Академический Документы

Профессиональный Документы

Культура Документы

Top 50 EMS 2011

Загружено:

Lina GanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Top 50 EMS 2011

Загружено:

Lina GanАвторское право:

Доступные форматы

PRINTED CIRCUIT DESIGN & FAB / CIRCUITS ASSEMBLY APRIL 2012 50

EMS TOP 50

+DUG/(66216/($51('

A March earthquake. September floods. Social unrest.

Throughout 2011, upheaval was in the air. by MIKE BUETOW

Acquisitions, bankruptcies and Mother Nature were the

name of the game in 2011, as topsy-turvy market condi-

tions coupled with inexplicable environmental disasters and

unprecedented social backlash led to what were in some cases

previously inconceivable opportunities.

In what will remain a year for the books, an earthquake and

subsequent tsunami hit northeastern Japan, wiping out scores

of manufacturing plants and other business, and leaving painful

images of the dead. But in what turned out to be Japans finest

hour, the nation recovered quickly, with most multinational

business back to normal within two quarters. Thailand wasnt

so fortunate. Plants there took such a drubbing that it could be

a year before they are usable again. Worse, the repeat disasters

had decision-makers rethinking their supply-chain plans.

Had it not been for the weather, the story of the year would

have been Elcoteq. Once a top 5 EMS company, the onetime

main supplier to Nokia found the competition from Foxconn

too much to overcome. It saw sales and profits spiral down

over a five-year span, then finally declared bankruptcy last fall,

shuttering or selling all but four of its 13 manufacturing sites.

Watching, and perhaps

learning from, Elcoteqs

mistakes, No. 2 Flextronics

bailed from the price-sensi-

tive PC assembly space in

2011. Having just formally

entered the PC production

business in 2008, Flextron-

ics quickly grew that seg-

ment to $4 billion in annual

revenue, only to see margin

erosion threaten to wipe

out the companys profits.

Competing in a commodity

space works only for the

largest player, it seems.

Speaking of the larg-

est player, Foxconn (who

else?) in 2011 continued

its long reign at the top of

the pile. It seems hard to imagine, but 10 years ago, Foxconn

trailed Flextronics, Solectron, Sanmina-SCI and Celestica in

annual revenues. Still, cracks in its formidable armor began to

show. Dinged by government-mandated wage hikes, Foxconn

has moved much of its reportedly 800,000-man workforce

inland, leaving its Shenzhen campus to Apple (more on that

in a moment). Worldwide social pressures shone an uncom-

fortable spotlight on Foxconn, where a blitzkrieg of worker

suicides, plant explosions, inflammatory statements (and, per-

haps, just a little bit of Apple fatigue) put the firm squarely in

the crosshairs of the mainstream media, not to mention several

workers rights NGOs. In response, Foxconn intimated plans

to automate a number of its operations with robots.

Upheaval. An army of robots would have made no difference

in Thailand, which was turned upside down when fall floods

like none seen in the country in 50 years soaked the nation

for the better part of two months. No EMS company was

decimated more than Fabrinet, No. 19 on the 2010 list and

headed for an even higher ranking. High waters breached two

of its facilities, rendering one permanently closed and taking

the other offline for months. Others that felt the impact in

Thailand included No. 6 Cal-Comp, No. 7 Benchmark, No. 42

Hana Microelectronics and No. 47 SVI Public Co.

No. 14 Beyonics also was hit hard by the Thailand

floods. Having seen sales fall about 15% over the past two

years, and in the midst of five straight unprofitable quarters,

the Singapore-based firm in October announced plans to go

private. (The company should know something about going

private; its founders came from Flextronics, which did the

same thing in 1987 before relisting in 1991.)

