Академический Документы

Профессиональный Документы

Культура Документы

VU Accounting Lesson 27

Загружено:

ranawaseemИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

VU Accounting Lesson 27

Загружено:

ranawaseemАвторское право:

Доступные форматы

Financial Accounting - I – MGT101 VU

Lesson # 27

CONTROL ACCOUNT (Continued)

A person is both debtor and creditor:

This happens so many times in business that a person is both your debtor and creditor. This

means that you are purchasing one thing from him. So, you have to pay him against that

purchase and at the same time you are selling him another thing for which he has to pay you.

For example, you purchase item X from Mr. A for Rs. 50,000 and sell him item Y for Rs.

25,000. Now, one way of settling the payable and receivable is that you can pay Mr. X 50,000

and ask him to pay you Rs. 25,000. The other and may be the wiser method is that you pay him

Rs. 25,000 and both transactions are settled. This is how such transactions are handled in real

life.

Journal Entries

Normally where no control accounts are maintained, following entries will be recorded:

Debit: A (payable/creditor) account 25,000

Credit: A (receivable/debtor) account 25,000

o This will bring down the balance of A (receivable/debtor) account to 0 and that

of A (payable/creditor) account to 25,000. The other entry will be:

Debit: A (payable/creditor) account 25,000

Credit: Cash / Bank 25,000

o This will settle the payable account fully.

Where control accounts are being maintained the above two entries are still recorded but with

slight modification:

Debit: Creditors Control account 25,000

Credit: Debtors Control account 25,000

At the same time A’s account in Creditor’s ledger is debited with 25,000 and Credited in

Debtors’ ledger with the same amount.

Debit: A (payable/creditor) account 25,000

Credit: Cash / Bank 25,000

This entry comes from the creditor’s column of cash / bank book payment side as usual.

Bad Debts

Provision does not affect debtors account in simple books. It will, therefore, have no effect

either on debtor control account or debtors ledger.

© Copyright Virtual University of Pakistan 197

Financial Accounting - I – MGT101 VU

At the time of actual bad debt, the journal entry

Debit Provision / Bad Debts

Credit Individual Debtors Account

If control account system is in operation, the debit entry will be same but the credit effect will

go to Debtors control account with a credit effect to Individual Debtors Account in Debtors

Ledger.

Similar treatment is given to discounts received and allowed.

Recording Of Bad Debts in Control Accounts

To record bad debts in control accounts, following entries are recorded:

• In case no provision was created for doubtful debts:

Debit: Bad Debts

Credit: Debtors Control Account

• In case provision was created for doubtful debts:

Debit: Provision for Doubtful Debts

Credit: Debtors Control Account

Recording is also made in the respective accounts of the debtor in subsidiary ledger.

Recording of Discounts Received In Control Accounts

To record discount received in control accounts, following entry is recorded:

Debit: Creditors Control Account

Credit: Discount Received Account

Recording is also made in respective accounts of the creditors in subsidiary ledger.

Recording of Discounts Allowed In Control Accounts

To record discount allowed in control accounts, following entry is recorded:

Debit: Discount Allowed Account

Credit: Debtors Control Account

Recording is also made in the respective account of the debtors in subsidiary ledger.

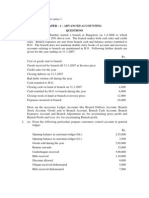

Illustration # 1:

Following information is given from the books of Mr. A(Debtor) for the month of June, 2002.

You are required to prepare Debtors Control Account and work out the closing balance of

debtors control account of Mr. A.

© Copyright Virtual University of Pakistan 198

Financial Accounting - I – MGT101 VU

Opening Balance Dr. 85,500

Transactions during the month:

Sales for the month 90,000

Sales return for the month 2,500

Payments received 140,000

Discount allowed 5,000

Bad debts written off 4,000

Solution:

Debtors Control Account

Debit Side Credit Side

Date No. Narration Dr. Rs. Date No. Narration Cr. Rs.

