Академический Документы

Профессиональный Документы

Культура Документы

Exploring New Oil Frontiers

Загружено:

anyak1167032Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Exploring New Oil Frontiers

Загружено:

anyak1167032Авторское право:

Доступные форматы

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

ExploringNewOilFrontiers

Source: Viscidi (2010)

A Bachelor Thesis written by Sven Wagner

Date: Summer, 2011

Client: Gateway Capital

Author: Sven Wagner

Supervisor: Prof. Dr. Mathias Binswanger

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

Contactdetails

Author:

Sven Wagner Mobile: Q41 79 522 04 43

Stebligerweg 11 Home: Q41 61 971 54 53

4450 Sissach mailto:sven.wagnerYgatewaycap.com

Client:

Gateway Capital Work: Q41 61 975 85 85

Michel Bossong mailto:mbYgatewaycap.com

Steinenberg 1

4051 Basel

Supervisor:

FHNW Work: Q41 848 821 011

Prof. Dr. Mathias Binswanger mailto:mathias.binswangerYfhnw.ch

Riggenbachstrasse 16

4600 Olten

Place/Date: Basel,19

th

August2011

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

Abstract

The first part of my paper deals with the reasons why new oil frontiers are explored and

shows the motivation that drives oil companies in new water territories. Further, it explains

the challenges international oil companies (IOCs) have to reach sustained production. Also

the outlooks of the International Energy Agency (IEA) and the International Monetary Fund

(IMF) regarding the development of the oil supply and the oil price are highlighted.

The second part shows historical exploration activities with focus on cost and reserves. It

evaluates whether or not increased capital expenditures (CAPEX) could increase world

reserve estimates in the last decade.

The last part identifies the possible future places of interest based on undiscovered

petroleum reserves. Particular focus will be given on the continent Africa where possible

countries are discussed in more detail. The Jubilee field, recent oil discovery offshore Ghana,

is analysed for production and F & D costs. Also the tax situation of Ghana is analysed and

compared to the legislation in the North Sea.

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

Declarationonhonour

I hereby declare that the work in this assignment is my own work and nothing has been

taken from sources without giving them credit in the bibliography. All references have been

clearly stated at the end of the paper and cited within the document.

I am aware that the University of Applied Sciences, Switzerland, can sanction infringements

regarding this matter.

Basle, 19th August 2011

Sven Wagner

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

Glossary

Offshore/Onshore Drilling for oil and gas can either take place on land (onshore)

or under water (offshore) whereas is the biggest difference in

the way the rig is supported. Offshore drilling is more

challenging than onshore drilling due to the harsher

environment as well as the remoteness from the logistical base.

Hydrocarbons Are organic compound consisting entirely of hydrogen and

carbon. The majority of hydrocarbons found naturally occur in

crude oil.

ReferenceScenario According to IEA the Normal Case Szenario. It takes into

account governmental action regarding limiting the emission of

CO2. Their regulations are determining the demand for fossil

energy.

Frontierbasin No oil discoveries prior to Jan 1 2000

Emergingbasin Oil discoveries made before 2000 but less than 33% of

resources have been produced.

Maturebasin Oil discoveries made before 2000 and more than 33% of

resources have been produced.

Explorationwell Wildcat well used interchangeably. A well drilled in an area

where no oil or gas production exists

Appraisalwell Additional well drilled after discovery to confirm the potential

and size of the deposit.

CAPEX Funds used to acquire or upgrade physical assets such as

buildings, property or equipment.

Liftingcost Refers to the production of oil & gas. Production costs is used

interchangeably. Calculated based on operating costs.

F&Dcost Refers to the cost of finding and developing reserves.

Calculated based on capital expenditures.

BOE Barrels of Oil Equivalent (6 MCF of Gas = 1 BOE of Oil)

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

Tableofcontent

1. Introduction.................................................................................................................. 1

2. Why are new Oil Frontiers explored?.......................................................................... 2

2.1. Change in the Global Energy Industry.......................................................................... 2

2.2. Industry sectors............................................................................................................ 3

2.3. Reserves and Resources Classification......................................................................... 3

2.4. Securing the oil supply................................................................................................. 5

2.5. Frontier Exploration..................................................................................................... 6

2.6. Reserve Replacement Ratio (RRR) .............................................................................. 7

3. Historical exploration activities and production ......................................................... 8

3.1. Costs involved in the upstream industry....................................................................... 8

3.2. Cost pressures in the upstream industry........................................................................ 9

3.3. Capital expenditures (CAPEX) in the upstream industry ............................................ 10

3.4. Historical development of Reserves ........................................................................... 11

4. Possible future places of interest ................................................................................ 13

4.1. Resource estimation Region 1 (Former Soviet Union)................................................ 14

4.2. Resource estimation Region 2 (Middle East & North Africa) ..................................... 15

4.3. Resource estimation Region 3 (Asia Pacific).............................................................. 16

4.4. Resource estimation Region 4 (Europe) ..................................................................... 17

4.5. Resource estimation Region 5 (North America) ......................................................... 17

4.5.1. Arctic frontier exploration National Petroleum Reserve in Alaska (NPRA) .......... 18

4.6. Resource estimation Region 6 (Central and South America) ...................................... 19

4.6.1. Brazil frontier exploration Identification of vast resources.................................... 19

4.6.2. Falklands frontier exploration ................................................................................. 20

4.7. Resource estimation Region 8 (South Asia) ............................................................... 20

5. Focus Africa................................................................................................................ 21

5.1. Resource estimation Region 7 (Sub Saharan Africa and Antarctica)........................... 21

5.2. Exploring new oil frontiers in Africa.......................................................................... 22

5.2.1. Ghana: The Jubilee field ......................................................................................... 22

5.2.2. Ghana: Operating Environment............................................................................... 23

5.2.3. Ghana: PSC agreement ........................................................................................... 24

5.2.4. Ghana & United Kingdom: Comparison of PSC agreement..................................... 24

5.3. The next oil frontiers in Africa................................................................................... 27

5.3.1. South Atlantic Margin (Namibia)............................................................................ 27

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

5.3.2. West African Coastal Province (Guinea-Bissau, Sierra Leone, Liberia)................... 29

5.3.3. Four West Africa Geologic Provinces ..................................................................... 30

6. Conclusion and Recommendations ............................................................................ 31

7. Bibliography ............................................................................................................... 33

Tableoffigures

Figure 1: Petroleum Resource Management System (PRMS) ................................................. 4

Figure 2: Reserve Replacement Ratio (RRR) from 2000-2006 ............................................... 7

Figure 3: Cost pressures in the upstream oil industry 1988-2006............................................ 9

Figure 4: F & D cost per boe per region from 2001 to 2006 ................................................... 9

Figure 5: Capital expenditures in the upstream industry 2000-2010.................................... 10

Figure 6: Conventional oil discoveries and production worldwide 1960-2009...................... 12

Figure 7: Global undiscovered conventional petroleum resources estimation..................... 13

Figure 8: Resource estimation Former Soviet Union ........................................................... 14

Figure 9: Resource estimation Middle East & North Africa .................................................. 15

Figure 10: Resource estimation Asia Pacific ........................................................................ 16

Figure 11: Resource estimation Europe .............................................................................. 17

Figure 12: Resource estimation North America ................................................................... 17

Figure 13: Resource estimation Central and South America ................................................ 19

Figure 14: Resource estimation South Asia ......................................................................... 20

Figure 15: Resource estimation Sub Saharan Africa and Antarctica ..................................... 21

Figure 16: Capital Expenditures Phase 1 Jubilee field Ghana................................................ 22

Figure 16: F & D and lifting cost across continents............................................................... 23

Figure 18: Profit margin in Ghana under different oil price scenarios .................................. 25

Figure 19: Profit margin in the U.K. under different oil price scenarios ................................ 26

Figure 20: Profit margin comparison Ghana and U.K. .......................................................... 26

Figure 21: Profit margin in Namibia under different cost scenarios ..................................... 28

Figure 22: Resource estimation West Coast Africa............................................................... 30

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

1

1. Introduction

In a 15-car security convoy rode Pete Landau, a local adviser of Range Resources, a small

E&P company, to view two oil blocks he later bought. He reported back to the CEO of Range

Resources that he has two choices when coming to Somalia: Either with enough security

people or alone that no attention is created. (Thompson, 2011) Despite increased political

and geological risks, oil companies are increasingly pushing towards frontier exploration. As

Andrew Fry (2011) of Goldman Sachs points out:

Investors are looking for explorers with a proven record of success going to

riskier areas. As a result, the majors are now increasing their exploration as

low-hanging fruit runs out. That means a greater risk profile generally.j

(Financial Times, 2011, p.16)

Gateway Capital, as an independent Asset Manager, located in Basle, is doing direct

investments in natural resource companies and is influenced by this shift in the oil industry.

