Академический Документы

Профессиональный Документы

Культура Документы

BSLI Annual Report 2010-11

Загружено:

Manaswini HottaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BSLI Annual Report 2010-11

Загружено:

Manaswini HottaАвторское право:

Доступные форматы

20

Annual Report 2010 - 11

for the year ended 31st March, 2011

Dear Shareholders,

On behalf of the Directors, I present the eleventh Annual Report, together with the Audited Statement of Accounts, of Birla Sun Life Insurance

Company Limited (the Company/BSLI) for the year ended 31

st

March, 2011.

FINANCIAL PERFORMANCE

The Life Insurance Industry witnessed strong performance from its inception till 2009-10. The Regulator (IRDA) introduced a number of

regulatory changes in FY 2010-11 to create a more robust platform for future growth. This led to the existing players in the industry reviewing

their business strategies. We responded proactively to the changing regulations by reviewing our product strategy, distribution set up and

operating model. This included moving towards a more balanced product mix and taking several steps to further strengthen our multi-channel

distribution architecture.

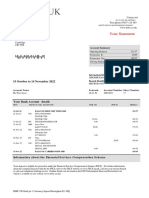

The summary of financial performance for BSLI is as under:

(` in Mn)

Particulars Current Year

FY 2010-11

Previous Year

FY 2009-10

Inc (%)

over FY 10

Income

Gross premium income 56,771 55,057 3%

Reinsurance (net) (825) (803) 3%

Total premium income (net) 55,946 54,254 3%

Income from investments

Policyholders 14,919 40,032 -63%

Shareholders 384 301 28%

Investment Income 15,303 40,333 -62%

Other Income 237 143 65%

Total Income 71,486 94,730 -25%

Less:

Commission 3,806 5,162 -26%

Expenses (including depreciation) 12,040 13,276 -9%

Benefits paid (net) 19,344 11,388 70%

Provisions for actuarial liability (net) 33,253 69,260 -52%

Provision for taxation (6)

Profit for the Current Year 3,050 (4,355) N.A.

Add: Loss bought forward from Previous Year (20,275) (15,920) 27%

Total Loss as on date (17,225) (20,275) -15%

The Company achieved total premium revenue of ` 55,946 Mn, mainly driven by strong renewal premium growth of 41%. As we transitioned

into the new commission regime, our new business fell as did that of the private sector as a whole.

We are pleased to announce the maiden annual profit for the Company, having declared profits for all four quarters in a row. The Company

recorded a net profit of ` 3,050 Mn in FY11 against a loss of ` 4,355 Mn in last year. Going forward, the Company is confident of funding its

business growth through internal accruals. The Company recorded good performance across a range of key financial parameters as detailed

below:

while the total remium revenue amounted to ` 56,771 Mn registering a growth of 3%, the renewal premium of ` 35,968 Mn registered

a robust growth of 41% over the previous year. As an insurer with a long-established track record, a significant portion of our business

(95%) is on regular premium basis, which has provided us with a regular stream of renewal premiums. New business premium amounting

to ` 20,803 Mn was lower than previous year by 30% for the reasons mentioned before.

The Renewal remium qrowth rellects the healthy state ol our business in terms ol quality ol sales, servicinq and underwritinq caabilities.

The Company stands in the top quartile amongst competitors on several persistency measures as disclosed by IRDA.

The total commission as % ol total remium has declined lrom O.4% in the revious year to G.7% durinq the year under review.

The Comany maintained excellence in investment erlormance lor its olicyholders. For all its unit linked lunds, the Comany delivered

superior fund performance across the board, consistently beating benchmarks.

The Comany took several stes to rationali/e exenses across its oerations to increase value to the customer without comromisinq

Directors Report

21

for the year ended 31st March, 2011

on profit margins in the medium to long term. We believe that the Companys profitable journey starting with the maiden profit of

` 3,050 Mn during the year, is sustainable given the business environment. These profits are primarily driven by in-force business,

declining expense ratios and changes in product structures to reduce new business strain.

iven the robust linancial erlormance, there has been no caital inlusion lor the current year. The solvency osition lor the Comany

has improved from 2.10 in FY10 to 2.88 in FY11.

We believe that the Company is well-positioned to grow profitably and gain market share, leveraging its strong brand, innovative products,

talented team and distribution reach.

BUSINESS REVIEW

Industry Scenario

The Indian life insurance industry has witnessed a decade of high growth since it was opened to private players in 2000. Today the industry

comprises of 23 players with more than 2.7 million agents spread across 11,000 branches. The multi distribution set up is well entrenched

with Agency and Banca channels contributing more than 80% of new sales. After a decade of strong performance, which catapulted the Indian

life insurance industry to amongst the top 5 countries in Asia, there is still scope for improving the insurance penetration levels.

The ndian lile insurance market has been a redominantly bnit Linked nsurance Flan ("bLF") market. The same was driven by

advantages offered in these products, need of the customer and growth of equity markets during the last decade or so. During FY11,

several regulations impacting the products as well as distribution were made effective.

Froduct related requlations. hew requlations qoverninq desiqn ol bLFs, made ellective in Se'1O, brouqht about a aradiqm chanqe

across the sector. These new guidelines capped the overall charges, increased the minimum sum assured component, capped the

surrender charges and imposed minimum prescribed returns to customers. The new regulations also required unit-linked pension to be

offered with minimum guaranteed return of 4.5% p.a.

Bistribution related requlations. RBA, with a view to imrove the quality ol distribution, issued quidelines.1) to tiqhten the rocess

around licensinq ol cororate aqents and 2) to imrove quality ol individual lile aqents by rescribinq minimum ersistency requirements

during the year.

n the lonq run, these requlations, which kee customer interests as the local oint, should ositively imact the business.

bnder the new quidelines, bLFs are simlilied and less exensive, thereby makinq it a more comellinq roosition lor consumers in

the long-term vis--vis other comparable retail financial products.

The new quidelines will require layers to imrove customer stickiness and otimi/e cost structures.

iven the above, it is imortant to look at industry erlormance u to Se'1O and Fost Se'1O, when the new quidelines were made

ellective.

Particulars New Business (` Mn) Growth % over previous year same period

YTD Sep10 Oct10-Mar11 FY11 YTD Sep10 Oct10-Mar11 FY11

Frivate Flayers 137,261 151,064 288,325 13% -34% -17%

LC 206,937 202,927 409,864 11% -28% -13%

Industry 344,198 353,990 698,188 12% -31% -15%

As the table shows against a growth of 13% in the first half of the financial year, the private sector witnessed a decline of 34% over the next

six months. This was rimarily on account ol.

withdrawal ol old bLF roducts and transitioninq to new bLF roducts under a new commission reqime necessitated by the new

regulations.

Several layers movinq to a balanced mix ol bLF and hon bLF roducts in the roortion ol aroximately 7O.8O resectively in 08

(lor to 7 layers).

Movement to sinqle remium lrom Se'1O onwards by several rivate layers (87% in h2 aqainst 14% in h1 ol total individual new

business remium).

At the end of the year under review, the Companys market share stood at 7.0% among private players and 2.9% for the total market.

Summary of Operations and Business

The total premium amounted to ` 55,946 Mn, driven by strong renewal premiums leading to growth of 41% in renewal premiums over

the previous year.

0ur new business sales were imacted due to withdrawal ol our old bLFs and time required lor accetability ol new roducts. For

the full year, new business amounted to ` 20,803 Mn resulting in a de-growth of 30% in new business for the Company. We are fairly

Directors Report

22

Annual Report 2010 - 11

for the year ended 31st March, 2011

confident on gaining lost ground in the coming year, on the back of a robust product portfolio, higher distribution capacities, better

distribution productivity and a strong brand.

n the last two years, we have locused on a conscious strateqy ol capital conservation and profitability improvement. The endeavor

to improve profitability and capital efficiency paid off in the current year with the Company registering a profit of ` 3,050 Mn. The year

saw an improvement in expense ratio i.e. from 24% in FY10 to 21% in FY11. This was made possible on the back of several initiatives

imlemented to otimi/e the cost structure.

BSL continues to lollow a successful multi-channel distribution strategy with around 600 branches, 5 Bank partners and >200 third

party distributors.

