Академический Документы

Профессиональный Документы

Культура Документы

Let's Go For Derivative 18 March 2013 by Mansukh Investment and Trading Solution

Загружено:

Mansukh Investment & Trading SolutionsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Let's Go For Derivative 18 March 2013 by Mansukh Investment and Trading Solution

Загружено:

Mansukh Investment & Trading SolutionsАвторское право:

Доступные форматы

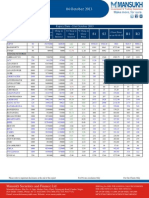

Daily Derivative Report

NIFTY FUTURE : 5,901.00

18 March 2013

-38.75 -0.65%

F & O HIGHLIGHTS

1.09 0.68

Nifty March 2013 futures closed at 5,897.10 on Friday at a premium of 24.50 points over spot closing of 5,872.60, while Nifty April 2013 futures ended at 5,931.65, at a premium of 59.05 points over spot closing. Nifty March futures saw contraction of 0.06 million (mn) units taking the total outstanding open interest (OI) to 14.97 mn units. The near month March 2013 derivatives contract will expire on March 28, 2013. From the most active contracts, Hindalco Industries March 2013 futures were trading at a premium of 0.85 points at 96.15 compared with spot closing of 95.30. The number of contracts traded was 10,403.Tata Motors March 2013 futures were trading at a premium of 1.55 points at 292.80 compared with spot closing of 291.25. The number of contracts traded was 14,225. DLF March 2013 futures were trading at a premium of 2.15 points at 274.20 compared with spot closing of 272.05. The number of contracts traded was 20,064. Titan Industries March 2013 futures were at a discount of 1.15 points at 243.25 compared with spot closing of 244.40. The number of contracts traded was 9,956. ICICI Bank March 2013 futures were at a premium of 4.75 points at 1074.10 compared with spot closing of 1069.35. The number of contracts traded was 32,519.

Nifty Sentiment Indicators

Put Call Ratio-Index Options Put Call Ratio-Stock Options

Product

Index Futures Stock Futures Index Options Stock Options Total F&O

14.03.13 557180

580,391 6687704 398469 8223744

Volume 15.03.13 387323

503,496 4283135 324621 5498575

% Chg

-30.49% -13.25% -35.96% -18.53% -33.14%

Index

NIFTY BANK NIFTY CNXIT

Spot

5,872.60 11,816.55 7,224.35

Last price 138.2 613.60 5,015.30 1,301.55 441.1 Chg (%) 2.90% 1.61% 2.13% 3.04% 1.61%

Future

5,901.00

Basis

28 69 13

11,886.00

7,237.00

Increase in Open Interest with Increase in price Symbol DABUR LUPIN ASIANPAINT JUBLFOOD RANBAXY Open Interest 1,846,000 1,352,500 352,000 1,396,000 4,679,000 11.07% 10.18% 9.61% 9.13% 4.07%

ALBK YESBANK ICICIBANK SYNDIBANK RELIANCE

Increase in Open Interest with Decrease in price Symbol Last price Chg (%) Open Interest 139.25 476.4 1,074.10 121.15 846.75 -2.38% -2.34% -3.88% -2.61% -2.16% 4,230,000 6,276,000 8,794,500 3,680,000 8,748,250 12.68% 8.21% 8.20% 7.85% 7.19% Increase (%)

Increase (%)

t 12,000,000 s 10,000,000 e r e t 8,000,000 n i 6,000,000 n e 4,000,000 p o 2,000,000 0

CP

call put

Nifty Option Open Interest Distribution Nifty March 5900 call added 2.16 lakh shares in OI and 6000 call added 4.22 lakh shares in OI. On the put side nifty March 5800 put shed 7.75 lakh shares in OI and 5700 put added 0.47 lakh in OI. The put-call ratio of stock option decreased from 0.77 to 0.68 while put-call ratio of index option decreased from 1.39 to 1.09. On the whole the put call ratio was at 1.05.

strike price

For Private circulation Only

For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834

Mansukh House, PlotMansukh No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, Securities and Finance Ltd New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Email: research@moneysukh.com, Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

Mansukh Securities and Finance Ltd

SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 NSE: INB 230781431, F&O: INF 230781431,

PMS Regn No. INP000002387 DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

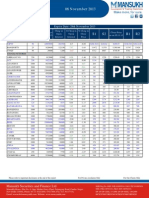

Daily Derivative Report

NIFTY OUTLOOK :

The nifty future is likely to trade in the range of 5510 - 6148 level in short term as the OI is added. The trading strategy would be create long positions if the nifty takes support around 5850 levels for the target of 5950 and 6000 .On the other hand, one can also create short positions if the nifty future resist support around 6050 levels.

