Академический Документы

Профессиональный Документы

Культура Документы

Code On Payment of Bills

Загружено:

Varun SainiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Code On Payment of Bills

Загружено:

Varun SainiАвторское право:

Доступные форматы

KARNATAKA

ELECTRICITY REGULATORY BANGALORE

COMMISSION

CODE OF PRACTICE ON PAYMENT OF BILLS 1. SHORT TITLE, COMMENCEMENT AND INTERPRETATION: a. This code may be called the code of Practice on Payment of Bills. b. It shall come into force from such date as may be notified by Karnataka Electricity Regulatory Commission and shall be adopted by the Licensee i.e., Karnataka Power Transmission Corporation Limited c. It extends to the whole of the State of Karnataka. 2. DEFINITIONS: Unless the context otherwise requires, words or expressions occurring in this code shall bear the same meaning as in the Karnataka Electricity Reform Act, 1999, The Karnataka Electricity Regulatory Commission, (General and Conduct of Proceedings) Regulations, 2000 and the Karnataka Electricity Regulatory Commission (Electricity Supply and Distribution) Code, 2000-01 (hereinafter referred to as Supply Code.) If a word is not defined in these documents, it shall have the meaning as understood generally in the electricity supply industry. 3. BILLS FOR SUPPLY OF POWER: 3.1. PERIODICITY: In accordance with Section 29.02 (a) of KERC (ES&D) Code, 2000-01, (a) The Licensee will furnish to the Consumer every month or at such interval, as prescribed by the Licensee from time to time, the power supply bills for the actual or in its absence, the assessed demand and/or consumption, either at the spot or by post. The billed amount shall be rounded off to the nearest Rupee i.e., the bill amount of 50 paise and above shall be rounded off to the next rupee and amount less than 50 paise ignored. Bills shall be served to the consumer on the spot or sent through courier or by post. The bill shall be issued on the same day in case of spot billing and not later than 4 days after reading of meter in other cases whether it is computerized or manual billing. Where spot billing is not followed, the bill date as incorporated in the print out of the bill should be meter reading date + 4 days. Consequently the due date for payment would be 15 days from bill date i.e., meter reading date + 19 days. (b) It shall be clearly indicated on the bill that a maximum period of 15 days from the bill date is allowed for making the payment and

also that the installation shall be disconnected with out further notice after expiry of 7 clear days from the end of this period of 15 days in case of nonpayment. Note: 1) The energy consumption shall be rounded off to the nearest unit. 2) Non-receipt of the bill by the Consumer is not a valid reason for non-payment. The Consumer shall notify the office of issue if the bill is not received within 7 days from the meter reading date. Otherwise, it will be deemed that the bills have reached the Consumer in due time.

3.2

INFORMATION TO BE PROVIDED IN THE BILL: The following information shall be included on the body of the bill. a) Name, address and R.R.No. of the installation. b) Name and address of the Office issuing the bill. c) Contracted Demand and / or Sanctioned Load of Consumer. d) Classification of Tariff Category. e) Status of meter (Working / not recording / out of order / no meter/ seal missing). f) Period of Billing. g) Previous meter reading of the billing period / cycle. h) Present meter reading of the billing period / Cycle. i) Number of units consumed during the billing period. j) Power factor, where applicable. k) Date of the bill and Due date of payment. l) If due date for payment indicated in the bill happens to be a holiday for the office of issue, the next working day shall be treated as the due date. m) It shall be clearly indicated on the bill the period of 15 days allowed for payment and also that the installation shall be disconnected with out further notice after expiry of 7 clear days from the due date in case of nonpayment. n) Billing details. Current Power Supply charges showing separately various components (e.g., fixed charges, energy charges for different slabs where applicable, fuel escalation charge, if any, meter rental and any other charges) as applicable. Arrears in Power Supply Charges showing separately principal and interest components. Electricity Tax. Interest on arrears. Rebate allowed, if any. Adjustment made, if any during the billing period. Total amount due. o) Designation and address of authorities with whom complaints /grievances can be lodged.

