Академический Документы

Профессиональный Документы

Культура Документы

Shefasebis tarifebi-ENG PDF

Загружено:

nbegeoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Shefasebis tarifebi-ENG PDF

Загружено:

nbegeoАвторское право:

Доступные форматы

Decree #79 issued by the Minister of Justice of Georgia

17 May 2012 Tbilisi

Amendment made to Decree #144 issued by the Minister of Justice of Georgia on 30 July 2010 concerning the rates and mode of payment stipulated by the Law of Georgia on Enforcement Proceedings

In compliance with the Article 4 of Paragraph 20 of the Law on Normative Acts of Georgia, I decree:

Article 1. the following amendment should be made to the Decree #144 issued by the Minister of Justice of Georgia on 30 July 2010 concerning the rates and mode of payment stipulated by the Law of Georgia on Enforcement Proceedings

1. Preamble of the Decree should be editted: In compliance with Articles 13 and 14 of Paragraph 3, 41 Article of Paragraph 147, Aricle B of Paragrapg 5, Article 2 of Paragraph 1418 , Article 6 of Paragraph 191 , Aricles 4 and 10 of Paragraph 38, Article 5 of Paragraph 914 , Article 2 of Paragraph 9110 , Article 3 of Paragraph 9118 of the Law of Georgia on Enforcement Proceedings and according to Article 6 of Paragraph 38 of the Law on Insolvency Proceedings, 2. The Article 8 of the Rule adopted by the Decree should be stipulated as follows: a) Article 8 1. The due pay of the valuation service supplied by NBE as a result of application should be defined according to Appendix 1. 2. According to the periods, while providing the service, the due pay is doubled. b) article 9 should be followed by Articles 10 and 11: Article 10 In compliance with the Law on Enforcement Proceedings, the due pay while conducting summary proceedings is defined as: a) Application fee 100 GEL per legal application. In case of contributory liabilities, if an application is made by more than one applicant or/and is applied against more than one respondent, the application fee totals 100GEL per each person; b) For attaching the property 50GEL per item; c) While paying the due for summary proceedings when a respondent is making a full or partial payment of the debt 2% of the paid sum (no less than 50GEL). Article 11 1. According to Law on Enforcement Proceedings of Georgia, the service due for the statement of facts constitutes: a) 100 GEL for service provided by NBE during working hours b) 150 GEL for service provided by NBE during non-working hours and day offs. 2. The Bureaus side delivers the statement of fact materials only after payment of the due. 3. Appendix 1 should be edited:

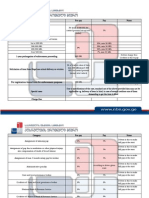

Appendix 1

Service Due for Valuation Conducted by NBE on the basis of Application

1 2 3 4 5 6 Item Land (rural) up to 1ha Land (rural) from 1ha up to 10ha Land (non-rural) Flat Private house Commercial and business premises up to 200 sq/m 1 1 1 1 1 1 () 50 100 150 150 200 250 extra 50GEL per every additional 100 sq/m Extra 20GEL per every additional 100 sq/m, no more than 7 000 GEL extra 5 GEL per every additional 1ha

7 8 9 10 11 12 13 14

Industrial premises up to 500 sq/m Basement, attic, motor-garage Stationery, printed materials, electro-technical and household goods Furniture (garniture) Goods for business use (except chemical substances) Clothes and footwear Food (packed according to regulations, no need for lab examination) Perfume, Hygiene, Cleaning goods

1 1

500 95

Up to 100 GEL 15 GEL, from 100 GEL to 5 000 GEL 40 GEL, over 5 000 GEL to 10 000 GEL 100 GEL, over10 000 GEL 300 GEL

