Академический Документы

Профессиональный Документы

Культура Документы

Scotts Garments-Dilip Davda

Загружено:

Narendra JoshiИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Scotts Garments-Dilip Davda

Загружено:

Narendra JoshiАвторское право:

Доступные форматы

14

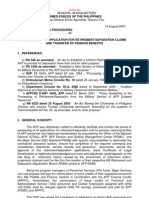

THE ECONOMICREVOLUTION

Date : 22.04-2013 to 28.04-2013

By Dilip Davda

IPO &Biz Brief:

Email: dilip_davda@rediffmail.com

Veteran stock market analyst contributing to print and electronic media since 1985 and visiting stock analyst on DD News - Mumbai.

SCOTTS GARMENTS LTD IPO OPENS ON 25.04.13

After the news of SEBI clearance for IPO of Just Dial, primary market operators were eagerly waiting for the official announcement and pricing details of the said IPO, but with a great Best Seller-Denmark, Old Navy, H & M -USA, C & A Buying Germany, Vila A/s- Denmark, Rhodi Suppliers UK etc. Its manufacturing capacity as on 31.03.12 was 217.08 lakh pieces per 450000 equity shares for its employees and has also made pre-IPO placement of 1739130 equity share at a price of Rs. 115 per share on 26.12.12. It issued bonus in the ratio of 12 for 1

ASKING HIGHER PRICE FOR IPO AGAINST PRE-IPO PLACEMENT PRICE IS NOT JUSTIFIED. ALTHOUGH GARMENT INDUSTRY IS POISED FOR BRIGHT PROSPECTS AHEAD AS PER RECENT BUDGET, CONSIDERING LISTING IN "T "GROUP FOR INITIAL PERIOD, IT IS BETTER TO BUY AT DISCOUNT POST LISTING.

SOME MAY CLAIM IT IS A WORTHY BET, BUT CONSIDERING THE PRE-IPO PLACEMENT PRICE, THE CURRENT IPO PRICE IS TOTALLY UNJUSTIFIED IN PRESENT SCENARIO OF SUBDUED SECONDRY MARKET, IT'S GRADING 3/ 5 ALSO INDICATES "AVERAGE" FUNDAMENTALS SO IT IS BETTER TO BUY AT DISCOUNT POST LISTING.

IT IS BETTER TO BUY AT DISCOUNT POST LISTING.

surprise to all, we have the announcement from Scotts Garments Ltd, that is taking the onus of bemonth and has windmill power generation capacities of 4.05 MW in southon 28.03.2006 and during 2007-2009 issued equity shares in different price bands ranging between Rs. 20 to Rs. 80 per share. Issue opens for subscription on 25.04.13 and will close on 29.04.13. Minimum application is to be made for 100 shares and in multiples thereof thereafter. Shares will be listed on BSE and NSE post allotments. BRLM to the issue are Keynote Corporate Services Ltd. and Canara Bank. Link Intime India is the registrar to the issue. CARE has assigned IPO Grade 3 to this IPO indicating at average fundamentals of the company. For the fiscals 20102011 and 2012 respectively the company reported total turnover of Rs. 434.36 crore, 503.75 crore and 566.13 crore (including other income of Rs. 4.19 crore, 8.47 crore and 65.88 crore) with a net profit of Rs. 27.84 crore, Rs. 34.93 crore and Rs. 84.03 crore. Thus fiscal 2012 witnessed quantum jumps with higher other income. For the first seven months ended 31.10.12 it has posted turnover of Rs. 335.33 crore with a net profit of Rs. 20.41 crore. If we attribute this earning on annualized basis on post IPO Companys equity of Rs. 38.98 crore then the asking price is at a P/E of around 14.5 and at a P/ BV of 1.4 plus considering its NAV of Rs. 90.98. Thus is appears to be aggressively priced against its peers that are trading at a P/E of 10 to 16. On BRLMs performance front, Keynote Corporate had mandate for 17 IPOs out of which 8 failed to give listing day gains. For Canara Bank this is perhaps first mandate after very long. Remarks: Asking higher price for IPO against pre-IPO placement price is not justified. Although garment industry is poised for bright prospects ahead as per recent budget, considering listing in T group for initial period, it is better to buy at discount post listing.

ing the first main line IPO for the fiscal 201314. Details of the Scotts Garment IPO are as under: Scotts Garments Ltd. (SGL) is a garment manufacturing company in India having state of the art facilities for manufacturing of high quality fashion garments mainly for global markets. Its facility is fully backed by product development, design studio, and efficient sampling infrastructure supported by facilities like embroidery, printing, dyeing and washing. Its list of international clients includes

ern region. For last three fiscals its exports contributed above 91% in the total turnover. The company is now planning to set up Trouser manufacturing unit at Doddabalapaur in Karnataka and Knitting and Fabric Processing unit at Kolhapur in Maharashtra. To part finance this along with raising general corpus fund and working capital, it is offering 10506954 equity share of Rs. 10 each via book building process and fixed a price band of Rs. 130-132 to mobilize around Rs. 136 crore. Company has reserved

