Академический Документы

Профессиональный Документы

Культура Документы

Balance Sheet and Ratio Analysis of Itc

Загружено:

Niraj VishwakarmaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Balance Sheet and Ratio Analysis of Itc

Загружено:

Niraj VishwakarmaАвторское право:

Доступные форматы

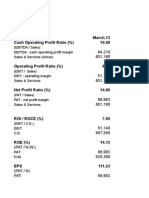

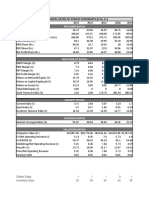

Ratios

Mar ' 12

Mar ' 11

Mar ' 10

Mar ' 09

Mar ' 08

Adjusted EPS (Rs)

7.69

6.24

10.38

8.43

7.87

Adjusted cash EPS (Rs)

8.58

7.08

11.98

9.89

9.03

Reported EPS (Rs)

7.88

6.45

10.64

8.65

8.28

Reported cash EPS (Rs)

8.78

7.29

12.23

10.10

9.44

Dividend per share

4.50

4.45

10.00

3.70

3.50

Operating profit per share (Rs)

11.41

9.30

16.06

13.04

11.76

Book value (excl rev res) per share (Rs)

23.97

20.55

36.69

36.24

31.85

Book value (incl rev res) per share (Rs.)

24.04

20.62

36.84

36.39

32.00

Net operating income per share (Rs)

32.09

27.29

48.63

39.70

37.23

Free reserves per share (Rs)

22.50

19.07

34.73

34.27

29.88

Operating margin (%)

35.55

34.08

33.02

32.84

31.57

Gross profit margin (%)

32.77

30.97

29.74

29.17

28.44

Net profit margin (%)

23.97

22.91

21.30

21.18

21.50

Adjusted cash margin (%)

26.10

25.17

23.98

24.22

23.45

Adjusted return on net worth (%)

32.07

30.34

28.29

23.26

24.71

Reported return on net worth (%)

32.88

31.36

28.98

23.85

25.99

Return on long term funds (%)

46.95

44.95

42.64

34.75

36.88

Long term debt / Equity

0.01

0.01

0.01

0.01

Total debt/equity

0.01

0.01

0.01

0.01

99.57

99.37

99.23

98.71

98.24

1.44

1.69

1.58

1.44

1.59

Current ratio

1.08

1.08

0.92

1.44

1.39

Current ratio (inc. st loans)

1.08

1.08

0.92

1.42

1.36

Quick ratio

0.50

0.50

0.39

0.60

0.56

Inventory turnover ratio

6.53

6.05

6.04

5.26

5.51

Dividend payout ratio (net profit)

66.35

80.24

109.63

50.06

49.45

Dividend payout ratio (cash profit)

59.59

70.91

95.34

42.84

43.36

Earning retention ratio

31.98

17.06

-12.31

48.67

47.98

Cash earnings retention ratio

39.06

26.99

2.64

56.23

54.68

Per share ratios

Profitability ratios

Leverage ratios

Owners fund as % of total source

Fixed assets turnover ratio

Liquidity ratios

Payout ratios

Mar ' 12

Mar ' 11

Mar ' 10

Mar ' 09

Mar ' 08

0.01

0.01

0.02

0.04

0.06

Financial charges coverage ratio

109.56

100.46

73.42

112.17

199.51

Fin. charges cov.ratio (post tax)

79.84

73.25

52.72

81.02

145.60

39.59

40.72

38.45

45.80

44.95

6.67

6.80

6.66

7.12

7.44

Exports as percent of total sales

10.44

13.32

12.68

14.85

15.45

Import comp. in raw mat. consumed

13.03

13.34

12.03

12.98

12.78

0.61

0.58

0.63

0.56

0.57

90.87

91.81

85.85

86.84

86.98

Coverage ratios

Adjusted cash flow time total debt

Component ratios

Material cost component (% earnings)

Selling cost Component

Long term assets / total Assets

Bonus component in equity capital (%)

Dividend

Year

Month

Dividend (%)

2012

May

450

2011

May

445

2010

May

1,000

2009

May

370

2008

May

350

2007

May

310

2006

May

265

2005

May

310

2004

May

200

2003

May

150

2002

May

135

2001

Apr

100

2000

May

75

Annual results in brief

Sales

Operating profit

Interest

Gross profit

EPS (Rs)

