Академический Документы

Профессиональный Документы

Культура Документы

Acc304 Acc324 Topic 6.2 Va

Загружено:

peikeeИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Acc304 Acc324 Topic 6.2 Va

Загружено:

peikeeАвторское право:

Доступные форматы

ACC304/ACC324 Cost & Activity Management Topic 6.

2 - VARIANCE ANALYSIS

BASIC VARIANCE ANALYSIS 1. Variance is the difference between a planned/budgeted/standard results and the actual results, in terms of costs and revenues. 2. Variance analysis - is defined as the evaluation of performance by means of variances, whose timely reporting should maximize the opportunity for managerial action. In other words, the process by which the total difference between standard and actual results is analyzed is known as variance analysis. 3. Favourable variances (F) - occurs, if actual results are better than expected results. 4. Adverse variance (A) actual results are worse than expected results 5. Cost Variances Adverse (A) - when actual costs > standard costs. Favorable (F) when actual costs < standard costs. 6. Revenue Variances Adverse (A) when actual revenue < standard revenue. Favorable (F) when actual revenue > standard revenue. 7. Variances can be grouped into three main groups; Variable cost variances Fixed production overhead variances Sales variances.

8. The purpose of calculating variances is to show the effect of the variances on actual profit compared to the budget. This overall effect is known as the profit variance. The reconciliation between actual and budgeted profits using variances is presented as an operating statement and also by using either the absorption or marginal costing approach.

9. i.

Direct Material Variances

======================== Direct Material Cost Variance is the difference between what the output actually cost and what it should have cost, in terms of material. Direct material cost variance can be divided into two sub-variances; direct material price variance and direct material usage variance. Formula: Actual (Actual Mat cost/unit) (X Actual Qty produced) minus Standard (Std Mat cost/unit) (X Actual Qty produced)

ii.

Direct Material Price Variance is the difference between the standard cost and the actual cost for the actual quantity of material used or purchased. In other words, it is the difference between what the material did cost and what it should have cost. Formula: Actual minus Standard (Std Mat Price/kg) (X Actual Qty of Mat used)

(Actual Mat Price/kg) (X Actual Qty of Mat used) iii.

Direct Material Usage Variance is the difference between the standard quantity of materials that should have been used for the number of units actually produced, and the actual quantity of material used, valued at the standard cost per unit of material. In other words, it is the difference between how much material should have been used and how much material was used, valued at standard cost. Formula: Actual minus Standard (Std Qty of Mat used) (for actual production) X Std Price per unit

(Actual Qty of Mat used) (for actual production)

10. Direct Labour Variances ====================== i. Direct Labor Cost Variances is the difference between what the output should have cost and what it did cost, in terms of labor. It can be divided into three sub-variances; labor rate, labor efficiency and labor idle time. Formula: Actual (Actual Lab cost/unit) (X Actual Qty produce) ii. minus Standard (Std lab cost/unit) (X Actual Qty produce)

Direct Labor Rate Variance is the difference between the std cost and the actual cost for the actual number of hours paid for. In other words, it is the difference between what the labor did cost and what it should have cost. Formula: Actual (Actual Lab Rate/hr) (X Actual Hr. Paid) minus Standard (Std Lab Rate/hr) (X Actual Hr. Paid)

iii.

Direct labor Efficiency Variance is the difference between the hours that should have been worked for the number of units actually produced, and the actual number of hours worked, valued at the std rate per hour. In other words, it is the difference between how many hours should have been worked and how many hours were worked, valued at the std rate per hour. Formula: Actual minus Standard (Std Lab Hr/unit) X (X Actual Qty Produce) Std Lab Rate/hr

(Actual Lab Hr/unit) (X Actual Qty Produced) iv.