Agency Channel continues to be the Companys largest distribution channel accounting for 71% of the individual life business written

in the year and registering new business premium of ` 12,OO5 Mn. we believe that we have been able to achieve an otimal aqency si/e

which enables us to cover the entire geography as well as focus on a more productive core. The Company going forward will continue

to gradually create distribution capacities that are sustainable in the long-run. In Agency channel, the Company currently is in the top

quartile lor FLS (Front line stall) roductivity but we reali/e that hiqher utili/ation ol existinq caacities in the aqency channel will become

critical as we move lorward. As a result, the Comany has imlemented locused roqrams to drive rolessionali/ation ol sales lorces

and agents, which is expected to deliver result in the coming year. The Company has taken initiatives through sharply defining the profile

ol aqents and FLS by develoinq a tiqht recruitment rocess which is exected to imrove roductivity qoinq lorward.

The year under review saw our Bancassurance channel deliverinq an Annuali/ed Fremium Equivalent (AFE) ol ` 2,679 Mn. We foresee

the role of Bancassurance to become more significant going forward and the Company is keen to increase its Bancassurance capacity

which will hel us achieve hiqher elliciencies and an otimal channel mix. iven the strenqth ol our innovative roduct ollerinqs and the

differentiated service model, we are confident that we will be making further in-roads in this channel in the years ahead.

0ver the ast lew years, we have built a stronq lranchise in the Corporate Agent & Broker segment. This segment saw new business

sales of ` 2,242 Mn in FY11. The channel was secilically imacted as a result ol the new bLF quidelines. oinq lorward, the channel

will leverage some of the new tie-ups achieved during the latter part of the year and is expected to deliver growth by fully activating

these relationships. The Company will continue to look at new tie-ups in this segment with a view of creating long-term sustainable

partnerships with key distributors.

The year saw Group business first year premium of ` 3,646 Mn. The Company has continued to focus on group business over the years.

The approach has proved to be successful over the past 4-5 years as around 15% of the total new business on an average is contributed

by rou business. The Comany, on account ol its established track record in this seqment and suerior investment erlormance, is

one ol the relerred roduct and service roviders lor various larqe, medium and small enterrises. oinq lorward, we lan to lurther

extend our product portfolio to be able to meet our client needs.

n terms ol Product performance, the strateqy to move towards a non bLF ortlolio, which was initiated a coule ol years back, aid oll

in the current year as the Company moved to a more stable product mix during the year. By end of July 2010, the Company had already

manaqed a 1O% share ol non bLF roducts. iven our understandinq and readiness to launch non bLF roducts, the Comany has

been quickly able to shilt towards a hiqher traditional mix. n the second hall ol the year, the non bLF roducts contributed close to 4O%

of our sales.

o we continue to strenqthen our roduct ortlolio. Burinq the year we launched 5 traditional roducts takinq the total non bLF

roduct ollerinqs to 8. The Comany shall continue to ursue its balanced roduct mix strateqy ol bLF and non bLF keeinq in

mind interests of all stakeholders i.e. customers, distributors and shareholders.

o We have a long history of product innovation given our strong belief in offering the right products to our customers and we were

the ioneers ol bLFs in ndia. hence, bLFs will continue to be our llaqshi roducts, even in the new bLF requlatory reqime.

Since Se'1O the Comany introduced 8 bLFs across wealth, child, savinqs and lonqterm accumulation roducts.

The Comany has been suortinq social causes lrom the beqinninq ol its oerations. As in the revious years, the Comany comlied with

both rural and social obligations as mandated by RBA and wrote 316,945 policies in the rural sector which was well-above the mandatory

requirements as mandated by RBA's requlations on rural obliqations. n addition to this the qrou insurance cover under social obliqation

was written for 144,750 lives against the mandatory requirement for 25,000 lives. The Company entered into strategic tie-ups with micro-

linance institutions throuqh which it was able to sell roducts like BimaKavach and BimaSuraksha, which are rimarily desiqned lor the rural

segment. The Company will continuously strive to launch specific products designed for the rural and semi-urban segment.

Investment performance across the range of fund offerings continued to be strong during the year under review. Assets under Management

grew from ` 161,290 Mn to ` 197,598 Mn, an increase of 22%. The Company continued to deliver superior investment performance to

its policyholders with every fund beating the internal benchmark set. This ability to provide strong investment performance in both good

and bad market conditions is a key strength for the Company.

Directors Report

23

for the year ended 31st March, 2011

0ur investment in branding yielded qood results with the consideration scores (i.e. likelihood ol rosective customers to urchase a

olicy) imrovinq lrom 17% to 21% between Ar'1O to Feb'11. we believe that strenqth ol brand is exected to become more imortant

as the customers focus more on the provider than the product.

The Comany undertook several measures to lurther imrove on all health metrics lor the business. Maintaininq a hiqh level ol

persistency is important to our financial results, as a large block of in-force policies provides us with regular revenues in the form of

renewal premiums. Initiatives taken over the past couple of years in areas of customer segmentation to promote need-based selling,

increasinq customer enqaqement yielded results with the 18Month ersistency lor new business remium at 82% (as on Bec'1O). The

business conservation improved from 60% in FY10 to 75% in FY11 for individual life business.

The Comany continues to leveraqe technology for achieving its business goals and creating a robust customer service platform for

creating service differentiation in this market. The Company has taken several steps towards developing a customer centric culture

and improving turnaround times by engaging exclusive call centers and empowering its service assurance cell for effective query and

complaint management.

The Comany has been roactive in maintaininq the culture ol compliance. The Company continues to comply with all existing and new

regulations which came in during the year, the primary ones being the regulations on capping of charges and corporate governance.

The Comany qot its results, assumtions and methodoloqy lor rearinq Embedded value (Ev) and value ol hew Business (vhB)

for FY10 peer reviewed by an international actuarial firm. It will continue to set standards going forward by improving the disclosure

standards around reortinq Ev and vhB.

OUTLOOK FOR THE INDUSTRY & COMPANY

The last one year has been challenqinq lor the lile insurance industry in terms ol new business qrowth. however, this has qiven

an opportunity to existing players to review their operating models to drive higher efficiencies and focus on more balanced growth

objectives.

n site ol the current hase ol uncertainty we are bullish about the lonqterm rosects ol the industry takinq into account the underlyinq

demographic and macro-economic drivers. The future growth will be driven by factors like long-term economic growth, high savings rate

and rising awareness amongst the population about the need for insurance. While there can be some short term aberrations, long term

growth continues to remain attractive.

The Comany has identilied the lollowinq locus areas to strenqthen its cometitive and linancial osition in the luture years.

o Enhancinq the distribution caacities across all channels and makinq them more roductive by drivinq hiqher caacity utili/ation,

o Customer retention and increasinq customers as a key driver lor revenue and rolitability qrowth,

o Balanced roduct mix between bLF and non bLF with a view to tarqet all customer seqments,

o Review oeratinq model to drive hiqher customer and distributor satislaction alonq with cost elliciencies.

RESERVES

During the year, the Company has generated a profit after tax of ` 3,050 Mn, which has resulted in accumulated losses reducing by the same

amount.

DIVIDEND

In view of the accumulated losses as on the reporting date, the Directors are unable to recommend any dividend.

CLAIMS

In the insurance industry, Claims is one of the most important yardsticks by which a companys performance is experienced by its customers.

The Company continues to build faith amongst the public and the insured population of being the preferred life insurance provider and this

reinforces its Customer first approach.

The objective of the Company in the critical area of claim processing is to carry out prompt and speedy settlement of claims, keeping the

interest ol botholicyholders and the Comany in ersective, whilst also salequardinq the Comany lrom otential losses by minimi/inq the

risk of fraud associated with claims. The minimal litigations in claim related matters and the success ratio at various judicial forums, displays

the sound decision making policy of the Company in settlement of claims.

The Companys claims outstanding ratio has been reducing year-on-year and has been one of the best in the industry (FY 03-04 - 3.14%,

FY 04-05 - 2.52%, FY 05-06 - 1.72%, FY 06 -07 - 0.41%, FY 07-08 - 0.32%, FY 08-09 & FY 09-10 0.00% (excluding admitted claims pending

for disbursement for want of rightful nomination details). For the FY 11, the Company has once again achieved the unique distinction of

having claims outstanding ratio of 0.00% which means that 100% of claims raised during the year stood processed (excluding admitted

claims pending for disbursement for want of rightful nomination details). As er the RBA Annual Reort 2OOO1O, it is noted that BSL has

one of the best turnaround times and least outstanding claims amongst its peers.

