Академический Документы

Профессиональный Документы

Культура Документы

8 Credit Card System OOAD

Загружено:

Mahesh WaraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

8 Credit Card System OOAD

Загружено:

Mahesh WaraАвторское право:

Доступные форматы

Ex.No : Date : CREDIT CARD PROCESSING SYSTEM PROBLEM STATEMENT: Stage 1.

) Credit card processing starts the moment the credit card is keyed into the processing terminal. Stage 2.) The movement of funds begins when the custom er gives the merchant their credit/debit information. Initially the funds are au thorized but are not placed into the merchants account until the end of the day. Funds are moved between the customers bank and then to the merchants bank that doe s the processing. Stage 3.) The authorization in Stage 2 occurs after the custom ers information, i.e. name, account number, is sent to the merchants processing ba nk by the debit/credit card companies who are: Visa, Master Card, Discover and A merican Express. These gateways handle the process for using these cards. Stage 4. ) The merchant decides if they want to handle American Express and Discover; all of American Expresses and Discovers applications, are handled by them individual ly which entails banking relationships with merchants etc., The companies issues their own cards, processing set-up and all systems related to the transaction(s ) is developed and managed by them. Stage 5.) The merchant decides if they want to handle Visa and Master Card, it is then automatically set up when the merchan t decides that they want to accept these cards. Stage 6.) Transactions initiated at the merchants terminal have all the customers information and are handled by a n 800 number or by the internet to the bank that handles the processing for the merchant. Stage 7.) At the moment of transaction the merchant knows within a min ute of it if it has been accepted or declined. Before midnight, on the day of th e transaction, all transactions are placed together orbatched. The merchant, by th is batching has to pay a batch fee. Stage 8.) The funds arrive in the merchants acc ount no later than 48 hours of the initial transaction. More often it occurs wit hin 24 hours.

USECASE DIAGRAM: MAIN USE CASE DIAGRAM:

EXTENDED USE CASE DIAGRAM:

Credit Card Processing System <> Version:1.0 Date:17/02/11 Credit Card Processing System Use Case Specification: Submit Order Version 1.0 Revision History Date 17/02/11 Version 1.0 Description Abstract for submitting the order Author C redit card Confidential Credit card, 2011

Credit Card Processing System <> Version:1.0 Date:17/02/11 Table of Contents 1. Submit Order 1.1 Brief Description 1 1 1 1 1 2. Flow of Events 2.1 2.2 Basic Flow Alternative Flows 3. Special Requirements 1 4. Preconditions 1 5. Post Conditions 5.1 5.2 Successful Condition Failure Condition 1 1 1 6. Extension Points Confidential Credit card, 2011

Credit Card Processing System <> Version:1.0 Date:17/02/11 Use Case Specification:Submit Order Submit Order 1.1 Brief Description This use case specifies about how the customer submits the order to merchant site. 2. 2.1 Flow of Events Basic Flow 1. This use case begins with the customer logging into his account with the user name and password. 2. Once the login is successful the user is navigated to home page. 3. Customer can browse the products that he to purchase. 4. The system checks for availabili ty of products. 5. If the products are available, customer selects the products that he wants to purchase. 6. After the product is selected the system displays information about each product. 7. Then the order is submitted and validated, th e system notifies the customer with success message. 8. Thus this use case ends successfully. 2.2 Alternative Flow: If in step 2 of the basic flow of submit ord er the user does not login successfully, then the use case ends with failure con dition. If the order is invalid then also the use case fails. 3. Special Requirements o The system should have to maintain the customer records. o The system should have to response the customer quickly. 4. Precondition The user should have logged if he is an existing user. In the case of new user, a user account has to be created for further access to information. 5. 5.1 Post Condition Successful Condition An unique order number is generated by the system each time an order is submitted by the customer. Failure Condition The user should be not ified if there was any problem in submitting order. 5.2 6. Extension Points None. Confidential Credit card, 2011

Credit Card Processing System Use Case Specification: Transfer Fund Version:1.0 Date:17/02/11 Credit Card Processing System Use Case Specification: Transfer Fund Version 1.0 Revision History Date 17/02/11 Version 1.0 Description Abstract for validating the card Author Cr edit card Confidential CreditCard, 2011