p) In case payment is to be made by cheques or bank drafts, the receiving authority in whose favour the amount should be drawn. q) Mode of payment, Bill collection centers and address, Working Hours of Bill collection centers. r) Applicable Tariff information. Note: 1) Information of Sl. Nos. l, m, o, p, and r shall be printed on the reverse of the bill and the Information of Sl. No q shall be printed on the front side of the bill. 2) The bill may contain additional information in respect of consumers covered under two-part tariffs. 3.3 PAYMENT OF BILL: (a) The Consumer shall pay the Power Supply charges at the office of issue or at the jurisdictional cash counters as indicated hereunder: i) In respect of revenue payments ie, monthly power supply charges up to and inclusive of Rs.10, 000/-shall be made by cash or cheque or D.D. and payments above Rs.10, 000/- shall be by cheque or D.D. only ii) Payments under other heads of account i.e., other than revenue payments shall be made by cash or D.D.upto and inclusive of Rs.10, 000/- and above Rs.10, 000/-shall be by D.D. only iii) By availing Electronic clearing system (ECS)/ through Credit cards / On line E-Payment @ www.billjunction.com at counters wherever such facility is provided by the Licensee. iv) Through banks authorised by the Licensee. (The date of payment in the bank will be the date of payment of the bill) Note: (I) Demand Draft / Cheque shall be issued in favor of Licensee drawn on any scheduled commercial bank situated at the headquarters of the office of issue along with the bill. No outstation cheques shall be accepted. The R.R. No. and ledger folio No. shall be indicated on the reverse side of the Demand Draft / Cheque. Receipt for payment shall be obtained. (II) Payment by Cheque / Demand Draft sent by post or by money order shall also be accepted. The Consumer shall invariably furnish RR No., Ledger No and Folio Number on the reverse of Cheque / Demand Draft sent by post /on money order form. The Consumer has to collect the receipt.

(b) In case the amount is paid at the cash counter in person, bill shall be produced. In the absence of the bill, the RR No., ledger and Folio No. shall be furnished. (c) The Licensee will accept the cheque from the Consumer in good faith and shall issue receipt subject to realisation. If the cheque is not realised but returned by the bank, it amounts to non-payment and the Consumer is liable for levy of interest and disconnection of power supply with out further notice or after expiry of 7 clear days from the due date which ever is later. (d) In the event of non-realisation of cheque, no further cheques shall be accepted from such Consumer without prejudice to the Licensee taking action such as levying cheque dishonour fee as per Section 30.18 of the KERC (ES&D) Code, 2000-01 and initiating other actions as per Law. (e) Cheques can be dropped in a box meant for the same at the Licensees designated office for payment of bill charges and the Licensee shall draw the receipt and Consumer shall collect the receipt. (f) If any Consumer wishes to make advance payment of power supply bills for his own convenience he may do so. The same will be adjusted towards the periodical bills and will be shown in the bills furnished to the Consumer. 3.4 INSTALMENT FACILITY The Licensee may grant the facility of paying the bills in installments in cases where the Licensee reasonably believes that the consumer is creditworthy and is satisfied regarding the deserving nature of the request. The Licensee may allow the facility for payment of bills in installments and the consumer will be charged interest for the period of deferment at the rate applicable for belated payment on the remaining balance. The Licensee shall designate the authorities for granting these facilities to different categories of consumers from time to time. 3.5 LEVY OF INTEREST AND ELECTRICITY TAX In case of belated payment of bills, interest will be levied at the rate of 2% per month on actual number of days of delay from the expiry of due date, subject to a minimum of Re.1/- for LT installations and Rs.100/- for HT installation. However, no interest is leviable for arrears of Rs.10/- and less. The interest for belated payment of Electricity Tax will be levied at the

rates prescribed by the Government of Karnataka from time to time. 3.6 PRIORITY FOR ADJUSTMENT OF PAYMENT All payments made by the consumer will be adjusted in the following order of priority as prescribed in Section 29.08 of the KERC (Electricity Supply and Distribution) Code, 2000-01: i. Interest on Electricity Tax arrears. ii. Tax arrears. iii. Interest on revenue arrears. iv. Revenue arrears. v. Current months Power Supply charges. 4(a) ERRONEOUS BILL AND ITS ADJUSTMENT