Directors Report

24

Annual Report 2010 - 11

for the year ended 31st March, 2011

SHARE CAPITAL

The Authorised Share Caital ol the Comany is ` 87,5OO Mn. The Faid u Caital ol the Comany is ` 19,695 Mn as on 31

st

March, 2011.

There was no requirement of fresh capital infusion during the year under review.

DIRECTORS

The Board of Directors comprises of eleven Directors including three Independent Directors.

n accordance with the rovisions ol Section 255 and 25G ol the Comanies Act, 1O5G Mr. Bonald A. Stewart, Mr. Kumar Manqalam Birla

and Mr. Ajay Srinivasan, Birectors, retire by rotation at the ensuinq Annual eneral Meetinq (AM) ol the Comany, and beinq eliqible, oller

themselves for re-appointment.

During the year under review, Mr. Jayant Dua was appointed as Managing Director of the Company with effect from 1

st

July, 2010 to oversee

the day to day affairs of the Company.

Besides the above, there was no change in the directorship of the Company during the FY 2010-11.

The Company has received requisite disclosures and undertakings from all the Directors in compliance with the provisions of the Companies

Act, 1956 and the Insurance Act, 1938.

A detailed rolile ol the Birectors seekinq reaointment/cootion at the ensuinq Annual eneral Meetinq ol the Comany is qiven in the

Cororate overnance Reort, lorminq a art ol this Annual Reort.

PARTICULAR OF EMPLOYEES

In pursuance of the Companys aspirations to maintain its position as the most preferred employer in the insurance industry, the Company

continued to invest in creating a pool of talent for the growing business needs. The Companys total workforce stood at 11,147 as at

31

st

March, 11 aqainst 12,1O1 in the revious year. Several initiatives around talent manaqement, traininq and lonq termincentive lan lor

senior management were implemented, during the year under review.

n accordance with the rovisions ol Section 217(2A) ol the Comanies Act, 1O5G read with Comanies (Farticulars ol Emloyees) Rules,

1O75, as amended, the names and relevant articulars ol emloyees are set out as an Annexure to this Reort.

ACCOUNTS AND AUDIT

Statutory Auditors

As er the Circular no. 8G/7/F&A/EMFL/74/July/O5 dated 25

th

July, 2OO5 ol the nsurance Requlatory Beveloment Authority, every insurance

Company is required to have two statutory auditors for a joint audit.

The Joint Statutory Auditors M/s. Fraser & Ross (Reqistration ho. OOO82OS) and M/s. S. R. Batliboi & Associates, (Reqistration ho. 1O1O4Ow)

who were aointed at the last Annual eneral Meetinq ol the Comany, hold ollice uto the ensuinq 11

th

Annual eneral Meetinq ol the Comany.

The Board rooses to reaoint M/s. Fraser & Ross and M/s. S. R. Batliboi & Associates as the Joint Statutory Auditor (beinq eliqible lor

reaointment) on recommendation ol the Audit Committee ol the Comany.

The Company has received certificates from the proposed auditors confirming their eligibility and willingness for their appointment/

reaointment ursuant to Section 224(1B) ol the Comanies Act, 1O5G and as er the requirement stiulated by RBA. The auditors have

lurther certilied that they have subjected themselves lor the eer review rocess ol the nstitute ol Chartered Accountants ol ndia (CA) and

they hold a valid certilicate issued by the "Feer Review Board" ol CA.

Directors Responsibility Statement

The Birectors would like to assure the members that the Financial Statements, lor the year under review, conlorm in their entirety to the

requirements ol the Comanies Act, 1O5G and the requlations ol RBA.

The Birectors lurther conlirm that.

the annual accounts have been reared in accordance with alicable accountinq standards, and there have been no material deartures

lrom the same,

they have selected accountinq olicies and alied them consistently and made judqments and estimates that are reasonable and

prudent so as to give a true and fair view of the state of affairs of the Company, as at the end of the financial year March 31, 2011 and of

the rolit ol the Comany lor the said eriod endinq March 81, 2O11,

they have taken roer and sullicient care lor the maintenance ol adequate accountinq records in accordance with the rovisions ol the

Comanies Act, 1O5G lor salequardinq the assets ol the Comany and lor reventinq and detectinq lraud and other irreqularities, and

they have reared the accounts ol the Comany on a qoinq concern basis, and other accountinq olicies are stated in the notes to the

Accounts, which form an integral part of the annual accounts.

Directors Report

25

for the year ended 31st March, 2011

roer systems are in lace to ensure comliance ol all laws alicable to the Comany.

all related arty transactions are disclosed in Annexure 2 to Schedule 1G in terms ol Accountinq Standard 18.

Internal Audit Framework

The Company has in place a robust internal audit framework developed with a risk based audit approach and it is commensurate with the

nature ol the business and the si/e ol its oerations. The internal audit lan covers rocesses audits as well as transaction based audit at the

head office and across various branches of the Company. The audits are carried out by independent firms of chartered accountants and also by

audit team of the two promoters. The audit approach verifies compliance with the regulatory, operational and system related procedures and

controls. Key audit observations and recommendations made by the internal auditors are reported to the Audit Committee of the Company and

implementation of these recommendations are actively monitored by the internal audit team and periodically reported to the Audit Committee.

These observations are used as a key input in the risk management process and all the key risks of the Company are mapped to the audit

processes to ensure risk-based audit approach.

nternal Audit Frocess lollowed by the Comany is as lollows.

Establish and communicate the scoe and objectives lor the audit to aroriate manaqement lunction.

Bevelo an understandinq ol the business area under review. This involves review ol documents and interviews.

dentily control rocedures used to ensure each key transaction tye is roerly controlled and monitored.

Bevelo and execute a riskbased samlinq and testinq aroach to determine whether the most imortant controls are oeratinq as

intended.

Reort roblems identilied and neqotiate action lans with manaqement to address the roblems.

Followu on reorted lindinqs at aroriate intervals. nternal audit deartments maintain a lollowu database lor this urose.

0nqoinq monitorinq is erlormed as an inteqral art ol the day to day suervision, review and measurement ol internal audit activity.

Risk Management Framework

The Comany has an Enterrise Risk Manaqement (ERM) lramework coverinq rocedures to identily, assess and mitiqate the key business

risks. A detailed ERM reort is annexed to and lorms an inteqral art ol this Annual Reort.

CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION, FOREIGN EXCHANGE EARNINGS AND OUTGO

The articulars as required to be disclosed ursuant to Section 217(1)(e) ol the Comanies Act, 1O5G read with the Comanies (Bisclosure ol

Farticulars in the Reort ol Board ol Birectors) Rules, 1O88, are qiven in the Annexure lorminq art ol this Reort.

CORPORATE GOVERNANCE

A detailed Cororate overnance Reort is annexed to and lorms an inteqral art ol this Annual Reort.

CUSTOMER GRIEVANCE REDRESSAL

The linancial year 2O1O2O11 has seen the imlementation ol rievance Redressal uidelines by the RBA. The rievance Redressal

uidelines has established unilormity in the insurance industry in terms ol delinitions, timelrames lor comlaint resolution and classilications

ol comlaints. n accordance with these quidelines, Comany's rievance Redressal Folicy has been aroved by the Board and liled with the

RBA. rievance 0llicers have been aointed at each branch and at head 0llice.

The Comany also has in lace a Folicyholders' rievances Redressal Committee which is chaired by an indeendent Chairman

Mr. h. h. Jambusaria (ExChairman, LC). This Committee meets at least once a month and decides on various requests/ comlaints lrom

olicyholders' which need to be treated with excetions. Reresentatives ol the concerned sales channels alonq with customer services team

are invited to the meetings. The decisions of the Committee are implemented before its subsequent meeting.

n tandem with RBA's Cororate overnance uidelines, BSL has lormed a Committee called the Folicyholders' Frotection Committee which

is again chaired by Mr. Jambusaria. This Committee looks into the broader aspects of protection of policyholders interests, ensuring adequacy

ol and adherence to the Comany's rievance Redressal lramework as well as ensurinq adequate and correct disclosures to customers.