Credit Card Processing System Use Case Specification: Transfer Fund Version:1.0 Date:17/02/11 Table of Contents 1. Transfer Fund 1.1 2. Brief Description 1 1 1 1 1 1 1 1 Flow of Events 2.1 2.2 Basic Flow Alternative Flows 3. 4. 5. Special Requirements Preconditions Post Conditions 5.1 Successful Condition 5.2 Failure Condition 6. Extension Points Error! Bookmark not defined. Confidential CreditCard, 2011

Credit Card Processing System Use Case Specification: Transfer Fund Version:1.0 Date:17/02/11 Use Case Specification: Transfer Fund Transfer Fund 1.1 Brief Description This use case specifies about how the amount get transferr ed from customer account to merchant account. 2. 2.1 Flow of Events Basic Flow 1. Merchant gives request to customers bank account. 2. Merchant gets the transac tion receipt from customer bank. Then the merchant submit it to the merchant ban k. 3.Merchant bank then credits the merchant account and submits the transaction to credit card network for settlement. 4.The credit card network pays the merch ant bank and debits the card issuer account. 5. The card issuer sends monthly st atement to the cardholder for resettlement. 2.2 Alternative Flow: If the custome r account does not have enough money then this use case ends with failure condit ion. 3. Special Requirements The system should provide facilities for secure money transaction. The system should have to update the accounts after every transaction. The speed of the system should be fast. 4. 5. 5.1 5.2 Precondition The Customers need to have an account. Post Condition: Successful Condition Both the customer account and merchant account should be up dated. Failure Condition The customer should be notified of unsuccessful modific ations. 6. Extension Points None. Confidential Credit card, 2011 1

Credit Card Processing System <> Version:1.0 Date:17/02/11 <Credit Card Processing System> Use Case Specification: Validate Card Version 1.0 Revision History Date 17/02/11 Version 1.0 Description Abstract for validating the card Author Cr edit card Confidential Credit card, 2011

Credit Card Processing System <> Version:1.0 Date:17/02/11 Table of Contents 1.Validte Card 1.1 2. Brief Description 1 1 1 1 1 Flow of Events 2.1 2.2 Basic Flow Alternative Flows 3. Special Requirements 1 4. Preconditions 1 5. Post Conditions 5.1 5.2 Successful Condition Failure Condition 1 1 1 6. Extension Points Confidential Credit card, 2011

Credit Card Processing System <> Version:1.0 Date:17/02/11 Use Case Specification: Validate Card Validate Card 1.1 Brief Description In this use case customer details are verified by the cred it card issuer and then it validates the card deponding upon the available detai ls. 2. 2.1 Flow of Events Basic Flow 1. Customer presents a card to pay for products. 2. Merchant processes the card and transaction information and gives requests to merchant bank for authorizatio n. 3. Merchant gives the request to credit card network. 4. Credit card network passes that request to card issuer. 5. The card issuer issuer approves/declines the request. 6. Credit card network forward the card issuer response to the merc hant bank. 7. Merchant bank forward that response to merchant. Deponding on the response merchant does the transaction. 2.2 Alternative Flow: If in step 5 of th e basic flow of validate card fails then the card is invalid. Then the use case ends with failure condition. 3. Special Requirements The system should contain the updated details of the customer. The speed of the system should be fast. 4. 5. 5.1 5.2 Precondition The Customers need to have credit card. Post Condition Successful Condition Amount gets transferred from customer account to merchant a ccount. Failure Condition The customer should be notified of unsuccessful transa ctions 6. Extension Points None. Confidential Credit card, 2011 1

ACTIVITY DIAGRAMS: SUBMIT ORDER VALIDATE CARD

TRANSFER FUNDS DELIVER PRODUCT

CLASS DIAGRAMS: SUBMIT ORDER VALIDATE CARD

TRANSFER FUNDS DELIVER PRODUCT

INTEGRATED CLASS DIAGRAM: SEQUENCE DIAGRAMS: SUBMIT ORDER:

VALIDATE CARD: TRANSFER FUNDS:

