Академический Документы

Профессиональный Документы

Культура Документы

Commercial Market - Midtown NYC

Загружено:

AliHaidar85Авторское право

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Commercial Market - Midtown NYC

Загружено:

AliHaidar85Авторское право:

Executive Summary

Our research identified 25 advertising agencies currently operating in Manhattan with the most prominent names located in the Midtown area (Leo Burnett, Impact BBDO, DDB Worldwide, Omnicom and others)

Integrity & Trust

It is evident that the primary market is Midtown East, specifically on Park/Madison Avenue due to accessibility to the area and proximity to major financial institutions. Average rents are at $70/SF/Yr with vacancy rates at 10% and a dominance of Class A office space.

Professional

LEASING ACTIVITY 3.9 MSF NYC UNEMPLOYMENT RATE (OCT12) 7.8 % NYC OFFICESER. JOBS 2,545,000 Y-O-Y US GDP CHANGE (Q212) 2.14% US CONS. CONF. INDEX (SEP 2) 70.3

Passion & Creativity

Client

The secondary market is Midtown West, specifically around Times Square and Penn Station. This market presents more of an accessibility challenge. Average rents are at $55/SF/Yr with vacancy rates of 6 to 7% and a mix of Class A and B office space. Space efficiency has been a major subject in 2012 where most companies have reduced their office space requirements in an effort to reduce fixed cost. The average required space is below 10,000 Sqft allowing anchor tenants to have more bargaining power over price.

Excellence

Background Information

Mauro Gabrielle LLP (MG), a well-established advertising agency based in Chicago, engaged Valhalla Global Consultants (VGC) to conduct market research in New York City in order to identify potential office space for their future expansion. MG is unfamiliar with the market and has communicated to VGC that they require between 10,000 and 15,000 square feet in Midtown.

Recommended Locations

1270 Ave. of the Americas, NY 10020 Office Building Class A 32 Stories Year built 1932 18,851 SF 52$/SF/Yr Times Square Plaza 1500 Broadway, New York, NY 10036 Office Building Class A 52 Stories Year built 1974 12,200SF 47$/SF/Yr 600 Madison Avenue, NY 10020 Office Building Class A 26 Stories Year built 1964 13,115SF 17,852SF 75$/SF/Yr 79$/SF/Yr

Neighborhood Analysis

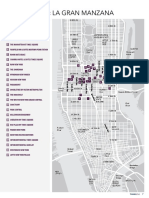

The Midtown area of Manhattan stretches from approximately 34th Street to 59th Street and from East to West across the entire island. The area is Manhattans most densely populated office property sector. It is home to some of the city's tallest and most famous buildings, such as the Empire State Building and Chrysler Building. It also contains world-famous commercial zones such as Rockefeller Center, Broadway, and Times Square. Midtown Manhattan is the busiest single commercial district in the United States and among the most intensely used pieces of real estate in the world. The majority of New York City's skyscrapers, including its tallest hotels and apartment towers, lie within Midtown. More than 700,000 commuters work in its offices, hotels, and retail establishments; the area also hosts many tourists, visiting residents, and students. Some areas, such as Times Square and Fifth Avenue, have large clusters of retail stores. Sixth Avenue in Midtown holds the headquarters of three of the four major television networks. It is also a growing center of finance, second in importance within the United States only to Downtown Manhattan's Financial District. Times Square is also the center of American theater. The economic base in NYC is financial services; however there has been a boom in technology companies and new startups. According the state media, $14.7Bn is spent on advertising with 52% in Television ads and rest split between social and online ads. Grand Central Station, Manhattan's largest transportation hub, lies directly in the heart of midtown east at 42nd st. between Lexington Ave and 3rd Ave. There are eight subway lines, and all of the metro north trains, directly connected to Grand Central. This is a major advantage for office tenants in the midtown east area because it dramatically cuts down on their commute time coming from Queens, Westchester and lower Manhattan. The west side of midtown hosts Pennsylvania Station, which is on 34th street between 7th and 8th avenues. Penn Station services six subway lines and all of the long island railroad, which is also a major asset for commercial tenants commuting to work.

Global Consultants LLC.

Manhattan Advertising Agencies

General Market Review

Midtown logged 3.90 million square feet of leasing activity during Q3 2012 which was 28% above the previous quarters 3.05 million square feet of leasing and 13% above the five-year quarterly average. Leasing activity through the first three quarters of 2012 totaled 9.61 million square feet, 27% below the 13.11 million square feet recorded during the same nine-month period in 2011. Notably, three of the top five transactions completed during the quarter were new leases, reversing the trend from the first half of the year, when leasing activity was dominated by renewal activity. The largest deal completed during Q3 2012 was Chadbourne & Parke LLPs new lease for 203,000 square feet at 1301 Avenue of the Americas in September. The next two largest deals were renewals and expansions, led by Havas Worldwides deal for 170,000 square feet at 200 Madison Avenue in August, and Mitsubishi International Corporations 117,000 square feet at 655 Third Avenue in September. Several new availabilities were brought to market during Q3 2012, including 238,000 square feet of Citibank sublease space at 666 Fifth Avenue, 226,000 square feet of direct space at 475 Fifth Avenue, 211,000 square feet of direct space at 1301 Avenue of the Americas, and 114,000 square feet of General Motors Corp. sublease space at 530 Fifth Avenue. In addition, 123,000 square feet of direct space at 101 Park Avenue, already on the market, fell within 12 months of tenant possession during the quarter, impacting availability statistics. Above-average leasing activity offset the quarters new availabilities, resulting in 110,000 square feet of positive absorption in Q3 2012. However, year to date absorption levels, at negative 2.36 million square feet, remained deep in negative territory. By comparison, Midtown experienced 630,000 square feet of positive absorption through the first nine months of 2011. Midtowns overall availability rate remained unchanged from the previous quarter at 12.0%. The sublease availability rate, at 2.8%, also remained unchanged. Pricing remained stable during the quarter, with the overall average asking rent inching upward by $0.55, or 1%, to $65.11 per square foot. The slight increase was largely due to the leasing of lower-priced space. The average asking rent for direct space increased by $0.28 to $67.54 per square feet, while the sublease average rose by $1.22 to $54.62 per square feet.