Any complaint with regard to errors in the regular bill shall be made either in person or in writing to the office of issue of the bill. The Licensee shall issue the revised bill if found necessary on the same day. Even after issue of the revised bill if the Consumer disputes the amount, such bill shall be paid under protest within the due date or the aggrieved Consumer may prefer an appeal in writing to the Appellate Authority in accordance with the provisions of Section 44.00 of KERC (ES&D) Code, 2000-01. (i) At any time during verification of the Consumers account if any erroneous claims are noticed, the Consumer is liable to pay the difference, in case the revised claims are more than the claims already made in the regular bills with in 30 days from the presentation of a separate supplemental bill for the short claim. However, the Licensee shall not claim any payment towards short claim for back period beyond 3 years. In case the revised claims are less than the claims already made, the excess amount pointed out shall be credited to the Consumers account with in one month under intimation to him. If for any reason there is delay in crediting to the Consumers account, interest at 2 % per month shall be paid to the Consumer for the period beyond one month from the date of pointing out of revised claims. (ii) When the difference is payable by the Consumer, claims shall be made by a separate supplemental bill furnishing all the relevant details. (iii) The supplemental claims shall be paid within 30 days from the date of intimation of the claims, failing which the installations is liable for disconnection and such amount shall be deemed to be arrears of electricity charges. The aggrieved Consumer may prefer an appeal, in writing to the Appellate Authority in accordance with the provisions of Section 44.00 of the KERC (ES&D) Code, 2000-01 within a period of 30 days from the date of intimation of the claims under intimation to the office of issue. 4(b) SUPPLEMENTAL BILL The Licensee may raise supplemental bills to recover back billing

charges arising out of prejudicial use of power or faulty meter or short claims caused due to erroneous billing. The Licensee shall serve a provisional bill with 15 days notice to the Consumer to file his objections, if any, against the provisional bill. After considering the objections of the Consumer, the Licensee shall issue the final bill. The Consumer shall make payment within 30 days from the date of the bill, failing which the power supply to the installation shall be disconnected without any further notice and such amount shall be deemed to be arrears of electricity charges. 5 APPEAL 5.01 Any Consumer, who is aggrieved by claims made by the Licensee on grounds of prejudicial use of power or on account of faulty metering equipment or due to any supplemental claims, can file an appeal to the Appellate Authority prescribed in Section 44.00 of the KERC (ES&D) Code, 2000-01. Such appeals shall be made within 30 days from the date of the bill of claims served on him, under intimation to the office of issue, by making payment as indicated below: PERMANENT / TEMPORARY INSTALLATION: a) Dishonest abstraction / consumption / use is alleged : or more. b) Other cases: more.

50 % of the claims

25% of the claims or

NOTE: - (i) However in case of domestic installations of permanent nature, Consumers may prefer an appeal by making payment of only undisputed amount out of the total billed amount. (ii) The Apex body of the Licensee may reduce the amount to be deposited by the appellant consumer depending on the merits of the case before admitting the appeal. 5.02 The Consumer is liable to pay the interest on the amount finally decided by the Appellate Authority (less the amount paid by the consumer before the due date, if any) from the due date of the original claim. 5.03 The First Appellate Authority shall decide the case with in 120 days and communicate the orders thereon to the Consumer and the office of issue. The Consumer shall pay the amount if any, as decided by the First Appellate Authority together with interest, within 30 days from the date of the claim served on him from the office of issue failing which the installation will be disconnected without further notice.

