Академический Документы

Профессиональный Документы

Культура Документы

Effect V1 1 Spring2007Dube TaxEffectiveMarket

Загружено:

Nyegosh DubeИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Effect V1 1 Spring2007Dube TaxEffectiveMarket

Загружено:

Nyegosh DubeАвторское право:

Доступные форматы

EFFECT | spring 2007

LOREM IPSUM 12

exactly understand the need, and so we will have to make a

greater effort to not only explain the need, but also the will of

foundations to have such a tool for their work in Europe, says

Charhon. Its a misunderstanding of the capacity of the sector

to address the needs of citizens. We have to work on that to

explain and explain and explain.

Foundations are perceived as being intermediary bodies that

are not in touch with whats needed on the ground. But the

Commission has to understand that foundations are very

close to the needs of the eld, insists Charhon. Were people

who are working on projects, addressing problems and

nancing solutions.

This year Charhon would like to see more efforts made

at national level to convince key people in governments

of the value of a European Foundation Statute. He hopes

national governments would then press the Commission

to go forward with the Statute. So this would be a parallel

approach alongside ongoing efforts of the foundation sector,

particularly through the EFC, to convince the Commission.

The sector is growing at an exponential rate in all EU

countries. Figures suggest a high growth rate in the sector in

various EU states, with 28% up to 40% of the national-level

sectors having been set up in the last decade in countries such

as Belgium, Finland, France, Italy and Germany. Foundations

are increasingly active beyond their own borders, a trend that

is expected to continue. The EFCs estimate, extrapolating

from databases of known foundations, is that 25,000 of these

foundations have combined assets of 174 billion euros at their

disposal.

New wealth has been created in a variety of new sectors of

the economy, and within the next 20 years Europe will witness

the most important intergenerational transfer of wealth ever.

The EFC believes that part of this private wealth should be

directed towards the European public good. A European

Foundation Statute would provide foundations with the

necessary vehicle to channel these resources for the benet of

the European project and the EUs citizens.

Nyegosh Dube, EFC

More information on the Statute:

www.efc.be/european_statute

Such steps complement efforts, led by the European

Foundation Centre, to bring about the adoption of a European

Foundation Statute as a powerful new tool for cross-border

foundation activity in Europe. Enactment of a European legal

form for foundations and changes in national tax laws can

together contribute to creating a Europe-wide market for

philanthropy.

In fact, market is not an inappropriate term, since provisions

of the European Community Treaty geared primarily towards

business activities are now also being applied to philanthropic

activities. These are provisions on freedom of establishment

and free movement of capital, as well as free movement of

labour and people. Given the tremendous increase in the role

of philanthropy since the original Treaty was signed 50 years

ago, Treaty provisions are being applied in a exible way in

response to changing realities.

The rst major step in this direction came in 2002 when the

European Commission formally requested Belgium to change

its legislation on gift and inheritance tax, as it restricted

preferential rates on philanthropic donations and legacies

to entities established in Belgium. Actually, the request

concerned legislation in the countrys three regions. While

Flanders and Brussels amended their laws to satisfy EU

requirements, Wallonia did not go far enough. So in 2005 the

Commission referred the Walloon case to the European Court

of Justice (ECJ).

In 2006, the Commission decided to cast its net wider. It sent

formalrequeststothegovernmentsoftheUK,|relandand

Poland to end discrimination against foreign PBOs in their

income tax legislation. According to the Commission, these

Member States allow tax relief for gifts to charities, but

only if they are established in their own territory. Charities

in other Member States are excluded from the relief... The

Commission, moreover, threatened to refer specic national

cases to the ECJ if the governments in question did not

respond satisfactorily within two months. In December

2006, the Commission turned its attention again to Belgium,

sending it a similar request and warning.