Mar ' 12

Mar ' 11

Mar ' 10

Mar ' 09

Mar ' 08

25,173.82

21,468.25

18,382.24

15,582.73

13,947.53

8,848.62

7,454.11

6,303.05

5,053.16

4,403.94

77.92

48.13

53.36

18.32

4.61

9,596.04

7,924.15

6,624.02

549.41

438.46

7.88

6.45

10.64

8.65

8.28

Annual results in details

Mar ' 12

Mar ' 11

Mar ' 10

Mar ' 09

Mar ' 08

Other income

825.34

518.17

374.33

340.31

610.90

Stock adjustment

-65.59

-254.29

175.24

-123.69

-5.69

7,660.91

7,000.99

5,797.96

5,315.78

4,639.35

1,265.41

1,159.41

1,002.77

890.88

733.32

Excise

Admin and selling expenses

Research and development expenses

Expenses capitalised

7,464.47

6,108.03

5,103.22

4,446.60

4,176.61

698.51

655.99

608.71

549.41

438.46

Taxation

2,735.16

2,280.55

1,954.31

1,562.15

1,451.67

Net profit / loss

6,162.37

4,987.61

4,061.00

3,263.59

3,120.10

Extra ordinary item

Prior year adjustments

781.84

773.81

381.82

377.44

376.86

Agg.of non-prom. shares (Lacs)

77942.73

77126.13

38034.76

37530.88

37415.01

Agg.of non promotoHolding (%)

99.69

99.67

99.61

99.44

99.28

OPM (%)

35.15

34.72

34.29

32.43

31.58

GPM (%)

36.91

36.04

35.32

3.45

3.01

NPM (%)

23.70

22.68

21.65

20.50

21.43

Raw material

Power and fuel

Employee expenses

Other expenses

Provisions made

Depreciation

Equity capital

Equity dividend rate

Вам также может понравиться

- RatiosДокумент2 страницыRatiosEthan Hunt NadimОценок пока нет

- Jio Financial Analysis (5 Yrs)Документ2 страницыJio Financial Analysis (5 Yrs)Yash Saxena KhiladiОценок пока нет

- Key Financial Ratios Over 5 YearsДокумент4 страницыKey Financial Ratios Over 5 YearsMadani MaddyОценок пока нет

- EPS ratios dividends book value profit margins financial ratios over timeДокумент2 страницыEPS ratios dividends book value profit margins financial ratios over timeSonali BiyaniОценок пока нет

- Per Share RatiosДокумент3 страницыPer Share RatiosRuchy SinghОценок пока нет

- Financial Ratios Over 5 YearsДокумент3 страницыFinancial Ratios Over 5 Yearsvignesh_sundaresan_1Оценок пока нет

- Per Share RatiosДокумент3 страницыPer Share RatiosAtul SahuОценок пока нет

- M&M Annual ReportДокумент21 страницаM&M Annual ReportThakkar GayatriОценок пока нет

- DR Reddy RatiosДокумент6 страницDR Reddy RatiosRezwan KhanОценок пока нет

- Excel financial ratios Canara BankДокумент12 страницExcel financial ratios Canara Bankkapish1014Оценок пока нет

- Ratios: Mar ' 12 Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08Документ5 страницRatios: Mar ' 12 Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08Prajapati HiteshОценок пока нет

- Bajaj AutoДокумент7 страницBajaj AutoAatish J ShroffОценок пока нет

- Analysis of key financial ratios for major Indian fertilizer companiesДокумент8 страницAnalysis of key financial ratios for major Indian fertilizer companiesYash ShahОценок пока нет

- MarutiДокумент2 страницыMarutiVishal BhanushaliОценок пока нет

- Ratios of Scheduled Commercial Banks in IndiaДокумент11 страницRatios of Scheduled Commercial Banks in IndiacsmankooОценок пока нет

- Financial Ratios and Metrics for Mutual Fund AnalysisДокумент3 страницыFinancial Ratios and Metrics for Mutual Fund AnalysislakhipatelОценок пока нет

- Key Financial Ratios of GAIL India - in Rs. Cr.Документ2 страницыKey Financial Ratios of GAIL India - in Rs. Cr.Anonymous N7yzbYbHОценок пока нет

- Particulars: Mar. 12 Amt. (RS.) Mar. 13 Amt. (RS.)Документ4 страницыParticulars: Mar. 12 Amt. (RS.) Mar. 13 Amt. (RS.)reena MahadikОценок пока нет

