Академический Документы

Профессиональный Документы

Культура Документы

Market Outlook Report 22 April 2013

Загружено:

zenergynzИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Market Outlook Report 22 April 2013

Загружено:

zenergynzАвторское право:

Доступные форматы

22 April 2013

Market Outlook Issue # 19

Oil market factors

Factors Affecting Crude Oil and Refined Product Markets Overall Trend: Over the last two weeks the market has weakened further as three international bodies United States Energy Information Administration (US EIA), Paris based International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC) have all published data where global oil demand growth has weakened due to the economic outlook for the United States and Europe. Supporting this is that commodities have had a broad sell off led by gold, due to disappointing Chinese economic data compounded by concerns about the global economy. We expect Brent crude to continue to trade in the US$95-105/bbl range absent of any major economic or political developments. Crude Oil F F Over the last two weeks Brent crude prices have fallen by approximately US$5/bbl to finish last week at US$98.74/bbl (decrease of US$5.22/bbl). Brent benchmark pushed lower due to weak oil fundamentals i.e. stronger North Sea output, increasing production out of Saudi Arabia, easing up of disruptions in Libya, and the restart of production in South Sudan after over a year of no output. According to the latest published statistics for April 2013, US crude stocks decreased by approximately one million barrels though still well above the upper limit of the average range for this time of year. The March-April refinery maintenance season continues in the United States, Europe and Asia, restricting the demand for crude. The Brent forward price curve has continued to be backwardated in the near term with June contracts trading US22c below May. Prices further out drop by around US$2/bbl by the fourth quarter. Products In the last two weeks US product stocks for Gasoline (petrol) have increased by one million barrels. In the last two weeks US product stocks for Gasoil (diesel) stocks have also increased by two million barrels. No change to the demand for high octane gasoline in Asia so the significant premium for 95/97 octane gasoline continues over the base grades.

Likely Impact on prices

F F

22 April 2013

Market Outlook Issue # 19

F The forward price curve for gasoline continues to be backwardated for the next few months, with near month refining margins remaining at US$8/bbl versus Dubai crude though is expected to weaken to US$6bbl by the fourth quarter. This drop is still attributed to plunging US gasoline prices and weakness in the European market. Kerosene (Jet) premiums continue to stay low as this reflects typical seasonal demand weakness after winter. Jet refining margins versus Dubai crude have weakened to US$15/bbl though it is expected to increase to US$18/bbl by the fourth quarter as oil demand gradually picks up from seasonal lows. Gasoil (diesel) demand is also weak in Asia as supply is ample and this is reflected in the refining margins versus Dubai crude which have fallen to US$15/bbl. However, it is expected to increase to US$18/bbl by the fourth quarter. F: Fundamentals (supply & demand) / M: Momentum (sentiment)

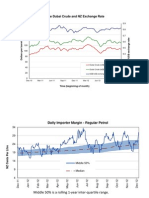

Figure 1: Brent Oil & Gas Oil month average and futures contracts

$145

$135

U S D

/

b b l

$125

$115

$105

$95

$85

Brent Oil (Mth Average) Gas Oil (Mth Average) Source: Bloomberg & Production.investis.com

Brent Oil Futures Gas Oil Futures

22 April 2013

Market Outlook Issue # 19

Macro-Economic indicators

Euro Zone finance ministers have backed a 10 billion Euro bailout for Cyprus. Ireland and Portugal are to be given an additonal seven years to repay aid. US GDP data is due to be released on Friday. Expections are growth of 3.1% for the first quarter of this year. Growth for the previous quarter was 0.4%. The Chinese economy grew by 7.7% during the first quarter of this year, this was lower than the previous quarter which grew at 7.9% and below the 8% expected by analysts.

Currency factors

The NZD/USD has been range bound over the last fortnight, between .8350-.8500, with one major spike outside the range to .8676. The market sentiment has moved to being positive for the NZD, due to increased quantitative easing by offshore central banks, and positive NZ economic data releases (e.g. Fourth quarter GDP growth, increased commodity prices and trade data). This has led to strong interest from offshore investors to buy NZ bonds and hold NZD investments. The two competing themes continued this month: Global economic growth momentum remains weak, which suggests NZD should struggle to move higher. Fundamental currency valuations suggest NZD should be weaker due to lower world growth outlooks from a weak US recovery, Australia reducing interest rates, parts of Europe in recession, and Chinese economic activity falling below market expectations. NZD strength based on investor perceptions around the holding of commodity currencies like the NZD, to participate in being linked to a higher growth Asia/Pacific region, currency diversification, higher relative interest rates and higher food commodity prices.

