Академический Документы

Профессиональный Документы

Культура Документы

Ma 2

Загружено:

Tausif NarmawalaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ma 2

Загружено:

Tausif NarmawalaАвторское право:

Доступные форматы

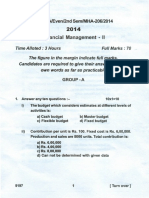

Quiz Management Accounting II

1. In which of the following situations, can cost based transfer prices be used? I. No market price exists. II. Difficulties in negotiating market prices. III. Where the product contains a secret ingredient or production process which the management do not wish to disclose to outside customers. IV. The transferor division is constrained by capacity limitation. (a) Both (I) and (II) above (c) Both (III) and (IV) above (e) (I), (II), (III) and (IV) above. 2. (b) Both (II) and (IV) above (d) (I), (II) and (III) above (1 mark) The estimated annual production of products X and Y are 10,000 and 20,000 respectively. The budgeted cost details of these products are as under: Particulars Direct materials per unit Direct labor per unit (@Rs.9 per hour) Selling overheads per unit (50% variable) X Rs.45 Rs.27 Rs. 9 Y Rs.42 Rs.18 Rs.12

The other overheads are charged to the products as under: Factory overheads (50% fixed) - 100% of direct wages Administrative overheads (100% fixed) - 10% of factory cost The fixed capital investment is Rs.10,00,000 and the working capital requirement is equivalent to 6 months stock of cost of sales of both the products. A return on investment of 25% is expected. The expected return on capital employed is (a) Rs.6,41,875 (d) Rs.6,80,500 3. (b) Rs.6,00,000 (e) Rs.6,90,875. (c) Rs.6,13,500 (2 marks) Consider the following data of Shituja Ltd. for the year 2004-05: Variable cost per unit Fixed costs Estimated profit Normal volume of production The mark-up percentage on total cost is (a) 78.00% 4. (b) 48.75% (c) 40.00% (d) 30.00% (e) 25.00%. (1 mark) Which of the following is true in respect of full cost pricing method? (a) (b) (c) (d) (e) 5. It is used to recover market price plus mark-up It is used to recover standard cost plus mark-up It is used to recover fixed costs only It is used to recover variable costs only It is used where a company does not have the basic idea of demand for the product. (1 mark) If a company charges different prices in different markets for the same product, this pricing strategy is known as (a) Target pricing (b) Standard pricing (c) Full cost pricing (d) Discriminatory pricing (e) Shadow pricing. (1 mark) Rs.25 Rs.4,00,000 Rs.1,95,000 10,000 units

6.

A company manufactures 780 units of product A during 2004-05. The variable cost per unit and fixed costs per annum are Rs.12 and Rs.5,600 respectively. If the company expects an annual profit of Rs.7,200, the mark-up percentage on variable cost is (a) 128.57% (b) 130.00% (c) 132.82% (d) 136.75% (e) 236.75%. (1 mark)

7.

Excel Ltd. operates under standard cost system. Factory overhead cost is applied to products on a direct labor hour basis. At normal operating level, the company utilizes 3,60,000 direct-labor hours per year. The budgeted overhead cost at normal capacity level is as follows: Variable Fixed Rs.7,20,000 Rs.1,80,000.

During the year 2004-05, the actual labor hours were 3,70,000 to get production that should have required only 3,50,000 hours. The overhead efficiency variance is (a) Rs.50,000 (F) (d) Rs.40,000 (A) 8. (b) Rs.50,000 (A) (e) Rs.20,000 (A). (c) Rs.40,000 (F) (2 marks) Which of the following statements is true with regard to the difference between a flexible budget and a fixed budget? (a) A flexible budget primarily is prepared for planning purposes while a fixed budget is prepared for performance evaluation (b) A flexible budget provides cost allowances for different levels of activity whereas a fixed budget provides costs for one level of activity (c) A flexible budget includes only variable costs whereas a fixed budget includes only fixed costs (d) A flexible budget is established by operating management while a fixed budget is determined by management (e) The variances are usually larger with a flexible budget than with a fixed budget. (1 mark) 9. In analyzing company operations, the controller of the Sarkar Corporation found a flexible-budget revenue variance of Rs.2,50,000 favorable. The variance was calculated by comparing the actual results with the flexible budget. This variance can be wholly explained by (a) (b) (c) (d) (e) 10. The total flexible budget variance The total sales volume variance The total static budget variance The changes in unit selling price The changes in unit market price. (1 mark) Which of the following pricing techniques ignores fixed cost? (a) Standard cost based pricing (c) Cost plus profit pricing (e) Differential cost pricing. 11. (b) Full cost pricing (d) Return on investment based pricing (1 mark) Which of the following schedules would be the last item to be prepared in the normal budget preparation process? (a) Sales budget (c) Direct labor budget (e) Manufacturing overhead budget. 12. (b) Cash budget (d) Cost of goods sold budget (1 mark) Which of the following statements is/are true? I. Quarterly manufacturing cost budgets may legitimately show widely varying manufacturing costs per unit, if production is not evenly distributed. II. The first financial budget prepared is the cash budget. III. A flexible budget is a budget prepared for different levels of activity. (a) Only (I) above (d) Both (I) and (III) above (b) Only (II) above (e) (I), (II) and (III) above. (c) Only (III) above (1 mark)

13.

