Академический Документы

Профессиональный Документы

Культура Документы

Electricity Consumption and Economic Growth in China: Cointegration and Co-Feature Analysis

Загружено:

RashidAliОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Electricity Consumption and Economic Growth in China: Cointegration and Co-Feature Analysis

Загружено:

RashidAliАвторское право:

Доступные форматы

Energy Economics 29 (2007) 1179 1191 www.elsevier.

com/locate/eneco

Electricity consumption and economic growth in China: Cointegration and co-feature analysis

Jiahai Yuan a,, Changhong Zhao a , Shunkun Yu a , Zhaoguang Hu b

a

School of Business Administration, North China Electric Power University, China b State Power Economic Research Center, China

Received 23 December 2005; received in revised form 25 September 2006; accepted 25 September 2006 Available online 7 November 2006

Abstract This paper applies the cointegration theory to examine the causal relationship between electricity consumption and real GDP (Gross Demostic Product) for China during 19782004. Our estimation results indicate that real GDP and electricity consumption for China are cointegrated and there is only unidirectional Granger causality running from electricity consumption to real GDP but not the vice versa. Then HodrickPrescott (HP) filter is applied to decompose the trend and fluctuation component of the GDP and electricity consumption series. The estimation results indicate that there is cointegration between not only the trend components, but also the cyclical components of the two series, which implies that, the Granger causality is probably related with the business cycle. The estimation results are of policy implication to the development of electric sector in China. 2006 Elsevier B.V. All rights reserved.

JEL classification: Q43; C32 Keywords: Electricity consumption; Economic growth; China; Cointegration; Co-feature

1. Introduction In the past two decades China has achieved rapid economic growth and emerged as the second largest electricity consumption country in the world, just behind the United States. In the end of 2004 the installed generation capacity in China amounted to more than 420 GW and electricity generated is 2130.2 TWH.

Corresponding author. Tel./fax: +86 10 80798654. E-mail address: yuanjh126@126.com (J. Yuan). 0140-9883/$ - see front matter 2006 Elsevier B.V. All rights reserved. doi:10.1016/j.eneco.2006.09.005

1180

J. Yuan et al. / Energy Economics 29 (2007) 11791191

However electricity supply and economic growth have never been coincided in China. Historically there was widespread electricity shortage since 60th of the last century. In 1997 with the decrease of economic growth rate there emerged electricity surplus for the first time. However electricity shortage again emerged since 2002 and worsened in 2004. In 2004, the provinces in shortage of electric power amounted to 24 and the total gap is 31 GW in China. The disharmony between electricity supply and economic growth in China proposes some important questions: does there exist long-term equilibrium between electricity consumption and economic growth in China? How do they influence each other in the short term? Proper reply to the questions is helpful for electricity development policy in China. The study of causal relationship between energy and economic growth started with the seminal work of Kraft and Kraft (1978), in which causality was found to run from GNP to energy consumption in the United States. Empirical studies were later extended to cover other industrial countries like the United Kingdom, Germany, Italy, Canada, France, Japan and Greece (Yu and Choi, 1985; Erol and Yu, 1987; Hondroyiannis et al., 2002). In the subsequent studies, instead of relying on the standard Granger causality test, the cointegration and errorcorrection models were applied to test for stationarity of the variables in the time-series. Moreover some studies (Stern, 1993) tested for Granger causality in a multivariate setting by using a vector auto-regression model. Recently some effort has been paid to the causal relationship between electricity consumption and economic growth in China (Lin, 2003; Shiu and Lam, 2004). However contradicting results have been obtained. Lin (2003) covered the period of 19782001 and concluded that economic growth is the Granger cause of electricity consumption but not the vice versa. While (Shiu and Lam, 2004) covering the period of 1971 to 2000 obtained rightly the opposite conclusion that there exists unidirectional Granger causality running from electricity consumption to economic growth. In fact the Granger cause analysis is sensitive to minor changes in model structure, such as adding linear trend term in the cointegrated equation or changing lag periods from 2 to 3. So it is often criticized that Granger cause results obtained may not be the real relationship among time series but only the manipulation of Error Correction Model (ECM) (Granger and Hyung, 2004). Another root of controversy is time period. Sometimes with different periods opposite results are obtained for a same country (See the overview in Shiu and Lam, 2004). Because of the sensitivity of causal relationship analysis result to the sampling period and because that since 1978 with the reform and opening up to outside world China has gradually stepped to the regular road of economic growth, it is important to analyze the causal relationship in China after 1978. However no research has covered the period. Moreover when applying Granger causality analysis we should be cautious with the empirical results and explain them carefully. Some more detailed evidences should be provided and analyzed to validate the empirical results. All the empirical analysis on the relationship between electricity consumption and economic growth has only studied the relationship of the trend, not the cyclical components, with the exception of (Thoma, 2004), in which the frequency Granger relationship for the United States from 1973 to 2000 is identified to operate with low frequency business cycle movement. In fact the causality between the cyclical components of the interested series is very important because it is correlated with fluctuation in output, an important phenomenon in macroeconomics. One of the objects of our work is to fill the void for China in this direction, though only a preliminary effort. The remainder of the paper is organized as follows: Section 2 gives an overview of energy sector in China, with emphasis on electricity. Section 3 discusses the methodology and the data of the study. We report our empirical analysis in Section 4. Section 5 provides the policy implications of the empirical analysis and finally is the conclusion.