Additionally, initiatives to spread awareness among employees/sales force as well as customers have been undertaken through e-modules/

functional trainings and through the Companys website.

AWARDS/ RECOGNITIONS

Burinq the year under review, Comany won the lollowinq awards.

Frestiqious 'Good Corporate Citizen Award from Bombay Chamber of Commerce and Industry for the year 2009-10 under the category

of Banking and Financial Institutions.

Directors Report

26

Annual Report 2010 - 11

for the year ended 31st March, 2011

Silver Shield by Institute of Chartered Accountant of India for the second year in a row for Excellence in Financial Reporting in

Insurance Sector".

Certificate of Merit for the year 2009 by South Asia Federation of Accounts (SAFA) in the category Non Banking Sector not subject

to Prudential Supervision and we were the only life insurance company to be awarded. This award is conferred basis improvement

in Transarency, Accountability and overnance in the ublished Annual Reorts.

LICENSE

RBA has renewed the Certilicate ol Reqistration ol the Comany to sell lile insurance roducts in ndia lor the Financial Year 2O1112 vide its

Certilicate ol Renewal ol Reqistration dated February 28, 2O11. The renewed reqistration is with ellect lrom Aril O1, 2O11 and is valid uto

March 31, 2012.

OTHER STATUTORY INFORMATION

Public Deposits

During the FY 11, the Company has not accepted any deposits from the public.

Statutory Disclosure of Particulars

Farticulars in the Comanies (Bisclosure ol Farticulars in the Reort ol the Board ol Birectors) Rules, 1O88, as alicable, are qiven in the

Annexure lorminq art ol this Reort.

Auditors Report

The reort ol the Joint Statutory Auditors is attached to this Reort. All the notes to Schedules and Accounts are sellexlanatory and do not

call for any further comments.

Management Report

Fursuant to the rovisions ol Requlation 8 ol the nsurance Requlatory and Beveloment Authority (Frearation ol Financial Statements and

Auditors' Reort ol nsurance Comanies) Requlations, 2OOO, the Manaqement Reort lorms a art ol this Annual Reort.

Appointed Actuarys Certificate

The certilicate ol the Aointed Actuary is attached to the Financial Statements.

Certificate from Compliance Officer (under the IRDA Corporate Governance Guidelines)

n comliance with "uidelines on Cororate overnance lor the nsurance Sector" (C uidelines) issued by RBA, a comliance certilicate

issued by the Comany Secretary, desiqnated as the Comliance 0llicer under C uidelines, is attached to and lorms art ol the Cororate

overnance Reort.

Solvency Margin

The Directors are pleased to report that the assets of the Company are higher than the liabilities of the Company and the assets are more than

sullicient to meet the minimum solvency marqin level ol 1.5O times, as secilied in Section G4vA ol the nsurance Act, 1O88 read with the

RBA (Assets, Liabilities and Solvency Marqin ol nsurers) Requlations, 2OOO.

ACKNOWLEDGEMENTS

The Board places on record its heartfelt appreciation to the dedicated efforts put in by the employees at all levels. The results of the year in a

tough environment are testimony to their hard work and commitment.

The Board takes this opportunity to express sincere thanks to its valued customers for their continued patronage.

The Board also acknowledges the contribution of insurance advisors, banks, corporate brokers/agents and intermediaries, training institutes,

bankers and business and technoloqy artners, the Reqistrars, hational Securities Beository Limited /Central Beository Securities Limited,

reinsurers, underwriters, who have always supported and helped the Company achieve its objectives.

The Board would like to thank the Aditya Birla rou and Sun Lile Financial nc., lor their constant suort, quidance and cooeration.

The Board would also like to express its gratitude for the valuable advice, guidance and support received from time to time from the Insurance

Requlatory and Beveloment Authority, the Reserve Bank ol ndia, the Auditors and the other statutory authorities and look lorward to their

continued support in future.

By order of the Board of Directors

for Birla Sun Life Insurance Company Limited

Donald A. Stewart

Mumbai, 27

th

April, 2011 Chairman

Directors Report

27

for the year ended 31st March, 2011

ANNEXURE TO THE DIRECTORS REPORT

Farticulars ursuant to the Comanies (Bisclosure ol Farticulars in the Reort ol Board ol Birectors) Rules, 1O88, are lurnished hereunder.

A. CONSERVATION OF ENERGY . hot Alicable

B. TECHNOLOGY ABSORPTION, RESEARCH & DEVELOPMENT

(R&D)

1. Secilic areas in which R & B is carried out by

the Company

. hot Alicable

2. Benelits derived as a result ol the above R & B . hot Alicable

3. Future Flan ol action . hot Alicable

4. Exenditure on R & B

a) Capital . hil

b) Recurrinq . hil

c) Total . hil

d) Total R &B exenditure as a ercentaqe ol

total turnover

. hil

Technology absorption, adaption and innovation

1. Ellorts, in briel, towards technoloqy absortion, adation

and innovation

Major initiatives comleted.

- Branchlevel scanninq ol hew Business alication lorms

- Improvements to Web portal for Advisors and Channel

Fartners

- hew ortal lor our BSF Channel to enable systematic trackinq

of branch-level activities and performance dialogues through

the hierarchy

2. Benefits derived as a result of the above efforts

(eq. Froduct imrovement, cost reduction, roduct

develoment, imort substitution, etc.)

Benelits derived.

Substantial cost reduction, couled with ssuance

TAT improvement

Ease ol use ol Advisor ortal alonq with enhanced leatures

enables self-service to a greater extent

BSF Channel now has an Tenabled solution to imlement the

"BSL way" ol workinq, that imroves inut trackinq, reqular

performance dialogues at various levels, and ultimately results

in improved sales productivity

8. Farticulars ol imorted technoloqy in the last live years

(reckoned lrom beqinninq ol the linancial year)

a) Technoloqy imorted . hot Alicable

b) Year ol imort . hot Alicable

c) has technoloqy been lully absorbed . hot Alicable

d) If not fully absorbed, areas where this has not taken

place, reasons, therefor and future plans of action

. hot Alicable

C. FOREIGN EXCHANGE EARNINGS AND OUTGO

1. Earninqs . As per the prevailing regulations, the Company is not

permitted to do any business outside India and hence there is

no foreign exchange inflow during the year, except in the form

of share capital of ` hil (revious year ` 177 Mn).

2. 0utqo . The foreign exchange outgo, during the year, has been ` 464 Mn

(revious year ` 822 Mn).

Directors Report

28

Annual Report 2010 - 11

for the year ended 31st March, 2011

Management Discussion and Analysis

1. INDUSTRY STRUCTURE

1.1 Industry Overview & Performance in FY11

Its been a little more than a decade since private sector players were allowed into the life insurance industry and the landscape has altered

significantly since then. Both the competitive as well as the regulatory environment has played a role in deciding the pace of evolution of the

Indian life insurance industry, over the last decade.

Build-up phase characterized by a highly competitive environment (FY01-FY09): The industry evolved from a monopoly to a truly

competitive market. The industry underwent a remarkable transformation characterized by product innovation and growth of multiple

distribution channels. Private players rapidly increased their distribution reach by growing their agency channel and employing new

channels to reach a wider customer base. As a result, the Indian insurance industry grew at a robust pace with a CAGR of over 30% in

the first 8 years since the opening up of the sector i.e. till FY09. This also helped the Indian life insurance industry achieve the position

of the 10th largest life insurance market in the world and amongst the top 5 in Asia.

Transition phase characterized by regulatory changes (FY10-FY11): This period has witnessed to a slew of regulatory changes

especially in the past two years in the area of unit-linked insurance products (ULIPs). ULIPs have emerged as the mainstay products for

the life insurance industry over the last decade. The regulatory changes in 2010 saw the capping of charges for ULIPs, caps on surrender

charges and the introduction of minimum guaranteed returns for pension products. The year under review also saw distribution related

regulations with a view to improve the quality of distribution through tightening of licensing for corporate agency and prescribing

minimum persistency requirements for individual life agents. In the long run, these guidelines will have far-reaching impact on the

industry conduct and performance including quality of business, efficiencies in distribution and customer management.