Foreign exchange factors

Factors Affecting NZD/USD Overall: The NZD has been slightly stronger but appears to be stuck in a range. The strong offshore investor interest will support the NZD on any dips to .8200, while sellers will emerge at .8550/.8650 again. The NZD appears overvalued on local economic conditions, but the risk is the NZD/USD will move higher based on global currency moves and offshore buying of NZD. Based on the external trade balance the structural fair value estimate is that the long term NZD/USD is lower. Fair value factors (interest rates, commodities & economic growth) suggest NZD/USD fair value is below current levels. NZ has higher interest rates relative to rest of world which creates demand for the NZD. Offshore investors are buying NZ Likely Impact

Fair value long term Fair value short term Interest Rates

22 April 2013

Market Outlook Issue # 19

bonds to diversify part of their investments into higher interest rate economies (such as NZ and Australia). The Reserve Bank (RBNZ) has changed their outlook by signalling that the OCR (Official Cash Rate) which is currently 2.5% can move in either direction based on: the level of the NZD dollar, economic effect of drought in NZ, and overseas economic developments. In contrast Australia is expected to reduce interest rates. NZ commodity prices have been stable with small price increases. In NZD terms, export commodity prices are 23% lower than the March 2011 highs. Relative high prices will continue to provide a boost to NZD sentiment due to being a food exporter. NZ drought conditions have pushed up milk prices, due to reduced supply volumes. The market continues to be focussed on three key areas of risk: Monetary Policy US economic data releases, to see if US economy is improving, European sovereign debt issues and banking system and Chinese economic data and flow on effect to commodity prices.

Commodities

Risk aversion

Technical Analysis

Stimulus packages from world Central Banks (in the form of Quantitative Easing) have increased. Japan joined USA and Europe in quantitative easing. Further stimulus from China, in the form of greater government spending will add further support for economic growth. This stimulus will provide short term support for investor sentiment and provide a boost to the NZD. NZD having failed to maintain .8650 high point means that it risks moving lower toward .8165. If the NZD moves lower through .8380 support, then it will decline toward the .8300 level, enroute to the low .8165. If NZD stays above .8380, then it is likely to range trade between .8380-.8550.

Glossary

Contango: is a condition where forward prices exceed spot prices, so the forward curve is upward sloping. Backwardation: is the opposite condition, where spot prices exceed forward prices, and the forward curve slopes downward. Arbitrage: the purchase of assets on one market for immediate resale on another market in order to profit from a price discrepancy. Disclaimer: This publication has been provided for general information only and we recommend you seek professional advice before acting on this information. The information presented has been obtained from original and published sources believed to be reliable, but its accuracy cannot be guaranteed and are subject to change without notice. Actual events may differ materially from those reflected in this document. This document has been prepared by Z Energy Ltd, 3 Queens Wharf, Wellington 6140, New Zealand. http://www.z.co.nz

Вам также может понравиться

- Market Outlook Report 18 March 2013Документ4 страницыMarket Outlook Report 18 March 2013zenergynzОценок пока нет

- Market Outlook Report 15 October 2012Документ4 страницыMarket Outlook Report 15 October 2012zenergynzОценок пока нет

- Market Outlook Report 20 August 2012Документ4 страницыMarket Outlook Report 20 August 2012zenergynzОценок пока нет

- Market Outlook Report 23 July 2012Документ4 страницыMarket Outlook Report 23 July 2012zenergynzОценок пока нет

- Market Outlook Report 17 September 2012Документ4 страницыMarket Outlook Report 17 September 2012zenergynzОценок пока нет

- Market Outlook Report 10 December 2012Документ4 страницыMarket Outlook Report 10 December 2012zenergynzОценок пока нет

- Market Outlook Report 12 November 2012Документ4 страницыMarket Outlook Report 12 November 2012zenergynzОценок пока нет

- Market Outlook Report 26 November 2012Документ4 страницыMarket Outlook Report 26 November 2012zenergynzОценок пока нет

- Energy Information Administration Latest Release: SourceДокумент6 страницEnergy Information Administration Latest Release: SourceSunil DarakОценок пока нет

- Sprott On Oil and Gold Where Do We Go From HereДокумент12 страницSprott On Oil and Gold Where Do We Go From HereCanadianValueОценок пока нет

