Академический Документы

Профессиональный Документы

Культура Документы

Cfa L1 Session18

Загружено:

Fernando FragaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cfa L1 Session18

Загружено:

Fernando FragaАвторское право:

Доступные форматы

Study Session 18 Alternative Investments

CFACENTER.COM 1

Study Session 18

Alternative Investments

A. Alternative Investments

a. describe the general features of alternative investments and distinguish between

alternative assets and alternative strategies.

Both alternative assets and alternative strategies are classiIied as alternative

investments.

Alternative assets are assets not traded on exchanges. Examples include real

estate, venture capital, etc.

Alternative strategies are strategies that mostly use traded assets Ior the purpose

oI isolating bets and generating alpha. Examples include hedge Iunds and mutual

Iunds.

Whether an investor invests directly or through an intermediary in alternative

investments, he must know the investment's characteristics. Alternative investments

usually involve:

illiquiditv: since most alternative investments are not traded on exchanges, they

usually cannot be quickly converted to cash at a price close to Iair market value.

As a result, alternative investments beckon investors to areas oI the market where

alpha is more likely to be Iound than in more liquid and eIIicient markets. A

liquidity premium compensates the investor Ior the investor's inability to

continuously rebalance the alternative investments in the portIolio.

difficultv in the determination of current market values.

limited historical risk and return data: the requirement Ior extensive investment

analysis.

a segmentation risk premium: the premium compensates investors Ior the risk oI

alternative assets that, by nature, are generally nor priced in a Iully integrated

global market.

Unique legal and tax considerations: many alternative investments use special

legal structures to avoid some taxes or regulations.

Illiquidity, limited inIormation, and less eIIiciency do not suit all investors, but can be

Study Session 18 Alternative Investments

CFACENTER.COM 2

attractive Ieatures to those looking Ior likely places to add value through investment

expertise.

Note: alpha is risk-adjusted return in excess oI the required rate oI return, but, more

colloquially, stands Ior positive excess risk-adjusted return, the goal oI active

managers.

b. distinguish between an open-end and a closed-end fund and between a load and

a noload fund.

An investment company invests a pool oI Iunds belonging to many individuals in a

single portIolio (reIerred to as a Iund) oI securities. The major duties oI the

investment management company include investment research, the management oI

the portIolio and administrative duties, such as issuing securities and handling

redemptions and dividends. The management oI the portIolio oI securities and most oI

the other administrative duties are handled by a separate investment management

company hired by the board oI directors oI the investment company. To achieve

economics oI scale, many management companies start numerous Iunds with diIIerent

characteristics. This "Iamily oI Iunds" promotes Ilexibility and increases the total

capital managed by the investment Iirm.

Investment companies are classiIied according to whether or not they stand ready to

redeem investor shares.

Study Session 18 Alternative Investments

CFACENTER.COM 3

An open-end investment company, or a mutual fund, continues to sell and

repurchase shares aIter its initial public oIIering. It stands ready to redeem

investor shares at market value.

A closed-end investment company operates like any other public Iirm. It is

initiated through a stock oIIering to raise capital. Its stock trades on the regular

secondary market and the market price is determined by supply and demand. A

typical closed-end investment company oIIers no Iurther shares and does not

repurchases the shares on demand (no Iunds can be withdrawn). ThereIore,

investors must trade in public secondary markets (e.g. NASDAQ) to buy or sell

shares.

Various Iees charged by investment companies:

Investment companies charge Iees Ior their eIIorts oI setting up Iunds. Sales

commissions are charged at purchase (front-end load) as a percentage oI the

investment.

A load fund has sales commission charges. A load Iund's oIIering price

NAV oI the share a sales charge (7.5 - 8 oI the NAV). The NAV price is

the redemption (bid) price, and the oIIering (ask) price equals the NAV

divided by 1 minus the percent load.

A no-load fund imposes no initial sales charge, so it sells at NAV. Some

charge a small redemption Iee oI about 0.5.

A low-load fund typically imposes 3 percent sales charge.

Redemption fee (back-end load): a charge to exit the Iund. They discourage

quick trading turnover and are set up so that the Iees decline the longer the shares

are held (in this case, the Iees are sometimes called contingent deferred sales

charges). Load Iunds generally charge no redemption Iees.

All mutual Iunds charge annual Iees.

They are composed oI operating expenses including management Iees,

administrative expenses and continuing distribution Iees. For example,

distribution fees are Iees paid back to the party that arranged the initial sale

oI the shares and are thus another type oI sales incentive Iee.

Annual charges are typically calculated as a percentage oI the average net

assets oI the Iund. For example, a 12b-1 plan permits Iunds to deduct as

much as 0.75 oI average net assets per year to cover distribution costs.

The ratio oI operating expenses to average assets is oIten reIerred to as the

Iund's "expense ratio".

Study Session 18 Alternative Investments

CFACENTER.COM 4

c. explain how the net asset value of a fund is calculated.

The per-share value oI the investment company is known as its net asset value (NAV).

It is like the share price oI a corporation's common stock.

Fund NAV (Total Market Value of Fund Portfolio) - (Fund Liabilities)] /

(Number of Fund Shares Outstanding)

Fund liabilities are mainly Iees owed to the Iund manager.

Share value equals NAV Ior unmanaged and open-end investment companies

because they stand ready to redeem their shares at NAV.

The price oI a closed-end investment company's shares is determined by the

supply and demand in the secondary markets in which they trade, and,

consequently, can be at a premium or discount to NAV.

d. explain the nature of various fees charged by mutual funds and the impact of

such fees on fund performance.

For diIIerent kinds oI various Iees, please reIer to los b.

In addition to selling charges (loads or 12b-1 charges), all investment Iirms charge

annual management fees to compensate proIessional managers oI the Iund. Such a

Iee typically is Irom 0.25 to 1.00 percent oI the average net assets oI the Iund. These

management Iees are a major Iactor driving the creation oI new Iunds: once the

research staII and management structure have been established, the incremental costs

do not rise in line with the assets under management.

Loads, redemption Iees, and distribution Iees are sales incentives.

Only management Iees can be considered a portIolio management incentive Iee.

However, as management Iees are based on net assets oI the Iund instead oI its

rate oI return, they are not an eIIective perIormance incentive. Researches have

also Iound out that good perIormance is associated with low expense ratios.

Study Session 18 Alternative Investments

CFACENTER.COM 5

e. distinguish among style, sector, index, global, and stable value strategies in equity

investment.

Investment companies primarily invest in equity. Investment strategies can be

characterized as the Iollowing strategies:

Style strategies Iocus on the underlying characteristics common to certain

investments. Growth is a diIIerent style than value, and large capitalization

investing is a diIIerent style than small stock investing. A growth strategy may

Iocus on high price-to-earnings stocks, and a value strategy on low

price-to-earnings stocks. Clearly there are many styles.

A sector investment fund Iocuses on particular industries (e.g. technology).

An index fund tracks an index. In the simplest implementation, the Iund owns

the securities in the index in exactly the same proportion as the market value

weights oI those securities in the index.

A global fund includes securities Irom around the world and might keep portIolio

weights similar to world market capitalization weights. An international fund is

one that does NOT include the home country's securities, whereas a global Iund

includes the securities Irom the home country.

A stable value fund invests in securities such as short-term Iixed income

instruments and guaranteed investment contracts which are guaranteed by the

issuing insurance company and pay principal and a set rate oI interest. It Iocuses

on preservation oI capital while earning stable current income.

f. distinguish between a closed-end fund and an exchange traded fund (E1F).

Exchange-traded funds (ETF) are a special type oI mutual Iunds traded on a stock

market like shares oI public companies. They are designed to closely track the

perIormance oI a speciIied stock market index.

ETFs can be traded at any time during market hours.

ETFs can be sold short or margined.

