Академический Документы

Профессиональный Документы

Культура Документы

Co Hourly Labor Rate Worksheet

Загружено:

Ailyn O. DungogОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Co Hourly Labor Rate Worksheet

Загружено:

Ailyn O. DungogАвторское право:

Доступные форматы

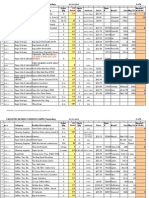

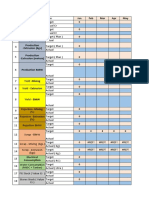

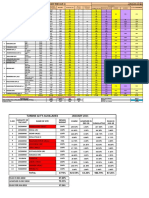

PROJECT NAME CONTRACTOR SUBCONTRACTOR

PROJECT NO. CONTRACT NO. DATE

(Reference 'Change Orders' in Contract General Conditions. Certified payrolls required for all workers on Project. Contractor shall enter data into all fields highlighted in yellow; for fields highlighted in blue, data will automatically populate.) TRADE: Item Rate Per $100 $

Benefit Paid Benefit Provided

HOURLY LABOR RATE WORKSHEET

CLASSIFICATION: Regular Time Prevailing Wage Rate Overtime 56.10 $ Double Time Notes

Base Labor Rate

37.40 $

74.80 Use certified payroll to verify.

Fringe Benefits: Pension 1 Health/Welfare 1 Training/Certification 1 Vacation/Holiday 1 Other Fringe Benefits Subtotal Total PW Hourly Rate Benefits Paid Total Paid Hourly Rate Burden: Taxes & Insurance 2 FICA Medicare Federal Unemployment California Unemployment Workers Compensation 1 Other 1 Other 1 Burden Subtotal Contractor Liability Insurance Small Tools Other (warranty, record drawings,

payment bonds, performance bonds, etc.)

(put X in appropriate box)

X X X X X $ $ $ $

5.65 10.40 0.70 0.41 17.16 $ 54.56 $ 11.10 $ 48.50 $

5.65 10.40 0.70 0.41 17.16 $ 73.26 $ 11.10 $ 67.20 $

5.65 10.40 0.70 0.41 17.16 91.96 = Base Labor Rate + Benefits Paid + Benefits

Provided

11.10 85.90 = Base Labor Rate + Benefits Paid

0.0620 0.0145 0.0080

3.01 0.70 0.39 $ N/A N/A N/A $ 58.66 $ 4.10 $ N/A N/A N/A

4.17 0.97 0.54 5.68 $ N/A N/A N/A 78.94 $

5.33 1.25 0.69 7.26

Included in OH&P per CGC Included in OH&P per CGC Included in OH&P per CGC Maximum - 0.062. Usually less than 11%; can request policy.

TOTAL HOURLY RATE (Total Hourly Rate + Burden)

99.22 = Amount Contractor paid to employee

Note: For change order work, mark-ups for overhead and profit shall be applied to the above rates (these rates are subject to audit) in accordance with the provisions of CGCs, under 'Change Orders'. Mark-up rates for utility repair work shall be adjusted in accordance with the CGCs, under 'Contractor's Responsibility for the Work', subsection 'e-Utilities'.

1 2

Costs for Overtime and Double Time are same as for Regular Time. Taxes & Insurance apply to Total Paid Hourly Rate which includes Base Labor Rate plus benefits paid in cash.

By signing below, the submitter certifies and declares under penalty of perjury under the laws of the State of California that the foregoing is true and correct. Rates certified by:

(print name)

Company Name:

Signature:

