Академический Документы

Профессиональный Документы

Культура Документы

Puneeth Project

Загружено:

Jayanth KumarАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Puneeth Project

Загружено:

Jayanth KumarАвторское право:

Доступные форматы

PERFORMANCE EVALUATION OF MUTUAL FUNDS

1. INTRODUCTION Right from its existence, Banks, whether nationalize or corporate, always dominated others, in case of public investments or retail investments. But in past few years due to various reasons like continuously falling of interest rates, various scams etc. investors will have to look for various other investments avenues that will give them better returns with minimization of risks. Here Mutual Funds Industry has very important role to play in providing alternate investment avenue to entire gamut of investors in scientific and professional manner. Indian Mutual Fund Industry has been definitely maturing over the period. In four decades of its existence in India Mutual Funds have gone through various structural changes and gained prominent position in Financial Industry. Because of easy of investments, professional management and diversification more and more investors are gaining confidence in Mutual Funds. Even government policies like abolishment of long term capital benefit taxes added advantage to growth of Mutual Funds. This is all the way is leading to pool of more and more money from retail investors into the Mutual Funds. So I carried out project in Mutual Funds to understand Mutual Funds, Mutual Fund Industry, analyze the trend in Mutual Funds. The Report first provides the fundamentals, explaining what mutual funds are and how they work. Data Analysis of Indian Index Mutual fund market has been done to give a comparative analysis of the selected six funds in the category. Various factors surrounding the performance of these

KARNATAKA STATE OPEN UNIVERSITY

-1-

PERFORMANCE EVALUATION OF MUTUAL FUNDS

mutual funds are then highlighted along with a brief of various applications. Finally, the report depicts the conclusion. 1.1. Objectives STATEMENT OF THE PROBLEM Investment decisions mainly depend upon the investors attitude towards risk and return of each of the avenues of investment. Planning and advisory services play an important role in facilitating an investor in investing process. For advising an investor for investment, PORTFOLIO EVALUATION is necessary for minimizing risk through diversification.

OBJECTIVES OF THE STUDY To understand the Mutual Fund industry in India. To understand various types of schemes operated and the overall operations of a Mutual fund in general. To understand and analyze the Risk-Return aspects of Mutual Funds. To compare the market return with the fund return. To rank the mutual funds on the basis of their performance using Treynors Index, Sharpes Index and Jensens Index. To offer suggestions if necessary, based on the above rankings.

KARNATAKA STATE OPEN UNIVERSITY

-2-

PERFORMANCE EVALUATION OF MUTUAL FUNDS

SCOPE OF THE STUDY This study covers Equity growth funds of which ANANDRAHTI is a distributor. The study covers the period of 10 weeks The study applies only three approaches to evaluate performance, namely Treynors Index, Sharpes Index and Jensens Index.

SCHEMES CONSIDERED FOR THE PORTFOLIO EVALUATION STUDY 1) Reliance banking fund 2) UTI Pharma and health care fund 3) Franklin FMCG fund 4) ICICI prudential Technology fund 5) Franklin Pharma fund

KARNATAKA STATE OPEN UNIVERSITY

-3-

PERFORMANCE EVALUATION OF MUTUAL FUNDS

2. Research Design

ADVANTAGES OF MURUAL FUND: Diversification Return Potential Liquidity Transparency Flexibility DIVERSIFICATION: Mutual Funds invest in a number of companies across a broad cross-section of industries and sectors. This diversification reduces the risk because seldom do all stocks decline at the same time and in the same proportion. You achieve this diversification through a Mutual Fund with far less money than you can do on your own. RETURN POTENTIAL: Over a medium to long term, Mutual Funds have the potential to provide a higher return as they invest in a diversified basket of selected securities. LIQUIDITY: In open-end schemes, the investor gets the money back promptly at net asset

KARNATAKA STATE OPEN UNIVERSITY

-4-

PERFORMANCE EVALUATION OF MUTUAL FUNDS

value related prices from the Mutual Funds. In close-end schemes, the units can be sold on a stock exchange at the prevailing market price or the investor can avail of the facility of direct repurchase at NAV related prices by the Mutual Funds. TRANSPARENCY: You get regular information on the value of your investment in addition to disclosure on the specific investments made by your scheme, the proportion invested in each class of assets and the fund managers investment strategy and outlook. FLEXIBILITY: Through features such as regular investment plans, regular withdrawal plans and dividend reinvestment plans, you can systematically invest or withdraw funds according to your needs and convenience. NO GUARANTEES: No investment is risk free. If the entire stock market declines in value, the value of mutual fund shares will go down as well, no matter how balanced the portfolio. Investors encounter fewer risks when they invest in mutual funds than when they buy and sell stocks on their own. However, anyone who invests through a mutual fund runs the risk of losing money.

KARNATAKA STATE OPEN UNIVERSITY

-5-

PERFORMANCE EVALUATION OF MUTUAL FUNDS

DRAWBACKS OF MUTUAL FUNDS Mutual funds have their drawbacks and may not be for everyone: FEES AND COMMISSIONS: All funds charge administrative fees to cover their day-to-day expenses. Some funds also charge sales commissions or "loads" to compensate brokers, financial consultants, or financial planners. Even if you don't use a broker or other financial adviser, you will pay a sales commission if you buy shares in a Load Fund. TAXES: During a typical year, most actively managed mutual funds sell anywhere from 20 to 70 percent of the securities in their portfolios. If your fund makes a profit on its sales, you will pay taxes on the income you receive, even if you reinvest the money you made.

MANAGEMENT RISK: When you invest in a mutual fund, you depend on the fund's manager to make the right decisions regarding the fund's portfolio. If the manager does not

KARNATAKA STATE OPEN UNIVERSITY

-6-

PERFORMANCE EVALUATION OF MUTUAL FUNDS

perform as well as you had hoped, you might not make as much money on your investment as you expected. Of course, if you invest in Index Funds, you forego management risk, because these funds do not employ managers.

RESEARCH DESIGN It is the basic plan which guides the researcher in the collection and analysis of data required for practicing the research. The fundamental base for the success of the project depends on its effective research design. Research design simply means a search for facts, answers to the questions and solutions to problems. METHODOLOGY Descriptive research: The main purpose of Descriptive Research is to describe the state of view as it exists at present. Simply stated, it is fact finding investigation. In Descriptive Research definite conclusion can be arrived at, but it doesnt establish a cause and effect relationship

SOURCE OF DATA After identifying and defining the research problem and determining specific information required to solving the problem the research will look for the type and sources of data which may yield the desired results, while deciding about the method of data collection to be used for the study. There are two types of

KARNATAKA STATE OPEN UNIVERSITY

-7-

PERFORMANCE EVALUATION OF MUTUAL FUNDS

data, 1. Primary data. 2. Secondary data. PRIMARY DATA: These are those data which are collected for the first time. Primary data is collected by enquiring certain employees, manager who was chosen on the basis of their depth knowledge and work experience in the stock market. This enquiry was informal in nature to gain as much as possible information. SECONDARY DATA: These are those data which are already been collected and analyzed by someone and can save the time of the researcher. Secondary data may be available in the form of company records, trade publications, libraries etc. THE SECONDARY SOURCES ARE: Company annual report Fact Sheet of different funds Articles Text books Broachers TOOLS AND TECHNIQUES PERFORMANCE MEASURE Trenors Index

KARNATAKA STATE OPEN UNIVERSITY

-8-

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Sharpes Index Jensens Index

7.5 LIMITATIONS OF THE STUDY The primary data collected is only from the customers of

ANANDRATHI. The study is limited to the Portfolio evaluation of equity funds of the selected funds. Dividends declared for the period has not been considered in calculating the returns from the funds. NAV s considered for the calculations of returns is obtained from MUTUALFUND INDIA website and the same is taken as true value without verification. The evaluation of Portfolio is limited to three main approaches viz Treynors Index approach, Shapres Index approach and Jensen Index approach.

