DasОценок пока нет

- Sharekhan Top Picks for February 2013Документ7 страницSharekhan Top Picks for February 2013nit111Оценок пока нет

- Nivesh Stock PicksДокумент13 страницNivesh Stock PicksAnonymous W7lVR9qs25Оценок пока нет

- SharekhanTopPicks 030811Документ7 страницSharekhanTopPicks 030811ghachangfhuОценок пока нет

- HDFC Bank: CMP: INR537 TP: INR600 NeutralДокумент12 страницHDFC Bank: CMP: INR537 TP: INR600 NeutralDarshan RavalОценок пока нет

- Axis Bank Q4FY12 Result 30-April-12Документ8 страницAxis Bank Q4FY12 Result 30-April-12Rajesh VoraОценок пока нет

- SharekhanTopPicks 070511Документ7 страницSharekhanTopPicks 070511Avinash KowkuntlaОценок пока нет

- Sharekhan Top PicksДокумент7 страницSharekhan Top PicksLaharii MerugumallaОценок пока нет

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapДокумент7 страницSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriОценок пока нет

- Initiating Coverage HDFC Bank - 170212Документ14 страницInitiating Coverage HDFC Bank - 170212Sumit JatiaОценок пока нет

- Loblaws Writting SampleДокумент5 страницLoblaws Writting SamplePrakshay Puri100% (1)

- Top 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The SameДокумент4 страницыTop 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The Sameapi-234474152Оценок пока нет

- Maruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsДокумент9 страницMaruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsAmritanshu SinhaОценок пока нет

- Diwali Icici 081112Документ8 страницDiwali Icici 081112Mintu MandalОценок пока нет

- IDFC Bank: CMP: Inr50 TP: INR65 (+30%)Документ12 страницIDFC Bank: CMP: Inr50 TP: INR65 (+30%)darshanmaldeОценок пока нет

- Mid-Cap Marvels: RCM ResearchДокумент20 страницMid-Cap Marvels: RCM ResearchmannimanojОценок пока нет

- Top Picks Sep 2012Документ15 страницTop Picks Sep 2012kulvir singОценок пока нет

- (Kotak) ICICI Bank, January 31, 2013Документ14 страниц(Kotak) ICICI Bank, January 31, 2013Chaitanya JagarlapudiОценок пока нет

- Rambling Souls - Axis Bank - Equity ReportДокумент11 страницRambling Souls - Axis Bank - Equity ReportSrikanth Kumar KonduriОценок пока нет

- Top PicksДокумент7 страницTop PicksKarthik KoutharapuОценок пока нет

- Muhurat Picks 2012 Muhurat Picks 2012 Muhurat Picks 2012Документ8 страницMuhurat Picks 2012 Muhurat Picks 2012 Muhurat Picks 2012Mahendra PratapОценок пока нет

- SharekhanTopPicks 31082016Документ7 страницSharekhanTopPicks 31082016Jigar ShahОценок пока нет

- Sharekhan top picks outperform in FY2010Документ6 страницSharekhan top picks outperform in FY2010Kripansh GroverОценок пока нет

- Bajaj Capital Centre For Investment Research: Buy HDFC BankДокумент9 страницBajaj Capital Centre For Investment Research: Buy HDFC BankShikhar KumarОценок пока нет

- Weekly Wrap: Investment IdeaДокумент4 страницыWeekly Wrap: Investment IdeaAnonymous 0JhO3KdjОценок пока нет

- CRISIL Research Ier Report Alok Industries 2012Документ38 страницCRISIL Research Ier Report Alok Industries 2012Akash MohindraОценок пока нет

- HDFC Bank - Visit Update - Oct 14Документ9 страницHDFC Bank - Visit Update - Oct 14Pradeep RaghunathanОценок пока нет

- HDFC 2qfy2013ruДокумент9 страницHDFC 2qfy2013ruAngel BrokingОценок пока нет

- Ambit - Highest Conviction Buys & Sells From AmbitДокумент11 страницAmbit - Highest Conviction Buys & Sells From Ambitmaamir2000Оценок пока нет