Jun 01 Bal B/F 85,500Jun Returns 2,500

Jun Sales 90,000Jun Receipts 140,000

Jun Discount allowed 5,000

Bad Debts 4,000

Jun 31 Bal C/F 24,000

Total 175,500 Total 175,500

Illustration # 2:

Following information is given from the books of Mr. B(Creditor) for the month of June, 2002.

You are required to prepare Creditors Control Account and work out the closing balance of

Creditors control account of Mr. B.

Opening Balance Cr. 65,000

Transactions during the month:

Purchases for the month 70,000

Purchases return for the month 5,000

Payments made 90,000

Discount received 3,000

Solution:

Creditors Control Account

Debit Side Credit Side

Date No. Narration Dr. Rs. Date No. Narration Cr. Rs.

Jun Returns 5,000Jun 01 Bal B/F 65,000

Jun Payments 90,000Jun Total purchases 70,000

Jun Discounts 3,000

received

Jun 31 Bal C/F 37,000

Total 135,000 Total 135,000

© Copyright Virtual University of Pakistan 199

Financial Accounting - I – MGT101 VU

Illustration # 3:

The financial year of Atif Brothers is closed on June 30, 2002. You are required to prepare

Debtors control account and Creditor control account from the data given below:

Opening balances

Debtors 150,000

Creditors 250,000

Sales

Cash Note 1 180,000

Credit 260,000

Purchases

Cash Note 1 120,000

Credit 200,000

Total receipts Note 2 350,000

Total payments Note 2 250,000

Discount allowed 15,000

Discount received 10,000

Bad debts written off 25,000

Increase in provision for doubtful debts Note 3 5,000

Solution

Debtors Control Account

Debit Side Credit Side

Date No. Narration Dr. Rs. Date No. Narration Cr. Rs.

Jun 01 Bal B/F 150,000Jun Receipts(N2) 170,000

Jun Sales(N1) 260,000Jun Discount allowed 15,000

Bad Debts 25,000

Jun 31 Bal C/F 200,000

Total 410,000 Total 410,000

Creditors Control Account

Debit Side Credit Side

Date No. Narration Dr. Rs. Date No. Narration Cr. Rs.

Jun Payments 130,000Jun 01 Bal B/F 250,000

Jun Discounts 10,000Jun Total purchases 200,000

received

Jun 31 Bal C/F 310,000

Total 450,000 Total 450,000

© Copyright Virtual University of Pakistan 200

Financial Accounting - I – MGT101 VU

Notes to the accounts:

1. In control accounts, only cash sales/purchases are dealt with. Credit sales/purchases are

not included in control accounts,

2. Receipts/Payments include both cash and credit receipts/payments. So, we enter the

figures in control accounts, after deducting cash sales/purchases from total

receipts/payments. i. e.

Receipts = 350,000 – 180,000 = 170,000

Payments = 250,000 – 120,000 = 130,000

3. Provision for doubtful debts has no effect on control accounts. So, any change in

provision will not affect actual bad debts.

Benefits of Subsidiary Ledgers

• Subsidiary ledgers contain the record of all individuals Debtors and Creditors.

• Subsidiary ledgers give information about the main clients and slow moving

clients which is helpful for the management in decision making.

• If the business has distributors in different areas, subsidiary ledger gives

information about sale of different distributors in different areas which are

helpful for the management in decision making.

© Copyright Virtual University of Pakistan 201

Вам также может понравиться

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveОт EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveОценок пока нет

- Mar Opening Balance 50,390 Mar Returns 1,550 Mar Total Sales 60,500 Mar Receipts 75,500 Mar Mar Discounts 2,000 Mar Bad Debts 1,800Документ6 страницMar Opening Balance 50,390 Mar Returns 1,550 Mar Total Sales 60,500 Mar Receipts 75,500 Mar Mar Discounts 2,000 Mar Bad Debts 1,800shamaОценок пока нет

- Additional Questions On Financial Statements and Cash BookДокумент5 страницAdditional Questions On Financial Statements and Cash BookBoi NonoОценок пока нет

- MG T 101 Short Notes Lectures 2345Документ29 страницMG T 101 Short Notes Lectures 2345Abdul wadoodОценок пока нет