J. Yuan et al. / Energy Economics 29 (2007) 11791191

1181

2. Overview of energy sector in China The transition of energy supply and demand in China since 1978 can be characterized as three stages. From 1978 to 1996 with the rapid growth of the economy, the energy supply is in serious shortage to hamper the vigor of the national economy. Stage two is from 1997 to 2000, with the slowness of the economy growth, the total energy consumption trends downward. However 2001 is the turning point year when energy consumption increased rapidly and the supplydemand gap persisted since then. With the development of electrization, electricity becomes an indispensable input of production and office and necessity of modern life, characterizing the continual substitution of other energy types. As for China, it is worth noticing that since 1990 the share of electricity in total end user energy consumption increases sharply. The trend of energy and electricity intensity can also testify the existence of electricity's substitution effect. While the energy intensity has dropped dramatically by more than half from 1978 to 2004, the electricity intensity has dropped by merely 15%, which indicates that with the enhancement of energy efficiency, electricity plays an even more important role in energy mix. The energy structure of China is dominated by coal. Even the share of coal in primary energy consumption decreased from 72.2% in 1980 to 65.3% in 2001, the number is relative too high to other countries and increased again since 2001 because of rapid growth in energy demand and because of China's resource gift. Of all the coal consumed, more than half is for electricity production. In 2003, 53.5% of the coal was used for electricity production. The side effect of energy consumption is environment damage. It is estimated that the direct cost of environmental damage in the 1990s amounted to 7% of China's GDP (ERI, 2000). In 2003, the SO2 emission by all the industries amounted to 15.75 million ton. Of all the air pollution 75% is due to the burn of fuel. Concerning electric sector, it is estimated that in 2003 50.9% of total SO2 emitted is due to electric sector (National Bureau of Statistics, 2005). If the energy and electricity consumption continues the current trend without substantive change, it is inevasible that China cannot realize sustainable development. Having cognizance of the puzzle, in the newly formulated eleventh five-year plan for social and economic development, the central government firstly stipulated specific energy efficiency goal and declared to reduce the energy intensity by 20% in the eleventh five-year plan period (20062010) (Figs. 1 and 2). 3. Methodology and data 3.1. Stationarity, cointegration and Error Correction Model According to Engle and Granger (1987), a linear combination of two or more non-stationary series (with the same order of integration) may be stationary. If such a stationary linear combination exists, the series are considered to be cointegrated and long-run equilibrium relationships exist. Incorporating these cointegrated properties, an Error Correction Model (ECM) could be constructed to test for Granger causation of the series in at least one direction (Engle, 1999). In this paper the ECM is specifically adopted to examine the Granger causality between real GDP and electricity consumption in China. Since the use of ECM requires the series to be cointegrated with the same order, it is essential to first test the series for stationarity and cointegration. A series is said to be nonstationary if it has non-constant mean, variance, and autocovariance over time. If a nonstationary series has to be differenced d times to become stationary, then it is said to be integrated of order d: i.e. I(d ).

1182

J. Yuan et al. / Energy Economics 29 (2007) 11791191

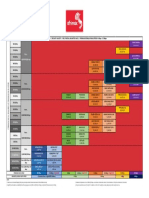

Fig. 1. The share of China's primary energy production (Source: State Statistical Bureau, 2006a,b).

When both series are integrated of the same order, we can proceed to examine for the presence of cointegration. The Johansen Maximum likelihood procedures are used for the test (Johansen and Juselius, 1990). Any long-term cointegrating relationship found between the series will contribute an additional errorcorrection term to the ECM. The Johansen procedure is a vector autogressive (VAR) based test on restriction imposed by cointegration in the unrestricted VAR. The null hypothesis in consideration is Ho, that there are a different number of cointegration relationship, against H1, that all series in the VAR are stationary. The ECM used in this paper is specified as follows: Dyt a2 b2 ECTt1 Dxt a1 b1 ECTt1 X X

i i

a21 iDyti a11 iDyti

X X

i i

a22 iDxti e2t a12 iDxti e1t

1 2

Where yt and xt represent natural logarithms of real GDP and electricity consumption, respectively, yt and xt are the differences in these variables that capture their short-run disturbances, 1t,2t are the serially uncorrelated error terms, and ECTt1 is the errorcorrection term (ECT) which is derived from the long-run cointegration relationship and measures the magnitude of the past disequilibrium. In each equation, change in the endogenous variable is caused not only by their lags, but also by the previous period's disequilibrium in level, i.e. ECTt1. Given such a specification, the presence of short and long-run causality could be tested. Consider Eq. (1), if the estimated coefficients on

Fig. 2. The electricity and energy intensity of China from 1978 to 2004 (GDP is calculated as consistent price on the base of 1990).

J. Yuan et al. / Energy Economics 29 (2007) 11791191

1183

lagged values of electricity consumption are statistically significant, then the implication is that the electricity consumption Granger causes real GDP in the short-run. On the other hand, long-run causality can be found by testing the significance of the past disequilibrium term. 3.2. The HodrickPrescott filter In order to further test the Granger causality between the fluctuation component of electricity consumption and economic growth, we need first to decompose the trend and cyclical component of the interested series. The HP filter is such a tool and gives an estimate of the unobserved variable (trend) as the solution to the following minimization problem (Basdevant, 2003): min :

Ty t T X t 1

yTyt 2 kD2 Tyt 2

2 Where y is the observed variable, Tyt is the unobserved variable being filtered, c is the 2 variance of the cyclical component y Tyt and T is the variance of the growth rate of the trend 2 2 component. And = T / c is the smoothing coefficient. After applying HP filter, we can get the cyclical component

Cyt yt Tyt

t 1; 2; : : : ; T

With the decomposed components we can analyze the causality among trend and among cyclical components of the original series. If the original series are cointegrated and the cyclical components are also cointegrated, we can say that the series are of cointegration and co-feature, a result stronger than cointegration, which implies that the causality relationship may be correlated with business cycle. 3.3. The data Our empirical study uses the time series data of real GDP and electricity consumption for the 19782004 period of China. Nominal GDP and electricity consumption data for China are obtained from the National Bureau of Statistics (2005), China State Electricity Power Information Center (2004). In this paper, electricity consumption is expressed in terms of billion kilowatt hours (kWh) or terawatt hours (TWh) and nominal GDP is deflated by the GDP deflator (using 1990 as the base year) to obtain the figure of real GDP in billion yuan. In the paper, the Granger relationship between the un-filtered series of real GDP and electricity consumption for China is test firstly. Granger causality test is then applied to the corresponding HP trend and cyclical components. 4. Empirical results and robustness analysis 4.1. The results of un-filtered data Table 1 reports the results of the ADF and PP tests on the integration properties of the real GDP and electricity consumption for China. Results of the two tests indicate that the two series are found to be nonstationary. However first differences of these series lead to stationarity.