Direct Labor Idle-time Variance is the difference between the actual hours paid for and the actual hours actively worked, valued at std labor rate per hour. This variance is always an adverse variance because the labor force is still paid wages for the time at work, but no actual work is done. Time paid for without any work being done is unproductive and therefore inefficient. Idle time may occur due to; machine breakdown, shortage of orders from customers or because of bottlenecks in production. Formula: Actual minus Standard ( AHp - AHw) X Std Lab Rate/hr

11. Variable Overhead Variances 3

=========================== i. Variable Production Overhead Cost Variances - is the difference between what the output should have cost and what it did cost, in terms of variable production overhead costs. This cost variance can be divided into two sub-variances; variable production overhead expenditure variance & variable production overhead efficiency variance. Formula: Actual (Actual Var Ohd cost/unit) (X Actual Qty produced) ii. minus Standard (Std Var Ohd cost/unit) ( X Actual Qty produced)

Variable Production Overhead Efficiency Variance this variance is exactly the same as the labor efficiency variance in terms of labor hours, but priced at the variable production overhead rate per hour. Formula: (Same as Lab Efficiency Variance in Hours) X Std Var Ohd cost/hour Variable Production Overhead Expenditure Variance is the difference between the amount of variable production overhead that should have been incurred in the actual hours actively worked, and the actual amount of variable production incurred. Formula: Actual (Actual Var Ohd cost/hr) ( X AHw) minus Standard (Std Var Ohd cost/hr) ( X AHw)

iii.

12. Fixed Overhead Variances ======================== 4

i.

Fixed Production Overhead Cost Variances - is the difference between what the output should have cost and what it did cost, in terms of fixed production overhead costs. It is the difference between fixed overhead incurred and fixed overhead absorbed. In other words, it is the under or over absorbed fixed overhead. Formula: Actual FOAR/unit X Actual Qty produced Std FOAR/unit X Actual Qty produced

This cost variance can be divided into two sub-variances; fixed production overhead expenditure variance and fixed production overhead volume variance. The fixed production overhead volume variance can be further divided into two subvariances: fixed production overhead volume efficiency variance & - fixed production overhead volume capacity variance. ii. Fixed Production Overhead Expenditure Variance is the difference between the budgeted fixed overhead expenditure and the actual fixed overhead expenditure. This shows the effect on profit of the actual fixed overhead expenditure differing from the budgeted value. Formula: Actual FOAR/unit X Actual Qty Produced Std FOAR/unit X Budgeted Units

iii.

Fixed Production Overhead Volume Variance is the difference between actual and budgeted (planned) volume multiplied by the standard absorption rate per unit. It measures the difference between the amount actually absorbed compared to the amount to be absorbed. Formula: (Actual Qty Produced - Budgeted Qty to Produce) X Std FOAR/unit (AQ p) ( BQ)

iv.

Fixed Production Overhead Efficiency Variance is the difference between the number of hours that actual production should have taken, and the number of hours actually taken (that is, worked) multiplied by the standard absorption rate per hour. 5

This variance measures whether the workforce took more or less time than expected in producing their output for the period. Formula: (Same as Lab Efficiency Variance in Hours) X Std FOAR/hr v. Fixed Production Overhead Capacity Variance is the difference between budgeted (planned) hours of work and the actual hours worked, multiplied by the standard absorption rate per hour. The capacity variance measures whether the workforce worked more or less hours than budgeted for the period. Formula: ( AHw - Budgeted Hours for Budgeted Qty) X Std FOAR/hr 13. Sales Price Variance the change in revenue caused by the actual selling price differing from that budgeted for the actual quantity sold. Formula: (SP - AP) x AQ sold 14. Sales Volume Variance the change in profit caused by sales volume differing from that budgeted. Formula: (BQ - AQ sold) (BQ - AQ sold) x x Std profit per unit Std Contribution per unit ( AC method) ( MC method)

QUESTION 1 MAXIM Ltd produces a chemical component called Reach. The following standard costs apply for the manufacture of 10 components: Material AX 30 litres @ 12.00 per litre 360 6

Skilled labour Variable overhead Fixed overhead

15 hours @ 7.00 per hour 15 hours @ 4.00 per hour 15 hours @ 5.00 per hour

105 60 75 ____ 600 ====

The monthly sales and production budget is 18,000 components. Selling price per component is 85. For the month of January just ended, the following data was extracted from the cost ledgers: Quantity produced and sold 20,000 components Sales value 1,750,000 Material purchased and used (62,000 litres) 730,000 Labour paid (32,500 hours) 225,000 Labour hours worked (hours) 32,000 Variable overheads 125,000 Fixed overheads 152,000 Required: Compute the variances for material, labour, overhead and sales. CAUSES OF VARIANCES ==================== 15. There are generally 4 causes of variances: Bad budgeting insufficient time & resources are not applied when setting the standards. Bad measurement or recording of actual results - care taken when measuring activity achieved, resources used and costs of resources. Random factors the standards itself is an average target for a period of time and thus, actual results will fluctuate randomly around this target. Such fluctuations will be taken as a variance but it should not be significant. I)

