Академический Документы

Профессиональный Документы

Культура Документы

ACCA F2 AC N MC

Загружено:

Samuel DwumfourИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ACCA F2 AC N MC

Загружено:

Samuel DwumfourАвторское право:

Доступные форматы

ACCA F2 Management Accounting

Short Questions

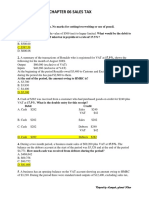

Data for Q4 Q7: For decision making purposes, a company uses the following figures for product B for a one-year period. Activity Sales and production (000 units) 50% 200 $000 Sales Production costs: Variable Fixed Selling, distribution and administration expenses: Variable Fixed 200 300 400 300 1,000 400 200 100% 400 $000 2,000 800 200

The normal level of activity for the current year is 400,000 units. The fixed costs are incurred evenly throughout the year and actual fixed costs are the same as budgeted. There were no stocks of Product B at the start of the quarter in which 110,000 units were produced and 80,000 units were sold. Q4: The amount of fixed production costs absorbed by Product B in the first quarter, using absorption costing, is: A B Q5: $80,000 $40,000 C D $110,000 $55,000

The over/(under) absorption of fixed production costs in the first quarter is: A B ($5,000) $5,000 C D $10,000 $15,000

Q6:

The net profit (or loss) for the first quarter using absorption costing, is: A B ($115,000) $50,000 C D ($175,000) $125,000

Q7:

The net profit (or loss) for the first quarter, using marginal costing, is: A B $35,000 ($340,000) C D $65,000 ($115,000)

Answer: Budgeted fixed production overheads Budgeted production units Fixed production overheads absorption rate Actual production units Fixed production overheads absorbed Fixed production overheads incurred Over/ (under) absorption of overheads (200,000 4) 200,000 400,000 0.50 110,000 55,000 50,000 5,000 (Q5) (Q4)

AC & MC -1-

ACCA F2 Management Accounting

(Q6)

Absorption costing profit Sales Cost of sales Gross Profit Adjustment: over/ (under) absorption Gross Profit (after adjustment) Selling, distribution and administration expenses: - Variable - Fixed Net Profit/ (Loss) (1 x 80,000) (200,000 4) (80,000) (75,000) 50,000 (5.00 x 80,000) (2.50 x 80,000) 400,000 200,000 200,000 5,000 205,000

(Q7)

Marginal costing profit Sales Variable production cost of sales Variable non-production cost of sales Contribution Fixed costs: - Production - Non production (S/A/D) Net Profit/ (Loss) (200,000 4) (300,000 4) (50,000) (75,000) 35,000 (5.00 x 80,000) (2.00 x 80,000) (1.00 x 80,000) 400,000 (160,000) (80,000) 160,000

Q8:

A company sold 56,000 units of its single product in a period for total revenue of $700,000. Finished stock increased by 4,000 units in the period. Costs in the period were: Variable production Fixed production Fixed non-production : $3.60 per unit : $258,000 (absorbed on the actual number of units produced) : $144,000

Using absorption costing, what was the profit for the period? A B $82,000 $96,400 C D $113,600 $123,200 700,000 (3.60 x 56,000) (258,000 x 56,000 / 60,000) 201,600 240,800 (442,400) 257,600 (144,000) 113,600

Sales revenue Cost of sales Variable production cost Fixed production cost Gross profit Non production cost Net profit Q9:

An organisation manufactures a single product which it sells at a standard price of $50 per unit. The cost structure is as follows: standard variable production cost total fixed production cost per month - $8 per unit - $120,000 (10,000 units of production are planned per month) standard variable selling cost - $5 per unit