Hot Topics

Q3 2012 leasing activity was 28% above the previous quarters level and 13% above Midtowns five-year quarterly average. New leases have been signed during the last quarter suggesting new businesses and comers to the market and an expansion in business. Above-average leasing activity offset new availabilities, resulting in positive net absorption for the quarter. Midtowns average asking rent remained stable, inching up by 1% during the quarter. The overall availability rate and the sublease availability rate remained stable.

Asking Rents

The overall average asking rent remained stable during Q3 2012, inching upward by 1%, to $65.11 per sq. ft. The slight increase was largely due to the leasing of lower-priced space. The average asking rent for direct space increased by $0.28 to $67.54 per square foot. At $96.50 per square foot, The Plaza remained Midtowns most expensive segment, while Penn Station, at $45.65 per square foot, and Times Square South, at $44.68, were the least expensive.

Quick Stats

Contact Information

Valhalla Global Consultants LLC 280 Park Avenue, 44th Floor New York, 10010 NY, USA Chris Doscas & Ali Haidar Research Department +1(516) 382-5057 +1(347) 348-2346 cd@valhalla.com ah@valhalla.com

Source: CBRE 2012

Global Consultants LLC.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Nyc ZonesДокумент2 страницыNyc ZonesSean Ennis60% (5)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Realestate Management Companies NYCДокумент25 страницRealestate Management Companies NYCclaireqfwОценок пока нет

- Financial Model - 225 East 13th Street, New YorkДокумент13 страницFinancial Model - 225 East 13th Street, New YorkAliHaidar85100% (2)

- Proposed Gowanus Development - Brooklyn NYДокумент33 страницыProposed Gowanus Development - Brooklyn NYAliHaidar85Оценок пока нет

- Boston Properties (BXP) - Credit ReportДокумент5 страницBoston Properties (BXP) - Credit ReportAliHaidar85Оценок пока нет

- Boston Properties (BXP) - Investment AnalysisДокумент5 страницBoston Properties (BXP) - Investment AnalysisAliHaidar85Оценок пока нет

- Manhattan Americas MarketBeat Office Q32017Документ4 страницыManhattan Americas MarketBeat Office Q32017Josef SzendeОценок пока нет

- IN New York Media Kit - 9.18.17Документ10 страницIN New York Media Kit - 9.18.17MVP_NYОценок пока нет

- REBNY Retail Report Spring09Документ11 страницREBNY Retail Report Spring09danarubinsteinОценок пока нет

- The Observer's Luxury RentalsДокумент11 страницThe Observer's Luxury RentalsJesse CostelloОценок пока нет

- Manhattan Monthly Snapshot - Oct 2021Документ2 страницыManhattan Monthly Snapshot - Oct 2021Kevin ParkerОценок пока нет

- 1CO1800A0911Документ1 страница1CO1800A0911NewYorkObserverОценок пока нет

- For Immediate Release (4 Pages) Contact: Monday July 8, 2013 James Delmonte (212) 729-6973 EmailДокумент4 страницыFor Immediate Release (4 Pages) Contact: Monday July 8, 2013 James Delmonte (212) 729-6973 EmailAnonymous Feglbx5Оценок пока нет

- The Rental Report: Real LifeДокумент4 страницыThe Rental Report: Real LifebawssenterprisesОценок пока нет

- Mid-Year 2019 Brooklyn Office Market Report PDFДокумент4 страницыMid-Year 2019 Brooklyn Office Market Report PDFAnonymous 9FiuKvWq8qОценок пока нет

- Municipal Art Society Report: A Bold Vision For The Future in East MidtownДокумент65 страницMunicipal Art Society Report: A Bold Vision For The Future in East MidtownThe Municipal Art Society of New York100% (1)

- Citi Habitats 10-Year Rental Report 2007-2016 FINALДокумент17 страницCiti Habitats 10-Year Rental Report 2007-2016 FINALcrainsnewyorkОценок пока нет

- Brooklyn Map Media KitДокумент6 страницBrooklyn Map Media KitMVP_NYОценок пока нет

- Nueva York:: La Gran ManzanaДокумент77 страницNueva York:: La Gran Manzanayaqueline Baez S.Оценок пока нет

- Midtown Streetscape Final Master PlanДокумент54 страницыMidtown Streetscape Final Master PlanjedweeksОценок пока нет

- Walmart MidtownДокумент51 страницаWalmart MidtownNone None NoneОценок пока нет

- Complete POWER 100 List 2011Документ63 страницыComplete POWER 100 List 2011NewYorkObserverОценок пока нет

- Commercial Power 2013Документ103 страницыCommercial Power 2013NewYorkObserverОценок пока нет

- tripadvisor ru 21 01 11 21 05 result 11916 База от белорусовДокумент1 390 страницtripadvisor ru 21 01 11 21 05 result 11916 База от белорусовАнна ПилюгаОценок пока нет