1184

J. Yuan et al. / Energy Economics 29 (2007) 11791191

Table 1 Unit root test results of GDP and electricity consumption logarithmic series Variables ADF test Level LGDP LELEC 5% critical value 0.57 First difference 3.63 2.9907 PP test Level 0.36 1.09 First difference 2.99 3.10 2.985

These indicate that the integration of real GDP and electricity consumption of China is of order one, i.e. I(1). Given that integration of the two series is of the same order, we continued to test whether the two series are cointegrated over the sample period. Table 2 shows the results of the Johansen test. The likelihood ratio (LR) test rejects the hypothesis of none cointegrating equation at the 1% significance level, i.e. there is a long-run relationship between real GDP and electricity consumption for China. The normalized cointegrating coefficient (0.88) is shown in the last row of Table 2, and the signs of the variables conform to the theory in literature, i.e. there is positive relationship between electricity consumption and real GDP. Following the detection of the cointegrating relationship between real GDP and electricity consumption, an ECM was set up for investigating short and long-run causality. In the ECM, the first difference of each endogenous variable (real GDP or electricity consumption) was regressed on a one period lag of the cointegrating equation and lagged first differences of all the endogenous variables in the system. Table 3 shows the results of causality test. We have performed several tests for Granger causality: (1) short-run causality the significance of the sum of lagged terms of each explanatory variable by joint F test; (2) long-run causality the significance of the error correction terms by t-test; and (3) short-run adjustment to re-establish long-run equilibrium the joint significance of the sum of lagged terms of each explanatory variable and the ECT by joint F test. The lag of the system is decided by AIC criterion as 4. Short-run causality is found only from electricity consumption to real GDP, but not the reverse, i.e. there is unidirectional Granger causality. The coefficient of the ECT is found to be significant in the real GDP equation, which indicates that given any deviation in the ECT, both variables in the ECM would interact in a dynamic fashion to restore long-run equilibrium. Results of the significance of interactive terms of change in electricity, along with the ECT in the GDP equation are consistent with the presence of Granger-causality running from electricity consumption to real GDP. These indicate that whenever there is the presence of a shock to the system, electricity consumption would make short-run adjustment to re-establish long-run equilibrium.

Table 2 Johansen cointegration estimation results between logarithmic series of GDP and electricity consumption Eigenvalue Likelihood ratio 5% Critical value 1% Critical value Number of cointegration 16.31 6.51 None At most 1

0.663132 29.99184 12.53 0.240581 6.054447 3.84 Normalized cointegration equation LELEC = 0.88LGDP

Note: () is 5% (1%) critical level. L.R. test indicates the existence of one cointegration relation at 1% level.

J. Yuan et al. / Energy Economics 29 (2007) 11791191 Table 3 Estimation results of Error Correction Model for logarithmic series of GDP and electricity consumption Source of causality Short-run Variables F-statistics GDP ELEC 0.67 2.76 GDP ELEC ECT ECT t-statistics 1.768 0.3518 Joint short/long term test GDP and ECT F-statistics 0.76 2.92

1185

ELEC and ECT

Note: GDP and ELEC are the first difference series of LGDP and LELEC respectively; ECT is the Error Correction Term. is 10% critical level and is 5% critical level.

Granger method can only test causality within sample period; we use variance decomposition analysis (VDC) as robustness analysis of the ECM (Soytas and Sari, 2003). The variance of the forecast error of a variable can be partitioned in our case into two with respect to the innovations in each variable in the system. For example, the variance of the forecast error in GDP can be attributable to innovations in electricity consumption as well as to its own innovations. In that sense, VDC can be viewed as out of sample causality tests. The VDC results are consistent with our findings in ECM model analysis. As of China, LGDP does not appear to explain more than 14% of an innovation in LELEC even after 10 years. While LELEC can explain 64% after 4 years and more than 80% after 5 years of the innovation in LGDP. So VDC supports our empirical results that there runs unilateral cause from electricity consumption to economic growth, in line with the result of Alice Shiu and Lam (2004) for the period of 19712000. 4.2. The results of filtered data Then we get the trend and cyclical components of the two series by HP filter, as shown in Figs. 3 and 4. It is evidently that the trend components of real GDP and electricity consumption in China are almost of the same trend while the cyclical components of the two series are of same cyclical characteristic (Fig. 5). It is also noted that before 1990 the peak and valley of electricity consumption lagged 1 to 2 years after GDP while after 1990 the relationship was inverse (Figs. 6 and 7). Unit root test shows that the trend and cyclical components of the both series are of integration order one and we then proceed to cointegration test. Tables 5 and 6 report the results.

Fig. 3. The share of electricity consumption in total end user energy consumption (calculated as of calorific value according to the research of State Power Economic Research Center).

1186

J. Yuan et al. / Energy Economics 29 (2007) 11791191

Fig. 4. Real GDP and electricity consumption of China from 1978 to 2004.

The likelihood ratio (LR) test of the trend components of electricity consumption and GDP rejects the hypothesis of none cointegrating equation at the 1% significance level, i.e. there is a long-run relationship between real GDP and electricity consumption trend component for China. The normalized cointegrating coefficients (0.91) are shown in the last row of Table 4, which is significantly higher than that of unfiltered series. The test result in Table 5 shows that there is also cointegration relationship between cyclical components of the two series. From the normalized cointegration equation the relationship between the cyclical components is negative, i.e. there exists restricting relationship between the fluctuation of GDP and electricity consumption and it is rightly the reason why the cointegration coefficient of unfiltered series is lower than filtered ones. Further we want to identify the direction of Granger causality between the cyclical components of the two series. The test indicates that there exists bilateral Granger causality. However because the unit root test shows that the cyclical components of the series are nearly steady, we are cautious with the results and proceed further with VDC check. VDC check seems to validate the Granger test results. The innovation of CGDP, in 3 years, is almost explained by itself, however after 5 years, can be explained 50% by CGDP and vice versa, implying that in the long-run,

Fig. 5. Variance decomposition of LELEC and LGDP.