WONDERLA HOLIDAYS FILES DRHP WITH SEBI

Wonderla Holidays Limited has filed a DRHP with SEBI for an initial public offering of 14,500,000 equity shares of face value of Rs. 10 each for cash at a price to be decided through a 100% book-building process. The Issue would constitute 25.66% of the fully diluted post Issue paid up equity share capital of the Company. The Equity Shares offered in the Issue are proposed to be listed on the BSE and NSE. The Book Running Lead Managers to the Issue are Edelweiss Financial Services Limited and ICICI Securities Limited. The Company currently owns and operates two amusement parks under the brand name Wonderla, situated at Kochi and Bangalore. It also owns and operates a resort beside the amusement park in Bangalore under the brand name Wonderla Resort. The Company is in the process of setting up their third amusement park in Hyderabad, and the Issue proceeds will primarily be utilized towards this purpose.

SUBSCRIBE TER, A MULTI ANALYST WEEKLY TO GET SATURDAY AND SUNDAY THE ECONOMIC REVOLUTION MIDNIGHT, ALL (3) WEEKLY PUBLICATIONS, SUBSCRIPTION IS ONLY RS. 1000 PER YEAR

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Ter Issue 28 Yr. 8 FrontДокумент1 страницаTer Issue 28 Yr. 8 FrontNarendra JoshiОценок пока нет

- Nirmal Metro Issue 99 Yr 1Документ4 страницыNirmal Metro Issue 99 Yr 1Narendra JoshiОценок пока нет

- Scotts Garments-Dilip DavdaДокумент1 страницаScotts Garments-Dilip DavdaNarendra JoshiОценок пока нет

- Ter English Issue 9 Yr 6 FEW PAGESДокумент9 страницTer English Issue 9 Yr 6 FEW PAGESNarendra JoshiОценок пока нет

- Ter Issue 28 Yr. 8Документ8 страницTer Issue 28 Yr. 8Narendra JoshiОценок пока нет

- Nirmal Metro Issue 99 Yr 1Документ4 страницыNirmal Metro Issue 99 Yr 1Narendra JoshiОценок пока нет

- Ter Issue 26 Yr. Front PageДокумент1 страницаTer Issue 26 Yr. Front PageNarendra JoshiОценок пока нет

- Economic 27Документ1 страницаEconomic 27Narendra JoshiОценок пока нет

- Ter Issue 28 Yr. 8Документ8 страницTer Issue 28 Yr. 8Narendra JoshiОценок пока нет

- Ter Issue 28 Yr. 8 FrontДокумент1 страницаTer Issue 28 Yr. 8 FrontNarendra JoshiОценок пока нет

- Ter English Issue 19 Yr 4.fewpagesДокумент9 страницTer English Issue 19 Yr 4.fewpagesNarendra JoshiОценок пока нет

- Ter Englih Issue 24 Yr 3 Some PagesДокумент9 страницTer Englih Issue 24 Yr 3 Some PagesNarendra JoshiОценок пока нет

- Charts 060309Документ1 страницаCharts 060309Narendra JoshiОценок пока нет

- Ter Issue 27 Yr. 8Документ8 страницTer Issue 27 Yr. 8Narendra JoshiОценок пока нет

- Ter Englih Issue 25 Yr 3. SOME PAGESДокумент8 страницTer Englih Issue 25 Yr 3. SOME PAGESNarendra JoshiОценок пока нет

- Ter English Issue 17 Yr 4 Few PagesДокумент11 страницTer English Issue 17 Yr 4 Few PagesNarendra JoshiОценок пока нет

- Ter Issue 25 Yr. 8Документ8 страницTer Issue 25 Yr. 8Narendra JoshiОценок пока нет

- Ter English Issue 14 Yr 4Документ18 страницTer English Issue 14 Yr 4Narendra JoshiОценок пока нет

- Ter Issue 25 Yr. 8 Front PageДокумент1 страницаTer Issue 25 Yr. 8 Front PageNarendra JoshiОценок пока нет

- Ter English Issue 16 Yr 4 Few PagesДокумент9 страницTer English Issue 16 Yr 4 Few PagesNarendra JoshiОценок пока нет

- Ter Englih Issue 25 Yr 3. SOME PAGESДокумент8 страницTer Englih Issue 25 Yr 3. SOME PAGESNarendra JoshiОценок пока нет

- Ter Englih Issue 23 Yr 3.Документ20 страницTer Englih Issue 23 Yr 3.Narendra JoshiОценок пока нет

- Ter Englih Issue 25 Yr 3Документ17 страницTer Englih Issue 25 Yr 3Narendra JoshiОценок пока нет

- Ter English Issue 16 Yr 4 Few PagesДокумент9 страницTer English Issue 16 Yr 4 Few PagesNarendra JoshiОценок пока нет

- The Economic RevolutionДокумент1 страницаThe Economic RevolutionNarendra JoshiОценок пока нет

- Ter Englih Issue 23 Yr 3 SOME PAGESДокумент10 страницTer Englih Issue 23 Yr 3 SOME PAGESNarendra JoshiОценок пока нет