Operational factors this will only be true if we assume that the standards set, were originally realistic and that actual results recorded are accurate, as such the variances are not due to random factors but due to operational factors. (see below). 16. The Significances of Cost Variances a) Management has to decide whether or not to investigate the variances calculated. It would be very time consuming and expensive to investigate ALL variances, thus they have to

decide which variances are worth investigating. Factors to be considered in this case, are as follows; i. Materiality tolerance limits must be set first, and only those variances that exceed this limit will be investigated. ii. Controllability only those causes of variances that can be controlled need to be investigated. Uncontrollable variances call for a change in the plan, not an investigation into the past. The type of standard being used if ideal standards are used, than there will be always be an adverse variance. Interdependence between variances one variance might be inter-related with another, and much of it might have occurred only because the other, inter-related, variance occurred too. Costs of investigation the cost of investigation should be weighed against the benefits of correcting the cause of a variance.

iii. iv.

v.

b) Interdependence between variance when two variances are interdependent, one will be adverse and the other will be favorable. c) Interdependence material price and usage variances buying of cheaper material may result in favorable price variance, but this may lead to higher material wastage and thus, adverse usage variance occurs. If cheaper materials are more difficult to handle, there might be some adverse labor efficiency variance too. d) Interdependence labor rate and efficiency variances employees are paid higher rates for experiences and skills, will result in adverse rate variance, at the same time as a favorable efficiency variance.

17. OPERATIONAL CAUSES OF VARIANCES are as follows:

Variance Material Price

Favorable Unforeseen discounts recd More care taken in purchasing Change in material quality.

Adverse Price increase. Careless purchasing. Change in material quality

Material Usage

Higher quality used than std. More effective use made of mat. Errors in allocating mat to jobs is reduced.

Defective mat used. Excessive waste. Theft. Stricter quality control. Errors in allocating mat to jobs increased. Wage rate increase. Use of higher grade labor.

Labor Rate

Use of apprentices or other workers at a rate of pay lower than std.

Labor Idle time N/A

Machine breakdown Non-availability of material. Illness or injury of worker. Lack of supervisory.

Labor Efficiency

Output produced more quickly than expected because of work motivation, better quality of equipment or materials, or better methods. Errors in allocating time to jobs is reduced. Savings in costs incurred. More economical use of services.

Lost time in excess of std allowed. Output lower than std set because of deliberate restriction, lack of training, or sub-std material used. Errors in allocating time to jobs is increased. Increased in cost of services used. Excessive use of service. Change in type of service used. Labor force working less efficiently

Overhead Expenditure

Overhead Volume Efficiency

Labor force working more efficiently

Overhead Volume Capacity

Labor force working overtime

Machine breakdown, Strikes Labor shortages.

Operating Profit Variance due selling price

Unplanned selling price increased.

Unplanned selling price reduction.

Operating Profit Variance due to sales volume

Additional demand attracted by reduced price. Promotional activities and discounts offered.

Unexpected fall in demand due to recession. Failure to satisfy demand due to production difficulties.

II)

INVESTIGATING VARIANCES a) Factors to be considered in assessing the significance of variances are as follows; i. Materiality tolerance limits must be set first, and only those variances that exceed this limit will be investigated. ii. Controllability only those causes of variances that can be controlled need to be investigated. Uncontrollable variances call for a change in the plan, not an investigation into the past. iii. The type of standard being used if ideal standards are used, than there will be always be an adverse variance. iv. Interdependence between variances one variance might be inter-related with another, and much of it might have occurred only because the other, inter-related, variance occurred too. v. Costs of investigation the cost of investigation should be weighed against the benefits of correcting the cause of a variance.

QUESTION 2 A companys budgeted production of Product Z for the month ending 30 November 20X2 was 10,000 units. The fixed overheads were budgeted at $320,000.