15

Air, Sea and land vehicles, spare parts and accessories

Up to 5000 GEL3% of value, no less than 50 GEL, from 5000GEL to 100 000 GEL 200+5000 GEL 2% of value, from 100 000 to 1 000 000 GEL 2050+100 000 - 1% of value, over 1 000 000 GEL 0,8% of value Up to 100 GEL 20 GEL, from 100 to 5 000 GEL 50 GEL, over 5 000 GEL to 10 000 GEL 150 GEL, over 10 000 GEL 400 GEL Over 100 GEL 15 GEL, from 100 to 5 000 GEL 40 GEL, over 5 000 to 10 000 GEL 100 GEL, over 10 000 GEL 300 GEL 1 ton 15 GEL 5% of total value Up to 5000 GEL 3% of value, no less than 50 GEL, from 5000 to 100 000 GEL 200+5000, 2% of value, from 100 000 to 1 000 000 GEL 2050+100 000, 1% of value, over 1 000 000 GEL 0,8% of value Up to 100 GEL 15 GEL, from 100 to 5 000 GEL 40 GEL, over 5 000 GEL to 10 000 GEL 100 GEL, over 10 000 GEL 300 GEL Up to 5000 GEL 5% of value, no less than 50 GEL, from 5000 to 100 000 GEL 400+5000, 2% of value, from 100 000 to 1 000 000 GEL 2500+100 000, 1% of value, over1 000 000 GEL 0,8% of value 1 1 1 1 300 + according to valuation service due of enterprise-owned (material and non-material) assets, no more than 10 000 GEL 500 200 50

16 17 18 19

Equipment, machinery Oil products and other chemical substances (to be packed for retail sale, no need for lab examination) Scrap-iron for black and color metal Flora and fauna

20 Building materials and constructions 21 22 Tobacco Alcoholic drinks

23

Other or mixed property

24 25 26 27

Valuation of share in enterprise Licenses Rent (movable/immovable property) Identification of market value for vehicle services

4. Appendix 2 should be abolished. Article 2 1. Cases started prior to the adoption of the Article 8 of Decree 144 (issued by the Minister of Justice on 30 July 2010 concerning the adoption of rates and pay modes stipulated by the Law on Enforcement Proceedings of Georgia) should be conducted in compliance with the prior regulation. 2. The decree should take force after its publication.

Z. Adeishvili

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Annual Report 2012Документ14 страницAnnual Report 2012nbegeoОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- NBE Annual Statistics 2012Документ9 страницNBE Annual Statistics 2012nbegeoОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Better Enforcement System Through Twinning (Bestt)Документ3 страницыBetter Enforcement System Through Twinning (Bestt)nbegeoОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Better Enforcement System Through Twinning (Bestt)Документ3 страницыBetter Enforcement System Through Twinning (Bestt)nbegeoОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Better Enforcement System Through Twinning (Bestt)Документ3 страницыBetter Enforcement System Through Twinning (Bestt)nbegeoОценок пока нет

- Map of Enforcement Process - EngДокумент6 страницMap of Enforcement Process - EngnbegeoОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Better Enforcement System Through Twinning (Bestt)Документ3 страницыBetter Enforcement System Through Twinning (Bestt)nbegeoОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- NBE Annual Statistics 2012Документ9 страницNBE Annual Statistics 2012nbegeoОценок пока нет

- Better Enforcement System Through Twinning (Bestt)Документ3 страницыBetter Enforcement System Through Twinning (Bestt)nbegeoОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- Final Report Review NBEДокумент47 страницFinal Report Review NBEnbegeoОценок пока нет

- Annual Report 2011Документ15 страницAnnual Report 2011nbegeoОценок пока нет

- NBE Strategic Plan 2012-2015 EngДокумент11 страницNBE Strategic Plan 2012-2015 Engnbegeo0% (1)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- About The Reforms Implemented PrefaceДокумент4 страницыAbout The Reforms Implemented PrefacenbegeoОценок пока нет

- Competencies of Chairman of The National Bureau For EnforcementДокумент2 страницыCompetencies of Chairman of The National Bureau For EnforcementnbegeoОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- NBE-Annual Report 2010Документ6 страницNBE-Annual Report 2010nbegeoОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- NBE-Annual Report 2011Документ12 страницNBE-Annual Report 2011nbegeoОценок пока нет

- NBE CostsДокумент4 страницыNBE CostsnbegeoОценок пока нет

- NBE-Annual Report 2011Документ12 страницNBE-Annual Report 2011nbegeoОценок пока нет

- Strategic Plan of The National Bureau of Enforcement (2010-2012)Документ53 страницыStrategic Plan of The National Bureau of Enforcement (2010-2012)nbegeoОценок пока нет

- The Code of ConductДокумент8 страницThe Code of ConductnbegeoОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Equasis - Ship Folder Caribbean FidelityДокумент6 страницEquasis - Ship Folder Caribbean FidelityEmre ErciyesОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Amy K Carpenter-HolmesДокумент6 страницAmy K Carpenter-HolmesPopovici LiviuОценок пока нет