This paper investigates if frontier exploration will be attaining greater consideration in the

future and what influence this shift could have on production and finding & development

cost of oil companies. Especially of importance is also the identification of possible future

places of interest in Africa.

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

2

2. WhyarenewOilFrontiersexplored?

2.1. ChangeintheGlobalEnergyIndustry

Since the beginning of 2000 the global energy industry is changing. Until a few years ago, the

top six companies of the worlds largest oil and gas industry, measured by market

capitalization, were ExxonMobil, BP, Shell, Total, Chevron and Eni (Xu, 2008). These are all

international oil companies (IOCs) that are fully accessible for investors on the financial

market. The latest rating of PFC shows that still five of the six are in the Top 10 of the

ranking, but only Exxon Mobil remains in the Top Three (regained the top position after

falling to second place in 2009). The rising companies, however, are the National Oil

Companies (NOCs). In 2005 less than 25% of worldwide proven oil reserves were accessible

by private international capital (PFC, 2011).

Not only are NOCs investing in their home

country also they are investing outside their boarders. The total number of NOCs with

outside subsidiaries in 2008 was 40 and the number is rising (Xu, 2008). According to the

IEA World Energy Outlook (2010) their share of production will rise to over 66% in 2035

(from currently just above 40%) shifting profits away from shareholders of IOCs.

1

Further

the strategy of NOCs of going global raises competition, because NOCs aggressively compete

with IOCs for the most prospective new oil fields. In NOCs home country, the U.S. Geological

Survey (2011) points out that IOCs are relegated to minority project partners, contractors, or

to hydrocarbon resources which require special technologies to extract. The economic value

of such reserves is only marginal (USGS 2011). The time for cheapj oil seems definitely to

be over for IOCs. With the declining available resources onshore, oil companies are forced to

move towards deep and ultra-deep water exploration and production offshore (GBI

Research, 2010).

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

3

2.2. Industrysectors

The oil & gas industry has been classified into three sub-sectors:

The upstream (also referred to Exploration and Production (E&P) sector) industry deals

with exploring, acquiring, drilling, developing, and producing of oil and gas (Gallun &

Wright, 2008).

2

It includes exploration activities that aim to find new hydrocarbons

through exploratory drilling and proofing these through appraisal and developing wells

drilling. Wright & Gallun (2008) point out that a high level of risk involved, a long time

span before a return on investment is received as well as a lack of correlation between

expected expenditures and the value of any resulting reserves, apart from other points,

uniquely characterizes the E&P industry.

The midstream sector processes, stores, markets, and transports the crude oil, natural gas

or natural gas liquids (PSAC, 2011). Basically it connects the upstream with the

downstream segment and brings oil closer to customers, for example through

transmission pipelines.

The downstream activities generally include refining, processing, marketing and

distribution of oil & gas products such as gasoline or diesel (PSAC, 2011).

A company may engage in one or more of these activities. An integrated oil and gas

company is involved in E&P activities as well as at least in one downstream activity. A

company focused only on E&P activities is called an independent oil and gas company.

2.3. ReservesandResourcesClassification

The amount of hydrocarbons on the earth is unknown and can only be estimated. In 2007

different organisations and councils have approved a new Petroleum Resources

Management System (PRMS) that should give a common understanding about reserves and

resources and also sets a standard on how oil and gas reserves and resources should be

defined and classified (Barker, 2008). According to the new classification, Reserves have to

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

4

satisfy four criteria. They must be discovered, recoverable, commercial and remaining

(Ritter, 2007).

Reserves are further categorised in accordance with the level of certainty associated and are

classified in the subcategories proved (1P), probable (2P) and possible (3P). 1P reserves have

a 90% probability that oil can be extracted profitably based on current assumptions (about

cost, geology, technology and future prices) whereas 2P have a 50% probability according to

the IEA (2010).

Resources on the other hand are those quantities where commerciality not yes has proven

(contingent resources) or are yet to be discovered (prospective resources) through the

drilling of exploration wells. Resources show compared to Reserves less probability and

confidence that the volumes in place can be put into production.

Figure 1 gives an overview of the Resources classification system.

Source: Society for Petroleum Engineers (2007)

Figure 1: Petroleum Resource Management System (PRMS)

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

5

2.4. Securingtheoilsupply

Since the late 1990s the oil prices have generally risen and supply constraints contributed to

this trend (IMF, 2011). Total Reserves (proved) totalled at the end of 2009 1.38 trillion

barrels. Should the estimates of world oil reserves be correct in 2010 they would be

sufficient to meet 46.2 years of global production at current rate. This is slightly down from

the previous year due to an increased global production of 2.2% over 2009 (BP, 2011).

However, it should be noted that Saudi Arabia that accounts for nearly 20% of global

Reserves has verified its reserves the last time in 1979 (Owen, 2006). In addition, also for the

Saudis seems the time of the cheapj oil to be over. To reach the billions of barrels of heavy

oil that lay beneath the dessert, Saudi Arabia, together with Chevron, invest hundred of

millions. Further, heavy oil is harder to get out of the ground and also to refine into gasoline,

what increases the production cost (Casselman, 2011). Reasonable doubt about the ability of

sufficient supply of oil in the future is further given through the fact that, according to the

scenario of the IEA, the world oil production and supply in the Reference Scenario will even

more rely on production from members of the Organization of the Petroleum Exporting

Countries (OPEC), particularly in the Middle East. Their share of global production needs to

grow from 44% in 2007 to 51% in 2030 to meet global demand under the Reference Scenario

(IEA, 2010). The tightness of supply at the beginning of the crisis in Libya has shown that oil

supply cannot be expected to be upholding without interruptions. Any tightness in supply,

demand kept constant, from the Middle East due to interruptions in production may raise

the price of oil sharply. According to the World Economic Outlook (WEO) release (IMF,

2011), some major oil-exporting economies have already production constraints, with oil

fields reaching maturity. The IMF expects the oil price to stay high and states that scarcity of

oil is a fact. Also the IEA (2010) expects the average crude oil price to reach m113 per barrel

(up from just over 60m in 2009) in 2035 reflecting higher production cost. In nominal terms,

prices more than double to m204/barrel.

Under the assumption of increasing oil prices, offshore deepwater exploration will receive

ongoing increasing importance in the future. According to the IEA (2010) production cost

curve, production cost for Deep Water and Arctic exploration reach between 40 and 100m. A

higher oil price does increase the economic value of such higher risk exploration projects.

