Академический Документы

Профессиональный Документы

Культура Документы

Confessions of A Share Trader - The Intrepid Investor Series (Part 1)

Загружено:

Matt BrennanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Confessions of A Share Trader - The Intrepid Investor Series (Part 1)

Загружено:

Matt BrennanАвторское право:

Доступные форматы

Confessions of a share trader The Intrepid Investor Series (Part 1) Matt Brennan My name is Matt Brennan, and it has

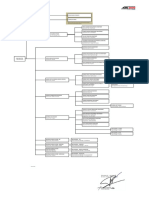

s been longer than 18 months since I could be officially classed as a highly active share trader. The practise of frequent share trading has acquired Omert status, which is the code of silence Mafioso used to protect their interests. In the same class as an expert magician, a high volume share trader would exercise maximum caution when divulging secrets as more profits can be earned from successful trades than publicising their secrets in even the most lucrative of book deals. Viewing the worlds of share trading from both sides, the intellectual property that share traders have been so adamant in protecting is merely the illusion that there is in fact one guaranteed secret of success. During the period from the 15/03/2010 to the 24/06/2010, I reinvested my opening capital of $3550 until it turned into $5820.78, or a profit of 63.97%. This figure factors in brokerage as well as the vast quantity of sms price alerts I used to monitor the entry and exit points for my selected stocks. Becoming an active trader was a product of circumstance and personality. Working at an accounting firm where share market banter was a lunch time staple, in conjunction with my enthusiasm for economics and the share market, it was largely inevitable that I would dabble in the share market. It was the meager return offered by my savings account which hastened my entry into the share market. My stock selection early on was not exactly based on fundamental analysis. Mount Burgess Mining, my first trade as a high volume trader (I previously bought BHP and CSL as longer term holds) was chosen merely because the ASX code was the same as my initials (MTB). Nonetheless 18% was made in a little over a month. Audax, or ADX Energy Ltd (ADX) as they are now known, was located through scrolling through the list of ASX codes starting with AAA. This trade turned out to be incredibly profitable, and was a good choice based on strong liquidity (based on a combination of trading volumes and market capitalisation) as well as having the necessary volatility to be successfully traded. But I was not thinking about these aspects at the time, and it was scary to consider that I could easily have invested in the later bankrupted ABC Learning Centres (ABC) or an array of other dud stocks at the time. Scattered throughout history are tales of people placing merit in hunches. Car dealership guru and Perthonality John Hughes told of one story at a recent high school reunion (we attended the same school, just a few decades apart) how he elected not to proceed with a business decision based on an upset stomach. Amazingly, after he confided within himself not to make the decision the ailment was gone and indeed he did make the right decision. Acclaimed author Steven Johnson in 2010 wrote the book Where good ideas come from, which demonstrates the notion that chance and serendipity play a big part in the innovation process. For a more concise read on the topic, refer to Hunches in bunches by Dr. Seuss. One of the few trading rules I had then that has survived to the present day is to have a minimum investment of $1000 per trade to ensure profits are not eaten alive by brokerage. Brokerage used to be $29.95 per buy and $29.95 per sell which only exacerbates what is displayed in the table below. Brokerage is currently $19.95 per buy/sell, for simplicity sake I have rounded this up to $20. The lowest possible trading order is $500 net brokerage (which means $520 must be initially invested)

and it is at the $1000 mark in which the law of diminishing returns becomes most noticeable (regardless of the gain %).

Share Trading Profit Spectrum

Amount Invested Buy Brokerage 10% Gain Sale Brokerage Gain Net Brokerage Realised Gain

$ $520 $1,020 $2,020 $5,020 $10,020 $20 $20 $20 $20 $20 $550 $1,100 $2,200 $5,500 $11,000 $20 $20 $20 $20 $20 $530 $1,080 $2,180 $5,480 $10,980 $10 $60 $160 $460 $960

