Академический Документы

Профессиональный Документы

Культура Документы

Lalit Trades Investing Opportunities in Commodity Markets.

Загружено:

lalittradesОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Lalit Trades Investing Opportunities in Commodity Markets.

Загружено:

lalittradesАвторское право:

Доступные форматы

21st April 2013 Presented To Borivali (Central) CPE Study Circle Of WIRC of the Institute of Chartered Accountants of India

WHAT MAKES MONEY/ RICHES / WEALTH SO IMPORTANT IN OUR LIFE ?

` God wants us to prosper financially, to have plenty of money, to fulfill the destiny he has laid out for us.

` Money is a guarantee that we may have, what we want in the future. Though we need nothing at the moment it insures the possibility of satisfying a new desire when it arises ` Wealth is not a matter of intelligence. Its a matter of inspiration ` Money will make you more of what you already are. If youre not a nice person, moneys going to make you a despicable individual. If you are a good person, moneys going to make you a better person. ` If a person gets his attitude toward money straight, it will help straighten out almost every other area in his life. ` Money isnt everythingbut it ranks right up there with oxygen. ` The only thing that money gives you is the freedom of not worrying about money. ` Wealth is known to be a great comforter. ` Success is having to worry about every damn thing in the world, except money. ` You can be young without money, but you cannot be old without it. ` Money doesnt buy happiness, but it will solve any problem you can write a check for, and that covers a lot of problems.

MOST FAVORED MARKETS FOR WEALTH CREATION

WHY COMMODITY MARKETS ?

The markets for investments are not limited, but commodity markets are more stable because they are regulated with delivery mechanism the scope of price manipulation is very limited and controlled. The Commodity Markets follow a seasonal pattern, which also makes it a safe investment avenue. Commodity prices reflect realistic economic factors more precisely. The Commodity Markets also hold certain degree of certainty in a very uncertain market and the price moves do not divert from the fundamentals for a longer period as opposed to the other markets. Diversification into commodity market offers tremendous scope to become a separate asset class for investors, arbitrageurs and speculators. Commodity trading can be used to hedge against inflation, currency fluctuations and event risks. It gives the option to directly invest in the commodity rather than in commodity stocks which are also affected by other factors along with the commodity prices. Commodity markets are established as an asset class worldwide. In India commodity futures markets have been in origin since 1921 with the Cotton Exchange. In the 1940s and 1970s commodity markets did face some difficulties due to government regulations. In 1999 since the opening up of the government to remove all commodities from restrictive list and incorporation of proper regulations and guidelines the markets are now very controlled and stable.

To sum up, commodity markets if traded under proper guidance and discipline can reap enormous returns.

COMMODITY MARKETS ARE DIVIDED INTO 3 MAJOR MARKETS

Spot markets are basically the Mandis where the agriculture produce is bought in to a centralized locations by farmers and auctioned. Mostly used by farmers, traders and wholesalers. Forward markets / forward contracts are agreement to purchase or sell a specified amount of commodity on a fixed future date at a predetermined price. Physical delivery is compulsory. Futures markets / futures contracts are exchange traded agreements to buy or sell a given quantity of a commodity at a predetermined price and time. But unlike forward contracts, physical delivery is not necessary, instead it is offset on maturity date with reverse transaction.

THE USERS OF COMMODITY MARKETS

Commodity Futures Markets Have The Following Users:

Farmers Traders / Stockists Corporates / Exporters Arbitrageurs / Speculators

With all the participants mentioned above that are active today in the commodity markets, there is one class that is missing..

THE INVESTORS

The only reason why there are no investors in the commodity futures markets is because all the above classes mentioned above are only using this market to hedge their physical commodity against any wild price fluctuations, with exception to arbitrageurs or speculators who are merely interested in profiting from the price fluctuations.

