Академический Документы

Профессиональный Документы

Культура Документы

2013m03 Press Release

Загружено:

Belinda WinkelmanИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2013m03 Press Release

Загружено:

Belinda WinkelmanАвторское право:

Доступные форматы

Embargoed until: 11.

30am Tuesday 9 April 2013

Monthly Business Survey

March 2013

Business conditions fall to weakest level in almost four years but confidence steady. Previous surge in activity in consumer sectors retail & manufacturing unwinds, with signs lower interest rates need more time to fully work through economy. Businesses seemingly unfazed by events in Cyprus or political leadership scuffles at home at least no more than usual. Forward indicators still poor, not boding well for near-term demand.

The business environment remained challenging in March, with business conditions deteriorating to the lowest level since May 2009. The slump in activity reflects a weakening in trading and employment conditions, while profitability was unchanged at a subdued level. While forward orders improved, they remained weak, with the outlook for near-term demand not helped by still low levels of capacity utilisation and capital expenditure. Heavy falls in manufacturing and retail business conditions indicate we are yet to see the upswing in consumer demand that policy makers are searching for; instead, it seems that either lower interest rates need more time, or more stimulus (eg. RBA rate cuts) may be needed to set the economy back on a steady growth path. Business confidence was resilient in March, lifting marginally despite reignited worries about a European crisis and political uncertainty at home. It is possible that relatively higher equity prices and lower borrowing rates are keeping firms somewhat optimistic. However, the mood has deteriorated sharply in mining, with confidence falling to its weakest level in four years. This was offset by better confidence in interest sensitive sectors. Overall, the survey implies underlying demand growth (6-monthly annualised) of around 2% in the March quarter. Our wholesale leading indicator suggests little near-term improvement in already weak activity levels. Labour costs growth was unchanged at a below-average rate, held down by subdued employment conditions. Overall wage cost pressures appear well contained at present. Price deflation was apparent in March, with the poor outcome consistent with the weakness in trading conditions. Combined with modest costs growth, the survey implies further pressure on margins, especially in retail. Implications for NAB forecasts (See latest Global and Australian Forecasts report also released today): Global forecasts little changed. The latest bout of Euro-zone instability has taken a toll on global equity markets and we remain to see the impact of the changes in Japanese monetary policy. While business surveys in the advanced economies show a lift in sentiment, the reality is Europe is likely to be in recession until late 2013. USA is reasonable and only China is showing signs of accelerated growth. Overall we still expect growth to pick up in the latter half of this year, before strengthening to an above-trend 3.9% in 2014 as recessions end in Europe, Japan reflates and the big emerging market economies pick up speed. GDP forecasts broadly unchanged we have lifted Q1 consumption (strong retail data) and softened outlook for investment (lower commodity prices). We see GDP of 2.4% in 2013 (was 2.3%), lifting to 3.0% in 2014 (was 3.1%). While there are signs the Australian economy is strengthening, falling commodity prices and high AUD still weighing on activity. We see unemployment rising to around 5% by late 2013. With inflationary pressures well contained, there is thus scope for two more rate cuts by year-end (possibly June & November). Timing is still fluid with higher house prices a possible delay factor but the unemployment path will be the key variable.

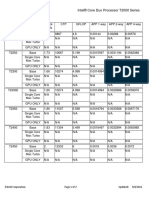

Key monthly business statistics*

Jan Feb 2013 2013 Net balance Business confidence Business conditions Trading Profitability Labour costs Purchase costs Final products prices

Mar 2013 Employment Forward orders Stocks Exports Retail prices Capacity utilisation rate

Jan Feb 2013 2013 Net balance

Mar 2013

3 1 2 -2 -3 -7 0 0 -4 -3 -6 -6 % change at quarterly rate 0.3 0.8 0.8 0.3 0.5 0.5 0.0 0.1 -0.2

-6 -3 -5 -5 -11 -5 -2 -4 0 -2 -1 0 % change at quarterly rate -0.2 0.0 -0.4 Per cent 79.4 79.9 79.9

* All data seasonally adjusted and subject to revision. Cost and prices data are monthly percentage changes expressed at a quarterly rate. Fieldwork for this survey was conducted from 22 to 28 March, covering over 400 firms across the non-farm business sector.