AC & MC -2-

ACCA F2 Management Accounting

total fixed non-production costs

- $150,000 per month

In Month 1, when the opening stock is 1,000 units, production of 10,000 units is planned and sales of 8,000 units are expected. What would be the net profit for Month 1 under (i) AC and (ii) MC? Marginal costing SP VPC VNPC Contribution Volume Total contribution FC: Production FC: Non Production Net profit Profit reconciliation statement AC profit Add: Less: FOH in Opening stock FOH in Closing stock (12 x 1,000) (12 x 3,000) 12,000 (36,000) (24,000) 26,000 Q10: A company currently uses absorption costing. The following information relates to Product X for Month 1: Opening stock Production Sales Nil 900 units 800 units 50,000 50 (8) (5) 37 8,000 296,000 (120,000) (150,000) 26,000

If the company had used marginal costing, which of the following combinations would be true? Profit Higher Lower Scenario 1: Production Closing stk AC PROFIT Sales Opening stk MC PROFIT Stock Higher Lower

Q11:

The use of marginal costing as opposed to absorption costing may result in a difference in the reported profit for an accounting period. In which of the following circumstances, would the use of marginal costing, rather than absorption costing, result in higher reported profits? Opening stocks A B C D 100 units 0 units 100 units 0 units Closing stocks 50 units 50 units 100 units 0 units

AC & MC -3-

ACCA F2 Management Accounting

Scenario 2:

Production Closing stk AC PROFIT

Sales Opening stk MC PROFIT

Q12:

The overhead absorption rate for product Y is $2.50 per direct labour hour. Each unit of Y requires 3 direct labour hours. Stock of product Y at the beginning of the month was 200 units and at the end of the month were 250 units. What is the difference in the profits reported for the month using absorption costing compared with marginal costing? A B C D The absorption costing profit would be $375 less The absorption costing profit would be $125 greater The absorption costing profit would be $375 greater The absorption costing profit would be $1,875 greater

Profit Reconciliation Statement Absorption Costing Profit Add: Less: FOH in Opening Stock FOH in Closing Stock (2.50 x 3 x 200) (2.50 x 3 x 250) 1,500 (1,875) (375) Marginal Costing Profit AC profit higher by 375 Q13: A company produces a single product for which cost and selling price details are as follows: $ per unit Selling price Direct material Direct labour Variable overhead Fixed overhead Profit per unit 10 4 2 5 21 7 $ per unit 28

Last period, 8,000 units were produces and 8,500 units were sold. The opening stock was 3,000 units and profits reported using marginal costing was $60,000. The profits reported using an absorption costing system would be A B $47,500 $57,500 C D $59,500 $62,500

Profit Reconciliation Statement Absorption Costing Profit Add: Less: FOH in Opening Stock FOH in Closing Stock (5 x 3,000) (5 x 2,500) 57,500 15,000 (12,500) 2,500 Marginal Costing Profit AC profit lower by 2,500 AC profit is $57,500 60,000

AC & MC -4-

ACCA F2 Management Accounting

Q14:

A company had opening stock of 48,500 units and closing stock of 45,500 units. Profits based on marginal costing were $312,250 and on absorption costing were $288,250. What is the fixed overhead absorption rate per unit? A B $5.94 $6.34 C D $6.50 $8.00

Profit Reconciliation Statement Absorption Costing Profit Add: Less: FOH in Opening Stock FOH in Closing Stock (48,500) (45,500) 24,000 Marginal Costing Profit AC profit lower by 2,500 Q15: AC profit is $57,500 312,250 (8 x 3,000) 288,250

When comparing the profits reported under marginal costing and absorption costing when the level of stocks increased: A Absorption costing profits will be lower and closing stock valuations higher than the marginal costing B C Absorption costing profits and closing stock valuations lower than the marginal costing Absorption costing profits will be higher and closing stock valuations lower than the marginal costing D Absorption costing profits and closing stock valuations higher than the marginal costing

Q16:

A company made 17,500 units at a total cost of $16 each. Three quarters of the costs were variable and one quarter was fixed. 15,000 units were sold at $25 each. There were no opening stocks. By how much will the profits calculated using absorption costing principles differ from the profit if marginal costing principles had been used? A B C D The absorption costing profit would be $22,500 less. The absorption costing profit would be $10,000 greater The absorption costing profit would be $135,000 greater The absorption costing profit would be $10,000 less

Production Sales Increase in stocks FOH per unit (1/4 x 16) FOH in the stock difference Production Closing stk AC PROFIT Sales Opening stk MC PROFIT

17,500 15,000 2,500 4 10,000

Scenario 1:

AC & MC -5-

ACCA F2 Management Accounting

Q17:

In a period where opening stocks were 15,000 units and closing stocks 20,000, a firm had a profit of $130,000 using absorption costing. If the fixed overhead absorption rate was $8 per unit, the profit using marginal costing would be: A B $90,000 $130,000 C D $170,000 Impossible to calculate

Profit Reconciliation Statement Absorption Costing Profit Add: Less: FOH in Opening Stock FOH in Closing Stock (8 x 15,000) (8 x 20,000) 130,000 120,000 (160,000) (40,000) Marginal Costing Profit AC profit higher by 40,000 Q18: MC profit is $90,000 90,000

A manufacturing company produces a single product which has a selling price of $19 per unit and a unit cost of $14 as follows: $ per unit Direct material Direct labour Variable production overhead Fixed production overhead 5 4 2 3 14 Last period, the opening stock was 3,000 units and 13,000 units were produced. Sales were 14,000 units and the profits reported using marginal costing was $67,000. The profits reported under an absorption costing system would be: A B $64,000 $65,000 C D $70,000 Impossible to calculate

Profit Reconciliation Statement Absorption Costing Profit Add: Less: FOH in Opening Stock FOH in Closing Stock (3 x 3,000) (3 x 2,000) 64,000 9,000 (6,000) 3,000 Marginal Costing Profit Q22: A product has the following costs: $/unit Variable production costs Total production costs Total variable costs Total costs 4.80 7.50 5.90 10.00 67,000

11,400 units of the product were manufactured in a period during which 11,200 units were sold. What is the profit difference using absorption costing rather than marginal costing?

AC & MC -6-

ACCA F2 Management Accounting

A B C D

The profit for the period is $540 lower The profit for the period is $540 higher The profit for the period is $820 lower The profit for the period is $820 higher 4.80 (7.50 4.80) 2.70 7.50 (5.90 4.80) (10.00 1.10 7.50) 1.10 1.40 10.00 11,400 11,200 200 2.70 540 Sales Opening stk MC PROFIT

Variable production cost Fixed production cost Total production cost Variable non production cost Fixed non production cost Total cost Production Sales Increase in stocks FOH per unit FOH in the stock difference Scenario 1: Q23: Production Closing stk AC PROFIT

A company uses a marginal costing system. 10,000 units of its single product were manufactured in a period during which 9,760 units were sold. If absorption costing is applied instead what would be the effect on profit? A B C Higher by (240 units x fixed production overhead cost per unit) Lower by (240 units x fixed production overhead cost per unit) Higher by [240 units x (fixed production overhead cost per unit + fixed non-production overhead cost per unit)] D Lower by [240 units x (fixed production overhead cost per unit + fixed non-production overhead cost per unit)] Production Closing stk AC PROFIT Sales Opening stk MC PROFIT

Scenario 1:

AC & MC -7-

ACCA F2 Management Accounting

Additional Questions

Q1:

Workings: Cost per unit Direct materials Direct labour Prime cost Fixed production overheads Full production cost Stock level Opening stock Production Sales Closing stock Over/ (under) absorption of overheads Budgeted overheads Budgeted base Overhead absorption rate Actual base Overhead absorbed Overhead incurred Over/ (under) absorption of overheads (a) 800 50 16 52 832 830 2 52,000 (45,000) 7,000 (800/ 50) 400 6.00 10.00 16.00 26.00

