Академический Документы

Профессиональный Документы

Культура Документы

Hight

Загружено:

Aditya ChauhanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Hight

Загружено:

Aditya ChauhanАвторское право:

Доступные форматы

Tenth AIMS International Conference on Management

January 6-9, 2013

Performance and Sustainability of Microfinance Institutions in India

Zohra Bi Ajita Poudel Junaid Saraf zohra.bi@alliance.edu.in ajitapoudel@gmail.com junaid_saraf@yahoo.com Alliance University, Bangalore Abdullah Yousuf yousufaroma@gmail.com Krupanidhi Business School, Bangalore Aatika Bi Aatikakhan@ymail.com Mount Carmel College

Microfinance in India has been viewed as a development tool which would alleviate poverty. India is a country which has the highest number of households which are excluded from banking. With Andhra crisis and issues that microfinance institutions have a mission drift, the aim of the paper is to study the performance and efficiency of microfinance. A sample of MFI's have been selected based on their ratings given by MIX for the study. The performance of these sample MFIs as well as their performance with respect to commercial banks in India have been studied using statistically tools Keywords: Microfinance, financial inclusion, MFIs, MIX.

1. Introduction

Microfinance in India has been viewed as a development tool which would alleviate poverty and enhance growth of the country through financial inclusion.1According to the M-CRIL Microfinance Review, India has the largest microfinance industry in the world with the phenomenal growth of 62% per annum in terms of numbers of unique clients and 88% per annum in terms of portfolio over the past five years and around 27 million borrower accounts. The high growth rate of microfinance has been fuelled by commercial bank funding which inherently gravitates towards forprofit institutional structures. Thus, there is a continued India-wide trend towards the transformation of MFIs into for-profit non-bank finance companies (NBFCs) so that over 50% of the 66 MFIs in the M-CRIL analysis now consist of such institutions. At the regional level, the South continues to dominate the sector in concentration of numbers of MFIs. However, there are some MFIs which now have multistate operations and cannot be clearly categorized as working in a particular region. Such MFIs have been grouped as All India for the purpose of analysis. The rush to be regulated (as NBFCs) along with the push for growth has become the dominant characteristic of Indian microfinance according to the report. 2Out of 6 lakh villages in India, only approximately 50000 have access to finance. India is a country which has the highest number of households which are excluded from banking. With the Andhra crisis of microfinance institutions and issues that microfinance institutions have a mission drift, the aim of the paper is to study the performance and Operating efficiency of microfinance institutions and its contribution to the Indian economy. Based on the analysis, the performance of the microfinance institutions and their impact on financial inclusion, the various issues faced by the microfinance institutions and the recommendations to overcome those obstacles have been found.

1 2

M-CRIL Microfinance Review, November 2011, www.mcril.com. Rajarshi Ghosh research paper Microfinance in India: A critique, the evolution of microfinance in empowerment of women and poverty alleviation is studied. Microfinance is viewed as an important tool for providing self employment for the low income rural population. 2509