For more information contact: Alan Oster, Chief Economist (03) 8634 2927 Mobile 0414 444 652

Next release: 13 May 2013 (April monthly)

Embargoed until 11:30am Tuesday, 9 April 2013

Analysis

Business conditions fell from -3 to -7 index points in March the weakest outcome since May 2009 providing further evidence that the domestic demand environment is still challenging. The pull back in conditions in March was particularly marked in the consumer dependent sectors as well as mining, where activity has turned down sharply since mid-2012. However, activity in construction has recovered from very poor levels. While lower borrowing rates and the recent upturn in equity prices appear to be working to gradually strengthen activity in the retail, wholesale and manufacturing sectors, this survey implies that these effects may need longer to fully work through the economy, or perhaps more stimulus may be necessary for normal activity to resume (ie. more RBA rate cuts). Overall, the survey indicates little intention by business to expand operations, with capex and forward orders still weak, and capacity utilisation and demand for finance at very low levels. Business confidence improved only marginally in March up 1 to +2 index points and remained below the series long-run average level (of +5 points since 1989). While there was little variation in sentiment across most industries in March, a severe lack of confidence is persisting in mining, with the index deteriorating to -25 points. This was the weakest outcome since Feb 2009, likely reflecting concern about weaker commodity prices and the approaching end to the mining investment phase. In aggregate, the announcement of the unprecedented levy to be imposed on Cyprus bank deposits in order to secure bailout funding from the European Union and the potential consequences of such a move on other already fragile euro-zone economies appears to have caused little concern for Australian firms. There is also little evidence that political leadership uncertainty at home has shaken sentiment (most of the survey period fell after the federal government leadership ballot), though general uncertainty about the state of politics may already be factored into the belowaverage level of confidence. More broadly, confidence has held up reasonably well over recent months, possibly helped by lower interest rates and improving financial and equity markets.

Conditions deteriorate to weakest level in almost four years

Business conditions (net balance)

20

10

-10

-20

-30

-40 I II III 2010 IV I II III IV I II III IV I 2013 2011 Seasonally adjusted Conds 1990s recn 2012 Trend Conds GFC

Average of the indexes of trading conditions, profitability and employment.

Confidence steadies

Business confidence (net balance)

20

10

-10

-20

-30

-40 I II III 2010 IV I II III IV I II III IV I 2013 2011 Seasonally adjusted Conf 1990s recn 2012 Trend Conf GFC

Excluding normal seasonal changes, how do you expect the business conditions facing your industry in the next month to change?

Business conditions by industry. The weakness in overall activity in March largely reflected very poor business conditions in manufacturing (-33 points) and retail (-21), after showing recent signs of improvement. Business conditions in these industries deteriorated heavily in March due largely to poor trading conditions and profitability, despite product prices declining for both industries in the month. There has also been a clear weakening in mining conditions over the past six or so months, likely in response to lower commodity prices. In contrast, conditions strengthened modestly in construction, albeit activity is still subdued at -7 points, suggesting lower borrowing costs may be having an effect. While conditions in services finance/ business/ property, recreation & personal services and transport & utilities have clearly softened over the past year, they continue to outperform all other industries. Overall, the snap back in activity in the consumer dependent sectors and general softness elsewhere suggests the economy may require more stimulus via either monetary or fiscal policy to regain its growth momentum.

Embargoed until 11:30am Tuesday, 9 April 2013

Analysis (cont.)

Business conditions by state. Conditions deteriorated considerably in WA in March down 15 to -13 points, the weakest outcome since May 2009 possibly a sign that the weakness in mining activity is spreading to other industries, particularly mining-services industries. Elsewhere, conditions deteriorated modestly in Victoria (down 6 to -7 points), while activity was modestly better in NSW, Queensland and SA, albeit still subdued. Conditions in Tasmania have been surprisingly resilient of late, and are now stronger than in any other state; trend conditions edged up 1 point to -1 index point in March, though care should be taken when interpreting data for Tasmania due to small sample size. Business confidence by industry. Mining confidence was shattered in March, falling to -25 points its weakest reading in four years. The general shift in focus of mining companies towards cost cutting, which has led to the scaling back of capacity, coupled with the general softening in commodity prices has softened the outlook for mining activity. Mining employment conditions have also been scaled back over recent months, providing further evidence that mining investment is approaching its peak. Changes in confidence elsewhere were somewhat mixed in March; confidence improved solidly in wholesale (up 8 to -1 point), construction and recreation & personal services (both up 5 points), while it deteriorated notably in finance/ business/ property (down 7 to +4 points), more than unwinding a solid pick up in the previous month. With the exception of mining, confidence levels were fairly similar across industries, ranging from -1 point for wholesale, to +5 points for construction, with the latter industry possibly optimistic about the outlook for dwellings investment due to an improving housing market. Business confidence by state. Confidence levels were little changed across the mainland states in March. WA, Queensland and SA became a touch more optimistic in the month, while sentiment weakened a little in NSW and Victoria. The slight reduction in confidence in NSW and Victoria may in part reflect some unwinding of consumer activity, which contributes more to growth in these states than elsewhere. Confidence was broadly similar across the mainland states, ranging from -1 point in NSW to +4 points in WA. Consistent with a solid improvement in (seasonally adjusted) conditions, Tasmanian confidence also strengthened considerably in the month. In trend terms, confidence in Tasmania was unchanged at +7 points (on a small sample). The forward orders index rebounded in March up 6 points to -5 index points after recording its weakest outcome since May 2009 in the previous month. Orders strengthened across all industries in the month, with the exception of finance/ business/ property, where they were a touch weaker. The strongest improvements in orders occurred in mining, retail, manufacturing and transport & utilities. Despite the broad-based improvement in new orders in the month, not a single industry reported positive orders; orders were weakest in construction, wholesale (both -8 points), manufacturing and finance/ business/ property (both -4). Capacity utilisation was unchanged at a low 79.9% in March a level not too dissimilar to levels reported at the bottom of the GFC. Capacity utilisation was very low in manufacturing and mining where it fell heavily while it continued to hold up relatively well in recreation & personal services and finance/ business/ property. The stocks index also a good indicator of current demand improved modestly in March, though the level, at zero points, implies little change in inventories. The capital expenditure index improved slightly in March up 1 to zero points but remained below the series long-run average level of +5 points since 2002. Much of the recent moderation in the capex index reflects a softening in mining capex consistent with anecdotal evidence that mining firms are reducing capacity and scaling back projects though mining capex did spike up in March after an even bigger decline in the previous month. The capex index was highest in retail (+19), construction (+9) and mining (+8), while it was lowest in manufacturing (-9), wholesale and finance/ business/ property (both -4).