- Weekly Investment Notes - 2015.10.09Документ20 страницWeekly Investment Notes - 2015.10.09jeet1970Оценок пока нет

- International Active Update: Fourth Quarter 2014Документ7 страницInternational Active Update: Fourth Quarter 2014CanadianValueОценок пока нет

- Weekly Market Commentary 3-5-2012Документ3 страницыWeekly Market Commentary 3-5-2012monarchadvisorygroupОценок пока нет

- Macroeconomic Factors Affecting USD INRДокумент16 страницMacroeconomic Factors Affecting USD INRtamanna210% (1)

- Daily CommentaryДокумент5 страницDaily Commentarysilviu_catrinaОценок пока нет

- MPC Statement November 20 FinalДокумент11 страницMPC Statement November 20 FinalMatthewLeCordeurОценок пока нет

- The Future of Commodity Markets in IndiaДокумент11 страницThe Future of Commodity Markets in Indiakumar vivekОценок пока нет

- Weekly Commodity Review - 7 - 11 May 2012Документ1 страницаWeekly Commodity Review - 7 - 11 May 2012gordjuОценок пока нет

- Beta Times Markets Edition11Документ4 страницыBeta Times Markets Edition11VALLIAPPAN.PОценок пока нет

- Viewpoint From Palladiem - January 2015: ValuationДокумент1 страницаViewpoint From Palladiem - January 2015: Valuationapi-275925231Оценок пока нет

- Q3 - 2015 Commentary: 5.1% and 10.3%, RespectivelyДокумент5 страницQ3 - 2015 Commentary: 5.1% and 10.3%, RespectivelyJohn MathiasОценок пока нет

- CommodityMonitor Monthly Aug2014Документ11 страницCommodityMonitor Monthly Aug2014krishnaОценок пока нет

- Chaanakya 5 - 10Документ22 страницыChaanakya 5 - 10Apoorv JhudeleyОценок пока нет

- Nedbank Se Rentekoers-Barometer November 2016Документ4 страницыNedbank Se Rentekoers-Barometer November 2016Netwerk24SakeОценок пока нет

- LINC Week 7Документ10 страницLINC Week 7TomasОценок пока нет

- RIG April 2013Документ40 страницRIG April 2013cuntingyouОценок пока нет

- Wisco Team: First QuarterДокумент4 страницыWisco Team: First QuarterGreg SchroederОценок пока нет

- Weekly Views From The Metro: HighlightsДокумент3 страницыWeekly Views From The Metro: HighlightsRobert RamirezОценок пока нет

- NAB Forecast (12 July 2011) : World Slows From Tsunami Disruptions and Tighter Policy.Документ18 страницNAB Forecast (12 July 2011) : World Slows From Tsunami Disruptions and Tighter Policy.International Business Times AUОценок пока нет

- Hadrian BriefДокумент11 страницHadrian Briefspace238Оценок пока нет

- Week 51: This Week's HeadlinesДокумент9 страницWeek 51: This Week's HeadlinesLINCОценок пока нет

- GX CB Global Power of Luxury WebДокумент52 страницыGX CB Global Power of Luxury WebFahad Al MuttairiОценок пока нет

- Commodities Letter December 2014Документ5 страницCommodities Letter December 2014Swedbank AB (publ)Оценок пока нет

- Buzz (Metal) Oct28 11Документ3 страницыBuzz (Metal) Oct28 11Mishra Anand PrakashОценок пока нет

- Weekly CommentaryДокумент4 страницыWeekly Commentaryapi-150779697Оценок пока нет

- Fundamentals Dec 2014Документ40 страницFundamentals Dec 2014Yew Toh TatОценок пока нет

- 2015.10 Q3 CMC Efficient Frontier NewsletterДокумент8 страниц2015.10 Q3 CMC Efficient Frontier NewsletterJohn MathiasОценок пока нет

- Speak of The Week Aug 10-2012Документ3 страницыSpeak of The Week Aug 10-2012Bonthala BadrОценок пока нет

- BlackRock 2014 OutlookДокумент8 страницBlackRock 2014 OutlookMartinec TomášОценок пока нет

- FICC Times 22 Mar 2013Документ6 страницFICC Times 22 Mar 2013r_squareОценок пока нет

- Weekly Sentiment Paper: Distributed By: One Financial Written By: Andrei WogenДокумент14 страницWeekly Sentiment Paper: Distributed By: One Financial Written By: Andrei WogenAndrei Alexander WogenОценок пока нет