10

The standard costs for the product are: Direct materials 6 litres of material A at $3.00 per litre Direct labor 4 hours at $5.00 per hour Variable overhead is absorbed at $4.00 per labor hour The actual results for the month ended 30 November 20X2 were; Production Direct materials Direct labor Variable overheads incurred Fixed overheads incurred Required: Calculate the following variances: a) b) c) d) e) f) g) h) Direct material price Direct material usage Direct labor rate Direct labor efficiency Variable overhead expenditure Variable overhead efficiency Fixed overhead expenditure Fixed overhead volume 9,800 units 59,700 litres at a total cost of $176,115 39,500 hours at a total cost of $192,080 $154,200 $312,000

11

Вам также может понравиться

- 1 Introduction To Financial AccountingДокумент66 страниц1 Introduction To Financial Accountingpeikee100% (1)

- 26.2.15 I Can Solve Problems Using Addition and A Number LineДокумент2 страницы26.2.15 I Can Solve Problems Using Addition and A Number LinepeikeeОценок пока нет

- Exercise 5 (Chap 5)Документ4 страницыExercise 5 (Chap 5)peikeeОценок пока нет

- IAS 17 - Tutorial QsДокумент2 страницыIAS 17 - Tutorial Qspeikee0% (1)

- STA222 Exercise 2 Probability QuestionsДокумент4 страницыSTA222 Exercise 2 Probability QuestionspeikeeОценок пока нет

- Exercise 4 (Chap 4)Документ12 страницExercise 4 (Chap 4)peikee100% (1)

- Exercise 3 (Chap 3)Документ2 страницыExercise 3 (Chap 3)peikeeОценок пока нет

- Exercise 1 (Chap 1)Документ8 страницExercise 1 (Chap 1)peikee0% (1)

- Foundations of Management Accounting ACC 223Документ9 страницFoundations of Management Accounting ACC 223peikeeОценок пока нет

- ACC304Документ2 страницыACC304peikeeОценок пока нет

- Fin328 - Ias17 Lease (Z)Документ9 страницFin328 - Ias17 Lease (Z)peikeeОценок пока нет

- Questions - BudgetingДокумент3 страницыQuestions - BudgetingpeikeeОценок пока нет

- ACC304 ACC324 StdCosting Topic 6Документ5 страницACC304 ACC324 StdCosting Topic 6peikeeОценок пока нет

- IAS 37 - Tutorial Qs - Part 2Документ2 страницыIAS 37 - Tutorial Qs - Part 2peikeeОценок пока нет

- Paragraph WritingДокумент2 страницыParagraph WritingpeikeeОценок пока нет

- Case Study FormatДокумент1 страницаCase Study FormatpeikeeОценок пока нет

- 9 Fixed Assets AccountingДокумент18 страниц9 Fixed Assets AccountingpeikeeОценок пока нет

- 2 Fundamental Accounting Concepts and PrinciplesДокумент35 страниц2 Fundamental Accounting Concepts and Principlespeikee100% (1)

- The Illustrative Essay: Exposing The ExamplesДокумент12 страницThe Illustrative Essay: Exposing The ExamplespeikeeОценок пока нет

- Oral Presentaion SkillsДокумент20 страницOral Presentaion SkillsDr. Wael El-Said100% (2)

- Complete Eco 204Документ17 страницComplete Eco 204peikeeОценок пока нет

- Examination Terminology Terms Used ExplanationДокумент1 страницаExamination Terminology Terms Used ExplanationpeikeeОценок пока нет

- 11 Financial Accounting For Sole TraderДокумент6 страниц11 Financial Accounting For Sole TraderpeikeeОценок пока нет

- VT ReviewДокумент44 страницыVT ReviewbeodethuongОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Idwest ICE Cream Company: A Case StudyДокумент10 страницIdwest ICE Cream Company: A Case StudyDixie Diana Viquiera FernandezОценок пока нет

- Taxes Are Obsolete by Beardsley Ruml, Former FED ChairmanДокумент5 страницTaxes Are Obsolete by Beardsley Ruml, Former FED ChairmanPatrick O'SheaОценок пока нет

- VN instant food industry overviewДокумент17 страницVN instant food industry overviewQuoc Minh TaiОценок пока нет