J. Yuan et al. / Energy Economics 29 (2007) 11791191

1187

Fig. 6. Trend components of logarithm series of GDP and electricity consumption by HP filter.

fluctuation in economic growth and electricity consumption are bilaterally Granger caused. The test of HP filtered series show that there exist not only co-trend but also co-feature relationship between electricity consumption and economic growth in China (Table 6, Fig. 8). 5. Explanations and policy implications of the empirical results 5.1. Explanations of the empirical results We can explain the existence of unilateral Granger running from electricity consumption to economic growth from perspective of economic structure and electricity usage structure. China is undergoing the development process of industrialization and the percent of industry output in GDP keeps increasing from 29% in 1978 to 49% in 2004. On the other hand, the percent of industry electricity consumption keeps about 70% to 80% of total electricity consumption since 1980th. The high ratio of industry output in GDP means that the growth of industry electricity consumption leads to the growth of GDP by increasing industry output. Whereas, the shortage of electricity supply will negatively influence the growth of industry output and restrain the growth of aggregate output. On the other hand, the increase of industry electricity consumption is influenced by not only the growth of industry output, but also industry output structure, electrification level and energy efficiency, so there does not exist the Granger causality running from industry output to industry electricity consumption. To validate the adequacy of the above explanation, we test the Granger causality in the following four pairs: primary industry output vs. primary industry electricity consumption, industry

Fig. 7. Cyclical components of logarithm series of GDP and electricity consumption by HP filter.

1188

J. Yuan et al. / Energy Economics 29 (2007) 11791191

Table 4 Johansen cointegration estimation results between trend components of logarithm series of GDP and electricity consumption Eigenvalue Likelihood ratio 5% Critical value 1% Critical value Number of cointegration 16.31 6.51 None At most 1

0.482793 22.49653 12.53 0.304593 7.991670 3.84 Normalized cointegration equation HPELEC = 0.91HPGDP

Note: is 5% critical level. L.R. test indicates the existence of two cointegration relations at 5% level. HPGDP and HPELEC are the HP trend components of LGDP and LELEC.

output vs. industry electricity consumption, secondary industry output vs. secondary industry electricity consumption, tertiary industry output vs. tertiary industry electricity consumption. Because China only publicizes the electricity consumption statistic in three-industry mode from 1986, the sampling period is 1986 to 2004. The test results reported in Table 7 validate our explanation. But why there exists bilateral causality between the cyclical components of electricity consumption and GDP in the long-run? It is comprehensive that economy fluctuation leads to fluctuation in electricity consumption, but it is not so intuitionistic to understand that fluctuation in electricity consumption leads fluctuation in total output. Knowing that power plant construction generally has the lead-time of 45 years, when economy recovers and needs more electricity electric sector cannot supply the needed electricity if there was no plan and capacity installation 4 years ago. Shortage of electricity supply probably is the one of the sources of next time economy decline because electricity is the Granger cause of economy growth.1 5.2. Policy implications The empirical analysis of electricity consumption and economic growth has important policy implications on China's economic policy. The unilateral cause from electricity consumption to economic growth indicates that, with existed economic structure keeping on, the shortage of electricity supply will hamper the growth of output. Although electricity is only one of the vital sources of economic growth, enough electricity supply is a necessity condition for regular output growth. So China must keep regular growth of electricity supply to boost the growth of output. And since in cyclical sense electricity consumption is the cause of economic fluctuation, electricity may be a leading indicator for business cycle. Smooth installation of electricity generation capacity may be placating power for business cycle.2 Chinese government must ameliorate the power source structure to meet with the electricity demand and the environment protection requirement. According to the power plan, from 2004 to 2010, China has to install 250 GW new generation capacities to meet with the electricity demand

1 In 2000 with the slowness of economic growth and the surplus of electricity, China Central government decide not to construct large-scale coal power plant in 3 years and cut off small coal power plant. It is criticized that rightly the government policy is the main cause of electricity shortage since 2003. 2 However under the current condition without too much effective market rule, China has to face up to another risk of over supply in electricity. Electricity shortage is apt to cause over-reaction of the government and the investors. It is stated that in the early of 2005 that the current under-construction generation project without legal permission amounted to as high as 125 GW.

J. Yuan et al. / Energy Economics 29 (2007) 11791191

1189

Table 5 Johansen cointegration estimation results between cycle components of logarithm series of GDP and electricity consumption Eigenvalue Likelihood ratio 5% Critical value 1% Critical value Number of cointegration 24.60 12.97 None At most 1

0.567234 28.84428 19.96 0.305308 8.742876 9.24 Normalized cointegration equation CELEC = 1.477CGDP

Note: is 5% critical level. L.R. test indicates the existence of one cointegration relations at 5% level. CGDP and CELEC are the HP cyclical components of LGDP and LELEC.

and 165 GW will come from coal plant. Accordingly, it is estimated that the newly installed coal plant will discharge 23 million ton SO2, 25 million ton Nox, 300 thousand ton TSP and 615.7 million ton CO2 during the period. The electric sector's SO2 emission will amount to 65 70% of total SO2 and electric sector will be the primary source of air pollution. So the government must accelerate to popularize clear coal technology to enhance the coal combustion efficiency. And the more important is to ameliorate the power structure, to substitute coal power with hydropower, nuclear power and more important, renewable energy. However, if the structure of China's economic output keeps on, the energy sector as well as the economy as a whole will not be sustainable. Since 2002, because of the abrupt growth of ferrous metal, nonferrous metal, chemical and nonmetal mineral product industries, the above four industries account for more than 42% of total industry electricity consumption. If China keeps relying its economic growth on these resource and energy dependent industries, the future of China's economic growth will doom. Whereas, if China can jump through the mesh of heavyindustrialization to a more efficiency-oriented and less resource-depleted development mode, more electricity can be saved without sacrificing the quality of economic development and a more friendly environment can be kept for the next generation. 6. Concluding remarks and future work The causality analysis between electricity consumption and economic growth is helpful for us to understand the role of electricity power in the process of boosting economic growth. The longrun equilibrium implies that in China the policy of electricity supply must lead economic growth should be insisted for a long period. Particularly the short-run Granger cause running