3. Dynamics of Mutual Fund Industry

3.1. INTRODUCTION A Mutual Fund is a trust that pools the savings of a number of investors who share a common financial goal. The money thus collected is then invested in capital market instruments such as shares, debentures and other

KARNATAKA STATE OPEN UNIVERSITY

-9-

PERFORMANCE EVALUATION OF MUTUAL FUNDS

securities. The income earned through these investments and the capital appreciation realized is shared by its unit holders in proportion to the number of units owned by them. Thus a Mutual Fund is the most suitable investment for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost. The flow chart below describes broadly the Working of mutual funds.

Mutual fund is a mechanism for pooling the resources by issuing units to the investors and investing funds in securities in accordance with objectives as disclosed in offer document. Investments in securities are spread across a wide cross-section of industries and sectors and thus the risk is reduced. Diversification reduces the risk because all stocks may not move in the same direction in the same proportion at the same time. Mutual fund issues units to the investors in

KARNATAKA STATE OPEN UNIVERSITY

- 10 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

accordance with quantum of money invested by them. Investors of mutual funds are known as unit holders. The investors in proportion to their investments share the profits or losses. The mutual funds normally come out with a number of schemes with different investment objectives that are launched from time to time. A mutual fund is required to be registered with Securities and Exchange Board of India (SEBI), which regulates securities markets before it can collect funds from the public. Different investment avenues are available to investors. Mutual funds also offer good investment opportunities to the investors. Like all investments, they also carry certain risks. The investors should compare the risks and expected yields after adjustment of tax on various instruments while taking investment decisions.

3.2. ORGANISATION OF A MUTUAL FUND A mutual fund is set up in the form of a trust, which has sponsor, trustees, Asset Management Company (AMC) and custodian. The trust is established by a sponsor or more than one sponsor who is like promoter of a company. The trustees of the mutual fund hold its property for the benefit of the unit holders. Asset Management Company (AMC) approved by SEBI manages the funds by making investments in various types of securities. Custodian, who is registered with SEBI, holds the securities of various schemes of the fund in its custody. The trustees are vested with the general power of superintendence and direction over AMC. They monitor the performance

KARNATAKA STATE OPEN UNIVERSITY

- 11 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

and compliance of SEBI Regulations by the mutual fund SEBI Regulations require that at least two thirds of the directors of trustee company or board of trustees must be independent i.e. they should not be associated with the sponsors. Also, 50% of the directors of AMC must be independent. All mutual funds are required to be registered with SEBI before they launch any scheme.

3.3. Mutual fund structure:

The structure consists of:

KARNATAKA STATE OPEN UNIVERSITY

- 12 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

3.3.1. Sponsor:

Sponsor is the person who acting alone or in combination with another body corporate establishes a mutual fund. Sponsor must contribute at least 40% of the net worth of the Investment Managed and meet the eligibility criteria prescribed under the Securities and Exchange Board of India (Mutual Funds) Regulations, 1996.The Sponsor is not responsible or liable for any loss or shortfall resulting from the operation of the Schemes beyond the initial contribution made by it towards setting up of the Mutual Fund.

3.3.2. Trust:

The Mutual Fund is constituted as a trust in accordance with the provisions of the Indian Trusts Act, 1882 by the Sponsor. The trust deed is registered under the Indian Registration Act, 1908.

3.3.3. Trustee:

Trustee is usually a company (corporate body) or a Board of Trustees (body of individuals). The main responsibility of the Trustee is to safeguard the interest of the unit holders and inter alia ensure that the AMC functions in the interest of investors and in accordance with the Securities and Exchange Board of India (Mutual Funds) Regulations, 1996, the provisions of the Trust Deed and the Offer Documents of the respective Schemes. At least 2/3rd directors of the Trustee are independent directors who are not associated with the Sponsor in any manner.

3.3.4. Asset Management Company:

The Trustee as the Investment Manager of the Mutual Fund appoints the AMC. The AMC is required to be approved by the Securities and Exchange Board of India (SEBI) to act as an asset management company of the

KARNATAKA STATE OPEN UNIVERSITY

- 13 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Mutual Fund. At least 50% of the directors of the AMC are independent directors who are not associated with the Sponsor in any manner. The AMC must have a net worth of at least 10 crore Rupees at all times. The role of an Asset management companies is to act as the investment manager of the trust. They are the ones who manage money of investors. An AMC takes decisions, compensates investors through dividends, maintains proper accounting & information for pricing of units, calculates the NAV, & provides information on listed schemes. It also exercises due diligence on investments & submits quarterly reports to the trustees.

3.3.5. Custodian:

The custodian is appointed by the Board of Trustees for safekeeping of securities in terms of physical delivery and eventual safe keeping or participating in the clearing system through approved depository companies.

3.3.6. Registrars & Transfer Agent(R & T Agent):

The Registrars & Transfer Agents(R & T Agents) are responsible for the investor servicing function, as they maintain the records of investors in mutual funds. They process investor applications; record details provide by the investors on application forms; send out to investors details regarding their investment in the mutual fund; send out periodical information on the performance of the mutual fund; process dividend payout to investor; incorporate changes in information as communicated by investors; & keep the investor record up-to-date, by recording new investors & removing investors who have withdrawn their funds.

KARNATAKA STATE OPEN UNIVERSITY

- 14 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

3.4. Role of SEBI in mutual funds industry Unit Trust of India was the first mutual fund set up in India in the year 1963. In early 1990s, Government allowed public sector banks and institutions to set up mutual funds. In the year 1992, Securities and exchange Board of India (SEBI) Act was passed. The objectives of SEBI are to protect the interest of investors in securities and to promote the development of and to regulate the securities market. As far as mutual funds are concerned, SEBI formulates policies and regulates the mutual funds to protect the interest of the investors. SEBI notified regulations for the mutual funds in 1993. Thereafter, mutual funds sponsored by private sector entities were allowed to enter the capital market. The regulations were fully revised in 1996 and have been amended thereafter from time to time. SEBI has also issued guidelines to the mutual funds from time to time to protect the interests of investors. All mutual funds whether promoted by public sector or private sector entities including those promoted by foreign entities are governed by the same set of Regulations. There is no distinction in regulatory requirements for these mutual funds and all are subject to monitoring and inspections by SEBI. The risks associated with the schemes launched by the mutual funds sponsored by these entities are of similar type.

KARNATAKA STATE OPEN UNIVERSITY

- 15 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

3.5. Association of Mutual Funds in India (AMFI) With the increase in mutual fund players in India, a need for mutual fund association in India was generated to function as a non-profit organization. Association of Mutual Funds in India (AMFI) was incorporated on 22nd August, 1995. AMFI is an apex body of all Asset Management Companies (AMC) which has been registered with SEBI. Till date all the AMCs are that have launched mutual fund schemes are its members. It functions under the supervision and guidelines of its Board of Directors. Association of Mutual Funds India has brought down the Indian Mutual Fund Industry to a professional and healthy market with ethical lines enhancing and maintaining standards. It follows the principle of both protecting and promoting the interests of mutual funds as well as their unit holders. 3.6. History of the Indian Mutual Fund Industry The formation of Unit Trust of India marked the evolution of the Indian mutual fund industry in the year 1963. The primary objective at that time was to attract the small investors and it was made possible through the collective efforts of the Government of India and the Reserve Bank of India. The history of mutual fund industry in India can be better understood divided into four distinct phases.

KARNATAKA STATE OPEN UNIVERSITY

- 16 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

3.6.1. First Phase 1964-87 (Establishment and Growth of Unit Trust

of India) Unit Trust of India enjoyed complete monopoly when it was established in the year 1963 by an act of Parliament. UTI was set up by the Reserve Bank of India and it continued to operate under the regulatory control of the RBI until the two were de-linked in 1978 and the entire control was transferred in the hands of Industrial Development Bank of India (IDBI). UTI launched its first scheme in 1964, named as Unit Scheme 1964 (US64), which attracted the largest number of investors in any single investment scheme over the years. It launched ULIP in 1971, six more schemes between 1981-84, Children's Gift Growth Fund and India Fund (India's first offshore fund) in 1986, Mastershare (Indias first equity diversified scheme) in 1987 and Monthly Income Schemes (offering assured returns) during 1990s. By the end of 1987, UTI's assets under management grew ten times to Rs 6700 Crores.