Embargoed until 11:30am Tuesday, 9 April 2013

Analysis (cont.)

Based on forward orders, the survey implies 6-monthly annualised demand growth was around 2% in Q4 2012, higher than the actual level of 0.6%. The survey predicts a similar level of growth (2%) for Q1 2013 demand growth. If we assume forward orders for March are continued into the June quarter, the survey implies 6-monthly annualised demand growth will strengthen to around 2% in Q2 2013. Similarly, based on average business conditions for Q4 2012, the survey implies 6-monthly annualised GDP growth (excluding mining) was around 2% in Q4 2012, slightly below actual growth of 2.5%, while growth is expected to pick up to 3% in Q1 2013. But if business conditions for March are continued into the June quarter, the implied growth rate would fall to around 2% in Q2 2013. Elsewhere in the survey, cash flow (not seasonally adjusted) was strongest in recreation & personal services and weakest in manufacturing. Labour costs growth (a wages bill measure) was unchanged at 0.8% in March (at a quarterly rate). When combined with a deterioration in employment conditions, this outcome implies a slight pick up in wage pressures in the month. However, the overall pace of labour costs growth remains below the series long-run average (of 1.1% since 1997), suggesting overall wages growth remains modest at best. By industry, labour costs growth was strongest in transport & utilities (1.8%; at a quarterly rate) consistent with relatively stronger employment conditions in this industry while costs growth was softest in wholesale (0.2%), manufacturing and construction (both 0.4%). Final product prices fell by 0.2% in March (at a quarterly rate). The weakness in prices is consistent with weak trading conditions in March, particularly in the retail sector, were very poor trading appears to have contributed to a 0.4% decline in retail prices. Price deflation eased modestly in mining, while inflation softened most noticeably in retail, recreation & personal services and finance/ business/ property. Growth in prices was strongest in transport & utilities (0.7% at a quarterly rate) and recreation & personal services (0.1%), while prices fell notably in mining (-0.9%), retail (-0.4%) and construction (-0.3%). Purchase cost growth was unchanged in March at 0.5% (at a quarterly rate). This outcome reflected solid increases in the cost inflation in manufacturing (up 0.9 ppts) and wholesale (up 0.4 ppts), which were broadly offset by a reduction in finance/ business/ property and retail (both down 0.5 ppts). Overall, growth in purchase costs was strongest in manufacturing (1.3%) and weakest in retail (-0.2%). The increase in costs growth combined with a fall in prices implies margins continue to be squeezed. 4

Demand growth to strengthen marginally in Q2

Forward orders (change & level) as an indicator of domestic demand (6-monthly annualised) 10 8 6 4 2 0 -2 -4 04 05 06 07 08 09 10 11 12 13

Domestic demand

Prediction from orders

GDP (ex coal) growth to weaken in mid 2013

Business conditions (change & level) as an indicator of GDP (6-monthly annualised) 8

-2 04 05 06 GDP 07 08 09 10 11 12 13

Prediction from bus conds

Labour costs growth still belowaverage, held down by weak employ.