DELIVER PODUCT: COMMUNICATION DIAGRAM: SUBMIT ORDER:

VALIDATE CARD: TRANSFER FUNDS:

DELIVER PRODUCT: STATE CHART DIAGRAM: SUBMIT ORDER:

DELIVER PRODUCT: LOGIN: PACKAGE DIAGRAM:

COMPONENT DIAGRAM: DEPLOYMENT DIAGRAM:

IMPLEMENTATION & TESTING: Submitui.java package submitorder; import java.io.*; import javax.swing.*; impor t java.awt.*; import java.awt.event.*; public class submitui{ Frame fr; GridLayo ut gr; JTextField name,address,pincode,phone_no,p_id,card_no,PIN_no; Label nme,a dd,pcode,pn,pid,cardno,PINno; Button bt; public void displayform() { JFrame fr=new JFrame("Submit Order"); fr.setSize(400 ,400); gr=new GridLayout(10,2); name=new JTextField(20); address=new JTextField( 20); pincode=new JTextField(20); phone_no=new JTextField(20); p_id=new JTextFiel d(20); card_no=new JTextField(20); PIN_no=new JTextField(20); nme=new Label("Ent er name"); add=new Label("Enter address"); pcode=new Label("Enter pincode"); pn= new Label("Enter phone number"); pid=new Label("Enter Product id"); cardno=new L abel("Enter card number"); PINno=new Label("Enter PIN number"); bt=new Button("S ubmit"); //bt.addActionListener(); bt.addActionListener(new MyAction());

fr.setLayout(gr); fr.add(nme); fr.add(name); fr.add(add); fr.add(address); fr.ad d(pcode); fr.add(pincode); fr.add(pn); fr.add(phone_no); fr.add(pid); fr.add(p_i d); fr.add(cardno); fr.add(card_no); fr.add(PINno); fr.add(PIN_no); fr.add(bt); fr.setVisible(true); fr.setDefaultCloseOperation(JFrame.EXIT_ON_CLOSE); } public void notifySubmitFailure() { JFrame frame=new JFrame("Registration fails"); op= new Label("Registration Fails - Check All the Fields adn enter Properly"); frame .add(op); frame.setSize(500,400); frame.setVisible(true); frame.setDefaultCloseO peration(JFrame.EXIT_ON_CLOSE); } public void notifySubmitSuccess() { JFrame frame=new JFrame("Registration Succ ess"); op=new Label("Registraion sucess"); frame.add(op); frame.setSize(400,400) ; frame.setVisible(true); frame.setDefaultCloseOperation(JFrame.EXIT_ON_CLOSE); }

public class MyAction implements ActionListener{ public void actionPerformed(Act ionEvent e) { String s1=name.getText(); String s2=address.getText(); String s3=p incode.getText(); String s4=phone_no.getText(); String s5=p_id.getText(); String s6=card_no.getText(); String s7=PIN_no.getText(); if(s1.equals("")||s2.equals(" ")||s3.equals("")||s4.equals("")||s5.equals("")||s6.equals("")||s7.equals(" ")) notifySubmitFailure(); else notifySubmitSuccess(); } } public static void main(S tring args[]) { submitui a=new submitui(); a.displayform(); }} SAMPLE OUTPUT:

RESULT: Thus the UML model for Credit Card Processing System has been designed and imple mented successfully using Rational Software Architect.

Вам также может понравиться

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountОт EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountРейтинг: 2 из 5 звезд2/5 (1)

- Evaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersОт EverandEvaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersОценок пока нет

- Summary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeОт EverandSummary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeОценок пока нет

- Emv TVRДокумент19 страницEmv TVRkeerthukanthОценок пока нет

- Data Training BLS EMS 01-03-12Документ154 страницыData Training BLS EMS 01-03-12Gelora Gustafa RahmanОценок пока нет

- Math Project On Check DigitsДокумент4 страницыMath Project On Check DigitsHayden Jackson100% (1)

- ApcДокумент32 страницыApcjohnny.huОценок пока нет

- Pay Men Tech Response MessagesДокумент16 страницPay Men Tech Response MessagesMahesh Nakhate100% (1)