3.6.2. Second Phase 1987-1993 (Entry of Public Sector Funds)

1987 marked the entry of non- UTI, public sector mutual funds set up by public sector banks and Life Insurance Corporation of India (LIC) and General Insurance Corporation of India (GIC). SBI Mutual Fund was the first non- UTI Mutual Fund established in June 1987 followed by Canbank Mutual Fund (Dec 87), Punjab National Bank Mutual Fund (Aug 89), Indian Bank Mutual Fund (Nov 89), Bank of India (Jun 90), Bank of Baroda Mutual Fund (Oct 92). LIC established its mutual fund in June 1989 while GIC had set up its mutual fund in December 1990. At the end of 1993, the mutual fund industry had assets under management of Rs.47, 004

KARNATAKA STATE OPEN UNIVERSITY

- 17 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

crores. However, UTI remained to be the leader with about 80% market share.

3.6.3. Third Phase 1993-2003 (Entry of Private Sector Funds)

With the entry of private sector funds in 1993, a new era started in Indian mutual fund industry, giving the Indian investors a wider choice of fund families. Also, 1993 was the year in which the first Mutual Fund regulations came into being, under which all mutual funds, except UTI were to be registered and governed. The erstwhile Kothari Pioneer (now merged with Franklin Templeton) was the first private sector mutual fund registered in July 1993. The 1993 SEBI (Mutual Fund) Regulations were substituted by a more comprehensive and revised Mutual Fund Regulations in 1996. The industry now functions under the SEBI (Mutual Fund) Regulations 1996. The number of mutual fund houses went on increasing, with many foreign mutual funds setting up funds in India and also the industry has witnessed several mergers and acquisitions. As at the end of January 2003, there were 33 mutual funds with total assets of Rs. 1,21,805 crores. The Unit Trust of India with Rs.44,541 crores of assets under management was way ahead of other mutual funds.

3.6.4. Fourth Phase since February 2003

In February 2003, following the repeal of the Unit Trust of India Act 1963 UTI was bifurcated into two separate entities. One is the Specified Undertaking of the Unit Trust of India with assets under management of

KARNATAKA STATE OPEN UNIVERSITY

- 18 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Rs.29,835 crores as at the end of January 2003, representing broadly, the assets of US 64 scheme, assured return and certain other schemes. The Specified Undertaking of Unit Trust of India, functioning under an administrator and under the rules framed by Government of India and does not come under the purview of the Mutual Fund Regulations. The second is the UTI Mutual Fund Ltd, sponsored by SBI, PNB, BOB and LIC. It is registered with SEBI and functions under the Mutual Fund Regulations. With the bifurcation of the erstwhile UTI which had in March 2000 more than Rs.76,000 crores of assets under management and with the setting up of a UTI Mutual Fund, conforming to the SEBI Mutual Fund Regulations, and with recent mergers taking place among different private sector funds in the mutual fund industry. The Mutual Fund Marker has entered its current phase of consolidation and growth. At present there are 44 Mutual Fund Houses in India with Average Assets under Management (AAUM) Rs. 71328123.33 Lakhs.. The graph indicates the growth of assets over the years.

KARNATAKA STATE OPEN UNIVERSITY

- 19 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

GROWTH IN ASSETS UNDER MANAGEMENT

Note: Erstwhile UTI was bifurcated into UTI Mutual Fund and the Specified Undertaking of the Unit Trust of India effective from February 2003. The Assets under management of the Specified Undertaking of the Unit Trust of

KARNATAKA STATE OPEN UNIVERSITY

- 20 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

India has therefore been excluded from the total assets of the industry as a whole from February 2003 onwards.

FREQUENTLY USED TERMS Net Asset Value (NAV): Net Asset Value is the market value of the assets of the scheme minus its liabilities. The per unit NAV is the net asset value of the scheme divided by the number of units outstanding on the Valuation Date. The net asset value (NAV) is the market value of the fund's underlying securities. It is calculated at the end of the trading day. Any open-end funds buy or sell order received on that day is traded based on the net asset value calculated at the end of the day. The NAV per units is such Net Asset Value divided by the number of outstanding units.

Sale Price: Is the price charged while investing in an open-ended scheme. This is also called Offer Price. Repurchase Price: Is the price at which a close-ended scheme repurchases its units. This is also called Bid Price.

KARNATAKA STATE OPEN UNIVERSITY

- 21 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Redemption Price: Is the price at which open-ended schemes repurchase their units and close-ended schemes redeem their units on maturity. Such prices are NAV related.

3.7. ADVANTAGES OF MUTUAL FUNDS There are numerous benefits of investing in mutual funds and one of the key reasons for its phenomenal success in the developed markets like US and UK is the range of benefits they offer, which are unmatched by most other investment avenues.

3.7.1. Affordability:

A mutual fund invests in a portfolio of assets, i.e. bonds, shares, etc. depending upon the investment objective of the scheme. An investor can buy in to a portfolio of equities, which would otherwise be extremely expensive. Each unit holder thus gets an exposure to such portfolios with an investment as modest as Rs.500/-. This amount today would get you less than quarter of an Infosys share. Thus it would be affordable for an investor to build a portfolio of investments through a mutual fund rather than investing directly in the stock market.

3.7.2. Economies of Scale:

Because a mutual fund buys and sells large amounts of securities at a time, its transaction costs are lower than you as an individual would pay.

KARNATAKA STATE OPEN UNIVERSITY

- 22 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

3.7.3. Diversification:

It simply means that spread the investment across different securities (stocks, bonds, money market instruments, real estate, fixed deposits etc.) and different sectors (auto, textile, information technology etc.). This kind of diversification may add to the stability of returns, for example during one period of time equities might under perform but bonds and money market instruments might do well enough to offset the effect of a slump in the equity markets. Similarly the information technology sector might be faring poorly but the auto and textile sectors might do well and may protect principal investment as well as help to meet return objectives.

3.7.4. Variety:

Mutual funds offer a tremendous variety of schemes. This variety is beneficial in two ways: first, it offers different types of schemes to investors with different needs and risk appetites; secondly, it offers an opportunity to an investor to invest sums across a variety of schemes, both debt and equity. For example, an investor can invest his money in a Growth Fund (equity scheme) and Income Fund (debt scheme) depending on his risk appetite and thus create a balanced portfolio easily or simply need to buy a Balanced Scheme.

KARNATAKA STATE OPEN UNIVERSITY

- 23 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

3.7.5. Professional management:

Qualified investment professionals who seek to maximize returns and minimize risk monitor investor's money. When you buy in to a mutual fund, you are handing your money to an investment professional that has experience in making investment decisions. It is the Fund Manager's job to (a) find the best securities for the fund, given the fund's stated investment objectives; and (b) keep track of investments and changes in market conditions and adjust the mix of the portfolio, as and when required.

3.7.6. Regulations:

Securities Exchange Board of India (SEBI), the mutual funds regulator has clearly defined rules, which govern mutual funds. These rules relate to the formation, administration and management of mutual funds and also prescribe disclosure and accounting requirements. Such a high level of regulation seeks to protect the interest of investors.

3.7.7. Liquidity:

In open-ended mutual funds, you can redeem all or part of your units any time you wish. Some schemes do have a lock-in period where an investor cannot return the units until the completion of such a lock-in period.

3.7.8. Convenience:

An investor can purchase or sell fund units directly from a fund, through a broker or a financial planner. The investor may opt for a Systematic Investment Plan (SIP) or a Systematic Withdrawal Advantage Plan (SWAP). In addition to this an investor receives account statements and portfolios of the schemes.

KARNATAKA STATE OPEN UNIVERSITY

- 24 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

3.7.9. Flexibility:

Mutual Funds offering multiple schemes allow investors to switch easily between various schemes. This flexibility gives the investor a convenient way to change the mix of his portfolio over time.

3.7.10. Transparency:

Open-ended mutual funds disclose their Net Asset Value (NAV) daily and the entire portfolio monthly. This level of transparency, where the investor himself sees the underlying assets bought with his money, is unmatched by any other financial instrument. Thus the investor is in the know of the quality of the portfolio and can invest further or redeem depending on the kind of the portfolio that has been constructed by the investment manager.

