Академический Документы

Профессиональный Документы

Культура Документы

Practice Questions

Загружено:

shanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Practice Questions

Загружено:

shanАвторское право:

Доступные форматы

Qs 1: Company currently has long-term debt of 1000 and equity of 1000.

How much equity should the company issue in order to reduce the long-term debt ratio to 25%?

Qs 2: Company currently has EBIT of 100 and interest payments of 50. To what extent can EBIT fall so that Times Interest Earned is 1.0?

Qs 3: Describe two ways in which company can increase its net working capital to total asset ratio?

Qs 4: If the companys cash balance increases by 500 but marketable securities decrease by 200 and account receivable remain the same with no change to current liabilities, what will happen to the quick ratio?

Qs 5: Suggest two ways in which Operating profit margin remains the same but net profit margin decreases?

Qs 6: Company already had 1000 in equity and issued 1000 worth of more equity during the year. Its profit increased from 250 to 500? What will happen to the firms ROE? (Average equity last year was 1000)

Qs 7: Company currently has long-term debt of 1000 and equity of 1000. How much long-term debt should the company issue in order to increase the long-term debt ratio to 75%?

Qs 8: Companys current assets are 1000 and current liabilities are 500, while total assets stand at 5000. What happens to the net working capital to total asset ratio if current assets increase by 100 but current liabilities stays the same?

Qs 9: Company already has cash balance of 500, account receivables worth 500 and current liability at 800. Later company decides to borrow 500 as short-term loans and invest in marketable securities what will happen to the quick ratio?

Qs 10: Suggest in what situation Operating profit margin remains the same but net profit margin increases?

Qs 11: Company makes a constant profit each year and gives no cash dividends, what will happen to ROE over time?

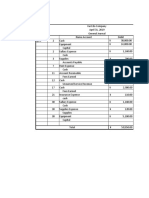

Qs 12: Compute ROE and ROA for the company via Dupont Analysis and suggest ways in which company can boost its ROE and ROA.

Balance Sheet Assets Fixed Assets Current Assets Cash

2010 4,000 500 600 5,100 2,500 2,600 5,100

2009 4,000 600 400 5,000 2,800 2,300 5,100

Income Statement Sales COGS Gross Profit Admin Expenses EBIT Interest Expense Tax Net Income 2010 2009 5,000 4,000 3,500 3,000 1,500 1,000 700 400 800 600 200 200 300 400 300 -

Liabilities Equity

Qs 12: Use the following information to compute Additional Financing Needed for the company.

Income Statement Sales COGS Gross Profit Other Expenses Net Income Dividend

2010 6,000 4,800 1,200 240 960 480

2009 5,000 4,000 1,000 200 800 400

Balance Sheet Assets Liabilities Equity

2010 10,200 4,920 5,280 10,200

2009 9,600 4,800 4,800 9,600

Qs 12: Use the following information to compute Working Capital requirement for the company. Projected Annual Sales = 1000,000 units Selling Price = PKR 3 per unit Carry inventory for 10 weeks Credit received from customer is 12 weeks Credit received from supplier is 8 weeks Profit Margin is 20% Contingency is 20% of Net Working Capital Calculate GWC, NWC and length of the Working Capital Cycle?

Formula Sheet: Long-term debt ratio = Long-term debt / (long-term debt + equity) Times Interest Earned = EBIT / Interest Payments Cash Coverage Ratio = (EBIT + depreciation) / interest payments Net working capital to total asset ratio = Net Working Capital / Total Assets Quick Ratio = (Cash + Marketable Securities + Receivables) / Current Liabilities Cash Ratio = (Cash + Marketable Securities) / (Current liabilities) NWC Turnover = Sales / (Average Net working capital) Average Collection Period = average receivables / average daily sales Inventory Turnover Ratio = Cost of goods sold / average inventory Days sales in inventory = (Average Inventory / Cost of Goods Sold) x 365 Net Profit Margin = Net Profit / Sales Operating Profit Margin = EBIT / Sales Gross Profit Margin = Gross Profit / Sales Return on Asset = Net Income / average total assets Return on Equity = Net Income / average equity Payout Ratio = Dividends / Net Income Plowback Ratio = 1 Payout Ratio P/E Ratio = Current Price per share / Earning per Share Forecasted P/E Ratio = Current Price per Share / Forecasted Earning per share Dividend Yield = Dividend per Share / Current Price per Share Dividend Discount Model - Price per Share = Next yrs dividend / (r-g) Market to Book Ratio = Stock Price / Book Value per Share Tobins Q = Market Value of Assets / estimated replacement cost Dupont Analysis:

ROA = (Sales / Assets) x (Net Income / Sales) ROE = (Assets / Equity) x (Sales / Assets) x (EBIT / Sales) x (Net Income / EBIT) Economic Profit = (ROI r) x Capital invested Economic Value Added (EVA) = Income earned (cost of capital x investment) Additional Financing Needed = (A/S) x g x S (L/S) x g x S Net Margin x (1 + g) x S D Gross Working Capital = Total Current Assets Net Working Capital = Current Assets Current Liabilities

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Business ValuationДокумент2 страницыBusiness Valuationjrcoronel100% (1)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- SBDC Valuation Analysis ProgramДокумент8 страницSBDC Valuation Analysis ProgramshanОценок пока нет

- Business VocabularyДокумент179 страницBusiness VocabularyPrintare Xeroxare Belvedere94% (18)

- Venture CapitalДокумент5 страницVenture CapitalMichel KropfОценок пока нет

- Stakeholder TheoryДокумент10 страницStakeholder TheoryKaoru AmaneОценок пока нет

- Alibaba FCFEДокумент60 страницAlibaba FCFEAhmad Faiz SyauqiОценок пока нет

- Corporation Law DigestsДокумент17 страницCorporation Law DigestsRmLyn MclnaoОценок пока нет

- The Impact of HRM On Organizational Performance Becker GerhartДокумент25 страницThe Impact of HRM On Organizational Performance Becker GerhartshanОценок пока нет

- The Impact of HRM On Organizational Performance Becker GerhartДокумент25 страницThe Impact of HRM On Organizational Performance Becker GerhartshanОценок пока нет

- Damodaran FCFFginzuДокумент28 страницDamodaran FCFFginzushanОценок пока нет

- Numerical ExersiseДокумент8 страницNumerical ExersiseshanОценок пока нет

- Cost of CapitalДокумент4 страницыCost of Capitalshan50% (2)

- SKODA AUTO-2007 (Case Study) : Group MembersДокумент10 страницSKODA AUTO-2007 (Case Study) : Group MembersshanОценок пока нет

- Case Assignment # 1Документ8 страницCase Assignment # 1shan0% (1)

- Bond PracticeДокумент3 страницыBond PracticeshanОценок пока нет

- Amazon 555Документ12 страницAmazon 555shanОценок пока нет

- Definition of ModarabaДокумент1 страницаDefinition of ModarabashanОценок пока нет

- Sales Tax Act 1990 Updated Upto 2010Документ84 страницыSales Tax Act 1990 Updated Upto 2010Sohail AnjumОценок пока нет

- 1 Assignment Worth 30 Marks & Has To Be Submitted in Second Last ClassДокумент2 страницы1 Assignment Worth 30 Marks & Has To Be Submitted in Second Last ClassshanОценок пока нет

- Use Correct Format and Answer The Questions Separately in SequenceДокумент4 страницыUse Correct Format and Answer The Questions Separately in SequenceshanОценок пока нет

- S.I For Managers 2Документ4 страницыS.I For Managers 2shanОценок пока нет

- Model QuestionДокумент2 страницыModel QuestionshanОценок пока нет

- Essentials of Islamic Finance: Final Quiz Fall 2012 AnswersДокумент2 страницыEssentials of Islamic Finance: Final Quiz Fall 2012 Answersshan100% (1)

- Persuasive SpeechДокумент16 страницPersuasive SpeechshanОценок пока нет

- Sukuk ProblemsДокумент4 страницыSukuk ProblemsshanОценок пока нет

- 1 NBP 2 Ubl 3 Abl 4 MCB 5 Blue Moon 6 Abdul Wakeel 7 Bank Islami 8 Bank Muslim 9 Bank Pakistan 10 Scan IndustriesДокумент2 страницы1 NBP 2 Ubl 3 Abl 4 MCB 5 Blue Moon 6 Abdul Wakeel 7 Bank Islami 8 Bank Muslim 9 Bank Pakistan 10 Scan IndustriesshanОценок пока нет