- Oathtaking Speech For The 2018 Bar PassersДокумент3 страницыOathtaking Speech For The 2018 Bar Passersrobertoii_suarezОценок пока нет

- Seperation of Power.Документ3 страницыSeperation of Power.Subaiyal MalicОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Leonel Hernandez OpinionДокумент38 страницLeonel Hernandez OpinionErika EsquivelОценок пока нет

- Ethics Assignment 15 NovДокумент5 страницEthics Assignment 15 NovRounak VirmaniОценок пока нет

- Financial Statements under OHADAДокумент5 страницFinancial Statements under OHADACheikh Omar Touré100% (1)

- Outline of JurisdictionДокумент8 страницOutline of JurisdictionClarebeth Recaña RamosОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Pro Reo Principle: Gatchalian, G.R. No. L-12011-14 (1958) ) in Dubio Pro ReoДокумент4 страницыPro Reo Principle: Gatchalian, G.R. No. L-12011-14 (1958) ) in Dubio Pro ReoMikaela DeguitoОценок пока нет

- Girnar CaseДокумент6 страницGirnar CaseBidisha GhoshalОценок пока нет

- BEL RecruitmentДокумент4 страницыBEL Recruitmentishare digitalОценок пока нет

- Assignment by Anees Rajper BL-0498Документ2 страницыAssignment by Anees Rajper BL-0498M.Zaigham RazaОценок пока нет

- Admit Card - Candidate LoginДокумент3 страницыAdmit Card - Candidate LoginLelouch Vi BritanniaОценок пока нет

- Self Asssessment FormДокумент4 страницыSelf Asssessment FormEmeng Ramos LeronaОценок пока нет

- Jose P. LaurelДокумент8 страницJose P. LaurelGeline Joy D. Samillano100% (1)

- Sample EngagementДокумент3 страницыSample Engagementkcsb researchОценок пока нет

- Hazard Identification Worksheet AnalysisДокумент4 страницыHazard Identification Worksheet AnalysissibusisoОценок пока нет

- G.R. No. 144214 - Villareal v. RamirezДокумент5 страницG.R. No. 144214 - Villareal v. RamirezKimmy May Codilla-AmadОценок пока нет

- Grant and Voucher Application FormДокумент11 страницGrant and Voucher Application FormAyizamaОценок пока нет

- Doctor Faustus A Text AnnotatedДокумент80 страницDoctor Faustus A Text Annotatedapi-5393515570% (1)

- Election Integrity Violation Report Against Ross MillerДокумент2 страницыElection Integrity Violation Report Against Ross MillerJessica HillОценок пока нет

- Counterclaim ExampleДокумент12 страницCounterclaim ExampleAndyJackson87% (15)

- Mindanao Shopping Destination v. DuterteДокумент16 страницMindanao Shopping Destination v. DuterteDevilleres Eliza DenОценок пока нет

- Civilpro Assigned CasesДокумент57 страницCivilpro Assigned CasesMiqz ZenОценок пока нет

- 4 ConsignmentДокумент57 страниц4 Consignmentayushi guptaОценок пока нет

- Hawaii Five O ThemeДокумент4 страницыHawaii Five O Theme2014johnh100% (1)

- Sale of Large Cattle DeedДокумент3 страницыSale of Large Cattle DeedChristian jade HensonОценок пока нет

- Wonder Pets stock picksДокумент9 страницWonder Pets stock picksMiguel MartinezОценок пока нет

- Sison, Jr. v. Ancheta Et AlДокумент7 страницSison, Jr. v. Ancheta Et AlVernie TinapayОценок пока нет

- 2017 Petitionn For Renewal NotarialДокумент3 страницы2017 Petitionn For Renewal NotarialMario Rizon Jr.Оценок пока нет

- An Unfinished Love Story: A Personal History of the 1960sОт EverandAn Unfinished Love Story: A Personal History of the 1960sРейтинг: 5 из 5 звезд5/5 (1)

- Age of Revolutions: Progress and Backlash from 1600 to the PresentОт EverandAge of Revolutions: Progress and Backlash from 1600 to the PresentРейтинг: 4.5 из 5 звезд4.5/5 (6)

- If You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodОт EverandIf You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodРейтинг: 4.5 из 5 звезд4.5/5 (1788)