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

6

2.5. FrontierExploration

As Wright & Gallun (2008) wrote there is a high risk involved in the upstream sector of the

oil & gas industry. Advancements in seismic and drilling technologies, however, have

reduced the risk of deep water as well as frontier exploration. Frontiers in the oil industry

are characterized as being data-poor and barely or completely unexplored (Business Insights,

2006). As a result wildcat exploration bears the highest risk compared to exploration in areas

with an already proven petroleum system. In addition, apart from the exploration risks

involved, these areas often pose political, economical, geographical and technological

challenges that may seriously influence the business of an oil company (Business Insights,

2006). Frontiers are believed to hold substantial undiscovered oil/gas resources and may

help companies for sustained production. As Henriksen (2011) points out in her paper, oil

companies have to spread their exploration risk in order to have a balance. A way to do that

is to operate in different regions of the world with different risks involved in each project.

The risk related to each play is shown by the probability of discovery that differs significantly

for each area. In order to balance the risk big oil companies do not expose themselves fully

to frontier exploration. Often smaller oil companies are doing extensive studies beforehand,

and take the risk involved in finding no indications of hydrocarbons, and let the big

companies farm in their blocks after potential for gas or oil resources has been shown. At

the exploration stage there is not a big amount of risk capital needed. However, in case of

success, the rewards are huge for the small companies. Small explorers will look to exit

before the big development costs are needed to further mature the prospect (Financial

Times, 2011). IOCs can also secure resources without engaging themselves in exploration

through a takeover of a smaller company inclusive the prospective resources the company

may hold.

Although M&A helps oil companies to replace their reserves, it does not provide sustained

organic growth. For Gateways investment decisions it is important that IOCs can also report

new discoveries in their own fields and replace their production (represented by a RRR o 1).

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

7

2.6. ReserveReplacementRatio(RRR)

However, as the next graph will show, oil companies could in average not growth

organically.

Source: Herold (2007, p.5)

Figure 2: Reserve Replacement Ratio (RRR) from 2000-2006

This graph shows that added oil reserves could not hold pace with production for most of

the years between 2000 and 2006. The RRR for oil was below one for the five-years period

between 2000 and 2006. Discoveries of natural gas during the measured period exceeded

the production during theses years. Companies do not have problems to replace their gas

reserves and gas seems to be abundant in the world; but it is not regarded as worthwhile to

invest by Gateway (low margin, high capital investments, abundance).

Many investors use the RRR calculation for judging the operating performance of the E&P

industry. It measures the amount of proved reserves added to a companys reserve base

during a year relative to the production of that year (Fox, 2009). The higher the ratio, the

better the operating performance of the company. A ratio above one (o100%) denotes that

the company could replace its reserves through adding new reserves during that year

whereas a company with a ratio below one (q100%) could not replace the reserves used for

production. The RRR can be calculated inclusive of sales and acquisition of reserves as well

as without (determines organic growth of a company).

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

8

3. Historicalexplorationactivitiesandproduction

3.1. Costsinvolvedintheupstreamindustry

Upstream costs can be divided broadly into the subcategories finding cost, operating cost,

and development cost.

Findingcostare all costs that are related with identifying hydrocarbons, gaining the approval

to extract them as well as determining the size of the basin. Costs generally involve the

preparation and shooting of seismic data, drilling of exploration and appraisal wells (UBS,

2008). However, the interpretation of finding cost differs widely. One reason is, that there is

no general consensus what should be included in finding costs. Also oil companies use

different accounting methods, full cost and successful efforts method, that need different

treating of costs in terms of expense and capitalization. Lastly, there is a timing difference

between the reporting of the finding costs and the adding of new reserves to a companys

book (Gallun & Wright, 2008). Therefore, investors should interpret finding costs carefully.

Developingcostinclude the purchase and installation of equipment, building of the facilities,

engineering and design processes, drilling, as well as all associated interest and taxation cost

(Gallun & Wright, 2008). However, interest and taxation are not considered as developing

costs in valuations of Gateway Capital.

Liftingcostis part of the operating expenditures that are controllable by a company to

extract oil & gas out of the ground. Non-controllable cost such as depreciation, property

taxes and severance taxes are therefore not included. Lifting costs and production costs are

used interchangeably (Gallun & Wright, 2008).

CAPEX(Capital Expenditures) are all the cost that should create future benefits for the

company. It includes the funds used for acquiring or upgrading buildings or equipment. F&D

costs are part of the CAPEX (Investopia, 2011).

OPEX(Operating Expenditures) in contrast are the ongoing cost a company has to pay to run

the business. OPEX create no future benefits. Lifting costs are part of the OPEX.

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

9

3.2. Costpressuresintheupstreamindustry

A clear trend towards higher costs is visible since 2000, after costs have fluctuated for over

one decade, for all subcategories explained above.

Source: UBS (2008, p.97), based on FAS 69 data

Figure 3: Cost pressures in the upstream oil industry 1988-2006

According to figures provided by UBS (2008), operating cost decreased per barrel from 4.2m

in 1993 to 3.3m in 2000, but took a sharp reverse back to m5.8/barrel in 2006. Also, finding

and developing costs (1999: 4.8m/bbl) increased sharply in the last 10 years to 12.7m/bbl in

2006.

The data compiled by Herold (2007) shows a similar pattern for rising F&D costs for the

period 2001 to 2006.

Source: Herold (2007, p12)

Figure 4: F & D cost per boe per region from 2001 to 2006

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

10

The highest cost with over m30 was reported by Europe and the United States in 2006

whereas the Eastern region of the world show lower F & D cost. However, it should be noted

that the Asia-Pacific and Russia & Caspian region does have rather gas than oil resources

that are less attractive to develop and produce.

There are several causes leading to this general cost pressure in the upstream oil industry.

According to UBS (2008) service inflation as well as increased prices for construction and raw

materials, a stronger demand for equipment and inventory (oil reserves), and a growth in

domestic wages has led to this shift.

However, under the fact that the average Brent oil price increased from 28.3m in 2000 to

65.3m in 2006, total costs as a percentage of the Brent oil price has declined steadily from

45% in 1999 to 27% in 2006. Therefore higher costs could be offset easily through a higher

oil price.

3.3. Capitalexpenditures(CAPEX)intheupstreamindustry

Historically total worldwide upstream spending in the oil & gas industry has risen every year,

except 2009, and since 2007, the spending doubles the investments of 2000 (adjusted for

inflation). The year 2009, saw investments fall due a lower oil price.

Source: Energy Outlook (2010, p.138)

Figure 5: Capital expenditures in the upstream industry 2000-2010

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

11

Worldwide total upstream capital expenditure for both oil & gas is expected to set to bounce

back in 2010 (after a 15% fall in 200) and amount m470 billion. This is an increase of 9% to

the previous year. This figure is based on adjusting upwards the spending of 70 companies,

according to the companys share of total production during each year (IEA, 2010).

Although private companies and the super majors (ExxonMobil, Shell, BP, Chevron and

Total) still dominate the upstream oil and gas capital spending, national oil companies are

expected to rise investments faster and taking their share of total investment to 39% in

2010. According to the report of BP (2010), Petrobras with m23.8 billion (29% YoY increase)

and Petrochina with m23.1 billion (22% YoY increase) dominate the upstream investments of

the National Oil Companies. For IOCs, ExxonMobil with m27.5 billion (33% YoY increase) is

expected to spend more in the upstream segment during 2010. The second biggest (Shell)

does reduce its budget by 5% to m19.4 billion.

3.4. HistoricaldevelopmentofReserves

Despite soaring capital expenditures (up more than 100% compared to 2000), total world

reserve growth shows only a marginal increase during the last decade. According to the IEA

(2010) reserves stood at 1.38 trillion at the end of 2009, compared to 2000 (1.11 trillion

barrels) an increase by 25%. World reserves reached the highest level ever attained.