3.8. Drawbacks of Mutual Funds Mutual funds have their drawbacks and may not be for everyone:

3.8.1. No Guarantees:

No investment is risk free. If the entire stock market declines in value, the value of mutual fund shares will go down as well, no matter how balanced the portfolio. Investors encounter fewer risks when they invest in mutual funds than when they buy and sell stocks on their own. However, anyone who invests through a mutual fund runs the risk of losing money.

KARNATAKA STATE OPEN UNIVERSITY

- 25 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

3.8.2. Fees and commissions:

All funds charge administrative fees to cover their day-to-day expenses. Some funds also charge sales commissions or "loads" to compensate brokers, financial consultants, or financial planners.

3.8.3. Taxes:

During a typical year, most actively managed mutual funds sell anywhere from 20 to 70 percent of the securities in their portfolios. If a fund makes a profit on its sales, investor needs to pay taxes on the income received, even if the money is reinvested.

3.8.4. Management risk:

When you invest in a mutual fund, you depend on the fund's manager to make the right decisions regarding the fund's portfolio. If the manager does not perform as well as you had hoped, you might not make as much money on your investment as you expected. Of course, if you invest in Index Funds, you forego management risk, because these funds do not employ manage.

3.8.5. Dilution

It's possible to have too much diversification because funds have smallholdings in so many different companies, high returns from a few investments often don't make much difference on the overall return. Dilution is also the result of a successful fund getting too big. When money pours into funds that have had strong success, the manager often has trouble finding a good investment for all the new money.

KARNATAKA STATE OPEN UNIVERSITY

- 26 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

3.9. TYPES OF MUTUAL FUND SCHEMES Wide variety of Mutual Fund Schemes exists to cater to the needs such as financial position, risk tolerance and return expectations etc. The table below gives an overview into the existing types of schemes in the Industry.

3.9.1. By structure

Open-Ended schemes Close-ended schemes Interval schemes

3.9.2. By Investment objective

Growth schemes Income schemes Balanced schemes Money market schemes

3.9.3. Other schemes

Tax saving schemes Special saving schemes Index schemes

KARNATAKA STATE OPEN UNIVERSITY

- 27 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Sector specific schemes

3.9.4. By Maturity Period:

A mutual fund scheme can be classified into open-ended scheme or closeended scheme depending on its maturity period.

a. Open-ended Fund/ Scheme

An open-ended fund or scheme is one that is available for subscription and repurchase on a continuous basis. These schemes do not have a fixed maturity period. Investors can conveniently buy and sell units at Net Asset Value (NAV) related prices, which are declared on a daily basis. The key feature of open-end schemes is liquidity.

b. Close-ended Fund/ Scheme

A close-ended fund or scheme has a stipulated maturity period e.g. 5-7 years. The funds give an option of selling back the units to the mutual fund through periodic repurchase at NAV related prices. SEBI Regulations stipulate that at least one of the two exit routes is provided to the investor i.e. either repurchase facility or through listing on stock exchanges. These mutual funds schemes disclose NAV generally on weekly basis, open for subscription only during a specified period at the time of launch of the scheme. Investors can invest in the scheme at the time of the initial public issue and thereafter they can buy or sell the units of the scheme on the stock exchanges where the units are listed. Key Differences between open and close open ended schemes

KARNATAKA STATE OPEN UNIVERSITY

- 28 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

S.No

Feature

Open end

Close end Limited

Capitalizatio n

Unlimit ed Yes

Any time entry

No

Any time exit

Yes

No

Tax advantages

Yes

No

Listed on exchange

General ly no

Yes

3.9.5. By Investment Objective:

A scheme can also be classified as growth scheme, income scheme, or balanced scheme considering its investment objective. Such schemes may be open-ended or close-ended schemes as described earlier. Such schemes may be classified mainly as follows:

a. Growth / Equity Oriented Scheme:

The aim of growth funds is to provide capital appreciation over the medium to long- term. Such schemes normally invest a major part of their corpus in equities. Such funds have comparatively high risks. These schemes provide different options to the investors like dividend option, capital appreciation, etc. and the investors may choose any option depending on their preferences. The investors must indicate the option in the application form. The mutual funds also allow the investors to change

KARNATAKA STATE OPEN UNIVERSITY

- 29 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

the options at a later date. Growth schemes are good for investors having a long-term outlook seeking appreciation over a period of time.

b. Income / Debt Oriented Scheme:

The aim of income funds is to provide regular and steady income to investors. Such schemes generally invest in fixed income securities such as bonds, corporate debentures, Government securities and money market instruments. Such funds are less risky compared to equity schemes. These funds are not affected because of fluctuations in equity markets. However, opportunities of capital appreciation are also limited in such funds. The NAVs of such funds are affected because of change in interest rates in the country. If the interest rates fall, NAVs of such funds are likely to increase in the short run and vice versa. However, long-term investors may not bother about these fluctuations

c. Balanced Fund:

The aim of balanced funds is to provide both growth and regular income as such schemes invest both in equities and fixed income securities in the proportion indicated in their offer documents. These are appropriate for investors looking for moderate growth. They generally invest 40-60% in equity and debt instruments. These funds are also affected because of fluctuations in share prices in the stock markets. However, NAVs of such funds are likely to be less volatile compared to pure equity funds.

KARNATAKA STATE OPEN UNIVERSITY

- 30 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

3.9.6. Other Schemes:

a. Money Market or Liquid Fund:

These funds are also income funds and their aim is to provide easy liquidity, preservation of capital and moderate income. These schemes invest exclusively in safer short-term instruments such as treasury bills, certificates of deposit, commercial paper and inter-bank call money, government securities, etc. Returns on these schemes fluctuate much less compared to other funds. These funds are appropriate for corporate and individual investors as a means to park their surplus funds for short periods.

b. Gilt Fund:

These funds invest exclusively in government securities. Government securities have no default risk. NAVs of these schemes also fluctuate due to change in interest rates and other economic factors as are the case with income or debt oriented schemes.

c. Index Funds:

Index Funds replicate the portfolio of a particular index such as the BSE Sensitive index, S&P NSE 50 index (Nifty), etc. These schemes invest in the securities in the same weight age comprising of an index. NAVs of such schemes would rise or fall in accordance with the rise or fall in the index, though not exactly by the same percentage due to some factors known as "tracking error" in technical terms. Necessary disclosures in this regard are made in the offer document of the mutual fund scheme.

KARNATAKA STATE OPEN UNIVERSITY

- 31 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

There are also exchange traded index funds launched by the mutual funds, which are traded on the stock exchanges.

d. Sector specific funds/schemes:

These are the funds/schemes, which invest in the securities of only those sectors or industries as specified in the offer documents. e.g. Pharmaceuticals, Software, Fast Moving Consumer Goods (FMCG), Petroleum stocks, etc. The returns in these funds are dependent on the performance of the respective sectors/industries. While these funds may give higher returns, they are more risky compared to diversified funds. Investors need to keep a watch on the performance of those sectors/industries and must exit at an appropriate time. They may also seek advice of an expert.

e. Tax Saving Schemes:

These schemes offer tax rebates to the investors under specific provisions of the Income Tax Act, 1961 as the Government offers tax incentives for investment in specified avenues. e.g. Equity Linked Savings Schemes (ELSS). Pension schemes launched by the mutual funds also offer tax benefits. These schemes are growth oriented and invest pre-dominantly in equities. Their growth opportunities and risks associated are like any equityoriented scheme.

f. Fund of Funds (FOF) scheme:

A scheme that invests primarily in other schemes of the same mutual fund or other mutual funds is known as a FOF scheme. A FOF scheme enables

KARNATAKA STATE OPEN UNIVERSITY

- 32 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

the investors to achieve greater diversification through one scheme. It spreads risks across a greater universe.

g. Assured return scheme:

Assured return schemes are those schemes that assure a specific return to the unit holders irrespective of performance of the scheme. A scheme cannot promise returns unless such returns are fully guaranteed by the sponsor or AMC and this is required to be disclosed in the offer document. Investors should carefully read the offer document whether return is assured for the entire period of the scheme or only for a certain period. Some schemes assure returns one year at a time and they review and change it at the beginning of the next year.

h. Asset allocation funds:

These funds invest in various asset classes including, but not limited to, equities, fixed income securities, and money market instruments. They seek high total return by maintaining precise weightings in asset classes. Global asset allocation funds invest in a mix of equity & debt securities issued worldwide

i. Flexible portfolio fund:

These funds invest in common stocks, bonds, other debt securities, and money market securities to provide high total return. These funds may

KARNATAKA STATE OPEN UNIVERSITY

- 33 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

invest up to100 percent in any one type of security and may easily change weightings depending upon market conditions.