The relationship between the budgeted number of working hours and the maximum possible working hours in a budgeted period is (a) Efficiency ratio (c) Calendar ratio (b) Activity ratio (d) Capacity usage ratio (e) Capacity utilization ratio. (1 mark)

14.

To identify the interrelationships between key activities and resources consumed, is a part of the (a) (b) (c) (d) (e) Activity Based Costing method of cost allocation Classification of costs as either fixed, mixed, variable or semi-fixed Absorption costing method Step-down method to allocate cost pools from one service department to other service departments Reciprocal services method. (1 mark)

15.

Which of the following statements is true? (a) (b) (c) (d) (e) Material price variance is caused on account of pilferage of materials Material usage variance is caused on account of excessive shrinkage or loss of material in transit Material price variance occurs, if defective materials are purchased Material price variance arises because of purchasing substitute materials at different prices Material mix variance will result, if materials are placed into production in the same ratio as the standard mix. (1 mark)

16.

Consider the following data pertaining to Nandini Ltd. for 1,000 units of product-N which requires two raw materials A and B: Standard material cost per unit: Material A 2 kg. at the rate of Rs.10 Material B 3 kg. at the rate of Rs.20 = = Rs.20 Rs.60

Materials issued: Material A 2,050 kg. at a cost of Rs.43,050 Material B 2,980 kg. at a cost of Rs.56,620 The total material usage variance is (a) Rs.900 (Adverse) (b) Rs.900 (Favorable) (c) Rs.500 (Adverse) (d) Rs.400 (Favorable) 17.

(e) Rs.100 (Adverse). (1 mark)

The master budget is a proforma financial statement. It summarizes all the planned activities of all subunits. The information comprises of the (a) (b) (c) (d) (e) General estimates of financial targets and costs Detailed schedules and financial statements Activity cost drivers and cost-volume-profit analysis Planned expenditures for new facilities and financing plans Changes in financial cash flows only. (1 mark)

18.

Consider the following data pertaining to production department in Skylab Ltd. for the month of March 2005: Actual overhead costs Standard hours for actual work Actual hours during the month Standard overhead rate The overhead variance is (a) Rs.2,000 (Favorable) (c) Rs.1,500 (Favorable) (b) Rs.2,000 (Adverse) (d) Rs.1,000 (Adverse) Rs.11,000 4,500 hours 5,000 hours Rs.2 per hour

(e) Rs.1,000 (Favorable). (1 mark)

19.

Which of the following statements is false? (a) Differential cost pricing could bring about pricing decisions that tend to disregard the necessity of recovering total costs in the long run (b) Differential cost pricing is not related to economic marginal analysis (c) Full cost pricing ignores the vital economic considerations of demand and competition (d) Full cost pricing is prone to distortion by accounting misapplication such as an unjustifiable inclusion of manufacturing overhead based on predetermined rates (e) ROI pricing method guides management in determining what selling price will provide at a given rate of return. (1 mark)

20.

Which of the following is/are particularly associated with operating a system of transfer pricing? I. II. III. IV. (a) (c) (e) Ensuring that goal congruence is retained among the organizations separate divisions. Ensuring that divisional performance measurement is not affected. Ensuring that corporate profits are maximized. Ensuring that the group remains competitive. Only (I) above (b) Only (IV) above Both (II) and (III) above (d) (I), (II) and (III) above (I), (II), (III) and (IV) above. (1 mark)

21.

Individual budget schedules are prepared to develop an annual comprehensive or master budget. The budget schedule which provides the necessary input data for the Direct Labor Budget is (a) (b) (c) (d) (e) Sales budget Raw materials purchases budget Schedule of cash receipts and disbursements Schedule of manufacturing overhead Production budget. (1 mark)

22.

Neem Ltd. has furnished the following data for the month of March 2005: Particulars Variable overhead cost Labor hours Units produced Budget Rs.4,000 4,000 hours 16,000 units Actual Rs.3,900 3,500 hours 13,400 units

The variable overhead efficiency variance is (a) Rs.650 (Adverse) (b) Rs.500 (Favorable) (c) Rs.500 (Adverse) (d) Rs.150 (Favorable) 23.