- Ter Englih Issue 22 Yr Some PagesДокумент10 страницTer Englih Issue 22 Yr Some PagesNarendra JoshiОценок пока нет

- Ter Englih Issue 21 Yr 3 SOME PAGESДокумент10 страницTer Englih Issue 21 Yr 3 SOME PAGESNarendra JoshiОценок пока нет

- Ter Englih Issue 21 Yr 3.Документ19 страницTer Englih Issue 21 Yr 3.Narendra JoshiОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Ewellery Ndustry: Presentation OnДокумент26 страницEwellery Ndustry: Presentation Onharishgnr0% (1)

- Cinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Документ8 страницCinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Social Scientists' AssociationОценок пока нет

- Faida WTP - Control PhilosophyДокумент19 страницFaida WTP - Control PhilosophyDelshad DuhokiОценок пока нет

- Si KaДокумент12 страницSi KanasmineОценок пока нет

- SOP No. 6Документ22 страницыSOP No. 6Eli CohenОценок пока нет

- ARISE 2023: Bharati Vidyapeeth College of Engineering, Navi MumbaiДокумент5 страницARISE 2023: Bharati Vidyapeeth College of Engineering, Navi MumbaiGAURAV DANGARОценок пока нет

- ILRF Soccer Ball ReportДокумент40 страницILRF Soccer Ball ReportgabalauiОценок пока нет

- Well Stimulation TechniquesДокумент165 страницWell Stimulation TechniquesRafael MorenoОценок пока нет

- Marshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianДокумент3 страницыMarshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianValenVidelaОценок пока нет

- Business Occupancy ChecklistДокумент5 страницBusiness Occupancy ChecklistRozel Laigo ReyesОценок пока нет

- Coca-Cola Summer Intern ReportДокумент70 страницCoca-Cola Summer Intern ReportSourabh NagpalОценок пока нет

- I5386-Bulk SigmaДокумент1 страницаI5386-Bulk SigmaCleaver BrightОценок пока нет

- Tech Mahindra Sample Verbal Ability Placement Paper Level1Документ11 страницTech Mahindra Sample Verbal Ability Placement Paper Level1Madhav MaddyОценок пока нет

- A Perspective Study On Fly Ash-Lime-Gypsum Bricks and Hollow Blocks For Low Cost Housing DevelopmentДокумент7 страницA Perspective Study On Fly Ash-Lime-Gypsum Bricks and Hollow Blocks For Low Cost Housing DevelopmentNadiah AUlia SalihiОценок пока нет

- Statable 1Документ350 страницStatable 1Shelly SantiagoОценок пока нет

- 990-91356A ACRD300 CE-UL TechnicalSpecifications Part2Документ25 страниц990-91356A ACRD300 CE-UL TechnicalSpecifications Part2Marvin NerioОценок пока нет

- La Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlДокумент6 страницLa Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlMarlouis U. PlanasОценок пока нет

- Immovable Sale-Purchase (Land) ContractДокумент6 страницImmovable Sale-Purchase (Land) ContractMeta GoОценок пока нет

- Omae2008 57495Документ6 страницOmae2008 57495Vinicius Cantarino CurcinoОценок пока нет

- Two 2 Page Quality ManualДокумент2 страницыTwo 2 Page Quality Manualtony sОценок пока нет

- Payment Plan 3-C-3Документ2 страницыPayment Plan 3-C-3Zeeshan RasoolОценок пока нет

- Ground Vibration1Документ15 страницGround Vibration1MezamMohammedCherifОценок пока нет

- Sem 4 - Minor 2Документ6 страницSem 4 - Minor 2Shashank Mani TripathiОценок пока нет

- Hoja Tecnica Item 2 DRC-9-04X12-D-H-D UV BK LSZH - F904804Q6B PDFДокумент2 страницыHoja Tecnica Item 2 DRC-9-04X12-D-H-D UV BK LSZH - F904804Q6B PDFMarco Antonio Gutierrez PulchaОценок пока нет

- Singapore Electricity MarketДокумент25 страницSingapore Electricity MarketTonia GlennОценок пока нет

- WWW - Manaresults.co - In: Internet of ThingsДокумент3 страницыWWW - Manaresults.co - In: Internet of Thingsbabudurga700Оценок пока нет

- T R I P T I C K E T: CTRL No: Date: Vehicle/s EquipmentДокумент1 страницаT R I P T I C K E T: CTRL No: Date: Vehicle/s EquipmentJapCon HRОценок пока нет

- Common OPCRF Contents For 2021 2022 FINALE 2Документ21 страницаCommon OPCRF Contents For 2021 2022 FINALE 2JENNIFER FONTANILLA100% (30)

- Typical World Coordinates Are: Pos X-Axis Right Pos Y-Axis Back Pos Z-Axis UpДокумент2 страницыTypical World Coordinates Are: Pos X-Axis Right Pos Y-Axis Back Pos Z-Axis UpSabrinadeFeraОценок пока нет

- Annotated Portfolio - Wired EyeДокумент26 страницAnnotated Portfolio - Wired Eyeanu1905Оценок пока нет