Table 6 Estimation results of Error Correction Model for CGDP and CELEC Source of causality Short-run Variables F-statistics CGDP CELEC 14.07 5.33 CGDP CELEC ECT ECT t-statistics 4.12 3.77 Joint short/long term test CGDP and ECT F-statistics 7.04 17.01 CELEC and ECT

Note: CGDP and CELEC are the first difference series of CGDP and CELEC respectively. The lag is decided by AIC criterion as 1. is 5% critical level and is 1% critical level.

1190

J. Yuan et al. / Energy Economics 29 (2007) 11791191

Fig. 8. Variance decomposition of CELEC and CGDP.

from electricity consumption to GDP indicates that electricity shortage even in short-run will constrain the regular pace of economic growth, which is evident from 2003. However, in the longrun, for China's development to be sustainable, China has to change its economic structure to a more efficiency-oriented and less resource-depleted one and rely more upon renewable energy source. The Granger cause between the cyclical components of electricity consumption and economic growth is only a preliminary result. What has not been examined is the cyclical frequency at which the relationship between aggregate output and electricity usage operates. Whether it is a high frequency relationship, for example 1- to 2-year, or a low frequency one, for example 8- to 9-year business cycle frequency, is an important question for energy policy. This is the direction for our future research.

Table 7 Granger causality between industry outputs and industry electricity consumptions Null hypothesis F statistic P value Conclusion 0.26 0.01 0.39 0.001 0.41 0.006 0.013 0.57 Accepted Rejected Accepted Rejected Accepted Rejected Rejected Accepted

Primary industry is not the Granger cause of primary industry electricity consumption 1.56 Primary industry electricity consumption is not the Granger cause of primary industry 6.31 Secondary industry is not the Granger cause of secondary industry electricity 1.13 consumption Secondary industry electricity consumption is not the Granger cause of secondary 14.14 industry Industry output is not the Granger cause of industry electricity consumption 1.07 Industry electricity consumption is not the Granger cause of industry output 9.03 Tertiary industry is not the Granger cause of tertiary industry electricity consumption 7.96 Tertiary industry electricity consumption is not the Granger cause of tertiary industry 0.32

J. Yuan et al. / Energy Economics 29 (2007) 11791191

1191

Acknowledgements The author would like to thank two anonymous referees and the Editor for their valuable suggestions and helpful comments which have greatly enhanced the quality of this paper. Any remaining errors are, of course, belong to the authors. References

Basdevant, Oliver, 2003. On application of state-space modeling in Macroeconomics. Discussion Paper Series of Reserve Bank of New Zealand. China State Electricity Power Information Center, 2004. Power statistics data. http://www.sp.com.cn/. Engle, R.F., 1999. Cointegration, Causality and Forecasting. Oxford University Press. Engle, R.F., Granger, C.W.J., 1987. Cointegration and error correction: representation, estimation and testing. Econometrica 55, 251276. ERI, 2000. China's energy problems and development strategy. Mimeo, Energy Research Institute, State Development Planning Commission, Beijing. Erol, U., Yu, E.S.H., 1987. On the causal relationship between energy and income for industrializing countries. Journal of Energy and Development 13, 113122. Granger, Clive W.J., Hyung, Namwon, 2004. Occasional structural breaks and long memory with an application to the S and P 500 absolute stock returns. Journal of Empirical Finance 11 (3), 399421. Hondroyiannis, George, Lolos, Sarantis, Papapetrou, Evangelia, 2002. Energy consumption and economic growth: assessing the evidence from Greece. Energy Economics 24, 319336. Johansen, S., Juselius, K., 1990. Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxford Bulletin of Economics and Statistics 52, 169210. Kraft, J., Kraft, A., 1978. On the relationship between energy and GNP. Journal of Energy and Development 3, 401403. Lin, Boqiang, 2003. Structural change, efficiency improvement and electricity demand forecasting (In Chinese). Economic Research 5, 5765. Shiu, Alice, Lam, Pun-Lee, 2004. Electricity consumption and economic growth in China. Energy Policy 32 (1), 4754. Soytas, U., Sari, R., 2003. Energy consumption and GDP: causality relationship in G7 countries and emerging markets. Energy Economics 25, 3337. State Statistical Bureau of China, 2005. China Statistical Yearbook 2004. China Statistics Press. State Statistical Bureau of China, 2006a. China Statistical Yearbook 2005. China Statistics Press. State Statistical Bureau of China, 2006b. China Energy Statistical Book 2005. China Statistics Press. Stern, D.I., 1993. Energy and growth in the USA: a multivariate approach. Energy Economics 15, 137150. Thoma, M., 2004. Electrical energy usage over the business cycle. Energy Economics 26, 463485. Yu, E.S.H., Choi, J.Y., 1985. The causal relationship between energy and GNP: an international comparison. Journal of Energy and Development 10, 249272.