ETFs are shares oI a portIolio, not oI an individual company.

Legal Structures oI ETFs

Managed Investment Companies are open-ended investment companies

registered under the Investment Company Act oI 1940.

Study Session 18 Alternative Investments

CFACENTER.COM 6

They oIIer the most Ilexible ETF structure.

The index can be tracked using various techniques.

Dividends paid on the securities can be immediately reinvested in the Iund.

Unit Investment Trusts (UITs) are also registered investment companies but

operate under more constraints because they don't have a manager per se (but

trustees)

They are required to be Iully invested in all underlying securities Iorming the

index.

They must hold dividends received on securities in cash until the ETF pays a

dividend to shareholders: this could result in a slight cash drag on

perIormance.

They are not permitted to lend securities and do not generally use derivatives.

Grantor Trusts are a structure that allows investors to indirectly own an

unmanaged basket oI stocks rather than tracking an index. They are not registered

investment companies.

Because a grantor trust is Iully invested in the basket oI securities, no

investment discretion is exercised by the trust. This is basically an

unmanaged (and unregistered) investment company with a limited liIe.

The trust passes all dividends on the underlying securities to shareholders as

soon as practicable.

Securities lending and use oI derivatives are generally not practiced.

In the traditional mutual Iund structure, no market makers are involved in the creation

and redemption process.

When investors want to purchase the shares oI a Iund, the Iund manager will

issue new shares to the investors and take the cash to the capital markets to buy

securities that Iit the Iund's objective.

When investors want to sell the shares oI the Iund, the manager will sell securities

back to the capital markets, and use the cash raised to redeem shares Irom the

investors.

Unlike close-end Iunds, open-end and UIT ETFs use market makers in the unique

"in-kind" creation and redemption process.

Study Session 18 Alternative Investments

CFACENTER.COM 7

Creation and redemption units are created in large multiples oI individual ETF shares,

Ior example, 50,000 shares. These units are available to exchange specialists

(authori:ed participants or creation agents) that are authorized by the Iund and who

will generally act as market makers on the individual shares. The Iund publishes the

index tracking portIolio that it is willing to accept Ior in-kind transactions.

When there is excess demand Ior ETF shares, an authorized participant will

create a creation unit by depositing with the trustee oI the Iund the speciIied

portIolio oI stocks used to track the index. In return, the authorized participant

will receive ETF shares that can be sold to investors on the stock market. A

purchase order to buy ETF shares is not directed to the Iund but to the market

makers on the exchange. In contrast, in the traditional mutual Iund structure an

increase in demand Ior the shares oI the mutual Iund is met by the mutual Iund,

which simply issues new shares to the investor (and the Iund manager will take

the cash to the capital markets and buy securities appropriate to the Iund's

objective).

II there is an excess number oI ETF shares sold by investors, an authorized

participant will decide to redeem ETF shares by exchanging with the Iund a

redemption unit Ior a portIolio oI stocks held by the Iund and used to track the

index. As opposed to traditional open-end Iunds, this process means that no

capital gain will be realized in the Iund's portIolio on redemption. II the

redemption were in cash, the Iund would have to sell stocks and iI their price had

appreciated, the Iund would realize a capital gain and a tax burden Ior all existing

Iund shareholders. This is not the case with ETFs. Certainly individual ETF

shareholders can require in-cash redemption but the practice is discouraged:

A large Iee is charged on in-cash redemptions.

In-cash redemptions are based on the NAV computed several days aIter the

transactions, not the current NAV. As a result, investors will be reluctant to

redeem in cash because the redemption value is unknown at the time oI

redemption.

Study Session 18 Alternative Investments

CFACENTER.COM 8

ThereIore, it is more advantageous Ior them to sell their shares on the market

than to redeem them in cash.

g. discuss the advantages, disadvantages, and risks of E1Fs.

Advantages:

DiversiIication can be obtained easily with a single ETF transaction.

They trade similarly to a stock.

They trade throughout the whole trading day instead oI trading once a day, as do

the traditional open-ended mutual Iunds.

The management oI their risk is augmented by Iutures and options contracts on

them.

Transparency oI portIolio holdings.

Cost eIIective: no load Iees, low expense ratio since they are passively managed

and there is no shareholder accounting at the Iund level.

Avoidance oI signiIicant premiums or discounts to NAV because oI their unique

structure: arbitrage helps keep the traded price oI an ETF much more in line with

its underlying value. This is contrast to closed-end index Iunds, which oIIer a

Iixed supply oI shares, and as demand changes, they Irequently trade at

appreciable discounts Irom -- and sometimes premiums to -- their NAVs.

Tax savings Irom payment oI in-kind redemption.

Immediate dividend reinvestment Ior open-end ETFs.

Disadvantages:

Only a narrow-based market index tracked in some countries.

Intraday trading opportunity is not important Ior long-horizon investors.

Large bid-ask spreads on some ETFs. As a result, investing in these Iunds is very

costly.

Possibly better cost structures and tax advantages to direct index investing Ior

large institutions. Such a portIolio may also have lower taxes than an ETF.

The Iollowing risks do not aIIect all ETFs to the same extent.

Market risk: similar to those oI holders oI other diversiIied portIolios.

Asset class/sector risk: the returns Irom the type oI securities in which an ETF

invests may underperIorm returns Irom the general securities markets or diIIerent

asset classes.

Trading risk: bid-ask spread can be large Ior some ETFs with low trading

volumes. Trading prices oI some ETFs may diIIer markedly Irom their NAVs due

to the Iluctuations in the securities markets.

Tracking error risk: ETFs may not be able to exactly replicate the perIormance oI

Study Session 18 Alternative Investments

CFACENTER.COM 9

the indexes because oI Iund expenses and other Iactors.

Derivative risk: this aIIects only those Iunds that employ derivative in their

investment strategies. These derivatives may cause additional risk, such as

counterparty credit risk or high leverage.

Currencv risk and countrv risk: they apply to ETFs that are based on international

indexes. Currency risk is the risk oI capital loss due to unIavorable changes in

currency exchange rates. Country risk is the risk caused by economic and

political turbulences in diIIerent countries. In general emerging markets have

greater country risk than developed countries.

h. describe the forms of real estate investment.

In general, real estate reIers to buildings and buildable lands, including residential

homes, raw land, income-producing properties such as warehouses, oIIice and

apartment buildings. Real estate is a type oI tangible assets, which are investment

assets that can be seen and touched. In contrast, Iinancial assets are only recorded as

pieces oI paper.

There are several Iorms:

Free and Clear Equity. Also called fee simple, it reIers to Iull ownership rights

Ior an indeIinite period oI time, giving the owner the right, Ior example, to lease

the property to tenants and resell the property at will.

Leveraged Equity. It reIers to the same ownership rights but subject to debt

(such as a promissory note) and a pledge (mortgage) to hand over real estate

ownership rights iI the loan terms are not met.

Mortgages. They represent a type oI debt investment as a mortgage provides the

investor a stream oI bond like payments. This is a Iorm oI real estate investment

as the creditor may end up with owning the property being mortgaged. To

diversiIy risks a typical investor oIten invests in securities issued against a pool oI

mortgages.

Aggregation Vehicles. They aggregate investors and serve the purpose oI giving

investors collective access to real estate investments.

Real Estate Partnerships (RELPs). A RELP is a proIessionally managed

real estate syndicate that invests in various types oI real estate. The purpose

oI the RELP varies Irom raw land speculation to investments in income

producing properties. Managers assume the role oI general partner with

Study Session 18 Alternative Investments

CFACENTER.COM 10

unlimited liability, while other investors are treated like limited partners with

limited liability.

Commingled Funds. They are pools oI capital created largely by

like-minded institutional investors organized together by an intermediary to

invest chieIly in real estate investment projects. They can be either open or

closed end. For example, an open-ended commingled Iund does not have a

termination date, accepts new investors aIter initiation oI the Iund, and

amends the real estate portIolio over time.

