Академический Документы

Профессиональный Документы

Культура Документы

JGarg TP Program May 17-19

Загружено:

Gaurav GargАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

JGarg TP Program May 17-19

Загружено:

Gaurav GargАвторское право:

Доступные форматы

Executive Program / Transfer Pricing

UNDERSTANDING TRANSFER PRICING

Dates: May 17 19, 2013 Place: India Habitat Centre, New Delhi Fees: INR 7,500/- ; Early bird discount of 20% if applied before April 15, 2013 (Fees include lunches and materials)

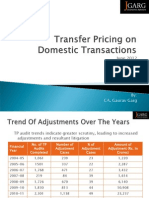

In recent years, transfer pricing has become one of the most important tax issue faced by the corporate taxpayer in terms of compliances, litigation and costing. Accordingly, the objective of this program is to develop an understanding of transfer pricing principles and methodologies. After attending this 3 day program on transfer pricing, participants should be able to gain strength in analyzing intercompany transactions from transfer pricing perspective and creating reasonable documentation for the same. CONTENT OVERVIEW & SCHEDULE May 17 10:00 AM 10:20 AM :: Welcome 10:20 AM 11:30 AM :: Introduction to Indian transfer pricing regulations OECD Article 9 Domestic transfer pricing International transfer pricing 11:30 AM 11:45 AM :: Tea Break 11:45 AM 01:30 PM :: IntroductionConti 01:30 PM 02:30 PM :: Lunch 02:30 PM 04: 00 PM :: Comparability Analysis Comparability factors Entity Characterization FAR Analysis Types of comparables Conducting search on database 04:00 PM 04:15 PM :: Tea Break 04:15 PM 05:30 PM :: Transfer Pricing Documentation & Issuance of Accountants Report May 18 10:00 AM 11:30 AM :: Transfer Pricing Methods 11:30 AM 11:45 AM :: Tea Break 11:45 AM 01:30 PM :: IntroductionConti 01:30 PM 02:30 PM :: Lunch 02:30 PM 04:00 PM :: Intra-group Services & Cost Contribution Arrangements 04:00 PM 04:15 PM :: Tea Break 04:15 PM 05:30 PM :: Intangibles & Transfer Pricing

WHO SHOULD ATTEND

This program is designed for finance and tax personnel of multinational enterprises, tax consultants, inhouse tax managers and any-one else who wants build strong foundation in transfer pricing either for career enhancement or handling in-house transfer pricing issues. It is appropriate for executives/ professionals from organizations of any size in any industry.

FACULTY

CA Gaurav Garg CA Gaurav Garg is a Chartered Accountant and holds a Bachelor Degree in Commerce from Delhi University. He has more than 8 years of full time experience in transfer pricing and has worked with Big4 accounting firm earlier. CA Gaurav Garg is a visiting faculty to the Committee on International Taxation of ICAI, and a regular speaker on transfer pricing at various seminars/ lectures organized by different professional bodies including The Chamber of Tax Consultants, GCM Worldwide, different Branches & Study Circles of ICAI.

Batch size only 25, hurry block your seat

Executive Program / Transfer Pricing

UNDERSTANDING TRANSFER PRICING Our

Dates: May 17 19, 2013 Place: India Habitat Centre, New Delhi

CONTENT OVERVIEW & SCHEDULE (CONTI) May 19 10:00 AM 11:30 AM :: Resolving Transfer Pricing Disputes Dispute Resolution Panel Advance Pricing Agreement MAP Penalties 11:30 AM 11:45 AM :: Tea Break 11:45 AM 01:30 PM :: Permanent Establishment Attribution of Profits 01:30 PM 02:30 PM :: Lunch 02:30 PM 04:00 PM :: Case Studies 04:00 PM 04:15 PM :: Tea Break 04:15 PM 05:30 PM :: Open House & Certificate Distribution FOR RESERVATION For reserving your seat in Understanding Transfer Pricing, please contact: Ms. Sakshi, Program coordinator, Phone: +91 11 47094934, Email: sakshi@jgarg.com ONLINE MEDIA PARTNER

TESTIMONIALS

"Gaurav, over the years, has horned skills and acumen in developing a strong foundation which buries disputes at the strength of well orchestrated transfer pricing understanding and documentation. Listening Gaurav is always a good investment of time and money." Chandan Agarwal, Head of Tax, Dabur India Gaurav is an inspiring trainer for business professionals aspiring their career in transfer pricing. He is a leading transfer pricing consultant and is different from others as he will tell you just what you need to know - no more, no less. Parul Jolly, Partner, S C Vasudeva & Co. I appreciate the dedicated and focused approach of Gaurav to Transfer Pricing. I have seen his teaching capability at various platform specially in CTC and he makes the audience to understand TP in a very simple way. CA Manoj Mittal I have known Gaurav for almost 3 years now and have had the privilege of working with him as well as seeing him giving lectures on Transfer Pricing. I can say with confidence that he is one of the very few experts in Transfer Pricing and International Tax who can combine the law with a very sound practical approach. His sound technical skills, coupled with his passion for sharing knowledge and helping his fellow members makes him a truly remarkable professional. CA Amit Maheshwari, Partner, Ashok Maheshwary & Associates