However, half of the increase was due to adding reserves of Canadian oil sand reserves

(unconventional oil) as well as through revisions of previous estimates of fields already in

production, particularly in Venezuela, Qatar and Iran. New discoveries did not add to the

increase in Reserves rather the technological development allows recovering more reserves

at existing fields. Improved and enhanced oil recovery from existing field could potentially

double current proven reserves according to the IEA (2010). A reason for the slow increase

in oil reserves is the fact that discoveries in average become smaller.

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

12

Source: IEA (2010, p.117)

Figure 6: Conventional oil discoveries and production worldwide 1960-2009

It is clearly visible that the ratio production to new discoveries has changed since 1980s.

Today the production exceeds by far the amount of new discoveries. Also the average size of

discovered fields has declined steadily. According to Wood Mackenzies Exploration Service

(Financial Times, 2011), frontier discoveries showed the highest average size (between 2000

and 2009) of 145.5million bbl / field, compared to emerging (117.4 million bbl / field) and

mature fields (38.4 million bbl/field). Since 2000, deep-water exploration is contributing with

a share of 50% most to the find of new discoveries (IEA, 2010). Jad Mouawad (2006) points

out that advances in offshore technology as well as tremendous improvements in

supercomputers and available data, the regions deepest waters have become the hottest

exploration prospects. With that he refers to drilling in new frontiers in the Golf of Mexico in

ultra deep waters. Also the promise of high production rates, apart from the hope of finding

extensive reserves, has led to a shift to deepwater fields. (Schlumberger, 2000). The average

U.S. well produces about 10 barrels of oil a day whereas the production volume of offshore

deepwater wells reach thousands of barrels a day (Handwerk, 2011).

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

13

4. Possiblefutureplacesofinterest

Based on estimates for undiscovered conventional petroleum provided by the USGS (2000),

world resources total 1673 bn barrels of oil equivalent in total. Estimates for undiscovered

gas reach 801 bn barrels of oil

1

, for LNG (Liquified Natural Gas) 196 bn barrels and for

conventional undiscovered oil 676 bn barrels. The energy mix ratio between oil & gas is

important in determining the next new oil frontier because it is a ratio Gateway Capital uses

for doing evaluations of oil & gas companies. Gas accounts for 48%, Oil for 40%, and LNG for

12% of undiscovered petroleum. Oil liquids are later referred to oil and LNG.

The biggest resource potential of undiscovered resources offers the Middle East & North

Africa, which may hold 30% of remaining resources. In Iran and Saudi Arabia are nearly 70%

of these undiscovered resources estimated. The Former Soviet Union, mainly Russia, has the

second biggest resource estimate, followed by North America (incl. USA) and Central and

South America.

Source: Own representation (data from USGS, 2000)

Figure 7: Global undiscovered conventional petroleum resources estimation

1

Gas has been converted to Oil with a ratio of 6:1 (6 MCF Gas = 1 Barrel Oil Equivalent (BOE))

1'673 bn

Barrels

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

14

Based on the data from USGS (2000) total undiscovered oil, gas and NGL is equally

distributed onshore and offshore. However, this is only the case because in the Region

Middle East and North Africa, 80% of its conventional petroleum is expected to be onshore.

Apart from Middle East & North Africa as well as South Asia, all other regions show a higher

potential to find resources offshore.

4.1. ResourceestimationRegion1(FormerSovietUnion)

Source: Own representation (data from USGS, 2000)

Figure 8: Resource estimation Former Soviet Union

2

Russia is the biggest holder of conventional undiscovered resources in the Former Soviet

Union. However of the total 283 bn barrels of undiscovered oil, gas or NGL, only 37% is

expected to be Oil Liquids. The majority of 62% will comprise of gas only that is regarded as

less economic attractive to develop.

2

only countries with 2% or more of total undiscovered petroleum of the region are labelled in the figure

401 bn

Barrels

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

15

4.2. ResourceestimationRegion2(MiddleEast&NorthAfrica)

Source: Own representation (data from USGS, 2000)

Figure 9: Resource estimation Middle East & North Africa

3

In the Region Middle East & Africa are seven out of the twelve member states (8 incl.

Algeria) of the Organization Petroleum Exporting Countries (OPEC) domiciled. These are Iran,

Iraq, Kuwait, Lybia, Qatar, Saudi Arabia, and United Arab Emirates. With a total estimate of

nearly 520 bn barrels of oil equivalent, it is apart from the current biggest producer of oil,

also the most prospective resource area in the future. Saudi Arabia is the biggest holder of

undiscovered oil, followed by Iran (21%), Iraq (13%) and the rest of the OPEC nations of this

region with 2% resp. 3%. Nearly 60% of the undiscovered petroleum is expected to be Oil

Liquids with 80% of its resources lying onshore.

3

only countries with 2% or more of total undiscovered petroleum of the region are labelled in the figure

520 bn

Barrels

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

16

4.3. ResourceestimationRegion3(AsiaPacific)

Source: Own representation (data from USGS, 2000)

Figure 10: Resource estimation Asia Pacific

4

China, Indonesia and Australia hold nearly all of the estimated undiscovered petroleum

resources in the Asia Pacific Region that amounts to 100 bn barrels according to the data of

USGS (2000). Only 41% of all resources are expected to be oil liquids, with the majority (59%)

to be gas prone.

An frontier that also has led to tensions in recent time is in the South China Sea Region. Vast

amounts of resources are claimed (between 105 and 213 bn barrels) by different

surrounding states (China, Philippines, Indonesia).

4

only countries with 2% or more of total undiscovered petroleum of the region are labelled in the figure

100 bn

Barrels

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

17

4.4. ResourceestimationRegion4(Europe)

Source: Own representation (data from USGS, 2000)

Figure 11: Resource estimation Europe

5

Europe is after the Region South Asia the Region with the smallest amount of expected oil &

gas resources. Norway (61%) with United Kingdom (13%) account nearly for all undiscovered

resources in Europe with a declining rate.

4.5. ResourceestimationRegion5(NorthAmerica)

Source: Own representation (data from USGS, 2000)

Figure 12: Resource estimation North America

5

only countries with 2% or more of total undiscovered petroleum of the region are labelled in the figure

76 bn

Barrels

256 bn

Barrels

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

18

The United Stats of America are after Russia and Saudi Arabia the country where most

undiscovered potential is estimated.

The Gulf of Mexico (GOM) does not look like a new oil frontier due to the fact that most of

U.S. oil production is coming from the GOM and more than 3400 offshore facilities were

installed in 2011. But estimates suggest that still 13 bn of recoverable resources are lying

there, particularly in the frontier fields in deep to ultra deepwater off the coast. However,

the technological challenges to drill in 7000-8000 meters are immense (Handwerk, 2011).

4.5.1. ArcticfrontierexplorationNationalPetroleumReserveinAlaska

(NPRA)

USGS published in 2010 a report about the assessment of the undiscovered oil and gas in the

National Petroleum Reserve in Alaska and updated an assessment of 2002 made also by the

USGS. The new data was collected through drilling of 30 exploration wells. The outcome

gave indication that the formations are rather bearing gas than oil. As a result the estimated

mean value of undiscovered oil had to be revised from 10.6 billion boe to new 895 MMBoe

(USGS, 2010). This sharp downward revision resulted, as prior to drilling no data was

available about the frontier. The assessment further points out that the wildcat drilling is

limited for winter only, when the environment supports the drilling activities (no icy road).

The special anticipated drilling technique from remote, the harsh environments and the

missing infrastructure are the main challenges that are pointed out in the paper. As a result,

development and exploration costs are expected to be high compared to onshore fields in

the US for example. Wildcat well drilling costs are assumed to double the price for wells for

the particular economic zone. The volume assessed let expect, that most interest will be

attained in the case of a commercial discovery of natural gas. The oil reservoirs found are

not sufficiently large enough to attract exploration. However, there is no pipeline in place to

transport the gas. The assessment assumes that it takes 10- to 20 years from discovery to

first production and delivery of gas. The analysis points out that gas will be economically

recoverable at gas prices per MCF of m8.