- Urrency Forecast: $ Continued To Weaken Vs Other Major CurrenciesДокумент4 страницыUrrency Forecast: $ Continued To Weaken Vs Other Major CurrenciesprinceasatiОценок пока нет

- Weekly OverviewДокумент4 страницыWeekly Overviewapi-150779697Оценок пока нет

- Winter 2016Документ3 страницыWinter 2016Amin KhakianiОценок пока нет

- Energy Sector Outlook: What We Are Watching: MarketДокумент5 страницEnergy Sector Outlook: What We Are Watching: MarketdpbasicОценок пока нет

- PHP HRty 8 RДокумент5 страницPHP HRty 8 Rfred607Оценок пока нет

- OPEC - Monthly Oil Market ReportДокумент75 страницOPEC - Monthly Oil Market Reportrryan123123Оценок пока нет

- MOMR January 2015Документ100 страницMOMR January 2015Raza SamiОценок пока нет

- Forex Round Up 06.12.09Документ11 страницForex Round Up 06.12.09Neha DhuriОценок пока нет

- RBI Monetary Policy - 03-02-2015Документ8 страницRBI Monetary Policy - 03-02-2015Pritam ChangkakotiОценок пока нет

- Ranges (Up Till 11.30am HKT) : Currency CurrencyДокумент3 страницыRanges (Up Till 11.30am HKT) : Currency Currencyapi-290371470Оценок пока нет

- Is The Tide Rising?: Figure 1. World Trade Volumes, Industrial Production and Manufacturing PMIДокумент3 страницыIs The Tide Rising?: Figure 1. World Trade Volumes, Industrial Production and Manufacturing PMIjdsolorОценок пока нет

- Slide in Oil PricesДокумент7 страницSlide in Oil PricesRituparna SamantarayОценок пока нет

- Minutes January 2008Документ10 страницMinutes January 2008alina.w.siddiquiОценок пока нет

- Crude OilДокумент12 страницCrude OilRanjithОценок пока нет

- The Commodity Investor S 102885050Документ33 страницыThe Commodity Investor S 102885050Parin Chawda100% (1)

- Oil Market Outlook 022013Документ9 страницOil Market Outlook 022013Venkatakrishnan IyerОценок пока нет

- Commodities Overview: Consolidating With China's HelpДокумент22 страницыCommodities Overview: Consolidating With China's HelpAlberto DelsoОценок пока нет

- Weekly Average Dubai Crude and NZ Exchange Rate: Time (Beginning of Month)Документ8 страницWeekly Average Dubai Crude and NZ Exchange Rate: Time (Beginning of Month)zenergynzОценок пока нет

- Market Outlook Report 10 December 2012Документ4 страницыMarket Outlook Report 10 December 2012zenergynzОценок пока нет

- Market Outlook Report 26 November 2012Документ4 страницыMarket Outlook Report 26 November 2012zenergynzОценок пока нет

- Market Outlook Report 12 November 2012Документ4 страницыMarket Outlook Report 12 November 2012zenergynzОценок пока нет

- The Energy Drop - May 12Документ4 страницыThe Energy Drop - May 12zenergynzОценок пока нет

- Regal Haulage Help Us Trial Our New Truck Stop Cardreaders: Z.co - NZДокумент4 страницыRegal Haulage Help Us Trial Our New Truck Stop Cardreaders: Z.co - NZzenergynzОценок пока нет

- The Energy Drop - July 12Документ4 страницыThe Energy Drop - July 12zenergynzОценок пока нет

- The Energy Drop - June 12Документ4 страницыThe Energy Drop - June 12zenergynzОценок пока нет

- The Energy Drop - April 12Документ4 страницыThe Energy Drop - April 12zenergynzОценок пока нет

- The Energy Drop - February 12Документ4 страницыThe Energy Drop - February 12zenergynzОценок пока нет

- The Energy Drop - January 12Документ4 страницыThe Energy Drop - January 12zenergynzОценок пока нет

- Oil Price Monitoring Graphs (MED)Документ8 страницOil Price Monitoring Graphs (MED)zenergynzОценок пока нет

- Cigarettes and AlcoholДокумент1 страницаCigarettes and AlcoholHye Jin KimОценок пока нет

- Versana Premier Transducer GuideДокумент4 страницыVersana Premier Transducer GuideDigo OtávioОценок пока нет