(e) Rs.150 (Adverse). (1 mark)

Krokodile Ltd. has furnished the following budgeted and actual sales for the month of March 2005: Particulars Units sold Sale price The sales volume variance is (a) Rs.13,400 (Adverse) (c) Rs.13,000 (Adverse) Budget 4,000 units Rs.65 per unit Actual 4,200 units Rs.62 per unit

(b) Rs.13,400 (Favorable) (d) Rs.13,000 (Favorable)

(e) Rs.12,400 (Favorable). (1 mark)

24.

Which of the following information is required by the Operating Management? (a) Changes in government policies (c) Working capital (b) Overtime payments (d) Order bookings (e) Return on investment. (1 mark)

25.

Which of the following does not form a part of needs according to Maslows hierarchy of human needs? (a) Psychological needs (d) Esteem needs (b) Safety needs (c) Social needs (e) Self-fulfillment needs. (1 mark)

26.

Which of the following is/are not true in relation to Value Chain Analysis? I. Value chain is the linked set of value-creating activities from the basic raw material sources for suppliers to the ultimate end-use product delivered to the customer. II. No individual firm is likely to span the entire value chain. III. Value chain requires an internal focus unlike conventional management accounting in which focus is external to the firm. IV. Each firm must be understood in the context of the overall value chain of value-creating activities. (a) Only (I) above (d) Only (IV) above (b) Only (II) above (e) Both (II) and (III) above. (c) Only (III) above (1 mark)

27.

Which of the following statements is false in respect of activity based costing? (a) (b) (c) (d) (e) It does not segregate variable and fixed costs It tends to be more costly than the traditional methods of costing It is based on historical costs It highlights the causes of costs It deals with the direct costs only. (1 mark)

28.

Which of the following statements is false with respect to target costing? (a) Target costing is a customer oriented technique (b) Target costing requires market research to determine the customers perceived value of the product based on its functions and attributes (c) The maximum advantage of adopting target costing is, when it is deployed at the products selling stage (d) A major feature of target costing is that a team approach is adopted to achieve the target cost (e) Target costs are conceptually different from standard costs. (1 mark)

29.

Target pricing (a) (b) (c) (d) (e) Is more appropriate when applied to mature and long-established products Considers the variable costs and excludes fixed costs Is often used when costs are difficult to control Is a pricing strategy used to create competitive advantage Is well suited for complex products that require many sub-assemblies. (1 mark)

30.

Which of the following statements is false with respect to Total Quality Control (TQC)? (a) (b) (c) (d) (e) TQC is a management process based on the belief that quality costs are minimized with zero defects The proponents of TQC do not advocate that quality is free TQC begins with the design and engineering of the product TQC is often associated with JIT manufacturing TQC is sometimes referred to as TQM (Total Quality Management). (1 mark)

31.

A profit making firm can increase its return on investment by (a) (b) (c) (d) (e) Increasing sales revenue and operating expenses by the same amount in rupees Increasing investment and operating expenses by the same amount in rupees Decreasing sales revenue and operating expenses by the same percentage Increasing sales revenue and operating expenses by the same percentage Decreasing investment and sales by the same percentage. (1 mark)

32.

Consider the following data relating to Max Ltd.: Sales Variable costs Traceable fixed costs Average invested capital Imputed interest rate The residual income of the company is (a) Rs.1,50,000 (b) Rs.1,44,000 (d) Rs.1,26,000 (e) Rs.1,24,000. (c) Rs.1,30,000 (1 mark) Rs. 5,00,000 Rs. 3,00,000 Rs. 26% 50,000 Rs. 1,00,000

33.

Which of the following is false with respect to Return on Investment (ROI) and Residual Income (RI)? (a) In case of RI, there is a problem of defining the minimum required rate of return associated with various investment opportunities (b) ROI can be readily employed for inter-divisional comparisons (c) A project will be rejected under ROI method and accepted under RI method if the rate of return from such project is more than the minimum required rate of return but less than the current ROI (d) RI is the rate of return which a division is able to earn above the minimum required rate of return on operating assets (e) Under RI approach, the larger divisions will be expected to have more RI than the smaller divisions. (1 mark)

34.

The imputed interest rate used in the residual income approach to perform evaluation can best be described as the (a) (b) (c) (d) (e) Average return on investments for the company over the last several years Target return on investment set by the companys management Average lending rate for the year being evaluated Historical weighted-average cost of capital for the company Marginal after-tax cost of capital on new equity capital. (1 mark)

35.

A segment of an organization is referred to as a profit center, if it has (a) Responsibility for developing markets for and selling the output of the organization (b) Authority to make decisions affecting the major determinants of profit, including the power to choose its markets and sources of supply (c) Responsibility for combining materials, labor and other factors of production into a final output (d) Authority to provide specialized support to other units within the organization (e) Authority to make decisions affecting the major determinants of profit, including the power to choose its markets and sources of supply and significant control over the amount of invested capital. (1 mark)

36.