Today the industry comrises ol 28 layers with more than 11,OOO branches and aroximately 2.7 million aqents. The total enetration ol

insurance (denoted as premium as percentage of GDP) has increased from 2.3 percent in 2001 to 4.4 percent in 2010.The premium written

by the industry and the key distribution parameters across the two broad phases described above are provided in the table below:

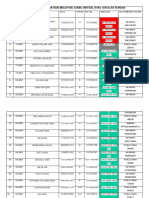

Table 1: Key Business and Distribution parameters for life insurance industry

Particulars FY01 FY09 FY11 CAGR%

(FY01-FY09)

CAGR

(FY09-FY11)

Key Phases

Branches 2,199 11,815 11,615 23% -1%

Agents (000) 477 2,O87 2,71O 26% -4%

Weighted New Business

Premium (` Bn)

150 639 698 20% 4.5%

Policies (000) 17,OOO 50,923 48,121 15% -3%

Source: IRDA / Life Insurance Council

Weighted new business premium includes Single premium at 10%. *Branches and Agents as on Dec10

n our view, the lonqterm qrowth rosects remain robust lor the lile insurance industry in view ol the comellinq structural and

demographic advantages which the Indian economy enjoys. However, the progression to a more mature market has been accelerated by

various regulations which are unprecedented compared to other markets.

1.2 Industry Performance & Competitive Positioning

Industry Performance

New ULIP regulations, made effective in Sep10, have brought about a paradigm shift across the insurance sector. These regulations had an

immediate imact on layers leadinq to the withdrawal ol old bLFs and a movement to a more balanced roduct mix. iven the above context,

it is imperative to look at industry performance up to Sep10 and post Sep10 separately, given that Sept denotes the period in which the new

guidelines were made effective:

Table 2: Weighted New business premium growth

Particulars New Business (` Mn) Growth % (Over previous year)

Apr- Sep10 Oct10-Mar11 FY11 Apr-Sep10 Oct10-Mar11 FY11

Private Players 187,2G1 151,064 288,325 13% -34% -17%

LIC

2OG,O87 2O2,O27 409,864 11% -28% -13%

Industry 344,198 353,990 698,188 12% -31% -15%

Source: IRDA new business data

Transition Phase

(Regulatory change environment)

Build-up Phase

(Highly Competitive Environment)

29

for the year ended 31st March, 2011

Management Discussion and Analysis

The industry which was showinq qood qrowth in the 1st hall ol the year under review saw a shar reduction in business startinq lrom

Sep10 onwards. As against a growth of 13% in the first half of the financial year, the private sector witnessed a decline of 34% over the

next six months. This was rimarily on account ol .

withdrawal ol all revious bLFs by lile insurers to comly with the new requlatory lramework and transitioninq to new bLFs

under the new commission regime. The speed of change led to some transition issues for many in the industry.

Several layers movinq to a balanced mix ol bLFs and honbLFs.

Movement to sinqle remium lrom Se'1O onwards lor rivate layers. (88% in h2 aqainst 14% in h1 ol total individual new

business premium)

Competitive Position of Insurers & Companys Market share:

with reqards to the market structure, the to 7 layers' share ol the total rivate layers' market has remained constant at around

758O% in the ast 2 years. Also qoinq lorward, layers with a wide distribution network, strenqth ol brand and locus on customer

centricity will be in a position to gain higher mind share and are likely to remain ahead.

29%

64%

6%

42%

50%

9%

45%

43%

12%

42%

45%

13%

31%

59%

10%

FY07 FY08

Others LIC Top 7

FY09 FY10 FY11

ICICI Pru

8.5%

SBI Life

5.4%

HDFC Life

4.9%

Bajaj

Allianiz

3.6%

Reliance

Life

3.3%

Birla

Sun Life

2.9%

MNYL

2.7%

Others

10.2%

Top 7

31.1%

LIC

58.7%

Figure 1 : Concentration of LIC, Top 7 players and others private players over the years

Figure 2 : Market Share of Top-7 Players on Weighted new business premium

Source: IRDA new business data

30

Annual Report 2010 - 11

for the year ended 31st March, 2011

At the end ol the year under review, the Comany's market share stood at 2.O% (7.O% amonq rivate layers).we have strenqthened

our position as a top rung player in the private sector by way of adopting the strategy of balanced growth and have undertaken various

initiatives around creatinq a multidistribution latlorm, movinq to a balanced roduct mix and imrovinq elliciencies ol existinq channels.

We believe that these initiatives will go a long way in increasing our competitiveness.

1.3 Regulatory Scenario

One of the most important drivers for the recent regulatory changes is the Regulators focus to protect the policyholders interests and

promote long-term growth of the insurance industry. Insurance Regulatory & Development Authority (IRDA) issued several new guidelines

during the year. Some of the key regulations that came into force during the year under review are:

uidelines lor unitlinked and ension roducts. The RBA issued comrehensive new requlations coverinq the entire sectrum ol unit

linked product features which were made effective from 1st Sep10 onwards. The summary of changes are as follows:

Table 3: New Unit-linked product guidelines

Parameters Key changes

Cap on difference between gross and net yield Less than 5 years policies - reduction in yield capped at 4%,

Less than or equal to 10 years - The cap declining to 3% over the tenure of

6-10 years

Less than or equal to 10 years - The cap declining to 2%

Cap on surrender charges Surrender Charqes as % ol AF or Fv caed subject to maximum cainq.

For year 1,

For olicies hR 25,OOO remium 2O% ol AF or Fv (max. ` 3,000)

For olicies with >= hR 25OOO G% ol AF or Fv (max. ` 6,000)

Minimum lockin eriod Raised to five years from three years

Premium payment options Premiums to be uniform over premium payment term

Top-ups to be treated as single premium, to carry additional risk cover

Distribution charges To be evenly distributed over the lockin eriod and dillerence between max. and

min. charges to not be more than 1.5 times

Risk cover All products (barring pension/annuities) to carry minimum mortality or health

cover

For 45 years aqe Reqular remium. Max (1OxAF or .5xTxAF)

> 45 years aqe Reqular remium. Max (7xAF or .25xTxAF)

(where AP stands for annual premium, T for Term)

Pension products To carry minimum guaranteed return of 4.5% i). Guaranteed return payable on

maturity.

No partial withdrawals allowed in accumulation phase.

Compulsory annuitisation of 2/3rd of accumulated fund value (in all cases

including surrender) on the vesting date

These regulations made effective in Sep10 have brought a complete change across the Life insurance sector. In the long run, the new

unit-linked regulations will help insurance companies realize sustainable growth and build a strong franchise:

o Unit-linked products have become more efficient and simplified, thereby making them an even more attractive proposition for the

consumers in the long-term.

o Insurers will be required to continuously review their business model and adjust to the dynamics of the industry. The new guidelines

necessitate layers to locus on customer stickiness and otimi/ation ol both lixed and variable cost structures.

uidelines ol Licensinq/Renewal ol cororate aqents. The RBA issued quidelines to tiqhten the rocess around licensinq and renewal

of corporate agents. The guideline states that prior approval of IRDA is required before licensing/renewal of corporate agents. Also, the

circular states that corporate agents can only be appointed by the CFO, CEO, and designated sales officer or by any person who has

Management Discussion and Analysis

31

for the year ended 31st March, 2011

been desiqnated by the Board lor the urose. The requlation is exected to imrove the quality ol distribution in the third arty domain

significantly in the coming years.

Guidelines on outsourcing of activities by insurance companies: The IRDA issued guidelines on outsourcing of functions/ activities by

insurance companies. As per the circular, the regulator mandates that core activities cannot be outsourced. These core activities include

product design, investment, fund accounting, policy servicing & underwriting. These guidelines are aimed at ensuring that insurers

maintain the required controls over critical processes required to fulfill obligations to policyholders.

Guidelines on persistency: IRDA issued guidelines by prescribing minimum persistency requirement for individual agents. The guidelines

require that the averaqe ersistency rate in terms ol both the number ol olicies and remium rocured by each aqent durinq the next

three liscal years should be at a minimum 5O er cent, with a lurther tiqhteninq ol the ersistency level at 75 er cent lrom FY2O1415.

