Академический Документы

Профессиональный Документы

Культура Документы

Servicewide Specialists v. CA

Загружено:

temporiariАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Servicewide Specialists v. CA

Загружено:

temporiariАвторское право:

Доступные форматы

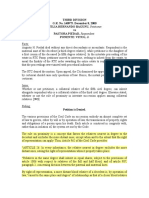

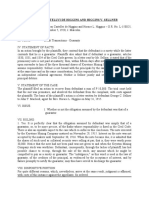

SERVICEWIDE SPECIALISTS v.

CA, HILDA TEE, & ALBERTO VILLAFRANCA 1999 / Purisima FACTS Leticia Laus purchased on credit a Colt Galant from Fortune Motors. Promissory note o P56,028, inclusive of interest at 12% per annum o Payable within 48 months at P1,167.25/month due and demandable on the 17th day of each month o In case of default in the payment of any installment, the total principal sum + interest shall become immediately due and payable Chattel mortgage was constituted over the said motor vehicle as a security for the promissory note o With a deed of assignmentcredit and mortgage rights were assigned by Fortune Motors in favor of Filinvest Credit Corporation with Laus consent The vehicle was registered in Laus name with the chattel mortgage annotated on said certificate. Filinvest assigned the credit in favor of Servicewide, transferring all its rights under the promissory note and the chattel mortgage with the notice of assignment sent to Laus. Laus failed to pay. Servicewide demanded payment of the outstanding balance. Servicewide instituted a complaint for replevin, impleading Hilda Tee and John Dee in whose custody the vehicle was believed to be at the time of the filing of the suit. Allegations of Servicewide: It had superior lien over the mortgaged vehicle It is lawfully entitled to the possession of the same together with all its accessories and equipment Hilda Tee was wrongfully detaining the motor vehicle for the purpose of defeating its mortgage lien A sufficient bond had been filed in court The court approved the replevin bond. Alberto Villafranca filed a third party claim. He is the absolute owner of the subject motor vehicle duly evidenced by the Bureau of Land Transportation's Certificate of Registration issued in his name. He acquired the said vehicle from a certain Remedios D. Yang under a Deed of Sale He acquired the same free from all lien and encumbrances Said automobile was taken from his residence by the deputy sheriff pursuant to a seizure order Villafranca was substituted as defendant. Villafranca filed a MTDthere is another action pending between the same parties, involving the seizure of subject motor vehicle and the indemnity bond posted by Servicewide. Eventually, the complaint was dismissed for insufficiency of evidence. In its appeal to the CA, Servicewide said that a suit for replevin aimed at the foreclosure of a chattel is an action quasi in rem, and does not require the inclusion of the principal obligor in the Complaint. However, CA affirmed RTC. The promissory note maker and mortgagor are one and the same person: Leticia Laus As there is no privity of contract, not even a causal link, between Servicewide and Villafranca, RTC was correct in dismissing the case for insufficiency of evidence against Tee and Villafranca since the evidence pointed to Laus as the party liable for the obligation sued upon. Servicewides MfR was denied by the CA, as it took notice of another case pending between the same parties relating to the very chattel mortgage of the motor vehicle in litigation. ISSUE & HOLDING WON a case for replevin may be pursued against Villafranca without impleading Laus. NO RATIO An applicant for replevin must show that he is the owner of the property claimed, particularly describing it, or is entitled to the possession thereof [Rule 60]. Where the right of the plaintiff to the possession of the specified property is evident, the action need only be maintained against him who so possesses the property. In rem action est per quam rem nostram quae ab alio possidetur petimus, et semper adversus eum est qui rem possidet . BA Finance, citing Northern Motors, Inc. v. Herrera: Persons having a special right of property in the goods the recovery of which is sought, such as a chattel mortgagee, may maintain an action for replevin therefor. Where the mortgage authorizes the mortgagee to take possession of the property on default, he may maintain an action to