In case any amount becomes refundable as per the decision of the First Appellate Authority, such amount shall be refunded to the Consumer within 90 days from the date of the order of the First Appellate Authority. If the dispute is not decided by First Appellate Authority within above time limit the Consumer is not liable for payment of interest on the arrears for further period beyond120 days. 5.04 If the Licensees Engineer is not satisfied with the order of the First Appellate Authority, he may file an appeal to the Second Appellate Authority within 30 days of the receipt of the orders. 5.05 If the Consumer is not satisfied with the orders of the First Appellate Authority, he may also file a second appeal to the Second Appellate Authority within 30 days of receipt of the order of the First Appellate Authority. However, such appeal shall be filed only after payment of 50% of the amount as decided by the First Appellate Authority, less the amount already paid while filing the Appeal with the First Appellate Authority, for admitting the Second Appeal. 5.06 Second Appellate Authority shall decide the case within 60 days and communicate the orders thereof to the concerned. 5.07 Delayed appeals may be entertained at the discretion of the Appellate Authority depending upon the merits of the case and delay condonation shall be for a maximum period of 60 days only, after duly recording the reasons for such condonation. 5.08 Action shall be taken either by the Licensee or the Consumer, as the case may be in accordance with the decision of the Second Appellate Authority. 6 DISCONNECTION DUE TO NON-PAYMENT It shall be clearly indicated on the bill the period of 15 days allowed for payment and also that the installation shall be disconnected with out further notice after expiry of 7 clear days from the due date in case of nonpayment. Where a Consumer fails to pay the billed amount in respect of supply of power or any part of it, the Licensee may disconnect the supply of power to the installation until the dues are paid. According to Section 4.12 (vi) of the KERC (ES&D) Code, 2000-01 arrears in any particular installation, which is under disconnection for non-payment, shall be collected as arrears of any other installation except residential installation standing in the name of the same Consumer. Further the Licensee shall issue a separate notice clearly explaining the circumstances before recovery is pursued by claiming the arrears of any installation as arrears of another installation of the same Consumer.

RECOVERY OF DUES BY LICENSEE Notwithstanding disconnection of the installation, the Licensee shall be entitled to all legal modes of recovery including enforcing the provisions of the Karnataka Electricity Board (Recovery of dues) and Other Laws (Amendment) Act, 2001, and Rules made there under. By Order of the Commission Secretary

Karnataka Electricity Regulatory Commission.

Вам также может понравиться

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeОт Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeРейтинг: 1 из 5 звезд1/5 (1)

- Consumer Service Manual - NEPRAДокумент66 страницConsumer Service Manual - NEPRAstubborn002Оценок пока нет

- Access Devices Regulation Act of 1998: Disclosure Requirements During Application and Solicitation ExceptionsДокумент9 страницAccess Devices Regulation Act of 1998: Disclosure Requirements During Application and Solicitation ExceptionsJustin CebrianОценок пока нет

- Housing Co Operative Societies 946 PDFДокумент32 страницыHousing Co Operative Societies 946 PDFArchana SahaОценок пока нет

- Republic of The Philippines Regional Trial Court Tarlac City Branch - Roberto Sentry R. ReynaldoДокумент4 страницыRepublic of The Philippines Regional Trial Court Tarlac City Branch - Roberto Sentry R. ReynaldoIngrid Frances CalmaОценок пока нет

- Concubinage, Adultery, BigamyДокумент13 страницConcubinage, Adultery, BigamyMichael Datucamil100% (1)

- LTE IdentifiersДокумент12 страницLTE IdentifiersDONALFYОценок пока нет

- Wrongful Restraint & Wrongful ConfinementДокумент9 страницWrongful Restraint & Wrongful ConfinementShreya VermaОценок пока нет

- Jails and The BJMPДокумент40 страницJails and The BJMPCinja Shidouji100% (5)

- Southern District of Florida Local Rules (April 2002)Документ176 страницSouthern District of Florida Local Rules (April 2002)FloridaLegalBlogОценок пока нет

- Credit Cards and Access Devices Regulation - ExplainedДокумент4 страницыCredit Cards and Access Devices Regulation - Explainedhaze_toledo50770% (1)