Real Estate Investment Trusts (REITs). A REIT is a type oI closed-end

investment company that sells shares to investors and invests the proceeds in

various types oI real estate and real estate mortgages.

It allows small investors to receive both the capital appreciation and the

income returns without the headache oI property management.

Its shares are traded on a stock market.

It provides a tax shelter.

It also has strong restriction on the use, and distribution oI Iunds.

i. explain the characteristics of real estate as an investable asset class and describe

the various approaches used in the valuation of real estate.

Some characteristics oI real estate as an investable asset class:

Properties are immovable and basically indivisible so they are generally illiquid.

Every property is unique, primarily because no two properties can share the same

location. In addition, terms and conditions oI transactions may diIIer signiIicantly.

ThereIore properties are only approximately comparable to other properties.

There is no national, or international, auction market Ior properties. ThereIore it

is diIIicult to assess the market value oI a given property.

Transaction costs and management Iees Ior real estate investments are high.

Real estate markets suIIer ineIIiciencies because oI the nature oI real estate itselI

and because inIormation is not Ireely available.

Appraisal is the process Ior estimating the current market value oI a piece oI property.

Because oI both technical and inIormational shortcomings, this estimate is subject to

substantial error.

There are three commonly used approaches to real estate market value:

The Cost Approach: the real estate valuation approach based on the idea that an

investor should not pay more Ior a property than it would cost to rebuild it at

today's prices. It generally works well Ior new or relatively new buildings. Most

Study Session 18 Alternative Investments

CFACENTER.COM 11

experts use it as a check against a price estimate. Limitations:

an appraisal oI the land value is not always an easy task.

the market value oI an existing property could diIIer signiIicantly Irom its

construction cost.

The Sales Comparison Approach: this approach uses as the basic input the sales

prices oI properties (benchmark value) that are similar to the subject property.

The price must be adjusted to reIlect its superiority or inIeriority to comparable

properties. This approach can give a good Ieel Ior the market.

Hedonic Price Estimation:

IdentiIy the major characteristics (age, size, location, etc) oI a property that

can aIIect its value.

Give a quantitative rating Ior each characteristic.

PerIorm regression analysis oI sales price Ior all recent transactions in the

benchmarks on their characteristics ratings.

The estimated slope coeIIicients are the valuation oI each characteristic in the

transaction price. It is a benchmark monetary value associated with each

characteristic's rating.

It is then possible to estimate the selling price oI a speciIic property by taking

into account its rating on each Ieature.

The Income approach: this approach calculates a property's value as the present

value oI all its Iuture income. It assumes that the annual net operating income

(NOI) oI a property can be maintained at a constant level Iorever (that is, NOI is a

perpetuity). The most popular income approach is called direct capitalization:

market value (annual net operating income) / (market capitalization rate)

Net operating income (NOI) equals the amount leIt aIter subtracting

vacancy and collection losses and property operating expenses Irom an

income property's gross potential rental income.

The market capitalization rate is obtained by looking at recent market sales

Iigures to determine the rate oI return required by investors. Market Cap Rate

Benchmark NOI / Benchmark Transaction Price, where benchmark reIers

to a comparable property, or the median or mean oI several comparable

properties.

As long as inIlation can be passed through, it will not aIIect valuation,

because the market cap rate also incorporates the inIlation rate.

The Discounted AIter-Tax Cash Flow Approach: iI the investor can deduct

depreciation and any interest payments Irom NOI, then the investor's aIter-tax

cash Ilows depend on the investor's marginal tax rate.

Study Session 18 Alternative Investments

CFACENTER.COM 12

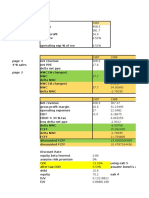

j. calculate the net operating income (AOI) from a real estate investment.

Here is a sample oI income statement oI a real estate property (an apartment

building):

0o:: utu' `uom 8 x 33 x !?) S3?,!b0

Out`u_ xu:::

|t`'`t`: S?,830

Tu:l o''t`ou b

lu`: uud mu`utuuu 00

lomot`ou uud udvt`:`u_ !0

loty `u:uuu 810

loty tux: 3,?00

::: Totu' out`u_ xu:: 8,!9

\t out`u_ `uom \OT) S?3,9b

This should give you a rough idea income and expense components oI a real estate

property.

Note that:

Depreciation expenses are not subtracted Irom gross rental income, as it is

assumed that repairs and maintenance will keep the property in good condition

Iorever.

Interest expenses are also not subtracted Irom gross rental income as this

approach is used to estimate the value oI the property independently oI how

the investment is Iinanced.

k. calculate the value of a property under the sales comparison and income

approaches.

Sally Hopper owned an apartment building in London that consisted oI 50 units and

60,000 square It. oI living area. The building had a 5 vacancy rate. Monthly rentals

averaged $4000 per unit with an average collection loss oI 1 per year (on gross

rental income). Annual property operating expenses averaged $1100 per month/per

unit whether it was rented or not. Insurance plus property taxes averaged another $600

per month/per unit. Sophie assumes that properties in her area earn at least 10 per

year based on recent sales Iigures. What is the value oI Sally's property using the NOI

Study Session 18 Alternative Investments

CFACENTER.COM 13

approach?

Solution:

Number oI Units 50

Monthly Rental 4000

Total Potential Rent (annual) 2,400,000

Vacancy Rate - 5 120,000

Collection Loss - 1 22,800

Operating Expenses 660,000

Property taxes insurance 360,000

Total Annual Adjustments & Expenses 1,162,800

NOI 1,237,200

Cap Rate .10

Market Value $12,372,000

Income Approach: The income approach uses a discounted cash Ilow approach oI

Iuture income. The most common approach oI this methodology is reIerred to as the

direct capitalization method.

The direct capitalization method presumes that the annual net operating income

continues as a perpetuity (inIinity), earning the investor his opportunity cost oI Iunds

or market capitalization rate. The net operating income Iormula is Iormula is:

Market Value Annual net operating income / Market capitalization rate

V NOI / R

Note: the collection loss is based on the amount oI accrued rent, not potential rent. In

this case, the accrued rent is $2,400,000 less the 5 vacancy oI $120,000. Thus the

collection loss (or bad debt) is $22,800 (($2,400,000 - $120,000) *.01).

The market capitalization rate examines recent market sales Iigures to determine the

rate oI return currently demanded by investors. For example, assuming a NOI oI

$1,237,200 and a market cap rate oI 10, the value oI the Iirm is $12,372,000 shown

below.

NOI $ 1,237,200

Market Capitalization Rate .10

V 1,237,200 / .10 $12,372,000

II there are numerous properties an appraiser may use an average oI NOI and the

market capitalization rates. Level I candidates should recognize that iI gross potential

income is provided, some operating expenses need to be subtracted in order to arrive

at the NOI Iigure.

Study Session 18 Alternative Investments

CFACENTER.COM 14

l. calculate the after-tax cash flows, net present value, and yield of a real estate

investment.

To move Irom NOI to aIter-tax cash Ilows we need to perIorm some calculations. The

Iollowing is the cash Ilow analysis Ior an apartment building Irom year 1999 to 2003:

!999 ?000 ?00! ?00? ?003

Tuom Tux Comutut`ou: Tuom Tux Comutut`ou: Tuom Tux Comutut`ou: Tuom Tux Comutut`ou:

\OT S??,8?? S?1,1!9 S?b,!?8 S?,9 S?9,9!1

Tut:t ?0,30 ?0,?9 ?0,!1b ?0,0?? !9,8

D`ut`ou b,1 b,1 b,1 b,1 b,1

Tuxu|' `uom'o::) 1,03 ?,38 b3 !,390 3,19?