recover possession of the mortgaged chattels from the mortgagor or from any person in whose hands he may find them. In default of the mortgagor, the mortgagee is constituted as the mortgagors attorney-in-fact. That Villafranca is not privy to the chattel mortgage should be inconsequential. By the fact that the object of replevin is traced to his possession, one can be a defendant in an action for replevin. It is assumed that the plaintiff's right to possess is not or cannot be disputed. However, in case the right of possession on the part of the plaintiff, or his authority to claim such possession or that of his principal, is put to doubt (a contending party may contest the legal bases for plaintiffs cause of action or an adverse and independent claim of ownership or right of possession may be raised by that party), it could become essential to have other persons impleaded for a complete determination of the controversy. In this case, there is an adverse and independent claim of ownership by Villafranca as evinced by the existence of another pending case. In a suit for replevin, a clear right of possession must be established. A foreclosure under a chattel mortgage may be commenced only once there is default on the part of the mortgagor [Laus] of his obligation. The replevin in this case has been resorted to in order to pave the way for foreclosure. There is a need to show the existence of the chattel mortgage and the mortgagors [Laus] default, because the validity of the mortgagees [Servicewide] exercise of the right of foreclosure depends on it. Since the mortgagee's [Servicewide] right of possession is conditioned upon the actual fact of default, the inclusion of other parties (debtor or mortgagor himself [Laus]) may be required to allow a conclusive determination of the case. When the mortgagee [Servicewide] seeks a replevin to effect the eventual foreclosure of the mortgage, it is not only the existence of, but also the mortgagor's [Laus] default on, the chattel mortgage that can uphold the right to replevy the property. The burden to establish a valid justification for such action lies with the plaintiff. An adverse possessor (who is not the mortgagor) cannot just be deprived of his possession, let alone be bound by the terms of the chattel mortgage contract, simply because the mortgagee brings up an action for replevin. Laus, being an indispensable party, should have been impleaded in the complaint for replevin and damages. That Servicewide could not locate the mortgagor Laus is no excuse for resorting to a procedural shortcut. It could have properly availed of substituted service of summons. Petition DENIED; CA decision AFFIRMED.

Вам также может понравиться

- Medida vs. CAДокумент1 страницаMedida vs. CANiñoMaurinОценок пока нет

- Manabat v. Laguna FederationДокумент3 страницыManabat v. Laguna FederationKristineSherikaChyОценок пока нет

- Zobel v. CAДокумент3 страницыZobel v. CAPio MathayОценок пока нет

- E Zobel, Inc. vs. CA CDДокумент1 страницаE Zobel, Inc. vs. CA CDJumen Gamaru TamayoОценок пока нет

- Rule.68.Forem - Movido vs. RFCДокумент1 страницаRule.68.Forem - Movido vs. RFCapple_doctoleroОценок пока нет

- Chan v. Maceda (Credit Trans. Digest)Документ2 страницыChan v. Maceda (Credit Trans. Digest)Francisco Ashley Acedillo100% (2)

- Rubberworld (Phils.), Inc. v. NLRCДокумент2 страницыRubberworld (Phils.), Inc. v. NLRCAnjОценок пока нет

- J.L Bernardo vs. CAДокумент2 страницыJ.L Bernardo vs. CANivra Lyn EmpialesОценок пока нет

- de Barreto V. VillanuevaДокумент5 страницde Barreto V. VillanuevaRea Ann Autor LiraОценок пока нет

- Diño V CA GuarantyДокумент2 страницыDiño V CA GuarantyRed HaleОценок пока нет

- First Metro Investment vs. Estate of Del SolДокумент3 страницыFirst Metro Investment vs. Estate of Del SolEmir MendozaОценок пока нет

- #9 Southern Motors Vs Eliseo BarbosaДокумент1 страница#9 Southern Motors Vs Eliseo BarbosaChristian Paul Chungtuyco100% (3)

- 134.diego vs. Fernando GR No. L 15128 August 25 1960 AntichresisДокумент1 страница134.diego vs. Fernando GR No. L 15128 August 25 1960 AntichresisAnonymous 53bboBОценок пока нет

- 9.) Quintos v. Beck Case DigestДокумент1 страница9.) Quintos v. Beck Case Digestjoyce100% (1)

