Академический Документы

Профессиональный Документы

Культура Документы

Mutual Fund Questionnaire

Загружено:

Bhaumik TrivediАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mutual Fund Questionnaire

Загружено:

Bhaumik TrivediАвторское право:

Доступные форматы

Mutual Fund Marketplace

MUTUAL FUND QUESTIONNAIRE FOR NEW FUND FAMILIES Please return this fully completed questionnaire with the following: o two copies of the current Prospectus (including any supplements filed after Prospectus), o two copies of the current Statement of Additional Information (SAI), and the date of the

o one copy of the investment advisers current, composite Form ADV (Part I, Part II, and all applicable

Schedules including the Disclosure Reporting Page) for every Investment Adviser and every Sub-Adviser to the funds. Schwab absolutely requires that advisers attach any Schedules that relate to affirmative answers to disciplinary questions in ADV Item 11. Current, composite ADVs can be obtained from Disclosure, Inc., at 800-777-3272. PLEASE NOTE : Incomplete ADVs will delay the review process. In order for us to consider offering your fund(s) through the Mutual Fund Marketplace, your fund(s) must be operationally compatible with Schwabs platform. Accordingly, each fund must meet these basic operational requirements: o o o o o o o o o o o o o o Processes trades and settlements through NSCC Fund/SERV Settles all trades next day (T+1) through Fund/Serv or by wire, agreeing to consolidated wires for both purchases and redemptions Participates in NSCC Networking (Level 3) for omnibus and sub-accounts Participates in NSCC Mutual Fund Profile Service for pricing and dividends Provides Schwab with NAV on trade date prior to 7:00 p.m. EST Uses NSCC ACATS Fund/SERV settlement and B51/B52 Change of Dealer for transfers Accepts facsimile instructions in lieu of original paperwork transfers effected outside of ACATS Fund/SERV settlement Participates in DCC&S for retirement plan trades Provides Internet-based access to view Schwab's omnibus accounts and/or sub-accounts Fund waives initial and subsequent minimums and redemption fees for retirement plan accounts Is qualified for sale in all 50 states and Puerto Rico If the fund accrues dividends daily and pays monthly, accrual must begin on purchase settlement date and end on and up to and including the redemption trade date If the fund has retained the right to redeem in kind, it has filed a form N-18f-1 with the SEC If the fund has a front or back-end sales load, it will be waived for orders placed in Schwab accounts

The following conditions are incompatible with Schwabs Mutual Fund Marketplace. o o o o o o Contingent deferred sales charges or sales loads of any kind Loads assessed on reinvested distributions Redemption fees assessed according to methodology other than FIFO, based on number of calendar days Daily accrual funds that compound daily or with accrual methodology other than as specified above Money market funds Purchase fees

1 J: PROCEDURES BINDER/MF RG PROCEDURES 2001\MF QUESTIONNAIRE for NEW FUND FAMIILIES (03) 101766-1

Mutual Fund Marketplace

Additionally, if your fund(s) are approved for participation in the Mutual Fund Marketplace, the fund(s) will be required to enter into contracts with Schwab that will require, among other things, certain prospectus disclosures. In the event the following language does not currently appear in each funds prospectus, then Schwab will require that the prospectus be stickered accordingly. o o o o o Investors may be charged a fee if they effect transactions through broker or agent. The Fund has authorized one or more brokers to receive on its behalf purchase and redemption orders. Such brokers are authorized to designate other intermediaries to receive purchase and redemption orders on the Funds behalf. The Fund will be deemed to have received a purchase or redemption order when an authorized broker or, if applicable, a brokers authorized designee, receives the order. Customer orders will be priced at the Funds Net Asset Value next computed after they are received by an authorized broker or the brokers authorized designee.