Tenth AIMS International Conference on Management

January 6-9, 2013

According to the research paper Performance Analysis for a Sample of Microfinance Institutions in India by Alain de Crombrugghe, Michael Tenikue and Julie Sureda(2007), the self-sustainability of a sample of microfinance institutions in India was studied. This paper studies three important aspects of sustainability such as repayment of loans, financial self sustainability or operational self sustainability and cost-control or efficient use of resources. The greatest challenge faced by microfinance institutions is the trade-off between sustainability and outreach. This paper accesses the ability of the sample of MFIs to reach sustainability without affecting the outreach to the low income population. 4According to Rajarshi Ghosh in his research paper Microfinance in India: A critique, the evolution of microfinance in empowerment of women and poverty alleviation is studied. Microfinance is viewed as an important tool for providing self-employment for the low income rural population. This paper studies the various delivery models of microfinance institutions which contribute to women empowerment in India. The paper also studies about the various sources of finances available for Self-help groups and the various categories of microfinance institutions and the legal framework under which they are registered. The trend of outreach and sustainability of microfinance institutions are studied. 5The financial performance of microfinance institutions in India was studied by Pankaj K Agarwal and S.K.Sinha (2010). The sustainability of microfinance institutions is important in order to pursue their objectives through good financial performance. This paper studies the various players in the microfinance sector which range from notfor-profit organizations which work towards a developmental objective to commercial banks which view microfinance as a good source of deposits with sound banking and as a measure to reach their priority lending targets. The study also highlights the fact that though various tools are available for assessment of social performance, whereas there has not been a concrete tool for assessment of financial performance. The study 6Financial inclusion and microfinance in India: An overview by Jayasheela, Dinesha.P.T and V.Basil Hans (2008) studies the role of microfinance in the empowerment of people and provision of a sustainable credit availability to the rural low income population. The research studies the opportunities available for the microfinance institutions with an increasing demand for credit in the rural areas due to inadequate formal sources of credit. The paper also studies the role and importance of financial inclusion in the Indian financial system, the various approaches to financial inclusion, the role of banks in bringing about financial inclusion and the importance of the SHG-Bank linkage program in financial inclusion. The paper 7The Microfinance promise in Financial Inclusion: Evidence from India by Naveen K.Shetty and Dr.Veerashekharappa (2009) studies the importance of microfinance in bringing about financial inclusion. The paper studies impact of the increasing gap in demand and supply of financial services in India which has led to the increasing population of the country to be excluded from the formal financial credit system. Microfinance aims at reducing the nonavailability of credit to the rural population and the poor recovery performance of the existing financial institutions in the rural areas. Thus microfinance provides access to improve credit to the rural population and reduce the unbanked segment of population in the country. This paper studies the nature and type of institutions that have emerged in the Indian financial system to provide credit to the excluded population which do not access to formal credit. The study finds the importance of the SHG-Bank linkage model and the MFI models in the Indian financial system and identifies the growing new microfinance institutions and also the NGOs which are transforming themselves into financial institutions, therefore providing credit to the rural low income population. The research paper 8Microfinance: A new Mantra for rural development by ReetaRautela, Gaurav Pant, Dr.Swati Anand and Deepika Sharma studies the evolution of microfinance institutions in India. Microfinance is viewed as a development tool both in the local and he global environment. With

2. Literature Review

According to the research paper Performance Analysis for a Sample of Microfinance Institutions in India by Alain de Crombrugghe, Michael Tenikue and Julie Sureda(2007), the self-sustainability of a sample of microfinance institutions in India was studied. This paper studies three important aspects of sustainability such as repayment of loans, financial self sustainability or operational self sustainability and cost-control or efficient use of resources. 4Rajarshi Ghosh in his research paper Microfinance in India: A critique 5financial performance of microfinance institutions in India was studied by Pankaj K Agarwal and S.K.Sinha (2010) 6Financial inclusion and microfinance in India: An overview by Jayasheela, Dinesha.P.T and V.Basil Hans (2008) 7The Microfinance promise in Financial Inclusion: Evidence from India by Naveen K.Shetty and Dr.Veerashekharappa (2009) 8Microfinance: A new Mantra for rural development by Reeta Rautela, Gaurav Pant, Dr.Swati Anand and Deepika Sharma 2510

Tenth AIMS International Conference on Management

January 6-9, 2013

approximately 70% of population in India living in rural areas and with about 26% of population living below the poverty line, microfinance in India is considered to be an important tool for poverty alleviation and rural development.

Problem Definition:

Microfinance is considered to be an important tool to bring about financial inclusion and poverty alleviation. Most of the microfinance institutions face the issue that they have a mission drift in their objectives. Some of the microfinance institutions are profit-oriented, transform into NBFCs and focus less on staff training, group formation and monitoring. This in turn leads to inefficient functioning of the microfinance institutions and hence higher repayment defaults. Thus there is need for proper and efficient regulation of policies and practices for sustainable functioning of the MFIs which would lead to the objective of financial inclusion.

Objectives of the Study:

To study the contribution and growth of Indian microfinance in the financial system. To study the outreach of the Indian microfinance institutions and its implications for financial inclusion. To study the operating efficiency and portfolio quality of Indian microfinance institutions.

Research Methodology:

Data sources: The data collected for the study includes secondary data. The various sources used to collect secondary data include research papers, journals, articles, annual reports of the company and data from the Microfinance information exchange (MIX) and various other websites. Methods: The methodology of study includes collection of secondary data from various research articles and journals. The secondary data collected is further analysed using statistical tools to draw conclusions based on the results obtained.

