Академический Документы

Профессиональный Документы

Культура Документы

Economic Snapshot: Tax Collection Is Big Business PDF

Загружено:

The Dallas Morning NewsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Economic Snapshot: Tax Collection Is Big Business PDF

Загружено:

The Dallas Morning NewsАвторское право:

Доступные форматы

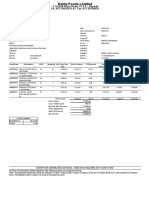

LOCAL ECONOMIC SNAPSHOT | TAX DAY PRIMER

Federal revenue collection is big business

By PAMELA YIP

Personal Finance Writer pyip@dallasnews.com

By TOM SETZER

Staff Artist tsetzer@dallasnews.com

Tax revenue collected by the IRS has grown steadily for the past 50 years. Individuals paid 82 percent of taxes and businesses accounted for 17 percent in 2012. About 81 percent of taxes were paid electronically.

Growth in income taxes

Total income taxes collected has grown from $67 billion in 1960 to $1.67 trillion in 2012, most of it from individuals.

(In trillions of dollars) $2

2012 tax collections

$1.5

$1

Almost 85% of all taxes collected last year by the IRS came from individuals.

(Net collections after refunds)

Business tax, $300 billion 16.8%

Estates and trusts, $20 billion 1.2%

Estate and trust income taxes Business income taxes

TOTAL: $1.67 trillion

$0.5

Individuals, $1.37 trillion 82%

Individual income taxes

1960

1965

1970

1975

1980

1985

1990

1995

2000

2005

2010

Top tax-paying states for 2012

1. California $249.3 billion 10. Minnesota $61.7 billion

5. Illinois $103.7 billion

2. New York $176.9 billion

9. Massachusetts $73.2 billion

6. Ohio $95.7 billion 8. New Jersey $92 billion 7. Pennsylvania $94.7 billion

The most populous states pay the most individual income taxes, with Texas ranking third.

3. Texas $171.9 billion

4. Florida $113.2 billion

2012 by the numbers

Individual returns processed

Who got audited in 2012

Higher-income individuals are targeted for most examinations or IRS audits.

(Percentage audited) 40

237 million

Percentage filed electronically

81%

Total refunds paid

$373 billion

Total federal revenue collected

30

27.4%

$2.5 trillion Returns from Texans

In 2012: Individual income Corporate S corporations Partnership

SOURCES: IRS; ESRI

20

17.9%

10 2.67% 0

None

8.9% 1.05% 0.7%

$25.1K to $50K $50.1K to $75K

11,292,464 172,875 264,403 331,540

0.64%

0.64%

$75.1K to $100K

0.85%

1.96%

$200.1K to $500K

3.57%

$1.1 million to $5 million More than $10 million

(Income Up ranges) to $25K

$100.1K to $200K

$500.1K to $1 million

$5.1 million to $10 million

The bottom line

Audits would go up more on those with higher incomes because thats where a tax adjustment is likely to have a higher impact. They typically have things that prompt an audit, but were seeing a lot more audit activity just in general than weve seen in a number of years. High-income returns are often more complex, and generally, upper-income taxpayers have resources to engage in pass-through entities, such as partnerships, trusts and corporations. The IRS will sustain its focus on taxpayer populations where complexity creates opportunities for noncompliance. Clay Sanford, IRS spokesman Electronic filing of tax returns continues to rise. If youre not ready to file your tax return by now, consider filing for an extension, which will give you until Oct. 15 to submit the return. You file for an extension on IRS form 4868. Remember, an extension of time to file is not an extension of time to pay. Pamela Yip, personal finance writer, The Dallas Morning News

Ken Sibley, partner, CliftonLarsonAllen LLP

Вам также может понравиться

- The News' Top Texas Golf Courses 2020, Nos. 1-50Документ4 страницыThe News' Top Texas Golf Courses 2020, Nos. 1-50The Dallas Morning NewsОценок пока нет