Budgeted Profit and Loss Account for Walk-talk for the year ending 30 November 1999, using an absorption costing basis. $000 Sales Cost of sales Opening stock Production cost Closing stock Gross Profit Over/(under) absorption of overheads Gross Profit (revised) Non production costs Variable Fixed: Absorbed Over/ (under) Budgeted Net Profit 100 (100) 100 (26 x -) (26 x 50,000) (26 x -) 1,300 (1300) 200 200 (30 x 50,000) $000 1,500

AC & MC -8-

ACCA F2 Management Accounting

(b) (i) Absorption costing Sales Cost of sales Opening stock Production cost Closing stock Gross Profit Over/(under) absorption of overheads Gross Profit (revised) Non production costs Variable Fixed: Absorbed Over/ (under) Net Profit (ii) Marginal costing Sales Cost of sales Opening stock Production cost Closing stock Contribution Fixed Production costs Fixed Non production costs Net Profit (c) (i) Profit reconciliation statement Budgeted Absorption costing profit Lower Gross Profit Over absorption of production overheads Actual absorption costing profit (ii) Profit reconciliation statement Budgeted Marginal costing profit Adjustment Actual Absorption costing profit Add: FOH in opening stock Less: FOH in closing stock Actual marginal costing profit (16 x-) (16 x 7) (112) (112) (30) 100 (18) 82 (4 x 5) (20) 2 (18) 82 100 830 100 (930) (30) (10 x -) (10 x 52,000) (10 x 7,000) 520 (70) (450) 900 (30 x 45,000) $000 (2 x 45,000) 90 10 (100) 82 $000 1,350 (26 x -) (26 x 52,000) (26 x 7,000) 1,352 (182) (1,170) 180 2 182 (30 x 45,000) $000 $000 1,350

AC & MC -9-

ACCA F2 Management Accounting

Q2: (a) Profit Reconciliation Statement Absorption Costing Profit Add: Less: FOH in Opening Stock FOH in Closing Stock (8 x 7,000) (8 x 3,000) 120,000 56,000 (24,000) 32,000 Marginal Costing Profit AC profit lower by 32,000

(b) Absorption costing approach Sales (30 x 20,000) Cost of sales Opening stock Production Closing stock Gross Profit Adj: Over/ (under) GP (revised) (8 x 24 128) (24 x 2,000) (24 x 24,000) (24 x 6,000) 48,000 576,000 (144,000) 480,000 120,000 64,000 184,000 600,000

152,000 MC profit is $152,000

Profit Reconciliation Statement Absorption Costing Profit Add: Less: FOH in Opening Stock FOH in Closing Stock (8 x 2,000) (8 x 6,000) 184,000 16,000 (48,000) (32,000) Marginal Costing Profit AC profit higher by 32,000 152,000 MC profit is $152,000

AC & MC -10-

Вам также может понравиться

- F5 CKT Mock1Документ8 страницF5 CKT Mock1OMID_JJОценок пока нет

- FA October 16Документ37 страницFA October 16AngelaОценок пока нет

- All Fifty Questions CompulsoryДокумент13 страницAll Fifty Questions CompulsoryAngie Nguyen0% (1)

- ACCA F2 Revision Notes OpenTuition PDFДокумент25 страницACCA F2 Revision Notes OpenTuition PDFSaurabh KaushikОценок пока нет

- 2007 - Jun - QUS CAT T3Документ10 страниц2007 - Jun - QUS CAT T3asad19Оценок пока нет

- F2 and FMA Full Specimen Exam Answers PDFДокумент4 страницыF2 and FMA Full Specimen Exam Answers PDFSNEHA MARIYAM VARGHESE SIM 16-18Оценок пока нет

- F3 MOCK EXAM: KEY ACCOUNTING CONCEPTSДокумент21 страницаF3 MOCK EXAM: KEY ACCOUNTING CONCEPTSMaja Jareno GomezОценок пока нет