MOST ACTIVE CALLS Symbol NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY BANKNIFTY NIFTY BANKNIFTY

UNDERLYING ASSET CMP STRATEGY MAX LOSS MAX PROFIT BEP TIME HORIZON LOT SIZE NIFTY 5901 SELL NIFTY MARCH 6000 CALL@ 23 SELL NIFTY MARCH 5800 PUT @ 29 UNLIMITED 52 6052 & 5748 TILL EXPIRY 50

Expiry Date 28-Mar-13 28-Mar-13 28-Mar-13 28-Mar-13 28-Mar-13 28-Mar-13 28-Mar-13 25-Apr-13 28-Mar-13

Strike Price 6,000 5,900 6,100 6,200 5,800 6,300 12,200 6,000 12,500

Contracts Traded 6,69,842 4,73,817 3,20,637 1,52,163 86278 44,446 30,063 26,332 23,436

Open Interest 76,87,750 59,01,200 67,14,950 44,66,000 31,58,800 20,54,200 2,34,850 13,37,550 3,90,850

MOST ACTIVE PUTS Symbol NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY Expiry Date 28-Mar-13 28-Mar-13 28-Mar-13 28-Mar-13 28-Mar-13 28-Mar-13 28-Mar-13 25-Apr-13 Strike Price 5,900 5,800 5,700 6,000 5,600 5,500 5,400 5,900 Contracts Traded 5,83,244 5,68,187 2,72,161 1,70,070 1,64,162 88460 65118 36,263 Open Interest 54,65,800 85,90,250 1,08,97,700 28,65,900 71,28,500 63,61,750 33,11,300 13,69,300

STOCK STRATEGY AS ON 18 TH MARCH 2013

PAY OFF MATRIX 100 50 0 -50 0 -100 -150 -200 -250 -300 -350 -400

10

12 Series1

For any information or suggestion, please send your query at research@moneysukh.com

For Private circulation Only For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834

Mansukh House, PlotMansukh No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, Securities and Finance Ltd New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Email: research@moneysukh.com, Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

Mansukh Securities and Finance Ltd

SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 NSE: INB 230781431, F&O: INF 230781431,

PMS Regn No. INP000002387 DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Daily Derivative Report

STRATEGY TRACKER DATE OF STRATEGY UNDERLYING ASSET STRATEGY IN/OUT FLOW NET PROFIT/ LOSS AS ON 13/03/2013 REMARK

11/3/2013

NIFTY

SELL NIFTY JAN 6000 CALL@ 49 BUY TWO NIFTY JAN 6100 CALL@ 18 SELL NIFTY MARCH 5900 CALL@22 SELL NIFTY MARCH 5600 PUT@ 37 SELL NIFTY JAN 5900 CALL@50 SELL NIFTY JAN 5900 PUT@ 66 SELL NIFTY JAN 6000 CALL@ 40 BUY TWO NIFTY JAN 6100 CALL@ 15 SELL NIFTY JAN 6200 CALL@23 SELL NIFTY JAN 5900 PUT@ 35

13

7.00

BOOK PARTIAL PROFIT AS ON 14.03.2013 BOOK PARTIAL PROFIT AS ON 05.03.2013 BOOK PARTIAL PROFIT AS ON 19.02.2013 BOOK FULL PROFIT AS ON 22.02.2013 BOOK PARTIAL PROFIT AS ON 14.02.2013

4/3/2013

NIFTY

59

11.45

18/2/2013

NIFTY

116

7.00

11/2/2013

NIFTY

10

7.00

4/2/2013

NIFTY

58

5.00

NAME

Varun Gupta Pashupati Nath Jha Vikram Singh

DESIGNATION

Head - Research Research Analyst Research Analyst

E-MAIL

varungupta@moneysukh.com pashupatinathjha@moneysukh.com vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

For Private circulation Only

For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834

Mansukh House, PlotMansukh No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, Securities and Finance Ltd New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Email: research@moneysukh.com, Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

Mansukh Securities and Finance Ltd

SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 NSE: INB 230781431, F&O: INF 230781431,

PMS Regn No. INP000002387 DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Вам также может понравиться