Construction Mgmt. 703.33 - 04/12

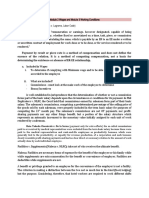

HOURLY LABOR RATE WORKSHEET INSTRUCTIONS

The following is intended to provide guidance and assistance in working with the Hourly Labor Rate Worksheet, Form 703.33. Contractor should enter data into all fields highlighted in yellow; once data is entered those fields highlighted in blue will automatically populate. These are the labor rates that should be used on all change order requests when labor hours are broken out. The rate sheet must be signed. Fringe Benefit Statement: In order to confirm an hourly labor rate worksheet, a signed Fringe Benefit Statement is required. If the fringe benefits are paid directly to the employee, that should be noted on the Fringe Benefit Statement and signed. Base Labor Rate This rate can be done a couple of ways: 1) It can be the base hourly rate, or 2) Occasionally, contractors will include vacation pay in this rate because it is a taxable benefit. The contractor only has to enter the regular time base rate, the form calculates Overtime (1.5) and Double time (2) automatically. Fringe Benefits The total of the Fringe Benefit column should match the total of the Fringe Benefits statement. Many times the benefits may be distributed differently among the various types, but Vacation and Pension almost always match. Usually, with a Union contractor, the vacation benefits are taxable, so the sheets are set up to add the vacation pay into the base rate to calculate the taxes in the burden area. The only difference in this is when the vacation is actually a deduction from their base rate. There will be nothing filled in the fringe benefit section. On the statement it will note that this is a deduction. 'Other' fringe benefits may include subsistence payments to the employee, or union required expenses, i.e. safety equipment. If the fringe benefits are paid directly to the employee, the entire hourly labor rate is taxable. In the worksheet, the burden is calculated based on the total hourly labor rate. Burden - Burden includes taxes and insurance. Taxes: Those cells in the column labeled % Rate that have a percentage filled in are mandated rates by the government. We just need to monitor changes. Contractors payroll departments should notify us when these percentages are incorrect. Workers Compensation Insurance: will vary widely from Contractor to Contractor. It can be as low as 5% and as high as 30 or 40%. It's an individual assessment made by insurance companies based upon several things, including the Contractors claim history. Contractor shall insert its Worker's Comp. rate in the adjacent '% Rate' column. Liability Insurance: A contractor pays liability premiums based on sales, and they are usually billed a rate per thousand dollars of sales. Contractor shall insert its liability rate in the adjacent '% Rate' column.

October 2010

HOURLY LABOR RATE WORKSHEET INSTRUCTIONS

Page 2

Example of liability premium: If a contractor does $60 million in sales per year, and his liability insurance premium is $5 for every $1,000 dollars of sales, his total liability insurance premium for the year would be $300,000. However, probably only 25-33% of the sales figures are labor costs. The Contractor then needs to divide the labor portion of the premium by the total labor hours for the year. The Contractor's premium is $300,000, and 33% of this is labor. Therefore, $100,000 is the labor portion of the premium. If the Contractor has 100 employees and the average number of work hours per employee per year is 2,000, then labor hours per year would be 200,000. The labor portion of the premium, $100,000, is then divided by the total labor hours per year, 200,000, resulting in a cost of $0.50 cents per hour. If the base and vacation pay is $34.00 per hour, the cost equals 1.47%. This is how liability premiums on the labor rate worksheet should be calculated. Typical liability on labor is less than 2% but can be as high as 5% on rare occasions. If the Contractor insists on more than 2%, he needs to produce their liability premium sheets as backup. These are the only items allowed to be factored into this rate. Pickup trucks, small tools, etc. are not allowed. Any other needs should be considered extraordinary and must be explained and documented completely. (Most campuses will never allow any other charges.) Campus should go through the certified payroll records and spot check the base rate. Most of the time the spot checking will show the rates to be okay, and sometimes even low. If the Contractor has employees that they pay over scale, the Contractor could actually submit an individual hourly rate worksheet for that employee. We allow them to bill for actual labor costs. Time and material change order requests must use these rates. The mistake contractors often make on these requests is billing journeyman rates for an apprentice. If campus has certified payrolls for that time period, campus can verify it. If campus doesn't have them, request that the contractor submit them for that time period. NOTE: The hourly labor rate worksheets may change over time as negotiated rates in union contracts change. There may be a change in either benefit costs, base rates or both. The work performed should be charged at the applicable rates for that time period.