- 3uk - 2007 - Dec - Q CAT T3Документ10 страниц3uk - 2007 - Dec - Q CAT T3asad19Оценок пока нет

- Fa1 Mock 2Документ9 страницFa1 Mock 2smartlearning1977Оценок пока нет

- 13-ACCA-FA2-Chp 13Документ22 страницы13-ACCA-FA2-Chp 13SMS PrintingОценок пока нет

- F2 Past Paper - Question12-2005Документ13 страницF2 Past Paper - Question12-2005ArsalanACCA100% (1)

- AccountingДокумент7 страницAccountingHà PhươngОценок пока нет

- FA1 Mock 1Документ10 страницFA1 Mock 1Abdul MughalОценок пока нет

- 3int - 2008 - Jun - Ans CAT T3Документ6 страниц3int - 2008 - Jun - Ans CAT T3asad19Оценок пока нет

- F2 Past Paper - Question06-2007Документ13 страницF2 Past Paper - Question06-2007ArsalanACCA100% (1)

- Financial Accounting F3 25 August RetakeДокумент12 страницFinancial Accounting F3 25 August RetakeMohammed HamzaОценок пока нет

- CAT T10 - 2010 - Dec - AДокумент9 страницCAT T10 - 2010 - Dec - AHussain MeskinzadaОценок пока нет

- Overhead absorption costing questionsДокумент8 страницOverhead absorption costing questionsIshfaq AhmadОценок пока нет

- FFA Imp Questions-2Документ20 страницFFA Imp Questions-2Abdul Ahad YousafОценок пока нет

- T2 Mock Exam (Dec'08 Exam)Документ12 страницT2 Mock Exam (Dec'08 Exam)vasanthipuruОценок пока нет

- FA2 S20-A21 Examiner's ReportДокумент6 страницFA2 S20-A21 Examiner's ReportAreeb AhmadОценок пока нет

- Irrecoverable Debts ReviewДокумент11 страницIrrecoverable Debts ReviewThidarothОценок пока нет

- 2006 - Dec - Ans CAT T3Документ7 страниц2006 - Dec - Ans CAT T3asad19Оценок пока нет

- Financial Information For Management: Time Allowed 3 HoursДокумент14 страницFinancial Information For Management: Time Allowed 3 HoursAnousha DookheeОценок пока нет

- T4 June 08 AnsДокумент6 страницT4 June 08 Anssmhgilani0% (1)

- Chapter 6 Suspense Practice Q HДокумент5 страницChapter 6 Suspense Practice Q HSuy YanghearОценок пока нет

- 2006 - Dec - QUS CAT T3Документ9 страниц2006 - Dec - QUS CAT T3asad190% (1)

- Practice Qs Chap 13HДокумент4 страницыPractice Qs Chap 13HSuy YanghearОценок пока нет

- Chapter 6 Bank Recon Practice QHДокумент3 страницыChapter 6 Bank Recon Practice QHSuy Yanghear100% (1)

- Sales Tax Chapter QuestionsДокумент4 страницыSales Tax Chapter QuestionsBilal GouriОценок пока нет

- 3int - 2005 - Dec - Ans CAT T3Документ8 страниц3int - 2005 - Dec - Ans CAT T3asad19Оценок пока нет

- T4 June 08 QuesДокумент10 страницT4 June 08 QuessmhgilaniОценок пока нет

- Examiner's report on MA2 exam questionsДокумент3 страницыExaminer's report on MA2 exam questionsAhmad Hafid Hanifah100% (1)

- 3int - 2006 - Jun - QUS CAT T3Документ10 страниц3int - 2006 - Jun - QUS CAT T3asad19Оценок пока нет

- 02 MA2 LRP QuestionsДокумент36 страниц02 MA2 LRP QuestionsKopanang Leokana50% (2)