- VU Accounting Lesson 24Документ6 страницVU Accounting Lesson 24ranawaseemОценок пока нет

- Chapter 3the Accounting CycleДокумент10 страницChapter 3the Accounting CycleonakhogxamsheОценок пока нет

- Liabilities With Answer For StudentsДокумент29 страницLiabilities With Answer For StudentsDivine CuasayОценок пока нет

- BAC 223 Topic TwoДокумент39 страницBAC 223 Topic TwoGABRIEL KAMAU KUNG'UОценок пока нет

- Abm Ss1 Module II BaДокумент8 страницAbm Ss1 Module II Baeloixxa samОценок пока нет

- SLLC - 2021 - Acc - Review Question - Set 05Документ6 страницSLLC - 2021 - Acc - Review Question - Set 05Chamela MahiepalaОценок пока нет

- 7 - Conversion of Single Entry To Double Entry PDFДокумент6 страниц7 - Conversion of Single Entry To Double Entry PDFmiftah fauzi100% (2)

- Receivable ManagementДокумент49 страницReceivable Managementrekha123Оценок пока нет

- Control Account Reconciliations ExamplesДокумент3 страницыControl Account Reconciliations ExamplesRameen FatimaОценок пока нет

- IntAcc-1 Accounting For ReceivablesДокумент13 страницIntAcc-1 Accounting For ReceivablesShekainah BОценок пока нет

- Final Accounts - That's It BatchДокумент16 страницFinal Accounts - That's It BatchKunika PimparkarОценок пока нет

- Bad Debts and Provision For Bad DebtsДокумент7 страницBad Debts and Provision For Bad DebtsSyed Ali HaiderОценок пока нет

- 04 Accounts Receivable (Student) - 1Документ24 страницы04 Accounts Receivable (Student) - 1Christina DulayОценок пока нет

- Receivables - AccountingДокумент11 страницReceivables - AccountingDairymple MendeОценок пока нет

- SET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsДокумент9 страницSET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsmuravbookОценок пока нет

- Module4 AccountsReceivablePartIДокумент6 страницModule4 AccountsReceivablePartIGab OdonioОценок пока нет

- Module 3 - ProblemsДокумент28 страницModule 3 - ProblemsCristina TayagОценок пока нет

- Control AccountsДокумент8 страницControl Accountsdayna davisОценок пока нет

- Test PaperДокумент27 страницTest PaperAnand BandhuОценок пока нет

- Ac1 Reviewer FinalsДокумент5 страницAc1 Reviewer FinalsMark Christian BrlОценок пока нет

- HW On ReceivablesДокумент13 страницHW On ReceivablesHimawari NaminayagiОценок пока нет

- Cachuela 4Документ25 страницCachuela 4Daphn CuencaОценок пока нет

- Recording Business Transactions: Student Name Student ID Course ID DateДокумент8 страницRecording Business Transactions: Student Name Student ID Course ID DateSami Ur RehmanОценок пока нет

- Weekly Summary For Self Study - Week 4 (Ch7-Receivables) (Rev F23)Документ3 страницыWeekly Summary For Self Study - Week 4 (Ch7-Receivables) (Rev F23)That kid 246Оценок пока нет

- Debit Relevant Expense A/c Credit Debit Credit Debit Bank Charges Account CreditДокумент27 страницDebit Relevant Expense A/c Credit Debit Credit Debit Bank Charges Account CreditAsif AslamОценок пока нет

- Single Entry AccountingДокумент12 страницSingle Entry AccountingArjun ThawaniОценок пока нет

- Chapter 7 - Accounting For ReceivablesДокумент53 страницыChapter 7 - Accounting For ReceivablesJes ReelОценок пока нет

- Interm - Financ.acc-Acc1232 - Updated On 27may 2019Документ214 страницInterm - Financ.acc-Acc1232 - Updated On 27may 2019Théotime HabinezaОценок пока нет

- Set 1 MB0025 Financial and Management AccountingДокумент7 страницSet 1 MB0025 Financial and Management AccountingcaggandhiОценок пока нет