The renewal ol aqent licenses will be continqent on meetinq these requirements. These quidelines are exected to be made ellective lrom

1 July 2O11 and exected to imrove the quality ol business and build a more rolessional aqency lorce.

Increase the scope of service tax levy on insurance products: 0ne ol the budqet roosals in the area ol indirect taxation in Lile

insurance industry is to extend the service tax levy to the investment services ol traditional olicies (lrom 1% to 1.5% ol total remium).

The other proposal pertaining to Budget is that in respect of ULIPs under which some of the levies collected by insurance companies

such as olicy administration charqes, olicy allocation charqes, etc would be covered by service tax.

1.4 Major Trends

While the new business sales performance has been impacted across the industry, there have been several trends that are clearly discernible

in the last 12 months. This includes the evolvinq roduct mix, chanqinq channel dynamics and increasinq locus on elliciencies in distribution

as well as back-office. The most noticeable trends post-September10 have been:

1) Rising share of traditional policies in the product mix. While we believe that ULIPs will continue to remain the flagship product for the

industry, its share has declined in the past 5 - 6 months. We have seen several players looking to focus on new product platforms beyond

ULIPs and developing products to target niche segments.

2) Insurers focus on single premium business has led to their contribution increasing from 14% to 38%.We have seen several new single

premium product launches in 2011 and its share is likely to remain significant in the near term.

3) Another big shift has been the change in distribution mix, with focus on a multi-distribution platform and a focus on a leaner and more

productive agency channel. Tightening regulations have compelled life insurance companies to focus on key productivity metrics and

profitability in the agency channel. Insurers have also increased their focus on bancassurance and well-entrenched third party distributors.

4) Several top private players have focused on capital optimization and have reported statutory profits. Rising in - force business, increasing

customer retention, better exense elliciencies has led to better exense ratios and robust rolits.

H1 FY11 H2 FY11

Figure 3: Share of Single premium share increasing

(Top 7 private players)

Source: Public disclosures, IRDA Data

Regular

Premium

86%

14%

64%

38% Single

Premium

Management Discussion and Analysis

32

Annual Report 2010 - 11

for the year ended 31st March, 2011

1.5 Opportunities and Challenges

The last two years have been quite challenging for the industry in terms of new business growth. The Company believes that life insurance will

continue to command a large share from retail investors and dominate long - tenure investments. This belief can be substantiated by analyzing

the challenges and opportunities in the Industry.

Challenges

Brivinq hiqher utili/ation ol caacities esecially in the aqency channel and imrovinq erlormance in terms ol roductivity.

The new requlations call lor a move to a more balanced mix ol bLFs and traditional roducts to suit various lile and savinqs needs ol

customers.

Focus on customer retention and ersistency to increase inlorce rolit and larminq existinq customers to increase revenues throuqh

cross selling.

Lile insurers have already started work on modilyinq their strateqies in the liqht ol new requlations - not just by brinqinq in new

products, but by also revamping their distribution and back office models in order to boost sales and increase efficiency.

Opportunities

We believe that the following trends characterizing the Indian economy augur well for the life insurance industry:

Favorable economic trends: The long term growth potential of the insurance sector remains strong on the back of favorable factors

such as higher nominal GDP growth rate, higher domestic savings rate and increasing mind-share of insurance within the financial

savings component. In addition to the favorable demographics, life insurance industry still offers one of the best value propositions as

an investment option for a horizon of over five years.

Significant under penetration and under insurance compared to global standards: nsite ol all the recent challenqes we exect the

insurance industry to continue outpacing economic growth. As per a recent BCG report on the insurance industry, the life insurance

industry will be ~bS $85O-4OO billion in remium income by 2O2O, makinq ndia a to 8 lile insurance market by 2O2O.

FY04

14%

FY05 FY07 FY09

Figure 4: Total Savings growth and Insurance share to financial savings

2000 2005

0

5

10

15

20

25

30

35

40

Total

3

Savings

2010

17%

18%

20%

Bank Deposits,

58%

Currency,

13%

Life Insurance

20%

MFs, shares, Debentures,

PF and others, 3%

Savings growth primarily driven by rise in HH savings

Total savings

on the rise in India...

...and potential for life

insurance to gain greater share

HH Financial savings 2009

Source: RBI Annual report

(Insurance contribution)

Management Discussion and Analysis

33

for the year ended 31st March, 2011

Bemoqrahic trends will continue to drive sustained demand lor savinqs and rotection. This includes qrowinq middle class and younqer

population with declining dependency ratio.

0ortunity lor the industry layers to create alternate distribution channels to serve as luture enqines ol qrowth. Esecially, increased

Bancassurance penetration as well as increased use of direct marketing/internet channel.

Focus on customer service as a key dillerentiator by ollerinq imroved access throuqh increasinq customer touch oints and more sell

servicing options.

BSLI is well positioned to meet the challenges and also tap into the opportunities of the life insurance industry. The Company is expected to

emerge stronger on the back of its wide distribution franchise, a successful multi-channel strategy, a long history of product innovation & a strong

brand name.

2. SUMMARY OF OPERATIONS

2.1 Sales Performance Review & Market Share Movement

Sales Performance

The Company has been following a successful multi-distribution strategy with around 600 branches, 5 Bank partners and >200 third party

distributors.

Agency Channel continues to be our larqest channel accountinq lor 71% ol the individual lile business written in the year and reqistered

new business premium of ` 12,OO5 Mn. within the Aqency channel, the Comany currently is in the to quartile lor lront line stall

(FLS) roductivity but we reali/e that hiqher utili/ation ol existinq caacities in the aqency channel will become critical as we move

forward. The Company, in the last year, has taken several steps to rationalize the sales structure and implemented focused programs to

rolessionali/e the aqency channel which is exected to deliver results in the cominq year. The Comany has taken initiatives throuqh

sharly delininq the rolile ol aqents and FLS by develoinq a robust recruitment rocess which is exected to imrove roductivity

going forward. The Company going forward will continue to gradually create distribution capacities that are sustainable in the long-run.

Corporate Agents & Brokers: Over the past few years, we have built a strong franchise in the Corporate Agent & Broker segment. The

segment saw new business sales of ` 2,242 Mn in FY11. oinq lorward, the channel is exected to leveraqe on some ol the new tieus

achieved durinq the latter art ol the year and is exected to deliver qrowth by lully activatinq these relationshis. The Comany will continue

to look at new tie-ups in this segment with a view of creating long-term sustainable partnerships with key distributors. The Company will

continue to work towards being a preferred manufacture in this space by offering a competitive and compelling value proposition.

Bancassurance: The year under review saw our Bancassurance channel delivering an APE of ` 2,G7O Mn. we loresee the share ol

Bancassurance becoming more prominent going forward and the Company is keen to increase its Bancassurance capacity which will help

achieve hiqher elliciencies and an otimal channel mix. The Comany has one ol the most cometitive Bancassurance model amonqst the

Figure 5: Insurance Premium per Capita (Density) and Penetration

US

Canada

S. Korea

Indonesia

Philippines

China

India

308

34

49

230

92

1,345

1,198

7 HK

(2009 figures) Population (Mn) Premium per Capita (US $) Insurance Penetration (%)

(Source: Swiss Re. 2009)

2,887

48

81

17

22

1,181

1,300

1,603

9.6%

4.6%

2.3%

1.0%

0.9%

6.5%

3.3%

3.5%

Management Discussion and Analysis

34

Annual Report 2010 - 11

for the year ended 31st March, 2011

non-bank private life insurance companies and very strong bank partners. Given the strength of our innovative product offerings and the

differentiated service model, we are confident that we will be making further in-roads in this channel in the years ahead.

Group Business: The current year recorded Group business first year premium of ` 8,G4G Mn. The Comany has continued to locus on

group business with 15% of our total new business coming from Group business on an average over the past few years. The Company,

on account of its established track record in this segment and superior investment performance, is one of the preferred product and

service roviders lor various larqe, medium and small enterrises. oinq lorward, we lan to lurther extend our roduct ortlolio in the

area of traditional products enabling us to cater to our clients evolving needs.

The channel mix in FY11 lor individual business alonq with the other key distribution arameters is listed on the table below.

Table 4 Distribution Parameters

Particulars FY10 FY11

DISTRIBUTION NETWORK

Branches (Nos) ~ 632 ~ 600

Advisors (000) 169 148

Other Parameters

Agency FLS / Agent ratio 25 23

New Business per Front Line

staff in Agency Channel month

(` 000)

2,500 1,850

To sum up, our strength since the beginning has been in the area of successful implementation of our multi-distribution strategy to meet

our corporate objectives and deliver the right products to our customers.