THE COMMODITY INVESTORS WAY TO WEALTH

An investor makes a very calculative trade to earn returns on investments over a longer period of time. Commodity Futures Market serves as one of those investment markets. Commodity markets if approached with a long term view based on factors like, demand and supply, weather fluctuations & economic fluctuations can give the trend of that commodity and accordingly traded in futures markets with rolling positions over a period of time. Even though commodity futures trading profits are calculated as speculation income and not business income, the returns can be much more than the returns from any other markets. But the approach has to be very disciplined be that any market including commodity. (example of systematic approach to the commodity markets is explained in following slides) Creating wealth should not be limited to only few markets. Wealth flows in from where ever money flows. Commodity Futures allows create wealth without huge investment. It allows trade in big quantity with fraction of margin. All commodities can be traded in futures markets as opposed to equity markets where futures are restricted to few scrips.

SYSTEMATIC APPROACH CASE STUDY 1. COTTON FUNDAMENTALS

CASE STUDY 1. COTTON TRADING ANALYSIS

www.lalittrades.com

CASE STUDY 1. COTTON TRADING ANALYSIS The previous 2 slides give a very clear picture of the fundamentals and the price movement of cotton. A clear disconnect between supply and demand made the prices of cotton move from point 1. to point 2. on the chart. (Sudden drop of production in the year 2008 and 2009, consumption exceeded supply chart 1 & 2) With such clear fundamentals in place, a futures market allows to trade cotton in international and also in domestic exchange. Since cotton is also traded domestically the advantage is not missed. Had this trade been done in the spot market it would not be feasible for a investor, as the cost of maintaining the inventory do not prove to be very profitable in returns. (cotton is moisture absorbent hence cannot be stored over years) Futures market allows the investor to trade such big moves with margins ranging from 5%35%. (35% margins on extreme volatility) The futures market also pushes away the possibility of big loss as the contracts can be cancelled off immediately as opposed to spot market where the investor is burdened with physical delivery of the said commodity. Because a sudden fall in prices will make it difficult to dispose off the physical stock.

CASE STUDY 1. COTTON TRADING ANALYSIS Informed calculations for entry and exit point, result into a trade strategy that are protected by stop losses. This trade opportunity may rarely occur in equity markets, as the scrip of the company that is the purchaser of cotton, may not be available to short in the markets. The cotton trade on futures exchange does cover up the losses of the investor who is invested in such cotton company scrip. This becomes a hedge as well as an open trade strategy to profit as well as cut losses. A similar trade opportunity also arises from price point 2. to price point 3. where a short position can also result into profits, based on calculated trade strategy. (production of cotton exceeded in the years 2010 and 2011. The price rise encouraged the farmers to increase cotton production- chart 1 & 2) The shifts in fundamentals are caught precisely in commodities and the price moves cannot deviate from the fundamental for very long periods of time as opposed to equity index and equity scrips.

SYSTEMATIC APPROACH CASE STUDY 2. SUGAR FUNDAMENTALS

India Sugar cane and Sugar Production

SYSTEMATIC APPROACH CASE STUDY 2. SUGAR FUNDAMENTALS

www.lalittrades.com

2008-$147

CASE STUDY 2. SUGAR TRADING ANALYSIS

www.lalittrades.com

CASE STUDY 2. SUGAR TRADING ANALYSIS Brazil and India contribute more than 40% of sugarcane crop to the world supply. ( chart 3) World crude oil prices started a bull run in 2006-07 from $ 40 to $ 147 in 2008. (chart 8). This bull run resulted in boost in ethanol production by Brazil from sugarcane (chart 5), as ethanol became the blending substitute with gasoline to cut the fuel consumption at such high prices. This demand rise of ethanol put pressure on the prices of sugar from point 1. to point 2. , as more of sugarcane started being diverted to ethanol production by Brazil- the number 1 producer of sugarcane in the world (chart 5). The production of ethanol picked up since 2006 (chart 7) and so did exports from Brazil. World cane production further came under constraint in 2007-08 when the second largest producer of sugarcane India suffered drought condition and it continued till 2009-10. (chart 2 & 4)

This production shortfall further fuelled the price rise of sugar till 2008-09.