Вам также может понравиться

- DIY Homemade Septic System PDFДокумент9 страницDIY Homemade Septic System PDFCebu CribsОценок пока нет

- Powershell Simple and Effective Strategies To Execute Powershell Programming - Daniel JonesДокумент53 страницыPowershell Simple and Effective Strategies To Execute Powershell Programming - Daniel JonesdemisitoОценок пока нет

- Plate and Frame Filter PressДокумент11 страницPlate and Frame Filter PressOmar Bassam0% (1)

- 15 Types of Regression You Should KnowДокумент30 страниц15 Types of Regression You Should KnowRashidAliОценок пока нет

- ETL Vs ELT White PaperДокумент12 страницETL Vs ELT White PaperDeepak RawatОценок пока нет

- SAP-Document Splitting: GL Account DR CR Profit Center Vendor Pur. 1 Pur. 2 TaxДокумент16 страницSAP-Document Splitting: GL Account DR CR Profit Center Vendor Pur. 1 Pur. 2 Taxharshad jain100% (1)

- Yuan2007 PDFДокумент13 страницYuan2007 PDFJose Luis RomeroОценок пока нет

- Name Ikram Aslam Roll No 53 The Impact of Electrical Consumption Toward Economic Growth of Pakistan: 1) IntroductionДокумент7 страницName Ikram Aslam Roll No 53 The Impact of Electrical Consumption Toward Economic Growth of Pakistan: 1) IntroductionAnonymous Hx7MTiОценок пока нет

- Sectoral Energy Consumption by Source and Economic Growth in TurkeyДокумент10 страницSectoral Energy Consumption by Source and Economic Growth in TurkeyYosraGarouiОценок пока нет

- Does Electricity Consumption Panel Granger Cause Economic Growth in South Asia? Evidence From Bangladesh, India, Iran, Nepal, Pakistan and Sri-LankaДокумент14 страницDoes Electricity Consumption Panel Granger Cause Economic Growth in South Asia? Evidence From Bangladesh, India, Iran, Nepal, Pakistan and Sri-LankaMirza KulenovicОценок пока нет

- Decomposition Analysis of Factors Affecting Energy Demand in Vietnam From 1990 To 2018Документ10 страницDecomposition Analysis of Factors Affecting Energy Demand in Vietnam From 1990 To 2018tuananh9a7lhpqnОценок пока нет

- Energy Consumption and Economic Growth in Vietnam: Threshold Cointegration and Causality AnalysisДокумент17 страницEnergy Consumption and Economic Growth in Vietnam: Threshold Cointegration and Causality AnalysisNiraj ShrivastavaОценок пока нет

- Energy Policy: Sabuj Kumar Mandal, S. MadheswaranДокумент6 страницEnergy Policy: Sabuj Kumar Mandal, S. MadheswaranapetekaОценок пока нет

- MPRA Paper 16774Документ32 страницыMPRA Paper 16774pramitasОценок пока нет

- Modelling The Impact of Energy Use On Economic Growth 2015Документ36 страницModelling The Impact of Energy Use On Economic Growth 2015adamОценок пока нет

- Electricity Consumption-Growth Nexus EviДокумент5 страницElectricity Consumption-Growth Nexus EviChahine BergaouiОценок пока нет

- Economic Research Vol.25 No.3 2012 01 PDFДокумент331 страницаEconomic Research Vol.25 No.3 2012 01 PDFPuvanarajan Renganathan100% (1)

- Herrerias PDFДокумент41 страницаHerrerias PDFKorchak JohnОценок пока нет

- Economic Impacts of Power Shortage: SustainabilityДокумент21 страницаEconomic Impacts of Power Shortage: SustainabilitySabab MunifОценок пока нет

- Electricity Sector and Economic Growth: Student: Irakli GaldavaДокумент29 страницElectricity Sector and Economic Growth: Student: Irakli GaldavaIrakli GaldavaОценок пока нет

- 2013.electricity GDPДокумент8 страниц2013.electricity GDPIpan Parin Sopian HeryanaОценок пока нет

- Sustainability 09 01484 v2Документ16 страницSustainability 09 01484 v2Ritik VermaОценок пока нет

- Present Situation of Power Supply and Demand in China: IEEJ: March 2004Документ10 страницPresent Situation of Power Supply and Demand in China: IEEJ: March 2004Jeevanend ArumugamОценок пока нет

- The Impact of Energy Conservation On TecДокумент40 страницThe Impact of Energy Conservation On TecMa. Helen AbongОценок пока нет

- Mohsin 2021Документ14 страницMohsin 2021NdjdjsОценок пока нет

- Energy VecmДокумент7 страницEnergy VecmnimidaОценок пока нет

- Determinants of Regional Energy DemandДокумент19 страницDeterminants of Regional Energy DemandGabrielito MenezesОценок пока нет

- Economic Growth and Energy Consumption Causal Nexus Viewed Through A Bootstrap Rolling WindowДокумент14 страницEconomic Growth and Energy Consumption Causal Nexus Viewed Through A Bootstrap Rolling WindowMehdi Ben JebliОценок пока нет

- For Students14Документ9 страницFor Students14sunil kumarОценок пока нет

- Energy and Economic Growth in G20 Countries: Panel Cointegration AnalysisДокумент17 страницEnergy and Economic Growth in G20 Countries: Panel Cointegration Analysisthe pitchsiderОценок пока нет

- MPRA Paper 80780Документ22 страницыMPRA Paper 80780Slim MahfoudhОценок пока нет

- Energy Consumption and Economic GrowthДокумент8 страницEnergy Consumption and Economic Growthkashif imranОценок пока нет

- Sue Wing 2008Документ29 страницSue Wing 2008biblioteca economicaОценок пока нет

- Energy Consumption PatternДокумент6 страницEnergy Consumption Patternchem_muruОценок пока нет

- Empirical Analysis of The Relationship Between Economic Growth and Energy Consumption in Nigeria: A Multivariate Cointegration ApproachДокумент12 страницEmpirical Analysis of The Relationship Between Economic Growth and Energy Consumption in Nigeria: A Multivariate Cointegration ApproachTI Journals PublishingОценок пока нет

- Energies: How Population Age Distribution A Electricity Demand in Korea: Applying Population Polynomial FunctionДокумент17 страницEnergies: How Population Age Distribution A Electricity Demand in Korea: Applying Population Polynomial Functionpragya mindmapОценок пока нет