Costs & prices (% change at a quarterly rate)

2.5 2.0 1.5 1.0 0.5 0.0 -0.5 -1.0 I II III 2010 Labour IV I II III IV I II III IV I 2013 2011 Product price 2012

Retail price

Based on respondent estimates of changes in labour costs and product. Retail prices are based on retail sector product price estimates.

Embargoed until 11:30am Tuesday, 9 April 2013

Current business conditions

The business conditions index recoiled in March down 4 to -7 index points. In trend terms, conditions were unchanged at -4 index points; at 9 points below the series average since 1997, the strength in activity implied by the survey remains lacklustre.

Trading & employment weaken. Profits unchanged but still weak.

All components of business conditions (net bal., s.a.)

20

Trading, profitability and employment

The pull back in activity in March was driven by a moderation in trading and employment conditions, while profitability was unchanged at a very poor level. The deterioration in trading conditions was broadly based across industries; the only exceptions were transport & utilities (up 20 points), where conditions rebounded sharply following a heavy decline in the previous month, and construction (up 2), where conditions are likely to have been aided by stronger investment activity in response to a slowly improving property sector. Trading conditions weakened significantly in manufacturing (down 23), retail (down 22) and mining (down 19), while conditions deteriorated modestly across all other industries.

10

-10

-20

-30

-40 I II III 2010 Trading Conds 1990s recn IV I II III IV I II III IV I 2013 Employment 2011 Profitability Conds gfc 2012

Net balance of respondents who regard last months trading / profitability / employment performance as good.

Employment conditions (in trend terms) softened modestly in transport & utilities in March (down 3 points), manufacturing, finance/ business/ property and wholesale (all down 2 points). Not a single industry reported a strengthening in trend employment conditions in March, while only one industry transport & utilities reported positive conditions (+5). In contrast, trend employment conditions were very subdued in manufacturing (-15), wholesale (-13), construction (-12) and mining (-11). The generally weak employment conditions reported here are consistent with other forward indicators and are somewhat at odds with the upward trend in official ABS employment data. While profitability was unchanged in aggregate, a couple of industries reported very heavy declines in March. Profitability weakened considerably in manufacturing (down 24 to -43 points) and retail (20 points to -33 points). The reading for manufacturing was the weakest outcome in the history of the series (since 1997), putting into perspective just how much strain manufacturers are under as a result of the still high AUD and import competition. Profitability improved solidly in mining (up 10), albeit remained subdued, and transport & utilities (up 9), while it was marginally better in finance/ business/ property. In levels terms, profitability was most subdued in manufacturing (-43), retail (-33), wholesale (-17) and mining (15), while it was strongest in transport & utilities (+7), finance/ business/ property (+4) and recreation & personal services (+3). Business conditions components (net balance)

Trading performance

15 10 5 0 -5 -10 -15 I II III 2011 IV I II III IV I 2013 Trend 2012

15 10 5 0 -5 -10 -15 I II III 2011 IV I II III IV I 2013 Trend 2012

Profitability

15 10 5 0 -5 -10 -15 I II III 2011

Employment

IV

II

III

IV

I 2013

2012

Seasonally adjusted

Seasonally adjusted

Seasonally adjusted

Trend

Net balance of respondents reporting trading performance / profitability / employment as good or very good (rather than poor or very poor).

Embargoed until 11:30am Tuesday, 9 April 2013

Current business conditions (cont.)

Wholesale: Signalling continued softness in the domestic economy?

The weakness in wholesaling that has persisted for the best part of 3 years has continued into 2013. While conditions have been volatile in recent months, trend business conditions in wholesaling remained very poor in March, at just -10 points. Based on historical relationships, wholesale conditions appear to be a reasonably good predictor of overall business conditions certainly there is strong statistical evidence of a leading relationship (Granger causality). Our analysis suggests that if wholesale conditions in March (-13) were to continue though the remainder of H1 2013, overall business conditions could be expected to remain poor (but improving), averaging just -3 index points over the next quarter. That, in turn, is suggestive of an economy still running below trend and with little upward momentum in the growth rate.

Wholesale weakness a worry

Wholesale as a leading indicator of business conditions

Net bal. Business conditions Prediction from wholesale leading indicator Net bal.

20

20

10

10

-10

-10

-20 2000 2002 2004 2006 2008 2010 2012

-20

Indicator = f(business conditions_wsl, business conditions_wsl(-1 to -4), ar(1), ar(3))

Forward orders

The forward orders index rebounded in March, after slumping to its lowest level since May 2009 in February. At -5 index points, the index remains well below the series long-run average of zero points (since 1997), providing little indication of a nearterm strengthening in domestic demand. The improvement in forward orders was broadly based, with finance/ business/ property (where orders eased slightly) the only industry to buck the trend. Orders strengthened most in mining (up 14), retail (up 13) and manufacturing (up 12). In levels terms, orders were most subdued in construction, wholesale (both -8), manufacturing and finance/ business/ property (both -4). No industry reported positive orders in March.