Worldwide Transfer Pricing Reporter (WWTPR) is an international transfer pricing knowledge portal. We publish an online journal and report the latest developments through our e-news alerts. Journal contains an in-depth, practical and expert analysis of latest and contentious transfer pricing issues. To know more about WWTPR visit us at: www.wwtpr.com

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Social Implications in The Hound of The BaskervillesДокумент8 страницSocial Implications in The Hound of The BaskervillesDaffodilОценок пока нет

- The Great Hack and data privacy in the PhilippinesДокумент2 страницыThe Great Hack and data privacy in the PhilippinesVINCENT ANGELO ANTEОценок пока нет

- Civil Procedure Doctrines UPDATEDДокумент64 страницыCivil Procedure Doctrines UPDATEDJose RocoОценок пока нет

- Carpio vs. DorojaДокумент2 страницыCarpio vs. DorojaAimee Dela Cruz100% (1)

- Reyes vs. Lim, G.R. No. 134241, 11aug2003Документ2 страницыReyes vs. Lim, G.R. No. 134241, 11aug2003Evangelyn EgusquizaОценок пока нет

- Dharma & Karma by Gaurav Garg 7th June 2020Документ8 страницDharma & Karma by Gaurav Garg 7th June 2020Gaurav GargОценок пока нет

- UAE - Various Penalties Under VAT & Excise LawДокумент4 страницыUAE - Various Penalties Under VAT & Excise LawGaurav GargОценок пока нет

- FTAP 7th Residential Conference - Final BrochureДокумент5 страницFTAP 7th Residential Conference - Final BrochureGaurav GargОценок пока нет

- FAQs On Country by Country ReportingДокумент13 страницFAQs On Country by Country ReportingGaurav GargОценок пока нет

- JGarg's GST Certificate Course, Rs.6000, Extensive and DetailedДокумент2 страницыJGarg's GST Certificate Course, Rs.6000, Extensive and DetailedGaurav GargОценок пока нет

- Safe Harbour Rules June 2017 - JGargДокумент4 страницыSafe Harbour Rules June 2017 - JGargGaurav GargОценок пока нет

- JGarg IDT Budget2016Документ8 страницJGarg IDT Budget2016Gaurav GargОценок пока нет

- 2 Days Advance Level Transfer Pricing Workshop in MumbaiДокумент4 страницы2 Days Advance Level Transfer Pricing Workshop in MumbaiGaurav GargОценок пока нет

- JGarg's 3 Days Transfer Pricing Course - August 2013Документ3 страницыJGarg's 3 Days Transfer Pricing Course - August 2013Gaurav GargОценок пока нет

- Corporate Social Responsibility - Companies Act 2013Документ11 страницCorporate Social Responsibility - Companies Act 2013Gaurav GargОценок пока нет

- Place of Effective Management - Finance Act 2015Документ9 страницPlace of Effective Management - Finance Act 2015Gaurav GargОценок пока нет

- Taxmann May 2013 Transfer Pricing DocumentationДокумент11 страницTaxmann May 2013 Transfer Pricing DocumentationGaurav GargОценок пока нет

- JGarg's 3 Days Transfer Pricing Course - August 2013Документ3 страницыJGarg's 3 Days Transfer Pricing Course - August 2013Gaurav GargОценок пока нет

- JGarg's 3 Days TP Course - August 2013Документ4 страницыJGarg's 3 Days TP Course - August 2013Gaurav GargОценок пока нет

- JGarg's 3 Days Transfer Pricing Course - August 2013Документ3 страницыJGarg's 3 Days Transfer Pricing Course - August 2013Gaurav GargОценок пока нет

- Domestic Transfer Pricing - IndiaДокумент13 страницDomestic Transfer Pricing - IndiaGaurav GargОценок пока нет

- BVSS - 1st Intensive Residential Course On Domestic Transfer PricingДокумент1 страницаBVSS - 1st Intensive Residential Course On Domestic Transfer PricingGaurav GargОценок пока нет

- JGarg: 3 Days Transfer Pricing Program May 17-19 2013.Документ1 страницаJGarg: 3 Days Transfer Pricing Program May 17-19 2013.Gaurav GargОценок пока нет