- Fa2 Mock Exam 2Документ10 страницFa2 Mock Exam 2Iqra HafeezОценок пока нет

- FIA FFM Mock Exam Questions on Investment Appraisal, Inventory Management and Business FinanceДокумент9 страницFIA FFM Mock Exam Questions on Investment Appraisal, Inventory Management and Business Financetheizzatirosli100% (1)

- Manufacturing process WIP calculationДокумент6 страницManufacturing process WIP calculationNasir Iqbal100% (1)

- F2 Mock Questions 201603Документ12 страницF2 Mock Questions 201603Renato WilsonОценок пока нет

- Toaz - Info Acca f3 LRP Questions PRДокумент64 страницыToaz - Info Acca f3 LRP Questions PRArt and Fashion galleryОценок пока нет

- Seminar 2-3Документ8 страницSeminar 2-3Nguyen Hien0% (1)

- MA1 (Mock 1)Документ16 страницMA1 (Mock 1)Shamas 786Оценок пока нет

- 3int - 2006 - Dec - Ans CAT T3Документ7 страниц3int - 2006 - Dec - Ans CAT T3asad19Оценок пока нет

- FA2 - MOCK PAPER REVIEWДокумент9 страницFA2 - MOCK PAPER REVIEWLinh ThuyОценок пока нет

- Fa2 Mock Test 2Документ7 страницFa2 Mock Test 2Sayed Zain ShahОценок пока нет

- Test of Labour Overheads and Absorption and Marginal CostingДокумент4 страницыTest of Labour Overheads and Absorption and Marginal CostingzairaОценок пока нет

- FIA Maintaining Financial Records FA2 BPP Learning Media BPP Learning MediaДокумент10 страницFIA Maintaining Financial Records FA2 BPP Learning Media BPP Learning Mediamamoona ehsanОценок пока нет

- Fma Past Papers 1Документ23 страницыFma Past Papers 1Fatuma Coco BuddaflyОценок пока нет

- Examiner's Report - FA2 PDFДокумент40 страницExaminer's Report - FA2 PDFSuy YanghearОценок пока нет

- BPP F3 KitДокумент4 страницыBPP F3 KitMuhammad Ubaid UllahОценок пока нет

- Sales Tax QuestionДокумент3 страницыSales Tax QuestionKhushi SinghОценок пока нет

- Slo 02 Acc230 08 TestДокумент5 страницSlo 02 Acc230 08 TestSammy Ben MenahemОценок пока нет

- Managerial Accounting - WS4 Connect Homework GradedДокумент9 страницManagerial Accounting - WS4 Connect Homework GradedJason HamiltonОценок пока нет

- Costing Methods Comparison for Umbrella ManufacturerДокумент70 страницCosting Methods Comparison for Umbrella ManufacturerNavin Joshi70% (10)

- Absorption % Marginal Costing - Practice QuestionsДокумент6 страницAbsorption % Marginal Costing - Practice Questionssramnarine1991Оценок пока нет

- Revise Mid TermДокумент43 страницыRevise Mid TermThe FacesОценок пока нет

- CH 011 AIA 5e PDFДокумент7 страницCH 011 AIA 5e PDFfaizthemeОценок пока нет

- Solving ProblemsДокумент1 страницаSolving Problemstryingacc2Оценок пока нет

- Cost Volume Profit Analysis - With KEYДокумент8 страницCost Volume Profit Analysis - With KEYPatricia AtienzaОценок пока нет

- Handling Your Sex DriveДокумент9 страницHandling Your Sex DriveSamuel DwumfourОценок пока нет

- NewGRE WordsДокумент7 страницNewGRE WordsMatt Daemon Jr.Оценок пока нет

- 1000 Most Common Words (SAT)Документ70 страниц1000 Most Common Words (SAT)grellian95% (20)

- Section 1 General ProblemsДокумент44 страницыSection 1 General ProblemsSamuel DwumfourОценок пока нет

- Standard CostingДокумент8 страницStandard CostingSamuel DwumfourОценок пока нет