October 2010

Вам также может понравиться

- RecrutareДокумент22 страницыRecrutareAndreea ChiurtuОценок пока нет

- Oursuite:Daily Activity Report/Time Record: Hourly RegularДокумент2 страницыOursuite:Daily Activity Report/Time Record: Hourly RegularSandipan BasuОценок пока нет

- Balance Sheet: JK Cement LTDДокумент3 страницыBalance Sheet: JK Cement LTDHimanshu SharmaОценок пока нет

- ANALYSISTABS Project Plan Excel Template 2003Документ11 страницANALYSISTABS Project Plan Excel Template 2003chagollaОценок пока нет

- Assignment-Week7Документ1 страницаAssignment-Week7Mirna D. OjedaОценок пока нет

- Trash Data Form: Here How It WorksДокумент3 страницыTrash Data Form: Here How It WorksMhel AliasОценок пока нет

- Cost Control ReportДокумент9 страницCost Control Reportsohail2006Оценок пока нет

- ScribedДокумент2 страницыScribedDavid PylypОценок пока нет

- Cost-Benefit Analysis TemplateДокумент4 страницыCost-Benefit Analysis TemplateGeorgios PalaiologosОценок пока нет

- Commercial Kitchen Equipment CalculatorДокумент16 страницCommercial Kitchen Equipment CalculatorMohammad pharabiaОценок пока нет

- Restaurant: Meal Period: Date: (A) (B) (C) (D) (E) (F) (G) (H) (I) (J)Документ1 страницаRestaurant: Meal Period: Date: (A) (B) (C) (D) (E) (F) (G) (H) (I) (J)Mohammad pharabiaОценок пока нет

- Financial FinalДокумент25 страницFinancial Finalapi-302542741Оценок пока нет

- Calculating Unit Rates IsДокумент12 страницCalculating Unit Rates Iskavi_prakash6992Оценок пока нет

- Sales Break-Even CalculationДокумент5 страницSales Break-Even CalculationTaranum RandhawaОценок пока нет

- Start End: Example Project Plan TemplateДокумент6 страницStart End: Example Project Plan TemplateSabyasachi DasguptaОценок пока нет

- Budget PlannerДокумент7 страницBudget Plannerkisan singhОценок пока нет

- Pay Slip TemplateДокумент1 страницаPay Slip TemplateJohn Rheymar TamayoОценок пока нет

- Detail Unit Price Analysis 1Документ4 страницыDetail Unit Price Analysis 1Miks BideoОценок пока нет

- PHD Project Budget Process - Coursematerial - Sept2021Документ25 страницPHD Project Budget Process - Coursematerial - Sept2021Savas BOYRAZОценок пока нет

- PCR# Project: MDC CatarmanДокумент54 страницыPCR# Project: MDC CatarmanA.J. ArellanoОценок пока нет

- Inventory+7 31 13Документ4 страницыInventory+7 31 13agrawaln3Оценок пока нет

- Personal WeeklyДокумент8 страницPersonal WeeklyIwa SugriwaОценок пока нет

- Time Sheet For Daily Work at MCS-TB1 2016Документ5 страницTime Sheet For Daily Work at MCS-TB1 2016Roland NicolasОценок пока нет

- FB Form Report CashierДокумент1 страницаFB Form Report CashierQuy TranxuanОценок пока нет

- Cost AnalysisДокумент3 страницыCost AnalysisRegenia D. ChapmanОценок пока нет

- Unit RatesДокумент238 страницUnit RatesJoe NjoreОценок пока нет

- Tender For Medical Cover and Group Life Cover Cra - Tender No. Cra - 002 - 2013 - 2014Документ0 страницTender For Medical Cover and Group Life Cover Cra - Tender No. Cra - 002 - 2013 - 2014CRA-KenyaОценок пока нет

- Budgeting and Cost ControlДокумент15 страницBudgeting and Cost ControlMazhar BasaОценок пока нет

- Project Management Quick Reference GuideДокумент5 страницProject Management Quick Reference GuidejcpolicarpiОценок пока нет

- Action PlanДокумент1 страницаAction PlanMustafa MoatamedОценок пока нет

- Budget 2021Документ5 страницBudget 2021Jobeth DaculaОценок пока нет

- Annex III. Budget For The Action Total Project Budget Project Budget Per Year 1Документ30 страницAnnex III. Budget For The Action Total Project Budget Project Budget Per Year 1juneluОценок пока нет