The rules of the Internal Market forbid discrimination against

charities in other Member States, said EU Taxation and

CustomsCommissionerLaszloKovacsina1uly2006Luropean

Creating a tax-effective philanthropic market in the EU

Cross-border philanthropy in Europe may be getting easier. European institutions have taken steps to bring

national tax legislation into line with key provisions of EU law to end discrimination against public benet

organisations (PBOs) based in other EU states and against those who give to such organisations.

THE LEGAL AND FISCAL SCENE

European Foundation Centre | www.efc.be

EFFECT | spring 2007

13

Commission press release. Gifts to bona de charities in other

Member States should get the same tax treatment as gifts

made to domestic charities.

The Commission considers that differential tax treatment of

gifts infringes on the free movement of capital guaranteed

by Article 56 of the EC Treaty; the free movement of persons

guaranteed by Articles 18 and 39 of the Treaty; and the

freedom of establishment guaranteed by Articles 43 and 48.

Article 56 does not in fact dene free movement of capital,

but Council Directive 88/361/EEC provides a Community

denition of capital movements which explicitly includes

cross-border gifts. As for free movement of persons, Articles

18 and 39 establish the right to reside and work freely within

the Union. While on rst sight differential tax treatment might

not appear to infringe on this right, the Commission takes the

view that citizens of a Member State who move to another

Member State and wish to make donations to organisations in

their home state should be able to do so without suffering any

discrimination, giving equal tax treatment vis--vis citizens of

the state they have moved to, not their home state.

Regarding freedom of establishment, Article 48 refers to

companies or rmsor other legal personssave for those

which are non-prot-making. This would seem to exclude

foundations and charities. However, the Commission now

interprets this provision in a broad way, arguing that legal

persons take part in economic life, even if their main goal

is not to make prots. It should be added that in both the

Walloon and Polish cases, the Commission also cited Article

12 of the Treaty, which prohibits discrimination on grounds of

nationality. Since the provision does not specify any areas (e.g.

taxation) or objects of discrimination (e.g. natural persons), it

can be applied in a rather exible way.

In response to the Commissions request, Poland has amended

its corporate income tax law. As of January 1st 2007, tax

deductions have been extended to include donations to PBOs

in other EU states. At rst the Polish government proposed

entirely abolishing tax incentives for legal persons who give

to PBOs, but retreated in the face of a strong protest by the

NGO sector. Poland is now only the second EU country after

the Netherlands to allow tax deductions for donations to

foreignP8Os.TheUK,however,islikelytodefenditspresent

legislation at the ECJ if the Commission goes ahead and refers

the matter to the Court.

Apart from action initiated by the Commission, which may

lead to action by the ECJ, the Court has already made a

signicant ruling regarding an infringement of the EC Treaty.

In September 2006, the Court ruled in the so-called Stauffer

case that sections of German tax law are in conict with the

free movement of capital stipulated by Article 56 of the Treaty.

According to current German tax law, the tax exemption

granted to PBOs on rental income does not apply to PBOs

that have their registered ofce and/or governance structure

outside Germany. The case concerned Centro di Musicologia

Walter Stauffer, a public benet foundation based in Italy that

had income from German real estate holdings. This income

was taxed by the Munich tax authorities. The foundation

questioned this taxation and took its case to the Federal Tax

Court, which in turn called for a ruling by the ECJ.

Clearly, things are happening at the European level to create a

more tax-effective European market for philanthropy through

the scrapping of discriminatory national legal provisions.

Although these actions are very welcome and necessary, they

are far from sufcient. The adoption of a European Foundation

Statute remains the key step to be taken to ensure that

foundations fully benet from the EUs Internal Market. Only if

they can act without hindrance across national borders within

the Union can truly European philanthropy become a reality.

Nyegosh Dube, EFC

THE LEGAL AND FISCAL SCENE

The Dutch cross-border tax environment gets friendly

The Dutch Ministry of Finance an-

nounced in February 2007 the new

criteria for public beneft organisations

(PBOs), which will take effect as of Jan-

uary 1st 2008. Charitable tax incentives

are given to organisations recognised by

the Dutch tax authorities as PBOs - these

can be organisations based in the Nether-

lands and in any other EU Member State.