- Punjab National Bank: CMP: INR760 TP: INR964 Buy Asset Quality Deteriorates Asset-Liability Well-MatchedДокумент14 страницPunjab National Bank: CMP: INR760 TP: INR964 Buy Asset Quality Deteriorates Asset-Liability Well-MatchedDavid ThambuОценок пока нет

- Top Picks: Research TeamДокумент30 страницTop Picks: Research TeamPooja AgarwalОценок пока нет

- IndusInd Bank-2QFY14 Result Update - 15 October 2013 Longtermgrp++ NBДокумент4 страницыIndusInd Bank-2QFY14 Result Update - 15 October 2013 Longtermgrp++ NBdarshanmaldeОценок пока нет

- Ashiana Crisil PDFДокумент22 страницыAshiana Crisil PDFJaimin ShahОценок пока нет

- Federal BankДокумент20 страницFederal BankbbaalluuОценок пока нет

- Mid Cap Ideas - Value and Growth Investing 250112 - 11 - 0602120242Документ21 страницаMid Cap Ideas - Value and Growth Investing 250112 - 11 - 0602120242Chetan MaheshwariОценок пока нет

- HDFC 4Q Fy 2013Документ9 страницHDFC 4Q Fy 2013Angel BrokingОценок пока нет

- Investment Funds Advisory For Today: Buy Stock of Powergrid and IFGL Refractories LTDДокумент23 страницыInvestment Funds Advisory For Today: Buy Stock of Powergrid and IFGL Refractories LTDNarnolia Securities LimitedОценок пока нет

- When The Gap Between Perception and Reality Is The Maximum, Price Is The Best''Документ20 страницWhen The Gap Between Perception and Reality Is The Maximum, Price Is The Best''sukujeОценок пока нет

- India Equity Analytics: HCLTECH: "Retain Confidence"Документ27 страницIndia Equity Analytics: HCLTECH: "Retain Confidence"Narnolia Securities LimitedОценок пока нет

- First Source Solutions LTD - Karvy Recommendation 11 Mar 2016Документ5 страницFirst Source Solutions LTD - Karvy Recommendation 11 Mar 2016AdityaKumarОценок пока нет

- Simplex Infra ICДокумент7 страницSimplex Infra ICAyush KillaОценок пока нет

- Rambling Souls - Axis Bank - Equity ReportДокумент11 страницRambling Souls - Axis Bank - Equity ReportSrikanth Kumar KonduriОценок пока нет

- Savera HotelsДокумент21 страницаSavera HotelsMansi Raut Patil100% (1)

- BAFL: Lower Provisions A Key Factor - Maintain Hold': Morning BriefingДокумент2 страницыBAFL: Lower Provisions A Key Factor - Maintain Hold': Morning Briefingtrillion5Оценок пока нет

- Market Outlook 20th January 2012Документ11 страницMarket Outlook 20th January 2012Angel BrokingОценок пока нет

- Reliance Infrastructure 091113 01Документ4 страницыReliance Infrastructure 091113 01Vishakha KhannaОценок пока нет

- Axis Enam MergerДокумент9 страницAxis Enam MergernnsriniОценок пока нет

- Ranbaxy, 1st March, 2013Документ11 страницRanbaxy, 1st March, 2013Angel BrokingОценок пока нет

- ICICIdirect HDFCBank ReportДокумент21 страницаICICIdirect HDFCBank Reportishan_mОценок пока нет

- 2013 Year Strategy CLSAДокумент20 страниц2013 Year Strategy CLSAeknathОценок пока нет

- HDFC CenturionДокумент4 страницыHDFC CenturionurmishusОценок пока нет

- Analyst Report Issued by IIFL (Company Update)Документ16 страницAnalyst Report Issued by IIFL (Company Update)Shyam SunderОценок пока нет

- Qs - Bfsi - Q1fy16 PreviewДокумент8 страницQs - Bfsi - Q1fy16 PreviewratithaneОценок пока нет