- GPRS and GSM System Information DetailДокумент62 страницыGPRS and GSM System Information Detailpham_chauОценок пока нет

- Property ManagementДокумент8 страницProperty ManagementMyCura ServicesОценок пока нет

- 12 Guerrero V VillamorДокумент3 страницы12 Guerrero V VillamorJudy Ann ShengОценок пока нет

- People vs. Pacayna - ParricideДокумент13 страницPeople vs. Pacayna - ParricidegeorjalynjoyОценок пока нет

- Written Arguments of Santosh PrintersДокумент4 страницыWritten Arguments of Santosh PrintersMukesh LalОценок пока нет

- Timers in LTEДокумент18 страницTimers in LTEVarun SainiОценок пока нет

- People vs Campos Partnership Dispute Case SummaryДокумент3 страницыPeople vs Campos Partnership Dispute Case SummaryRhena SaranzaОценок пока нет

- Resuena, Et Al. vs. Court of Appeals and Juanito Boromeo, SR., G.R. No. 128338, March 28, 2005Документ2 страницыResuena, Et Al. vs. Court of Appeals and Juanito Boromeo, SR., G.R. No. 128338, March 28, 2005Edeniel Cambarihan100% (1)

- Radio Link Failure-PA2Документ63 страницыRadio Link Failure-PA2Varun Saini100% (2)

- Voice Over LTEДокумент149 страницVoice Over LTEVarun Saini100% (1)

- Code PracticeДокумент8 страницCode PracticebalaramОценок пока нет

- SECTIONVIIДокумент8 страницSECTIONVIIchavisharmarr00Оценок пока нет

- English Electricity Tariff 2024Документ60 страницEnglish Electricity Tariff 2024UNNI KUTTANОценок пока нет

- Electricity Tariff For FY 17 PDFДокумент38 страницElectricity Tariff For FY 17 PDFPrashant TrivediОценок пока нет

- Andhra Pradesh Electricity Regulatory Commission: 1. Short Title, Commencement and InterpretationДокумент9 страницAndhra Pradesh Electricity Regulatory Commission: 1. Short Title, Commencement and InterpretationYazhisai SelviОценок пока нет

- Tariff Booklet 2015 16Документ38 страницTariff Booklet 2015 16sases guardОценок пока нет

- Tariff Booklet 2015 16Документ51 страницаTariff Booklet 2015 16SHUVASHISH CHATTERJEEОценок пока нет

- Licensee Supply Regulations 1990Документ10 страницLicensee Supply Regulations 1990Karl FariqОценок пока нет

- Magna Cart A For MeralcoДокумент7 страницMagna Cart A For Meralcost_richard04Оценок пока нет

- Comercial ProcedureДокумент16 страницComercial Proceduresdo jatliОценок пока нет

- Licensee Supply Regulations 1990 (PU (A) 384 1990)Документ15 страницLicensee Supply Regulations 1990 (PU (A) 384 1990)Bro Ikhwan IliasОценок пока нет

- To Bescom 2014.205 244Документ40 страницTo Bescom 2014.205 244Ankur RawalОценок пока нет

- B.O 1327 Kseb Trac Hteht Incentive 14 15Документ4 страницыB.O 1327 Kseb Trac Hteht Incentive 14 15Navin SanjeevОценок пока нет

- Maharashtra Electricity Duty Refund ProcedureДокумент5 страницMaharashtra Electricity Duty Refund Procedureroshan21Оценок пока нет

- Section 56Документ11 страницSection 56Pankaj SinghОценок пока нет

- Chapter 8 - Input Tax Credit - NotesДокумент57 страницChapter 8 - Input Tax Credit - Notesmohd abidОценок пока нет

- 09 - Proposed Electric Tariff Schedule For FY-21Документ35 страниц09 - Proposed Electric Tariff Schedule For FY-21harsha kunturОценок пока нет