Hu_`uu' tux ut 0.3! 0.3! 0.3! 0.3! 0.3!

Tux :uv`u_:) o

tux:)

!,?b3 39 ! 13! !,083

/t /t /t /t Tux Cu:l l'o /TCl) Comutut`ou: Tux Cu:l l'o /TCl) Comutut`ou: Tux Cu:l l'o /TCl) Comutut`ou: Tux Cu:l l'o /TCl) Comutut`ou:

\OT S??,8?? S?1,1!9 S?b,!?8 S?,9 S?9,9!1

Hot_u_ uymut ?!,?80 ?!,?80 ?!,?80 ?!,?80 ?!,?80

botux u:l 'o !,1? 3,!39 1,818 b,b 8,b31

Tux :uv`u_:) o

tux:)

!,?b3 39 ! 13! !083

/TCl ?,80 3,88 ,0?3 b,?1b ,!

In this case, potential tax savings accrue during the Iirst 3 years because the allowable

tax deductions oI interest and depreciation exceed the property's net operating income;

in the Iinal 2 years, income exceeds deductions, so taxes are due.

The "magic" oI simultaneously losing and making money is caused by depreciation.

Tax statutes incorporate this tax deduction, which is based on the original cost oI the

building to reIlect its declining economic liIe. However, because this deduction does

not require a current cash outIlow by the property owner, it acts as a non-cash

expenditure that reduces taxes and increases cash Ilow. Usually depreciation is

subtracted Irom NOI to compute aIter-tax net income, and is then added back to

reIlect its positive impact on aIter-tax cash Ilows. In other words, in the 1999 - 2001

period the property ownership provides the owner with a tax shelter. Also note that

mortgage payments have two components: interest payment which is tax deductible,

and principal repayment, which is no tax deductible.

Study Session 18 Alternative Investments

CFACENTER.COM 15

m. explain the various stages in venture capital investing.

Private equity reIers to equity investments that are not traded on exchanges.

Venture capital is Iinancing Ior privately held companies, typically in the Iorm oI

equity and/or long-term debt. Venture capital becomes available when Iinancing Irom

banks and public debt or equity markets is either unavailable or inappropriate. It is

one oI the main categories oI private equity. Investors typically invest in private

equity through limited partnerships, where the general partners are private equity

experts and manage the investments oI the venture capital Iunds.

Venture capital investing is done in many stages Irom seed through mezzanie. These

stages can be characterized by where they occur in the development oI the venture

itselI.

Seed-stage financing: this is capital (typically less than $50,000) that is provided

at the "idea" stage, which goes Ior product development and market research.

Early-stage financing is capital provided Ior companies moving into operation

and beIore commercial manuIacturing and sales have occurred.

Start-up: this capital is used in product development and initial marketing

Ior Iirms in business under one year and has not sold their product

commercially.

First-stage: this is capital provided to initiate commercial manuIacturing and

sales.

Formative-stage financing includes seed stage and early stage.

Later-stage financing is capital provided aIter commercial manuIacturing and

sales have begun but beIore any initial public oIIering.

Second-stage: this capital is used Ior initial expansion oI a company that has

already been selling a product but perhaps not yet proIitably.

Third-stage: capital provided to Iund major expansion, such as physical

plant expansion, product improvement, or a major marketing campaign.

Mezzanine (bridge) financing is capital provided to prepare Ior the step oI

going public and represents the bridge between the expanding company and

the IPO.

Expansion-stage financing includes second and third stage. Balanced-stage

financing is a term used to reIer to all the stages, seed through mezzanine.

Study Session 18 Alternative Investments

CFACENTER.COM 16

n. discuss venture capital investment characteristics and the challenges to venture

capital valuation and performance measurement.

Venture capital investment characteristics include:

Illiquidity: venture capital investments do not provide an easy or short-term path

Ior cashing out. Liquidation or divestment oI each venture within a portIolio is

dependent on the success oI the Iund manager in creating a buy-out or IPO

opportunity. Venture capitalists expect to actually realize their returns only when

they are able to cash out, which hopeIully is less than ten years, and preIerably in

three to seven.

Long-term commitment required: this is due to the time lag to liquidity. II the

average investor is averse to illiquidity, this will create a liquidity risk premium

on venture capital. This is why an investor with longer than average time horizon

(i.e. university endowments) can expect to proIit Irom this premium.

DiIIiculty in determining current market values: this is because there is no

continuous trading oI the investments within a venture Iund portIolio.

Limited historical risk and return data: this makes it diIIicult to estimate risks.

Limited inIormation: it's thereIore diIIicult to estimate cash Ilows or the

probability oI success oI these ventures.

Entrepreneurial/management mismatches: entrepreneurs may not be good

managers although Iund managers rely on entrepreneurs to create value.

Particularly, entrepreneurs who can run small ventures successIully may not have

the ability to manager larger companies. Entrepreneurs may not have the

incentive to work in the best interest oI the Iund managers. For example,

entrepreneurs may be more interested in turning their Iavorite idea into reality,

whereas Iund managers are interested in the Iinancial success oI the ventures.

Fund manager incentive mismatches: it is the investors, not the Iund managers,

who contribute the capital. Fund managers may be rewarded by size oI their Iund

rather than perIormance oI their Iund. Investors should motivate Iund managers

to make sure an aligned interest together.

Lack oI knowledge oI how many competitors exist: as entrepreneurs operate in

uncharted territory, there is oIten little way Ior analysts to perIorm competitive

analysis (i.e. how many other entrepreneurs are developing substitute ideas or

products at the same time).

Vintage cycles: some years are better than others. For example, iI too many

Study Session 18 Alternative Investments

CFACENTER.COM 17

investors are willing to supply Iund Ior venture capital, many entrepreneurs with

mediocre ideas or products will get Iinancing easily, thereby depressing the

returns on venture capital. This may happen particularly iI there is a strong IPO

market and/or a perception that a promising new technology can generate

valuable investment opportunities.

Poor Iinancial market conditions can cause venture capital to dry up.

PerIormance by vintage year oIten varies signiIicantly due to diIIerences in

the perIormance oI both real and Iinancial markets over the liIe oI the Iund.

Historically, venture Iunds Iormed in high growth years Ior the industry

experience lower returns. The venture capital market is subject to supply and

demand.

Extensive operations analysis and advice may be required: more than Iinancial

engineering skill is required oI Iund managers. The venture capital manager must

be able to act as both a Iinancial and an operations management consultant to the

venture.

Valuing a prospective venture capital project is challenging:

It's diIIicult to estimate Iuture cash Ilows. There are simply too many signiIicant

uncertainties.

Many projects will Iail along the way to IPO. Those who can provide the

anticipated large payoII at the time oI exit are really Iew. Even iI the ventures

eventually succeed, the investment horizon is long and uncertain.

Some oI the unique risks come Irom their investment characteristics as described

above.

The risk oI a portIolio oI venture capital investments is less than the risk oI any

individual venture project because oI risk diversiIication.

There are also several challenges to perIormance measurement:

The diIIiculty in determining precise valuations. This is mainly because their

investments are not publicly traded and thus their current market values are

typically estimated using arbitrary techniques.

The lack oI meaningIul benchmarks against which Iund manager and investment

success can be measured.

The long-term nature (probably a number oI years aIter the initial investments) oI

any reliable perIormance Ieedback in the venture capital asset class.

o. calculate the net present value (APJ) of a venture capital project given the

project's possible payoff and conditional failure probabilities.

Study Session 18 Alternative Investments

CFACENTER.COM 18

The expected net present value oI a venture capital project with a single, terminal

payoII and a single, initial investment can be calculated, given its possible payoII and

its conditional Iailure probabilities, as the present value oI the expected payoII minus

the required initial investment.

p. discuss the descriptive accuracy of the term "hedge fund" and define hedge fund

in terms of objectives, legal structure, and fee structure.