2 J: PROCEDURES BINDER/MF RG PROCEDURES 2001\MF QUESTIONNAIRE for NEW FUND FAMIILIES (03) 101766-1

Mutual Fund Marketplace

1. Please provide the following information. If necessary, use multiple pages: Note: The following information is necessary in order start the fund add process once the due diligence review has been completed and approval has been obtained. In particular, the Registrants name is crucial to locating your funds filings on the EDGAR system, which will facilitate the contract preparation process. Inexact or incomplete information will delay the review process. Fund Name (provide the exact legal name of the fund as it appears in the most recent prospectus) 1 2 3 4 5 6 7 8 9 Share Class, if any Exact name of Registrant as specified in its charter (as filed with the SEC) Cusip number NASDAQ symbol, if available Date of inception Assets* # of shareholders** Portfolio Manager*** Years of Mutual Fund Management experience

$ $ $ $ $ $ $ $ $

* Amount of Assets shown above are as of the following date: ** Number of Shareholder shown above are as of the following date: *** If a Fund is managed by a team of portfolio managers, please provide the requested information for each member of the team. 2. With respect to each Registrant, please provide the following information. Name of Registrant 1 2 3 4 5 6 7 8 9 Years in operation D&O insurance? Yes Yes Yes Yes Yes Yes Yes Yes Yes No No No No No No No No No Amount of coverage $ $ $ $ $ $ $ $ $ Deductible $ $ $ $ $ $ $ $ $

3 J: PROCEDURES BINDER/MF RG PROCEDURES 2001\MF QUESTIONNAIRE for NEW FUND FAMIILIES (03) 101766-1

Mutual Fund Marketplace

3. Provide the following fund contact information. a. b. c. d. Name: Snail mail address: E-mail address: Telephone number:

4. Please provide the following information with respect to each investment adviser for each of the funds listed above. a. b. c. d. e. f. g. h. Investment adviser name: Number of years in operation: Number of years of 1940 Act Management experience: Total assets under management: $ Total assets under management at Schwab: $ E&O insurance Yes No Amount of coverage? $ Deductible $ No

Is the investment adviser an NASD member? Yes Please describe 1940 Act experience:

5. Please provide the following information with respect to each sub-adviser. Sub-adviser Fund Years in operation Years of Mutual Fund Management experience

1 2 3 4 5 6 7 8 9

4 J: PROCEDURES BINDER/MF RG PROCEDURES 2001\MF QUESTIONNAIRE for NEW FUND FAMIILIES (03) 101766-1

Mutual Fund Marketplace

6. Please list your other service providers and provide the requested contact information: Service Provider Administrator: Distributor/Underwriter: Transfer Agent: Shareholder Services: Custodian: Fund Accountant: Legal/Outside Counsel: Independent Auditors: Contact Person Phone Number

Disciplinary History: During the last five (5) years, has the Registrant, a fund, or the funds investment adviser or any affiliates that will provide services to the fund been a party to any material litigation or disciplinary action that is not reported on the Investment Advisers current Form ADV? Yes No If Yes, please attach a description of the material litigation or disciplinary action. Schwab also encourages advisors to attach additional, clarifying explanations over and above what is included in the Form ADV and its Disclosure Reporting Pages. Report of Independent Accountants: Has each Fund received a satisfactory report from its independent accountant relating to the Funds financial statements? Yes No If No, please attach a copy of the report. Has each Fund received a satisfactory report from its independent accountant relating to the Funds internal controls? Yes No If No, please attach a copy of the report or explain why the report is unavailable. By executing this Mutual Fund Questionnaire you affirm with respect to each of the Funds that: 1. The portfolio turnover for the Fund is consistent with the investment objectives of the Fund and adequately disclosed in the prospectus. Yes No

5 J: PROCEDURES BINDER/MF RG PROCEDURES 2001\MF QUESTIONNAIRE for NEW FUND FAMIILIES (03) 101766-1

Mutual Fund Marketplace

2. For Bond Funds, the regional exposure, duration and bond quality is consistent with the investment objectives of the Fund and adequately disclosed in the prospectus. Yes 3. For Equity Funds, the sector weighting, regional exposure, market capitalization and country exposure is consistent with the investment objectives of the Fund and and adequately disclosed in the prospectus. Yes SIGNATURE I, the undersigned, hereby certify that the information provided above is, to the best of my knowledge, true and correct as of the date set forth below. _______________________________________________ Signature _______________________________________________ Name (please print) _______________________________________________ Title _______________________________________________ Date No