- Section 12 LymphaticsДокумент5 страницSection 12 LymphaticsSamuel DwumfourОценок пока нет

- Section 16 PoisonsДокумент60 страницSection 16 PoisonsSamuel DwumfourОценок пока нет

- Section 2 SKINДокумент48 страницSection 2 SKINSamuel DwumfourОценок пока нет

- How To Create A CompanyДокумент30 страницHow To Create A CompanySamuel DwumfourОценок пока нет

- Section 7 RespiratoryДокумент26 страницSection 7 RespiratorySamuel DwumfourОценок пока нет

- Section 3 ExtremitiesДокумент19 страницSection 3 ExtremitiesSamuel DwumfourОценок пока нет

- Section 2 SKINДокумент48 страницSection 2 SKINSamuel DwumfourОценок пока нет

- Chapter 16 Financial AssetsДокумент3 страницыChapter 16 Financial AssetsSamuel DwumfourОценок пока нет

- Break Even AnalysisДокумент18 страницBreak Even AnalysisSamuel DwumfourОценок пока нет

- Section 6 UrinaryДокумент18 страницSection 6 UrinarySamuel DwumfourОценок пока нет

- Associates Chapter 21 SummaryДокумент6 страницAssociates Chapter 21 SummarySamuel DwumfourОценок пока нет

- Chapter08 002 PricingДокумент71 страницаChapter08 002 PricingSamuel DwumfourОценок пока нет

- Liver Cleasing TherapyДокумент31 страницаLiver Cleasing TherapySamuel DwumfourОценок пока нет

- Ch18 AnsДокумент5 страницCh18 AnsSamuel DwumfourОценок пока нет

- Audit ReportsДокумент5 страницAudit ReportsSamuel DwumfourОценок пока нет

- Chapter 16 Financial Assets and Liabilities: 1. ObjectivesДокумент13 страницChapter 16 Financial Assets and Liabilities: 1. Objectivessamuel_dwumfourОценок пока нет

- Receivable 1Документ4 страницыReceivable 1Samuel DwumfourОценок пока нет

- Ch17 AnsДокумент13 страницCh17 AnsSamuel DwumfourОценок пока нет

- Chapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsДокумент3 страницыChapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsSamuel DwumfourОценок пока нет

- Chapter 17 Accounting for Taxation and Deferred TaxesДокумент23 страницыChapter 17 Accounting for Taxation and Deferred TaxesSamuel DwumfourОценок пока нет

- Solution Corporate Reporting Strategy May 2007Документ10 страницSolution Corporate Reporting Strategy May 2007Samuel DwumfourОценок пока нет

- Chapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsДокумент3 страницыChapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsSamuel DwumfourОценок пока нет

- Solution Financial Reporting May 2011Документ12 страницSolution Financial Reporting May 2011Samuel DwumfourОценок пока нет

- Associates Chapter 21 SummaryДокумент6 страницAssociates Chapter 21 SummarySamuel DwumfourОценок пока нет

- Solution Public Sector Accounting May 2010Документ10 страницSolution Public Sector Accounting May 2010Samuel DwumfourОценок пока нет

- Rural MarketingДокумент40 страницRural MarketingBARKHA TILWANIОценок пока нет

- The Concept of Relationship Marketing: Lesson 2.1Документ66 страницThe Concept of Relationship Marketing: Lesson 2.1Love the Vibe0% (1)

- ROSHNI RAHIM - Project NEWДокумент37 страницROSHNI RAHIM - Project NEWAsif HashimОценок пока нет

- The Customer and Car Rental Service RelationshipДокумент3 страницыThe Customer and Car Rental Service RelationshipAbhimanyu GuptaОценок пока нет

- Jun 2004 - Qns Mod BДокумент13 страницJun 2004 - Qns Mod BHubbak Khan100% (1)