In the aftermath of Japan and Thailand, certain OEMs and

EMS companies are rethinking their supply chains. No. 3 Jabil

already has made clear it wants to navigate away from the all-in-

one industrial parks where suppliers sit almost on top of each

other so characteristic of the Pacific Rim. Moreover, as com-

panies become more aware of time-to-market and the amounts

of capital tied up in product in transit from distant lands, a trend

is emerging toward positioning production closer to the point of

end-use, a phenomenon known in the US as reshoring. Social

1 USD

= 0.762613 euros

= 0.63738 British pound

= 6.56100 Chinese RMB

= 7.75637 Hong Kong dollars

= 222.241 Hungarian forint

= 82.4575 Japanese yen

= 3.01050 Malaysian ringgits

= 5.59383 Norwegian kroners

= 1.25386 Singaporean dollars

= 6.79566 Swedish kronors

= 29.51 Taiwanese dollars

= 30.557 Thai baht

TABLE 1. Currency Conversions

51 APRIL 2012 PRINTED CIRCUIT DESIGN & FAB / CIRCUITS ASSEMBLY

pressures, accented by the long and loud protests over alleged

worker exploitation that have landed Foxconn (and its leading

customer, Apple) on the front page of The Wall Street Journal

for all the wrong reasons, are also leading assemblers to contem-

plate not just higher but politically safer ground.

As usual, major mergers and acquisitions changed the

face of the Top 50 list. No. 21 OnCore Manufacturing, a

major defense and aerospace supplier, acquired Victron in

what was essentially a merger of financial equals. No. 31

Ducommun made the biggest splash in its 157-year history,

acquiring LaBarge in June to form a defense electronics pow-

erhouse. No. 16 AsteelFlash bought Catalyst EMS. (Just after

the year ended, No. 8 Plexus announced a deal to acquire

Kontron Design Manufacturing Services in Penang.)

Falling off the list was EPIQ, which sold a total of five plants

in Bulgaria, Czech Republic and Mexico to No. 25 Integrated

Microelectronics Inc. Also departing was Surface Mount Tech-

nology Holdings (No. 45 in 2010), the Hong Kong-based EMS

firm that endured a painful reorganization in 2011. Revenue

plunged 38% year-over-year to about $177.6 million. Suffering

a similar fate is former Top 50 mainstay Simclar, which has seen

sales fall from a high of $400 million in 2006.

Joining the list were several large flex circuit companies

whose EMS revenues were previously not properly accounted

for. Most flex PCB fabricators also perform assembly, and it is

difficult to get an accurate reading of the value of the bare board

from the finished assembly. However, based on data from IPC

and others, bare flex circuits comprise roughly 40% of the ship-

ment value. Based on such estimates, No. 12 Nippon Mektron

(which has at least 11 plants that perform SMT assembly) and

No. 28 MFLEX are now represented in the Top 50.

Whither Kaifa? Not making the list: Sichuan Changhong Elec-

tric, a huge Chinese entity (35,000 employees) that makes TVs,

white goods and other components. While it builds product

for several brand name Japanese OEMs, it was impossible to

determine just what its EMS/ODM sales were in 2011. Same

goes for Aeroflex. We also left off ODMs such as Qisda, Com-

pal, Wistron, BenQ, and others that are essentially OEMs.

Should Shenzhen Kaifa Technology be included in EMS

rankings? Its not an easy question to answer. On revenue

alone, perhaps: Kaifa, as the company is known, had sales of

over $4 billion last year. Using that gross number would place

it squarely between Sanmina-SCI and Cal-Comp in the Top 10.

But theres more to it than that. Kaifa generates an

extraordinary amount of its revenue from making and selling

hard disk drives to Seagate. In fact, under most classifica-

tions, Kaifa would rank as an ODM, and not just of printed

circuit board assemblies.

Then theres the confusion of what, exactly, Kaifa is. The

company, which is supposedly traded under the ticker symbol

00021 on the Shenzhen Exchange, has no current listing. How-

ever, it is also apparently a subsidiary of China Electronics Corp.

CEC is giant. The conglomerate says its annual revenues

topped $8 billion back in 2006, and it employs more than

70,000 workers across some 61 subsidiaries, including 13

listed holding companies. Among them are cellphone and

datacom OEM Panda Electronics, computer and TV manu-

facturer Greatwall Technology, and yes, Kaifa.

