Академический Документы

Профессиональный Документы

Культура Документы

8513-Financial Management

Загружено:

Sulaman SadiqОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

8513-Financial Management

Загружено:

Sulaman SadiqАвторское право:

Доступные форматы

ALLAMA IQBAL OPEN UNIVERSITY, ISLAMABAD (Department of Business Administration)

FINANCIAL MANAGEMENT (8513) CHECKLIST SEMESTER: AUTUMN, 2012

This packet comprises the following material: 1. 2. 3. 4. 5. Text Books (one) Course Outline Assignment No. 1 and 2 Assignment Forms (2 sets) Schedule for submitting the assignments.

Please contact at the address given below, if you find anything missing in the packet. Mailing Officer, Mailing Section, Block No. 28, Allama Iqbal Open University, H-8, ISLAMABAD. Phone: 051-9057611-12

Nadia Rashid Course Coordinator

ALLAMA IQBAL OPEN UNIVERSITY ISLAMABAD (Department of Business Administration) WARNING

1. 2. PLAGIARISM OR HIRING OF GHOST WRITER(S) FOR SOLVING THE ASSIGNMENT(S) WILL DEBAR THE STUDENT FROM AWARD OF DEGREE/CERTIFICATE, IF FOUND AT ANY STAGE. SUBMITTING ASSIGNMENTS BORROWED OR STOLEN FROM OTHER(S) AS ONES OWN WILL BE PENALIZED AS DEFINED IN AIOU PLAGIARISM POLICY.

Course: Financial Management (8513) Level: MBA (3 Years)

ASSIGNMENT No. 1

Semester: Autumn 2012 Total Marks: 100 Pass Marks: 50

Q. 1 Discuss in detail the significance of financial managements role in the corporate sector of Pakistan. (20) Q. 2 Critically examine the financial environment of Pakistan. Also compare it with the financial environment of India. (20) Q. 3 Select latest five years financial statements of a public bank of Pakistan. Using Common-size and Index analysis, evaluate trends in the companys financial condition and performance. (20) Q. 4 (a) Prepare an amortization schedule for a ten-year loan of Rs.100,000. The interest rate is 10 percent per year, and the loan calls for equal annual payments. How much interest is paid in the third year? How much total interest is paid over the life of the loan? (10) Pearson Industries bond has a 12 percent coupon rate and Rs.1,000 face value. Interest is paid on annual basis, and the bond has 10 years to maturity. If investors require a 14 percent yield, what is the bonds value? What is the effective annual yield on the bond? (10)

(b)

Q. 5 If the following situation is given: Return if state occurs State of Probability Economy of state Stock X Stock Y Bust 0.25 -0.10 -0.30 Normal 0.50 0.10 0.05 Boom 0.25 0.20 0.40 (a) Calculate the expected return on each stock. (15) (b) Assuming the capital asset pricing model (CAPM) holds and stock Xs beta is greater than stock Ys beta by 0.25, what is the expected market risk premium? (5) 2

GUIDELINES FOR ASSIGNMENT No. 1 You should look upon the assignments as a test of knowledge, management skills, and communication skills. When you write an assignment answer, you are indicating your knowledge to the teacher: Your level of understanding of the subject; How clearly you think; How well you can reflect on your knowledge & experience; How well you can use your knowledge in solving problems, explaining situations, and describing organizations and management; How professional you are, and how much care and attention you give to what you do. To answer a question effectively, address the question directly, bring important related issues into the discussion, refer to sources, and indicate how principles from the course materials apply. You must also be able to identify important problems and implications arising from the answer. The references should be given at the end of the assignment. For citing references, writing bibliographies, and formatting the assignment, APA format should be followed.