- Yau Chu v. Court of AppealsДокумент2 страницыYau Chu v. Court of AppealsAgee Romero-Valdes100% (2)

- Philippine Blooming Mills, Inc. vs. Court of AppealsДокумент2 страницыPhilippine Blooming Mills, Inc. vs. Court of AppealsRoxanne Avila100% (3)

- Syquia V CA and The Manila Memorial Park CemeteryДокумент1 страницаSyquia V CA and The Manila Memorial Park CemeteryLaura R. Prado-LopezОценок пока нет

- LANDOIL RESOURCES CORPORATION Vs AL RABIAH LIGHTING COMPANYДокумент3 страницыLANDOIL RESOURCES CORPORATION Vs AL RABIAH LIGHTING COMPANYAnonymous 0N2Figw100% (1)

- Bonilla v. BarcenaДокумент2 страницыBonilla v. BarcenaD De LeonОценок пока нет

- Credit Cases FinalsДокумент5 страницCredit Cases FinalsBelen Aliten Sta MariaОценок пока нет

- Macondray V Pinon Case DigestДокумент2 страницыMacondray V Pinon Case DigestZirk TanОценок пока нет

- Star Two V Paper CityДокумент2 страницыStar Two V Paper CityPam RamosОценок пока нет

- Bucton Vs Rural Bank of SalvadorДокумент2 страницыBucton Vs Rural Bank of Salvadorfermo ii ramos100% (1)

- National Labor Union v. CIR, 116 SCRA 417 (1982)Документ3 страницыNational Labor Union v. CIR, 116 SCRA 417 (1982)anonymousОценок пока нет

- 57 Baltazar Vs LaxaДокумент2 страницы57 Baltazar Vs LaxaWendell Leigh OasanОценок пока нет

- 14 Bank of Commerce V San PabloДокумент2 страницы14 Bank of Commerce V San PabloAleezah Gertrude RaymundoОценок пока нет

- Huerta Alba Resort Inc. v. CA DigestДокумент4 страницыHuerta Alba Resort Inc. v. CA DigestLeo Cag100% (1)

- 1 - Sarsaba V Vda de TeДокумент2 страницы1 - Sarsaba V Vda de TeJanelle ManzanoОценок пока нет

- Producers Bank of The Philippines Vs CAДокумент2 страницыProducers Bank of The Philippines Vs CAMacОценок пока нет

- 1995 (Case Digests) Tanjusay, Maria Katrina S.Документ15 страниц1995 (Case Digests) Tanjusay, Maria Katrina S.trinz_kat100% (1)

- Hacbang Vs AloДокумент4 страницыHacbang Vs AloSachuzen100% (1)

- Spouses Yap Vs Spouses DyДокумент1 страницаSpouses Yap Vs Spouses DyAlleine Tupaz100% (1)

- De Murga vs. Chan (Digeted) CivproДокумент2 страницыDe Murga vs. Chan (Digeted) CivproAnn Alejo-Dela TorreОценок пока нет

- De Rama vs. PalileoДокумент1 страницаDe Rama vs. PalileoCharlene GalenzogaОценок пока нет

- Bagunu Vs PiedadДокумент3 страницыBagunu Vs PiedadIvan Montealegre ConchasОценок пока нет

- Rule 9 - Pascua Vs FlorendoДокумент2 страницыRule 9 - Pascua Vs FlorendoMich ElleОценок пока нет

- Cawaling v. MeneseДокумент2 страницыCawaling v. MeneseGel MaulionОценок пока нет

- Canlas Vs Tubil Case DigestДокумент3 страницыCanlas Vs Tubil Case DigestRyanОценок пока нет

- GR No. 161237 (2009) - Macababbad v. MasiragДокумент2 страницыGR No. 161237 (2009) - Macababbad v. MasiragNikki Estores Gonzales83% (6)

- 03 Cordova vs. Reyes Daway Lim Bernando Lindo Rosales Law OfficesДокумент2 страницы03 Cordova vs. Reyes Daway Lim Bernando Lindo Rosales Law OfficesAlec VenturaОценок пока нет