- 5-Year Balance Sheet and Profit-Loss AnalysisДокумент4 страницы5-Year Balance Sheet and Profit-Loss AnalysisYogesh GuwalaniОценок пока нет

- Berger Paints RatiosДокумент1 страницаBerger Paints RatiosDeepОценок пока нет

- Particulars Mar 2013 Mar 2012 Mar 2011 Mar 2010 Mar 2009: Operational & Financial RatiosДокумент2 страницыParticulars Mar 2013 Mar 2012 Mar 2011 Mar 2010 Mar 2009: Operational & Financial Ratioskhushma8Оценок пока нет

- Maruti Suzuki financial analysisДокумент2 страницыMaruti Suzuki financial analysishgosai30Оценок пока нет

- Annual financial results of leading companyДокумент10 страницAnnual financial results of leading companyNeer YadavОценок пока нет

- Consolidated Key Financial Ratios of Hindalco IndustriesДокумент3 страницыConsolidated Key Financial Ratios of Hindalco IndustriesManav JhaveriОценок пока нет

- Larsen & Toubro: Deepak KhandelwalДокумент19 страницLarsen & Toubro: Deepak KhandelwaldeepakashwaniОценок пока нет

- Sun TV Networks FinancialsДокумент11 страницSun TV Networks FinancialsVikas SarangalОценок пока нет

- Operational / Financial Analysis 2007 2008 2009 2010 2011 Audited Audited Audited Estimates ProjectedДокумент1 страницаOperational / Financial Analysis 2007 2008 2009 2010 2011 Audited Audited Audited Estimates ProjectedparamsnОценок пока нет

- Axis RatioДокумент5 страницAxis RatiopradipsinhОценок пока нет

- AirtelДокумент3 страницыAirtelAkhil JayathilakanОценок пока нет

- Value Added Is The Amount by Which The Value of Goods or Services Are Increased by Each Stage in Its ProductionДокумент2 страницыValue Added Is The Amount by Which The Value of Goods or Services Are Increased by Each Stage in Its Productionparas61189Оценок пока нет

- Key Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Документ6 страницKey Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Virangad SinghОценок пока нет

- Financial Ratios Over 5 YearsДокумент2 страницыFinancial Ratios Over 5 YearsKishan KeshavОценок пока нет

- BEL - RatiosДокумент4 страницыBEL - RatiosArtiОценок пока нет

- RatiosДокумент2 страницыRatioschiragОценок пока нет

- FMCG Dividend PolicyДокумент11 страницFMCG Dividend PolicyNilkesh ChikhaliyaОценок пока нет

- Company Financial Ratios Over 5 YearsДокумент7 страницCompany Financial Ratios Over 5 Yearsjalpa1432Оценок пока нет

- Key Financial Ratios of Apollo TyresДокумент2 страницыKey Financial Ratios of Apollo TyreseswariОценок пока нет

- Key Indicators 2006 2007 OperatingДокумент2 страницыKey Indicators 2006 2007 OperatingUsman NasirОценок пока нет

- Bajaj Auto Financial Analysis: Presented byДокумент20 страницBajaj Auto Financial Analysis: Presented byMayank_Gupta_1995Оценок пока нет

- Infosys Technologies LTD RatioДокумент4 страницыInfosys Technologies LTD Ratioron1436Оценок пока нет

- CRISIL and ICRA financial ratios comparisonДокумент6 страницCRISIL and ICRA financial ratios comparisonAkshat JainОценок пока нет

- Airtel RatiosДокумент9 страницAirtel RatiosakshayuppalОценок пока нет

- Bajaj Auto Pvt. Ltd. Market Returns and Stock PriceДокумент4 страницыBajaj Auto Pvt. Ltd. Market Returns and Stock PriceArron CarterОценок пока нет

- Income Statement Balance Sheet Cash Flow Ratios FCFF Eva & Roic News Analysis 1 News Analysis 2Документ9 страницIncome Statement Balance Sheet Cash Flow Ratios FCFF Eva & Roic News Analysis 1 News Analysis 2ramarao1981Оценок пока нет

- Print/Copy To Excel:: Previous YearsДокумент3 страницыPrint/Copy To Excel:: Previous Yearssharmavikram876Оценок пока нет

- Ambuja Cements Financial Ratios 2016-2020Документ4 страницыAmbuja Cements Financial Ratios 2016-2020Rahul MalhotraОценок пока нет