ASSIGNMENT No. 2

(Units: 19) Total Marks: 100

This assignment is a research-oriented activity. Prepare a report of about 1000 words on the issue allotted to you to be submitted to your teacher for evaluation. You are required to select one of the following issues according to the last digit of your roll number. For example, if your roll number is P-3427180 then you will select issue # 0 (the last digit):List of Issues/Topics: 0. Critically examine the current tax environment of Pakistan. Also give a comprehensive theoretical background of the topic. 1. Select a manufacturing company of your choice and critically examine its inventory and management control system in detail. 2. Select any financial institution. Discuss in detail the structure and functions of finance department of selected institution in terms of reporting lines. 3. Select any bank of your choice operating in Pakistan. Discuss in detail the procedure of cash management in it. 4. Select any bank that operates in Pakistan. Discuss its procedure for analyzing the credit applicant. Give a comprehensive theoretical background of the topic and then analyze its practical application in a organization selected by you. 5. Discuss in detail various working capital issues faced by the financial managers of a merchandising organization operating in Pakistan. Also give the theoretical background of the topic. 3

6. 7.

8.

9.

Discuss with examples various project evaluation methods used by an investment company for evaluating a projects future worth. Select any two corporations listed on stock exchange. Calculate latest two years financial ratios of both corporations. Give calculations and analytical comments with each years ratio. Also make the comparison between the financial ratios of both corporations. Higher risk gives more return, but it also leads to financial collapse. Thus, it is the management of risk that results in handsome return. Give a comprehensive theoretical background of the topic and then analyze its practical application in an organization selected by you. Critically examine the features of various common money market instruments available in corporate sector of Pakistan. Also give theoretical background of the topic.

GUIDELINES FOR THE PREPARATION OF ASSIGNMENT # 2

The report should follow the following format: 1.Title page 2.Acknowledgements 3.An abstract (one page summary of the paper) 4.Table of contents 5.Introduction to the issue (brief history & significance of issue assigned) 6.Data collection methods 7.Conclusion (one page brief covering important aspects of your report) 8.Recommendations (specific recommendations relevant to issue assigned) 9.References (as per APA format) 10. Annexes (if any) Other Guidelines: 1.5 line spacing Use headers and subheads throughout all sections Organization of ideas Writing skills (spelling, grammar, punctuation) Professionalism (readability and general appearance) Do more than repeat the text Express a point of view and defend it.

You should use transparencies and any other material for effective presentation. The transparencies are not the presentation, but only a tool; the presentation is the combination of the transparencies and your speech. Workshop presentation transparencies should only be in typed format. You are required to prepare two copies of 2nd assignment. Submit one copy to your tutor/ teacher for evaluation and the second copy for presentations in the workshop in the presence of the resource person and classmates, which will be held at the end of the semester prior to the final examination. GUIDELINES FOR WORKSHOP PRESENTATION:

Make eye contact and react to the audience. Don't read from the transparencies or from report, and don't look too much at the transparencies (occasional glances are acceptable to help in recalling the topic to cover). A 15-minute presentation can be practiced several times in advance, so do that until you are confident enough. Some people also use a mirror when rehearsing as a substitute for an audience.

WEIGHTAGE OF THEORY & PRACTICAL ASPECTS IN ASSIGNMENT # 2 & WORKSHOP PRESENTATIONS: Assignment # 2 & workshop presentations are evaluated on the basis of theory & its applicability. The weightage of each aspect would be: Theory Applicability (practical study of the organization) 60% 40%

FINANCIAL MANAGEMENT (8513)

Course Outline

Unit 1: Introduction to Financial Management 1.1 The Role of Financial Management 1.1.1 Defining Financial Management 1.1.2 Goal of the Firm 1.1.3 Functions of Financial Management 1.2 The Business, Tax and Financial Environments 1.2.1 Business Environment 1.2.2 Tax Environment 1.2.3 Financial Environment Tools of Financial analysis and Planning 2.1 Financial Statement Analysis 2.1.1 Financial Statements 2.1.2 Balance Sheet Ratios 2.1.3 Income Statement and Income Statement/Balance Sheet Ratios 2.1.4 Trend Analysis 2.1.5 Common-size and Index Analysis 2.2 Cash-Flow Analysis and Financial Planning 2.2.1 Accounting Statement of Cash Flows 2.2.2 Cash-flow Forecasting 2.2.3 Range of Cash-flow Estimates 2.2.4 Forecasting Financial Statements Valuation 3.1 The Time Value of Money 3.1.1 Simple and Compound interest 5

Unit 2:

Unit 3:

3.1.2 Annuities 3.1.3 Compounding more than once a Year 3.1.4 Amortizing a Loan The Valuation of long-term Securities 3.1.5 Distinctions among Valuation Concepts 3.1.6 Bond Valuation 3.1.7 Preferred Stock Valuation 3.1.8 Common Stock Valuation 3.1.9 Rates of Return (or Yields) Unit 4: Risk and Return 4.1 Defining Risk and Return 4.2 Using Probability Distributions to Measure Risk 4.3 Attitudes Toward Risk 4.4 Risk and Return in a Portfolio Context 4.5 Diversification 4.6 Capital Asset Pricing Model (CAPM) 4.7 Arbitrage Pricing Theory(APT) Unit 5: Working Capital Management-I 5.1 Overview of Working Capital Management 5.1.1 Working Capital Issues 5.1.2 Financing Current Assets: Short-term and Long-term Mix 5.1.3 Combining Liability Structure 5.2 Cash and Marketable Securities Management 5.2.1 Motives for Holding Cash 5.2.2 Speeding up Cash Receipts 5.2.3 Slowing down Cash Payouts 5.2.4 Electronic Commerce 5.2.5 Investment in Marketable Securities

6.1.4

Unit 6: Working Capital Management-II Accounts Receivable and Inventory Management 6.1.1 Credit and Collection Policies 6.1.2 Analyzing the Credit Applicant 6.1.3 Inventory Management and Control Short-term Financing Spontaneous Financing 6.1.5 Negotiated Financing 6.1.6 Composition of Short-term Financing Unit 7: Investment in Capital Assets Overview of capital budgeting process Estimating project After-Tex incremental operating cash flows Capital Budgeting Techniques Risk and Managerial Options in Capital Budgeting 6

Unit 8:

Cost of Capital Required Returns and the Cost of Capital 8.1.1 Overall Cost of Capital of the Firm 8.1.2 CAPM: Project-Specific and Group-Specific Required Rates of Return 8.1.3 Evaluation of Projects on the Basis of Their Total Risk Operating and Financial Leverage 8.2.1 Operating Leverage 8.2.2 Financial Leverage 8.2.3 Total Leverage 8.2.4 Cash-Flow Ability to Service Debt 8.3 Dividend Policy 8.3.1 Active Versus Passive Dividend Policies 8.3.2 Factors Influencing Dividend Policies 8.3.3 Stock Dividend and Stock Splits 8.1 Unit 9: Long-term Financing 9.1 Long-Term Debt, Preferred Stock and Common Stock 9.1.1 Types of Long-term Debt Instruments 9.1.2 Bonds and their Features 9.1.3 Preferred Stock and its Features 8.1.4 Common Stock and its Features 8.1.5 Dual-class Common Stock 9.2 The Loans and Leases 9.3.1 Term Loans 9.3.2 Equipment and Lease Financing 9.3.3 Lease Financing vs. Debt Financing

Recommended Books: Horne, J.C.V. & Wachowicz, J. R. (2005). Fundamentals of Financial Management (12th ed.) USA: Pearson Education Ltd. Khan, M.Y. & Jains, P. K. (2007). Basic Financial Management (2nd ed.). New Delhi, India: Tata McGraw-Hill/Irwin. Brigham, E.F. & Ehrhardt, M.C. (2001). Financial Management (10th ed.). Ohio, USA: South Western Pub.

______[]______

Вам также может понравиться

- Global Slump: The Economics and Politics of Crisis and Resistance by David McNally 2011Документ249 страницGlobal Slump: The Economics and Politics of Crisis and Resistance by David McNally 2011Demokratize100% (5)

- Apartheid in South AfricaДокумент24 страницыApartheid in South Africaapi-300093410100% (1)

- CLEMENTE CALDE vs. THE COURT OF APPEALSДокумент1 страницаCLEMENTE CALDE vs. THE COURT OF APPEALSDanyОценок пока нет

- How To Format Your Business ProposalДокумент2 страницыHow To Format Your Business Proposalwilly sergeОценок пока нет