3.9.7. Dividend Option:

Generally two options are available for every scheme regarding dividend payout and growth option. By opting for growth option an investor can have the benefit of long-term growth in the stock market on the other side by opting for the dividend option an investor can maintain his liquidity by receiving dividend time to time. Some time people refer dividend option as dividend fund and growth fund. Generally decisions regarding declaration of the dividend depend upon the performance of stock market and performance of the fund. OPTION REGARDING DIVIDEND

Dividend

Growth

Payout

Reinvested

KARNATAKA STATE OPEN UNIVERSITY

- 34 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

COMPANY PROFILE IIFL PROFILE

The IIFL (India Infoline) group, comprising the holding company, India Infoline Ltd (NSE: INDIAINFO, BSE: 532636) and its subsidiaries, is one of the leading players in the Indian financial services space. IIFL offers advice and execution platform for the entire range of financial services covering products ranging from Equities and derivatives, Commodities, Wealth management, Asset management, Insurance, Fixed deposits, Loans, Investment Banking, GoI bonds and other small savings instruments. IIFL recently received an in-principle approval for Securities Trading and Clearing memberships from Singapore Exchange (SGX) paving the way for IIFL to become the first Indian brokerage to get a membership of the SGX. IIFL also received membership of the Colombo Stock Exchange becoming the first foreign broker to enter Sri Lanka.

KARNATAKA STATE OPEN UNIVERSITY

- 35 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

IIFL owns and manages the website, www.indiainfoline.com, which is one of Indias leading online destinations for personal finance, stock markets, economy and business. IIFL has been awarded the Best Broker, India by Finance Asia and the Most improved brokerage, India in the Asia Money polls. India Infoline was also adjudged as Fastest Growing Equity Broking House - Large firms by Dun & Bradstreet. A forerunner in the field of equity research, IIFLs research is acknowledged by none other than Forbes as Best of the Web and a must read for investors in Asia. Our research is available not just over the Internet but also on international wire services like Bloomberg, Thomson First Call and Internet Securities where it is amongst one of the most read Indian brokers. A network of over 2,500 business locations spread over more than 500 cities and towns across India facilitates the smooth acquisition and servicing of a large customer base. All our offices are connected with the corporate office in Mumbai with cutting edge networking technology. The group caters to a customer base of about a million customers, over a variety of mediums viz. online over the phone and at our branches

KARNATAKA STATE OPEN UNIVERSITY

- 36 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

HISTORY AND MILESTONES 1995 1997 Commenced operations as Probity Research & Services Pvt. Ltd. Launched research products of leading Indian companies, key sectors and the economy. Client included leading FIIs, banks and companies 1999 2000 Launched www.indiainfoline.com Launched online trading through www.5paisa.com. Started distribution of life insurance, mutual fund and personal financial products Acknowledged by Forbes as Best of the Web and must read for investors 2003 Launched proprietary trading platform Trader Terminal for retail customers 2004 Acquired commodities broking license Launched Portfolio Management Service. 2005 2006 Maiden IPO and listed on NSE, BSE Acquired membership of DGCX, Launched Wealth Advisory Services. 2007 Commenced institutional equities business under IIFL Formed Singapore subsidiary, IIFL (Asia) Pte Ltd

KARNATAKA STATE OPEN UNIVERSITY

- 37 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Launched consumer finance business. CLSA team joined IIFL in May 2007. 2008 Launched IIFL Wealth, Transitioned to insurance broking model Received Best Broker-India award from finance Asia; Most improved Brokerage-India award from Asia money. Got in principle approval from SEBI for sponsoring mutual fund in November 2008. 2009 Received registration for Housing Finance Received Fastest growing Equity Broking House-Large firms in India by Dun & Bradstreet. Entered into a strategic agreement with interactive Brokers, LLC(USA) to provide our clients direct market access to over 80 global exchanges in 18 countries. 2010 Received in-principle approval for membership of the Singapore Stock Exchange. Received membership of the Colombo Stock Exchange. 2011 IIFL gets approval for starting its Mutual Funds operations (Approval for AMC) IIFL will commence its Mutual funds operations in the second half of 2011

KARNATAKA STATE OPEN UNIVERSITY

- 38 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Our Business Model

IIFL, started as a company providing independent and unbiased research. Butoverthe years, we have added almost the entire gamut of financial products and services to our portfolio of offerings. We not only offer advice and products to customers, but also execute their orders and provide constant service thereafter.

KARNATAKA STATE OPEN UNIVERSITY

- 39 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Board of directors

Mr. Nirmal Jain, Chairman , India Infoline Ltd.

Mr. R. Venkataraman, Managing Director , India Infoline Ltd.

Mr. Nilesh Vikamsey, Independent Director , India Infoline Ltd.

Mr. A. K. Purwar, Independent Director , India Infoline Ltd.

KARNATAKA STATE OPEN UNIVERSITY

- 40 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Mr. Kranti Sinha, Independent Director , India Infoline Ltd.

KARNATAKA STATE OPEN UNIVERSITY

- 41 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

IIFL Today We are leading financial services intermediary where the customer can meet all his advisory, investing and borrowing needs under one roof.

So what is the underlying mega opportunity in the financial services industry? Positive macro-economic growth India has become the outsourcing capital of the world. With more and more businesses being outsourced to India, the number of jobs created by BPOs has given a tremendous boost to our economy India has the one of the worlds largest young working class Volatile interest rates have made people more cautious about where to invest their hard earned money

KARNATAKA STATE OPEN UNIVERSITY

- 42 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Investment habits changing from lazy to advise everyone wants to invest their savings where returns are maximum. Thats why there is an increased demand for financial services today.

Customers need an expert, an advisor who can help them with all their investing and borrowing needs. Someone who can help them secure their future by making the right choices! We help people secure their own future as well as their families future by helping them make the right investment decisions. We provide advice, offer a wide range of products to choose from, execute the orders and complete the value chain by providing constant service to all our customers. We help them fulfill their financial needs. In short, we are a one stop investment shop where customers can meet all their advisory, investing and borrowing needs under one roof.

IIFL Network

IIFL has a wide distribution network with: Over a million customers all over India Presence in over 3,000 business locations across 500 cities. Our global footprint extends across geographies with offices in Colombo, Dubai, Singapore and New York.

IIFL Businesses

KARNATAKA STATE OPEN UNIVERSITY

- 43 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

IIFL offers almost the entire gamut of financial services in India They can be broadly categorized into: Equities, commodities and currency broking Wealth Management services Investment banking Distribution of Life Insurance products Distribution of Mutual funds, Fixed Deposits, RBI Bonds and Small Savings among others Distribution of Mortgages and other Loan products Therefore as on date we are into the following businesses: We are registered with BSE and NSE for securities trading. We are registered with MCX, NCDEX and DGCX for commodities trading. We are registered with CDSL and NSDL as depository participants. We are registered as a Category I merchant banker where we focus on the SME space with strong distribution network. We have a strong presence in the QIP space. We are a SEBI registered portfolio manager. We are the first Indian broker to have memberships of the Colombo Stock Exchange and also on the Singapore Stock Exchange.