- Hotel Project DocumentationДокумент59 страницHotel Project DocumentationAmol KambleОценок пока нет

- Commercial Kitchen Equipment CalculatorДокумент16 страницCommercial Kitchen Equipment CalculatorDesigner ForeverОценок пока нет

- ProjectManager Budget Template NDДокумент6 страницProjectManager Budget Template NDLivingWellness RoadОценок пока нет

- Excel Cost of Services Spreadsheet-April 2011 - Rev 2 - (For Guidence Only)Документ1 страницаExcel Cost of Services Spreadsheet-April 2011 - Rev 2 - (For Guidence Only)AlejandroGonzagaОценок пока нет

- Draw The Plan and Elevation of The Given Drawing and Take The Print OutДокумент4 страницыDraw The Plan and Elevation of The Given Drawing and Take The Print Outvennila-puviОценок пока нет

- Budget Vs Actual Spreadsheet TemplateДокумент6 страницBudget Vs Actual Spreadsheet TemplateGolamMostafaОценок пока нет

- P&L AccountДокумент13 страницP&L AccountRajneesh SehgalОценок пока нет

- Lecture 7 - Project ControlДокумент35 страницLecture 7 - Project ControlJoseph KariukiОценок пока нет

- Alberta Innovates Work Plan and Budget Workbook - V2 102020Документ10 страницAlberta Innovates Work Plan and Budget Workbook - V2 102020Tayo ShonibareОценок пока нет

- OE Inventory-Quarterly Report FormatДокумент46 страницOE Inventory-Quarterly Report FormatMohd Shafiq Husin TutorОценок пока нет

- This Supply Is Composed of Two PartsДокумент92 страницыThis Supply Is Composed of Two PartsShyammurugesanОценок пока нет

- Mamma's Pizza Menu - Nutrition InformationДокумент3 страницыMamma's Pizza Menu - Nutrition InformationdanmppОценок пока нет

- IndexДокумент107 страницIndexAina RazafimandimbyОценок пока нет

- Daily Mis Aug 18 SN Indicator Date Jan Feb Mar Apr MayДокумент18 страницDaily Mis Aug 18 SN Indicator Date Jan Feb Mar Apr MayMarket NewsОценок пока нет

- Progress Report of Jan 2011Документ2 страницыProgress Report of Jan 2011Rajesh Peddiboyena100% (1)

- Duct & Insulation Calculation SheetДокумент2 страницыDuct & Insulation Calculation SheetAkshay KadiaОценок пока нет

- Technical Director Job DescriptionДокумент3 страницыTechnical Director Job DescriptiondboeversОценок пока нет

- Planificator COДокумент4 страницыPlanificator COALINA NUTAОценок пока нет

- Excel Drill Exercise 1 MDLДокумент16 страницExcel Drill Exercise 1 MDLEugine AmadoОценок пока нет

- Record Keeping ChecklistДокумент1 страницаRecord Keeping ChecklistalexandriasbdcОценок пока нет

- 002 - Application Form ARYADUTTAДокумент5 страниц002 - Application Form ARYADUTTAAchmad radiusОценок пока нет

- Menu Engineering Worksheet Restoran: Westaurant: Periode: JANUARI - DESEMBER 2016Документ10 страницMenu Engineering Worksheet Restoran: Westaurant: Periode: JANUARI - DESEMBER 2016Gilbert SilitongaОценок пока нет

- Timesheet: Date Task Description Start End # of Time Time Reg. Hrs References: CepartsrewardsДокумент5 страницTimesheet: Date Task Description Start End # of Time Time Reg. Hrs References: CepartsrewardssufiansgdОценок пока нет

- Co Hourly Labor Rate WorksheetДокумент3 страницыCo Hourly Labor Rate WorksheetpchakkrapaniОценок пока нет

- Boie-Takeda Chemicals v. de La Serna (Payment Only For Extra Efforts) The So-Called CommissionsДокумент19 страницBoie-Takeda Chemicals v. de La Serna (Payment Only For Extra Efforts) The So-Called CommissionsVedia Genon IIОценок пока нет