- MB0025 Financial and Management AccountingДокумент7 страницMB0025 Financial and Management Accountingvarsha100% (1)

- Self Balancing and Sectional Balancing - ProblemsДокумент4 страницыSelf Balancing and Sectional Balancing - ProblemsPronojit BasakОценок пока нет

- Paper - 2 Accounting SyllabusДокумент40 страницPaper - 2 Accounting SyllabusNguyen Dac ThichОценок пока нет

- 2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Документ8 страниц2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Melanie SamsonaОценок пока нет

- Lect 26Документ22 страницыLect 26Kashif ImranОценок пока нет

- Unit II A Accounts ReceivablesДокумент12 страницUnit II A Accounts ReceivablesJulie Ann TolinОценок пока нет

- Accounts ReceivableДокумент2 страницыAccounts ReceivableMike MikeОценок пока нет

- CHAPTER 10 Intermediate Acctng 1Документ49 страницCHAPTER 10 Intermediate Acctng 1Tessang OnongenОценок пока нет

- Chapter 3 Current Liability PayrollДокумент39 страницChapter 3 Current Liability PayrollAbdi Mucee Tube100% (1)

- IllustrationДокумент10 страницIllustrationAmaris AyeshaОценок пока нет

- Bad Debts Expense Notes and Loans ReceivableДокумент12 страницBad Debts Expense Notes and Loans Receivableliesly buticОценок пока нет

- 22441accounting For ReceivablesДокумент16 страниц22441accounting For ReceivablesSEHAR NadeeM100% (1)

- Control Account QuestionsДокумент6 страницControl Account QuestionsJaneth Patrick100% (2)

- Prob 3Документ3 страницыProb 3jikee11Оценок пока нет

- Maloloy On5Документ23 страницыMaloloy On5Daphn CuencaОценок пока нет

- Dissolution + Single EntryДокумент18 страницDissolution + Single EntryOm JainОценок пока нет

- Ia RF ND 1Документ75 страницIa RF ND 1Joy UyОценок пока нет

- AdvanceedДокумент102 страницыAdvanceedt8616046Оценок пока нет

- Addendum (30.8.2022)Документ4 страницыAddendum (30.8.2022)Arjita DubeyОценок пока нет

- Test Bank 3 - Ia 1Документ25 страницTest Bank 3 - Ia 1JEFFERSON CUTE100% (1)

- Single To DoubleДокумент4 страницыSingle To DoubleGarima GarimaОценок пока нет

- W-2013 Cor PDFДокумент21 страницаW-2013 Cor PDFKashif NiaziОценок пока нет

- Ia RF NDДокумент75 страницIa RF NDKimberly Quin Cañas83% (12)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?От EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Рейтинг: 5 из 5 звезд5/5 (1)

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersОт EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersРейтинг: 5 из 5 звезд5/5 (5)

- VU Accounting Lesson 29Документ4 страницыVU Accounting Lesson 29ranawaseemОценок пока нет

- Lesson # 14 Posting To Ledgers and Recording of StockДокумент7 страницLesson # 14 Posting To Ledgers and Recording of StockranawaseemОценок пока нет

- VU Lesson 8Документ5 страницVU Lesson 8ranawaseem100% (1)

- Lesson # 7 Basic Books of Accounts Areas Covered in This LectureДокумент4 страницыLesson # 7 Basic Books of Accounts Areas Covered in This LectureranawaseemОценок пока нет

- VU Lesson 5Документ4 страницыVU Lesson 5ranawaseemОценок пока нет

- Lesson # 6 Flow of Transactions Learning ObjectiveДокумент5 страницLesson # 6 Flow of Transactions Learning Objectiveranawaseem100% (1)

- Diploma in Cambodia Tax Pilot Exam AnswersДокумент13 страницDiploma in Cambodia Tax Pilot Exam AnswersVannak2015Оценок пока нет

- System of Financial Control & Budgeting 2006 (Updated October 2018)Документ51 страницаSystem of Financial Control & Budgeting 2006 (Updated October 2018)usman ziaОценок пока нет