- MTP - Intermediate - Syllabus 2016 - Jun 2020 - Set 1: Paper 8-Cost AccountingДокумент7 страницMTP - Intermediate - Syllabus 2016 - Jun 2020 - Set 1: Paper 8-Cost AccountingJagannath RaoОценок пока нет

- LCG LCPharma EN 160421Документ11 страницLCG LCPharma EN 160421Patrick MontegrandiОценок пока нет

- Solution Manual For Essentials of Corporate Finance by ParrinoДокумент21 страницаSolution Manual For Essentials of Corporate Finance by Parrinoa8651304130% (1)

- OECD HRM Profile - BrazilДокумент4 страницыOECD HRM Profile - BrazilRaymond LullyОценок пока нет

- Rent Control Myths RealitiesДокумент357 страницRent Control Myths RealitiesRedmond Weissenberger100% (1)

- CH 2 POP PRACTICE EXAMДокумент9 страницCH 2 POP PRACTICE EXAMErik WeisenseeОценок пока нет

- The U.S.-China Trade War and Options For TaiwanДокумент5 страницThe U.S.-China Trade War and Options For TaiwanThe Wilson CenterОценок пока нет

- Strategic Plan 2016-2019: A Place for People to ProsperДокумент20 страницStrategic Plan 2016-2019: A Place for People to ProsperKushaal SainОценок пока нет

- V. Financial Plan Mas-Issneun Samgyeopsal Income Statement For The Period Ended December 2022 SalesДокумент3 страницыV. Financial Plan Mas-Issneun Samgyeopsal Income Statement For The Period Ended December 2022 SalesYuri Anne MasangkayОценок пока нет

- Country Profile Serbia enДокумент16 страницCountry Profile Serbia enKatarina VujovićОценок пока нет

- Uganda National Fertilizer Policy April23-2016Документ33 страницыUganda National Fertilizer Policy April23-2016Elvis100% (1)

- The Challenges and Countermeasures of Blockchain in Finance and EconomicsДокумент8 страницThe Challenges and Countermeasures of Blockchain in Finance and EconomicsBlaahhh100% (1)

- Concur Expense: Taxation: Setup Guide For Standard EditionДокумент47 страницConcur Expense: Taxation: Setup Guide For Standard Editionoverleap5208Оценок пока нет

- ATM 8 Fleet Planning A162Документ11 страницATM 8 Fleet Planning A162Muhriddin OripovОценок пока нет

- Corporate PresentationДокумент32 страницыCorporate Presentationanand1kumar-31Оценок пока нет

- Assignment Classification Table: Topics Brief Exercises Exercises ProblemsДокумент125 страницAssignment Classification Table: Topics Brief Exercises Exercises ProblemsYang LeksОценок пока нет

- India's Leading Infrastructure Companies 2017Документ192 страницыIndia's Leading Infrastructure Companies 2017Navin JollyОценок пока нет

- Lecture Notes - 2 - The Hospitality and Tourist Market and SegmentationДокумент5 страницLecture Notes - 2 - The Hospitality and Tourist Market and SegmentationDaryl VenturaОценок пока нет

- Business OrganisationsДокумент3 страницыBusiness OrganisationsAnca PandeleaОценок пока нет

- Executive SummaryДокумент49 страницExecutive SummaryMuhsin ShahОценок пока нет

- Financial Planning of Financial InstitutionsДокумент3 страницыFinancial Planning of Financial InstitutionsSoniya Omir VijanОценок пока нет

- ProspectingДокумент40 страницProspectingCherin Sam100% (1)

- Essay About MonopolyДокумент15 страницEssay About MonopolyNguyễn Lan HươngОценок пока нет

- Advantage and Disadvantages of Business OrganizationДокумент3 страницыAdvantage and Disadvantages of Business OrganizationJustine VeralloОценок пока нет

- New Microsoft Word DocumentДокумент3 страницыNew Microsoft Word Documentishagoyal595160100% (1)