Академический Документы

Профессиональный Документы

Культура Документы

Cost and Asset Accounting

Загружено:

Mangesh UgrankarИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cost and Asset Accounting

Загружено:

Mangesh UgrankarАвторское право:

Доступные форматы

COST AND ASSET ACCOUNTING (chapter no 5) Q.

1 Outline the principle of accounting, balance sheet and profit & loss account (S-08) (10 Marks) Principles of accounting: The diagram in Fig. shows the standard accounting procedure, starting with the recording of the original business transactions and the final preparation of balance sheets and income statements. As the business transactions occur, they are recorded in the journal. A single journal may be used for all entries in small businesses, but large concerns use several types of journals, such as cash, sales, purchase, and general journals. The next step is to assemble the journal entries under appropriate account headings in the ledger. The process of transferring the daily journal entries to ledger is called posting. Statements showing the financial condition of the business concern are prepared periodically from the ledger accounts. These statements are presented in the form of balance sheets and income statements. The balance sheet shows the financial condition of the business at a particular time, while the income statement is a record of the financial gain or loss of the organization over a given period of time.

Balance sheet: A balance sheet for an industrial concern is based on Equation Assets = equities OR Assets = liabilities + proprietorship & shows the financial condition at any given date. The amount of detail included varies depending on the purpose. Consolidated balance sheets based on the last day of the fiscal year are included in the annual report of a corporation. These reports are intended for distribution to stockholders, and the balance sheets present the pertinent information without listing each individual asset and equity in detail. Assets are commonly divided into the classifications of current, fixed, and miscellaneous. Current assets, in principle, represent capital which can readily be converted into cash. Examples would be accounts receivable, inventories, cash, and marketable securities. These are liquid assets. On the other hand, fixed assets, such as land, buildings, and equipment, cannot be converted into immediate cash. Deferred charges, other investments, notes and accounts due after 1 year, and similar items are ordinarily listed as miscellaneous assets under separate headings. Modern balance sheets often use the general term liabilities in place of equities. Current liabilities are grouped together and include all liabilities such as accounts payable, debts, and tax accruals due within 12 months of the balance sheet date. The net working capital of a company can be obtained directly from the balance sheet as the difference between current assets and current liabilities. Other liabilities, such as long-term debts, deferred credits, and reserves are listed under separate headings. Proprietorship, stockholders equity, or capital stock and surplus complete the record on the equity (or liability) side of the balance sheet. Consolidated balance sheets are ordinarily presented with assets listed on the left and liabilities, including proprietorship, listed on the right. As indicated in Eq. the total value of the assets must equal the total value of the equities. The value of property items, such as land, buildings, and equipment, is usually reported as the value of the asset at the time of purchase. Depreciation reserves are also indicated, and the difference between the original property cost and the depreciation reserve represents the book value of the property. Thus, in depreciation accounting, separate records showing accumulation in the depreciation reserve must be maintained. In the customary account, reserve for depreciation is not actually a separate fund but is merely a bookkeeping method for recording the decline in property value. The ratio of total current assets to total current liabilities is called the current ratio. The ratio of immediately available cash (i.e., cash plus Government and other marketable securities) to total current liabilities is known as the cash ratio. The current and cash ratios are valuable for determining the ability to meet the financial obligations, and these ratios are examined by banks or other loan concerns before credit is extended.