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Results Tracker 09.11.2013Документ3 страницыResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Results Tracker 08.11.2013Документ3 страницыResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Results Tracker 07.11.2013Документ3 страницыResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Rodi TestSystem EZSDI1 Iom D603Документ25 страницRodi TestSystem EZSDI1 Iom D603Ricardo AndradeОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Mitsubishi diesel forklifts 1.5-3.5 tonnesДокумент2 страницыMitsubishi diesel forklifts 1.5-3.5 tonnesJoniОценок пока нет

- PVC PLasticisersДокумент2 страницыPVC PLasticisersKrishna PrasadОценок пока нет

- Curtis CatalogДокумент9 страницCurtis CatalogtharngalОценок пока нет

- Climate Change: The Fork at The End of NowДокумент28 страницClimate Change: The Fork at The End of NowMomentum Press100% (1)

- Astm D5501Документ3 страницыAstm D5501mhmdgalalОценок пока нет

- Methods For Assessing The Stability of Slopes During Earthquakes-A Retrospective 1Документ3 страницыMethods For Assessing The Stability of Slopes During Earthquakes-A Retrospective 1ilijarskОценок пока нет

- Alc10 DatasheetДокумент7 страницAlc10 Datasheetd4l170Оценок пока нет

- EET422 EMC Intro-Banana Skins 2011-2012 MSWДокумент6 страницEET422 EMC Intro-Banana Skins 2011-2012 MSWVeeradasan PerumalОценок пока нет

- SDH TechnologyДокумент26 страницSDH TechnologyJayesh SinghalОценок пока нет

- Measurements/ Specifications: Torque Wrench Selection GuideДокумент5 страницMeasurements/ Specifications: Torque Wrench Selection GuideSylvester RakgateОценок пока нет

- Home Automation Iot Bca Up (2ND SEMINAR PPT) RTДокумент30 страницHome Automation Iot Bca Up (2ND SEMINAR PPT) RTTejaswiniОценок пока нет

- Introducing WESAD, A Multimodal Dataset For Wearable Stress and Affect DetectionДокумент9 страницIntroducing WESAD, A Multimodal Dataset For Wearable Stress and Affect DetectionJhónatan CarranzaОценок пока нет

- FOT - CG Limitation A320neo - Web ConferenceДокумент7 страницFOT - CG Limitation A320neo - Web Conferencerohan sinha100% (2)

- Alpha New Bp12Документ54 страницыAlpha New Bp12AUTO HUBОценок пока нет

- Chapter 11 revision notes on budgeting and planningДокумент5 страницChapter 11 revision notes on budgeting and planningRoli YonoОценок пока нет

- Comparative Study Between Vyatra 3 and Vyatra 4 WBMДокумент9 страницComparative Study Between Vyatra 3 and Vyatra 4 WBMFatih RakaОценок пока нет

- Java10 PDFДокумент137 страницJava10 PDFswarup sarkarОценок пока нет

- Login Form: User Name Password Remember MeДокумент8 страницLogin Form: User Name Password Remember MeBridget Anne BenitezОценок пока нет

- How Dna Controls The Workings of The CellДокумент2 страницыHow Dna Controls The Workings of The Cellapi-238397369Оценок пока нет

- Ain 2016 Pilot Report m600Документ4 страницыAin 2016 Pilot Report m600Antonio Cesar de Sa LeitaoОценок пока нет

- CobolДокумент224 страницыCobolrahulravi007Оценок пока нет

- LTE and SchedulingДокумент25 страницLTE and SchedulingKrunoslav IvesicОценок пока нет

- Homa 2 CalculatorДокумент6 страницHoma 2 CalculatorAnonymous 4dE7mUCIH0% (1)

- WPS Office 2016Документ22 страницыWPS Office 2016Muhammad Aliff SyukriОценок пока нет

- F 2786538d6cdc0bb1Документ245 страницF 2786538d6cdc0bb1Daniel HarutyunyanОценок пока нет

- SUBstation Equipmens TLДокумент12 страницSUBstation Equipmens TLJecer Casipong NuruddinОценок пока нет

- MleplustutorialДокумент13 страницMleplustutorialvorge daoОценок пока нет

- Example 1 LS Dyna - Bullet Model SimulationДокумент6 страницExample 1 LS Dyna - Bullet Model Simulationsunil_vrvОценок пока нет

- ITTC Validation of ManoeuvringДокумент11 страницITTC Validation of ManoeuvringFelipe IlhaОценок пока нет