Contribution And Growth Of Indian Microfinance In The Financial System:

India is considered to have the worlds largest microfinance sector in the world. 9The banking sector comprised of 169 commercial banks (as of 2011-2012). The regional rural banks have been reported to be 82 in number after it has been consolidated from 196. The consolidation process of the regional rural banks has been started in 1996. Also, in 1996, the local area banks were mandated to be set up by Reserve Bank of India. The Indian financial system also in addition, comprises of 12740 non-banking finance companies (NBFC) (as of March 2009). Out of these 12740 NBFCs, 336 NBFCs have been permitted by Reserve Bank of India to accept public deposits. The financial system also comprises of 31 state cooperative banks and 371 district Central Cooperative Banks (DCCBs). The objective of the cooperative banks are such that they are required to provide crop and other working capital loans, especially for short term purposes to the rural artisans and the farmers. These loans are either sanctioned directly by the cooperative banks or by financing through primary agricultural cooperatives operating in their respective areas whereas in the urban areas, the financial services of banks and NBFCs have been supplemented by the operations and services of urban cooperative banks. It has been reported by the World Banks financial access Survey in two states in India namely Uttar Pradesh and Andhra Pradesh in 2003 that almost 59% of the rural households in those states do not have access to credit from a formal source. With so many opportunities available to provide credit to the low income families, the microfinance sector has emergence with a tremendous growth with a total of around 70 million accounts (as of March 2010). This shows clearly that India has emerged as a leading worlds largest microfinance market.

Region wise distribution of MFIs:

According to the data obtained from M-cril, it has been evident that the microfinance institutions have predominantly been established in the southern region. The microfinance institutions which have a nationwide presence have been classified as All-India MFIs. These All India MFIs constitute majority of the L-10 MFIs in India and comprise of a larger proportion of borrowers when compared to the other legal forms of MFIs in

Annual Policy Statement for the Year 2011-12 www.rbi.org by Dr Subbaroa Governor 2511

Tenth AIMS International Conference on Management

January 6-9, 2013

India. The region wise distribution of MFIs based on their number of active borrowers and legal forms have been explained later in the report. The region wise distribution of MFIs in India is shown in the graph as follows:

Region wise distribution of Microfinance institutions in India Source: M-cril Microfinance Review 2010 Almost two thirds of the microfinance institutions have been concentrated in the states of Andhra Pradesh, Karnataka and Tamil Nadu. The presence of microfinance institutions predominantly in the south is due to various reasons as follows: The SHG-Bank linkage program was originated in Karnataka by the initiatives taken by the nongovernmental organization MYRADA as well as involved greater participation from banks such as Canara Bank and Syndicate Bank in the program. Better governance practices in the South which has led the NGOs to develop into a good quality NGO and has helped in the transformation of those quality NGOs into NBFC MFIs. The local population who have a greater literacy rate and participation rates of women which have led to the establishment of the MFIs in the southern local economy which has in turn led to their growth. Presence of larger number of NGOs in the South.

Outreach of the Indian Microfinance Institutions and its Implications for Financial Inclusion Outreach:

Figure 4: Clients served by MFIs in India 2010 Source: M-cril Microfinance Review 2010 According to the data collected from M-cril, it can be seen from the above graph that the maximum number of credit accounts in India has been serviced by the NBFCs. It has been reported by the survey conducted by

2512

Tenth AIMS International Conference on Management

January 6-9, 2013

M-cril, that out of the total number of credit accounts of about 26 million, nearly 22 million are serviced by NBFC MFIs. Also, nearly 77.2% of the borrower accounts were reported to be serviced by L-10 microfinance institutions when compared to only 59% in 2006. The total number of credit accounts of NBFC MFIs has increased to 84% in March 2010 when compared to 73% in 2006. The reason for this is the transformation of NGOs and other legal forms of MFIs into NBFCs in order to attain higher growth, to obtain easy access to funds from commercial banks as banks have a belief that the NBFCs has a good governance and a better management system and hence would be more profitable and sustainable.

Active Borrowers by Legal Type of MFI:

The transformation and growth of MFIs into NBFC MFIs is also evident from the graph shown below which compares the data of 2006 with that of 2010.