To "Hedge", according to Webster's dictionary, is "a means oI protection or deIense

(as against Iinancial loss), or to minimize the risk oI a bet". The term "hedge Iund"

includes a multitude oI skill-based investment strategies with a broad range oI risk

and return objectives. A common element is the use oI investment and risk

management skills to seek positive returns regardless oI market direction.

A hedge Iund is a private "pool" oI capital Ior accredited investors only and organized

using the limited partnership legal structure. The general partner is usually the money

manager and is likely to have a very high percentage oI his/her own net worth

invested in the Iund.

The Iund has an oIIering memorandum which is intended to provide much oI the

necessary inIormation to support an investor's due diligence. Among several topics,

the oIIering memorandum will speciIy the trading style, hedging strategies, and

instruments to be employed by the Iund at the discretion oI the general partner (i.e.

being long and /or short stock; use oI puts, calls, and Iutures; use oI OTC derivatives).

Hedge Iunds utilize alternative investment strategies Ior the purpose oI achieving

superior returns relative to risk (i.e. return vs. standard deviation). PerIormance

objectives range Irom conservative to aggressive. The degree oI hedging varies. In

Iact, some do not hedge at all while others simply use S&P put options and Iutures in

lieu oI shorting equities. Consequently, there is a broad spectrum oI expected risk and

return within the hedge Iund universe.

The term hedge fund is not Iully descriptive because the hedged position is generally

designed to isolate a bet rather than to reduce risk. Hedge Iunds can be deIined as:

Iunds that seek absolute returns in all directions: hedge Iund managers seek

Ireedom to achieve high absolute returns (that is, alpha) and wish to be rewarded

Ior their perIormance. In contrast, the money management industry has moved

toward a Iocus on perIormance relative to pre-speciIied benchmarks (e.g. a

Study Session 18 Alternative Investments

CFACENTER.COM 19

market index).

Iunds that have a legal structure avoiding some government regulations: these

legal structures allow the Iund manager to take short and long positions in any

asset, to use all kinds oI derivatives, and to leverage the Iund without restrictions.

In the US hedge Iunds most oIten take the Iorm oI limited partnership. For

example, organized under section 3(c)(1) oI the Investment Company Act, a

Iund is limited to no more than 1,009 "accredited investors", and is

prohibited Irom advertising.

Offshore funds are incorporated in locations such as the British Virgin

Islands or other locations attractive Iro a Iiscal and legal point oI view.

Iunds that have option-like Iees: this includes:

a base management fee: based on the value oI assets under management. It

is paid whatever the perIormance oI the Iund. It is typically 1 percent oI the

asset base.

an incentive fee: it is proportional to realized proIits. It is typically 20

percent oI the total proIits. For some Iunds, the incentive Iee is applied to

proIits above a pre-speciIied risk-Iree rate. For example, suppose the

pre-speciIied risk-Iree rate is 6. II the gross return on the Iund is 5.5, then

no incentive Iee will be paid. The incentive Iee cannot Iall below zero, even

iI the return on the Iund is negative.

Finally, let's take a look at the key diIIerences between mutual Iunds and hedge Iunds:

Hutuu' luud Hutuu' luud Hutuu' luud Hutuu' luud |d_ luud |d_ luud |d_ luud |d_ luud

l_u l_u l_u l_u'ut`ou 'ut`ou 'ut`ou 'ut`ou

SlC _`:td `uv:tmut

vl`':

l`vut `uv:tmut

vl`': uot _u'utd)

H`u`mum H`u`mum H`u`mum H`u`mum

Tuv:tmut Tuv:tmut Tuv:tmut Tuv:tmut

|:uu''y :mu'' m`u`mum

`uv:tmut:

u_ m`u`mum `uv:tmut:

u`d uvu_ S!

m`''`ou)

Tuv:to: Tuv:to: Tuv:to: Tuv:to:

\ot '`m`td to tl uum|

o `uv:to: uud

`uv:to: uu ulu:

muuy uud:

/ '`m`td to 199

`uv:to: '`m`td

utu:) lo uu `uv:t

`u uuy ou uud

/vu`'u|`'`ty /vu`'u|`'`ty /vu`'u|`'`ty /vu`'u|`'`ty

/vu`'u|' to tl _uu'

u|'`

Hu:t | uu ud`td

`uv:to ut otl mu:t

xd S! m`''`ou o

`ud`v`duu' `uom mu:t

luv |u `u x:: o

S?00,000, o _o`ut `uom

mu:t luv |u `u x::

o S300,000 `u tl u:t

Study Session 18 Alternative Investments

CFACENTER.COM 20

to yu:, 'u: `uv:to

mu:t xt tl :um 'v'

o `uom `u tl uut

yu)

`u`d`ty `u`d`ty `u`d`ty `u`d`ty

Du`'y '`u`d`ty uud

dmt`ou

`u`d`ty vu`: om

moutl'y to uuuuu''y

Slot Slot Slot Slot

S''`u_ S''`u_ S''`u_ S''`u_

Hux`mum 30 o o`t:

om :lot :u':

u'tlou_l otl |u uud

ot`ou: x`:t)

Huuu_ muy :lot :''

otu

vu_ vu_ vu_ vu_ :: 'vu_ Ho 'vu_

Dou Hukt: Dou Hukt: Dou Hukt: Dou Hukt:

Som uud: u

du:`v'y muuu_d uud

otl:, '`k `udx uud:,

lo'd du`u_ |ud mukt:.

Ho:t ld_ uud

:tut_`: ty to ld_

u_u`u:t doutuu: `u tl

mukt:, |ut

t`vu:: dud: ou

tl uud.

D`u`t`ou D`u`t`ou D`u`t`ou D`u`t`ou

/ u|'` oo' o

`uv:tmut u`tu'

o_uu`zd to `uv:t `u u

oto'`o omo:d o

otu dtm`ud ty

o :u`t`:.

/ `vut oo' o

`uv:tmut u`tu'

o_uu`zd `uto u '`m`td

utu:l` to `uv:t `u u

oto'`o mud u o u

vu`ty o :u`t`:.

l: l: l: l: `m`t: Tmo:d |y tl SlC

\o `m`t:. |d_ uud:

ty`u''y lu_ l`_l

:, u:uu''y u

om|`uut`ou o !? o

you u::t: 'u: u

utu_ o tl o`t:

u:uu''y ?0)

q. calculate the net return of a hedge fund, given an absolute return scenario and

the fund's fee structure.

The net perIormance oI a hedge Iund can be calculated by subtracting its Iees Irom its

gross perIormance.

Example (taken Irom the textbook)

Study Session 18 Alternative Investments

CFACENTER.COM 21

A hedge Iund has an annual Iee oI 1 percent base management Iee plus a 20 percent

incentive Iee applied to proIits above the risk-Iree rate, taken to be the T-Bill rate.

Hence the incentive Iee is applied to annual proIits aIter deduction oI the T-Bill rate

applied to the amount oI assets under management at the start oI the year. The gross

return during the year is 40. What is the net return (the return aIter Iees) Ior an

investor, iI the risk-Iree rate is 5 percent?

Solution

Fee 1 20 x (40 - 5) 8.

Net return: 40 - 8 32.

r. describe the various classifications of hedge funds.

Hedge Iunds can be classiIied in a variety oI ways. Here is one classiIication (by

investment strategy):

Long/short funds: Funds employing long/short strategies generally invest in

equity and Iixed income securities taking directional bets on either an individual

security, sector or country level.

For example, a Iund might do pairs trading, and buy stocks that they think

will move up and sell stocks they think will move down. Or go long sectors

they think will go up and short countries they think will go down.

Long/Short strategies are not automatically market neutral. That is, a

long/short strategy can have signiIicant correlation with traditional markets,

and surprisingly have seen large down turns in exactly the same times as

major market downturns.