Net balance of respondents with more orders from customers last month.

New orders recover but still weak

Forward orders (net balance)

20

10

-10

-20

-30

-40 I II III 2010 IV I II III IV I II III IV I 2013 2011 Seasonally adjusted Orders 1990s recn 2012 Trend Orders GFC

Capacity utilisation

In March, capacity utilisation was unchanged at 79.9% below the series long-run average of 81.1% since 1997. Capacity utilisation fell very sharply in mining (down 4.3 ppts to 75.7%), which is consistent with a sharp deterioration in employment and trading conditions in this industry, followed by retail (down 1.8 ppts) and wholesale (down 1.6 ppts), while it rose solidly in recreation & personal services (up 2.2 ppts). In levels terms, capacity utilisation was highest in recreation & personal services (83.4%) and finance/ business/ property (82.0%), and lowest in manufacturing (74.7%) and mining (75.7%) the lowest mining outcome since November 2002.

Full capacity is the maximum desirable level of output using existing capital equipment.

Capacity utilisation still very low

Capacity utilisation (per cent)

84 83 82 81 80 79 78 77 76 75 I II III 2010 IV I II III IV I II III IV I 2013 2011 Seasonally adjusted CapU 1990s recn 2012 Trend CapU GFC

Embargoed until 11:30am Tuesday, 9 April 2013

Current business conditions (cont.)

Stocks

The stocks index jumped to its highest level in six months in March, up 4 to zero points. In trend terms, the stocks index was unchanged at -2 index points, to remain 4 points below the series long-run average of +2 points (since 1997). The stocks index rose significantly in mining (up 15 to -2 points), though the negative read still implied a fall in inventories, followed by transport & utilities and manufacturing. The pick up in stocks reported by these industries may have been involuntary, given the weakness in trading transport & utilities is the exception, where trading was robust. Recreation & personal services was the only industry to report a (marginal) decline. The stocks index was highest in retail (+8) and wholesale (+7), and lowest in construction (-8).

Net balance of respondents with a rise in stocks last month

Unwinding of stocks comes to an end

Stocks (net balance)

8 6 4 2 0 -2 -4 -6 I II III 2010 IV I II III IV I II III IV I 2013 2011 Seasonally adjusted 2012 Trend

Capital expenditure

The capex index rose marginally in March up 1 to zero points. A noteworthy rise was the increase in construction capex (up 19 to +9 points), which may indicate the expectation for activity to expand in this industry as the housing market strengthens. Capital expenditure also rose considerably in retail (up 18), mining and transport & utilities (both up 10). While mining capex picked up solidly in the month, this only partly unwound a very sharp contraction in the previous month. Capital expenditure, in levels terms, was highest in retail (+19) perhaps reflecting investment in online infrastructure and construction (+9), while it was lowest in manufacturing (-9), wholesale and finance/ business/ property (both -4).

Net balance of respondents with an increase in capital expenditure last month.

Capex still low, but mining spikes up

Capital expenditure (net balance)

12 10 8 6 4 2 0 -2 -4 I II III 2011 IV I II 2012 Seasonally adjusted Trend III IV I 2013

Exports

The exports index, which represents export conditions for the economy as a whole, rose to a one year high in March up 1 to zero points but there were variations across industries. The exports index rose modestly in manufacturing and mining, while it fell moderately in construction and transport & utilities. In levels terms, the exports index was lowest in transport & utilities (-7) and manufacturing (-3), while it was highest in mining and finance/ business/ property (both +1). The exporters sales index, which represents export conditions for exporting industries, fell marginally to -3 index points.

Net balance of respondents with an increase in export sales last month.

2 1 0 -1 -2 -3 -4 -5 I

Exports improve again

Exports (net balance)

II

III 2010

IV

II

III

IV

II

III

IV

I 2013

2011 Seasonally adjusted

2012 Trend

Embargoed until 11:30am Tuesday, 9 April 2013

Current business conditions (cont.)

Credit availability

Borrowing conditions improved considerably in March, suggesting that lending institutions may be looking to provide businesses with easier access to credit in the currently soft demand environment. The net borrowing index (easier minus harder) eased to -1 point in March, up from -5 index points in February. This outcome reflected a solid reduction in the proportion of firms finding borrowing more difficult, which was partly offset by a slight fall in the proportion of firms finding credit easier to obtain. However, overall demand for credit was extremely weak, with just 22% of respondents requiring finance in March, the weakest level of credit demand ever recorded in this survey (ie. since November 2008).