The Dutch government may extend this

rule also to other countries.

This introduces a very friendly cross-

border environment for foundations and

their funders in the Netherlands: For-

eign-based PBOs receive the same tax

treatment as domestic ones as long as

they qualify and register as a PBO. In ad-

dition, donations to foreign-based PBOs

may be deductible for Dutch income tax

purposes as long as they qualify and reg-

ister as a PBO.

Looking at the set of criteria, emphasis

is being put on the form of the endow-

ments and the spending obligation of the

organisations, as well as on transpar-

ency and the independence of the board.

The programme activities will have to

strictly correspond to the mission of the

organisation. A PBO can no longer be

dormant, and churches, research insti-

tutes and others can also be considered

to be PBOs.

More information:

www.fm-platform.nl

European Foundation Centre | www.efc.be

Вам также может понравиться

- How To Set Up An Npo in BrusselsДокумент2 страницыHow To Set Up An Npo in BrusselsNyegosh DubeОценок пока нет

- Languages of IndiaДокумент10 страницLanguages of IndiaNyegosh DubeОценок пока нет

- Faroe Islands GuideДокумент108 страницFaroe Islands GuideNyegosh Dube100% (2)

- Effect V1 2 Summer2007DubeRossiSurmatzДокумент2 страницыEffect V1 2 Summer2007DubeRossiSurmatzNyegosh DubeОценок пока нет

- Effect V1 2 Summer2007Dube Medina3Документ2 страницыEffect V1 2 Summer2007Dube Medina3Nyegosh DubeОценок пока нет

- Effect V1 2 Summer2007Dube ClosingGapДокумент2 страницыEffect V1 2 Summer2007Dube ClosingGapNyegosh DubeОценок пока нет

- Effect V2 3 Winter2008DubeДокумент2 страницыEffect V2 3 Winter2008DubeNyegosh DubeОценок пока нет

- Effect V1 1 Spring2007Dube YesonStatuteДокумент2 страницыEffect V1 1 Spring2007Dube YesonStatuteNyegosh DubeОценок пока нет

- Effect V2 2 Summer2008Dube Bosnia2Документ2 страницыEffect V2 2 Summer2008Dube Bosnia2Nyegosh DubeОценок пока нет

- Effect V3 1 Spring2009Dube PolishДокумент3 страницыEffect V3 1 Spring2009Dube PolishNyegosh DubeОценок пока нет

- The Danish Foundation Sector: Donors, Owners, and PartnersДокумент2 страницыThe Danish Foundation Sector: Donors, Owners, and PartnersNyegosh DubeОценок пока нет

- Looking Beyond The State: Norway's Foundation LandscapeДокумент2 страницыLooking Beyond The State: Norway's Foundation LandscapeNyegosh DubeОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Good Quality Free Legal Aid in India A Distant Dream: Mr. Hrishikesh JaiswalДокумент10 страницGood Quality Free Legal Aid in India A Distant Dream: Mr. Hrishikesh JaiswalHrishikeshОценок пока нет

- People Vs TudtudДокумент2 страницыPeople Vs TudtudjayОценок пока нет

- CSC V Magnaye FTДокумент10 страницCSC V Magnaye FTLuz Celine CabadingОценок пока нет

- 2018 1 Amr 456Документ11 страниц2018 1 Amr 456SarannRajSomasakaranОценок пока нет

- People VsДокумент3 страницыPeople VsAbbeyBandolaОценок пока нет

- Neral Defences in PPCДокумент3 страницыNeral Defences in PPCFaique MemonОценок пока нет

- CSC v. SojorДокумент4 страницыCSC v. SojorKarla Bee100% (1)