- Morales Vs OlondrizДокумент2 страницыMorales Vs OlondrizLloyd SanchezОценок пока нет

- Vitug vs. Court of Appeals: GR. No. 82027, March 29, 1990Документ2 страницыVitug vs. Court of Appeals: GR. No. 82027, March 29, 1990Lucas Gabriel Johnson67% (3)

- Mccullough Vs Aenille Co.Документ2 страницыMccullough Vs Aenille Co.Ria GabsОценок пока нет

- Article 415 Case Title Facts Ruling Benguet Corporation vs. CbaaДокумент2 страницыArticle 415 Case Title Facts Ruling Benguet Corporation vs. Cbaapatty uh100% (1)

- Santiago Versus Pioneer Savings BankДокумент2 страницыSantiago Versus Pioneer Savings BankJon SantosОценок пока нет

- Sps. Sy vs. Westmont BankДокумент2 страницыSps. Sy vs. Westmont BankASGarcia24Оценок пока нет

- Abeto V GarcesaДокумент1 страницаAbeto V GarcesaKenneth Peter MolaveОценок пока нет

- Bahia V Litonjua and LeynesДокумент2 страницыBahia V Litonjua and LeynesHoney BunchОценок пока нет

- Vda de Lopez Vs LopezДокумент5 страницVda de Lopez Vs LopezRap BaguioОценок пока нет

- Vda de Santiago Vs ReyesДокумент1 страницаVda de Santiago Vs ReyesTherese AmorОценок пока нет

- Pleasantville Dev. Corp. vs. CA, Et Al, G.R. No. 79688, February 1, 1996 ORIGINALДокумент10 страницPleasantville Dev. Corp. vs. CA, Et Al, G.R. No. 79688, February 1, 1996 ORIGINALJacquelyn AlegriaОценок пока нет

- Castellvi de Higgins and Higgins V. SellnerДокумент1 страницаCastellvi de Higgins and Higgins V. SellnerMarie Bernadette BartolomeОценок пока нет

- Calalang-Parulan vs. Calalang-Garcia DigestДокумент2 страницыCalalang-Parulan vs. Calalang-Garcia DigestElerlenne Lim67% (3)

- G.R. No. 159271Документ1 страницаG.R. No. 159271Javi HernanОценок пока нет

- Trinidad v. CAДокумент3 страницыTrinidad v. CATippy Dos SantosОценок пока нет

- Rule 57-Case No. 13Документ2 страницыRule 57-Case No. 13Aerylle GuraОценок пока нет

- Cathay Metal Corp Vs Laguna West Multi-Purpose CooperativeДокумент3 страницыCathay Metal Corp Vs Laguna West Multi-Purpose Cooperativeana ortizОценок пока нет

- Boman Environmental Development Corporation Vs Court of AppealsДокумент1 страницаBoman Environmental Development Corporation Vs Court of AppealsErikha AranetaОценок пока нет

- Servicewide Specialists v. CAДокумент2 страницыServicewide Specialists v. CAd2015memberОценок пока нет

- Dokumen - Tips - 34 Servicewide Specialists V Ca SolisДокумент2 страницыDokumen - Tips - 34 Servicewide Specialists V Ca SolisQueen Ann NavalloОценок пока нет

- ARTICLE - Death, Real Estate, and Estate TaxesДокумент10 страницARTICLE - Death, Real Estate, and Estate TaxestemporiariОценок пока нет

- BIR - Registration of Book of AccountsДокумент1 страницаBIR - Registration of Book of AccountstemporiariОценок пока нет

- In Re Shoop, November 29, 1920Документ6 страницIn Re Shoop, November 29, 1920temporiariОценок пока нет

- Amin Rasheed Shipping Corp. v. Kuwait InsuranceДокумент24 страницыAmin Rasheed Shipping Corp. v. Kuwait Insurancetemporiari100% (2)

- BIR - Affidavit of Cessation of Business OperationДокумент1 страницаBIR - Affidavit of Cessation of Business OperationtemporiariОценок пока нет