- Blank HT AgmtДокумент9 страницBlank HT AgmtUbais AliОценок пока нет

- Rule 2-06Документ2 страницыRule 2-06Khajan SinghОценок пока нет

- CUB Credit Card T&CДокумент7 страницCUB Credit Card T&CPushpa RajОценок пока нет

- Maharashtra State Electricity Distribution Co. Ltd. bill detailsДокумент2 страницыMaharashtra State Electricity Distribution Co. Ltd. bill detailsShubham GuptaОценок пока нет

- 14-Mescom - Annexure - 4-1 PDFДокумент39 страниц14-Mescom - Annexure - 4-1 PDFmallikarjunОценок пока нет

- RETURNS Under GST - Types, Applicability, Annual Returns, Matching, Final Returns With Rules CA. V.Vijay AnandДокумент8 страницRETURNS Under GST - Types, Applicability, Annual Returns, Matching, Final Returns With Rules CA. V.Vijay Anandshahista786Оценок пока нет

- Tarrif 2020 PDFДокумент38 страницTarrif 2020 PDFhalgeri hescomОценок пока нет

- Amendments - 23rd August, 2011Документ52 страницыAmendments - 23rd August, 2011Vipul MallickОценок пока нет

- Buyer's ModelДокумент5 страницBuyer's Modelkiraan999Оценок пока нет

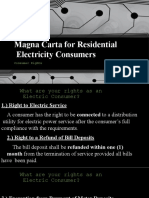

- Magna Carta For Residential Electricity Consumers - pptx-1Документ22 страницыMagna Carta For Residential Electricity Consumers - pptx-1Josh MaghanoyОценок пока нет

- Banking Cases 2Документ23 страницыBanking Cases 2DanielleОценок пока нет

- Vitaran: Ref: PR-3/COS/S626 Date: February 2011Документ7 страницVitaran: Ref: PR-3/COS/S626 Date: February 2011Additional Executive Engineer Flying Squad NRCОценок пока нет

- 807 Kar 5 006.engrossedДокумент11 страниц807 Kar 5 006.engrossedmohamed elmakhzniОценок пока нет

- RR 3-2016Документ5 страницRR 3-2016Boyet CariagaОценок пока нет

- Rights and Rules for Electricity Consumers in IndiaДокумент11 страницRights and Rules for Electricity Consumers in IndiajarvisОценок пока нет

- 14-Bescom - Annexure - 4Документ39 страниц14-Bescom - Annexure - 4રામ પ્રતાપОценок пока нет

- SapaДокумент1 страницаSapaSwathy Chandran PillaiОценок пока нет

- KERC Order Summarizes 2019 Electricity Tariffs for BESCOMДокумент39 страницKERC Order Summarizes 2019 Electricity Tariffs for BESCOMSanthosh AkashОценок пока нет

- Tariff 2018 HescomДокумент38 страницTariff 2018 HescomSachin RaiОценок пока нет

- ECS Debit PartДокумент18 страницECS Debit PartSai PremОценок пока нет

- Prakalathan, A008Документ5 страницPrakalathan, A008Vinayak PuriОценок пока нет

- Finacle 10 CommandsДокумент50 страницFinacle 10 Commandssonigaurav22Оценок пока нет

- RR 16-02Документ2 страницыRR 16-02saintkarriОценок пока нет

- Form of Agreement For The Supply of E.H.T. EnergyДокумент20 страницForm of Agreement For The Supply of E.H.T. EnergylihasmajeedОценок пока нет

- 9 - Subcontractors RecourseДокумент6 страниц9 - Subcontractors RecourseThe Daily LineОценок пока нет

- Fully Electronic Refund ProcessДокумент4 страницыFully Electronic Refund ProcessCA Sumit GargОценок пока нет

- Utility Billing Policy & ProceduresДокумент7 страницUtility Billing Policy & ProceduresYasir Raza MemonОценок пока нет

- Electric Service Contract: Yanez, Xandgiel Mark TuloyДокумент7 страницElectric Service Contract: Yanez, Xandgiel Mark TuloyYaОценок пока нет