- SCMДокумент19 страницSCMshanОценок пока нет

- Sukuk Pakistan Cotton Trading LTD.: Rs.100,000,000 20:80 Yousuf Ibnul HasanДокумент1 страницаSukuk Pakistan Cotton Trading LTD.: Rs.100,000,000 20:80 Yousuf Ibnul HasanshanОценок пока нет

- S.I For Managers: One-Sample TestДокумент2 страницыS.I For Managers: One-Sample TestshanОценок пока нет

- CGPAДокумент4 страницыCGPAshanОценок пока нет

- Estimation HandoutДокумент7 страницEstimation HandoutshanОценок пока нет

- MS Excel FormulasДокумент223 страницыMS Excel FormulasUok RitchieОценок пока нет

- We OpДокумент2 страницыWe OpshanОценок пока нет

- Skoda AutoДокумент5 страницSkoda AutoshanОценок пока нет

- Overconfidence Under Reaction BuffettДокумент43 страницыOverconfidence Under Reaction BuffettDevan PramuragaОценок пока нет

- Class 11 - Div Policy Case - Edited PDFДокумент6 страницClass 11 - Div Policy Case - Edited PDFFelik MakuprathowoОценок пока нет

- Courts Asia Limited - Annual Report 2016Документ126 страницCourts Asia Limited - Annual Report 2016garu1991Оценок пока нет

- Investment in Associate ActivityДокумент2 страницыInvestment in Associate Activitybrmo.amatorio.uiОценок пока нет

- Zurich Insurance Malaysia Investment-Linked Foreign Edge FundsДокумент39 страницZurich Insurance Malaysia Investment-Linked Foreign Edge Fundsnantah2299Оценок пока нет

- Apollo Shoes CaseДокумент156 страницApollo Shoes CasenishuОценок пока нет

- F& N Annual Report 2009Документ172 страницыF& N Annual Report 2009Thomas NgОценок пока нет

- Open OfferДокумент9 страницOpen OfferraghuОценок пока нет

- Auditing Problems QaДокумент12 страницAuditing Problems QaSheena CalderonОценок пока нет

- Kahn V Tremont and Harold C. Simmons, 694 A.2d 422 (Del. 1997)Документ13 страницKahn V Tremont and Harold C. Simmons, 694 A.2d 422 (Del. 1997)texaslegalwatchОценок пока нет

- Chapter 2 NotesДокумент38 страницChapter 2 NotesDonald YumОценок пока нет

- Week 4 Assignment FNCE UCWДокумент3 страницыWeek 4 Assignment FNCE UCWamyna abhavaniОценок пока нет

- Chapter 1 Question eДокумент4 страницыChapter 1 Question eĐỗ Thị HuyềnОценок пока нет

- Asquith and Mullins 1983Документ21 страницаAsquith and Mullins 1983Angelie AngelОценок пока нет

- Hermitage FundДокумент8 страницHermitage FundanuragОценок пока нет

- Veritas Registrars e Dividend Mandate FormДокумент1 страницаVeritas Registrars e Dividend Mandate FormDr Richard AnekweОценок пока нет

- AuditДокумент9 страницAuditrahul422Оценок пока нет

- Conference CD - IIC 2010Документ122 страницыConference CD - IIC 2010Markus SchullerОценок пока нет

- CH1&2 Homework AnswersДокумент5 страницCH1&2 Homework AnswersGabriel Aaron DionneОценок пока нет

- Gerrard Construction Co Is An Excavation Contractor The Following SummarizedДокумент3 страницыGerrard Construction Co Is An Excavation Contractor The Following SummarizedCharlotteОценок пока нет

- Solution Ch16Документ5 страницSolution Ch16Amanda AyarinovaОценок пока нет

- Where's The Risk in Risk Arbitrage?Документ18 страницWhere's The Risk in Risk Arbitrage?staikovicОценок пока нет

- QUIZДокумент3 страницыQUIZsabiliОценок пока нет

- Chapter 6 Share CapitalsДокумент5 страницChapter 6 Share CapitalsShreya AgarwalОценок пока нет

- Jawaban Latihan SoalДокумент31 страницаJawaban Latihan SoalRizalMawardiОценок пока нет