KARNATAKA STATE OPEN UNIVERSITY

- 44 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Two subsidiaries India Infoline Investment Services and Moneyline Credit Limited are registered with RBI as non-deposit taking non-banking financial services companies. Distribution of Mutual funds, Fixed Deposits, RBI Bonds and Small Savings among others. India Infoline Housing Finance Ltd, the housing finance arm, is registered with the National Housing Bank for distribution of Mortgages and other Loan products. We are Insurance brokers registered with the IRDA and we distribute insurance products of all leading insurance companies. We are one of the fastest growing companies in the Indian Wealth Management space. We have received approval in 2011 to start our Mutual Funds operations.

KARNATAKA STATE OPEN UNIVERSITY

- 45 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Awards and accolades

Best Equity Broker of the Year Bloomberg UTV, 2011 IIFL was awarded the Best Equity Broker of the Year at the recently held Bloomberg UTV Financial Leadership Awards, 2011. The award was presented by the Honble Finance Minister of India,

KARNATAKA STATE OPEN UNIVERSITY

- 46 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Shri Pranab Mukherjee. The Bloomberg UTV Financial Leadership Awards acknowledge the Extraordinary contribution of Indias financial leaders and visionaries from January 2010 to January 2011.

KARNATAKA STATE OPEN UNIVERSITY

- 47 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

IIFL Vision

To become the Most Respected Company in the financial services space in India

IIFL Culture

OM and AOM Owner Mindset and Application of Mind The Strong Foundation on which we stand Owner Mindset (OM) OM is the DNA and culture of our organization. Everyone behaves like an owner and not as an employee of the organization. When anyone from team IIFL is faced with a problem he thinks like an owner and finds a solution to it rather than blindly taking the problem to his seniors. At IIFL one has the autonomy to operate, be creative and even make mistakes, it provides all employees a platform to learn, experiment and grow. At IIFL, we never compromise on our vision or do anything that will affect the morale of our people

Application of Mind (AOM)

Keep the objective of the task assigned and the overall objective of the organization in mind all the time.

KARNATAKA STATE OPEN UNIVERSITY

- 48 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Dont follow rules / procedures without understanding the logic. When in doubt, ask questions and seek clarity. With OM and AOM everyone in the organization feels that work is fun. Its less tedious and more enjoyable We are a one-stop financial services shop, most respected for quality of its advice, personalized service and cutting-edge technology.

Equities IIFL is a member of BSE and NSE registered with NSDL and CDSL as a depository participant and provides broking services in the cash, derivatives and currency segments, online and offline. IIFL is a dominant player in the retail as well as institutional segments of the market. It recently became the first Indian broker to get a membership of the Colombo Stock Exchange and is also the first Indian broker to have received an in-principle approval for membership of the Singapore Stock Exchange. IIFLs Trader Terminal, its proprietary trading platform, is widely acknowledged as one of the best available for retail investors. Investors opt for IIFL given its unique combination of superior Service, cutting-edge proprietary Technology, Advice powered by worldacclaimed research and its unparalleled Reach owing to its over 2500 business locations across over 500 cities in India. IIFL received the BQ1 broker grading (highest grading) from CRISIL. The assigned grading reflects an effective external interface, robust systems

KARNATAKA STATE OPEN UNIVERSITY

- 49 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

framework and strong risk management. The grading also reflects IIFLs healthy regulatory compliance track record and adequate credit risk profile IIFLs analyst team won Zee Business Indias best market analysts awards 2009 for being the best in the Oil and Gas and Commodities sectors and a finalist in the Banking and IT sectors. IIFL has rapidly emerged as one of the premier institutional equities houses in India with a team of over 25 research analysts, a full-fledged sales and trading team coupled with an experienced investment banking team. The Institutional equities business conducted a very successful Enterprising India global investors conference in Mumbai in March 2010, which was attended by funds with aggregate AUM over US$5 trillion and CEOs and other executives representing corporates with a combined market capitalization of over US$500 billion. The Discover Sri Lanka global investors conference, held in Colombo in July 2010, was attended by more than 50 leading global and major local investors and 25 Sri Lankan corporates, along with senior Government officials. Commodities IIFL offers commodities trading to its customers vide its membership of the MCX and the NCDEX. Our domain knowledge and data based on in depth research of complex paradigms of commodity kinetics, offers our customers a unique insight into behavioral patterns of these markets. Our customers are

KARNATAKA STATE OPEN UNIVERSITY

- 50 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

ideally positioned to make informed investment decisions with a high probability of success.

Credit and finance IIFL offers a wide array of secured loan products. Currently, secured loans (mortgage loans, margin funding, loans against shares) comprise 94% of the loan book. The Company has discontinued its unsecured products. It has robust credit processes and collections mechanism resulting in overall NPAs of less than 1%. The Company has deployed proprietary loan-processing software to enable stringent credit checks while ensuring fast application processing. Recently the company has also launched Loans against Gold.

Insurance IIFL entered the insurance distribution business in 2000 as ICICI Prudential Life Insurance Co. Ltds corporate agent. Later, it became an Insurance broker in October 2008 in line with its strategy to have an open architecture model. The Company now distributes products of major insurance companies through its subsidiary India Infoline Insurance Brokers Ltd. Customers can choose from a wide bouquet of products from several insurance companies including Max New York Life Insurance, MetLife, Reliance Life Insurance, Bajaj Allianz Life, Birla Sunlife, Life Insurance Corporation, Kotak Life Insurance and others.

KARNATAKA STATE OPEN UNIVERSITY

- 51 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Wealth Management Service IIFL offers private wealth advisory services to high-net-worth individuals (HNI) and corporate clients under the IIFL Private Wealth brand. IIFL Private Wealth is managed by a qualified team of MBAs from IIMs and premier institutes with relevant industry experience. The team advises clients across asset classes like sovereign and quasi-sovereign debt, corporate and collateralized debt, direct equity, ETFs and mutual funds, third party PMS, derivative strategies, real estate and private equity. It has developed innovative products structured on the fixed income side. It also has tied up with Interactive Brokers LLC to strengthen its execution platform and provide investors with a global investment platform.

Investment Banking IIFLs investment banking division was launched in 2006. The business leverages upon its strength of research and placement capabilities of the institutional and retail sales teams. Our experienced investment banking team possesses the skill-set to manage all kinds of investment banking transactions. Our close interaction with investors as well as corporate helps us understand and offer tailor-made solutions to fulfill requirements.

KARNATAKA STATE OPEN UNIVERSITY

- 52 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

The

Company

possesses

strong

placement

capabilities

across

institutional, HNI and retail investors. This makes it possible for the team to place large issues with marquee investors. In FY10, the team advised and managed more than 10 transactions including four IPOs and four Qualified Institutions Placements Product Offerings.

FLAME, Indias largest financial literacy initiative, by IIFL FLAME (Financial Literacy Agenda for Mass Empowerment) is an IIFL (India Infoline Group) initiative towards spreading financial literacy amongst masses to help their inclusion in the economic prosperity of India. With accelerating GDP, per capita growth as well as savings, financial literacy is more relevant and important today than ever before. While the governments emphasis on financial inclusion is to widen the reach of banking services to unbanked rural areas, we endeavor to complement the effort by helping people make the most of the available banking and financial services. Even the people who qualify as banked population have limited understanding of how to use financial products to help enhancement of financial security, building up wealth and ensuring a comfortable life post retirement, and also how to avoid frauds and losses from unscrupulous agents and ponzi schemes. The objective is to light a FLAME, which will be ignite many a flame to remove the darkness of illiteracy and steer the inclusion of the masses

KARNATAKA STATE OPEN UNIVERSITY

- 53 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

towards the sunshine of growth and prosperity. As a part of the FLAME initiative, IIFL has planned an elaborate set of activities Financial awareness workshops across 1000 cities in India - As a part of this initiative, IIFL will hold financial awareness workshops at over 1,000 locations across India. These free workshops will be held across the country, including Tier II and Tier III cities where our expert speakers will spread financial literacy. A comprehensive mass media campaign This will be a huge campaign which will feature in the print media and will reach out to investors across the country. The idea is to convey the various concepts which are a part of the literacy drive through easy-to-grasp way e.g. our first campaign uses cartoon illustrations which will make it far easier for people to understand the various concepts explained therein. Books and publications -Multiple publications are planned which would seek to highlight the various concepts of finance as a part of this initiative. These publications will be given out at the workshops which will be held across the country. Financial awareness helpline - IIFL will setup a helpline, in our own call center, where anyone can call up and get answers to their queries pertaining to financial services. This helpline will be manned by IIFLs trained professionals who will provide a solution to such queries.