With the global meltdown in 2008-09 the prices of crude dropped to around $24, which resulted the sugar prices to also fall due to fear, as ethanol use could only be feasible with high crude oil prices. Price moved from point 2. to point 3.

CASE STUDY 2. SUGAR TRADING ANALYSIS

In 2009-10 and 2010-11 India sugarcane production levels were still not up to the previous levels, and the crude oil prices again rising from 2009 (Americas quantitative easing) to reach over $ 100 in 2010 further fuelled the price rise of sugar from point 3. to point 4. In 2011-12 with the Indian sugarcane production reaching comfortable level, Americas own crude oil production rising, Brazils reduced ethanol production eased the constraint on sugar prices which resulted in price move from point 4. to point 5. Right from 2006 till present sugar has given 5 opportunities to trade on both sides of the markets irrespective of the moves of the equity markets . The moves have been completely in rhythm with the tight fundamentals. Again with limited opportunities in the equity markets with regards to sugar scrips which follow the index direction more as opposed to the commodity fundamentals, commodity futures plays the role of hedge against falling sugar scrips investments and trade profits

SYSTEMATIC APPROACH CASE STUDY 3. CRUDE OIL FUNDAMENTALS

SYSTEMATIC APPROACH CASE STUDY 3. CRUDE OIL FUNDAMENTALS

CASE STUDY 3. CRUDE OIL TRADING ANALYSIS

www.lalittrades.com

CASE STUDY 3. CRUDE OIL TRADING ANALYSIS

As can be seen from the crude oil price chart, the market offered in total five opportunities for trading. The price move from point 1. - $ 18 to point 2. - $78 can be understood from the declining American crude oil output as shown in chart no. 3. At that point of time America was the worlds largest consumer of crude oil. With such big supply being wiped off, the pressure was absorbed (to some extent) by the Middle East countries to substitute the declining American supply as can be seen in chart no. 1. ( also to be noted the cut off of supply from Iraq during the American invasion in 2003) Even though the supply was increased by the other oil producing countries the demand too kept rising at a much faster pace as opposed to supply. Chart no. 2 clearly explains the boom in the demand bought in by America, Europe but mostly by the emerging economies of Russia, India and China where the GDP growth rates were more than 8% (chart 5). This further fuelled the prices of crude oil from point 2. to point 3. where crude oil prices reached a historic high of $147. Global shipping rates too showed a commendable rise since 2006 due to increase in the global shipping activities (chart 4).

CASE STUDY 3. CRUDE OIL TRADING ANALYSIS

It can also be observed that the Middle East too reached a tipping point in production and the first major decline started in 2006 right up 2008 (chart 3), which further tightened the global supply and fuel to the rising prices.

The price movement from point 3. - $147 to point 4. - $27 can be attributed to a mix of various fundamentals- 2008 the American crude oil supply started rising (chart 3)(supply increase), the financial meltdown hit America with collapse of Lehman Brothers (chart 6) (demand declining), 2009 Greece starts the meltdown of Euro with demand of bailout (chart 6) (demand declining), emerging economies Russia, India and China GDP growth slows down (chart 5) (demand declining), Iraq resumes its crude oil supply (supply increase) and America reaches its 2001 levels of crude oil production (chart 3) (supply increase).

Price rise from point 4. to point 5. can be attributed to the resumed growth of the American economy due to quantitative easing, which resulted in demand resuming in the markets. The emerging economies too, Russia, India and China (specially China) showed some improvement in their economies. The crude oil contracts are available on the Indian exchanges to trade and the money making opportunities were not limited to only 1 but extended to 5 on both sides of the trend.