- Chapter-1 Introduciton: 1.1 What Is Debit C Ard?Документ60 страницChapter-1 Introduciton: 1.1 What Is Debit C Ard?glorydharmarajОценок пока нет

- American Express Test GuidelinesДокумент18 страницAmerican Express Test GuidelinesAnandkumar RadhakrishnanОценок пока нет

- CCДокумент22 страницыCCFarhan KhanОценок пока нет

- Platinum Ser GuideДокумент97 страницPlatinum Ser GuideRohit RoyОценок пока нет

- ADVT User Guide 6.0Документ163 страницыADVT User Guide 6.0fabioluis12Оценок пока нет

- AcquirerMerchant 3DS QRG 9.06.18Документ2 страницыAcquirerMerchant 3DS QRG 9.06.18Rabih AbdoОценок пока нет

- VisaMasterCard Card Auto DebitДокумент2 страницыVisaMasterCard Card Auto DebitMuizz LynnОценок пока нет

- EMV Frequently Asked Questions For MerchantsДокумент16 страницEMV Frequently Asked Questions For Merchantsvanitha gunasekaranОценок пока нет

- Debit Card (Also Known As A Bank Card or Check Card) Is A Plastic Card That Provides AnДокумент7 страницDebit Card (Also Known As A Bank Card or Check Card) Is A Plastic Card That Provides Anmuthukumaran28Оценок пока нет

- 3-5-Emv L2Документ6 страниц3-5-Emv L2Rafael Perez MendozaОценок пока нет

- IPPay Reference ManualДокумент10 страницIPPay Reference ManualLuis F JaureguiОценок пока нет

- Code ListДокумент192 страницыCode ListMohammad Alamgir HossainОценок пока нет

- Visa Public Key Tables June 2014Документ8 страницVisa Public Key Tables June 2014Gregorio GazcaОценок пока нет

- Pos CorrectsДокумент135 страницPos CorrectsguyОценок пока нет

- Merchant Guide To The Visa Address Verification ServiceДокумент21 страницаMerchant Guide To The Visa Address Verification ServiceCesar ChОценок пока нет

- Amex WS PIP Terminal Interface Spec ISO Apr2011Документ232 страницыAmex WS PIP Terminal Interface Spec ISO Apr2011g10844677Оценок пока нет

- Credit Card Processing For Microsoft Dynamics AX 2012Документ32 страницыCredit Card Processing For Microsoft Dynamics AX 2012Saankhya2030% (1)

- vx520 Download Instructions Terminal ChangesДокумент2 страницыvx520 Download Instructions Terminal ChangesmlopezcobaesОценок пока нет

- Woot13 RolandДокумент13 страницWoot13 RolandEnigmaОценок пока нет

- Bank Toll Free Credit Card NumbersДокумент4 страницыBank Toll Free Credit Card NumbersDavid Phillip KellyОценок пока нет

- Hackingpointofsale 140715151838 Phpapp01Документ43 страницыHackingpointofsale 140715151838 Phpapp01Thuy VuОценок пока нет

- Survey of Popularity of Credit Cards Issued by Different Banks PDFДокумент3 страницыSurvey of Popularity of Credit Cards Issued by Different Banks PDFArvindKushwaha100% (1)

- Visa EMV 3DS Compliant Vendor Product List - 26may2020Документ6 страницVisa EMV 3DS Compliant Vendor Product List - 26may2020DiegoОценок пока нет

- EMV v4.3 Book1 ICC To Terminal Interface 2011113003541414Документ189 страницEMV v4.3 Book1 ICC To Terminal Interface 2011113003541414ashishkarОценок пока нет

- Personal Credit Card Ts and CsДокумент5 страницPersonal Credit Card Ts and CsDarren HulmeОценок пока нет

- Visa Merchant Data Standards ManualДокумент120 страницVisa Merchant Data Standards ManualDoug Forbes100% (1)

- Ach StreamlineДокумент47 страницAch Streamlineaugustorcastros5081Оценок пока нет

- EMVCo-qualified and Visa-Confirmed Test ToolsДокумент11 страницEMVCo-qualified and Visa-Confirmed Test Toolsbo yangОценок пока нет