- Economics 2016 14Документ29 страницEconomics 2016 14IwanОценок пока нет

- MPRA Paper 28403Документ29 страницMPRA Paper 28403JoseОценок пока нет

- Energy Economics: Yaobin Liu, Yichun XieДокумент12 страницEnergy Economics: Yaobin Liu, Yichun XieSyed Aal-e RazaОценок пока нет

- China Paper 1Документ10 страницChina Paper 1NavОценок пока нет

- Energy Consumption and Economic Growth in Thevolume 18 - Issue 57 - Pages 27-46Документ20 страницEnergy Consumption and Economic Growth in Thevolume 18 - Issue 57 - Pages 27-46julio CmОценок пока нет

- ART - 2020 - Carbon Emissions and Driving Forces of Chinas Power SectorДокумент9 страницART - 2020 - Carbon Emissions and Driving Forces of Chinas Power SectorAnita MarquezОценок пока нет

- IGC Energy and Environment Evidence Paper 3003Документ60 страницIGC Energy and Environment Evidence Paper 3003YaminОценок пока нет

- An Empirical Analysis of Electricity Demand in PakistanДокумент24 страницыAn Empirical Analysis of Electricity Demand in PakistanprosysscribdОценок пока нет

- Does Economic Growth Promote Electric Power Consumption - Implications For Electricity Conservation, Expansive, and Security PoliciesДокумент14 страницDoes Economic Growth Promote Electric Power Consumption - Implications For Electricity Conservation, Expansive, and Security PolicieszerolaahmОценок пока нет

- Energy: Zhan-Ming Chen, Pei-Lin Chen, Zeming Ma, Shiyun Xu, Tasawar Hayat, Ahmed AlsaediДокумент12 страницEnergy: Zhan-Ming Chen, Pei-Lin Chen, Zeming Ma, Shiyun Xu, Tasawar Hayat, Ahmed AlsaediAndrea Carolina Cubillos OnateОценок пока нет

- SDSN Indicator ReportДокумент16 страницSDSN Indicator ReportZulfiyah SilmiОценок пока нет

- Transportation: University of South FloridaДокумент12 страницTransportation: University of South FloridajtpmlОценок пока нет

- Impacts of Climate Change On Hydropower Generation in China: SciencedirectДокумент15 страницImpacts of Climate Change On Hydropower Generation in China: SciencedirectWaldo LavadoОценок пока нет

- Sustainability 11 05895 v2Документ13 страницSustainability 11 05895 v2saifounkhОценок пока нет

- Energies 12 02194Документ22 страницыEnergies 12 02194lombe changalaОценок пока нет

- ARDLboundtest FormДокумент11 страницARDLboundtest FormCao Nữ Thùy TrangОценок пока нет

- YehHuLin (2012)Документ13 страницYehHuLin (2012)stkarag113Оценок пока нет

- Energy Shocks and Bank Performance in The Advanced EconomiesДокумент9 страницEnergy Shocks and Bank Performance in The Advanced EconomiesrizkaОценок пока нет

- 569 Khuong Minh Abstract 2017-06-30 13-44Документ3 страницы569 Khuong Minh Abstract 2017-06-30 13-44lombe changalaОценок пока нет

- Energy Policy: Daisheng Zhang, Kristin Aunan, Hans Martin Seip, Haakon VennemoДокумент10 страницEnergy Policy: Daisheng Zhang, Kristin Aunan, Hans Martin Seip, Haakon VennemoEitavitaza Arzahzarah WillandОценок пока нет

- Energy Policy: Faisal Jamil, Eatzaz AhmadДокумент9 страницEnergy Policy: Faisal Jamil, Eatzaz AhmadAishaОценок пока нет

- 1.OLS Electricity Consumption DeterminantsДокумент8 страниц1.OLS Electricity Consumption DeterminantsQuỳnh ĐàoОценок пока нет

- Transmission and Distribution of Electricity in India Regulation, Investment and EfficiencyДокумент22 страницыTransmission and Distribution of Electricity in India Regulation, Investment and EfficiencyRahul ChintalaОценок пока нет

- CO2 CHINA WAng Energy Sust DevДокумент10 страницCO2 CHINA WAng Energy Sust DevmarcogiuliettiОценок пока нет

- Trutnevyte IEMSs EXPANSEДокумент8 страницTrutnevyte IEMSs EXPANSEMiaОценок пока нет

- CO Emissions, Energy Consumption, and Output in FranceДокумент7 страницCO Emissions, Energy Consumption, and Output in FranceEngr Fizza AkbarОценок пока нет

- Energy Savings Via FDI. HueblerДокумент23 страницыEnergy Savings Via FDI. HueblerAnasuya HalderОценок пока нет

- Electricity Consumption PDFДокумент14 страницElectricity Consumption PDFRashidAli0% (1)

- Energy Economics: Ansgar Belke, Frauke Dobnik, Christian DregerДокумент8 страницEnergy Economics: Ansgar Belke, Frauke Dobnik, Christian DregerRaju KalaОценок пока нет

- An Exploration into China's Economic Development and Electricity Demand by the Year 2050От EverandAn Exploration into China's Economic Development and Electricity Demand by the Year 2050Оценок пока нет

- A Guide To Eviews: Danijela MarkovicДокумент19 страницA Guide To Eviews: Danijela MarkovicRashidAliОценок пока нет

- Syed Rashid AliДокумент2 страницыSyed Rashid AliRashidAliОценок пока нет

- Template IJARДокумент2 страницыTemplate IJARRashidAliОценок пока нет

- Pak 1200 AliДокумент160 страницPak 1200 AliRashidAliОценок пока нет

- For Each ArtДокумент15 страницFor Each ArtRashidAliОценок пока нет

- Demand ExamplesДокумент12 страницDemand ExamplesRashidAliОценок пока нет

- Indirectutility PDFДокумент2 страницыIndirectutility PDFRashidAliОценок пока нет

- The Assessment of Taxation Impact On Economic Development. A Case Study of Romania (1995-2014)Документ14 страницThe Assessment of Taxation Impact On Economic Development. A Case Study of Romania (1995-2014)RashidAliОценок пока нет