SYSTEMATIC APPROACH CASE STUDY 4. SILVER FUNDAMENTALS

SYSTEMATIC APPROACH CASE STUDY 4. SILVER FUNDAMENTALS

CASE STUDY 4. SILVER TRADING ANALYSIS

www.lalittrades.com

CASE STUDY 4. SILVER TRADING ANALYSIS

Silver is derived from 3 main sources as explained in chart 8. Chart 1 shows clearly that the mine production has never been able to match the demand of silver. The demand for silver was always setoff by the sales from government stocks.

The price movement from $5 point 1. to $21 point 2. can clearly attributed to the rise of accumulation of silver by the Exchange Traded Funds as can be seen from chart 6.

The prices moved from $ 21 point 2. to $8 point 3. following the global meltdown started in 2008 and ended in the same year. In the year 2009 the prices started recovering from $ 8 point 3. to $ 49 point 4. . This recovery is attributed to the sudden rise of demand for silver as an investment avenue as the purchases of ETFs still continued at a much faster pace as seen in chart 6. The fall in inventory levels of silver in the Comex inventories added fuel to the fire (chart 4). But the fall in inventories were offset by the purchases of general public in silver coins and bars and ETFs. The industrial uses of silver hardly saw any commendable rise since 2002. It was only the rise of investment demand that contributed to the rise of silver prices.

CASE STUDY 4. SILVER TRADING ANALYSIS

The industrial demand rise is also attributed to the consumption of silver for use in solar panels used in solar energy extraction, the rise of use of smart appliances and white goods.

The price movement from $49 point 4. to point 5. $26 is supported by the fact that the global slowdown in the world economy drove down the demand for consumer goods. The fact that silver prices also were driven by euphorias and panics are also reflected in the price charts. Every fall in silver prices has only fuelled the demand growth on investment in form of coins, bars and ETFs.

Rumor had it that the prices of silver had been suppressed by the government since 1980 till 2005, for 25 years as an agreement between the US government and the Hunt Brothers who were barred from trading silver after their infamous cornering of silver markets and price manipulation in 1979. The price movements of silver provided 5 trading opportunities in the futures markets as opposed to physical. No doubt the physical silver too gave good returns but were more open to risk with the wild falls in prices too, which could have been hedged by silver futures on sell side.

AGAIN WHY COMMODITY FUTURES MARKET ?

` The case studies present in the previous slides show the clear advantage an Investor can gain by using the futures markets to trade and earn disciplined profits to create wealth. ` The market fundamentals along with the right trade strategy is the right tool in the hand of an investor to trade commodity futures. ` The examples provided in the slides give a clear picture to the price moves. A constant daily review of news and world events also help form the trade strategy for earning profits. It is not necessary that all the available moves can be traded. But the opportunity missed in one commodity also allows us to see the opportunity arising in some other commodity either on the buy side or sell side. ` All the price charts presented are of international commodities, but the presence of the same commodities in the domestic exchanges helped catch the similar trend moves and earn profit.

Lalit Khatri Investments Consultant Get Rich Get Wealthy Live BIG !!! +91 9967 60 6800 lalitkhatri@lalittrades.com

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Limitations and Decision of Capital BudgetingДокумент10 страницLimitations and Decision of Capital BudgetingAMAYA.K.P 18BCO406Оценок пока нет

- Format of Financial Statment As Per Revised Schedule III of Companies Act 2013Документ11 страницFormat of Financial Statment As Per Revised Schedule III of Companies Act 2013Mayank ParekhОценок пока нет

- VC Detailed LinkedinДокумент45 страницVC Detailed LinkedinMichael BuryОценок пока нет

- List of Licensees As at December 29 2021Документ13 страницList of Licensees As at December 29 2021Annette NgangaОценок пока нет

- Business-Finance-Final Exit-ExamДокумент5 страницBusiness-Finance-Final Exit-ExamEmarilyn Bayot75% (4)