- Santiago v. Republic 87 SCRA 294 DigestДокумент1 страницаSantiago v. Republic 87 SCRA 294 DigestJP DC100% (1)

- Villalon vs. ChanДокумент4 страницыVillalon vs. ChanRocky MagcamitОценок пока нет

- Module 1 - Labor - Personal NotesДокумент6 страницModule 1 - Labor - Personal NotesMerabSalio-anОценок пока нет

- Letters Letters To A Law StudentДокумент29 страницLetters Letters To A Law Studenttigerstyle1100% (1)

- Moot CourtДокумент8 страницMoot CourtKevin JoyОценок пока нет

- Labor Law 2 DigestДокумент5 страницLabor Law 2 DigestBernadette Luces Beldad100% (1)

- Commissioner of Internal Revenue vs. Tokyo Shipping Co. LTD G.R. No. L-68252 May 26, 1995 DigestДокумент2 страницыCommissioner of Internal Revenue vs. Tokyo Shipping Co. LTD G.R. No. L-68252 May 26, 1995 DigestAbilene Joy Dela CruzОценок пока нет

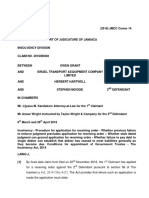

- Grant, Owen and Israel Transport and Equipment Company Limited V Hartwell, Herbert and Moodie, StephenДокумент12 страницGrant, Owen and Israel Transport and Equipment Company Limited V Hartwell, Herbert and Moodie, StephenClifton CampbellОценок пока нет

- MyLegalWhiz - Complaint For Damages Based On Quasi Delict Against Common CarrierДокумент4 страницыMyLegalWhiz - Complaint For Damages Based On Quasi Delict Against Common CarrierDon Nikko PelAez FernandezОценок пока нет

- Ignorantia Juris Non ExcusatДокумент2 страницыIgnorantia Juris Non ExcusatCrisanta MarieОценок пока нет

- Orphan Care: The Role of The Extended Family in Northern UgandaДокумент12 страницOrphan Care: The Role of The Extended Family in Northern UgandaJasiz Philipe OmbuguОценок пока нет

- Final Assignment Crime and Criminology IДокумент6 страницFinal Assignment Crime and Criminology IfirdousОценок пока нет

- Two MarksДокумент14 страницTwo MarksRamakrishnan KaruppiahОценок пока нет

- The Wedding DanceДокумент19 страницThe Wedding DanceRey-Anne Camille Sarmiento RodriguezОценок пока нет

- Recidivist Vs Habitual DelinquentДокумент3 страницыRecidivist Vs Habitual DelinquentAya Namuzar86% (7)

- EDU 292 (Introduction To Ethical Theory) (SEATWORK)Документ3 страницыEDU 292 (Introduction To Ethical Theory) (SEATWORK)Larriza Jane GalvanОценок пока нет

- United States v. Scott Repella, 3rd Cir. (2014)Документ10 страницUnited States v. Scott Repella, 3rd Cir. (2014)Scribd Government DocsОценок пока нет

- Admin Case Pool 2: 4. Reclassification of LandsДокумент131 страницаAdmin Case Pool 2: 4. Reclassification of LandsBenedict Jonathan BermudezОценок пока нет

- Termination Letter TagalogДокумент8 страницTermination Letter TagalogGerry MalgapoОценок пока нет

- Personal Information Sheet: University of The Cordilleras Senior High SchoolДокумент2 страницыPersonal Information Sheet: University of The Cordilleras Senior High SchoolKarl AngihanОценок пока нет

- SNMCC MemoДокумент19 страницSNMCC MemoVinay SahuОценок пока нет

- 166688-2011-Torbela v. Spouses RosarioДокумент30 страниц166688-2011-Torbela v. Spouses RosarioYi FanОценок пока нет

- The Plunder Law - Ateneo Law JournalДокумент35 страницThe Plunder Law - Ateneo Law JournalZednanreh C JnebОценок пока нет