Академический Документы

Профессиональный Документы

Культура Документы

Form No. 16: Details of Salary Paid and Any Other Income and Tax Deducted

Загружено:

Sundaresan ChockalingamИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Form No. 16: Details of Salary Paid and Any Other Income and Tax Deducted

Загружено:

Sundaresan ChockalingamАвторское право:

Доступные форматы

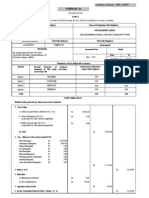

Form No.

16

[ See Rule 31 (1) (a) ] Certificate under section 203 of the Income Tax Act, 1961 for tax deducted at source from income chargeable under the head "Salaries"

Name and Address of the Employer

Acknowledgements nos. of all quarterly statement of TDS under sub-section (3) of section 200 as provided by TIN facilitation centre or NSDL website

Name and Designation of the Employee

Quarter

Acknowledgement No.

TAN OF THE DEDUCTOR

PAN OF THE EMPLOYEE

PAN OF THE DEDUCTOR Assessment Year :

PERIOD

From:

Rs. Rs.

To:

Rs.

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

1.

Gross Salary (a) Salary as per provisions contained in section 17 (1) (b) Value of perquisites under secion 17 (2)

(as per Form No. 12BA, wherever applicable)

(c) Profits in lieu of salary under section 17 (3)

(as per Form No. 12BA, wherever applicable)

(d) Total 2. Less : Allowance to the extent exempt under section 10 Rs.

3. 4.

Balance (1 - 2) Deductions Under Section 16

(a) Entertainment Allowance (b) Tax On Employment

5. 6. 7.

Aggregate of 4 (a to b) Income chargeable Under the head "SALARIES" (3 - 5) ADD : Any other income reported by the Employee

8. 9.

Gross Income (6 + 7) Deduction under Chapter VI-A

(a) Section 80C, 80CCC, 80CCD (a) Section 80C Particulars Amount Deductible Gross Amount Deductible Amount

(b) Section 80CCC : _____________________ (c) Section 80CCD : _____________________

Note 1. Aggregate amount deductible under Section 80C shall not exceed one lakh rupees. 2. Aggregate amount deductible under Section 80C, 80CCC, 80CCD shall not exceed one lakh rupees.

(b)

Other Section Under Chapter VI A Section Particulars Amount Deductible

10. Aggregate of deductible amount under chapter VI-A 11. Total Income (8 - 10) 12. (a) (b) Tax On total Income Tax On Capital Gain (i) Short Term : _______________ (ii) Long Term : _______________ 13. Surcharge ( On Tax computed at Sr. No. 12) 14. Education Cess (On tax computed at Sr. No. 12 & Surcharge at Sr. No. 13) 15. Tax Payable (12 + 13 + 14) 16. Relief Under Section 89 (attach details) 17. Tax Payable (15 - 16) 18. Less: (a) Tax Deducted at Source u/s. 192(1) (b) Tax paid by the employer on behalf of the employee u/s. 192(1A) on perquisites u/s 17(2) 19. Tax payable (17 - 18) / Refundable (18 -17)

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT

(The employer is to provide transaction-wise details of tax deducted and deposited) Sr. No. 1 2 3 4 5 6 7 8 9 10 11 12 TDS Rs. Surcharge Rs. Education Cess Rs. Total Tax Deposited Rs. Cheque / D.D. No.(if any) BSR Code of Bank Branch Date on which tax deposited Transfer Voucher/ Challan Identification No.

I, working in the capacity of a sum of Rs.

Son / Daughter of (deisgnation) do hereby Certified that

has been deducted at source and paid to the credit of the Central Government. I Further Certified that the above information is true & correct based on the books of accounts, documents and other available records.

Signature of person responsible for deduction of tax Place Date : : Full Name Designation : :

Вам также может понравиться

- Form 16Документ2 страницыForm 16orkid2100Оценок пока нет

- Form 16 TDS CertificateДокумент2 страницыForm 16 TDS CertificateHari Krishnan ElangovanОценок пока нет

- Form 16Документ4 страницыForm 16Aruna Kadge JhaОценок пока нет

- Form 16, Tax Deduction at Source... Income Tax of IndiaДокумент2 страницыForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilОценок пока нет

- Form 16Документ1 страницаForm 16Manish Varghese MathewОценок пока нет

- Summary of Tax Deducted at Source: TotalДокумент2 страницыSummary of Tax Deducted at Source: Totaladithya604Оценок пока нет

- FORM 16 TAX DEDUCTION CERTIFICATEДокумент3 страницыFORM 16 TAX DEDUCTION CERTIFICATEdugdugdugdugiОценок пока нет

- Form 16 TDS SummaryДокумент4 страницыForm 16 TDS SummarySushma Kaza DuggarajuОценок пока нет

- Form No 16 in Excel With FormuleДокумент3 страницыForm No 16 in Excel With FormuleSayal Ji33% (6)

- Form 16Документ6 страницForm 16Pulkit Gupta100% (1)