- 09.a - TaxДокумент16 страниц09.a - Taxmickael28Оценок пока нет

- Sales InvoicesДокумент1 страницаSales InvoicesMayank ManiОценок пока нет

- Robb Elementary School Attack Response Assessment and RecommendationsДокумент26 страницRobb Elementary School Attack Response Assessment and RecommendationsThe Dallas Morning NewsОценок пока нет

- ACORN: Missing MillionsДокумент13 страницACORN: Missing MillionsMatthew VadumОценок пока нет

- Global Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItОт EverandGlobal Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItОценок пока нет

- Acabar Payslip 2Документ1 страницаAcabar Payslip 2Niña Rica SembrinoОценок пока нет

- Payslip For: FEB-2022: Louis Berger SASДокумент1 страницаPayslip For: FEB-2022: Louis Berger SASMukhtar AhmedОценок пока нет

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformОт EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformОценок пока нет

- Revenue Regulations No 12-99Документ3 страницыRevenue Regulations No 12-99Zoe Dela Cruz0% (1)

- CIR vs. CAДокумент4 страницыCIR vs. CARobОценок пока нет

- Sample Exam Questionnaire and Answer in TaxationДокумент6 страницSample Exam Questionnaire and Answer in TaxationKJ Vecino Bontuyan75% (4)

- Comparative Tax Incentives Available To Bpo Companies Registered With The Boi and The PezaДокумент4 страницыComparative Tax Incentives Available To Bpo Companies Registered With The Boi and The Pezajilliankad100% (1)

- Scott Hodge, President Will Mcbride, Chief EconomistДокумент20 страницScott Hodge, President Will Mcbride, Chief EconomistTax FoundationОценок пока нет

- Business Organization and TaxesДокумент22 страницыBusiness Organization and TaxesChieMae Benson QuintoОценок пока нет

- The Kiplingertox Letter: Circulated Biweekly To Business Clients Since 1925 DC Vol. 92, No. 26Документ4 страницыThe Kiplingertox Letter: Circulated Biweekly To Business Clients Since 1925 DC Vol. 92, No. 26brandonОценок пока нет

- How Do Marginal Tax Rates WorkДокумент7 страницHow Do Marginal Tax Rates WorkFelippe QueirozОценок пока нет

- Trump's Tax Plan: Income Tax Rate Income Levels For Those Filing As: 2018-2025 Single Married-JointДокумент3 страницыTrump's Tax Plan: Income Tax Rate Income Levels For Those Filing As: 2018-2025 Single Married-JointJefri David SimanjuntakОценок пока нет

- Public Finance w3Документ13 страницPublic Finance w3Lê Huỳnh PhúОценок пока нет

- Part 1: Married With Children. Troy and Katie Are Married, File A Joint Return, and HaveДокумент3 страницыPart 1: Married With Children. Troy and Katie Are Married, File A Joint Return, and HaveLemon VeinОценок пока нет

- CH #3Документ7 страницCH #3Waleed Ayaz UtmanzaiОценок пока нет

- The Art of Deduction (WEB)Документ7 страницThe Art of Deduction (WEB)Derrie SuttonОценок пока нет

- Chapter 2 The Tax EnvironmentДокумент26 страницChapter 2 The Tax EnvironmentTehsEen NadeEmОценок пока нет

- Types of TaxesДокумент8 страницTypes of TaxesWool VestОценок пока нет

- Tax ProblemsДокумент3 страницыTax Problemsstrikers154Оценок пока нет

- TaxationДокумент12 страницTaxationjanahh.omОценок пока нет

- Oklahoma Task Force On Comprehensive Tax Reform: September 15, 2011Документ32 страницыOklahoma Task Force On Comprehensive Tax Reform: September 15, 2011okpolicyОценок пока нет