% 1.92 5.88 7.92 9.16 9.58

It was Gordan Gekko in the blockbuster movie Wall Street who proclaimed greed is good. This is not always the case. If I were to do a where are they now analysis of the two companies that I frequently traded, Mount Burgess Mining is now trading at 0.002, (down 86.67% from when I sold) and ADX Energy Ltd is currently perched at 0.025, (down 86.84% from when I sold). Just as the investor should have a stop loss, they should also have in mind a profit taking threshold. I am still a trader, but only to the extent of 5-15 trades per year depending on market volatility and performance. This approach places higher levels of capital into more reputable stocks based on actual fundamental and chart analysis* as opposed to solely using a hunch. I would now rather chase a 6% return off $5,000 which yields approximately the same gain as a 30% return off $1,000 (there are slight differences in brokerage), as the more conservative companies offer the protection of a fully franked dividend, which from an income and tax perspective, is the gift that keeps on giving. *To get started on learning about fundamental analysis, I recommend downloading the free Stock Doctor software 14 day trial from the link below. http://www.lincolnindicators.com.au/stockmarketsoftware

Share Trading Profit Spectrum

Realised Gain %

10.00 8.00 6.00 4.00 2.00 $520 $1,020 $2,020 $5,020 $10,020

Вам также может понравиться

- Russian Roulette - Doing Business in RussiaДокумент2 страницыRussian Roulette - Doing Business in RussiaMatt BrennanОценок пока нет

- Pulp Fiction: The Juicy Tale of The Australian Citrus IndustryДокумент2 страницыPulp Fiction: The Juicy Tale of The Australian Citrus IndustryMatt BrennanОценок пока нет

- Wall Street Chronicle - November 2013 PDFДокумент10 страницWall Street Chronicle - November 2013 PDFMatt BrennanОценок пока нет

- Code Cracking - A Breakdown of The ASX (The Intrepid Investor Series Part 4)Документ3 страницыCode Cracking - A Breakdown of The ASX (The Intrepid Investor Series Part 4)Matt BrennanОценок пока нет

- Piñata Investments - The Intrepid Investor Series (Part 3)Документ3 страницыPiñata Investments - The Intrepid Investor Series (Part 3)Matt BrennanОценок пока нет

- 2012 Wall Street ChronicleДокумент4 страницы2012 Wall Street ChronicleMatt BrennanОценок пока нет

- The Truffle KerfuffleДокумент2 страницыThe Truffle KerfuffleMatt BrennanОценок пока нет

- Currency SwapДокумент3 страницыCurrency SwapMatt BrennanОценок пока нет

- Youth Policy - The Future of Perth Business Has Never Looked BrighterДокумент4 страницыYouth Policy - The Future of Perth Business Has Never Looked BrighterMatt BrennanОценок пока нет

- The Naked Truth: Disrobing The Energy and Clean Tech SectorsДокумент2 страницыThe Naked Truth: Disrobing The Energy and Clean Tech SectorsMatt BrennanОценок пока нет

- The Art of The Candlestick Chart - The Intrepid Investor Series (Part 2)Документ3 страницыThe Art of The Candlestick Chart - The Intrepid Investor Series (Part 2)Matt BrennanОценок пока нет

- Advice You Can Bank OnДокумент2 страницыAdvice You Can Bank OnMatt BrennanОценок пока нет

- MISmanagedДокумент3 страницыMISmanagedMatt BrennanОценок пока нет

- There's Something About DairyДокумент2 страницыThere's Something About DairyMatt BrennanОценок пока нет

- Cliff Hanger - The US Fiscal CliffДокумент2 страницыCliff Hanger - The US Fiscal CliffMatt BrennanОценок пока нет

- Bargain HuntingДокумент3 страницыBargain HuntingMatt BrennanОценок пока нет

- Bargain HuntingДокумент3 страницыBargain HuntingMatt BrennanОценок пока нет

- Mined, Sealed, Withered - WA's Resource Boom Aftermath.Документ2 страницыMined, Sealed, Withered - WA's Resource Boom Aftermath.Matt BrennanОценок пока нет

- Mined, Sealed, Withered - WA's Resource Boom Aftermath.Документ2 страницыMined, Sealed, Withered - WA's Resource Boom Aftermath.Matt BrennanОценок пока нет

- The Matrix (BCG Edition)Документ2 страницыThe Matrix (BCG Edition)Matt BrennanОценок пока нет

- Cliff Hanger - The US Fiscal CliffДокумент2 страницыCliff Hanger - The US Fiscal CliffMatt BrennanОценок пока нет

- Stamp of ApprovalДокумент2 страницыStamp of ApprovalMatt BrennanОценок пока нет