It also is state-owned, and operates directly under the

Protect Your Printed Board

from Humidity Problems

#1 SM1 DESICCAA1 DRY BOX IA

1APAA AAD U.S.!

AEW COMPE1I1IJE PRICIAC!

Conforms to PC - 1601

MC-1001/MC-1002

PCB Low Humidity 8torage Cabinet

Low-Cost, High-Performance

MC-1002

Test Conditions

Pretreatment:

24-hour bake at 125C

1 Component stored in ambient

enviornment(30 degrees C,

85%RH) for 25 hours.

2 After process (1), the component is

stored in McDry cabinet(5%RH) for

150 hours.

3 Stored in McDry cabinet(5%RH)

after baking.

www.mcdry.us

USA Agent: SEIKA MACHINERY, INC

3528 Torrance Blvd. Suite 100, Torrance, CA 90503

Phone: 310-540-7310 Fax: 310-540-7930

Email: info@seikausa.com

www.mcdry.eu

Europe Agent: SEIKA SANGYO GMBH

Heltorfer Strae 16, D-40472 Dsseldorf

Phone: 0211-4158-0 Fax: 0211-4791428

Email: info@seika-germany.com

MC-1001

PBGA Carrier Board

Dehumidihcation Data

0.4

0.5

0.6

0.3

0.2

0.1

25

25 0 50 75 100 125 150

0

0

Humidifi

cation

Baking

N

a

t

u

r

a

I

m

o

i

s

t

u

r

e

a

b

s

o

r

p

t

i

o

n

C

o

e

f

f

i

c

e

n

t

o

f

m

o

i

s

t

u

r

e

a

b

s

o

r

p

t

i

o

n

(

W

e

i

g

h

t

%

)

0

.

4

2

EIapsed time(hr)

24h

DeIamination range

Safety range

Dehumidification

PRINTED CIRCUIT DESIGN & FAB / CIRCUITS ASSEMBLY APRIL 2012 52

EMS TOP 50

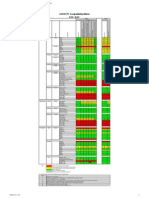

RANK COMPANY NATIONALITY 2011 REVENUES (US$M) URL NOTES

1 Foxconn Electronics

1,2

Taiwan $93,100 foxconn.com NGO backlash takes shine off iPad maker

2 Flextronics

1,3

US $27,450 flextronics.com Exits ODM PC biz, reducing consumer exposure

3 Jabil Circuit

1

US $16,760 jabil.com Biting off more of Apple

4 Celestica

1

Canada $7,210 celestica.com Quietly demonstrating technical and financial excellence

