Академический Документы

Профессиональный Документы

Культура Документы

Finergo Episode 17

Загружено:

finervaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Finergo Episode 17

Загружено:

finervaАвторское право:

Доступные форматы

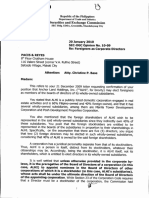

04 KALEIDOSCOPE ERGO Monday, March 23, 2009

Ask your query

I gave proof of my investments after my

company had already deducted the TDS. I

later realised that I paid more tax than I

need to. Have I lost the money?

Nizamdeen A, National Credits, Coimbatore

There is nothing to worry about. You can

get back the extra money from the Income

Tax department. All you need fill the in-

come tax return and claim the refund. You

will have to properly fill the Saral Form

(Form No 2D) and in the last row (Balance

Tax Payable/Refundable) fill in the amount

that needs to be refunded. Then file your

returns before the last date of filing and if

everything goes smoothly you should get a

cheque from the tax man within 3-4

months.

(Mail your personal finance queries to

finergo@goergo.in, with the subject line

‘Doctor’)

Quiz

1. ADR stands for

a) Anil Dhirubai Reliance

b) American Distribution Ratings

c) American Depository Receipt

d) Association For Democratic Reforms

2. ATM stands for A little planning can make your retirement a happy one

a) Automatic Teller Machine

b) Any Time Money

c) All Time Money

Sow and thou shall reap

d) Automated Teller Machine

Send your answers to finergo@goergo.in or

SMS your answers to 92813 98889. Example: If

you choose A as the answer to question 1 and

B as the answer to question 2, type 1A2B.

Winner will be chosen by lucky draw from all

correct answers and gets a free book on

Mutual Funds Participation of public and private (annuity)

In order to have a wide distribu-

Answers for last week’s quiz:

ETF- Exchange Traded Funds

body should make this new tion network the PFRDA has licensed

23 point of players, which includes

PFRD – Pension Fund Regulatory Devel-

opment Authority

pension scheme attractive banks, mutual funds and insurers.

Advantages

NPS offers flexibility to its mem-

SNEHA BAJAJ AND PRADEEP YUVARAJ bers. It allows members to access

their account from anywhere in the

News you can use

finergo@goergo.in

country, early withdrawals are al-

T

he New Pension Scheme, (NPS) individual retirement accounts. This lowed (but exit age remains 60, con-

which is to be launched on amount is invested in the member’s ditions apply).

IIFCL raises Rs 10K cr April 1, 2009 by the Pension accumulation phase. These fund op-

Fund Regulatory and Develop- tions would be renewed every three Disadvantages

India Infrastructure Finance Company ment Authority (PFRDA), will be years and new options might be add- The awareness level is low and it is

Limited (IIFCL) has managed to raise Rs. open to all citizens. NPS is being ed. The member after retirement can not yet a mandatory scheme. So,

10,000 crore by way of tax-free bonds at an awaited eagerly as there is this gen- withdraw a lump sum amount and what is the cost one needs to pay?

interest rate of 8.65 per cent on March 17 eral perception that any government the balance amount be invested in A joining fee of Rs. 350; registra-

way ahead of its March 31 deadline. run scheme is safe. Also, according annuities that would give the mem- tion fee of Rs. 40; transaction cost of

The funds will now be used to refinance to statistics the number of people ber regular income. Rs. 20 each time a new transaction is

banks for projects that were tendered after above the age of 60 is growing drasti- made and Rs. 9 as a fund manage-

January 2009. The company has already cally thus the need for more friendly How it works? ment fee to take care of Rs. 10 lakh.

sanctioned projects worth $3.8 billion since schemes. So, how does NPS come of The entire process of NPS involves Unfortunately, the number of

its inception in January 2006. It has help in your twilight years? three kinds of intermediaries: One members who will join this scheme

achieved financial closure in 75 of the 88 group of institutions to collect the is uncertain and the scheme will

projects sanctioned by it. What is NPS? contribution, another group to pro- work only if the members are large in

It is a defined contribution fessionally and profitably manage number.

scheme in which citizens are allowed the contributions and the final group So, let us wait for April to plan our

to make contributions in their own to ensure the distribution of amount retirement with the government! ■

Вам также может понравиться

- MetamorphosisДокумент6 страницMetamorphosisfinervaОценок пока нет

- Budgeting & Saving TamilДокумент31 страницаBudgeting & Saving TamilfinervaОценок пока нет

- Finergo Episode 21 DT 27apr09Документ1 страницаFinergo Episode 21 DT 27apr09finervaОценок пока нет

- Metroplus A Share in The Pie2Документ3 страницыMetroplus A Share in The Pie2finervaОценок пока нет

- Hindu - Bharathi SchoolДокумент1 страницаHindu - Bharathi SchoolfinervaОценок пока нет

- Episode 19 03apr09Документ1 страницаEpisode 19 03apr09finervaОценок пока нет

- Ergo April 20Документ16 страницErgo April 20KarthikОценок пока нет

- Ifm Primer Part TwoДокумент8 страницIfm Primer Part TwofinervaОценок пока нет

- Episode 19 03apr09Документ1 страницаEpisode 19 03apr09finervaОценок пока нет

- Ifm Primer Part OneДокумент13 страницIfm Primer Part OnefinervaОценок пока нет

- Hindu Nwepaper VendorsДокумент1 страницаHindu Nwepaper VendorsfinervaОценок пока нет

- How Much Insurance SifyДокумент3 страницыHow Much Insurance SifyfinervaОценок пока нет

- Pradeep SSMДокумент1 страницаPradeep SSMfinervaОценок пока нет

- Businessline ExpansionДокумент1 страницаBusinessline ExpansionfinervaОценок пока нет