- Cliff Hanger - The US Fiscal CliffДокумент2 страницыCliff Hanger - The US Fiscal CliffMatt BrennanОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- SWIFT Message Type Reference: Category 1 MessagesДокумент13 страницSWIFT Message Type Reference: Category 1 Messagessamba_luckyОценок пока нет

- Statement of Financial PositionДокумент4 страницыStatement of Financial PositionRandom AcОценок пока нет

- FDGFDSGDFGДокумент3 страницыFDGFDSGDFGJesus Colin CampuzanoОценок пока нет

- Multi Bagger AnalysisДокумент3 страницыMulti Bagger AnalysisKrishnamoorthy SubramaniamОценок пока нет

- Capital Small Finance Bank LimitedДокумент119 страницCapital Small Finance Bank Limitedriya sethОценок пока нет

- Chapter 6 International Banking and Money Market 4017Документ23 страницыChapter 6 International Banking and Money Market 4017jdahiya_1Оценок пока нет

- Financial Statements For The Half-Year ENDED 31 MAY 2022: Snowfit Group BerhadДокумент12 страницFinancial Statements For The Half-Year ENDED 31 MAY 2022: Snowfit Group BerhadJeff WongОценок пока нет

- PDF Volatility Index DD - PDFДокумент22 страницыPDF Volatility Index DD - PDFJeffОценок пока нет

- KskdraftДокумент356 страницKskdraftadhavvikasОценок пока нет

- 06 Task Performance 1Документ5 страниц06 Task Performance 1LunaОценок пока нет

- Chapter 06Документ41 страницаChapter 06nadeemОценок пока нет

- Behaviour of Short Run CurvesДокумент18 страницBehaviour of Short Run Curvesshashwat shuklaОценок пока нет

- A-Passive Residual Theory of Dividends: 1. Explain The Following TermsДокумент8 страницA-Passive Residual Theory of Dividends: 1. Explain The Following TermsJemmy RobertОценок пока нет

- MBA - AFM - Inflation AccountingДокумент20 страницMBA - AFM - Inflation AccountingVijayaraj JeyabalanОценок пока нет

- Variable and Absorption CostingДокумент5 страницVariable and Absorption CostingAllan Jay CabreraОценок пока нет

- CRISIL Research Ier Report Fortis HealthcareДокумент28 страницCRISIL Research Ier Report Fortis HealthcareSai SantoshОценок пока нет

- MOP-Capital Theory Assignment-020310Документ4 страницыMOP-Capital Theory Assignment-020310charnu1988Оценок пока нет

- 4 2004 Jun QДокумент10 страниц4 2004 Jun Qmonazdeo9418Оценок пока нет

- Competitors Analysis With 4 Others Bank: Total AssetДокумент3 страницыCompetitors Analysis With 4 Others Bank: Total AssetMd. Muhinur Islam AdnanОценок пока нет

- Question and Answer - 34Документ31 страницаQuestion and Answer - 34acc-expertОценок пока нет

- True or False-Conceptual Framework and Accounting StandardsДокумент3 страницыTrue or False-Conceptual Framework and Accounting StandardsSaeym SegoviaОценок пока нет

- Comparison Nike Adidas PerformanceДокумент20 страницComparison Nike Adidas Performancenewhunter2010Оценок пока нет

- Chapter 6 - Portfolio Evaluation and RevisionДокумент26 страницChapter 6 - Portfolio Evaluation and RevisionShahrukh ShahjahanОценок пока нет

- Update Terbaru Struktur Organisasi Agt2022Документ2 страницыUpdate Terbaru Struktur Organisasi Agt2022fmanggraОценок пока нет

- Case Summary FMДокумент7 страницCase Summary FMnrngshshОценок пока нет

- Risk Metrics Technical Doc 4ed PDFДокумент296 страницRisk Metrics Technical Doc 4ed PDFjamilkhannОценок пока нет

- Credit RatingДокумент33 страницыCredit RatingPALLAVI DUREJAОценок пока нет

- Anglais L3.S2Документ36 страницAnglais L3.S2Romain MizrahiОценок пока нет

- Session 7 - Equity - For Students and MoodleДокумент74 страницыSession 7 - Equity - For Students and Moodless9723Оценок пока нет

- Fundamental Analysis 12Документ5 страницFundamental Analysis 12Pranay KolarkarОценок пока нет