No

6 J: PROCEDURES BINDER/MF RG PROCEDURES 2001\MF QUESTIONNAIRE for NEW FUND FAMIILIES (03) 101766-1

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 4th MAILING - Validation Letter - SampleДокумент6 страниц4th MAILING - Validation Letter - SampleJeromeKmt100% (20)

- 15 International Portfolio InvestmentДокумент36 страниц15 International Portfolio InvestmentBhaumik TrivediОценок пока нет

- Attendees Ef12Документ23 страницыAttendees Ef12Bhaumik TrivediОценок пока нет

- Web SiteДокумент3 страницыWeb SiteBhaumik TrivediОценок пока нет

- Attendees Ef12Документ23 страницыAttendees Ef12Bhaumik TrivediОценок пока нет

- 15 International Portfolio InvestmentДокумент36 страниц15 International Portfolio InvestmentBhaumik TrivediОценок пока нет

- 15 International Portfolio InvestmentДокумент36 страниц15 International Portfolio InvestmentBhaumik TrivediОценок пока нет

- Chapter4miscasestudymumbaidabbawalas 090416224648 Phpapp01Документ23 страницыChapter4miscasestudymumbaidabbawalas 090416224648 Phpapp01Bhaumik TrivediОценок пока нет

- Excel Training EbookДокумент57 страницExcel Training EbookGarima GandhiОценок пока нет

- 15 International Portfolio InvestmentДокумент36 страниц15 International Portfolio InvestmentBhaumik TrivediОценок пока нет

- Deepak Mohanty: Money Market and Monetary Operations in IndiaДокумент12 страницDeepak Mohanty: Money Market and Monetary Operations in IndiaBhaumik TrivediОценок пока нет

- Deepak Mohanty: Money Market and Monetary Operations in IndiaДокумент12 страницDeepak Mohanty: Money Market and Monetary Operations in IndiaBhaumik TrivediОценок пока нет

- Derivatives Chapter - 01Документ28 страницDerivatives Chapter - 01hk_iitmОценок пока нет

- 15 International Portfolio InvestmentДокумент36 страниц15 International Portfolio InvestmentBhaumik TrivediОценок пока нет

- Attractive Project TitlesДокумент1 страницаAttractive Project TitlesBhaumik TrivediОценок пока нет

- Derivatives Chapter - 01Документ28 страницDerivatives Chapter - 01hk_iitmОценок пока нет

- Impact of Television Advertisements On Buying Pattern of Women in Dhaka CityДокумент13 страницImpact of Television Advertisements On Buying Pattern of Women in Dhaka CityParthesh PandeyОценок пока нет

- Derivatives Chapter - 01Документ28 страницDerivatives Chapter - 01hk_iitmОценок пока нет

- Derivatives Chapter - 01Документ28 страницDerivatives Chapter - 01hk_iitmОценок пока нет

- July 29.2011 - Inclusion of Road Safety Education in School Curriculums SoughtДокумент1 страницаJuly 29.2011 - Inclusion of Road Safety Education in School Curriculums Soughtpribhor2Оценок пока нет

- Financial Analysts - Occupational Outlook Handbook - U.S. Bureau of Labor StatisticsДокумент6 страницFinancial Analysts - Occupational Outlook Handbook - U.S. Bureau of Labor StatisticsHannah Denise BatallangОценок пока нет

- ANSYS Meshing Users GuideДокумент520 страницANSYS Meshing Users GuideJayakrishnan P SОценок пока нет

- The Birds of Pulicat Lake Vs Dugarajapatnam PortДокумент3 страницыThe Birds of Pulicat Lake Vs Dugarajapatnam PortVaishnavi JayakumarОценок пока нет

- The LetterДокумент13 страницThe Letterkschofield100% (2)