KARNATAKA STATE OPEN UNIVERSITY

- 54 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Driving the knowledge edge To educate and update the clients, IIFL brings out research reports on a daily, weekly, fortnightly, monthly, quarterly and yearly basis, spanning technical and fundamental research on funds, stocks, indexes, derivatives, commodities, insurance, corporate earnings and SMEs. Very recently, IIFL has ventured into regional research reports and books. During the year, IIFL research articles have been published in many regional newspapers. IIFL has Ask Analyst feature on its website, wherein clients can ask the research team questions on all sectors, and receive their answers within 24 hours. Another feature which the website carries is the Live Chat, wherein clients can call and have discussions with the research team. At IIFL, our core competence lies in research, which has been assiduously built over the years. We have come out with a number of comprehensive research reports, which have been well received by industry experts. IIFL has separate research teams for the institutional and the retail customer segments. The research is available on international wire services like Bloomberg, Thomson First Call and Internet Securities. The 50 member strong research team is based in Mumbai, Singapore and Colombo and covers 200+ stocks. Trader Terminal The Trader Terminal is a new world class trading software that provides single-screen products access to Equities, Derivatives, Commodities, Currencies, Mutual Funds and IPOs. The principal advantage is faster

KARNATAKA STATE OPEN UNIVERSITY

- 55 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

execution, multiple options for investors to trade from their desktop, over the web and using their mobiles. Trade across Equities, Commodities, Currencies, MFs, all in one screen Easy access to our world-class research, Trade on the Trader Terminal through your mobile. Advanced charting options and technical analysis tools Streaming quotes and instant order confirmation.

Reviewing 2010-11 Performance Business IIFL Mutual Fund During the year, IIFL Mutual Fund, the India Infoline Ltd sponsored mutual fund, received final regulatory approval from Securities and Exchange Board of India (SEBI) to commence operations. This will enable commencement of the mutual fund business and the launch of mutual fund schemes in due course. International Expansion IIFLs Singapore subsidiary received the final approval from Singapore Stock Exchange for its equities broking business. The subsidiary commenced its broking operations from December 2010. IIFL donated its entire first week commissions from trading operations in SGX to Community Chest, Singapore. The Company also received approval from the Colombo Stock Exchange and

KARNATAKA STATE OPEN UNIVERSITY

- 56 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

SEC, Sri Lanka for undertaking broking business, becoming the first Indian broker to set up business in Sri Lanka.

Technology Development Launch of Latest Version of Trader Terminal The Company launched the latest version of Trader Terminal, which enjoys lightning-fast execution speed, world-class user interface and a single click access to its worldclass research. The new terminal offers the facility to trade in cash, derivatives, mutual funds, IPOs, currencies and commodities all in one screen. Besides, investors can now trade from their desktops, over the web or using their mobile phones. Outsourcing Technology infrastructure to IBM IIFL has entered into a ten year IT outsourcing agreement with IBM to transform its IT Infrastructure and establish a direct linkage between business performance and IT costs. The` 3 bn agreement would help IIFL deliver enhanced levels of customer satisfaction, ensure continuous audit readiness, strengthen IT security framework and compliance and provide better visibility and control of IT operations. The agreement covers IIFLs 700 branches. IBM will set up a centralized helpdesk, a pan-India services desk, applications and infrastructure in branches, and deploy service management processes to cover assets, IT security, capacity, network, storage, incident /problem/change, and technology, among others

KARNATAKA STATE OPEN UNIVERSITY

- 57 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Customer Engagement Enterprising India-ii IIFLs global investor conference Enterprising India II held in Mumbai received an overwhelming response. The conference attracted a participation of over 400 institutional investors, over 75 Indian and Sri Lankan companies and select specialist speakers. The conference had a strong line-up of quality investors, including a number of marquee long-only funds with estimated investments of over US$ 100 bn in India. Discover Srilanka Conference IIFLs global investor conference, Discover Sri Lanka was held in Colombo in July 2010. The same was attended by more than 50 leading global and local investors and 25 Sri Lankan corporates, along with senior government officials. Retail Investor Meets IIFL conducted several investor meets and camps across India, on its own as well as with leading media house ET Now to spread financial literacy and awareness about risk- return of various products, aspects of financial planning and understanding of investor rights

KARNATAKA STATE OPEN UNIVERSITY

- 58 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

4. Performance Measures or Risk Measurement of

Mutual Funds Mutual Fund industry today, with about 44 players and more than one thousand schemes, is one of the most preferred investment avenues in India. However, with a plethora of schemes to choose from, the retail investor faces problems in selecting funds. Factors such as investment strategy and management style are qualitative, but the funds record is an important indicator too. Though past performance alone can not be indicative of future performance, it is, the only quantitative way to judge how good a fund is at present. Therefore, there is a need to correctly assess the past performance of different mutual funds. Worldwide, good mutual fund companies over are known by their AMCs and this fame is directly linked to their superior stock selection skills. For mutual funds to grow, AMCs must be held accountable for their selection of stocks. In other words, there must be some performance indicator that will reveal the quality of stock selection of various AMCs. Return alone should not be considered as the basis of measurement of the performance of a mutual fund scheme, it should also include the risk taken by the fund manager because different funds will have different levels of risk attached to them. Risk associated with a fund, in general, can be defined as variability or fluctuations in the returns generated by it. The higher the fluctuations in the returns of a fund during a given period, higher will be the risk associated with it. These fluctuations in the returns generated by a fund are

KARNATAKA STATE OPEN UNIVERSITY

- 59 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

resultant of two guiding forces. First, general market fluctuations, which affect all the securities present in the market, called market risk or systematic risk and second, fluctuations due to specific securities present in the portfolio of the fund, called unsystematic risk. The Total Risk of a given fund is sum of these two and is measured in terms of standard deviation of returns of the fund. Systematic risk, on the other hand, is measured in terms of Beta, which represents fluctuations in the NAV of the fund vis--vis market. The more responsive the NAV of a mutual fund is to the changes in the market; higher will be its beta. Beta is calculated by relating the returns on a mutual fund with the returns in the market. While unsystematic risk can be diversified through investments in a number of instruments, systematic risk can not. By using the risk return relationship, we try to assess the competitive strength of the mutual funds vis--vis one another in a better way. In order to determine the risk-adjusted returns of investment portfolios, several eminent authors have worked since 1960s to develop composite performance indices to evaluate a portfolio by comparing alternative portfolios within a particular risk class. The most important and widely used measures of performance are: Arithmetic Mean Standard Deviation Beta The Sharpe Measure The Treynor Measure

KARNATAKA STATE OPEN UNIVERSITY

- 60 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Jenson Model

4.1. Arithmetic Mean (Returns) Y/N Where Y- Return of NAV values N- Number of Observation

Average return that can be expected from investment. The arithmetic average return is appropriate as a measure of the central tendency of a number of returns calculated for a particular time i.e. for one year. 4.2. Standard Deviation It reflects the degree to which returns fluctuate around their average. The higher the standard deviation, the greater is the risk. The measure is typically calculated using monthly results which are generally disclosed by Fund houses in their fund updates. A conservative equity fund might have a number below 3.5% per month, whereas an extremely aggressive one could have a value of 6% or more. About two thirds of the time a funds actual monthly return will range within plus or minus one standard deviation of its monthly average. Its return will vary within the two standard deviations about 95 % of the time.