- The Corporate Tax Rate Debate: Lower Taxes On Corporate Profits Not Linked To Job CreationДокумент30 страницThe Corporate Tax Rate Debate: Lower Taxes On Corporate Profits Not Linked To Job CreationNancy AmideiОценок пока нет

- ExtraTaxProblem-TY2020 Student - SUSANДокумент6 страницExtraTaxProblem-TY2020 Student - SUSANhhunter530Оценок пока нет

- Americans Need To Get Involved More!!!!Документ5 страницAmericans Need To Get Involved More!!!!flyers20112011Оценок пока нет

- The Three Basic Tax Types in The U.S.Документ10 страницThe Three Basic Tax Types in The U.S.Ngan TruongОценок пока нет

- Taxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerДокумент21 страницаTaxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerKatherine SauerОценок пока нет

- Raising Revenue From Higher Earners 11 15-2Документ9 страницRaising Revenue From Higher Earners 11 15-2Robert ShawОценок пока нет

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Документ53 страницыAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Committee For a Responsible Federal BudgetОценок пока нет

- Introduced Budget InformationДокумент3 страницыIntroduced Budget InformationAndrew CasaisОценок пока нет

- Governor Rick Perry - Cut Balance and Grow - Full Economic and Tax PlanДокумент24 страницыGovernor Rick Perry - Cut Balance and Grow - Full Economic and Tax PlanZim VicomОценок пока нет

- The Design of A Tax SystemДокумент31 страницаThe Design of A Tax SystemMuhammad ImranОценок пока нет

- Miller 14e Ppt06 Mac AbbrevДокумент50 страницMiller 14e Ppt06 Mac AbbrevAbdulkerim SadıqovОценок пока нет

- Taxes Exam Review Part 1Документ5 страницTaxes Exam Review Part 1kateverettОценок пока нет

- October, 2012: Propositions 30 & 38 in Context - California Funding For Public SchoolsДокумент40 страницOctober, 2012: Propositions 30 & 38 in Context - California Funding For Public Schoolsk12newsnetworkОценок пока нет

- CH 2 SolutionДокумент7 страницCH 2 SolutionJohnОценок пока нет

- Transforming The Internal Revenue ServiceДокумент20 страницTransforming The Internal Revenue ServiceCato InstituteОценок пока нет

- Budget 090403 Fact FictionДокумент2 страницыBudget 090403 Fact FictionAlfonso RobinsonОценок пока нет

- Submitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharДокумент17 страницSubmitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharViveka BothraОценок пока нет

- LD 1495 "Tax Reform" The Real Facts: Albert A. Dimillo, Jr. Retired Corp Orate Tax Director & CpaДокумент30 страницLD 1495 "Tax Reform" The Real Facts: Albert A. Dimillo, Jr. Retired Corp Orate Tax Director & CpaMelinda JoyceОценок пока нет

- Chapter 6Документ19 страницChapter 6Steve CouncilОценок пока нет

- TaxEDU Primer The Three Basic Tax TypesДокумент10 страницTaxEDU Primer The Three Basic Tax TypesThảo LêОценок пока нет

- Taxation PlanningДокумент77 страницTaxation Planningdinesh saravananОценок пока нет

- Chapter No 2 TaxДокумент24 страницыChapter No 2 TaxsalwaburiroОценок пока нет

- 10 Page PaperДокумент12 страниц10 Page PaperDennis waitiki muiruriОценок пока нет

- Chapter 1 - Concise: Introduction To Financial ManagementДокумент17 страницChapter 1 - Concise: Introduction To Financial ManagementJohn DoesОценок пока нет

- Joint Explanatory StatementДокумент570 страницJoint Explanatory Statementacohnthehill50% (4)

- Tax Policy Center Cruz AnalysisДокумент37 страницTax Policy Center Cruz AnalysisAndrew NeuberОценок пока нет