- Altman Z Factor ROE ROA Gross Profit Profit MarginДокумент3 страницыAltman Z Factor ROE ROA Gross Profit Profit Marginprabin ghimireОценок пока нет

- ROE Debt/EquityДокумент13 страницROE Debt/EquityDeanna ZhangОценок пока нет

- BEL - RatiosДокумент8 страницBEL - RatiosVishal Kumar100% (1)

- Particulars Mar-11 Mar-10 Mar-09 Mar-08 Mar-07 Mar-06: Dabur IndiaДокумент3 страницыParticulars Mar-11 Mar-10 Mar-09 Mar-08 Mar-07 Mar-06: Dabur IndiaPurnima PandeyОценок пока нет

- Profitability Ratios: Solvency Measures / Capital Structure RatiosДокумент4 страницыProfitability Ratios: Solvency Measures / Capital Structure RatiosYogesh ChoudharyОценок пока нет

- Key Financial Ratios of Tata Consultancy ServicesДокумент13 страницKey Financial Ratios of Tata Consultancy ServicesSanket KhairnarОценок пока нет

- Balance Sheet of Dabur India LTDДокумент15 страницBalance Sheet of Dabur India LTDAshish JainОценок пока нет

- Key Financial Ratios of ACCДокумент2 страницыKey Financial Ratios of ACCcool_mani11Оценок пока нет

- CCS G4Документ14 страницCCS G4Harshit AroraОценок пока нет

- United Engineers - CIMBДокумент7 страницUnited Engineers - CIMBTheng RogerОценок пока нет

- Adlabs InfoДокумент3 страницыAdlabs InfovineetjogalekarОценок пока нет

- Dr. AmbedkarДокумент6 страницDr. AmbedkarNiraj VishwakarmaОценок пока нет

- Apollo PVTДокумент1 страницаApollo PVTNiraj VishwakarmaОценок пока нет

- Constitution of IndiaДокумент7 страницConstitution of IndiaNiraj VishwakarmaОценок пока нет

- Career With UsДокумент2 страницыCareer With UsNiraj VishwakarmaОценок пока нет

- Finance BookletДокумент13 страницFinance BookletNiraj VishwakarmaОценок пока нет

- Apollo PVTДокумент1 страницаApollo PVTNiraj VishwakarmaОценок пока нет

- 45654897Документ1 страница45654897saravanavelu39Оценок пока нет

- Indians Now Our Top MigrantsДокумент31 страницаIndians Now Our Top MigrantsNiraj VishwakarmaОценок пока нет

- Venture Capital in India - SEBI ReportДокумент52 страницыVenture Capital in India - SEBI Reportjaknap1802Оценок пока нет

- InflationДокумент6 страницInflationNiraj VishwakarmaОценок пока нет

- InflationДокумент6 страницInflationNiraj VishwakarmaОценок пока нет

- 06 FMA119 ASlides 34Документ28 страниц06 FMA119 ASlides 34Sean LcfОценок пока нет

- I apologize, but I do not have enough context to understand this document or provide a concise title. Could you please provide more details on what this document is aboutДокумент19 страницI apologize, but I do not have enough context to understand this document or provide a concise title. Could you please provide more details on what this document is aboutNiraj VishwakarmaОценок пока нет

- A Primer For Investment Trustees: Jeffery V. Bailey, CFA Jesse L. Phillips, CFA Thomas M. Richards, CFAДокумент120 страницA Primer For Investment Trustees: Jeffery V. Bailey, CFA Jesse L. Phillips, CFA Thomas M. Richards, CFANiraj VishwakarmaОценок пока нет

- SebiДокумент7 страницSebiAbhijeit BhosaleОценок пока нет

- Ulcus Decubitus PDFДокумент9 страницUlcus Decubitus PDFIrvan FathurohmanОценок пока нет

- English 10 - HVC - ĐềДокумент22 страницыEnglish 10 - HVC - ĐềAlin NguyenОценок пока нет

- The Turbo Air 6000 Centrifugal Compressor Handbook AAEDR-H-082 Rev 05 TA6000Документ137 страницThe Turbo Air 6000 Centrifugal Compressor Handbook AAEDR-H-082 Rev 05 TA6000Rifki TriAditiya PutraОценок пока нет

- Treating Thyroid Emergencies: Myxedema Coma and Thyroid StormДокумент17 страницTreating Thyroid Emergencies: Myxedema Coma and Thyroid StormMarlon UlloaОценок пока нет