In terms of the borrowings required for your business in the last month, has it been

Demand for credit falls to lowest level in (short) history, despite easier conditions

Borrowing conditions (% of firms)

100

80

60

40

20

0 IV 2011 More difficult I II 2012 Unchanged Easier III IV I 2013 No borrowing required

The variation in business conditions across industry has remained quite pronounced since late 2009, largely reflecting the relative strength of mining and service related industries compared to the weaker consumer dependant and trade based industries following the GFC. However, the range of industry conditions has narrowed notably over the past year or so. This can be observed by comparing the difference between the best performing and worst performing industries each month. While the variation in conditions across industries has narrowed more recently, it largely reflects a weakening in conditions of the previously stronger performing industries including mining, services and transport firms suggesting weakness elsewhere may be spreading.

Industry conditions converging to low levels

Monthly Business Conditions by Industry

Net balance, deviation from industry average since 1989

ppt ppt

Range of industry conditions

50 50

25

25

Average

-25 -25

-50 2000 2003 2006 2009 2012

Source: NAB

-50

Embargoed until 11:30am Tuesday, 9 April 2013

Industry sectors and states

Business confidence by industry (net balance): 3-month moving average

30 30

30

20

20

20

10

10

10

-10

-10

-10

-20 I II III 2011 Mining IV I II III IV I 2013 Constn 2012 Manuf

-20 I II III 2011 Retail IV I II III IV I 2013 Transp 2012 Wsale

-20 I II III 2011 Fin, bus, prop IV I II III IV I 2013 2012

Rec, pers

Business conditions by industry (net balance): 3-month moving average

40 30 20 10 0 -10 -20 -30 I II III 2011 Mining IV I II III IV I 2013 Constn 2012 Manuf 40 30 20 10 0 -10 -20 -30 I II III 2011 Retail IV I II III IV I 2013 Transp 2012 Wsale

40 30 20 10 0 -10 -20 -30 I II III 2011 Fin, bus, prop IV I II III IV I 2013 2012

Rec, pers

Business confidence by state (net balance): 3-month moving average

30 20 10 0 -10 -20 -30 I II III 2011 Australia IV I II III IV I 2013 VIC 2012 NSW 30 20 10 0 -10 -20 -30 I II III 2011 Australia IV I II III IV I 2013 WA 2012 QLD

30 20 10 0 -10 -20 -30 I II III 2011 Australia IV I II III IV I 2013 TAS 2012 SA

Business conditions by state (net balance): 3-month moving average

20 10 0 -10 -20 -30 -40 I II III 2011 Australia IV I II III IV I 2013 VIC 2012 NSW 20 10 0 -10 -20 -30 -40 I II III 2011 Australia IV I II III IV I 2013 WA 2012 QLD

20 10 0 -10 -20 -30 -40 I II III 2011 Australia IV I II III IV I 2013 TAS 2012 SA

Macroeconomic, Industry & Markets Research

Australia Alan Oster Jacqui Brand Rob Brooker Alexandra Knight Vyanne Lai Dean Pearson Gerard Burg Robert De Iure Brien McDonald Tom Taylor John Sharma Tony Kelly James Glenn Group Chief Economist Personal Assistant Head of Australian Economics & Commodities Economist Australia Economist Agribusiness Head of Industry Analysis Economist Industry Analysis Economist Property Economist Industry Analysis & Risk Metrics Head of International Economics Economist Sovereign Risk Economist International Economist Asia +(61 3) 8634 2927 +(61 3) 8634 2181 +(61 3) 8634 1663 +(61 3) 9208 8035 +(61 3) 8634 0198 +(61 3) 8634 2331 +(61 3) 8634 2788 +(61 3) 8634 4611 +(61 3) 8634 3837 +(61 3) 8634 1883 +(61 3) 8634 4514 +(61 3) 9208 5049 +(61 3) 9208 8129

Global Markets Research - Wholesale Banking Peter Jolly Global Head of Research Robert Henderson Chief Economist Markets - Australia Spiros Papadopoulos Senior Economist Markets David de Garis Senior Economist Markets New Zealand Tony Alexander Stephen Toplis Craig Ebert Doug Steel London Nick Parsons Tom Vosa Gavin Friend Chief Economist BNZ Head of Research, NZ Senior Economist, NZ Markets Economist, NZ Head of Research, UK/Europe & Global Head of FX Strategy Head of Market Economics UK/Europe Markets Strategist UK/Europe Foreign Exchange +800 9295 1100 +800 842 3301 +800 64 642 222 +800 747 4615 +1 800 125 602 +(65) 338 0019