- Cost Accounting2Документ12 страницCost Accounting2stephborinaga0% (2)

- Asian Development Bank QBS-TA-APP3 Prep of Financial ProposalДокумент20 страницAsian Development Bank QBS-TA-APP3 Prep of Financial Proposalrodval77Оценок пока нет

- Personal Income Tax Pike Fall2003 1Документ37 страницPersonal Income Tax Pike Fall2003 1Simon BurnettОценок пока нет

- List of V.OsДокумент43 страницыList of V.OsAilyn O. DungogОценок пока нет

- Site Daily ReportAprilДокумент111 страницSite Daily ReportAprilAilyn O. DungogОценок пока нет

- Unicorp Sendirian Berhad: Product Quotation InquiryДокумент8 страницUnicorp Sendirian Berhad: Product Quotation InquiryAilyn O. DungogОценок пока нет

- Enkadrain, ED-02-GB-A-07-2008Документ12 страницEnkadrain, ED-02-GB-A-07-2008Ailyn O. DungogОценок пока нет

- Project Pictures As of January 26Документ1 страницаProject Pictures As of January 26Ailyn O. DungogОценок пока нет

- Department of Technical ServicesДокумент1 страницаDepartment of Technical ServicesAilyn O. DungogОценок пока нет

- Binawan & UnicorpДокумент14 страницBinawan & UnicorpAilyn O. DungogОценок пока нет

- Public Works Department, Ministry of Development, Old Airport Road, Berakas BS3510, Negara Brunei DarussalamДокумент1 страницаPublic Works Department, Ministry of Development, Old Airport Road, Berakas BS3510, Negara Brunei DarussalamAilyn O. DungogОценок пока нет

- Progress Claim Submission 6Документ1 страницаProgress Claim Submission 6Ailyn O. DungogОценок пока нет

- Department of Technical ServicesДокумент1 страницаDepartment of Technical ServicesAilyn O. DungogОценок пока нет

- @accredited SubconДокумент15 страниц@accredited SubconAilyn O. DungogОценок пока нет

- Site Progress MeetingДокумент1 страницаSite Progress MeetingAilyn O. DungogОценок пока нет

- Sa Construction Daily DiaryДокумент6 страницSa Construction Daily DiaryAilyn O. DungogОценок пока нет

- CM Correction NoticeДокумент1 страницаCM Correction NoticeAilyn O. DungogОценок пока нет

- Co Contractor Cor SummaryДокумент1 страницаCo Contractor Cor SummaryAilyn O. DungogОценок пока нет

- Field Instruction No.: P P N - C C N - A DДокумент2 страницыField Instruction No.: P P N - C C N - A DAilyn O. DungogОценок пока нет

- Sa Weekly Activity ReportДокумент1 страницаSa Weekly Activity ReportAilyn O. DungogОценок пока нет

- CM Contractors Payment RequestДокумент2 страницыCM Contractors Payment RequestAilyn O. DungogОценок пока нет

- Examples of Consonant BlendsДокумент5 страницExamples of Consonant BlendsNim Abd MОценок пока нет

- MOOT 1 (Principal Sir)Документ3 страницыMOOT 1 (Principal Sir)vaibhav jainОценок пока нет

- SPE-171076-MS The Role of Asphaltenes in Emulsion Formation For Steam Assisted Gravity Drainage (SAGD) and Expanding Solvent - SAGD (ES-SAGD)Документ14 страницSPE-171076-MS The Role of Asphaltenes in Emulsion Formation For Steam Assisted Gravity Drainage (SAGD) and Expanding Solvent - SAGD (ES-SAGD)Daniel FelipeОценок пока нет

- Contemporary ArtsДокумент16 страницContemporary Artsantoinette100% (2)

- State Magazine, May 2001Документ38 страницState Magazine, May 2001State MagazineОценок пока нет

- Mock MeetingДокумент2 страницыMock MeetingZain ZulfiqarОценок пока нет

- Admission Prospectus2022 1 PDFДокумент10 страницAdmission Prospectus2022 1 PDFstudymba2024Оценок пока нет