- SpecPro SyllabusДокумент11 страницSpecPro Syllabustemporiari0% (1)

- Rivera v. MoranДокумент1 страницаRivera v. MorantemporiariОценок пока нет

- Locgov - Provisions - 12 Nov 2013 of A. Villafuerte (D2015)Документ6 страницLocgov - Provisions - 12 Nov 2013 of A. Villafuerte (D2015)temporiariОценок пока нет

- Heritage Hotel Manila v. NUWHRAIN-HHMSC (2011)Документ6 страницHeritage Hotel Manila v. NUWHRAIN-HHMSC (2011)temporiariОценок пока нет

- Source: Rule 85, Section 7 of The Rules of CourtДокумент3 страницыSource: Rule 85, Section 7 of The Rules of CourttemporiariОценок пока нет

- Luzon Stevedoring Corporation v. CTA and CIRДокумент1 страницаLuzon Stevedoring Corporation v. CTA and CIRtemporiariОценок пока нет

- Kairys, DanGat, VitugДокумент1 страницаKairys, DanGat, VitugtemporiariОценок пока нет

- TRANSPO TY Expanded SyllabusДокумент124 страницыTRANSPO TY Expanded SyllabustemporiariОценок пока нет

- Home Insurance Corporation v. CAДокумент2 страницыHome Insurance Corporation v. CAtemporiari100% (1)

- Marturillas v. PeopleДокумент3 страницыMarturillas v. PeopletemporiariОценок пока нет

- Nestle Phils. v. FY SonsДокумент2 страницыNestle Phils. v. FY SonstemporiariОценок пока нет

- People v. OcampoДокумент1 страницаPeople v. OcampotemporiariОценок пока нет

- Salas v. Sta. Mesa Market CorporationДокумент2 страницыSalas v. Sta. Mesa Market CorporationtemporiariОценок пока нет

- Razon v. IACДокумент3 страницыRazon v. IACtemporiariОценок пока нет

- Ortañez v. CAДокумент2 страницыOrtañez v. CAtemporiariОценок пока нет

- La Bugal-B'laan Tribal Assn. v. DENRДокумент5 страницLa Bugal-B'laan Tribal Assn. v. DENRtemporiariОценок пока нет

- Shopper's Paradise v. RoqueДокумент1 страницаShopper's Paradise v. RoquetemporiariОценок пока нет

- Albaladejo v. Phil. Refining Co.Документ1 страницаAlbaladejo v. Phil. Refining Co.temporiariОценок пока нет

- YSS Employees Union v. YSS LaboratoriesДокумент2 страницыYSS Employees Union v. YSS Laboratoriestemporiari100% (1)

- Valera v. Velasco.Документ1 страницаValera v. Velasco.temporiariОценок пока нет

- In Re Sycip Salazar Feliciano Hernandez and CastilloДокумент2 страницыIn Re Sycip Salazar Feliciano Hernandez and Castillotemporiari100% (4)

- Guidote v. BorjaДокумент1 страницаGuidote v. Borjatemporiari100% (2)

- Employees Union of Bayer Phils. v. Bayer Phils.Документ3 страницыEmployees Union of Bayer Phils. v. Bayer Phils.temporiariОценок пока нет

- Magalona v. PesaycoДокумент1 страницаMagalona v. Pesaycotemporiari100% (1)

- Pardo v. Hercules LumberДокумент1 страницаPardo v. Hercules LumbertemporiariОценок пока нет

- Labor DigestsДокумент62 страницыLabor Digestsejusdem generisОценок пока нет

- Alejo Mabanag Et - Al vs. Lopez Vito Et - al-G.R. L-1123351947Документ101 страницаAlejo Mabanag Et - Al vs. Lopez Vito Et - al-G.R. L-1123351947Kin CarilloОценок пока нет

- HPCL Price List Eff-01st July 2020Документ1 страницаHPCL Price List Eff-01st July 2020aee lwe100% (1)

- Composer's AgreementДокумент3 страницыComposer's AgreementErnesto RivasОценок пока нет