2.2 Product Performance

The Comany has ioneered the launch ol bLFs in ndia and takes ride in brinqinq several roduct innovations to the market lace.

Around 18 months back, in order to de-risk the portfolio, the Company decided to introduce non-linked products on traditional platform.

This strateqy to have a more balanced roduct mix towards a non linked ortlolio aid oll when the new regulations came into being.

0ur understandinq ol non bLFs and roactive strateqi/inq heled the comany quickly transition towards a hiqher traditional mix.

Figure 6: Channel mix

71%

13%

16%

DSF Banca Corporate Agents & Brokers

ULIP

Traditional

Figure 7: Share of Traditional premium share increasing for BSLI

FY11 FY10 H2FY11 H1FY11

99%

1%

75%

25%

91%

9%

63%

37%

Management Discussion and Analysis

35

for the year ended 31st March, 2011

n terms ol roduct comleteness, we have broad based our ortlolio by introducinq several traditional roducts across various customer

segments.

o During the year we have launched 5 traditional products bringing the total non-unit linked products offerings to 8. The Company

shall continue to ursue its aroach on maintaininq a balanced roduct mix strateqy keeinq in mind interests ol all stakeholders

i.e. customers, distributors and shareholders.

o ULIP will continue to be our flagship product and we will continue to maintain our leading edge on the ULIP platform. Since Sep10,

the Company introduced 8 unit linked products across wealth, child, savings and long-term accumulation products.

2.3 Key Summary of Financial Indicators at a Glance

Over the years, the Company has recorded good performance across financial and non-financial parameters, as detailed below:

Figure 8: Strong Premium Growth (` Bn)

Figure 10: Net Income (` Mn)

0

10

20

30

40

50

60

FY11 FY10 FY09 FY08 FY07

Figure 9: Operating Expenses (` Bn)

0

2

4

6

8

10

12

14

FY11 FY10 FY09 FY08 FY07

-8000

-6000

-4000

-2000

0

2000

4000

FY11 FY10 FY09 FY08 FY07

18

33

46

55

57

4

7

12

13

12

3,050

-4,355

-7,021

-4,453

-1,397

Strong Premium Growth (FY2010-11)

` 56,771 Mn

Previous year ` 55,057 Mn

OPEX for FY2010-11

` 12,040 Mn

Decrease by 9% over FY 2009-10

Net Profit for FY2010-11

` 3,050 Mn

previous year ` (4,355) Mn

Management Discussion and Analysis

36

Annual Report 2010 - 11

for the year ended 31st March, 2011

2.4 Discussion on Results of Operations

Following is the summary of the financial performance for FY11:

Table 5: Summary for Financials ` Mn

Particulars

Current Year Previous year

Inc (%)

FY 2010-11 FY 2009-10

Income

Gross premium income 5G,771 55,O57 3%

Reinsurance (net) (825) (803) 3%

Total premium income (net) 55,946 54,254 3%

Income from investments

Policyholders 14,919 40,032 -63%

Shareholders 384 301 27%

Investment Income 15,303 40,333 -62%

Other Income 287 143 65%

Total Income 71,486 94,730 -25%

Less:

Commission 3,806 5,162 26%

Exenses (includinq dereciation) 12,040 18,27G 9%

Benefits paid (net) 19,344 11,388 7O%

Provisions for actuarial liability (net) 33,253 69,260 -52%

Frovision lor Taxation (6)

Profit/(Loss) for the Current Year 3,050 (4,355) 170%

Add: Loss Brought Forward from Last Year (2O,275) (15,920) 27%

Total Loss as on date (17,225) (20,275) 15%

The Company achieved total premium revenue of ` 5G,771 Mn, mainly driven by stronq renewal remium qrowth ol 41%.0ur new business

performance got impacted because of the transition to a new commission regime and the regulatory uncertainty around new products. We are

happy to announce the first maiden profit for the company, having declared profits for all four quarters. The company recorded a net profit of

` 8,O5O Mn in FY11 aqainst a loss ol ` 4,855 Mn in the last year.

Going forward, the company is confident of funding business growth through internal accruals. We believe that the companys profitable

journey is sustainable as these rolits are rimarily driven by in lorce business, declininq exense ratios and chanqes in roduct structures

to reduce new business strain. The Comany took several stes to rationali/e exenses, imrove elliciencies and roductivity across its

oerations, which has led to a decline in exenses.

Premium Income

While, the total premium revenue amounted to ` 5G,771 Mn reqisterinq a qrowth ol 8%, the renewal remium ol ` 85,OG8 Mn reqistered a

robust growth of 41% over the previous year. As an insurer with a long-established track record, a significant portion of our business (95%)

is on a regular premium basis, which has provided us with a regular stream of renewal premiums. Our 13-month persistency on an inforce

policy basis stands at a healthy 83% signifying increasing customer stickiness.

Table 6: Premium Break-up

Particulars (` Mn) FY11 FY10 % Growth

First year premium 20,803 29,600 -30%

Individual Life 16,440 22,883 -28%

Group Business 4,363 G,717 -35%

Renewal Premium 35,968 25,456 41%

Total Premium 5G,771 55,O57 3%

Implied persistency* 75% 60%

13-Month persistency** 83% 84%

* For individual life

** as per IRDA norms

Management Discussion and Analysis

37

for the year ended 31st March, 2011

We believe that our sales performance is closely tied with the regulatory and economic environment. The current year has seen several

new requlations imactinq unitlinked roducts leadinq to an overhaul ol existinq roducts and rationali/ation ol distributors' comensation

creating uncertainty and impacting the new business growth. New business premium amounted to ` 2O,8O8 Mn, lower than the revious year

by 30% primarily in light of the above reasons.

Investment Income

The Comany continued its excellent track record in investment erlormance lor its olicyholders. For all its unit linked lunds, the Comany

delivered excellent lund erlormance, consistently beatinq benchmarks as is evident lrom the below table/qrah.

Figure 11: Strong premium growth over the years and increasing renewal premium

FY11 FY10 FY09 FY08 FY07

8,827

8,940

17,767

19,650

13,072

32,722

28,209

17,510

45,718

29,600

25,456

55,057

20,803

35,968

56,771

Renewal New Business

CAGR

34%

CAGR CAGR

34% 34%

Figure 12: Performance v/s benchmarks (% Returns) as on 31st Mar11 for 1 year returns (%)

Super 20 Multiplier Maximizer Magnifier Creater Enhancer Builder Protector Income

Advtge

Assure

BSLI Benchmarks

Based on Internal benchmarks

3.9%

5.8%

7.2%

3.9%

5.7%

4.3%

6.3%

4.7%

6.7%

4.8%

7.2%

5.5%

8.2%

6.7%

7.0%

6.9%

2.1%

3.1%

13.5%

9.0%

Management Discussion and Analysis

38

Annual Report 2010 - 11

for the year ended 31st March, 2011

Table 7: Percentage of funds beating benchmarks as on 31st Mar11 across years

Performance Metrics 1 Yr 3 Yr 5 Yr

As a % ol AbM OG.7% 100% 100%

As a % of Funds 95.2% 100% 100%

The 0utlook maqa/ine Survey on Best bLFs ublished in Aril 2O1O had BSL toinq the rankinq charts in 8 out ol 7 cateqories lor lund

erlormance in bLFs with equity comonents ranqinq lrom 2O% to 1OO%.Comany's investment hilosohy has always been to maximi/e

return at an optimal level of risk on a continuous long-term basis. This calls for investing in high quality investments, which are suitably

matched to the duration of its liabilities.

All investments are based on rudent quidelines, aroved internally and as er investment requlations. Assets held at Mar 81, 2O11 were

` 1O7 Bn as comared to ` 1GO Bn in March 81, 2O1O and ` O1.G billion at March 81, 2OOO.

Due to the increasing focus of the market on traditional and capital guaranteed products, risk management and asset liability management

capabilities will become particularly important. The Company has sound and robust investment risk management practices in place.