Active borrowers by Legal type of MFIs Source: M-cril Microfinance Review It is evident from the above graph the growth of NBFC MFIs from 73% in 2006 to 84% in 2010 because of their transformation and the decline in other legal forms of MFIs, such as section 25 companies from 21% in 2006 to 12% in 2010 and Cooperatives from about 6% in 2006 to just around 2% in 2010. The MFIs are densely concentrated in the southern region of India. This is because of the increasing low income population in the Southern regions. The L-10 MFIs alone which are described as All India MFIs alone comprise of about 57.2% borrower accounts and the MFIs present in the South comprise of nearly 24% of the borrower accounts.

Significance of MFIs in the Indian Financial System:

` Comparison of Microfinance credit accounts with other banks Source: www.rbi.org 2513

Tenth AIMS International Conference on Management

January 6-9, 2013

The microfinance sector consists of 26.7 million borrower accounts and the regional rural banks (RRBs) comprises of nearly 18.1 million borrower accounts. This shows the significance of the microfinance sector in the Indian financial system. The borrower accounts held by the MFIs contribute nearly 1.5 times the borrower accounts serviced by the RRBs as well as about 26% of the total number of small credit accounts serviced by the banking sector. It is reported by M-cril that the microfinance sector constitutes around 21% of the total number of small borrower accounts and 40% of the micro-accounts. It is also reported that the microfinance institutions service about 8% of the total population of around 220 million low income families in India which has been higher than that serviced by the regional rural banks and a proportion of the low income families served by the commercial banks in India.

Portfolio Size:

Distribution of Outstanding Portfolio by Legal Type Source: M-cril Microfinance Review 2010 The microfinance sector constitutes only a small proportion in the Indian financial system, but has shown a tremendous growth. The growth in bank credit was about 17.5% in 2008-2009 while the portfolio of the microfinance sector has reported a growth of 100%. Again, the NBFC MFIs have the highest portfolio outstanding when compared to the other legal forms. This growth in the microfinance sector again confirms the impact of and significance of the sector in the Indian financial system. It has been reported by M-cril, that as of March 2010, the portfolio of the microfinance sector is 0.64% of the total credit outstanding of the banking system, about 28% of the credit outstanding of the regional rural banks and nearly 20% of the credit outstanding of the district cooperative banks (DCCB). With this tremendous current growth rate, the microfinance sector would match and exceed the total portfolio the banking sector within the next few years. However the MFIs should maintain a sustainable growth which is considered even more important for the sector. The distribution of the microfinance institutions according to their portfolio size is shown in the graph below:

Portfolio size distribution of MFIs Source: M-cril Microfinance Review 2010 Most of the MFIs have a portfolio size of greater than Rs.100 crore. The microfinance institution which has a portfolio in excess of Rs.100 crore has been classified as systematically important non-deposit taking institutions by Reserve Bank of India. These MFIs are subject to stringent regulatory requirements when 2514

Tenth AIMS International Conference on Management

January 6-9, 2013

compared to the smaller NBFCs. These systematically important microfinance institutions account for nearly 93% of the portfolio.

Operating Efficiency and Portfolio Quality of Indian Microfinance Institutions

The efficient and effective operations for microfinance institutions are heavily dependent on their staff members. 10The efficiency of microfinance institutions can be studied by their staff productivity which is measured by the number of clients served per staff member.

Staff Productivity:

According to data given by M-cril, the data obtained for the accounts/ staff reported by the microfinance institutions to the microfinance information exchange (MIX) is depicted in the graph as follows:

Staff Productivity by Legal Type of MFIs Source: M-cril Microfinance Review 2010 The accounts/staff data shows that cooperatives are the most efficient among the legal types of microfinance institutions in India. The L-10 microfinance institutions have shown a 23% increase in productivity when compared to 2007. Also, the average of accounts/staff of the L-10 microfinance institutions is higher than the average of all the microfinance institutions surveyed by M-cril. Also, the staff productivity of microfinance institutions in India is higher when compared to the staff productivity of microfinance institutions in Asia (as of March 2010).