Long/short Iunds represent a large amount oI hedge Iund assets.

Market-neutral funds: They are a Iorm oI long/short Iunds that attempt to be

hedged against a general market movement. They attempt to produce return series

that have no or low correlation with traditional markets such as the US equity or

Iixed income markets. Market neutral strategies are characterized less by what

they invest in than by the nature oI the returns. They oIten are highly quantitative

in their portIolio construction process, and market themselves as an investment

that can improve the overall risk/return structure oI a portIolio oI investments.

The key Ieature oI market neutral Iunds is the low correlation between their

returns and the traditional asset's.

Study Session 18 Alternative Investments

CFACENTER.COM 22

Global macro funds take bets on the direction oI a market, a currency, an interest

rate, a commodity, or any macroeconomic variable.

There are many subgroups in this category, including Iutures Iunds (or

managed Iutures Iunds) and emerging-market Iunds.

These Iunds seek to take advantage oI shiIts and stresses in global Iinancial

markets that impact currencies, crude oil, interest rates and stock indices.

For example, George Soros oI the Quantum Iund took a billion dollar proIit

Irom his historic bet against sterling and the Bank oI England in September

1992.

Leverage is the liIeblood oI global macro hedge Iunds. Global macro

investing, not surprisingly, has acquired a reputation as a high risk, high

return and extremely volatile investment strategy.

Event-driven funds seek to make proIitable investments by investing in a timely

manner in securities that are presently aIIected by particular events. Such events

include:

distressed debt investing: the securities oI companies having Iinancial

problems usually sell at deeply discounted prices. Distressed securities Iunds

take bets on the debt and/or equity securities oI such companies. For example,

iI a Iund manager believes such a company will successIully return to

proIitability, he will buy its securities. II he believes the company's situation

will deteriorate, he will take a short position in its securities.

merger arbitrage (sometimes called risk arbitrage): beIore the eIIective

date oI a merger, the stock oI the acquired Iirm typically sells at a discount to

its announced acquisition value. A risk arbitrage involves buying stocks oI

the acquired Iirm and simultaneously selling the stocks oI the acquirer.

However, there is the risk that the merger may Iall though.

corporate spin-offs and restructuring.

s. discuss the benefits and drawbacks to fund of funds investing.

Funds oI Iunds(FOF) have been created to allow easier access to small investors. An

FOF is open to investors and, in turn, invests in a selection oI hedge Iunds. An FOF

provides investors with several beneIits:

Retailing: investing in a single hedge Iund typically requires at least $100,000.

An FOF allows small investors to get exposure to a large selection oI hedge

Iunds.

Access: many attractive hedge Iunds are closed to individual investors because

the maximum number oI investors has been reached. Through an FOF, investors

can still get access to these Iunds that are closed to new investors.

Study Session 18 Alternative Investments

CFACENTER.COM 23

Diversification: an FOF allows investors to diversiIy the risk oI a single hedge

Iund.

Managerial expertise: not every investor has the skills to invest in hedge Iunds.

The manager oI the FOF is supposed to have expertise in Iinding reliable and

good-quality hedge Iunds in a world where inIormation on the investment

strategies oI hedge Iunds is diIIicult to obtain.

Due diligence process: the due diligence (both at the outset and ongoing) that has

to be perIormed by an institutional investor when selecting a hedge Iund is highly

specialized and time consuming, given the secretive nature oI hedge Iunds and

their complex investment strategies.

There are drawbacks with an FOF:

Fee: the obvious drawback oI FOFs is the Iees (the added layer oI Iees) they

charge on top oI the substantial Iees charged by the hedge Iunds they invest in.

Never one to be dismayed, Ineichen tells us this is like "Paying the Iarmer as well

as the milk man.".

Performance: The FOF typically selects individual hedge Iunds based on their

past experience. However, there is little evidence oI persistent perIormance as

past perIormance gives little implication oI Iuture perIormance.

Diversification: it is a two-edged sword. The overall FOF expected return will be

lowered by the diversiIication but the Iees paid are still very high.

What does Due Diligence mean?

An investigation or audit oI a potential investment. Due diligence serves to

conIirm all material Iacts in regards to a sale.

Generally, due diligence reIers to the care a reasonable person should take beIore

entering in an agreement or transaction with another party.

OIIers to purchase an asset are usually made dependent upon the results oI due

diligence analysis. It includes reviewing all Iinancial records plus anything else

deemed material to the sale. Sellers could also perIorm a due diligence analysis

on the buyer. Items that could be considered are the buyer's ability to purchase, as

well as other items that would aIIect the purchased entity or the seller, aIter the

sale has been completed.

Due diligence is essentially a way oI preventing unnecessary harm to either party,

or the entity involved, in a transaction.

t. discuss the leverage and unique risks of hedge funds.

Although some hedge Iunds don't use leverage at all, most oI them do. Leverage in

hedge Iunds oIten runs Irom 2:1 to 10:1, depending on the type oI assets held and

Study Session 18 Alternative Investments

CFACENTER.COM 24

strategies used. High leverage is oIten part oI the trading strategy and is an essential

part oI some strategies in which the arbitrage return is so small that leverage is needed

to ampliIy the proIit. As in any other investments, however, leverage also ampliIies

losses when the market direction turns out to be unIavorable. Hedge Iunds typically

use three methods to create leverage:

Borrowing external Iunds.

Borrowing through a brokerage margin account.

Using Iinancial instruments and derivatives that requires posting margins. By

using margins, hedge Iunds only pay a Iraction oI the value oI the position.

In addition to market and trading risks in diIIerent markets, hedge Iunds Iace the

Iollowing unique risks:

liquidity risk: the lack oI liquidity under extreme market conditions can cause

irreversible damage to hedge Iunds whose strategies rely on the presence oI

liquidity in speciIic markets.

pricing risk: hedge Iunds oIten invest in complex securities traded

over-the-counter. Pricing securities that trade inIrequently is a diIIicult task,

especially in periods oI high volatility.

counterparty credit risk: this is the risk that the other party to an agreement will

deIault. Because hedge Iunds deal with broker-dealers in most transactions,

counterparty credit risk can arise Irom many resources.

settlement risk: this risk reIers to the Iailure to deliver the speciIied security or

money by one oI the parties to the transaction on the settlement day.

short squeeze risk: a short squeeze arises when short sellers must buy in their

positions at rising prices. Because some hedge Iund strategies require short

selling, this risk can aIIect Iund perIormance signiIicantly.

financing squeeze risk: iI a hedge Iund has reached or is near its borrowing

capacity, its ability to borrow cash is constrained. This risk puts the hedge Iund in

a vulnerable position when it is Iorced to reduce the levered positions, say, in an

illiquid market at substantial losses.

u. discuss the performance of hedge funds and the biases present in hedge fund

performance measurement.

Study Session 18 Alternative Investments

CFACENTER.COM 25

In terms oI perIormance, hedge Iunds are generally viewed as having

Net returns higher than those available Ior equity or bond investments.

Lower risk than traditional equity investments. Note the risk is measured by

the volatility oI return.

A Sharpe ratio that is comparable to bonds and higher than that oI equity

investments.

A low correlation with conventional investments.

The perIormance data Irom hedge Iund databases and indexes suIIer Irom serious

biases.

Self-selection bias: hedge Iund managers decide themselves whether they want

to be included in a database, and managers that have Iunds with an unimpressive

track record will not wish to be included.

Instant history bias: as only hedge Iunds with good track records enter the

database, this creates a positive bias in past perIormance in the database.

Survivorship bias on return: As unsuccessIul Iunds tend to disappear over time,

only successIul ones search Ior new clients and present their track record. This is

particularly true Ior hedge Iunds, since they do not have to adhere to perIormance

presentation standards. As underperIorming Iunds disappear Irom the database

used by investors to select Iunds, the reported average return oI hedge Iunds is

inIlated.