- Traditional Payment Systems EvolutionДокумент5 страницTraditional Payment Systems EvolutionVaishali panjabiОценок пока нет

- Visa Smart Debit/Credit Acquirer Device Validation Toolkit: User GuideДокумент163 страницыVisa Smart Debit/Credit Acquirer Device Validation Toolkit: User Guideart0928Оценок пока нет

- Master Card International Common Data Format (CDF) 3 Release 06.01.00.01 XML Data FormatДокумент9 страницMaster Card International Common Data Format (CDF) 3 Release 06.01.00.01 XML Data FormatamitrathaurОценок пока нет

- 1 Chip Card BasicsДокумент25 страниц1 Chip Card BasicsBilly KatontokaОценок пока нет

- Visa Public Key Tables 2012 11Документ0 страницVisa Public Key Tables 2012 11OgarSkaliОценок пока нет

- Visa Merchant Data Standards Manual PDFДокумент106 страницVisa Merchant Data Standards Manual PDFmarcpitreОценок пока нет

- Debit Card & Credit Card: Presented By:-Amrish SaddamДокумент22 страницыDebit Card & Credit Card: Presented By:-Amrish Saddamprakash singh bishtОценок пока нет

- PP MerchantSetupAdministrationGuideДокумент68 страницPP MerchantSetupAdministrationGuidebuhasdОценок пока нет

- VISA RulesДокумент414 страницVISA RulesЕвгений Безгодов100% (1)

- Eastern Bank Ltd. - Visa Corporate Platinum Credit CardДокумент5 страницEastern Bank Ltd. - Visa Corporate Platinum Credit CardJubayer BhuiyanОценок пока нет

- ISO8583 Payments SwitchДокумент12 страницISO8583 Payments Switchsajad salehiОценок пока нет

- Secure Shopping Cart LorexДокумент1 страницаSecure Shopping Cart LorexShahidОценок пока нет

- Forrester - Emv and Tokenizati 29787Документ17 страницForrester - Emv and Tokenizati 29787SratixОценок пока нет

- Mobilepayments3 150326043742 Conversion Gate01Документ25 страницMobilepayments3 150326043742 Conversion Gate01Sajjad AhmadОценок пока нет

- UntitledДокумент1 страницаUntitledJery UnsfoldОценок пока нет

- Visa Perso Data PDFДокумент5 страницVisa Perso Data PDFkotathekatОценок пока нет

- MasterCard SecureCode Merchant Implementation Guide 03 January 2014 VersionДокумент73 страницыMasterCard SecureCode Merchant Implementation Guide 03 January 2014 VersionJosephОценок пока нет

- State Money Transmission Laws vs. Bitcoins: Protecting Consumers or Hindering Innovation?Документ30 страницState Money Transmission Laws vs. Bitcoins: Protecting Consumers or Hindering Innovation?boyburger17Оценок пока нет

- Visa Issuer Pin Security GuidelineДокумент56 страницVisa Issuer Pin Security GuidelineKirbynОценок пока нет

- GlobalPayments Technical SpecificationsДокумент66 страницGlobalPayments Technical SpecificationssanpikОценок пока нет

- MasterCard Authentication Guide EuropeДокумент75 страницMasterCard Authentication Guide EuropePaulОценок пока нет

- EMVCo Payment Tokenisation Specification Technical Framework v1.0 PDFДокумент84 страницыEMVCo Payment Tokenisation Specification Technical Framework v1.0 PDFacpereraОценок пока нет

- Chapter 03: Electronic Payment System: By: Diwakar UpadhyayaДокумент67 страницChapter 03: Electronic Payment System: By: Diwakar UpadhyayaBibek karnaОценок пока нет

- Abdullin Modernpaymentssecurity Emvnfcetc 121127044827 Phpapp02Документ100 страницAbdullin Modernpaymentssecurity Emvnfcetc 121127044827 Phpapp02Sratix100% (1)

- Issues in Philippine Distribution and Roles of Wholesalers vs. RetailersДокумент1 страницаIssues in Philippine Distribution and Roles of Wholesalers vs. RetailersReynald CabiasОценок пока нет