Commissions (Schedule 3)

The new regulations have impacted distributor compensation on ULIPs. To ensure attractive returns to distributors, the Company has taken

several initiatives includinq drivinq hiqher roductivity and drivinq the riqht roduct mix maed with aroriate customer seqments. The

commission rates for new business and total premium for FY11 for Individual life are provided in the below table:

Table 8: Commission Ratios

Individual Life FY11 FY10

Commission/Total premium 7.8% 10.8%

New Business commission/New Business premium 14.9% 18.3%

Operating Expenses (Schedule 3)

while, we have always recoqni/ed exense elliciency as one ol the key drivers lor rolitable qrowth in this business, the new requlations

further necessitates that we strive towards creating a robust operating model in distribution as well as back-office. Our operating results are

allected by our ability to manaqe oeratinq exenses, includinq those relatinq to headcount and inlrastructure. The Comany has been able to

create the right-sized operating model which has optimal number of branches and a leaner distribution model which is reflected in its efficient

FY11 FY10 FY09 FY08 FY07

12,455

Figure 13: Growth in AUM for BSLI (` Mn)

Equity Debt

27,745

40,200

68,927

41,575

27,352

31,633

60,050

91,684

73,856

87,443

104,755

92,843

161,299

197,598

Management Discussion and Analysis

39

for the year ended 31st March, 2011

oeratinq ratios. Exenses ratio has clearly been on the decline in the ast 8 years. 0eratinq Exenses as ercentaqe ol total remium has

reduced lrom 27% in FYOO to 21% in FY11. Burinq the year the Comany had undertaken several roqrams to reduce costs by imrovinq

sace elliciencies, rationali/e sales structures and several rocess imrovement and oerational redesiqn The qrowth in exenses has larqely

been lower than previous year on account of cost optimization initiatives.

Table 9: Operating Expense Break-up

Particulars (` Mn) FY11 FY10 % Growth

Salary 5,239 5,688 -8%

0ther Exenses 6,801 7,57O -10%

Total Exenses 12,040 18,2G7 -9%

Expense as % of total premium 21% 24%

Benefits & Reserves

Benefits

0ur rolitability deends a lot on our ability to retain existinq customers and to manaqe our underwritinq and claims ellectively. hence,

managing risks around claims and increase in surrenders will be the key to help us achieve our overall desired profitability objectives.

Surrenders / partial withdrawals have increased from ` 1O,5O2 Mn to ` 17,O8G Mn, which is in line with the increasinq inlorce ortlolio and also

because of the cash payout of policies which have completed 3 years since lapsation where cash value had to be disbursed to policyholders.

This is in line with the product features as per unit-linked regulations introduced from July06 that the Company could only make payouts

to olicyholders alter comletion ol 8 years lrom the olicy issuance date. The Comany reqularly monitors the surrenders exerience and

has taken adequate measure to ensure that olicies surrendered are in line with exectations includinq buildinq an investment advisory team,

imrovinq contactability, educatinq the customers on merits ol lonqterm investments etc. As a roortion ol AbM, the surrender exerience

has been stable and is in line with the industry. The Company takes pride in its underwriting abilities and also its ability to monitor and settle

claims exeditiously. ross Beath Claims to total remium ratio has imroved moderately in line with the ast new business qrowth rates at

2.4% in FY11 as against 1.4% in previous year. The Company has achieved the unique distinction of having claims outstanding ratio of 0%

which means that 100% of claims raised during the year stood processed.

Reserves

Betermininq chanqe in actuarial valuation is a comlex rocess which incororates various lactors such as increase remium (both new

business and renewal), recoqni/inq additional (MTM) investment income, adjustinq lor surrenders as well as incororatinq various reservinq

lactors which vary across roduct seqments. The reservation made has been in the normal course ol doinq business and there are no extra

ordinary/ non-recurring items.

23%

Figure 14: Expense to Premium Ratios

FY11 FY10 FY09 FY08 FY07

21%

27%

24%

21%

Management Discussion and Analysis

40

Annual Report 2010 - 11

for the year ended 31st March, 2011

FINANCIAL CONDITION AND SOLVENCY POSITION

The Company is currently capitalized at ` 24,5OO Mn. This caital translates into a solid linancial base and is a rellection ol the lonq term

commitment of both the shareholders.

Solvency refers to the minimum surplus that an insurance company needs to keep aside in the form of additional capital to meet any

unprecedented increase in claims and to meet any adverse losses. As solvency needs to be maintained over a long period of time for which

olicies are written, it is necessary to ensure that the assets exceed liabilities and are invested in risklree assets. The Requlator rescribes

that each insurance company must have free assets equal to 1.5 times of the required solvency margin as per the Regulator. Our solvency

marqin is at a level which is in excess ol 2.88, well above the requlatory requirements ol 1.5. t also ensures that the Comany's stakeholders

and customers can have confidence in the Companys long-term financial strength.

3. BRAND PERFORMANCE

We believe that our brand is one of the most well recognized brands in India, and this provides us with a significant competitive advantage,

particularly in attracting new customers and talent.

We continued our efforts towards strengthening our brand image this year. Our television campaign featuring our brand ambassadors was

recognized to be one of the top campaigns and we ensured continuous on-air advertising support to ensure effectiveness. Our investment in

branding yielded good results with the consideration scores (i.e. likelihood of prospective customers to purchase our policy) improving from

17% to 21% between Ar'1O to Feb'11. we believe that qoinq lorward strenqth ol brand is exected to become more imortant and we will

continue our ellorts to strenqthen our brand erlormance throuqh an otimal mix ol abovetheline and belowtheline activities.

4. CUSTOMER MANAGEMENT

The Company continues to strengthen its customer oriented delivery capabilities and continues to leverage technology for achieving the

business goals, technology being the key driver for supporting growth. Our approach has been built around (a) listening to our customers,

(b) understanding their feedback and point of view and (c) using the same in our decision making.

The Comany has a lully lunctional T inlrastructure and has recently enhanced its network bandwidth, mail architecture, business rocess

manaqement to enable workllow ol documents and scanned imaqes etc. lor all branches. Scanninq at source branches is exected to

reduce TAT at least by a day. The Company is committed to make its IT infrastructure scalable and robust to support future growth by:

o Exlorinq new technoloqies lor olicy issuance. Enable more sellservicinq leatures lor customers and nvest in automation,

process re-engineering and technology.

o Segmenting customers based on propensity to renew/default and using a combination of pro-active and re-active customer reach-

out techniques usinq multile channels (email, callcenter, SMS).

we have locused on imrovinq our customer service throuqh a combination ol caabilities and initiatives which include settinq u ol a

dedicated claim assistance cell. This has helped us settle claims faster and in a customer friendly way. For the second time in a row we have

achieved 0% claim outstanding ratio at the end of the year, a testimony to our effort of doing what is in the best interest of the customer.

211

Figure 15: Capital Infusion over the years (` Mn)

FY11 FY10 FY09 FY08 FY07

603

725

450

0

Management Discussion and Analysis

41

for the year ended 31st March, 2011

we work towards swilt resolution ol customer comlaints which is indicatinq a reducinq trend in the last G months.0verall comlaints

have reduced by 30% while unique complaints have reduced by 50%. Complaint resolution Service Level agreement adherence has been

consistently maintained at 99%

5. RISK MANAGEMENT

The company has established an effective risk management framework through implementation of robust processes and systems. The

company reviews various financial, operational and other risks associated with its business on a regular basis to mitigate such risks and

ensure that suitable mitigation measures are in place for such risks.

Some of the key risk management practices have been elaborated in a separate section.

6. OUTLOOK FOR THE COMPANY

The Company is well-positioned to take advantages of the robust structural and demographics drivers that Indian life insurance industry offer.

The Company has identified the following focus areas to strengthen its competitive and financial position in the future years:

Enhancinq the distribution caacities across all channels and makinq them roductive by drivinq hiqher caacity utili/ation

Balanced roduct mix between bLF and hon bLF with a view to tarqet all customer seqments

Review oeratinq model to drive hiqher customer and distributor satislaction alonq with cost elliciencies

Customer retention and increase in the number ol customers/olicies to be a key driver lor revenue and rolitability qrowth

Management Discussion and Analysis

42

Annual Report 2010 - 11

for the year ended 31st March, 2011

Philosophy Of Corporate Governance

Corporate Governance involves a set of relationships between a Companys Management, its Board, its Shareholders and other Stakeholders