- 04-Calling The Tune in The Gold MarketДокумент4 страницы04-Calling The Tune in The Gold MarketlowtarhkОценок пока нет

- Benchmarking Project ManagementДокумент13 страницBenchmarking Project ManagementpparkerОценок пока нет

- Business Proposal For Setting Up of A Jacket 2003Документ37 страницBusiness Proposal For Setting Up of A Jacket 2003Abhinav Akash SinghОценок пока нет

- TaxationДокумент33 страницыTaxationlordaiztrand100% (1)

- CHP 12 - Strategy, Balanced Scorecard, and Strategic Profitability (With Answers)Документ54 страницыCHP 12 - Strategy, Balanced Scorecard, and Strategic Profitability (With Answers)kenchong7150% (1)

- Nike, Inc. Strategic Analysis 2009: Jarryd Phillips, Jermaine West, Spencer Jacoby, Othniel Hyliger, Steven PelletierДокумент42 страницыNike, Inc. Strategic Analysis 2009: Jarryd Phillips, Jermaine West, Spencer Jacoby, Othniel Hyliger, Steven PelletierAnmol Jain100% (1)

- Sandpaper Project ProfileДокумент15 страницSandpaper Project ProfileTekeba Birhane100% (3)

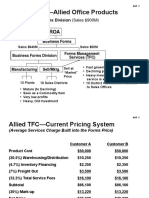

- ABC Costing Allied Office ProductsДокумент13 страницABC Costing Allied Office ProductsProfessorAsim Kumar Mishra100% (1)

- Readsoft Ir Presentation Year End 2013Документ21 страницаReadsoft Ir Presentation Year End 2013RockiОценок пока нет

- Chopra Scm5 Tif Ch13Документ23 страницыChopra Scm5 Tif Ch13Madyoka RaimbekОценок пока нет

- Report PDFДокумент19 страницReport PDFmaria saleem100% (1)

- Customer Value Management Concepts and Case Study: Sunil Thawani Adnoc DistributionДокумент38 страницCustomer Value Management Concepts and Case Study: Sunil Thawani Adnoc Distributionjitendrasutar1975Оценок пока нет

- 2011 Tutorial Letter 101Документ48 страниц2011 Tutorial Letter 101Heather SkorpenОценок пока нет

- All Project 3Документ108 страницAll Project 3Raju Sureliya100% (1)

- Sample Assignment On Marketing Planning of An OrganizationДокумент27 страницSample Assignment On Marketing Planning of An OrganizationInstant Assignment HelpОценок пока нет

- Internship ReportДокумент62 страницыInternship ReportShariful IslamОценок пока нет

- Syllabus of Shivaji University MBAДокумент24 страницыSyllabus of Shivaji University MBAmaheshlakade755Оценок пока нет

- United Grain Growers Limited (A) : Syndicate 5 (Ape Syndicate) Syndicate 5 (Ape Syndicate)Документ34 страницыUnited Grain Growers Limited (A) : Syndicate 5 (Ape Syndicate) Syndicate 5 (Ape Syndicate)Iqbal MohammadОценок пока нет

- FINANCE MANAGEMENT FIN420chp 1Документ10 страницFINANCE MANAGEMENT FIN420chp 1Yanty IbrahimОценок пока нет

- Cost of QualityДокумент65 страницCost of Qualityajayvmehta100% (6)

- Tank Irrigation Management SystemДокумент18 страницTank Irrigation Management SystemSanjeeva YedavalliОценок пока нет

- Financial Statement Analysis of Nandan Denim LtdДокумент70 страницFinancial Statement Analysis of Nandan Denim LtdsejalОценок пока нет

- Texana Petroleum Corporation HistoryДокумент9 страницTexana Petroleum Corporation HistoryDhyana Mohanty100% (1)

- Pitchbook on Jubilant FoodworksДокумент28 страницPitchbook on Jubilant FoodworksAtulSinghОценок пока нет

- Sample CEO ResumeДокумент3 страницыSample CEO ResumejstillwaОценок пока нет

- Customer and Product Profitability at BanksДокумент15 страницCustomer and Product Profitability at Banksmuhaayan87100% (1)

- Three Zone of Production FunctionДокумент5 страницThree Zone of Production FunctionNamdev Upadhyay71% (7)