5 Sanmina-SCI

1,4

US $6,040 sanmina-sci.com Two straight growth years

6 Cal-Comp Electronics/Kinpo Electronics

1,5

Thailand $4,469 calcomp.co.th Elbowing into N. America

7 Benchmark Electronics

1

US $2,300 bench.com Thailand floods proved finest hour

8 Plexus

1

US $2,195 plexus.com Coke eases networking volatility

9 SIIX

1

Japan $2,035 siix.co.jp Partnering in US; expanding in Indonesia

10 Universal Scientific Industrial Co. (USI)

1

Taiwan $1,953 usi.com.tw Now owned by ASE

11 Venture Corp.

1,5

Singapore $1,940 venture.com.sg Took a 9% sales hit in 2011

12 Nippon Mektron

1

Japan $1,390 mektron.co.jp 11 flex circuit plants worldwide

13 Zollner Elektronik Germany 1,255

E

zollner.de Expanding in style in US

14 Beyonics Technology

1,5

Singapore $929.1 beyonics.com Being taken private

15 UMC Electronics Japan $840

E

umc.co.jp Will be Japan's third billion dollar EMS

16 AsteelFlash Group France $780 asteelflash.com Acquisitions, not market, will drive 2012 growth

17 Global Brands Manufacture

1

Taiwan $690.8 gbm.com.tw Also a top 10 bare board fabricator

18 Fabrinet

1

US $668.1 fabrinet.com Bangkok flooding washed out profit streak

19 Kimball Electronics Group

1

US $653.9 kimball.com Feeling pinch from medical, industrial drops

20 Sumitronics Japan $650

E

sumitronics.co.jp Sumitomo subsidiary

21 On Core Manufacturing US $640

E

oncorems.com Victron deal doubled its size

22 Nam Tai Electronics

1

China $602.3 namtai.com Gov't delaying China expansion

23 Elcoteq

1,6

Luxembourg $600

E

elcoteq.com Total collapse

24 Creation Technologies Canada $547 creationtech.com Has never closed a facility

25 Integrated Microelectronics Inc. (IMI)

1,7

Philippines $501.5 imiphil.com Acquisitions boosting growth

26 3CEMS Group (FIC Group) China $500 3cems.com Lite-On's biggest supplier

27 Enics Switzerland $499.4 enics.com Expanding in Suzhou

28 MFLEX US $497.8 mflex.com Apple in their eye

29 Eolane France $476 eolane.com Picked up Elcoteq Tallin

30 Di-Nikko Engineering

1

Japan $466.6 dne.co.jp Expanding in Japan

31 Ducommun LaBarge

1

US $452.3

E

labarge.com Estimates $80M from LaBarge in Q2

32 Videoton Holding

1

Hungary $450 videoton.hu Pride of Eastern Europe is big in automotive

33 VTech Communications

1

Hong Kong $419.6 vtechems.com EMS division supplanting phone biz

34 Wong's Electronics/WKK Technology

1

Hong Kong $380 wongswec.com Solid year in China

35 Neways Electronics

1

the Netherlands $372.2 neways.nl Upgrading SMT lines and test capabilities

36 Topscom Precision Industry Hong Kong $350

E

topscom.com.cn Networking EMS; hard to pin down numbers

37 V.S. Industry

1

Malaysia $353.2 vs-i.com Under the radar, but customers everywhere

38 Alco Electronics

1,5

Hong Kong $342.5 alco.com.hk Heavily vested in Blu-ray

39 Selcom Italy $316.4

E

selcomgroup.com Will Italy's dive bring it down too?

40 PartnerTech

1

Sweden $328.5 partnertech.se Q4 rescued year

41 Computime Ltd.

1,5

Hong Kong $321.1 computime.com White goods maker

42 Hana Microelectronics

1

Thailand $320.1 hanagroup.com EMS now 60% of sales; also IC assembly/test

43 CTS Electronics Manufacturing Solutions

1

US $308.7 ctscorp.com Fires in Scotland, floods in Thailand

44 Kitron

1

Norway $296.1 kitron.com Slow Q3 couldn't derail Kitron

45 Key Tronic EMS US $283.7 keytronic.com 31 straight quarters of profitability

46 SRI Radio Systems Germany $283 sri.de Former Siemens unit spun off in 1997

47 SVI Public Co. Thailand $278.3 svi.co.th Floods marred rebound

48 Scanfil

1

Finland $276.3 scanfil.fi Went public Jan. 1, 2012

49 MC Assembly US $258

E

mcati.com Forecast 20-25% growth in 2012

50 Fittec International

1

Hong Kong $233.9 fittec.com.hk Loss of Toshiba biz brutal

Notes:

E = Estimate.

1. Publicly held.

2. Includes ODM work; excludes $1.3 billion in PWB sales

3. Includes ODM work; excludes $2 billion in PWB/component sales

4. Excludes $400M in PWB sales

5. Based on four quarters ended Sept. 31

6. H1 $487.2M, rest estimated

7. Excludes $74M from PSI Technologies

TABLE 2. The CIRCUITS ASSEMBLY Top 50 EMS Companies, 2011

53 APRIL 2012 PRINTED CIRCUIT DESIGN & FAB / CIRCUITS ASSEMBLY

administration of Chinas central government. Forget, for the

moment, how strange it is for what is essentially a government

entity to be publicly traded. Consider instead whether a gov-

ernment business can be considered a contract manufacturer,

especially in China, where the Communist Party still holds

sway over most economic policy and can pick the winners and

losers at the drop of a hat. Want to get a government contract?