- Chapter 18 CPWD ACCOUNTS CODEДокумент5 страницChapter 18 CPWD ACCOUNTS CODEarulraj1971Оценок пока нет

- MSEDCL Application For Open - AccessДокумент33 страницыMSEDCL Application For Open - AccesssunilgvoraОценок пока нет

- Collection Agency Contract: 1. Scope of ServicesДокумент9 страницCollection Agency Contract: 1. Scope of ServicesjoeОценок пока нет

- HERC Supply Code SummaryДокумент18 страницHERC Supply Code Summarypkgoyal1983Оценок пока нет

- Meter Reading Billing Cash Collections and Credit Management For Electricity Supplies in NigeriaДокумент10 страницMeter Reading Billing Cash Collections and Credit Management For Electricity Supplies in Nigeriajoseph KogiОценок пока нет

- Microsoft Word - Payment TermsДокумент2 страницыMicrosoft Word - Payment Termsuraza.octavoОценок пока нет

- Title 3 Blackline 2.15.12Документ83 страницыTitle 3 Blackline 2.15.12letscurecancerОценок пока нет

- Electricity Tariff-2011: Mangalore Electricity Supply Company LimitedДокумент44 страницыElectricity Tariff-2011: Mangalore Electricity Supply Company LimitedxytiseОценок пока нет

- Bản Dự Thảo Thư Tín DụngДокумент5 страницBản Dự Thảo Thư Tín DụngkenjinОценок пока нет

- Mobility in LTEДокумент21 страницаMobility in LTEGanesh JadhavОценок пока нет

- Ebook Connectivity Options QDN 04 FinalДокумент10 страницEbook Connectivity Options QDN 04 FinalVarun SainiОценок пока нет

- DT Notes Part-2Документ24 страницыDT Notes Part-2Bhanu Gautam100% (1)

- Switching - Commonly Used AbbreviationsДокумент12 страницSwitching - Commonly Used AbbreviationsVarun SainiОценок пока нет

- FTP Continuous Upload - DownloadДокумент2 страницыFTP Continuous Upload - DownloadVarun SainiОценок пока нет

- History & GSM IntroductionДокумент17 страницHistory & GSM IntroductionVarun SainiОценок пока нет

- Other Interfaces To The SwitchДокумент5 страницOther Interfaces To The SwitchVarun SainiОценок пока нет

- Radio Um InterfaceДокумент24 страницыRadio Um InterfaceVarun SainiОценок пока нет

- While Start Drive Test Learning, You Must Know The Basic Things! These All Conotents Are at Introductory LevelДокумент14 страницWhile Start Drive Test Learning, You Must Know The Basic Things! These All Conotents Are at Introductory LevelBhanu Gautam100% (1)

- (Ebook) Understanding General Packet Radio Service (GPRS)Документ32 страницы(Ebook) Understanding General Packet Radio Service (GPRS)chrispeweОценок пока нет

- While Start Drive Test Learning, You Must Know The Basic Things! These All Conotents Are at Introductory LevelДокумент14 страницWhile Start Drive Test Learning, You Must Know The Basic Things! These All Conotents Are at Introductory LevelBhanu Gautam100% (1)

- USSD Codes Check Status - HyderabadДокумент9 страницUSSD Codes Check Status - HyderabadVarun SainiОценок пока нет

- Anupam SharmaДокумент4 страницыAnupam SharmaVarun SainiОценок пока нет

- UMTS ChannelsДокумент7 страницUMTS ChannelsVarun SainiОценок пока нет

- UMTS ChannelsДокумент7 страницUMTS ChannelsVarun SainiОценок пока нет

- Abcdefghij Klmnopqr StuvwxyzДокумент1 страницаAbcdefghij Klmnopqr StuvwxyzVarun SainiОценок пока нет