- Movie Ethics ReviewДокумент4 страницыMovie Ethics ReviewpearlydawnОценок пока нет

- QUICK CLOSING VALVE INSTALLATION GUIDEДокумент22 страницыQUICK CLOSING VALVE INSTALLATION GUIDEAravindОценок пока нет

- Practical Research 1 Quarter 1 - Module 10: Through The SlateДокумент10 страницPractical Research 1 Quarter 1 - Module 10: Through The SlateMark Allen Labasan100% (1)

- (9F) Ankle - Bones, Joints, Tendons and LigamentsДокумент4 страницы(9F) Ankle - Bones, Joints, Tendons and LigamentsJeffrey RamosОценок пока нет

- Multiple Sentences and Service of PenaltyДокумент5 страницMultiple Sentences and Service of PenaltyAngelОценок пока нет

- RESEARCH PROPOSAL-Final AfraaaazzzzzzzzzДокумент13 страницRESEARCH PROPOSAL-Final AfraaaazzzzzzzzzRizwan Abdul Maalik50% (2)

- IOSA Self Evaluation Form - 31 October 2014Документ45 страницIOSA Self Evaluation Form - 31 October 2014pknight2010Оценок пока нет

- PTA Resolution for Donation to School WashroomДокумент2 страницыPTA Resolution for Donation to School WashroomMara Ciela CajalneОценок пока нет

- Ficha Tecnica Emeral 8C PDFДокумент11 страницFicha Tecnica Emeral 8C PDFLeticia KoerichОценок пока нет

- Power Systems-III Ditital NotesДокумент102 страницыPower Systems-III Ditital NotesSimranОценок пока нет

- Cell Biology & BiochemistryДокумент320 страницCell Biology & BiochemistryVai SanОценок пока нет

- Radiol 2020201473Документ37 страницRadiol 2020201473M Victoria SalazarОценок пока нет

- HBV Real Time PCR Primer Probe Sequncence PDFДокумент9 страницHBV Real Time PCR Primer Probe Sequncence PDFnbiolab6659Оценок пока нет

- Stepan Formulation 943Документ2 страницыStepan Formulation 943Mohamed AdelОценок пока нет

- Dar Breathing Filter Hme SellsheetДокумент2 страницыDar Breathing Filter Hme SellsheetmangkunegaraОценок пока нет

- Coal Workers' Pneumoconiosis (Black Lung Disease) Treatment & Management - Approach Considerations, Medical Care, Surgical CareДокумент2 страницыCoal Workers' Pneumoconiosis (Black Lung Disease) Treatment & Management - Approach Considerations, Medical Care, Surgical CareامينОценок пока нет

- Final Profile Draft - Zach HelfantДокумент5 страницFinal Profile Draft - Zach Helfantapi-547420544Оценок пока нет

- Persuasive Essay Eng 101nДокумент6 страницPersuasive Essay Eng 101napi-341545248Оценок пока нет

- 01 01Документ232 страницы01 01Muhammad Al-MshariОценок пока нет

- 21 - Effective Pages: Beechcraft CorporationДокумент166 страниц21 - Effective Pages: Beechcraft CorporationCristian PugaОценок пока нет

- Lab 9-Measurement of Filtrate Loss and Mud Cake Thickness of Drilling Mud Sample Using Dead Weight Hydraulic Filter Press Considering API Standard.Документ17 страницLab 9-Measurement of Filtrate Loss and Mud Cake Thickness of Drilling Mud Sample Using Dead Weight Hydraulic Filter Press Considering API Standard.Sunny BbaОценок пока нет

- Assessing Inclusive Ed-PhilДокумент18 страницAssessing Inclusive Ed-PhilElla MaglunobОценок пока нет

- Jee Main Sample Paper 5Документ19 страницJee Main Sample Paper 5DavidОценок пока нет

- Otology Fellowships 2019Документ5 страницOtology Fellowships 2019Sandra SandrinaОценок пока нет

- Eltra Cs 530Документ122 страницыEltra Cs 530ahalonsoОценок пока нет

- Human Resources Management Article Review On "The 3 Essential Jobs That Most Retention Programs Ignore"Документ14 страницHuman Resources Management Article Review On "The 3 Essential Jobs That Most Retention Programs Ignore"Pang Kok ShengОценок пока нет