Use a government provider. It becomes hard to distinguish

between what is competitive bidding and what is political.

Then theres the matter of CECs financials. They are

dense, to be sure. Its hard to tell what revenue comes from

external customers and what is just padding from its own

pyramid. Among those that can be discerned, Greatwall

alone made up $1.6 billion in revenue in 2010. Read the fine

print and youll see the company has several deals in place

to buy components and services from other CEC subsidiaries.

So should Kaifa be listed on the CIRCUITS ASSEMBLY Top 50?

Because it is next to impossible to know what its true revenue

from EMS-related activities is, we say no, while respecting

the decision of others to disagree.

EMS is a lopsided business. The CIRCUITS ASSEMBLY Top 50

make up about 87% of the total revenues of the entire elec-

tronics outsourcing industry, although that figure admittedly

includes a fair percentage of revenue that would properly be

classified as ODM work. The industry as a whole reached about

$205 billion in sales last year, according to IHS iSuppli. (The

research firm predicts industry revenue to be flat in 2012.)

The US continues to dominate the Top 10 list, with five of

the top eight entries, although we are seeing some minor shifts

take place (TABLE 3). Regionally, the Top 50 remain intact, led by

Southeast Asia (16 entries), North America (15) and Europe (12).

Japan gained two entries,

a reflection of heretofore

unacknowledged EMS

work. Notable for its

lack of entries is Russia,

which almost certainly has

domestic firms that would

qualify, and whose elec-

tronics assembly industry

was forecast to reach $14

billion in 2010 (55% of

which was industrial or

military). While changes

in the rankings have been

most common in the mid-

dle to lower half of the list,

a few firms are threatening

to shake up the top. Given

their organic growth

and acquisition strategy,

respectively, Zollner and

AsteelFlash look like good

bets to break into the Top

10, should any of the cur-

rent leaders falter. CA

MIKE BUETOW is editor in

chief of CIRCUITS ASSEMBLY.

US 13

Hong Kong 6

Japan 5

Thailand 3

Taiwan 3

Canada 2

China 2

Singapore 2

France 2

Germany 2

Finland 1

Hungary 1

Italy 1

Luxembourg 1

Malaysia 1

Netherlands 1

Norway 1

Philippines 1

Sweden 1

Switzerland 1

TABLE 3. Top 50 Entries by Nation

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Ipc 7093Документ7 страницIpc 7093Lina Gan0% (1)

- PE Lambda 750 Technical Description and SpecificationsДокумент3 страницыPE Lambda 750 Technical Description and SpecificationsLina GanОценок пока нет

- Spectro GuideДокумент3 страницыSpectro GuideLina GanОценок пока нет

- Through Hole Via in PadДокумент1 страницаThrough Hole Via in PadLina GanОценок пока нет

- Adecco Salary Guide: SingaporeДокумент21 страницаAdecco Salary Guide: SingaporeLina GanОценок пока нет

- LED Signalling HandbookДокумент68 страницLED Signalling HandbookLina GanОценок пока нет

- Top 104 PCB 2011Документ3 страницыTop 104 PCB 2011Lina GanОценок пока нет

- Electronic Documents: What Lies Ahead? Liew, C.L., & Foo, S. (2001) - Proc 4Документ18 страницElectronic Documents: What Lies Ahead? Liew, C.L., & Foo, S. (2001) - Proc 4Lina GanОценок пока нет

- Top 50 EMS 2012Документ1 страницаTop 50 EMS 2012Lina GanОценок пока нет

- Pin in PasteДокумент13 страницPin in PasteLina Gan100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- ActuatorsДокумент3 страницыActuatorselavarasanОценок пока нет

- Load-Sensing Control Block in Sandwich Plate Design SB23-EHS1Документ32 страницыLoad-Sensing Control Block in Sandwich Plate Design SB23-EHS1ВладиславГолышев100% (1)

- Itu-T: Timing Characteristics of Primary Reference ClocksДокумент11 страницItu-T: Timing Characteristics of Primary Reference ClocksRodrigo AderneОценок пока нет