- Balance Sheet Strain, Slower Project Execution: Reuters: HCNS - BO Bloomberg: HCC INДокумент4 страницыBalance Sheet Strain, Slower Project Execution: Reuters: HCNS - BO Bloomberg: HCC INAnanya DuttaОценок пока нет

- DCB Bank Buy Emkay ResearchДокумент23 страницыDCB Bank Buy Emkay ResearchGreyFoolОценок пока нет

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedДокумент24 страницыStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedОценок пока нет

- JainMatrix Investments Bajaj Finance Jan2012Документ6 страницJainMatrix Investments Bajaj Finance Jan2012Punit JainОценок пока нет

- Industry Report Card April 2018Документ16 страницIndustry Report Card April 2018didwaniasОценок пока нет

- Rbi Allowed Banks To Increase Limit From 10 To 15 PercentДокумент10 страницRbi Allowed Banks To Increase Limit From 10 To 15 PercentdidwaniasОценок пока нет

- 0hsie F PDFДокумент416 страниц0hsie F PDFchemkumar16Оценок пока нет

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveДокумент8 страницRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasОценок пока нет

- Information Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsДокумент8 страницInformation Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsdidwaniasОценок пока нет

- Idfc QTR FinancialsДокумент2 страницыIdfc QTR FinancialsdidwaniasОценок пока нет

- BandhanBank 15 3 18 PLДокумент1 страницаBandhanBank 15 3 18 PLdidwaniasОценок пока нет

- Weekly Technical PicksДокумент4 страницыWeekly Technical PicksMaruthee SharmaОценок пока нет

- Financials 7-11-08Документ6 страницFinancials 7-11-08didwaniasОценок пока нет

- APL Apollo Antique Stock Broking Coverage Aprl 17Документ17 страницAPL Apollo Antique Stock Broking Coverage Aprl 17didwaniasОценок пока нет

- Sensex AnalysisДокумент2 страницыSensex AnalysisdidwaniasОценок пока нет

- Bandhan Bank Building Strong Franchise Through Retail FocusДокумент13 страницBandhan Bank Building Strong Franchise Through Retail FocusdidwaniasОценок пока нет

- MARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodayДокумент2 страницыMARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodaydidwaniasОценок пока нет

- Sponge Iron Industry B K Oct 06 PDFДокумент30 страницSponge Iron Industry B K Oct 06 PDFdidwaniasОценок пока нет

- Shareholding Pattern BSEДокумент3 страницыShareholding Pattern BSEdidwaniasОценок пока нет

- Mawana FinancialsДокумент8 страницMawana FinancialsdidwaniasОценок пока нет

- Income & Growth One Pager 06302008Документ2 страницыIncome & Growth One Pager 06302008didwaniasОценок пока нет

- IDEA One PagerДокумент6 страницIDEA One PagerdidwaniasОценок пока нет

- 'A' Grade Turnaround: Associated Cement CompaniesДокумент3 страницы'A' Grade Turnaround: Associated Cement CompaniesdidwaniasОценок пока нет

- BHEL One PagerДокумент1 страницаBHEL One PagerdidwaniasОценок пока нет

- IFLEX One PagerДокумент1 страницаIFLEX One PagerdidwaniasОценок пока нет

- IAG+ +India+Strategy+ (June+08)Документ17 страницIAG+ +India+Strategy+ (June+08)api-3862995Оценок пока нет

- Citizens Guide 2008Документ12 страницCitizens Guide 2008DeliajrsОценок пока нет

- 24 Jun 08 - BHELДокумент4 страницы24 Jun 08 - BHELdidwaniasОценок пока нет

- The Subprime Meltdown: Understanding Accounting-Related AllegationsДокумент7 страницThe Subprime Meltdown: Understanding Accounting-Related AllegationsdidwaniasОценок пока нет

- HSBC Private Bank Strategy MattersДокумент4 страницыHSBC Private Bank Strategy MattersdidwaniasОценок пока нет