- Chapter 12Документ38 страницChapter 12Shiela MaeaОценок пока нет

- Joint Tax Hearing-Ron DeutschДокумент18 страницJoint Tax Hearing-Ron DeutschZacharyEJWilliamsОценок пока нет

- Capital Gains: Rob Mcclelland February 6, 2017Документ5 страницCapital Gains: Rob Mcclelland February 6, 2017Chandani DesaiОценок пока нет

- Direct Tax CodeДокумент12 страницDirect Tax CodeSaravanan VaithiОценок пока нет

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0Документ60 страницAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0Committee For a Responsible Federal Budget100% (1)

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0Документ58 страницAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0Committee For a Responsible Federal BudgetОценок пока нет

- Presenting: Direct Tax - Trends in IndiaДокумент27 страницPresenting: Direct Tax - Trends in IndiatusharОценок пока нет

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0Документ44 страницыAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0Committee For a Responsible Federal BudgetОценок пока нет

- Progressive Principles of Tax ReformДокумент3 страницыProgressive Principles of Tax ReformNational JournalОценок пока нет

- A. The Constitution and The Income Tax: Federal Income Tax Professor Morrison Fall 2003 CHAPTER 1: IntroductionДокумент67 страницA. The Constitution and The Income Tax: Federal Income Tax Professor Morrison Fall 2003 CHAPTER 1: IntroductioncjleopОценок пока нет

- Fair Tax For IllinoisДокумент8 страницFair Tax For IllinoisjroneillОценок пока нет

- Week 1Документ14 страницWeek 1kohalehОценок пока нет

- Fred Thompson 4/6/10Документ6 страницFred Thompson 4/6/10patrick_emerson6704Оценок пока нет

- Answer The Following Five Independent QuestionsДокумент5 страницAnswer The Following Five Independent Questionsaziza barekОценок пока нет

- The Top 25 Nine-Hole Golf Courses in Texas, Ranked (2020)Документ2 страницыThe Top 25 Nine-Hole Golf Courses in Texas, Ranked (2020)The Dallas Morning NewsОценок пока нет

- Kelcy Warren v. Beto O'RourkeДокумент16 страницKelcy Warren v. Beto O'RourkeThe Dallas Morning News100% (1)

- SchoolboySlantДокумент1 страницаSchoolboySlantThe Dallas Morning NewsОценок пока нет

- Supreme Court Ruling On NCAA AthleticsДокумент45 страницSupreme Court Ruling On NCAA AthleticsThe Dallas Morning NewsОценок пока нет

- The Top 25 High-Priced Golf Courses in Texas That Cost $80 and Above (2020)Документ3 страницыThe Top 25 High-Priced Golf Courses in Texas That Cost $80 and Above (2020)The Dallas Morning NewsОценок пока нет

- The Top 25 Economy Golf Courses in Texas That Cost $54 and Under (2020)Документ3 страницыThe Top 25 Economy Golf Courses in Texas That Cost $54 and Under (2020)The Dallas Morning NewsОценок пока нет

- The Dallas Morning News' Texas Golf Panel Ranks Texas' Best and Most Beautiful Golf Holes For 2020Документ2 страницыThe Dallas Morning News' Texas Golf Panel Ranks Texas' Best and Most Beautiful Golf Holes For 2020The Dallas Morning NewsОценок пока нет

- The News' Top 100 Texas Golf Courses 2020, 51-100Документ2 страницыThe News' Top 100 Texas Golf Courses 2020, 51-100The Dallas Morning NewsОценок пока нет

- The News' Top 50 Golf Courses Open To The Public (2020)Документ2 страницыThe News' Top 50 Golf Courses Open To The Public (2020)The Dallas Morning NewsОценок пока нет

- SMU Concussions LawsuitДокумент21 страницаSMU Concussions LawsuitThe Dallas Morning NewsОценок пока нет

- Letter To Rep. John Ratcliffe On TortureДокумент2 страницыLetter To Rep. John Ratcliffe On TortureThe Dallas Morning NewsОценок пока нет