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

19

4.6. ResourceestimationRegion6(CentralandSouthAmerica)

Source: Own representation (data from USGS, 2000)

Figure 13: Resource estimation Central and South America

6

Central and South America Region may hold around 180bn petroleum reserves of which

more than 60% are expected to be oil. In the assessment of USGS in 2000, nearly half of

these resources could be found in Brazil. In the year 2011, Brazil has developed to a place of

interest through vast discoveries in the last decade.

4.6.1. BrazilfrontierexplorationIdentificationofvastresources

The quantity of undiscovered petroleum in Brazil was assessed with 78bn barrels in 2000.

Two third were seen to be oil liquids and the smaller part to be gas prone.

Before the biggest discovery in the Western Hemisphere since 30 years off Rio de Janeiro in

October 2006, Brazil has seen nearly no exploration of its territory and if, it was in shallow

waters. The Tupi field, renamed to Lula meanwhile, however, has opened a new hunt for oil

in Brazil. It lies in the presalt area, 2000 meters water depth to more than 5000 meters real

depth (Parshall, 2010). Strong drilling activity in the presalt area during the last five years has

increased the production and reserves estimates dramatically. Brazil is seen as the single

country outside of the OPEC countries to increase oil supply over the next 20-25 years (U.S.

Energy Information Administration, 2010). According to the BP Statistical Review of 2011 oil

6

only countries with 2% or more of total undiscovered petroleum of the region are labelled in the figure

180 bn

Barrels

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

20

reserves (1P) in Brazil stood at 14.2 bn barrels at the end 2009. More than 93% of Brazils oil

reserves and 80% of the countrys gas reserves are located offshore, mainly in the ultra deep

water offshore Rio de Janeiro (Campos and Santos basins account for 80% of oil reserves)

(Ernst & Young, 2010). The Brazils National Petroleum Agency estimates that the Santos

Basin alone may contain 50 billion barrels of oil. Other estimates even reach 120 billion

barrels of oil (Kay, 2011).

4.6.2. Falklandsfrontierexploration

The Falklands Islands have also seen recent interest in the exploration of their offshore

frontier fields. However, only one company, Rockhopper Exploration, could make yet a

commercial discovery in its Sea Lion oil find in the North Falkland basin. All other players (i.e.

Borders & Southern, Desire Petroleum, Falklands Oil & Gas) could not report any success on

the island that is claimed by Argentina as well as the United Kingdom.

According to the British Geological Survey the Falklands Islands may hold vast amount of

resources that total billions. Especially in the North Falkland Basin could be as much as 60

billion barrels of undiscovered petroleum (Richards, 2002).

4.7. ResourceestimationRegion8(SouthAsia)

Source: Own representation (data from USGS, 2000)

Figure 14: Resource estimation South Asia

7

7

only countries with 2% or more of total undiscovered petroleum of the region are labelled in the figure

23 bn

Barrels

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

21

The South Asia Region has a rather small potential of only 23 bn barrels in total.

Furthermore is the region regarded as gas prone with an energy mix of 76% / 24% in favour

of gas to oil liquids.

5. FocusAfrica

5.1. ResourceestimationRegion7(SubSaharanAfricaandAntarctica)

Source: Own representation (data from USGS, 2000)

Figure 15: Resource estimation Sub Saharan Africa and Antarctica

8

According to the figures of USGS world petroleum assessment in 2000, Africas undiscovered

resources totalled 116bn boe with an energy mix of 32% gas and 68% oil liquids. 69bn

barrels are thought to be oil lying mainly in the offshore regions of Africa. Only Nigeria,

biggest producer and reserve (1P) holder in Africa, has been reported with onshore

resources reaching 1 bn boe. However, in recent years new frontiers have opened that were

not yet included in the estimates of USGS in 2000.

8

only countries with 2% or more of total undiscovered petroleum of the region are labelled in the figure

116 bn

Barrels

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

22

5.2. ExploringnewoilfrontiersinAfrica

5.2.1. Ghana:TheJubileefield

Tullow oil and its partners announced on Dec. 15, 2010 the first oil from their Joint-Venture

Project offshore Ghana. Although Ghana had no on- and offshore production prior to this

event, the first oil was achieved just 3.5 years after the first discovery (Anadarko, 2011). The

field is expected to hold 700 mmboe in the P50 szenario whereas the phase 1 development

of the project targets 300 mmboe. Tullow Oil gives the following cost structure for the phase

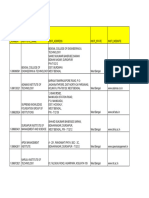

1 according to Tullow Oil (Wheaton, 2008):

Source: Tullow Oil (2008)

Figure 16: Capital Expenditures Phase 1 Jubilee field Ghana

Although we calculate at Gateway Capital finding & development cost in a slightly different

way, the capital expenditures of 3.1m bn can be taken as an estimate. Based on targeting

300mmboe we get F & D cost per barrel of discovered oil of m8.60. The historical upstream

costs found in section 2.2 show an average F & D costs in 2006 of 12.7m/bbl.

Operating Expenditures incl. G & A (General & Administrative) per barrel of oil are estimated

by Tullow Oil in the range of m7 and m10, depends on if a FPSO (floating production storage

and offloading) vessel is purchased or leased. In case of a lease the cost should be added to

the Operating Expenditures. In case of a purchase the cost are part of development cost and

thus are F & D cost. OPEX cost are higher per BOE than the average operating costs in 2006

of m5.80 / bbl in the oil industry. Unfortunately no clear overview over operating

expenditures is given, what makes the comparison of this two figures difficult.

!"#$%"&'()#*+,$%-.*/ 0123'4+

- Wells 1.3$ bn

- laclllLles and subsea 1.0$ bn

- re-operaLlons, Chana lnfra-sLrucLure, C&A 0.3$ bn

- ConLlngency 0.3$ bn

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

23

The cost estimates provided by Tullow Oil do not indicate higher lifting or F & D costs for the

frontier project in Ghana than the figures of UBS in section 2.2. Also the IEA (2010) expects

that Africa lifting cost will be with 4m and 9m in average of the production cost in other

continents. Also F & D costs (that are expected to be between m8 and m22 in average in

Africa) are within average of the worlds industry as figure 16 shows:

Source: IEA (2010, p.139)

Figure 17: F & D and lifting cost across continents

5.2.2. Ghana:OperatingEnvironment

Ghana, with 22.1 million inhabitants in 2006, is rated with a stable rating (BQ) by Standard &

Poors and the Rating Agency Fitch. The country became independent in 1957 as the first

sub-Saharan African country and has through four general elections during the last 18 years

(every four years one) established a democratic system. Although no production of oil & gas

has taken place before the identification of the Jubilee field offshore Ghana by Tullow Oil,

Ghana was known for other natural resources such as gold, diamonds, cocoa, timber and

fish. Although agriculture is still the most important sector, production of resources is

moving up. According to Tullow Oil Ghana is one of the most peaceful and stable

democracies in Africa (Mensah, 2008).

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

24

5.2.3. Ghana:PSCagreement

Important in the oil & gas industry are the so-called contractual arrangement like a

production sharing contract (PSC). It allows the production oil company to reclaim occurred

expenses for CAPEX and OPEX for the production of oil & gas. The remaining production is

split between the company and the government according to the PSC agreement. The

advantage for the government is that the state retains and controls the natural resources.

The oil company in turn receives a form of compensation for their capital efforts. PSCs are

the most common form in oil & gas production worldwide. However, the terms of the

agreement differs from country to country. The two main components of a PSC are the Cost

Oilj and the Profit Oilj. The first one deals with the amount the production company is

allowed to recover. Often a cap is set in place, limiting the oil company to recover all costs

occurred in a period (needs to be postponed to the next period). The Profit Oilj deals with

the distribution of the oil revenue between state and producing companies (UBS, 2008).