- The Role of Geography in Financial Integration: Foreign Direct InvestmentДокумент30 страницThe Role of Geography in Financial Integration: Foreign Direct InvestmentRashidAliОценок пока нет

- How Remittances Contribute To Poverty Reduction: A Stabilizing EffectДокумент30 страницHow Remittances Contribute To Poverty Reduction: A Stabilizing EffectRashidAliОценок пока нет

- Economics: Determinants of DemandДокумент2 страницыEconomics: Determinants of DemandRashidAliОценок пока нет

- Lecture Notes For Chapters 4 & 5: 1 Matrix AlgebraДокумент25 страницLecture Notes For Chapters 4 & 5: 1 Matrix AlgebraRashidAliОценок пока нет

- FBR Tax Collection: Sales Excise Customs Total Indirect Taxes Period Direct Taxes Total Tax CollectionДокумент4 страницыFBR Tax Collection: Sales Excise Customs Total Indirect Taxes Period Direct Taxes Total Tax CollectionRashidAliОценок пока нет

- Regression AnalysisДокумент41 страницаRegression AnalysisRashidAliОценок пока нет

- How To Correct The Balance of PaymentДокумент1 страницаHow To Correct The Balance of PaymentRashidAliОценок пока нет

- Economics: B. Com - IДокумент2 страницыEconomics: B. Com - IRashidAliОценок пока нет

- Acceleration PrincipleДокумент2 страницыAcceleration PrincipleRashidAliОценок пока нет

- Summary Applied Econometric Time SeriesДокумент10 страницSummary Applied Econometric Time SeriesRashidAliОценок пока нет

- Capital Standards For Banks: The Evolving Basel AccordДокумент11 страницCapital Standards For Banks: The Evolving Basel AccordRashidAliОценок пока нет

- College of Accounting & Management SciencesДокумент4 страницыCollege of Accounting & Management SciencesRashidAliОценок пока нет

- Quadcopter Design DocumentДокумент23 страницыQuadcopter Design Documentapi-556772195Оценок пока нет

- Changes in Bash Version 4.2 To Bash 4.3Документ123 страницыChanges in Bash Version 4.2 To Bash 4.3LordAjaxОценок пока нет

- Boston Matrix of CokeДокумент11 страницBoston Matrix of CokeIrvin A. OsnayaОценок пока нет

- Advanced Power ElectronicsДокумент4 страницыAdvanced Power ElectronicsLinkan PriyadarsiniОценок пока нет

- 24 - Counting of Bottles - Solution - ENGДокумент3 страницы24 - Counting of Bottles - Solution - ENGhaftu gideyОценок пока нет

- Flyover Construction ThesisДокумент4 страницыFlyover Construction ThesisLeyon Delos Santos60% (5)

- CH 01Документ28 страницCH 01Deepu MaroliОценок пока нет

- Pakistan Machine Tool Factory Internship ReportДокумент14 страницPakistan Machine Tool Factory Internship ReportAtif MunirОценок пока нет

- History Desktop PublishingДокумент16 страницHistory Desktop PublishingsanchezromanОценок пока нет

- 58MM Printer Programmer Manual-20161207 PDFДокумент31 страница58MM Printer Programmer Manual-20161207 PDFsatryaОценок пока нет

- Rehau Awadukt Thermo: Ground-Air Heat Exchanger System For Controlled VentilationДокумент36 страницRehau Awadukt Thermo: Ground-Air Heat Exchanger System For Controlled VentilationLeon_68Оценок пока нет

- PanasonicBatteries NI-MH HandbookДокумент25 страницPanasonicBatteries NI-MH HandbooktlusinОценок пока нет

- Afrimax Pricing Table Feb23 Rel BДокумент1 страницаAfrimax Pricing Table Feb23 Rel BPhadia ShavaОценок пока нет

- HS22186Документ4 страницыHS22186daviОценок пока нет

- Self Priming Centrifugal Pump: Models 03H1-GL, 03H1-GR, 03H3-GL and 03H3-GRДокумент4 страницыSelf Priming Centrifugal Pump: Models 03H1-GL, 03H1-GR, 03H3-GL and 03H3-GRdougОценок пока нет

- 1 Salwico Fire Alarm SystemДокумент173 страницы1 Salwico Fire Alarm SystemAung SquОценок пока нет

- أثر جودة الخدمة المصرفية الإلكترونية في تقوية العلاقة بين المصرف والزبائن - رمزي طلال حسن الردايدة PDFДокумент146 страницأثر جودة الخدمة المصرفية الإلكترونية في تقوية العلاقة بين المصرف والزبائن - رمزي طلال حسن الردايدة PDFNezo Qawasmeh100% (1)

- Agricultural Machinery Is Machinery Used in The Operation of An Agricultural Area or FarmДокумент4 страницыAgricultural Machinery Is Machinery Used in The Operation of An Agricultural Area or FarmvinzyyОценок пока нет

- ChE 132 - Oct 17Документ49 страницChE 132 - Oct 17datUPstudentdoe0% (2)

- Technical Data: An Innovative & Cutting-Edge Digital Radiography SystemДокумент12 страницTechnical Data: An Innovative & Cutting-Edge Digital Radiography SystemJacques GamelinОценок пока нет

- How To Draw Circuit DiagramДокумент1 страницаHow To Draw Circuit DiagramSAMARJEETОценок пока нет

- Top 20 Web Services Interview Questions and Answers: Tell Me About Yourself?Документ28 страницTop 20 Web Services Interview Questions and Answers: Tell Me About Yourself?sonu kumarОценок пока нет

- BRF90Документ10 страницBRF90Lukas Van VuurenОценок пока нет

- Artemis Data SheetДокумент2 страницыArtemis Data SheetmahmoudОценок пока нет

- Punjab ULBRFPVolume IAttachmentdate 21 Nov 2016Документ214 страницPunjab ULBRFPVolume IAttachmentdate 21 Nov 2016NishantvermaОценок пока нет