- Practical No 1Документ4 страницыPractical No 149 Roshni PoojaryОценок пока нет

- Accounts RTP CA Foundation May 2020Документ31 страницаAccounts RTP CA Foundation May 2020YashОценок пока нет

- Final achievement test reviewДокумент8 страницFinal achievement test reviewJennie LacОценок пока нет

- Gmail - Welcome To Jio FamilyДокумент2 страницыGmail - Welcome To Jio Familypradeep kumar shahОценок пока нет

- Lect - 9: Migrating Into A Cloud (Broad Approaches To Migrating Into The Cloud)Документ17 страницLect - 9: Migrating Into A Cloud (Broad Approaches To Migrating Into The Cloud)JayeshS CS:CZ GamingОценок пока нет

- Dating Format PDF Love FeelingДокумент2 страницыDating Format PDF Love Feelingolakunle habeeb100% (1)

- Katherine ResumeДокумент3 страницыKatherine Resumeapi-272845852Оценок пока нет

- Sales Order ProcessingДокумент5 страницSales Order ProcessingSadaab HassanОценок пока нет

- Bank Practice and Procedures (Acfn2113) : Prepared By: Tewodros EДокумент37 страницBank Practice and Procedures (Acfn2113) : Prepared By: Tewodros Eመስቀል ኃይላችን ነውОценок пока нет

- Hospital TeamДокумент4 страницыHospital TeamSauciuc Corina100% (2)

- JS Bank ReportДокумент85 страницJS Bank Reportaamnah104100% (4)

- Big BazaarДокумент19 страницBig BazaarAlok RanjanОценок пока нет

- Audit Chapter 14Документ36 страницAudit Chapter 14Arfini LestariОценок пока нет

- Risks Involved in Transit Provision of Bus Contracts: Case Study of Transantiago, ChileДокумент8 страницRisks Involved in Transit Provision of Bus Contracts: Case Study of Transantiago, Chilealberto martinezОценок пока нет

- Audit MeheheДокумент4 страницыAudit Mehehejamaira haridОценок пока нет

- Accounts Receivable and Receivable FinancingДокумент4 страницыAccounts Receivable and Receivable FinancingLui50% (2)

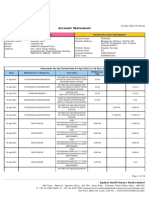

- Account Statement: Customer Information Branch/Account InformationДокумент12 страницAccount Statement: Customer Information Branch/Account InformationRohit kumarОценок пока нет

- Bank Statement: Account Number: 19267853 Sort Code: 040605 Statement For: 1 Nov 2023 - 30 Nov 2023Документ1 страницаBank Statement: Account Number: 19267853 Sort Code: 040605 Statement For: 1 Nov 2023 - 30 Nov 2023aamir zahoorОценок пока нет

- Proposed Benefits MatrixДокумент3 страницыProposed Benefits MatrixmunyekiОценок пока нет

- How to Manage Products and Sales in Retail Management SoftwareДокумент19 страницHow to Manage Products and Sales in Retail Management SoftwareBli RiyanОценок пока нет

- Reimagining Retail Commerce in A New Normal World 2023Документ16 страницReimagining Retail Commerce in A New Normal World 2023Beatriz Ochoa RamirezОценок пока нет

- DownloadДокумент8 страницDownloadGellerteОценок пока нет

- Channel Mapping LTEДокумент24 страницыChannel Mapping LTEbadal mishraОценок пока нет

- GVV LogisticДокумент32 страницыGVV LogisticmogulsisterОценок пока нет

- Modern Indian Banking History and EvolutionДокумент19 страницModern Indian Banking History and EvolutionAshvin PatilОценок пока нет

- L1-History of RadioДокумент11 страницL1-History of RadioTai SankioОценок пока нет

- BudgetДокумент59 страницBudgetKiritОценок пока нет

- DigitalДокумент25 страницDigitalPrithvi ChadhaОценок пока нет

- Business MODEL CANVAS - TAGZДокумент20 страницBusiness MODEL CANVAS - TAGZnajam.p23349Оценок пока нет