5.2.4. Ghana&UnitedKingdom:ComparisonofPSCagreement

Based on the PSC in Ghana (2006) for Tullow Oil for the deepwater Tanoj area, and the tax

system applied in the United Kingdom in the North Sea I will show how the margin of oil

companies in these areas are affected by different tax structures under different oil price

scenarios.

Ghana:

5% Royalty on production

10% free carried interest in favour of Ghana Government on production

Oil Entitlement Government on Oil Revenue (between 0% and 25%, depends on

Real Rate of Return (%))

35% Income taxes

UK:

50% Petroleum Revenue tax on Profit before tax

50% Windfall tax (applicable if oil price o65 USD / bbl)

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

25

Ghana & UK:

Assumption Lifting cost: 7m

Assumption F & D cost: 8m

Assumption production: 100000 barrels per year

The profit margin in Ghana develops as following under different oil price assumptions of

m70 and m90:

9

Source: Own representation (data from Tullow Oil, 2009)

Figure 18: Profit margin in Ghana under different oil price scenarios

The margin gross is calculated by subtracting the Cost Oil (1500000), that is finding &

development as well as lifting cost, from the Profit Oil (5950000).

The internal rate of return (we assume IRR = margin gross in %) is in the top region of the

terms of the Petroleum agreement. As a result the Government of Ghana is entitlement to

25% of Tullow Oils Oil Revenue. The final margins are between 25% and 28%, but have

reduced considerably through the oil entitlement of the Ghana Government.

9

please refer to the Appendix to see margin calculations under further oil price assumptions

!"#$#%&'#$(%#)*#+

70 80 90

Cll 8evenue 7'000'000 8'000'000 9'000'000

roflL Cll afLer 8oyalLles 3 6'630'000 7'600'000 8'330'000

roflL Cll 1ullow, afLer 10 free carrled lnLeresL Chana 3'930'000 6'800'000 7'630'000

CosL Cll (=l & u, LlfLlng cosL) 1'300'000 1'300'000 1'300'000

Margln Cross 4'430'000 3'300'000 6'130'000

Margln Cross ln 63.37 66.23 68.33

Cll LnLlLlemenL 23 23 23

Cll LnLlLlemenL (ACL) 1'730'000 2'000'000 2'230'000

neL proflL before Lax 2'700'000 3'300'000 3'900'000

lncome Lax 943'000 1'133'000 1'363'000

Net prof|t after tax 1'7SS'000 2'14S'000 2'S3S'000

Net prof|t marg|n |n 2S.07 26.81 28.17

C|| pr|ce

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

26

The calculation for the North Sea (United Kingdom) has resulted in the following profit

margin for oil companies:

Source: Own representation

Figure 19: Profit margin in the U.K. under different oil price scenarios

The Margin gross and net is relatively stable. However, the petroleum tax rate of 50% has a

significant impact on profit margin after tax.

We can compare the profit margin between these two countries in a line chart:

Source: Own representation

Figure 20: Profit margin comparison Ghana and U.K.

!"#$%&'(#")&*+',-*.$/'0%12

70 80 90

Cll 8evenue 7'000'000 8'000'000 9'000'000

CCCS (=l & u, LlfLlng cosL) 1'300'000 1'300'000 1'300'000

Margln Cross 3'300'000 6'300'000 7'300'000

Margln Cross ln before Lax 78.37 81.23 83.33

8egular peLroleum Lax raLe of 30 30 2'730'000 3'230'000 3'730'000

Margln Cross ln afLer flrsL Lax 2'730'000 3'230'000 3'730'000

Wlndfall Lax (Cameron AdmlnlsLraLlon) of 30 30 1'373'000 1'623'000 1'873'000

Net prof|t 1'37S'000 1'62S'000 1'87S'000

Net prof|t marg|n |n 19.64 20.31 20.83

C|| pr|ce

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

27

The windfall tax, applicable when oil price is above m65, does strongly influence the profit

margin in the UK. In case of an oil price below 65m, the profit margin is better than for the

same production under the tax system in Ghana. However, in times of higher oil prices,

shows Ghana a higher net profit margin in % for the operating companies.

5.3. ThenextoilfrontiersinAfrica

Since the assessment of USGS in 2000 we have seen aggressive exploration along the

Western Coast of Africa that opened new oil frontiers and revised resource estimates sharply

upwards. In the next section are different countries discussed that have seen interest in

exploration in their licence areas. Further most are countries that have showed only a small

amount of undiscovered petroleum resources in the assessment of USGS in 2000.

5.3.1. SouthAtlanticMargin(Namibia)

An increasing part in the petroleum production could also play Namibia the southern

neighbour of Angola, Africas second biggest oil producer and OPEC member. Although only

335 MMBOE of resources, mainly Gas, have been recorded in the USGS assessment in 2000,

many see Namibia as an emerging oil frontier in Africa. The huge discoveries across the

Atlantic in Brazil in ultra deep water have also increased the hopes to find similar fields in

Namibia, which is said to have similarities to the offshore basins in Brazil. Although no

commercial discovery of oil has yet been made, the prospective resources independent firms

operating in Namibia hold, is stunning. Many small independent exploration firms (Chariot

Oil & Gas, Tower Resources, HRT) have reported potential oil accumulations that reach

billions (Reed, 2011). Chariot Oil & Gas has recently brought in an other super major as a

partner, namely BP, for one of their licences to be drilled at the end of 2011. The other

partner of Chariot Oil & Gas drill is the Brazil major Petrobras that farmed in already in 2009

and is responsible for the huge offshore deepwater finds in Brazil. Results will proof whether

or not Namibia will be the next oil frontier.

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

28

In case of success the returns for all involved parties will be huge. A discovery for example in

the Southern License of Chariot Oil & Gas (together with Petrobras and BP) is estimated to

be bigger than the Jubilee field and is estimated at over 1 bn risked BOE (Chariot Oil / Gas,

2011).

There are currently no projections concerning CAPEX or OPEX available. Due to the fact that

Namibia has no oil & gas production yet, same as in Ghana prior to the Jubilee discovery, the

development cost for infrastructure could be similar as reported by Tullow Oil. Based on the

figures for the Jubilee field we can expect similar costs in Namibia in case of success. The

costs might be even lower due to the fact that the discovery size is expected to be bigger in

Namibia than in the Jubilee field. Assuming a similar PSC in Namibia I calculated the

expected net profit margin in % under different costs scenarios (total cost = F&D plus lifting

cost) for different oil prices.

Source: Own representation

Figure 21: Profit margin in Namibia under different cost scenarios

Please note that the lines represent different cost assumptions (between m5 and m30,

representing F & D plus lifting cost). It is visible that the tax structure in Namibia (when

similar to the legislation in Ghana) is attractive in times of higher oil prices (om80) meaning

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

29

that the net profit margin in % for the oil company is high. Of course have lower total cost

also a positive effect on the net profit margin of the oil company.

5.3.2. WestAfricanCoastalProvince(GuineaBissau,SierraLeone,Liberia)

With only 10 exploration wells drilled before the assessment of USGS in 2000, this region

was 10 years ago, very under explored. The resource estimates in 2000 totalled risked 64

million of undiscovered oil & gas, whereby only Guinea-Bissau has been listed as a country

with potential resources. The discovery of the Jubilee field in 2007 has encouraged the

interest to explore along the West African Coast, especially in offshore frontier regions such

as Cote dIvoire, Liberia and Sierra Leone. 10 years later the region looks at total

undiscovered resources of 7.6 bn barrels of oil equivalent. According to USGS (2011) the

largest oil field is expected to have a mean size of 783 MMBOE.