- Full Page Fax PrintДокумент2 страницыFull Page Fax PrintfinervaОценок пока нет

- Finergo Episode 14Документ1 страницаFinergo Episode 14finervaОценок пока нет

- Capital GainsДокумент4 страницыCapital GainsfinervaОценок пока нет

- Yahoo Finance Charge MachingДокумент4 страницыYahoo Finance Charge MachingfinervaОценок пока нет

- Finergo Episode 16Документ1 страницаFinergo Episode 16finervaОценок пока нет

- Pradeep SSMДокумент1 страницаPradeep SSMfinervaОценок пока нет

- JK Ram A Krishna HinduДокумент2 страницыJK Ram A Krishna HindufinervaОценок пока нет

- Tax Planning Business TodayДокумент3 страницыTax Planning Business TodayfinervaОценок пока нет

- JK RamakrishnaДокумент2 страницыJK RamakrishnafinervaОценок пока нет

- Finergo Episode 15Документ1 страницаFinergo Episode 15finervaОценок пока нет

- Debt Business TodayДокумент3 страницыDebt Business TodayfinervaОценок пока нет

- Finergo Episode 13Документ1 страницаFinergo Episode 13finervaОценок пока нет

- Finergo Episode 18Документ1 страницаFinergo Episode 18finervaОценок пока нет

- Finergo Episode 12Документ1 страницаFinergo Episode 12finervaОценок пока нет

- Finergo Episode 11Документ2 страницыFinergo Episode 11finervaОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Chapter 2+3-MCQДокумент2 страницыChapter 2+3-MCQNguyễn Việt LêОценок пока нет

- ASEAN Investment Report 2015Документ250 страницASEAN Investment Report 2015mhudzzОценок пока нет

- State Governments Incentives For InvestorsДокумент6 страницState Governments Incentives For InvestorsbalqueesОценок пока нет

- Cara Main BSGДокумент29 страницCara Main BSGArif PranandaОценок пока нет

- UncertaintyДокумент20 страницUncertaintySaji JimenoОценок пока нет

- TOEIC-style Error Recognition: 23130 Page 1 of 2Документ2 страницыTOEIC-style Error Recognition: 23130 Page 1 of 2Jessie Radaza TutorОценок пока нет

- Project Report On NestleДокумент54 страницыProject Report On Nestlesarhn69% (16)

- YGCC 2012 Casebook PreviewДокумент3 страницыYGCC 2012 Casebook Previewygccleadership50% (2)

- Bloomberg Markets Magazine The Worlds 100 Richest Hedge Funds February 2011Документ8 страницBloomberg Markets Magazine The Worlds 100 Richest Hedge Funds February 2011Wall Street WanderlustОценок пока нет

- CFI Financial Analyst ProgramДокумент26 страницCFI Financial Analyst ProgramJuan Carlos Fiallos Rodas50% (2)

- CPA Review: Accounting Theory ExamДокумент14 страницCPA Review: Accounting Theory Examralphalonzo100% (1)

- Assessment of Future Exchange Rate MovementsДокумент3 страницыAssessment of Future Exchange Rate MovementsNafiz Zaman100% (1)

- Bbmf2093 Corporate FinanceДокумент4 страницыBbmf2093 Corporate FinanceXUE WEI KONGОценок пока нет

- FLEXIBLE BUDGET VARIANCESДокумент55 страницFLEXIBLE BUDGET VARIANCESDrellyОценок пока нет

- Shapiro CapBgt IMДокумент76 страницShapiro CapBgt IMjhouvanОценок пока нет

- US Masters Property Fund OverviewДокумент4 страницыUS Masters Property Fund OverviewleithvanonselenОценок пока нет

- Introduction On Indian RailwaysДокумент64 страницыIntroduction On Indian Railwaysminalgosar63% (8)

- Project Report On IIFLДокумент67 страницProject Report On IIFLgaurav100% (1)

- Case Assignment 8 - Diamond Energy Resources PDFДокумент3 страницыCase Assignment 8 - Diamond Energy Resources PDFAudrey Ang100% (1)

- Thai Localized Manual 46CДокумент135 страницThai Localized Manual 46Cirresistiblerabbits100% (1)

- EY Portfolio Management in Oil and GasДокумент24 страницыEY Portfolio Management in Oil and GaswegrОценок пока нет

- Predicting Trends Intermkt AnalysisДокумент81 страницаPredicting Trends Intermkt AnalysisMike Brandt100% (3)

- Foreigners as Directors of Wholly-Owned SubsidiariesДокумент3 страницыForeigners as Directors of Wholly-Owned SubsidiariesJakko MalutaoОценок пока нет

- Glenview Capital Third Quarter 2009Документ12 страницGlenview Capital Third Quarter 2009balevinОценок пока нет

- PLAN KEYFACTS ORIGINAL Feb 2020 AMBITIOUSДокумент1 страницаPLAN KEYFACTS ORIGINAL Feb 2020 AMBITIOUSbobsmith26Оценок пока нет

- Time Value of Money (Module 2)Документ17 страницTime Value of Money (Module 2)Yuvaraj RaoОценок пока нет

- The Dividend PolicyДокумент10 страницThe Dividend PolicyTimothy Nshimbi100% (1)

- Maximizing Cash Flow Through Effective Cash Management StrategiesДокумент51 страницаMaximizing Cash Flow Through Effective Cash Management Strategiesatul_rockstarОценок пока нет

- Topic 3 Brand Equity - AmmДокумент62 страницыTopic 3 Brand Equity - AmmHarshesh Patel100% (1)

- Reinsurance Industry in IndiaДокумент18 страницReinsurance Industry in Indiapriyank2380804621100% (12)