KARNATAKA STATE OPEN UNIVERSITY

- 61 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

With the S&P 500 Fund B, the investor would be acquiring a larger amount of volatility risk than necessary to achieve the same returns as Fund A. Fund A would provide the investor with the optimal risk/return relationship

KARNATAKA STATE OPEN UNIVERSITY

- 62 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

The standard deviation is a measure of the variables around its mean or it is the square root of the sum of the squared deviations from the mean divided by the number of observations. 4.3. BETA Beta describes the relationship between the stocks return and index returns. There can be direct or indirect relation between stocks return and index return. Indirect relations are very rare. Beta= {N*XY- (X) (Y)} / { N(X) * (x) 2} Where N- No of observation X- Total of market index return value of return to Nav 1) Beta = + 1.0 It indicates that one percent change in market index return causes exactly one percent change in the stock return. It indicates that stock moves along with the market. 2) Beta= + 0.5 One percent changes in the market index return causes 0.5 percent change in the stock return. It indicates that it is less volatile compared to market. Y- Total

KARNATAKA STATE OPEN UNIVERSITY

- 63 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

3) Beta= + 2.0 One percent change in the market index return causes 2 percent change in the stock return. The stock return is more volatile. The stocks with more than 1 beta value are considered to be very risky. 4) Negative beta value indicates that the stocks return move in opposite direction to the market return.

4.4. The Sharpe Measure: In this model, performance of a fund is evaluated on the basis of Sharpe Ratio, which is a ratio of returns generated by the fund over and above risk free rate of return and the total risk associated with it. According to Sharpe, it is the total risk of the fund that the investors are concerned about. So, the model evaluates funds on the basis of reward per unit of total risk. Symbolically, it can be written as : St= Rp Rf S.D WHERE Rp Avereage Return on Portfolio(fund) S.D- Standard Deviation Higher the value of sharpe ratio better the fund has performed. Sharpe ratio can be used to rank the desirability of funds or portfolios. The fund that has performed well comapred to other will be ranked first then the others. R fRisk Free Rate of Interest

KARNATAKA STATE OPEN UNIVERSITY

- 64 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

4.5. The Treynor Measure: Developed by Jack Treynor, this performance measure evaluates funds on the basis of Treynor's Index. This Index is a ratio of return generated by the fund over and above risk free rate of return (generally taken to be the return on securities backed by the government, as there is no credit risk associated), during a given period and systematic risk associated with it (beta). Ty= Rp Rf B WHERE Rp- Average Return to Portfolio Beta Coeffecient While a high and positive Treynor's Index shows a superior risk-adjusted performance of a fund, a low and negative Treynor's Index is an indication of unfavorable performance. 4.6. The Jenson Model: Jenson's model proposes another risk adjusted performance measure. This measure was developed by Michael Jenson and is sometimes referred to as the Differential Return Method. This measure involves evaluation of the returns that the fund has generated vs. the returns actually expected out of the fund given the level of its systematic risk. The surplus between the two returns is called Alpha, which measures the performance of a fund compared with the actual returns over the period. Required return of a fund at agiven level of risk (Bi) can be calculated as: R f- Risk Less Rate of Interest. B-

KARNATAKA STATE OPEN UNIVERSITY

- 65 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Ri = Rf + Bi (Rm - Rf) Where, Rm is average market return during the given period. After calculating it, alpha can be obtained by subtracting required return from the actual return of the fund. Higher alpha represents superior performance of the fund and vice versa. Limitation of this model is that it considers only systematic risk not the entire risk associated with the fund and an ordinary investor can not mitigate unsystematic risk, as his knowledge of market is primitive.

KARNATAKA STATE OPEN UNIVERSITY

- 66 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

5. Fund Analysis:

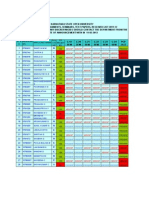

5.1. QUARTERLY COMPARISIONS Average Returns of the Index Fund Schemes Quart Quart Quart Quart Tota er-1 er-2 er-3 er-4 l 63.97 26.6 4.7 1.07 96.3 4 36.22 16.97 2.51 0.41 56.1 1 36.55 16.13 2.44 0.16 55.2 8 35.78 15.15 3 -0.16 53.7 7 30.87 14.63 -1.33 0.16 44.3 3 34.84 14.61 2.62 0.71 52.7 8 35.7 16.74 2.78 0.25 55.4 7 35.79 25.54 2.44 5.3 69.0 7

CNX NIFTY India info line HDFC ING JM LIC Tata UTI

QUARTER 1: HDFC has shown good returns when compared to other funds. FRANKLIN, UTI, TATA and ING also had the same returns. QUARTER 2: UTI has shown the same returns of the index when compared to other funds. All the remaining schemes have almost the same returns. QUARTER 3: ING has shown good returns when compared to other funds. All other funds except JM had similar returns.

KARNATAKA STATE OPEN UNIVERSITY

- 67 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

QUARTER 4: UTI has outperformed the INDEX and had given the best returns when compared to other funds. All other funds have similar returns.

Quarter 1 FY2009-2010 Std.D ev valu e Indi a info line HDF C ING JM LIC 3.106 92 3.045 29 3.050 15 3.043 95 3.020 Shar Treny jense pe or's n Rati Ratio o 0.99 0.111 0.451 0.140 6 3 95 0.97 5 0.97 78 1.06 28 0.96 0.114 7 0.111 9 0.171 0.109 0.4503 0.3493 0.4899 0.3431 0.141 39 0.001 76 0.044 7 R Rank Squa (Tren re yo) 0.999 8 0.630 8 0.999 1 0.974 9 0.998 2 Rank (Shar pe) 4

3 4 1 7

2 3 1 7

KARNATAKA STATE OPEN UNIVERSITY

- 68 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

34 Tata UTI 3.089 45 3.092 53

80

9 0.3439 0.3445

0.79 0.110 0 3 0.99 0.110 17 4

0.008 5 5 - 0.999 0.007 6 60 - 0.999 0.006 6 67

6 5

6 5

Standard Deviation: The value of the Standard deviation increases due to increase in volatility of the fund. The Standard deviation of all the schemes is almost the same which indicates that the schemes are efficient. Hence in this quarter we can say that all the schemes are equally good for investing in the view of volatility. Beta: Beta indicates the risk of the company for investment point of view. Higher the beta higher the risk and expect higher returns. Low beta values indicates low risk. The standard beta value is 1. All the schemes except TATA has Beta value of nearly 1. So, in the view of Beta TATA is not a good investment option.

KARNATAKA STATE OPEN UNIVERSITY

- 69 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Sharpe, Treynor and Jenson: Based on these performance measures, JM ,HDFC and Franklin are the best three investment options available. Recommendation: HDFC being topped in all the aspects including returns it is the best investment option available.

KARNATAKA STATE OPEN UNIVERSITY

- 70 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Quarter 2 FY2009-2010 Std.De v value India info line HDF C ING JM LIC Tata UTI 3.1069 23 1.6580 94 1.6601 24 1.7539 63 1.7166 6 1.7059 22 1.7264 07 Sharp Treny jensen R Rank Rank e or's Squar (Tren (Shar Ratio Ratio e yo) pe) 0.9964 0.1113 0.4510 0.1409 0.9998 1 2 1 77 3 54 11 0.9529 09 0.9531 63 1.0038 64 0.9796 45 0.9808 64 0.9928 93 0.0875 02 0.0814 84 0.0741 75 0.0756 51 0.0886 07 0.1385 37 0.1522 57 0.1419 2 0.1296 0.1325 65 0.1541 05 0.2408 83 0.0017 7 0.0018 5 0.0347 5 0.0267 5 0.0044 19 0.1411 2 0.9984 29 0.9965 2 0.9902 43 0.9956 25 0.9993 83 0.9998 87 4 5 7 6 3 2 4 5 7 6 3 1

Standard Deviation: The Standard deviation of all the schemes is almost the same except Franklin which indicates that the schemes are efficient. Hence in this quarter we can say that all the schemes are equally good for investing except Franklin in the view of volatility. Beta: All the schemes have Beta value of nearly 1. So, in the view of Beta all are equally good investment options.

KARNATAKA STATE OPEN UNIVERSITY

- 71 -

PERFORMANCE EVALUATION OF MUTUAL FUNDS

Sharpe, Treynor and Jenson: Based on these performance measures, Franklin, TATA, and UTI are the best three investment options available. Recommendation: UTI being topped in all the aspects including returns it is the best investment option available.