Anadarko made the first deepwater discovery in the Sierra-Leone-Liberia Basin in September

2009. Numerous further prospects have been identified in the follow up (Anadarko, 2011).

The discovery may open a new oil frontier area that extends from Ghana (Jubilee field) to

Sierra Leone (U.S. Energy Information Administration, 2010).

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

30

5.3.3. FourWestAfricaGeologicProvinces

Also further north and south of the West African

Coastal Province has the exploration gained speed.

More than 275 new fields have been discovered in the

four provinces: Senegal Basin (Senegal, Mauritania),

Gulf of Guinea (Cote dIvoire, Ghana, Benin), Niger

Delta (Nigeria) and the West-Central Coastal

(Cameroon, Gabon, Angola) since the last assessment

by USGS in 2000. The new estimated of undiscovered,

technically recoverable conventional oil and gas

resources is given in the next table:

Source: USGS (2010)

Source: Own representation (data from USGS, 2010)

Figure 22: Resource estimation West Coast Africa

Please note that only the offshore resources have been identified in this table. However,

according to the assessment of USGS this is also where most of the potential is estimated.

The countries in the Gulf of Guinea could increase their resources estimates since the last

assessment in 2000 from total 2.1 bn BOE to 7.9 bn BOE.

Sonangola announced at the end of 2010 the six winners of deep offshore blocks in Angola

(West-Central Coastal) that are placed in the pre-salt fields of Angola (similar to that of

Brazil). Except of Cobalt International Energy are all international major companies (Total,

Eni, ExxonMobile, Chevron, Statoil, and ConocoPhilips). Sonangola expects that it costs m100

IS0 o||, mmboe IS0 Gas, mmboe IS0 NGL, mmboe 1ota| und|scovered resources mmboe

Senega| 8as|n !"#$% !"$&' &(' )"%*)

Gu|f of Gu|nea !"('' &"*)) +!! $"(&%

N|ger De|ta *%"$#+ $"'+$ &"'+& !'"#$(

West-Centra| Coasta| &%"')# +"$') *"%+( )%"+#&

1ota| 4 Cffshore rov|nces 62'397 23'3S2 7'391 93'140

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

31

million to drill one pre-salt well compared to 20-30m million in the area where at the

moment 60% of Angolas oil is produced.

6. ConclusionandRecommendations

Frontier exploration will gain further attention by oil companies in the future due to the fact

that the places of the cheap oil production seems to be over and new places need to be

explored that oil companies can replace their production with new resources. We may see

two trends in frontier exploration: The first towards under explored countries where no

discovery has yet been made (especially continent Africa). Frontier projects in such areas

have resulted in huge discoveries, Jubilee field, especially in deep-water regions, during the

last decade. The second trend is towards frontiers in already oil producing countries (Angola,

Nigeria, USA with the GOM), which are further off the sea as well as deeper in the water in

unknown territories. Going to ultra deep areas may be observed in the future due to

promising resource estimates made by different parties that are indicating the real potential

of huge new discoveries will be in deep to ultra deep water regions.

Although all cost in the upstream industry are showing an increasing trend upwards, higher

costs could in the last decade be offset by higher oil prices. Frontier exploration is more

expensive than onshore exploration due to higher drilling cost and huge capital investments

needed for development of infrastructure. Based on the example of the Jubilee field

discovery in offshore Ghana, F & D costs and operating expenditures are expected to be in

average of the oil industry across the continents (due to the above average discovery size of

the field). Also the tax structure of the Ghana Government does not conclude that the oil

production from the Jubilee field will result in poorer profit margins compared to production

in the U.K.

The most prospective resource areas based on the data of USGS, 2000, are the continents

Middle East & North Africa as well as the Former Soviet Union Region (Russia) were most of

the undiscovered petroleum is expected. However, there are differences in the recoverable

energy mix, what influences the economic attractivity of exploration across continents. The

Eastern regions are said to hold rather gas than oil whereas the Middle East & North Africa

as well as Sub Saharan Africa indicate a higher portion to be oil prone. Several new frontiers

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

32

could be opened during the last decade. Especially in Africa along the West Coast have

discoveries raised hopes to find further prospective fields in under explored regions. The

success of Anadarko and Tullow Oil has shown that further potential lies in the unknown

waters in the Gulf of Guinea and Senegal Basin. A promising new frontier is said to extend

from Ghana to Sierra Leone. The success story of Brazil, with discoveries further down in the

sea as well as targeting a new area (the pre salt area), increased exploration for frontiers in

expected similar geological regions further offshore and deeper in the water (Brazil - Nigeria

- Angola - Namibia - Sierra Leone). Further have deeper water projects an increased flow

rate in case of production, what makes such exploration economically attractive.

The shift to new territories will increase the capital spending of oil companies further in the

next years and have an influence on their cash flow situation. But new discoveries that are

bigger in size could replace the production of companies. I expect increased M & A activity in

frontier regions, and international oil companies to secure prospective resources of smaller

firms. The potential for investments are in such case in favour of the small company.

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

33

7. Bibliography

Anadarko Petroleum. (2011). Operations Report, 2nd Quarter 2011. Available online at:

http://www.anadarko.com/SiteCollectionDocuments/PDF/Operations%20Reports/2

Q11%20Operations%20Report.pdf (p.15). Last accessed 10th Aug 2011.

Anadarko Petroleum. (2011). International / Frontier Overview. Available online at:

http://www.anadarko.com/Operations/Pages/InternationalFrontierOverview.aspx.

Last accessed 10th Aug 2011.

Attanasi, Emil D. & Freeman, Philip A.. (2011). Economic Analysis of the 2010 U.S. Geological

Survey Assessment of Undiscovered Oil and Gas in the National Petroleum Reserve in

Alaska . Available: http://pubs.usgs.gov/of/2011/1103/ofr2011-1103.pdf. Last

accessed 10th Aug 2011.

Barker, Geoff. (2008). A priceless reserves-reporting tool. Fundamentals of the Global Oil and

Gas Industry. (7.3), p. 135-139.

BP. (2011). Reserves-to-production (R/P) ratios. BP Statistical Review of World Energy., p.7.

Business Insights. (2010). Top Frontier Oil Countries: Potential, exploration opportunities and

risks. Available: http://www.prnewswire.com/news-releases/top-frontier-oil-

countries-potential-exploration-opportunities-and-risks-97932384.html. Last

accessed 10th Aug 2011.

Casselman, Ben. (2011). Facing Up to End of PEasy OilP. Available online at:

http://online.wsj.com/article/SB10001424052748704436004576299421455133398.h

tml. Last accessed 10th Aug 2011.

Chariot Oil & Gas. (2011). Unlocking AfricaQs Oil & Gas Potential. Available online at:

http://www.chariotoilandgas.com/uploads/compressedchariotcorporatepresentatio

n-updated08.08.11.pdf. Last accessed 10th Aug 2011.

Ernst & Young. (2010). Brazil oil and gas: Realities in a new frontier. Available online at:

http://www.ey.com/Publication/vwLUAssets/Braziltoiltandttgastfinal./mFILE/Brazil

toiltand%20tgastfinal.pdf. Last accessed 10th Aug 2011.

Financial Times. (2011). Oil groups go to the ends of the earth. Financial Times of 20

th

May

2011. p.16

Fox, Eric. (2009). Oil Companies With High Reserve-Replacement Ratios. Available:

http://stocks.investopedia.com/stock-analysis/2009/Oil-Companies-With-High-

Reserve-Replacement-Ratios-CRZO-UPL-XOM-GDP1012.aspx?printable=1. Last

accessed 10th Aug 2011.