The income statement: (Profit and loss account) A balance sheet applies only at one specific time, and any additional transactions cause it to become obsolete. Most of the changes that occur in the balance sheet are due to revenue received from the sale of goods or services and costs incurred in the production and sale of the goods or services. Income-sheet accounts of all income and expense items, such as sales, purchases, depreciation, wages, salaries, taxes, and insurance, are maintained, and these accounts are summarized periodically in income statements. A consolidated income statement is based on a given time period. It indicates surplus capital and shows the relationship among total income, costs, and profits over the time interval. The transactions presented in income-sheet accounts and income statements, therefore, are of particular interest to the engineer, since they represent the facts which were originally predicted through cost and profit analyses. The terms gross income or gross revenue used by accountants refers to the total amount of capital received as a result of the sale of goods or service. Net income or net revenue is the total profit remaining after deducting all costs, including taxes. Cost accounting methods: In the simplest form, cost accounting is the determination and analysis of the cost of producing a product or rendering a service. This is exactly what the designer engineer does when estimating costs for a particular plant or process, and cost estimation is one type of cost accounting. Accountants in industrial plants maintain records on actual expenditures for labor, materials, power, etc., and the maintenance and interpretation of these records is known as actual or postmortem cost accounting. From these data, it is possible to make accurate predictions of the future cost of the particular plant or process. These predictions are very valuable for determining future capital requirements and income, and represent an important type of cost accounting known as standard cost accounting. Deviations of standard costs from actual costs are designated as variances. There are many different types of systems used for reporting costs, but all the systems employ some method for classifying the various expenses. The total cost is divided into the basic groups of manufacturing costs and general expenses. These are further subdivided, with administrative distribution, selling, financing, and research and development costs included under general expenses. Manufacturing costs include direct production costs, fixed charges, and plant overhead. Each of the subdivided groups can be classified further. For example, direct production costs can be broken down into costs for raw materials, labor, supervision, maintenance, supplies, power, utilities, and laboratory Charges and royalties. Each business corporation has its own method for distributing the costs on its accounts. In any case, all costs are entered in the appropriate journal account, posted in the ledger, and ultimately reported in a final cost sheet or cost statement. 1) Accumulation, Inventory, and Cost-of-Sales Accounts In general, basic cost-accounting methods require posting of all costs in so-called accumulation accounts. There may be a series of such accounts to handle the various costs for each product. At the end of a given period, such as one month, the accumulated costs are transferred to inventory accounts, which give a summary of all expenditures during the particular time interval. The amounts of all materials produced or consumed are also shown in the inventory accounts. The information in the inventory account is combined with data on the amount of product sales and transferred to the costof-sales account. The cost-of-sales

Accounts give the information necessary for determining the profit or loss for each product sold during the given time interval When several products or by-products are produced by the same plant, allocation of the cost to each product must be made on some predetermined basis. Although the allocation of raw-material and direct labor costs can be determined directly, the exact distribution of overhead costs may become quite complex, and the final method depends on the policies of the particular concern involved. 2) Materials Costs The variation in costs due to price fluctuations can cause considerable difficulty in making the transfer from accumulation accounts to inventory and cost-of-sales accounts. In transferring the cost of chemical A to the inventory and cost-of-sales accounts, there is a question as to what price applies for chemical A. There are three basic methods for handling problems of this type. 1. The current-average method. The average price of the entire inventory on hand at the time of delivery or use is employed in this method. In the preceding 2. The first-in-first-out (or fifo) method. This method assumes the oldest material is always used first. 3. The last-in first-out (or lifo) method. With this method, the most recent prices are always used. Any of these methods can be used. The current-average method presents the best picture of the true cost during the given time interval, but it may be misleading if used for predicting future costs.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Stock Market I. What Are Stocks?Документ9 страницStock Market I. What Are Stocks?JehannahBaratОценок пока нет

- Ubisoft Swot AnalysisДокумент10 страницUbisoft Swot AnalysisAkash MandalОценок пока нет

- Industry Analysis of Two Wheeler MarketДокумент109 страницIndustry Analysis of Two Wheeler MarketGautam100% (1)

- Costing and PricingДокумент30 страницCosting and Pricingrose gabonОценок пока нет

- Porters Value ChainДокумент3 страницыPorters Value Chainkamal4sitmОценок пока нет

- ECO1104 Microeconomics NotesДокумент26 страницECO1104 Microeconomics NotesPriya Srinivasan100% (1)