- Form 16Документ3 страницыForm 16api-247505461Оценок пока нет

- Form No 16Документ5 страницForm No 16Rabiul KhanОценок пока нет

- Form 16 FormatДокумент2 страницыForm 16 FormatParthVanjaraОценок пока нет

- FORM 16 TDS CERTIFICATE DECODEDДокумент4 страницыFORM 16 TDS CERTIFICATE DECODEDSuman HalderОценок пока нет

- Form 16 TDS certificateДокумент2 страницыForm 16 TDS certificateSuchitra BakulyОценок пока нет

- Form 16 Word FormatДокумент4 страницыForm 16 Word FormatVenkee SaiОценок пока нет

- Form 16 TDS CertificateДокумент3 страницыForm 16 TDS CertificateBijay TiwariОценок пока нет

- Form 16Документ3 страницыForm 16tid_scribdОценок пока нет

- Itr 62 Form 16Документ4 страницыItr 62 Form 16Hardik ShahОценок пока нет

- TDS Certificate SalariesДокумент2 страницыTDS Certificate Salariesjwadje1Оценок пока нет

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Документ3 страницыLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461Оценок пока нет

- Form 16 Part A: WWW - Taxguru.inДокумент10 страницForm 16 Part A: WWW - Taxguru.inAjit KhurdiaОценок пока нет

- Tax Applicable (Tick One) 2 8 1Документ7 страницTax Applicable (Tick One) 2 8 1Gaurav BajajОценок пока нет

- A SimДокумент4 страницыA Simsana_rautОценок пока нет

- Form16fy10 11Документ3 страницыForm16fy10 11atishroyОценок пока нет

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceДокумент4 страницыForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxОценок пока нет

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Документ4 страницыPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilОценок пока нет

- Cit (TDS) : Emp CodeДокумент3 страницыCit (TDS) : Emp CodeMahaveer DhelariyaОценок пока нет

- 6-3-569/1, Surana House Somajiguda, Hyderabad-83Документ2 страницы6-3-569/1, Surana House Somajiguda, Hyderabad-83seshu18098951Оценок пока нет

- Form No. 16 Tax DetailsДокумент3 страницыForm No. 16 Tax DetailsYashika ChoudharyОценок пока нет

- (See Rule 31 (1) (A) ) : Form No. 16Документ8 страниц(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeОценок пока нет

- Form 16Документ6 страницForm 16Ravi DesaiОценок пока нет

- Form16 (2020-2021)Документ2 страницыForm16 (2020-2021)Saras ShendeОценок пока нет

- Form 16 Salary CertificateДокумент5 страницForm 16 Salary CertificateAshok PuttaparthyОценок пока нет

- Kaushik Sarkar Form 16 DynProДокумент5 страницKaushik Sarkar Form 16 DynProKaushik SarkarОценок пока нет

- Form16Документ5 страницForm16er_ved06Оценок пока нет

- Umesh C-Form16 - 2020-21Документ10 страницUmesh C-Form16 - 2020-21Umesh CОценок пока нет

- Form 16: Wipro LimitedДокумент5 страницForm 16: Wipro Limiteddeepak9976Оценок пока нет

- Form2FandInstructions 06062006Документ11 страницForm2FandInstructions 06062006Mnaoj PatelОценок пока нет

- Form 16Документ4 страницыForm 16neel721507Оценок пока нет

- 2011 - ITR2 - r6Документ33 страницы2011 - ITR2 - r6Bathina Srinivasa RaoОценок пока нет

- Form 16 WORD FORMATEДокумент2 страницыForm 16 WORD FORMATEJay83% (46)

- Form 16 TDS certificateДокумент8 страницForm 16 TDS certificateVikas PattnaikОценок пока нет

- Form 16Документ4 страницыForm 16harit sharmaОценок пока нет

- FORM 16 TITLEДокумент5 страницFORM 16 TITLEPunitBeriОценок пока нет

- Form No 16Документ4 страницыForm No 16Md ZhidОценок пока нет

- Form 16 Part A Name and Address of The Employer Name and Designation of The EmployeeДокумент3 страницыForm 16 Part A Name and Address of The Employer Name and Designation of The EmployeeishaqmdОценок пока нет

- TDS Certificate Form 16 SummaryДокумент3 страницыTDS Certificate Form 16 SummarySvsSridharОценок пока нет

- From 16 & 12ba (Dev)Документ6 страницFrom 16 & 12ba (Dev)jindalyash1234Оценок пока нет

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryДокумент2 страницыForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanОценок пока нет

- Trinidad and Tobago Emolument Income Tax 2012Документ5 страницTrinidad and Tobago Emolument Income Tax 2012Anand RockerОценок пока нет

- File ITR-1 Form for Individuals with Income from Salary and InterestДокумент6 страницFile ITR-1 Form for Individuals with Income from Salary and InterestManjunath YvОценок пока нет

- ITR-3 Indian Income Tax Return: Part A-GENДокумент7 страницITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeОценок пока нет

- 223957Документ4 страницы223957yuvionfireОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1От EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Оценок пока нет