- CSFB ExplanationДокумент7 страницCSFB ExplanationSana UllahОценок пока нет

- N1 99556Документ15 страницN1 99556Varun SainiОценок пока нет

- 131 CD Ma Exec OverviewДокумент52 страницы131 CD Ma Exec OverviewVarun SainiОценок пока нет

- Evdo 340Документ172 страницыEvdo 340Vimal Raj UОценок пока нет

- SMS MMSДокумент62 страницыSMS MMSVarun SainiОценок пока нет

- GPRS NortelДокумент42 страницыGPRS NortelAmit Baran ChatterjeeОценок пока нет

- 7.LTE Marketing and RF MeasurementДокумент58 страниц7.LTE Marketing and RF MeasurementVarun Saini100% (1)

- Call Flow and HandoverДокумент14 страницCall Flow and HandoverVarun SainiОценок пока нет

- Cellular ProtocolsДокумент28 страницCellular Protocolsdodi chaerul hardyОценок пока нет

- Supreme Court rules on mens rea in Essential Commodities Act caseДокумент5 страницSupreme Court rules on mens rea in Essential Commodities Act caseShantanu NemaniОценок пока нет

- DownloadedДокумент6 страницDownloadedHaaj J MohammedОценок пока нет

- Charles A. Albrecht v. Baltimore & Ohio Railroad Company, 808 F.2d 329, 4th Cir. (1987)Документ6 страницCharles A. Albrecht v. Baltimore & Ohio Railroad Company, 808 F.2d 329, 4th Cir. (1987)Scribd Government DocsОценок пока нет

- Bowsher v. Synar, 478 U.S. 714 (1986)Документ61 страницаBowsher v. Synar, 478 U.S. 714 (1986)Scribd Government DocsОценок пока нет

- Applying Law by Bradley J CharlesДокумент15 страницApplying Law by Bradley J Charlesseshadrimn seshadrimnОценок пока нет

- Crim JurДокумент15 страницCrim JurJohn Mark ParacadОценок пока нет

- Randall v. Prince George's Cnty, 4th Cir. (2002)Документ40 страницRandall v. Prince George's Cnty, 4th Cir. (2002)Scribd Government DocsОценок пока нет

- MODULE BLR301 BusinessLawsandRegulations1Документ141 страницаMODULE BLR301 BusinessLawsandRegulations1Jr Reyes PedidaОценок пока нет

- Matuguina Integrated Wood Products Inc. Vs Court of AppealsДокумент2 страницыMatuguina Integrated Wood Products Inc. Vs Court of AppealsAbdulateef SahibuddinОценок пока нет

- Romualdez III V CSCДокумент17 страницRomualdez III V CSCkresnieanneОценок пока нет

- Supreme Court: Statement of The CaseДокумент46 страницSupreme Court: Statement of The Casemangopie00000Оценок пока нет

- Iec Code Trade Notice 39 PDFДокумент88 страницIec Code Trade Notice 39 PDFsabaris ksОценок пока нет

- Questions AZB & PartnersДокумент1 страницаQuestions AZB & PartnersKunwarbir Singh lohatОценок пока нет

- Immigration Voice Brief in Save Jobs H4EAD LawsuitДокумент54 страницыImmigration Voice Brief in Save Jobs H4EAD LawsuitBreitbart NewsОценок пока нет

- Procurement Principles and Ethics ModuleДокумент34 страницыProcurement Principles and Ethics ModuleJordani MikeОценок пока нет

- 20A53 20A54 ResponseOfLuzerneCountyBoardOfElectionsToEmergencyApplicationsForAStayAДокумент12 страниц20A53 20A54 ResponseOfLuzerneCountyBoardOfElectionsToEmergencyApplicationsForAStayADiana PrinceОценок пока нет

- Ian Burow - Detention / Court DocumentДокумент2 страницыIan Burow - Detention / Court Documentkrcg_trialОценок пока нет

- Crim Rev Dolo V CulpaДокумент20 страницCrim Rev Dolo V CulpaJai KaОценок пока нет

- Abettor in IPCДокумент13 страницAbettor in IPCRvi MahayОценок пока нет