- BUSINESS-RESEARCH-METHODOLOGY - MBA Handwritten Notes PDFДокумент128 страницBUSINESS-RESEARCH-METHODOLOGY - MBA Handwritten Notes PDFSamОценок пока нет

- Partnership Deed: Now This Deed Wintesseth As UnderДокумент4 страницыPartnership Deed: Now This Deed Wintesseth As UnderAnshumanTripathiОценок пока нет

- Intro To LodgingДокумент63 страницыIntro To LodgingjaevendОценок пока нет

- Skills DevelopmentДокумент30 страницSkills DevelopmentT seriesОценок пока нет

- Stdy RCD PDFДокумент204 страницыStdy RCD PDFBol McSafeОценок пока нет

- Merchant Banking and Financial Services Mba Handwritten NotesДокумент91 страницаMerchant Banking and Financial Services Mba Handwritten Notesarunima singh100% (1)

- Floating PonttonДокумент9 страницFloating PonttonToniОценок пока нет

- Sarhad University, Peshawar: (Distance Education)Документ1 страницаSarhad University, Peshawar: (Distance Education)liaqat ali KhanОценок пока нет

- MBA-BBA Dissertation TemplateДокумент21 страницаMBA-BBA Dissertation TemplateQuratulain PervaizОценок пока нет

- Public AdministrationДокумент2 страницыPublic AdministrationOsama_Javed_7120Оценок пока нет

- Competitive AbcsДокумент125 страницCompetitive AbcssdsdawoodОценок пока нет

- Nature and Scope of HRMДокумент2 страницыNature and Scope of HRMsethuram42Оценок пока нет

- Thesis Sobia ShahzadiДокумент89 страницThesis Sobia ShahzadiRabia 8828Оценок пока нет

- SPSC Past Papers of Commerce Lecturer (BPS-17)Документ24 страницыSPSC Past Papers of Commerce Lecturer (BPS-17)Maher Zohaib Ahmed KhairaОценок пока нет

- Issues in Education System in PakistanДокумент22 страницыIssues in Education System in PakistanViqar AhmedОценок пока нет

- A Study Project of State Bank of PakistanДокумент91 страницаA Study Project of State Bank of PakistanRehanaShaffiОценок пока нет

- Chief District OfficerДокумент18 страницChief District OfficerBidhan PoudyalОценок пока нет

- SSSNY 16th SJEP Application FormДокумент4 страницыSSSNY 16th SJEP Application FormHsai Hseng Mao100% (1)

- Interview Tips For KPPSCДокумент2 страницыInterview Tips For KPPSCMurad KhanОценок пока нет

- 8606 2Документ16 страниц8606 2shu100% (1)

- Pakistan Country PresentationДокумент28 страницPakistan Country PresentationADBI Events100% (1)

- Role of Remittances in Strengthening The Economy With Reference To PakistanДокумент4 страницыRole of Remittances in Strengthening The Economy With Reference To PakistanNicholas StewartОценок пока нет

- Research Course Outline For Resarch Methodology Fall 2011 (MBA)Документ3 страницыResearch Course Outline For Resarch Methodology Fall 2011 (MBA)mudassarramzanОценок пока нет

- BISP DeputationДокумент3 страницыBISP DeputationAadil HaroonОценок пока нет

- Non ComparativeNon Comparative Scaling Techniques - PPT Scaling TechniquesДокумент16 страницNon ComparativeNon Comparative Scaling Techniques - PPT Scaling TechniquesSAASDASDA9682Оценок пока нет

- General Instructions For Students Attempting Open Book Examination PaperДокумент2 страницыGeneral Instructions For Students Attempting Open Book Examination PaperSardar Ahsan suduzaiОценок пока нет

- STA630 ResearchMethod Short NotesДокумент18 страницSTA630 ResearchMethod Short Notesanroid appОценок пока нет

- Essay Outline - Education in Pakistan (By Mureed Hussain CSP)Документ2 страницыEssay Outline - Education in Pakistan (By Mureed Hussain CSP)Ahmad Sarwar QadriОценок пока нет

- H.R.P. at Different LevelsДокумент3 страницыH.R.P. at Different LevelsShalini Swaroop0% (1)