Average Clients/ Staff Ratio Source: M-Cril Microfinance Review The staff productivity of the microfinance institutions was higher when compared to the regional rural banks and the rural banking system. The reason for this is because of the size of the loan. The sizes of the loan provided by the RRBs are substantially higher when compared to the microfinance institutions. This is the reason that the clients/staff for the RRBs are less when compared to the microfinance institutions whereas the MFIs service their clients with smaller sizes of loan and hence the clients/staff are higher in case of MFIs. Also,

2515

Tenth AIMS International Conference on Management

January 6-9, 2013

the microfinance institutions are required to train their staff members so as to build a strong relationship with the borrowers and thus this would result in lower default rates.

Findings:

Objective.1: To study the contribution and growth of Indian microfinance in the financial system. The microfinance sector has been reported to be the fastest growing sector in India and is viewed as an important sector to bring about financial inclusion and in poverty alleviation. The study highlights that the microfinance institutions are concentrated in the southern regions of India and majority of the MFIs are NBFCs especially the large ten MFIs. This is because of transformation of NGO MFIs into NBFC MFIs for easy access to funds from banks. Although India is reported to be the fastest growing microfinance sector in the world, only the large ten MFIs have reported good growth as they have access to capital markets while a majority of other smaller MFIs are still dependent on grants and donations.

Objective.2: To study the outreach of the Indian microfinance institutions and its implications for financial inclusion. The large NBFC MFIs have the maximum outreach due to their efficiency, sustainability and in order to grow. Also, the NBFC MFIs have the maximum portfolio size because of large loan volumes and more number of active borrowers. The MFIs have the maximum number of active borrowers concentrated in the Southern region because of various reasons such as maximum number of NGOs in the South, high women participation, initiation of SHG-Bank linkage Program etc. The NBFC MFIs have the highest savings/deposit ratio. The huge amount of savings reduces the default risk by increasing the amount of average loan balance which has been secured by the member deposits.

Objective.3: To study the operating efficiency and portfolio quality of Indian microfinance institutions. The small size of loans of the microfinance institutions have resulted in higher staff productivity for the microfinance institutions when compared to the regional rural banks. The cost of servicing loans is reported to be low for MFIs compared to the previous years. The operating expenses of MFIs are high than the other financial systems in India because of the door delivery business model of MFIs. The new MFIs have higher operating costs as they concentrate more on growth and sustainability. The margins are wide for the microfinance institutions because of the higher interest rates charged by them, though these rates are low when compared to other countries and these high margins are earned by the NBFCs and the large 10 MFIs.

3. Recommendations

Microfinance institutions have faced a lot of issues about its performance and sustainability. Microfinance institutions have been viewed as an important tool in poverty alleviation and financial inclusion. It is an important sector which would improve the living conditions of the poor and lead to the development of the country. Some of the issues faced by microfinance institutions include high interest rates, multiple lending, coercive methods of recovery, lack of transparency etc. The MFIs incur high operating costs because of their business model which is the door step service delivery model. They incur these costs because of training of staff and small loan sizes. These higher operational costs are the major reason for the higher interest rates of the MFIs. These operating costs could be reduced by the use of technology. Mobile banking would also provide a valuable tool for reducing costs. Technology is an important tool in building operating system for identification of borrowers and communication of data.

The UID (Unique Identification Program) project and the use of bio-metrics would serve as a valuable tool for the microfinance sector. This would provide sufficient details about the identity of the borrower. A separate agency such as CIBIL could be set up for the microfinance institutions to access the credit worthiness of the borrowers. This would reduce over-borrowing and control delinquency without resorting to coercive methods of recovery.

2516

Tenth AIMS International Conference on Management

January 6-9, 2013

Conclusion:

Microfinance has been an important tool in poverty alleviation, empowerment of women and in bringing about financial inclusion. However India has the highest number of households, about 145 million, which are excluded from the banking system. Also, out of the 6 lakh villages in India, only approximately 50000 have access to finance. (as on January 2011). Globally there are about 2.5 billion people which constitute nearly half of the worlds adult population do not use formal financial services (data as on January 2011). Out of these 2.5 billion, nearly 2.2 billion of the unbanked population live in Africa, Asia, Latin America and the Middle East. Hence there exists a great opportunity for the microfinance sector to provide credit to the low income population thereby reducing poverty and thus in the development of the country as a whole. Although the microfinance sector has reported an impressive growth, with the ordinances passed by the government, there is a lack of capital for some of the microfinance institutions in the country. Therefore, continuous efforts are required to diversify the sources of funding available for the microfinance institutions in order to attract foreign investments for well-established microfinance institutions in order to serve the rural low income population, increase efficiency of staff members, alleviate poverty and also make them profitable. Though the performance of microfinance institutions have improved significantly over the past years, sufficient regulatory and governance would help achieve the goal of poverty alleviation and financial inclusion and this could be achieved with the combined cooperation of banks, government and other players in the country. Thus with development of effective strategies and with the combined effort of all players in the society such as donors, government, banks, corporations, NGOs, etc, the long term goal of the government to achieve financial inclusion and poverty alleviation would be attained.

1. M-CRIL Microfinance Review, November 2011, www.mcril.com. 2. Rajarshi Ghosh research paper Microfinance in India: A critique, the evolution of microfinance in empowerment of women and poverty alleviation is studied. Microfinance is viewed as an important tool for providing self-employment for the low income rural population. 3. Alain de Crombrugghe, Michael Tenikue and Julie Sureda (2007), Annals of Public and Cooperative Economics 79:2 2008 pp. 269299 4. Rajarshi Ghosh in his research paper Microfinance in India: A critique 5. financial performance of microfinance institutions in India was studied by Pankaj K Agarwal and S.K.Sinha (2010) 6. Financial inclusion and microfinance in India: An overview by Jayasheela, Dinesha.P.T and V.Basil Hans (2008) 7. The Microfinance promise in Financial Inclusion: Evidence from India by Naveen K.Shetty and Dr.Veerashekharappa (2009) 8. Microfinance: A new Mantra for rural development by Reeta Rautela, Gaurav Pant, Dr.Swati Anand and Deepika Sharma 9. Financial performance of Microfinance Institutions: A comparison to performance of Regional Commercial banks by geographic regions by Michael Tucker and Gerald Miles 10. Performance and Sustainability of Self-Help Groups in India: A Gender Perspective by Purna Chandra Parida and Anushree Sinha (2010) 11. Performance and Transparency: A survey of Microfinance in South Asia by Blaine Stephens and Hind Tazi (2006) 12. Microfinance in India: Discussion by R.Srinivasan and M.S.Sriram

4. References

2517

Вам также может понравиться

- Abstract Ob After DoneДокумент6 страницAbstract Ob After DoneAditya ChauhanОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Abstract Ob After DoneДокумент6 страницAbstract Ob After DoneAditya ChauhanОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Bs PPT FulllДокумент8 страницBs PPT FulllAditya ChauhanОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Project Report On HRM On HR Policies of Sbi BankДокумент57 страницProject Report On HRM On HR Policies of Sbi BankAditya Chauhan60% (10)

- SBI Report Banking Sector Report On HRДокумент66 страницSBI Report Banking Sector Report On HRAditya ChauhanОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Furnish Your Dream - Com: Plan Your Living RoomДокумент1 страницаFurnish Your Dream - Com: Plan Your Living RoomAditya ChauhanОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Women EmpowerДокумент10 страницWomen EmpowerAditya ChauhanОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- ITC Chairman SpeaksДокумент11 страницITC Chairman SpeaksAditya ChauhanОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Choco DayДокумент26 страницChoco DayAditya ChauhanОценок пока нет

- Chocoday 1Документ26 страницChocoday 1Aditya ChauhanОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Women EmpowerДокумент10 страницWomen EmpowerAditya ChauhanОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

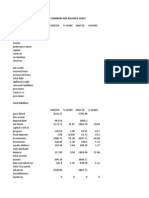

- Common Size Balance SheetДокумент9 страницCommon Size Balance SheetAditya ChauhanОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Muthoot Microfin Limited ChennaiДокумент79 страницMuthoot Microfin Limited ChennaivirtualatallОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- 2011.06.30 ASX Annual ReportДокумент80 страниц2011.06.30 ASX Annual ReportKevin LinОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- A STUDY On Financial Literacy Among Youths in MumbaiДокумент57 страницA STUDY On Financial Literacy Among Youths in Mumbaibhanushalidhruv59Оценок пока нет