- CD 116. Villaflor v. Summers, 41 Phil. 62 (1920)Документ1 страницаCD 116. Villaflor v. Summers, 41 Phil. 62 (1920)JMae MagatОценок пока нет

- Candlestick Charting: Quick Reference GuideДокумент24 страницыCandlestick Charting: Quick Reference GuideelisaОценок пока нет

- Beso v. DagumanДокумент3 страницыBeso v. DagumanMarie TitularОценок пока нет

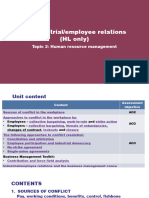

- 2.7 Industrial and Employee RelationДокумент65 страниц2.7 Industrial and Employee RelationadhityakinnoОценок пока нет

- Approach To Hackiing in Cameroon:Overview and Mitigation TechniquesДокумент14 страницApproach To Hackiing in Cameroon:Overview and Mitigation TechniquesWilly NibaОценок пока нет

- Punjab National BankДокумент28 страницPunjab National Bankgauravdhawan1991Оценок пока нет

- ASME - Lessens Learned - MT or PT at Weld Joint Preparation and The Outside Peripheral Edge of The Flat Plate After WДокумент17 страницASME - Lessens Learned - MT or PT at Weld Joint Preparation and The Outside Peripheral Edge of The Flat Plate After Wpranav.kunte3312Оценок пока нет

- The Marriage of King Arthur and Queen GuinevereДокумент12 страницThe Marriage of King Arthur and Queen GuinevereYamila Sosa RodriguezОценок пока нет

- Medieval India 2022 1007Документ30 страницMedieval India 2022 1007Kumar ShivrajОценок пока нет

- Facts:: Villarosa, Joan Cristine 2015-1635Документ3 страницыFacts:: Villarosa, Joan Cristine 2015-1635Tin VillarosaОценок пока нет

- Digest NegoДокумент9 страницDigest NegoMichael RentozaОценок пока нет

- Accounting For Cooperative SocietiesДокумент31 страницаAccounting For Cooperative SocietiesAbdul Kadir ArsiwalaОценок пока нет

- Advincula Vs TeodoroДокумент3 страницыAdvincula Vs TeodoroKeej DalonosОценок пока нет

- Combizell MHEC 40000 PRДокумент2 страницыCombizell MHEC 40000 PRToXiC RabbitsОценок пока нет

- Case 1 - Masters and Associates - Sasot GroupДокумент10 страницCase 1 - Masters and Associates - Sasot GroupRobin Venturina100% (1)

- Dyson Cylinder DC22 Vacuum User GuideДокумент16 страницDyson Cylinder DC22 Vacuum User Guidejames ryerОценок пока нет

- Exercise 2B: 1 A 700 G, As This Is The Most Often Occurring. B 500 + 700 + 400 + 300 + 900 + 700 + 700 4200Документ15 страницExercise 2B: 1 A 700 G, As This Is The Most Often Occurring. B 500 + 700 + 400 + 300 + 900 + 700 + 700 4200drsus78Оценок пока нет

- Stress Strain Curve For Ductile and Brittle MaterialsДокумент13 страницStress Strain Curve For Ductile and Brittle MaterialsDivyeshkumar MorabiyaОценок пока нет

- Bpats Enhancement Training ProgramДокумент1 страницаBpats Enhancement Training Programspms lugaitОценок пока нет

- Platform1 Server and HIO Configuration Guide V1.01Документ40 страницPlatform1 Server and HIO Configuration Guide V1.01sirengeniusОценок пока нет

- Political Teaching of T. HobbesДокумент15 страницPolitical Teaching of T. HobbesАЛЬБИНА ЖАРДЕМОВАОценок пока нет

- The Unity of The FaithДокумент2 страницыThe Unity of The FaithGrace Church ModestoОценок пока нет

- Table 1: Alagh Committee RecommendationsДокумент4 страницыTable 1: Alagh Committee RecommendationsNaveen Kumar Singh100% (1)

- Opposition To Motion To DismissДокумент24 страницыOpposition To Motion To DismissAnonymous 7nOdcAОценок пока нет