- IAG+ +India+Strategy+ (June+08)Документ17 страницIAG+ +India+Strategy+ (June+08)api-3862995Оценок пока нет

- CKP PresentationДокумент39 страницCKP PresentationdidwaniasОценок пока нет

- Sanjiv KaulДокумент18 страницSanjiv KaulsdОценок пока нет

- Kpo VsbpoДокумент3 страницыKpo VsbposdОценок пока нет

- Hatsun Supplier Registration RequestДокумент4 страницыHatsun Supplier Registration Requestsan dipОценок пока нет

- LIC Jeevan Anand Plan PPT Nitin 359Документ11 страницLIC Jeevan Anand Plan PPT Nitin 359Nitin ShindeОценок пока нет

- Chapter 29 PDFДокумент11 страницChapter 29 PDFSangeetha Menon100% (1)

- Symbiosis International University: Law of ContractsДокумент9 страницSymbiosis International University: Law of ContractsSanmati RaonkaОценок пока нет

- AДокумент6 страницAJuan Gabriel Garcia LunaОценок пока нет

- Bharat Raj Punj Versus Central Goods and Service Tax Commissionerate, Alwar Its Inspector (Anti Evasion)Документ2 страницыBharat Raj Punj Versus Central Goods and Service Tax Commissionerate, Alwar Its Inspector (Anti Evasion)Priyanshi DesaiОценок пока нет

- Vamsi Krishna Velaga - ITДокумент1 страницаVamsi Krishna Velaga - ITvamsiОценок пока нет

- Special Intake For 2022 Elite Lite Activity Bonus W.E.F. 1 Oct 2022Документ5 страницSpecial Intake For 2022 Elite Lite Activity Bonus W.E.F. 1 Oct 2022Kanaka DhasheneОценок пока нет

- Analysis of Surety ReservesДокумент14 страницAnalysis of Surety ReservesPaola Fuentes OgarrioОценок пока нет

- Exim PolicyДокумент11 страницExim PolicyRohit Kumar100% (1)

- Rosillo:61-64: 61) Pratts v. CAДокумент2 страницыRosillo:61-64: 61) Pratts v. CADiosa Mae SarillosaОценок пока нет

- About Ushar & Zakat 000000000000034 PDFДокумент3 страницыAbout Ushar & Zakat 000000000000034 PDFsyed Muhammad farrukh bukhariОценок пока нет

- Accounting EquationДокумент11 страницAccounting EquationNacelle SayaОценок пока нет

- Formula SheetДокумент5 страницFormula SheetAnna-Maria Müller-SchmidtОценок пока нет

- CtabДокумент11 страницCtabYonica Salonga De BelenОценок пока нет

- N - Chandrasekhar Naidu (Pronote)Документ3 страницыN - Chandrasekhar Naidu (Pronote)raju634Оценок пока нет

- Subject Outline FNCE20005 2018Документ7 страницSubject Outline FNCE20005 2018Claudia ChoiОценок пока нет

- Job Costing vs Process Costing: Key DifferencesДокумент2 страницыJob Costing vs Process Costing: Key DifferencesJayceelyn OlavarioОценок пока нет

- Investment Unit: Key Terms and ConceptsДокумент3 страницыInvestment Unit: Key Terms and ConceptsnhОценок пока нет

- Project Report On Market Survey On Brand EquityДокумент44 страницыProject Report On Market Survey On Brand EquityCh Shrikanth80% (5)

- TESCO worker plans retirement savings with 10% returnsДокумент8 страницTESCO worker plans retirement savings with 10% returnsTarun SukhijaОценок пока нет

- Introduction To Investment MGMTДокумент6 страницIntroduction To Investment MGMTShailendra AryaОценок пока нет

- Curriculam Vitae: Rohit Kumar GoyalДокумент2 страницыCurriculam Vitae: Rohit Kumar GoyalRohit kumar goyalОценок пока нет

- At 9004Документ12 страницAt 9004SirОценок пока нет