- Root Capital: A Roadmap For ImpactДокумент32 страницыRoot Capital: A Roadmap For ImpactChris EngstromОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Financial Access and The Finance - Growth Nexus - Evidence From Developing Economies PDFДокумент16 страницFinancial Access and The Finance - Growth Nexus - Evidence From Developing Economies PDFSucatta IDОценок пока нет

- (Red Flags) Indicators of OID Source of Data: Over-Indebtedness Monitoring DashboardДокумент22 страницы(Red Flags) Indicators of OID Source of Data: Over-Indebtedness Monitoring DashboardKIMBERLY BALISACANОценок пока нет

- PNP Annual Report 2007-2008Документ8 страницPNP Annual Report 2007-2008partnersinprosperityОценок пока нет

- The Role of NGOs in Promoting EmpowermentДокумент8 страницThe Role of NGOs in Promoting EmpowermentpriyambansalОценок пока нет

- National Baseline Survey On Financial InclusionДокумент52 страницыNational Baseline Survey On Financial InclusionReal Ethan LopezОценок пока нет

- Feasibility ASKI Isabela PhilippinesДокумент96 страницFeasibility ASKI Isabela PhilippinesAyne Cabacungan50% (2)

- Tamansiswa Accounting Journal International Volume 8, No 1, January 2023Документ133 страницыTamansiswa Accounting Journal International Volume 8, No 1, January 2023suryaningОценок пока нет

- An Appraisal of Nigeria's Micro Small and Medium Enterprises MSMES Growth Challenges and Prospects.Документ15 страницAn Appraisal of Nigeria's Micro Small and Medium Enterprises MSMES Growth Challenges and Prospects.playcharles89Оценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- NGO List of PakistanДокумент168 страницNGO List of PakistanMansoor Siddique100% (1)

- Tigist BirhanuДокумент77 страницTigist Birhanuhabtamu100% (1)

- Strengthening Strategies of The Informal Sector in Traditional Market: An Institutional ApproachДокумент10 страницStrengthening Strategies of The Informal Sector in Traditional Market: An Institutional ApproachFirdaus DausОценок пока нет

- Arman Financial Services LTD (BSE Code 531179) - HBJ Capital's (MPS Unit) Business Insight Penny Stock Reco For June'10Документ52 страницыArman Financial Services LTD (BSE Code 531179) - HBJ Capital's (MPS Unit) Business Insight Penny Stock Reco For June'10sumansaha33Оценок пока нет

- VLOOKUPДокумент14 страницVLOOKUPJeetendra ShresthaОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Annual Report 2017Документ120 страницAnnual Report 2017mirzaОценок пока нет

- Final Presentation On Housing LoanДокумент40 страницFinal Presentation On Housing Loanadebo_yemiОценок пока нет

- Gbnews - Ch-Micro and Small Enterprises in Ethiopia Access To Credit Challenges and SolutionsДокумент6 страницGbnews - Ch-Micro and Small Enterprises in Ethiopia Access To Credit Challenges and Solutionsetebark h/michaleОценок пока нет

- The Definition of MicrofinanceДокумент6 страницThe Definition of MicrofinanceAyush BhavsarОценок пока нет

- SecuritizationДокумент10 страницSecuritizationSimon ChowОценок пока нет

- Financial InclusionДокумент25 страницFinancial InclusionSurbhi GuptaОценок пока нет

- Synopsis of MPhil PHD StudiesДокумент4 страницыSynopsis of MPhil PHD Studiestaiphi78Оценок пока нет

- A Study On The Performance of Microfinance InstituДокумент13 страницA Study On The Performance of Microfinance Institu娜奎Оценок пока нет

- Coop MGT - COOP - INSДокумент14 страницCoop MGT - COOP - INSJames ChuaОценок пока нет

- Frauds in Micro FinanceДокумент6 страницFrauds in Micro FinanceSyed MohammedОценок пока нет

- Microinsurance ProjectДокумент59 страницMicroinsurance Projectmayur9664501232Оценок пока нет

- Graduates of 2018/2019 AY: Eaching NstitutesДокумент256 страницGraduates of 2018/2019 AY: Eaching Nstitutesyimam seeidОценок пока нет

- Definition and Evolution of Microfinance PDFДокумент22 страницыDefinition and Evolution of Microfinance PDFKitt EmataОценок пока нет