- Different Kinds of Obligations: ©2016 Atty. Raphael James Dizon Photo byДокумент24 страницыDifferent Kinds of Obligations: ©2016 Atty. Raphael James Dizon Photo byJimmy Boy DiazОценок пока нет

- QuestionsДокумент303 страницыQuestionsOsama DcОценок пока нет

- Warren Buffett 1985Документ7 страницWarren Buffett 1985anil1820Оценок пока нет

- Tvmreviewlecture 131226185711 Phpapp02Документ19 страницTvmreviewlecture 131226185711 Phpapp02Đào Quốc AnhОценок пока нет

- TLMДокумент32 страницыTLMsampada_shekharОценок пока нет

- FIN2012 Ovigele 10effectivetips ExcerptДокумент19 страницFIN2012 Ovigele 10effectivetips ExcerptOng OngОценок пока нет

- Marketing Strategies For Mortgage Lenders and BrokersДокумент2 страницыMarketing Strategies For Mortgage Lenders and BrokersTodd Lake100% (7)

- Wienerberger - Annual Report 2013Документ190 страницWienerberger - Annual Report 2013kaiuskОценок пока нет

- Advacc 3 Question Set A 150 CopiesДокумент6 страницAdvacc 3 Question Set A 150 CopiesPearl Mae De VeasОценок пока нет

- ACC 311 Ass#2Документ7 страницACC 311 Ass#2Justine Reine CornicoОценок пока нет

- CH 01Документ2 страницыCH 01flrnciairnОценок пока нет

- Jino Jose M CVДокумент3 страницыJino Jose M CVJo JiОценок пока нет

- Fire Nymph Products LTD V The Heating CentreДокумент8 страницFire Nymph Products LTD V The Heating CentrenorshafinahabdhalimОценок пока нет

- Dimensional Fund Advisors 2002 Case SoluДокумент3 страницыDimensional Fund Advisors 2002 Case SoluPawan PoollaОценок пока нет

- Seminar 7 N1591 - MCK Chaps 14 & 20 QuestionsДокумент4 страницыSeminar 7 N1591 - MCK Chaps 14 & 20 QuestionsMandeep SОценок пока нет

- MFiN HkustДокумент26 страницMFiN Hkustjackson510024Оценок пока нет

- Pakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)Документ8 страницPakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)mohammadtalhaОценок пока нет

- ch12 Principles of AccountingДокумент49 страницch12 Principles of AccountingAdam Rivera100% (2)

- Fractional Share FormulaДокумент1 страницаFractional Share FormulainboxnewsОценок пока нет

- Requirement 1 Total Per Unit: Banitog, Brigitte C. BSA 211 Exercise 1 (Contribution Format Income Statement)Документ4 страницыRequirement 1 Total Per Unit: Banitog, Brigitte C. BSA 211 Exercise 1 (Contribution Format Income Statement)MyunimintОценок пока нет

- Models and Theories of Corporate Governance PDFДокумент30 страницModels and Theories of Corporate Governance PDFSai Venkatesh RamanujamОценок пока нет

- Internal Control Internal Audit Internal Checks by Good PDFДокумент8 страницInternal Control Internal Audit Internal Checks by Good PDFpnditdeepak786Оценок пока нет

- Exide Life Sampoorna Jeevan1599746534637 PDFДокумент7 страницExide Life Sampoorna Jeevan1599746534637 PDFDarshan HN100% (1)

- Kerala Chitty Rules FAQДокумент7 страницKerala Chitty Rules FAQSree Vidyaprakasini Sabha100% (7)

- Salazar Research#6Документ4 страницыSalazar Research#6Darren Ace SalazarОценок пока нет

- Tips On Preparation A Report On A Video or DocumentaryДокумент3 страницыTips On Preparation A Report On A Video or DocumentaryZiha RusdiОценок пока нет

- The Effect of Economic Value Added FreeДокумент15 страницThe Effect of Economic Value Added FreeSumant AlagawadiОценок пока нет

- Anggi Anggraini (Shopping For Clothes)Документ2 страницыAnggi Anggraini (Shopping For Clothes)Anggi MartinОценок пока нет