- HBL AssignmentДокумент57 страницHBL AssignmentSonia A. Usman0% (1)

- Internship Report On ILM College (Sargodha)Документ19 страницInternship Report On ILM College (Sargodha)Usama KarimОценок пока нет

- Planning CommissionДокумент6 страницPlanning CommissionAnendya ChakmaОценок пока нет

- BMTC Pattar Savita 0493Документ88 страницBMTC Pattar Savita 0493Amith RajОценок пока нет

- Quality of Primary Education in Paksitan PDFДокумент45 страницQuality of Primary Education in Paksitan PDFtaz_taz3Оценок пока нет

- Revenue Collection ProposalДокумент6 страницRevenue Collection ProposalKola Samuel100% (1)

- Human Resource Accounting 132Документ12 страницHuman Resource Accounting 132sudhirkothiОценок пока нет

- 6552 AiouДокумент6 страниц6552 AiouAli RazaОценок пока нет

- GAT Subject SyllabusДокумент5 страницGAT Subject SyllabusAliОценок пока нет

- Pom Sem 1Документ2 страницыPom Sem 1profkalpeshОценок пока нет

- Madrasa Education SystemДокумент13 страницMadrasa Education Systemasifiqbal87100% (1)

- BPSC AdvertisementДокумент3 страницыBPSC AdvertisementIbrahimGorgageОценок пока нет

- Reserach MethodolgyДокумент24 страницыReserach MethodolgyAmeya NeheteОценок пока нет

- 02 Education Statistical Yearbook 2019Документ214 страниц02 Education Statistical Yearbook 2019CHRISTOPHER NSENGIYUMVAОценок пока нет

- Accountancy and Auditing SyllabusДокумент5 страницAccountancy and Auditing SyllabusSaad GulzarОценок пока нет

- Topic: Group-6: HR Practice of BkashДокумент28 страницTopic: Group-6: HR Practice of BkashTanjin PayelОценок пока нет

- Monetary Policy of State Bank of PakistanДокумент16 страницMonetary Policy of State Bank of PakistanAli Imran JalaliОценок пока нет

- BBA 3rd SemesterДокумент7 страницBBA 3rd Semestersimun3332000Оценок пока нет

- Good Governance in Pakistan ArticlesДокумент4 страницыGood Governance in Pakistan ArticlesMaryОценок пока нет

- Human Resource Development in PakistanДокумент20 страницHuman Resource Development in PakistanAhmad CssОценок пока нет

- PSO Final ReportДокумент43 страницыPSO Final ReportMohammad ZiaullahОценок пока нет

- Administrative Ethics PDFДокумент14 страницAdministrative Ethics PDFN Irina100% (1)

- Public Sector Planning in Pakistan by Dr. Imran Ahmad SajidДокумент31 страницаPublic Sector Planning in Pakistan by Dr. Imran Ahmad SajidimranahmadsajidОценок пока нет

- Banking Sector ReformsДокумент13 страницBanking Sector ReformsSahil NayyarОценок пока нет

- Taxation in PakistanДокумент22 страницыTaxation in PakistanAdnan AkramОценок пока нет

- General Instructions For Students Attempting Online ExaminationДокумент2 страницыGeneral Instructions For Students Attempting Online ExaminationSaqib JadoonОценок пока нет

- Ppa 670 ch5 Public Problems and Policy AlternativesДокумент4 страницыPpa 670 ch5 Public Problems and Policy AlternativesfadwaОценок пока нет

- Background Information: A Report On Industrial Internship Undertaken at Tema West Municipal AssemblyДокумент7 страницBackground Information: A Report On Industrial Internship Undertaken at Tema West Municipal AssemblyDotse BlessОценок пока нет

- UOG Prospectus 2013-14 For WebДокумент244 страницыUOG Prospectus 2013-14 For WebMuhammad Ali50% (4)

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Документ7 страницAllama Iqbal Open University, Islamabad (Department of Business Administration)Mosal WassiОценок пока нет

- 8524Документ7 страниц8524KhurramRiaz100% (1)

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Документ8 страницAllama Iqbal Open University, Islamabad (Department of Business Administration)apovtigrtОценок пока нет