- Consent Form Study Motor Skills ChildrenДокумент4 страницыConsent Form Study Motor Skills ChildrenSundaresan ChockalingamОценок пока нет

- Biochem ImpДокумент6 страницBiochem ImpSundaresan ChockalingamОценок пока нет

- A Study of Prevalence of Developmental Coordination Disorder (DCD) at Kattankulathur, ChennaiДокумент2 страницыA Study of Prevalence of Developmental Coordination Disorder (DCD) at Kattankulathur, ChennaiSundaresan ChockalingamОценок пока нет

- BiofeedbackДокумент6 страницBiofeedbackSundaresan ChockalingamОценок пока нет

- 3 5 3Документ4 страницы3 5 3Amr Mohamed RedaОценок пока нет

- 3.6 God Provides Water and Food MaryДокумент22 страницы3.6 God Provides Water and Food MaryHadassa ArzagaОценок пока нет

- IPIECA - IOGP - The Global Distribution and Assessment of Major Oil Spill Response ResourcesДокумент40 страницIPIECA - IOGP - The Global Distribution and Assessment of Major Oil Spill Response ResourcesОлегОценок пока нет

- Sebu6918 03 00 AllДокумент94 страницыSebu6918 03 00 AllAhmed Moustafa100% (1)

- Barker-Choucalas, Vida PDFДокумент176 страницBarker-Choucalas, Vida PDFAnn GarbinОценок пока нет

- Pathophysiology of Cardiogenic Pulmonary EdemaДокумент8 страницPathophysiology of Cardiogenic Pulmonary EdemaLili Fiorela CRОценок пока нет

- Technology Digital LiteracyДокумент7 страницTechnology Digital LiteracyCharlesVincentGalvadoresCarbonell100% (1)

- Report On Indian Airlines Industry On Social Media, Mar 2015Документ9 страницReport On Indian Airlines Industry On Social Media, Mar 2015Vang LianОценок пока нет

- Homeroom Guidance Grade 12 Quarter - Module 4 Decisive PersonДокумент4 страницыHomeroom Guidance Grade 12 Quarter - Module 4 Decisive PersonMhiaBuenafe86% (36)

- Microscopes Open Up An Entire World That You Can't See With The Naked EyeДокумент4 страницыMicroscopes Open Up An Entire World That You Can't See With The Naked EyeLouie Jane EleccionОценок пока нет

- Nigerian Romance ScamДокумент10 страницNigerian Romance ScamAnonymous Pb39klJОценок пока нет

- MinistopДокумент23 страницыMinistopAlisa Gabriela Sioco OrdasОценок пока нет

- MT8820C LTE Measurement GuideДокумент136 страницMT8820C LTE Measurement GuideMuthannaОценок пока нет

- Nortek Quick Guide: - To Vectrino ProfilerДокумент4 страницыNortek Quick Guide: - To Vectrino ProfilerAndresFelipePrietoAlarconОценок пока нет

- Strategic Marketing FiguresДокумент34 страницыStrategic Marketing FiguresphuongmonОценок пока нет

- Organization & Management: Manuel L. Hermosa, RN, Mba, Man, Edd, LPT, MaedcДокумент32 страницыOrganization & Management: Manuel L. Hermosa, RN, Mba, Man, Edd, LPT, MaedcManny HermosaОценок пока нет

- NT140WHM N46Документ34 страницыNT140WHM N46arif.fahmiОценок пока нет

- Optra - NubiraДокумент37 страницOptra - NubiraDaniel Castillo PeñaОценок пока нет

- V Ships Appln FormДокумент6 страницV Ships Appln Formkaushikbasu2010Оценок пока нет

- Some Technical Aspects of Open Pit Mine Dewatering: Section2Документ11 страницSome Technical Aspects of Open Pit Mine Dewatering: Section2Thiago MarquesОценок пока нет

- Living in a digital age unit review and digital toolsДокумент1 страницаLiving in a digital age unit review and digital toolsLulaОценок пока нет

- COP Grease BrochureДокумент4 страницыCOP Grease Brochured86299878Оценок пока нет

- ASTRO UserguideДокумент1 054 страницыASTRO UserguideMarwan Ahmed100% (1)

- #1Документ7 страниц#1Ramírez OmarОценок пока нет

- Securing Obligations Through Pledge and MortgageДокумент4 страницыSecuring Obligations Through Pledge and MortgagePrincessAngelaDeLeon100% (1)

- Adjective: the girl is beautifulДокумент15 страницAdjective: the girl is beautifulIn'am TraboulsiОценок пока нет

- Hics 203-Organization Assignment ListДокумент2 страницыHics 203-Organization Assignment ListslusafОценок пока нет

- On-Chip ESD Protection Design For IcsДокумент14 страницOn-Chip ESD Protection Design For IcsMK BricksОценок пока нет

- 09 Bloom Gardner Matrix Example 2009Документ2 страницы09 Bloom Gardner Matrix Example 2009Ellen Jaye BensonОценок пока нет

- Canary TreatmentДокумент117 страницCanary TreatmentRam KLОценок пока нет