Gallun, Rebecca A. & Wright, Charlotte J. (2008). Fundamentals of Oil & Gas Accounting. 5th

ed. Tulsa, Oklahoma: PennWellCorporation. p1-2 and p711

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

34

GBI Research. (2010). Increasing Trend Towards Deep and Ultra Deep Water Exploration and

Production is Driving the Growth of the Offshore Drilling Industry. In: The Future of

the Offshore Drilling Industry to 2015 - Market Analysis, Capital Expenditure and

Competitive Landscape. Available online at:

http://www.investorideas.com/Research/PDFs/OffshoretDrilling.pdf

Government of Ghana & Tullow Oil. (2006). Petroleum Agreement. Available online at:

http://www.tullowoil.com/files/pdf/petroleumtagreementtdeepwaterttano.pdf.

Last accessed 10th Aug 2011.

Handwerk, Brian. (2011). The Next Prospects: Four Offshore Drilling Frontiers. Available:

http://news.nationalgeographic.com/news/energy/2011/04/110418-future-of-

offshore-drilling/. Last accessed 10th Aug 2011.

Henriksen, B. (2011). Exploration Economics. Available:

http://www.norad.no/en/ThematicQareas/Energy/OilQforQDevelopment/OfDQInform

ationQPackage/ResourceQManagement. Last accessed 10th Aug 2011

Herold, John S.. (2007). Global Upstream Performance Review. (2007), p.5, p.11.

IEA. (2010). World Energy Outlook 2010. Paris: OECD / IEA. p69, p113, p114, p116, p117,

p127, p135, p138, p251.

IEA. (2010). Oil, Gas and Coal Technologies for the Energy Markets of the Future. In:

Resources to Reserves., p.2

IMF. (2011). World Economic Outlook April 2011. Available online at:

http://www.imf.org/external/pubs/ft/weo/2011/01/pdf/text.pdf. Last accessed 20th

Aug 2011.

Investopia. (2010). Capital Expenditures - CAPEX. Available:

http://www.investopedia.com/terms/c/capitalexpenditure.aspwaxzz1VAjdLFAw. Last

accessed 10th Aug 2011.

Kay, Stephen. (2011). BrazilQs Oil Discoveries Bring New Challenges. Available online at:

http://www.frbatlanta.org/documents/pubs/econsouth/11q1tbraziltoil.pdf. Last

accessed 10th Aug 2011.

Kreil, Eric. (2003). South China Sea Region. Available online at:

http://apps.americanbar.org/intlaw/committees/industries/energytnaturaltresourc

es/schina.pdf. Last accessed 10th Aug 2011.

Mensah, Sam. (2008). Socio-political background Ghana. Available online at:

http://www.tullowoil.com/files/pdf/ghana/Socio-political-background.pdf. Last

accessed 10th Aug 2011.

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

35

Moran, Jacinta. (2011). Angola opens new frontier in oil exploration with pre-salt blocks.

Available online at:

http://bx.businessweek.com/conocophillips/view?url=http%3A%2F%2Fwww.platts.c

om%2Fweblog%2Foilblog%2F2011%2F01%2F25%2Fangolatopenstne.html. Last

accessed 10th Aug 2010.

Mouawad, Jad. (2006). Drilling Deep in the Gulf of Mexico. Available online at:

http://www.nytimes.com/2006/11/08/business/worldbusiness/08gulf.html. Last

accessed 10th Aug 2011.

Owen, Anthony D. (2006). Presentation: The International Oil Market. Centre for Energy and

Environmental Markets. Slide 12. Available online at:

http://www.ceem.unsw.edu.au/content/documents/ReserveBank.pdf. Last accessed

20th Aug 2011.

PFC Energy 50. (2011). The Definitive Annual Ranking of the World[s \argest \isted Energy

Firms. Available online at:

https://www.pfcenergy.com/x/media/Files/Public%20Files/PFC%20Energy%2050/PF

CtEnergyt50t20111.pdf

Parshall, Joel. (2010). Presalt Propels Brazil into OilQs Front Rank. Available online at:

http://www.spe.org/jpt/print/archives/2010/04/13Brazil.pdf. Last accessed 10th Aug

2010.

Petroleum Services Association of Canada. (2011). What is the upstream oil & gas industry].

Available online at: www.psac.ca/industry-info/101-what-is-the-upstream-oil-a-gas-

industry. Last accessed 19th July 2011

Reed, Ed. (2011). Namibia in the crosshairs. Available online at:

www.africabusinesscentre.co.uk/downloads/.../namibia-in-the-crosshairs/. Last

accessed 10th Aug 2010.

Richards, Phil. (2002). Overview of petroleum geology, oil exploration and associated

environmental protection around the Falkland Islands . Available online at:

http://www.bgs.ac.uk/falklands-

oil/downloads/reports/RichardsEnvironmentConference2001.pdf. Last accessed 10th

Aug 2011.

Ritter, John. (2007). SPE Approves New Reserves/Resources Document. Available online at:

http://www.spe.org/spe-app/spe/jpt/2007/06/Reserves.htm. Last accessed 10th Aug

2011.

Schlumberger. (2000). Solving Deepwater Well-Construction Problems. Available online at:

http://www.slb.com/x/media/Files/resources/oilfieldtreview/ors00/spr00/p2t17.as

hx. Last accessed 10th Aug 2011.

Thompson, Christopher. (2011). Oil groups go to the ends of the earth. Financial Times of

20

th

May 2011. p.16

0 % Sven Wagner

Bachelor Thesis: Exploring New Oil Frontiers

36

UBS Investment Research (2008). Introduction to the Oil Industry. p89-84, p97-98.

USGS. (2011). Economics of Emerging Global Hydrocarbon Supplies by Marginal Resources.

Available online at: http://energy.usgs.gov/OilGas/Economics.aspx, navigate to

Researchj. Last accessed 10th Aug 2011.

USGS. (2011). Assessment of Undiscovered Oil and Gas Resources of the West African Coastal

Province, West Africa. Available online at: pubs.usgs.gov/fs/2011/3034/pdf/FS11-

3034.pdf. Last accessed 10th Aug 2011.

USGS. (2011). Assessment of Undiscovered Oil and Gas Resources of Four West Africa

Geologic Provinces. Available: http://pubs.usgs.gov/fs/2010/3006/pdf/FS10-

3006.pdf. Last accessed 10th Aug 2011

U.S. Energy Information Administration. (2010). International Energy Outlook. Available:

http://www.eia.gov/oiaf/ieo/pdf/0484(2010).pdf. Last accessed 10th Aug 2010.

Viscidi, Lisa. (2010). The Twilight of the Western Oil Ma^ors. In: Foreign Policy., Available

online at:

http://www.foreignpolicy.com/articles/2010/04/26/thettwilighttoftthetwesterntoil

tmajors?page=full. Last accessed 10th Aug 2011.

Wheaton, Stuart. (2008). _ubilee development pro^ect phase 1. Available online at:

http://www.tullowoil.com/files/pdf/ghana/Jubilee-development-project-phase1.pdf.

Last accessed 10th Aug 2011.

Xu, Xiaojie. (2008). The rise of an NOC. In: Fundamentals of the Global Oil and Gas

Industry. (3.9), p. 81-82.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Anatomy of the pulp cavity กย 2562-1Документ84 страницыAnatomy of the pulp cavity กย 2562-1IlincaVasilescuОценок пока нет

- PhenomenonДокумент1 страницаPhenomenonanyak1167032Оценок пока нет

- This Book Is Written For Advanced Earth Science Students, Geologists, Petroleum Engineers and Others Who Want To Get Quickly UpДокумент1 страницаThis Book Is Written For Advanced Earth Science Students, Geologists, Petroleum Engineers and Others Who Want To Get Quickly Upanyak1167032Оценок пока нет

- Biodegradation PDFДокумент11 страницBiodegradation PDFanyak1167032Оценок пока нет