- GS RXF 00E E Ed1Документ20 страницGS RXF 00E E Ed1Sani PoulouОценок пока нет

- Alarm ManagementДокумент14 страницAlarm Managementant29539432100% (1)

- GB LC70 - 60le740 - 741Документ80 страницGB LC70 - 60le740 - 741Joel WilliamsОценок пока нет

- Laney Lg-35-r 30w Guitar Amplifier SchematicДокумент3 страницыLaney Lg-35-r 30w Guitar Amplifier SchematicFrank Boz100% (1)

- Are Detonator Qualification and Lot Acceptance Test Requirements Rational?Документ17 страницAre Detonator Qualification and Lot Acceptance Test Requirements Rational?מוטי טננבוםОценок пока нет

- Techrite Fenwal Fenwal 17000 & 18000 Series Thermoswitch Temperature Controllers 2013050684Документ8 страницTechrite Fenwal Fenwal 17000 & 18000 Series Thermoswitch Temperature Controllers 2013050684jesusОценок пока нет

- Debugger CortexmДокумент145 страницDebugger Cortexmcarver_uaОценок пока нет

- Smart Host Microcontroller For Optimal Battery Charging in A Solar-Powered Robotic VehicleДокумент5 страницSmart Host Microcontroller For Optimal Battery Charging in A Solar-Powered Robotic VehicleRamesh CmsОценок пока нет

- Precommissioning Check LED Signal DocumentДокумент10 страницPrecommissioning Check LED Signal DocumentVikas SrivastavОценок пока нет

- TE30 Electricity Meter Tester and Power Quality Analyzer Presentation enДокумент19 страницTE30 Electricity Meter Tester and Power Quality Analyzer Presentation enalejandroОценок пока нет

- EA SERS 495 Presentation PDFДокумент36 страницEA SERS 495 Presentation PDFAnonymous O9PMnP2FОценок пока нет

- 10 Tips For Getting More Instagram Followers PDFДокумент3 страницы10 Tips For Getting More Instagram Followers PDFSunarto DaspanОценок пока нет

- MetДокумент2 страницыMetC P RajanОценок пока нет

- DMR PrimerДокумент59 страницDMR PrimerrigolafОценок пока нет

- VLSI Job OpportunitiesДокумент3 страницыVLSI Job OpportunitiesKulbhushan ThakurОценок пока нет

- GSR9 FP1 Compatibility Matrix Bts / BSCДокумент2 страницыGSR9 FP1 Compatibility Matrix Bts / BSCuukrul98Оценок пока нет

- Service Manual: Vertical Laboratory Steam SterilizerДокумент31 страницаService Manual: Vertical Laboratory Steam Sterilizererick cardozo100% (1)

- Anti-Static and Clean-Room Equipment: Static Eliminator General CatalogueДокумент44 страницыAnti-Static and Clean-Room Equipment: Static Eliminator General Cataloguesangaji hogyОценок пока нет

- HC-12 Wireless Serial Port Communication Module User Manual: Product ApplicationДокумент10 страницHC-12 Wireless Serial Port Communication Module User Manual: Product ApplicationBakhtiar TiarОценок пока нет

- Design and Analysis of An Equal Split Wilkinson Power DividerДокумент11 страницDesign and Analysis of An Equal Split Wilkinson Power DividerLucky AliОценок пока нет

- Ultra FXДокумент17 страницUltra FXmanikumar0Оценок пока нет

- Starting Guide Frenic MegaДокумент41 страницаStarting Guide Frenic MegaMuhammad Jazztyan Indra PradanaОценок пока нет

- Principles of Semiconductor DevicesДокумент515 страницPrinciples of Semiconductor Devicestrungkiendt9100% (1)

- 15 Saip 50Документ5 страниц15 Saip 50malika_00Оценок пока нет

- 4-1 - R09 JntuhДокумент5 страниц4-1 - R09 JntuhSushil PadmanОценок пока нет

- Fox515 Technical DataДокумент2 страницыFox515 Technical DatasyedpandtОценок пока нет

- Binary To BCDДокумент10 страницBinary To BCDbobbyn7Оценок пока нет