- IBCLC Conflict of Interest PDFДокумент8 страницIBCLC Conflict of Interest PDFFayrouz EssawiОценок пока нет

- Msweavb I Mikvi: F WGKVДокумент15 страницMsweavb I Mikvi: F WGKVScientia Online CareОценок пока нет

- IcjДокумент18 страницIcjakshay kharteОценок пока нет

- Ong Chua v. CarrДокумент2 страницыOng Chua v. CarrNorberto Sarigumba IIIОценок пока нет

- 1 Bachrach V Siefert DIGESTДокумент1 страница1 Bachrach V Siefert DIGESTGieann BustamanteОценок пока нет

- Transpo Public ServiceДокумент3 страницыTranspo Public ServiceJImlan Sahipa IsmaelОценок пока нет

- Rule 23 Depositions Pending ActionДокумент9 страницRule 23 Depositions Pending Actionfrank japosОценок пока нет

- Oclarit vs. PaderangaДокумент4 страницыOclarit vs. PaderangaRomy Ian LimОценок пока нет

- Government Intervention in International Business: Gary Knight Willamette University, USAДокумент2 страницыGovernment Intervention in International Business: Gary Knight Willamette University, USARavi ShankarОценок пока нет

- U.S. v. Stuart Carson El Al. (Declaration of Professor Michael Koehler)Документ152 страницыU.S. v. Stuart Carson El Al. (Declaration of Professor Michael Koehler)Mike KoehlerОценок пока нет

- Far Eastern University Institute of Law: Subject Offerings and ScheduleДокумент4 страницыFar Eastern University Institute of Law: Subject Offerings and ScheduleJames Patrick NarcissoОценок пока нет

- Pamplona Plantation vs. TinghilДокумент1 страницаPamplona Plantation vs. TinghilLance MorilloОценок пока нет

- Procedural SummaryДокумент7 страницProcedural SummaryyadmosheОценок пока нет

- Letter From Lord Ahmad of Wimbledon To Sam Tarry MP 05082021Документ2 страницыLetter From Lord Ahmad of Wimbledon To Sam Tarry MP 05082021Thavam RatnaОценок пока нет

- Baguio Midland Carrier v. CAДокумент12 страницBaguio Midland Carrier v. CAKPPОценок пока нет

- Case Digest: Cralaw Virtua1aw LibraryДокумент4 страницыCase Digest: Cralaw Virtua1aw LibraryGret HueОценок пока нет

- Taxation Law Internal Assignment Utkarsh DixitДокумент5 страницTaxation Law Internal Assignment Utkarsh DixitAshish RajОценок пока нет

- DILG-DSWD JMC 2010-01 (Creation of LCAT-VAWC) PDFДокумент5 страницDILG-DSWD JMC 2010-01 (Creation of LCAT-VAWC) PDFBegie Lucenecio71% (7)

- Foreign Policy Vs DiplomacyДокумент1 страницаForeign Policy Vs DiplomacyJames RobertsОценок пока нет

- Limanch-O Hotel Vs City of Olongapo GR No. 185121 (2010)Документ7 страницLimanch-O Hotel Vs City of Olongapo GR No. 185121 (2010)braindead_91Оценок пока нет

- Salary-Chp 3Документ38 страницSalary-Chp 3Rozina TabassumОценок пока нет

- Ereport 201819Документ105 страницEreport 201819Shi SUОценок пока нет

- Consti Reviewer Topnotcher'sДокумент105 страницConsti Reviewer Topnotcher'sSummer TanОценок пока нет

- 217 - de Guzman V TumolvaДокумент2 страницы217 - de Guzman V TumolvaJanine IsmaelОценок пока нет

- Cheveux Corp. v. Three Bird Nest - ComplaintДокумент32 страницыCheveux Corp. v. Three Bird Nest - ComplaintSarah BursteinОценок пока нет

- D D M M Y Y Y Y: Credit Card Services Form - 1Документ4 страницыD D M M Y Y Y Y: Credit Card Services Form - 1Zaiedul HoqueОценок пока нет