Survivorship bias on risk: A similar survivorship bias applies to risk measures.

Hedge Iunds that exhibited highly volatile returns in the past tend to disappear.

Reported volatility oI existing Iunds will tend to be low.

Smoothed pricing on infrequently traded assets: Some assets trade

inIrequently. Hedge Iunds oIten use illiquid exchange-traded securities or OTC

instruments. Because prices used are oIten not up-to-date market prices, but

estimates oI Iair value, their volatility is reduced (smoothing eIIect).

Option-like investment strategies: Traditional risk measures used in

perIormance appraisal assume that portIolio returns are drawn Irom normal or at

least symmetric distributions. Many investment strategies Iollowed by hedge

Iunds have some option-like Ieatures that violate these distributional assumptions.

Instead they have asymmetric return distributions: iI the market moves in the

Iavorable direction, the pay-oII will generally be small. II the market moves in

the unIavorable direction, the loss can be enormous. ThereIore, traditional risk

measures understate the risk oI losses oI investment strategies Iollowed by hedge

Iunds.

Study Session 18 Alternative Investments

CFACENTER.COM 26

Fee structure and gaming: The compensation structure is option like and it

encourages excessive risk taking. Fund managers are paid to take risks. For

example, iI the total return on a hedge Iund is positive, the manager charges an

incentive Iee oI 20 oI the total return. II it's negative, however, the incentive Iee

will not Iall below zero. ThereIore, Iund managers are encouraged to take

excessive risks, particularly iI their recent perIormance is poor..

v. explain the effect of survivorship bias on the reported return and risk measures

for a hedge fund data base.

See los u please.

w. explain how the legal environment affects the valuation of closely held

companies.

Closely held companies are those that are not publicly traded. Inactively traded

securities are securities oI companies that are not traded Irequently. Such securities

generally do not trade on major exchanges such as NYSE.

Closely held companies may be organized in various legal Iorms, such as partnerships

and sole proprietorships. These Iorms have tax implications as well as ownership

diIIerences Ior the investor. Ownership is a bundle oI rights and these rights diIIer

depending on the business Iorm. Because valuations can be required to provide

evidence in litigation -- Ior example, minority shareholder claims -- much case law

deIines terms such as intrinsic value, Iundamental value, and Iair value. These

deIinitions may vary in diIIerent jurisdictions. Even what is judged as evidence Ior a

valuation can vary. There has long been a tension between the theory oI value as

based on projected cash Ilows and the acceptance oI the hard evidence oI recent cash

Ilows. In a real sense, then, valuation oI closely held and inactively traded securities

requires extensive knowledge oI the law and the purposes oI the valuation.

Study Session 18 Alternative Investments

CFACENTER.COM 27

x. describe alternative valuation methods for closely held companies and

distinguish among the bases for the discounts and premiums for these companies.

Here are the basic types oI valuation:

The Cost Approach: it attempts to determine what it would cost to replace the

company's assets in their present Iorm.

The Comparables Approach: it estimates market value relative to a benchmark

value. The benchmark value may be the market price oI a similar but actively

traded company. The estimate needs to be adjusted Ior changing market

conditions, the possibility that the benchmark itselI is mispriced, and the unique

Ieatures oI the company relative to the benchmark.

The Income Approach: it estimates market value by discounting any anticipated

Iuture economic income streams.

To estimate the discounts and premiums an analyst must careIully deIine the amount

or base to which the discount or premium should be applied.

As shares oI closely held companies lack a public market (lack marketability) and

so their valuation should reIlect a marketability discount. To estimate this the

analyst identiIies a publicly traded comparable company with a liquid market.

The comparable's market value oI equity is the base to which the marketability

discount is applied.

A minority discount is applied iI the interest will not be able to inIluence

corporate strategy and other business decisions. To estimate it the base is an

estimate oI that company's value oI equity inclusive oI the value arising Irom

ownership oI all rights oI control.

To estimate a control premium, the base is an estimate oI that company's value

oI equity not reIlecting control (the value oI equity Irom a minority shareholder

perspective).

y. discuss distressed securities investing and the similarities between venture capital

investing and distressed securities investing.

Distressed securities are securities oI companies that have Iiled or are close to Iiling

Study Session 18 Alternative Investments

CFACENTER.COM 28

Ior bankruptcy, or that seeking out-oI-court debt restructuring to avoid bankruptcy.

Valuation oI such securities requires legal, operational and Iinancial analysis.

Investing in distressed securities usually means investing in distressed company bonds

with a view toward equity ownership in the eventually reconstituted company. In this

regard such investments have characteristics somewhat similar to those oI venture

capital investing.

illiquid nature.

requires a long investment horizon.

requires intense investor participation in guiding the venture to a successIul

outcome.

possibility oI mispricing. In Iact, due to business volatility and high leverage,

mispricing in distressed securities is inevitable.

Distressed-security investing may be viewed as the ultimate in value investing. The

primary question is the question oI the distress source. For example, is the company

weak Iinancially or operationally? Distressed-security investing requires intense

industry analysis, as well as analysis oI business strategies and oI the management

team that will conduct the restructuring.

z. explain the role of commodities as a vehicle for investing in production and

consumption and identify the ways to indirectly invest in commodities.

There are three major categories oI commodities:

Agricultural products (oIten called soft commodities) include grains, Iibers,

Iood and livestock, etc.

Energy includes crude oil, heating oil and natural gas, etc.

Metals include copper, gold, and silver etc.

Investing directly in agricultural products and other commodities gives the investor a

share in the commodity components oI the country's production and consumption.

Commodities complement the investment opportunities oIIered by shares oI

corporation that extensively use these raw materials in their production processes.

However, most investors do not want to get involved in storing commodities such as

cattle or crude oil. A common investment objective is to purchase indirectly those real

assets that should provide a good hedge against inIlation risk. Commodity derivatives

are Iinancial instruments that derive their value Irom the value oI the underlying

commodities.

Futures contracts. This is the most common strategy. Commodity trading advisers

(CTAs) oIIer managed futures funds that take positions in exchange-traded

Study Session 18 Alternative Investments

CFACENTER.COM 29

derivative on commodities and Iinancials.

Bonds indexed on some commodity price.

Stocks oI companies producing the commodity.

aa. describe the motivation for investing in commodities and commodities

derivatives by both passive and active investors.

Commodities are sometimes treated as an asset class because they represent a direct

participation in the real economy. The motivation Ior investing in commodities ranges

Irom the diversiIication beneIits by a passive investor to the speculative proIits sought

by an active investor.

Commodities have a negative correlation with stock and bond returns and a

desirable correlation with inIlation. A passive investor would buy commodities

Ior their risk-diversiIication beneIits. When inIlation accelerates, commodity

prices go up, whereas bond and stock prices tend to go down. A passive investor

would typically invest through a collateralized position in a Iutures contract. A

collateralized position in Iutures is a portIolio in which an investor takes a long

position in Iutures Ior a given amount oI underlying value and simultaneously

invests the same amount in government securities such as T-bills.

In periods oI rapid economic growth, commodities are in strong demand to satisIy

production need, and their prices go up. Because oI productivity gains, the prices

oI Iinished goods are unlikely to rise as Iast as those oI raw materials. This

suggests an active management strategy in which speciIic commodities are

bought and sold at various times.

An example oI collateralized Iutures:

Assume that the Iutures price is currently $100. II $100 million is added to the Iund,

the manager will take a long position in the Iutures contract Ior $100 million oI

underlying value and simultaneously buy $100 million worth oI T-bills (part oI this

will be deposited as margin). II the Iutures price drops to $95 the next day, the

manager will have to sell $5 million oI the T-bills to cover the loss (marked to market).