- Allama Iqbal Open University, Islamabad Warning: (Department of Business Administration)Документ7 страницAllama Iqbal Open University, Islamabad Warning: (Department of Business Administration)NadeemAdilОценок пока нет

- 8524Документ8 страниц8524Ghulam MurtazaОценок пока нет

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Документ7 страницAllama Iqbal Open University, Islamabad (Department of Business Administration)WasifОценок пока нет

- ITACPhoenix 6-03Документ13 страницITACPhoenix 6-03Sulaman SadiqОценок пока нет

- Lesson 6Документ66 страницLesson 6Sonal Brijesh KapoparaОценок пока нет

- Deedofreconstitutedpartnership 120908041435 Phpapp02Документ1 страницаDeedofreconstitutedpartnership 120908041435 Phpapp02Sulaman SadiqОценок пока нет

- Pay For Performance 1Документ18 страницPay For Performance 1Sulaman SadiqОценок пока нет

- Consideration For Formulation of A Bad News Messeges With The OrganizationДокумент18 страницConsideration For Formulation of A Bad News Messeges With The OrganizationSulaman SadiqОценок пока нет

- Sulaman Full CV With Documents PDFДокумент15 страницSulaman Full CV With Documents PDFSulaman SadiqОценок пока нет

- Downsizing To HR Presented by SULAMAN SADIQДокумент14 страницDownsizing To HR Presented by SULAMAN SADIQSulaman SadiqОценок пока нет

- Integration of Information Technology (In Education Classes)Документ50 страницIntegration of Information Technology (In Education Classes)Sulaman SadiqОценок пока нет

- 8506-Mgmt Theory & PracticeДокумент9 страниц8506-Mgmt Theory & PracticeSulaman SadiqОценок пока нет

- 8507-Management Information SystemДокумент7 страниц8507-Management Information SystemKhurramRiazОценок пока нет

- KR Ch12EДокумент36 страницKR Ch12ESulaman SadiqОценок пока нет

- Impact of DownsizingДокумент22 страницыImpact of DownsizingSulaman SadiqОценок пока нет

- Three 8502 HRM MBAДокумент9 страницThree 8502 HRM MBAhani856Оценок пока нет

- 8514-Business & Labor LawДокумент8 страниц8514-Business & Labor LawSulaman SadiqОценок пока нет

- Email Form (New1)Документ1 страницаEmail Form (New1)Sulaman SadiqОценок пока нет

- BR Code Branch Name Fep Deployed SCCM DeployedДокумент2 страницыBR Code Branch Name Fep Deployed SCCM DeployedSulaman SadiqОценок пока нет

- 8516-Project Management-BeenishДокумент8 страниц8516-Project Management-BeenishSulaman SadiqОценок пока нет

- 8517 OB BeenishДокумент7 страниц8517 OB BeenishSulaman SadiqОценок пока нет

- Curriculum Vitae: Jehangir SharifДокумент3 страницыCurriculum Vitae: Jehangir SharifSulaman SadiqОценок пока нет

- Managing Inventory, MRP and JITДокумент25 страницManaging Inventory, MRP and JITSulaman SadiqОценок пока нет

- MCS Ppt... Inventory ControlДокумент7 страницMCS Ppt... Inventory ControlNisha KheraОценок пока нет

- 8515 CB BeenishДокумент6 страниц8515 CB BeenishSulaman SadiqОценок пока нет

- FEPlSTATUS SIALKOTДокумент2 страницыFEPlSTATUS SIALKOTSulaman SadiqОценок пока нет

- P&Q SystemДокумент42 страницыP&Q SystemArun SivamОценок пока нет

- MCS Ppt... Inventory ControlДокумент7 страницMCS Ppt... Inventory ControlNisha KheraОценок пока нет

- Patnership ActДокумент27 страницPatnership ActJivaansha SinhaОценок пока нет

- 0 PodraftingДокумент92 страницы0 PodraftingSulaman SadiqОценок пока нет

- 1 - 10.drafting of Deed Etc. - 24012012Документ7 страниц1 - 10.drafting of Deed Etc. - 24012012Sulaman SadiqОценок пока нет