- Business Essentials: Entrepreneurship, New Ventures, and Business OwnershipДокумент45 страницBusiness Essentials: Entrepreneurship, New Ventures, and Business OwnershipAhmad MqdadОценок пока нет

- LG (Electronics) ,: Total 102260Документ2 страницыLG (Electronics) ,: Total 102260Ben HiranОценок пока нет

- Capital Budgeting Return On Investment1Документ2 страницыCapital Budgeting Return On Investment1Ariadi TjokrodiningratОценок пока нет

- United States v. Joseph Silvestri, 409 F.3d 1311, 11th Cir. (2005)Документ38 страницUnited States v. Joseph Silvestri, 409 F.3d 1311, 11th Cir. (2005)Scribd Government DocsОценок пока нет

- Net Present Value Approach Method For Economic AssДокумент8 страницNet Present Value Approach Method For Economic AssgeletetolinaОценок пока нет

- 12 - Accounting For Managers ObjectivesДокумент3 страницы12 - Accounting For Managers Objectivessukumaran321Оценок пока нет

- Introuction To Uganda Securities ExchangeДокумент14 страницIntrouction To Uganda Securities Exchange5pzpz7tm2pОценок пока нет

- l1 Simple InterestДокумент4 страницыl1 Simple InterestDivina IbayОценок пока нет

- Unit 2 Capital BudgetingДокумент24 страницыUnit 2 Capital BudgetingShreya DikshitОценок пока нет

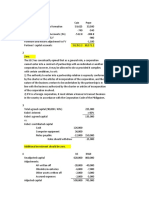

- Year 1 2 3 4 Sales Volume (Units/year) 350,000 380,000 400,000 400,000Документ13 страницYear 1 2 3 4 Sales Volume (Units/year) 350,000 380,000 400,000 400,000সৈকত হাবীবОценок пока нет

- Oa 3 Simple Options Strategies PDFДокумент38 страницOa 3 Simple Options Strategies PDFRoberto Passero100% (1)

- United International University: Assignment On Ratio Analysis & Dupont AnalysisДокумент8 страницUnited International University: Assignment On Ratio Analysis & Dupont AnalysisMostofa Reza PigeonОценок пока нет

- Icici Prudential AmcДокумент17 страницIcici Prudential AmcAnukriti AroraОценок пока нет

- Chapter - 4: Risk and Return: An Overview of Capital Market TheoryДокумент11 страницChapter - 4: Risk and Return: An Overview of Capital Market TheoryAkash saxenaОценок пока нет

- Deal of The Week - 6 Oct 2021Документ5 страницDeal of The Week - 6 Oct 2021jorgeОценок пока нет

- Assignment On Capital Market Prepared ForДокумент8 страницAssignment On Capital Market Prepared ForRazwana AishyОценок пока нет

- Part 3 - CAPM (IPM)Документ26 страницPart 3 - CAPM (IPM)Rakib HasanОценок пока нет

- Concept of Return and RiskДокумент6 страницConcept of Return and Risksakshigo100% (7)

- Credit Suisse Absolute Return GroupДокумент43 страницыCredit Suisse Absolute Return GroupgeorgethioОценок пока нет

- A Study of Portfolio Risk ManagementДокумент6 страницA Study of Portfolio Risk Managementharshal_salunkhe537Оценок пока нет

- Ratio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesДокумент3 страницыRatio Analysis Is The One of The Instruments Used For Measuring Financial Success of CompaniesSapcon ThePhoenixОценок пока нет

- Final PPT On Dow TheoryДокумент21 страницаFinal PPT On Dow Theorypari0000100% (2)

- CISA Reading ListДокумент4 страницыCISA Reading ListAnthonyОценок пока нет

- The Ultimate Guide To Trend FollowingДокумент35 страницThe Ultimate Guide To Trend Followingshreerajcody100% (1)

- Partnership Q3 SolutionДокумент2 страницыPartnership Q3 SolutionLorraine Mae RobridoОценок пока нет