- Concept of CFCДокумент22 страницыConcept of CFCGaurav GargОценок пока нет

- JGarg: 3 Days Transfer Pricing Program May 17-19 2013.Документ1 страницаJGarg: 3 Days Transfer Pricing Program May 17-19 2013.Gaurav GargОценок пока нет

- JGargДокумент1 страницаJGargGaurav GargОценок пока нет

- TP March 26Документ67 страницTP March 26Gaurav GargОценок пока нет

- Delhi ITAT: Royalty Rates Approved by RBI, Accepted As CUPДокумент2 страницыDelhi ITAT: Royalty Rates Approved by RBI, Accepted As CUPGaurav GargОценок пока нет

- Radical Reconstruction ActДокумент4 страницыRadical Reconstruction ActKhushi RajoraОценок пока нет

- ORDINANCE 2011-732: Code Providing For AnДокумент89 страницORDINANCE 2011-732: Code Providing For AnThe Florida Times-UnionОценок пока нет

- Criminological Analysis of Theft in India During the PandemicДокумент15 страницCriminological Analysis of Theft in India During the PandemicShreya KumariОценок пока нет

- Application Form Registration of Job, Service Contractor, Sub ContractorДокумент1 страницаApplication Form Registration of Job, Service Contractor, Sub ContractorJane PerezОценок пока нет

- Importance of Liquidity and Capital AdequacyДокумент21 страницаImportance of Liquidity and Capital AdequacyGodsonОценок пока нет

- Mendota MS-13 Investigative Doc5 229Документ54 страницыMendota MS-13 Investigative Doc5 229Dave MinskyОценок пока нет

- Joseph Resler - Vice President - First American Bank - LinkedInДокумент5 страницJoseph Resler - Vice President - First American Bank - LinkedInlarry-612445Оценок пока нет

- GudinaДокумент52 страницыGudinaLemessa NegeriОценок пока нет

- Khagendra Guragain (Garima Bank)Документ55 страницKhagendra Guragain (Garima Bank)Indramaya RayaОценок пока нет

- Answer To Exercises-Capital BudgetingДокумент18 страницAnswer To Exercises-Capital BudgetingAlleuor Quimno50% (2)

- Survey on quality of recognition process following Erasmus+ mobility periodДокумент4 страницыSurvey on quality of recognition process following Erasmus+ mobility periodEnrico VoltanОценок пока нет

- New Water RatesДокумент83 страницыNew Water RatesScott FisherОценок пока нет

- United States v. Makushamari Gozo, 4th Cir. (2015)Документ5 страницUnited States v. Makushamari Gozo, 4th Cir. (2015)Scribd Government DocsОценок пока нет

- Design of Road Overbridges: S C T RДокумент7 страницDesign of Road Overbridges: S C T RHe WeiОценок пока нет

- EPCtenderforImportantBridgeNo 1951Документ461 страницаEPCtenderforImportantBridgeNo 1951ankit panjwaniОценок пока нет

- Journal Reading 2 - Dr. Citra Manela, SP.F PDFДокумент15 страницJournal Reading 2 - Dr. Citra Manela, SP.F PDFSebrin FathiaОценок пока нет

- View Generated DocsДокумент1 страницаView Generated DocsNita ShahОценок пока нет

- Heirs of Malabanan Vs RepublicДокумент9 страницHeirs of Malabanan Vs RepublicAnisah AquilaОценок пока нет

- Matsyanyaya PDFДокумент17 страницMatsyanyaya PDFFrancisco Oneto Nunes100% (1)

- Instant Download Smith and Robersons Business Law 15th Edition Mann Solutions Manual PDF Full ChapterДокумент32 страницыInstant Download Smith and Robersons Business Law 15th Edition Mann Solutions Manual PDF Full Chapterrappelpotherueo100% (7)

- UCS-SCU22 BookДокумент36 страницUCS-SCU22 BookRicardo Olmos MentadoОценок пока нет

- Green Grid Business Model Canvas Brainstorm - 20240213 - 104649 - 0000Документ1 страницаGreen Grid Business Model Canvas Brainstorm - 20240213 - 104649 - 0000Inoc Charisse MaeОценок пока нет

- Financial Accounting 10th Edition Harrison Test Bank 1Документ73 страницыFinancial Accounting 10th Edition Harrison Test Bank 1harry100% (35)

- Performance Evaluation and Ratio Analysis of Apple IncДокумент18 страницPerformance Evaluation and Ratio Analysis of Apple IncSayed Abu SufyanОценок пока нет

- ULAB Midterm Exam Business Communication CourseДокумент5 страницULAB Midterm Exam Business Communication CourseKh SwononОценок пока нет