+(61 2) 9237 1406 +(61 2) 9237 1836 +(61 3) 8641 0978 +(61 3) 8641 3045 +(64 4)474 6744 +(64 4) 474 6905 +(64 4) 474 6799 +(64 4) 474 6923 +(44 20) 7710 2993 +(44 20) 7710 1573 +(44 20) 7710 2155 Fixed Interest/Derivatives +(61 2) 9295 1166 +(61 3) 9277 3321 +800 64 644 464 +(44 20) 7796 4761 +1877 377 5480 +(65) 338 1789

Sydney Melbourne Wellington London New York Singapore

DISCLAIMER: [While care has been taken in preparing this material,] National Australia Bank Limited (ABN 12 004 044 937) does not warrant or represent that the information, recommendations, opinions or conclusions contained in this document (Information) are accurate, reliable, complete or current. The Information has been prepared for dissemination to professional investors for information purposes only and any statements as to past performance do not represent future performance. The Information does not purport to contain all matters relevant to any particular investment or financial instrument and all statements as to future matters are not guaranteed to be accurate. In all cases, anyone proposing to rely on or use the Information should independently verify and check the accuracy, completeness, reliability and suitability of the Information and should obtain independent and specific advice from appropriate professionals or experts. To the extent permissible by law, the National shall not be liable for any errors, omissions, defects or misrepresentations in the Information or for any loss or damage suffered by persons who use or rely on such Information (including by reasons of negligence, negligent misstatement or otherwise). If any law prohibits the exclusion of such liability, the National limits its liability to the re-supply of the Information, provided that such limitation is permitted by law and is fair and reasonable. The National, its affiliates and employees may hold a position or act as a price maker in the financial instruments of any issuer discussed within this document or act as an underwriter, placement agent, adviser or lender to such issuer. UK DISCLAIMER: If this document is distributed in the United Kingdom, such distribution is by National Australia Bank Limited, 88 Wood Street, London EC2V 7QQ. Registered in England BR1924. Head Office: 800 Bourke Street, Docklands, Victoria, 3008. Incorporated with limited liability in the State of Victoria, Australia. Authorised and regulated in the UK by the Financial Services Authority. U.S DISCLAIMER: If this document is distributed in the United States, such distribution is by nabSecurities, LLC. This document is not intended as an offer or solicitation for the purchase or sale of any securities, financial instrument or product or to provide financial services. It is not the intention of nabSecurities to create legal relations on the basis of information provided herein. NEW ZEALAND DISCLAIMER: This publication has been provided for general information only. Although every effort has been made to ensure this publication is accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. To the extent that any information or recommendations in this publication constitute financial advice, they do not take into account any persons particular financial situation or goals. Bank of New Zealand strongly recommends readers seek independent legal/financial advice prior to acting in relation to any of the matters discussed in this publication. Neither Bank of New Zealand nor any person involved in this publication accepts any liability for any loss or damage whatsoever may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication. National Australia Bank Limited is not a registered bank in New Zealand. JAPAN DISCLAIMER: National Australia Bank Ltd. has no license of securities-related business in Japan. Therefore, this document is only for your information purpose and is not intended as an offer or solicitation for the purchase or sale of the securities described herein or for any other action.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Architecture and Interior DesignДокумент58 страницArchitecture and Interior DesignEconomic Policy Research CenterОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Research Paper Final Presentation1Документ19 страницResearch Paper Final Presentation1Satyendra DhakreОценок пока нет

- SD GTS Integration: Community WIKI SAP CommunityДокумент5 страницSD GTS Integration: Community WIKI SAP CommunitySUDHIRОценок пока нет

- Special Duties & Trade RemediesДокумент21 страницаSpecial Duties & Trade RemediesAlyanna JoyceОценок пока нет

- Pmi May13 FinalДокумент2 страницыPmi May13 FinalBelinda WinkelmanОценок пока нет

- Consumer Expectations: Inflation & Unemployment Expectation Chart PackДокумент24 страницыConsumer Expectations: Inflation & Unemployment Expectation Chart PackBelinda WinkelmanОценок пока нет

- HockeyДокумент12 страницHockeyBelinda WinkelmanОценок пока нет

- View Press ReleaseДокумент3 страницыView Press ReleaseDavid4564654Оценок пока нет

- Key Points: Trend Summary Seasonally Adjusted SummaryДокумент10 страницKey Points: Trend Summary Seasonally Adjusted SummaryBelinda WinkelmanОценок пока нет

- Westpac Budget Report 2013Документ16 страницWestpac Budget Report 2013Belinda WinkelmanОценок пока нет

- Er 20130513 Bull Phat DragonДокумент3 страницыEr 20130513 Bull Phat DragonBelinda WinkelmanОценок пока нет

- Er 20130507 Bull Phat DragonДокумент3 страницыEr 20130507 Bull Phat DragonBelinda WinkelmanОценок пока нет