- The News' Top Texas Golf Courses 2020, Nos. 1-50Документ4 страницыThe News' Top Texas Golf Courses 2020, Nos. 1-50The Dallas Morning NewsОценок пока нет

- SMU, Travis Mays ResponseДокумент32 страницыSMU, Travis Mays ResponseThe Dallas Morning NewsОценок пока нет

- 2020 NFHS Guidance For Opening Up High School Athletics and ActivitiesДокумент16 страниц2020 NFHS Guidance For Opening Up High School Athletics and ActivitiesThe Dallas Morning NewsОценок пока нет

- Dai'ja Thomas Lawsuit Against SMU, Travis MaysДокумент26 страницDai'ja Thomas Lawsuit Against SMU, Travis MaysThe Dallas Morning NewsОценок пока нет

- (15-00293 424-68) Frederick Collection LetterДокумент3 страницы(15-00293 424-68) Frederick Collection LetterJessie SmithОценок пока нет

- DDDDDDДокумент1 страницаDDDDDDZohaib hassanОценок пока нет

- UmeshДокумент1 страницаUmeshAman DubeyОценок пока нет

- Don't Miss Out On Free School Meals!: Application Form 2012/2013Документ1 страницаDon't Miss Out On Free School Meals!: Application Form 2012/2013esolnexusОценок пока нет

- Solution Performa - Mamta FashionsДокумент3 страницыSolution Performa - Mamta FashionsGarimaBhandariОценок пока нет

- Liability SheetДокумент1 страницаLiability Sheetaakashgupta viaanshОценок пока нет

- 1.2 Budget Process BДокумент4 страницы1.2 Budget Process BHarsh RajОценок пока нет

- Petitioner vs. vs. Respondents Dominguez Law Office Assistant City Fiscal Arquipo L. AdriaticoДокумент6 страницPetitioner vs. vs. Respondents Dominguez Law Office Assistant City Fiscal Arquipo L. AdriaticoMaraОценок пока нет

- Receipt 1Документ3 страницыReceipt 1Deepak KansalОценок пока нет

- 24 - 38221544103291 SCR GuntupalliДокумент3 страницы24 - 38221544103291 SCR GuntupalliAbhishek DahiyaОценок пока нет

- Tax LawДокумент3 страницыTax LawAnkit KumarОценок пока нет

- E-Book On ExemptionДокумент23 страницыE-Book On ExemptionMani MudaliarОценок пока нет

- Propotional Taxation and Its Role of The Government Revenue 2017 HargeisaДокумент56 страницPropotional Taxation and Its Role of The Government Revenue 2017 HargeisaYousuf abdirahmanОценок пока нет

- On January 1 2015 Evers Company Purchased The Following Two: Unlock Answers Here Solutiondone - OnlineДокумент1 страницаOn January 1 2015 Evers Company Purchased The Following Two: Unlock Answers Here Solutiondone - OnlineAmit PandeyОценок пока нет

- Inter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)Документ176 страницInter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)pradeep ozaОценок пока нет

- 0910 Business FarmДокумент2 страницы0910 Business Farmkeepst.louisfree766Оценок пока нет

- Payslip TemplateДокумент1 страницаPayslip TemplateLeonardo GonzalezОценок пока нет

- SA105-2018 (UK Property (SA105) - BlankisitДокумент2 страницыSA105-2018 (UK Property (SA105) - BlankisitMal WilliamsonОценок пока нет

- UL StatementДокумент3 страницыUL StatementrajeshbantaОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Gadde Niharika ChowdaryОценок пока нет

- MERGAДокумент41 страницаMERGAkassahun meseleОценок пока нет

- NPA CertificateДокумент3 страницыNPA CertificateRakesh DudiОценок пока нет

- SMP 15 Year 1 LAKHДокумент3 страницыSMP 15 Year 1 LAKHTamil Vanan NОценок пока нет