- Temple ManualДокумент21 страницаTemple Manualapi-298785516Оценок пока нет

- Lifetime Prediction of Fiber Optic Cable MaterialsДокумент10 страницLifetime Prediction of Fiber Optic Cable Materialsabinadi123Оценок пока нет

- 11-03-25 PRESS RELEASE: The Riddle of Citizens United V Federal Election Commission... The Missing February 22, 2010 Judgment...Документ2 страницы11-03-25 PRESS RELEASE: The Riddle of Citizens United V Federal Election Commission... The Missing February 22, 2010 Judgment...Human Rights Alert - NGO (RA)Оценок пока нет

- StrategiesДокумент7 страницStrategiesEdmar PaguiriganОценок пока нет

- STD 4 Maths Half Yearly Revision Ws - 3 Visualising 3D ShapesДокумент8 страницSTD 4 Maths Half Yearly Revision Ws - 3 Visualising 3D ShapessagarОценок пока нет

- Independence of Costa RicaДокумент2 страницыIndependence of Costa Ricaangelica ruizОценок пока нет

- Lipid Metabolism Quize PDFДокумент5 страницLipid Metabolism Quize PDFMadani TawfeeqОценок пока нет

- Hotel BookingДокумент1 страницаHotel BookingJagjeet SinghОценок пока нет

- OatДокумент46 страницOatHari BabuОценок пока нет

- Schopenhauer and KantДокумент8 страницSchopenhauer and KantshawnОценок пока нет

- Disciplinary Literacy Strategies To Support Transactions in Elementary Social StudiesДокумент11 страницDisciplinary Literacy Strategies To Support Transactions in Elementary Social Studiesmissjoseph0803Оценок пока нет

- What's More: Quarter 2 - Module 7: Deferred AnnuityДокумент4 страницыWhat's More: Quarter 2 - Module 7: Deferred AnnuityChelsea NicoleОценок пока нет

- Simple FTP UploadДокумент10 страницSimple FTP Uploadagamem1Оценок пока нет

- Brief For Community Housing ProjectДокумент5 страницBrief For Community Housing ProjectPatric LimОценок пока нет

- MigrationДокумент6 страницMigrationMaria Isabel PerezHernandezОценок пока нет

- Characteristics of Pop CultureДокумент3 страницыCharacteristics of Pop Culturekhimamad02Оценок пока нет

- Sociology of Arts & HumanitiesДокумент3 страницыSociology of Arts & Humanitiesgayle gallazaОценок пока нет

- Public Versus Private Education - A Comparative Case Study of A P PDFДокумент275 страницPublic Versus Private Education - A Comparative Case Study of A P PDFCindy DiotayОценок пока нет

- Klarna: Klarna A Company Valued To Be 5.5 Billion and 8 Most Valued Fintech Company in The WorldДокумент1 страницаKlarna: Klarna A Company Valued To Be 5.5 Billion and 8 Most Valued Fintech Company in The WorldChetan NarasannavarОценок пока нет

- ACA 122-My Academic Plan (MAP) Assignment: InstructionsДокумент5 страницACA 122-My Academic Plan (MAP) Assignment: Instructionsapi-557842510Оценок пока нет

- COSMO NEWS September 1, 2019 EditionДокумент4 страницыCOSMO NEWS September 1, 2019 EditionUnited Church of Christ in the PhilippinesОценок пока нет

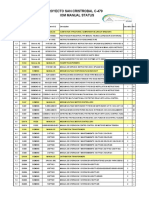

- Proyecto San Cristrobal C-479 Iom Manual StatusДокумент18 страницProyecto San Cristrobal C-479 Iom Manual StatusAllen Marcelo Ballesteros LópezОценок пока нет

- Ebook Essential Surgery Problems Diagnosis and Management 6E Feb 19 2020 - 0702076317 - Elsevier PDF Full Chapter PDFДокумент68 страницEbook Essential Surgery Problems Diagnosis and Management 6E Feb 19 2020 - 0702076317 - Elsevier PDF Full Chapter PDFmargarita.britt326100% (22)