- Unit 1 - Principles of MarketingДокумент29 страницUnit 1 - Principles of MarketingDuval Pearson100% (1)

- 17 - Pricing StrategiesДокумент2 страницы17 - Pricing StrategieszakavisionОценок пока нет

- Supply Chain Management: Facility LocationДокумент32 страницыSupply Chain Management: Facility LocationkoolyarОценок пока нет

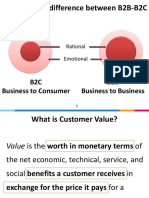

- Fundamental Difference Between B2B-B2C: B2C Business To Consumer B2B Business To BusinessДокумент24 страницыFundamental Difference Between B2B-B2C: B2C Business To Consumer B2B Business To BusinessALOK PRADHANОценок пока нет

- MARK301 Exam RevisionДокумент5 страницMARK301 Exam RevisionWilliam HodsonОценок пока нет

- Assignment MarketingДокумент14 страницAssignment MarketingHuzaifaОценок пока нет

- Advance Receipt Entry PDFДокумент9 страницAdvance Receipt Entry PDFWedsa KumariОценок пока нет

- Cottle-Taylor: Expanding The Oral Care Group in IndiaДокумент18 страницCottle-Taylor: Expanding The Oral Care Group in IndiaManav LakhinaОценок пока нет

- Inmediate Money Book David Garfinkel PDFДокумент132 страницыInmediate Money Book David Garfinkel PDFoscarОценок пока нет

- Contemporary Term PaperДокумент5 страницContemporary Term Paperheart100% (1)

- SecA - Group4 - Old Hand or New BloodДокумент12 страницSecA - Group4 - Old Hand or New BloodVijay KrishnanОценок пока нет

- Glossary of Key Accounting Terms This Glossary Contains Most ofДокумент20 страницGlossary of Key Accounting Terms This Glossary Contains Most ofNguyen_nhung1105Оценок пока нет

- Estimation Cost: Al Watania Gypsum Co. LTDДокумент2 страницыEstimation Cost: Al Watania Gypsum Co. LTDKariem R NoweerОценок пока нет

- Process of Production For Such Sale or in The Form of Materials or Supplies To Be Consumed in The Production Process or in The Rendering of ServicesДокумент11 страницProcess of Production For Such Sale or in The Form of Materials or Supplies To Be Consumed in The Production Process or in The Rendering of ServicesRyan Prado AndayaОценок пока нет

- Sarah TalleyДокумент3 страницыSarah TalleyMandeep Singh67% (3)

- Sample Profit and Loss StatementДокумент2 страницыSample Profit and Loss Statementwhyrice100% (1)

- Kone Case AnalysisДокумент6 страницKone Case AnalysisNikit Tyagi50% (2)

- Invoice: Num. DDT: 821588 Of: 16-05-2019 Villa Tunari 621533Документ2 страницыInvoice: Num. DDT: 821588 Of: 16-05-2019 Villa Tunari 621533Oscar MolinaОценок пока нет

- SCM Excel Based ModelsДокумент16 страницSCM Excel Based ModelssoldastersОценок пока нет

- Gareem LTD NotesДокумент19 страницGareem LTD NotesHaroon Z. ChoudhryОценок пока нет

- Florendo vs. FozДокумент1 страницаFlorendo vs. FozKing BadongОценок пока нет

- Solution To Point 5 of English SenaДокумент3 страницыSolution To Point 5 of English SenaYerly MorenoОценок пока нет

- "Analysis of Buying Behavior of Consumers at Ambuja Cement": A Dissertation Report ONДокумент8 страниц"Analysis of Buying Behavior of Consumers at Ambuja Cement": A Dissertation Report ONRavi SrivastavaОценок пока нет

- Customer Master Fields and Data Collection Template in Sheet 2Документ38 страницCustomer Master Fields and Data Collection Template in Sheet 2samit817504Оценок пока нет