- Institute of Metallurgy and Materials Engineering Faculty of Chemical and Materials Engineering University of The Punjab LahoreДокумент10 страницInstitute of Metallurgy and Materials Engineering Faculty of Chemical and Materials Engineering University of The Punjab LahoreMUmairQrОценок пока нет

- 2nd Quarter - Summative Test in TleДокумент2 страницы2nd Quarter - Summative Test in TleRachelle Ann Dizon100% (1)

- Alzheimer's Disease Inhalational Alzheimer's Disease An UnrecognizedДокумент10 страницAlzheimer's Disease Inhalational Alzheimer's Disease An UnrecognizednikoknezОценок пока нет

- Https - Threejs - Org - Examples - Webgl - Fire - HTMLДокумент9 страницHttps - Threejs - Org - Examples - Webgl - Fire - HTMLMara NdirОценок пока нет

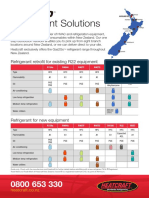

- Refrigerant Solutions: Refrigerant Retrofit For Existing R22 EquipmentДокумент2 страницыRefrigerant Solutions: Refrigerant Retrofit For Existing R22 EquipmentpriyoОценок пока нет

- Xu 2020Документ11 страницXu 2020Marco A. R. JimenesОценок пока нет

- Greyhound Free Patt.Документ14 страницGreyhound Free Patt.claire_garlandОценок пока нет

- Maharashtra Brochure (2023)Документ4 страницыMaharashtra Brochure (2023)assmexellenceОценок пока нет

- Surface & Subsurface Geotechnical InvestigationДокумент5 страницSurface & Subsurface Geotechnical InvestigationAshok Kumar SahaОценок пока нет

- Catalyst Worksheet - SHHSДокумент3 страницыCatalyst Worksheet - SHHSNerd 101Оценок пока нет

- Edrolo ch3Документ42 страницыEdrolo ch3YvonneОценок пока нет

- Moving Money Box: Pig (Assembly Instructions) : The Movements Work Better With Heavier CoinsДокумент6 страницMoving Money Box: Pig (Assembly Instructions) : The Movements Work Better With Heavier CoinsjuanОценок пока нет

- Welrod Silenced PistolДокумент2 страницыWelrod Silenced Pistolblowmeasshole1911Оценок пока нет

- NHouse SelfBuilder Brochure v2 Jan19 LowresДокумент56 страницNHouse SelfBuilder Brochure v2 Jan19 LowresAndrew Richard ThompsonОценок пока нет

- 240-Article Text-799-3-10-20190203Документ6 страниц240-Article Text-799-3-10-20190203EVANDRO FRANCO DA ROCHAОценок пока нет

- Servo Controlled FBW With Power Boost Control, Operations & Maint. ManualДокумент126 страницServo Controlled FBW With Power Boost Control, Operations & Maint. ManualKota NatarajanОценок пока нет

- HandbikeДокумент10 страницHandbikeLely JuniariОценок пока нет

- Computer From ScratchДокумент6 страницComputer From ScratchPaul NavedaОценок пока нет

- Photography Techniques (Intermediate)Документ43 страницыPhotography Techniques (Intermediate)Truc Nguyen100% (2)

- Chapter 1 Cumulative Review: Multiple ChoiceДокумент2 страницыChapter 1 Cumulative Review: Multiple ChoiceJ. LeeОценок пока нет

- 2011 33 MaintenanceДокумент16 страниц2011 33 MaintenanceKrishna Khandige100% (1)

- Unit-I: Digital Image Fundamentals & Image TransformsДокумент70 страницUnit-I: Digital Image Fundamentals & Image TransformsNuzhath FathimaОценок пока нет

- School: Grade Level: Teacher: Section Teaching Dates and Time: QuarterДокумент3 страницыSchool: Grade Level: Teacher: Section Teaching Dates and Time: QuarterZeny Aquino DomingoОценок пока нет

- Bio-Rad D-10 Dual ProgramДокумент15 страницBio-Rad D-10 Dual ProgramMeesam AliОценок пока нет

- Identifying - Explaining Brake System FunctionsДокумент39 страницIdentifying - Explaining Brake System FunctionsJestoni100% (1)

- Philips Family Lamp UV CДокумент4 страницыPhilips Family Lamp UV CmaterpcОценок пока нет

- Ddrive Transmission ReportДокумент43 страницыDdrive Transmission Reportelah150% (2)

- Static CMOS and Dynamic CircuitsДокумент19 страницStatic CMOS and Dynamic CircuitsAbhijna MaiyaОценок пока нет