- ANZ Commodity Daily 819 080513Документ5 страницANZ Commodity Daily 819 080513Belinda WinkelmanОценок пока нет

- Er 20130509 Bull Budget Preview 2013Документ5 страницEr 20130509 Bull Budget Preview 2013Belinda WinkelmanОценок пока нет

- Anz Research: Global Economics & StrategyДокумент14 страницAnz Research: Global Economics & StrategyBelinda WinkelmanОценок пока нет

- Final Pci April ReportДокумент2 страницыFinal Pci April ReportBelinda WinkelmanОценок пока нет

- Psi Final Report April 13Документ2 страницыPsi Final Report April 13Belinda WinkelmanОценок пока нет

- The RBA Observer - A Close Call, But We Still Expect Them To HoldДокумент6 страницThe RBA Observer - A Close Call, But We Still Expect Them To HoldBelinda WinkelmanОценок пока нет

- Anz Research: Global Economics & StrategyДокумент14 страницAnz Research: Global Economics & StrategyBelinda WinkelmanОценок пока нет

- Logistics Assignment 2.0Документ6 страницLogistics Assignment 2.0yonelaОценок пока нет

- Intel® Core Duo Processor T2000 Series: ©intel Corporation Page 1 of 2 9/8/2011 UpdatedДокумент2 страницыIntel® Core Duo Processor T2000 Series: ©intel Corporation Page 1 of 2 9/8/2011 UpdatedeuricoОценок пока нет

- Codel Assignment Cover 2020 Academic Year: Studentnumber - Modulecode - AssignmentnumberДокумент10 страницCodel Assignment Cover 2020 Academic Year: Studentnumber - Modulecode - AssignmentnumberLavinia Naita EeluОценок пока нет

- Economic Development Strategies of South KoreaДокумент47 страницEconomic Development Strategies of South KoreaZhibek AkmatovaОценок пока нет

- Market Entry StrategyДокумент13 страницMarket Entry StrategygauravpdalviОценок пока нет

- TCQTTTДокумент32 страницыTCQTTTdohongvinh40Оценок пока нет

- Intermediaries in LogisticsДокумент29 страницIntermediaries in LogisticsKoushik KoushiОценок пока нет

- Registration Form For Public Buyer - ForeignДокумент2 страницыRegistration Form For Public Buyer - ForeignJosé FernándezОценок пока нет

- Ecuadorian Cocoa Export AnalysisДокумент31 страницаEcuadorian Cocoa Export AnalysisKarla MataОценок пока нет

- WilsonДокумент12 страницWilsonedwineghwilsonОценок пока нет

- AfCFTAДокумент2 страницыAfCFTAeltonОценок пока нет

- JCBДокумент3 страницыJCBNhi NguyễnОценок пока нет

- IFM SyllabusДокумент17 страницIFM Syllabussagarzawar1Оценок пока нет

- State Control Over Import and Export of GoodsДокумент5 страницState Control Over Import and Export of GoodsSumit DashОценок пока нет

- 11 Business Studies Notes Ch01 Nature and Purpose of Business 02Документ10 страниц11 Business Studies Notes Ch01 Nature and Purpose of Business 02gmohit49Оценок пока нет

- The Star TunaДокумент2 страницыThe Star TunaCarlos BarunaОценок пока нет

- Chapter 3 - Gains From TradeДокумент20 страницChapter 3 - Gains From TradeShaikh imran RazeenОценок пока нет

- Chapter 12 - International Trade Practices and PoliciesДокумент24 страницыChapter 12 - International Trade Practices and PoliciesChelsea Anne VidalloОценок пока нет

- Gul Ahmed ReportДокумент40 страницGul Ahmed ReportKhizra AmirОценок пока нет

- Product CertificationДокумент9 страницProduct CertificationclementiОценок пока нет

- Kapoor Industries Limited-R-05062020 PDFДокумент8 страницKapoor Industries Limited-R-05062020 PDFMukesh TodiОценок пока нет

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledДокумент4 страницыBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledALEXANDRIA RABANESОценок пока нет

- Neo-Liberal Globalization in The Philippines: Its Impact On Filipino Women and Their Forms of ResistanceДокумент27 страницNeo-Liberal Globalization in The Philippines: Its Impact On Filipino Women and Their Forms of Resistancekyel.munozОценок пока нет

- Valuation of Goods Under Customs Law: Dr. Ram Manohar Lohiya National Law University LucknowДокумент18 страницValuation of Goods Under Customs Law: Dr. Ram Manohar Lohiya National Law University LucknowAbhay RajputОценок пока нет

- Last Golden LandДокумент42 страницыLast Golden LandHong MinhОценок пока нет

- Export Sales ManagerДокумент6 страницExport Sales ManagerNitinОценок пока нет