- A Guide To Energy Efficiency ComplianceДокумент16 страницA Guide To Energy Efficiency ComplianceOARIASCOОценок пока нет

- 16.3 - Precipitation and The Solubility Product - Chemistry LibreTextsДокумент14 страниц16.3 - Precipitation and The Solubility Product - Chemistry LibreTextsThereОценок пока нет

- Debit Note and Credit NoteДокумент2 страницыDebit Note and Credit Noteabdul haseebОценок пока нет

- Confirmation 2Документ11 страницConfirmation 2حمزة دراغمةОценок пока нет

- Proposal Mini Project SBL LatestДокумент19 страницProposal Mini Project SBL Latestapi-310034018Оценок пока нет

- Eimco Elecon Initiating Coverage 04072016Документ19 страницEimco Elecon Initiating Coverage 04072016greyistariОценок пока нет

- SAP HR and Payroll Wage TypesДокумент3 страницыSAP HR and Payroll Wage TypesBharathk Kld0% (1)

- Macroeconomics Measurement: Part 2: Measurement of National IncomeДокумент13 страницMacroeconomics Measurement: Part 2: Measurement of National IncomeManish NepaliОценок пока нет

- Flexure Hinge Mechanisms Modeled by Nonlinear Euler-Bernoulli-BeamsДокумент2 страницыFlexure Hinge Mechanisms Modeled by Nonlinear Euler-Bernoulli-BeamsMobile SunОценок пока нет

- Research InstrumentsДокумент28 страницResearch InstrumentsAnjeneatte Amarille AlforqueОценок пока нет

- Welcome Speech For Seminar in College 2Документ4 страницыWelcome Speech For Seminar in College 2Niño Jay C. GastonesОценок пока нет

- PESTEL AnalysisДокумент2 страницыPESTEL AnalysisSayantan NandyОценок пока нет

- Alburg-Caldwell Manor 1784-1826 Draft by Fay YoungДокумент3 страницыAlburg-Caldwell Manor 1784-1826 Draft by Fay YoungNancy Cunningham100% (1)

- FeCl3 Msds - VISCOSITYДокумент9 страницFeCl3 Msds - VISCOSITYramkesh rathaurОценок пока нет

- Effect of Different Laser Texture Configurations On Improving Surface Wettability and Wear Characteristics of Ti6Al4V Implant MaterialДокумент14 страницEffect of Different Laser Texture Configurations On Improving Surface Wettability and Wear Characteristics of Ti6Al4V Implant Materialnitish kumar100% (1)

- Airline and Airport Master - OdsДокумент333 страницыAirline and Airport Master - OdsGiri KumarОценок пока нет

- Congenital Abnormalities of The Female Reproductive TractДокумент14 страницCongenital Abnormalities of The Female Reproductive TractMary SheshiraОценок пока нет

- 9.LearnEnglish Writing A2 Instructions For A Colleague PDFДокумент5 страниц9.LearnEnglish Writing A2 Instructions For A Colleague PDFوديع القباطيОценок пока нет

- Medicinal Chemistry/ CHEM 458/658 Chapter 8-Receptors and MessengersДокумент41 страницаMedicinal Chemistry/ CHEM 458/658 Chapter 8-Receptors and MessengersMehak SarfrazОценок пока нет

- 3.6.4 Details of Courses For Nuclear Medicine TechnologyДокумент2 страницы3.6.4 Details of Courses For Nuclear Medicine TechnologyhemendrasingОценок пока нет

- BEGONTES, MESSY PORTFOLIO BATCH 2023 Episode 1-7Документ34 страницыBEGONTES, MESSY PORTFOLIO BATCH 2023 Episode 1-7Messy S. BegontesОценок пока нет

- Exercises: Use The Correct Form of Verbs in BracketsДокумент3 страницыExercises: Use The Correct Form of Verbs in BracketsThủy NguyễnОценок пока нет

- Fluid Mechanics and Machinery Laboratory Manual: by Dr. N. Kumara SwamyДокумент4 страницыFluid Mechanics and Machinery Laboratory Manual: by Dr. N. Kumara SwamyMD Mahmudul Hasan Masud100% (1)