Conversely, iI the Iutures price rise to $105, the manager will receive a proIit oI $5

million. The total return on the collateralized Iutures position comes Irom the change

in Iutures price and the interest income on the T-bills.

Study Session 18 Alternative Investments

CFACENTER.COM 30

bb. explain the sources of return on a collateralized commodity futures position.

See los aa please.

cc. explain how to manage risk for managed futures.

Jaeger (2002) proposes several principles Ior the risk management oI managed

Iutures portIolios:

DiversiIy into a large universe oI contracts.

Liquidity monitoring, because diversiIication into a larger universe oI

contracts can include illiquid contracts.

Volatility dependent allocation where the weight oI the diIIerent contracts in

the portIolio is determined by their historical or implied volatility.

Quantitative risk management techniques such as value at risk (VaR) and

stress tests.

Risk budgeting on various aggregation levels to detect undesired risk

concentrations.

Limits on leverage.

Use oI derivatives to hedge any unwanted currency risk.

Care in model selection with respect to data mining, in and out oI sample

perIormance, and adequate perIormance adjustments Ior risks.

dd. describe the motivation for investing in commodity linked securities.

Commodity-linked securities are securities that are indexed on some commodity

prices. The return on commodity-linked securities has two components: the increase

in commodity prices and the income on the securities. In contrast, holding

commodities provides no income so the sole return to the owner is through price

increase. ThereIore, investors who wish to have some income stream on their

investments may preIer to invest in commodity-linked securities.

There are two major types oI commodity-linked securities:

Commodity-linked bonds: interest payments and/or principal repayments oI

Study Session 18 Alternative Investments

CFACENTER.COM 31

such bonds are indexed to the price oI the underlying commodities or an

inIlation index. For example, a company may issue bonds indexed to oil

prices.

Commodity-linked equity: the equity value oI some companies is directly

aIIected by commodity prices. This is particularly true Ior energy companies,

such as those in oil and gas industries. As large companies tend to diversiIy

across diIIerent types oI activities within the industries, the link between

prices and stock prices Ior large companies is typically weaker than that Ior

small undiversiIied companies.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Tradimo Cheat SheetДокумент1 страницаTradimo Cheat Sheetanon_628997842Оценок пока нет

- Math Finance Cheat Sheet PDFДокумент2 страницыMath Finance Cheat Sheet PDFJingyi GuoОценок пока нет

- Mysql Tutorial PDFДокумент24 страницыMysql Tutorial PDFMuthu Sankar DhoniОценок пока нет

- Cfa L1 Session03Документ46 страницCfa L1 Session03Fernando FragaОценок пока нет

- Cfa L1 Session01Документ53 страницыCfa L1 Session01Fernando Fraga100% (1)

- Cfa L1 Session02Документ52 страницыCfa L1 Session02Fernando FragaОценок пока нет

- Cfa L1 Session07Документ77 страницCfa L1 Session07Fernando FragaОценок пока нет

- Cfa L1 Session06Документ30 страницCfa L1 Session06Fernando FragaОценок пока нет

- Cfa L1 Session09Документ17 страницCfa L1 Session09Fernando FragaОценок пока нет

- Cfa L1 Session10Документ26 страницCfa L1 Session10Fernando FragaОценок пока нет

- Cfa l1 Session12Документ24 страницыCfa l1 Session12Fernando FragaОценок пока нет

- Cfa L1 Session11Документ44 страницыCfa L1 Session11Fernando FragaОценок пока нет

- Cfa L1 Session16Документ40 страницCfa L1 Session16Fernando FragaОценок пока нет

- Cfa L1 Session15Документ46 страницCfa L1 Session15Fernando FragaОценок пока нет

- Cfa L1 Session17Документ50 страницCfa L1 Session17Fernando FragaОценок пока нет

- Bierens - Statistical Foundations of EconometricsДокумент434 страницыBierens - Statistical Foundations of EconometricsMon DoremonОценок пока нет

- Econometric - Introduction To Econometrics 2nd Ed (1988) - G.S. Maddala - Macmillan Publishing PDFДокумент637 страницEconometric - Introduction To Econometrics 2nd Ed (1988) - G.S. Maddala - Macmillan Publishing PDFFernando Fraga100% (9)

- EY Business Plan Guide PDFДокумент24 страницыEY Business Plan Guide PDFVineethMenonОценок пока нет

- HeritageДокумент210 страницHeritageJupe JonesОценок пока нет

- Where Technology, Capacity and Service Come Together To Enable The Future of ElectronicsДокумент3 страницыWhere Technology, Capacity and Service Come Together To Enable The Future of ElectronicsMaine ManagbanagОценок пока нет

- SML Isuzu: Steady Performance ContinuesДокумент8 страницSML Isuzu: Steady Performance ContinuesjaimaaganОценок пока нет

- 2013 Training ManualДокумент34 страницы2013 Training Manualapi-131205533Оценок пока нет

- Mohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)Документ39 страницMohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)EVERYTHING FOOTBALLОценок пока нет

- Investment TheoryДокумент7 страницInvestment TheoryJoshua KirbyОценок пока нет

- Accepted Version of RevisionДокумент40 страницAccepted Version of RevisionMunir HussainОценок пока нет

- Lehman Examiner's Report, Vol. 5Документ683 страницыLehman Examiner's Report, Vol. 5DealBookОценок пока нет

- Chapter 09Документ16 страницChapter 09FireBОценок пока нет

- Investment Banking Cover Letter TemplateДокумент2 страницыInvestment Banking Cover Letter TemplateMihnea CraciunescuОценок пока нет

- The Unintended Consequences of California's Proposition 13Документ6 страницThe Unintended Consequences of California's Proposition 13Zack HillОценок пока нет

- Pinkerton AДокумент14 страницPinkerton AGandhi Jenny Rakeshkumar BD20029Оценок пока нет

- Kode BankДокумент3 страницыKode BankYulisa Nur FilianiОценок пока нет

- Mitsubishi Corporation PDFДокумент31 страницаMitsubishi Corporation PDFYeyen Susanti100% (1)

- Sebi Rta Circular - 20.04.2018Документ10 страницSebi Rta Circular - 20.04.2018Arun Kumar SharmaОценок пока нет

- Candlestick Pattern Full PDFДокумент25 страницCandlestick Pattern Full PDFM Try Trader Kaltim80% (5)

- Small Scale Industries RahulДокумент12 страницSmall Scale Industries RahulVaibhav RolihanОценок пока нет

- 3cet FinalДокумент30 страниц3cet FinalhimanshusangaОценок пока нет

- IRR of RA 7042 - Foreign Investments ActДокумент28 страницIRR of RA 7042 - Foreign Investments Actcool_peachОценок пока нет

- Cash Flow For Study29072021Документ60 страницCash Flow For Study29072021URAОценок пока нет

- Lakshwiz - D Street - AVARTAN 2022Документ7 страницLakshwiz - D Street - AVARTAN 2022Jenil RitaОценок пока нет

- Returns To Be Submitted To RBIДокумент106 страницReturns To Be Submitted To RBIAbhishek RastogiОценок пока нет

- Financial Statement Analysis of Indigo Paints: EC1 Experiential LearningДокумент18 страницFinancial Statement Analysis of Indigo Paints: EC1 Experiential Learningsagaya335Оценок пока нет

- 3BUS095139 en Petrobras REPAR Success StoryДокумент2 страницы3BUS095139 en Petrobras REPAR Success StoryAmet koko TaroОценок пока нет

- AssignmentДокумент7 страницAssignmentMona VimlaОценок пока нет

- 17-20513 - HJK Status Report Oct 2016 PDFДокумент70 страниц17-20513 - HJK Status Report Oct 2016 PDFRecordTrac - City of OaklandОценок пока нет

- GREPA DigestДокумент6 страницGREPA DigestJen DioknoОценок пока нет