Which of the following is not true with respect to Zero-Based Budgeting? (a) (b) (c) (d) (e) It is developed using the concept of incrementalization It is done from scratch Previous years figures are not considered as the base It challenges the existence of every budgeting unit and every budget period It cannot be considered as an adjustment for the previous years figures. (1 mark)

37.

Consider the following data pertaining to a company for the month of March 2005: Budgeted hours Actual hours Maximum possible hours in the budget period Standard hours for actual production The capacity usage ratio of the company for the month is (a) 1.17 (b) 1.07 (c) 1.06 (d) 0.86 600 hrs. 560 hrs. 700 hrs. 660 hrs. (e) 0.80. (1 mark)

38.

When a normal costing system is used, budgeted rates would be used for applying costs by the absorption-costing method for (a) (b) (c) (d) (e) Direct labour and variable factory overhead Variable factory overhead and fixed factory overhead Fixed factory overhead and direct materials Direct materials and direct labour Fixed factory overhead and direct labour. (1 mark)

39.

A difference between standard costs used for cost control and budgeted costs (a) Can exist because standard costs must be determined after the budget is completed (b) Can exist because standard costs represent what cost should be, whereas budgeted costs represent expected actual costs (c) Can exist because budgeted costs are historical costs, whereas standard costs are based on engineering studies (d) Cannot exist because they should be the same amounts (e) Can exist because standard costs must be determined before the budget is completed. (1 mark)

40.

The number of standard hours equivalent to the work produced expressed as a percentage of the budgeted standard hours is known as (a) Efficiency ratio (d) Capacity usage ratio (b) Activity ratio (e) Capacity utilization ratio. (c) Calendar ratio (1 mark)

41. AB Ltd. is organized into two large divisions A and B. Division A produces a component which is used by division B in making a final product. The final product is sold for Rs.480. Division A has a capacity to produce 2,400 units and the entire quantity can be purchased by division B. Division A informed that due to installation of new machines, its depreciation cost has gone up and hence wanted to increase the price of the component to be supplied to division B to Rs.264. Division B, however, can buy the component from the outside market at Rs.264 each. The variable cost of division A is Rs.228 and fixed cost is Rs.24 per component. The variable cost of division B in manufacturing the final product by using the component is Rs.180 (excluding the component cost). If division B purchases the entire component from division A, the total contribution of the company as a whole is (a) Rs.5,47,200 (b) Rs.86,400 (c) Rs.1,72,800 (d) Rs.1,15,200 (e) Rs.5,18,400. (2 marks) 42. Kashmira Ltd. has two divisions - A and B. The division A has the capacity to manufacture 1,50,000 units of a special component LKJ annually and it has some idle capacity currently. The budgeted residual income for the division A is Rs.10,00,000. The relevant details extracted from the budget of division A are as under: Sales (to outside customers) Variable cost per unit Divisional fixed cost Capital employed Cost of capital 1,20,000 units @ Rs.180 per unit Rs.160 Rs.8,00,000 Rs.75,00,000 12% per annum

Division B received an order for which it requires 30,000 units of a component similar to LKJ. An additional variable cost of Rs.5 per unit will be incurred to make minor modifications to LKJ to suit the requirements of Division B. The minimum transfer price per unit, which A should quote to B to achieve its budgeted residual income is (a) Rs.185 (b) Rs.170 (c) Rs.165 (d) Rs.160 (e) Rs.175. (2 marks)

43. Srirupa Ltd. manufactures a single product at the operated capacity of 8,000 units while the normal capacity of the plant is 10,000 units per annum. The company has estimated 25% profit on sales realization and furnished the following budgeted information: Particulars Fixed overheads Variable overheads Semi-variable overheads Sales realization 10,000 units (Rs.) 1,50,000 50,000 1,00,000 8,00,000 8,000 units (Rs.) 1,50,000 40,000 88,000 6,40,000

The company has received an order from a customer for a quantity equivalent to 10% of the normal capacity. It is noticed that prime cost per unit of product is constant. If the company desires to maintain the same percentage of profit on selling price, the minimum price per unit to be quoted for the new order is (a) Rs.36.25 (b) Rs.48.33 (c) Rs.37.70 (d) Rs.38.06 (e) Rs.30.75. (2 marks) 44. Dcent Ltd. pays commission to its salesmen in the month the company receives cash for sales, which is equal to 5% of the cash inflows. The company has budgeted sales of Rs.4,25,000 for April 2005, Rs.5,25,000 for May 2005 and Rs.5,85,000 for June 2005. 60% of the sales are on credit. Experience indicates that 60% of the budgeted credit sales will be collected in the month following the sales. 35% are expected to be realized in the second month following the month of sales and remaining 5% will be non-recoverable. The total amount of sales commission for the month of June 2005 is (a) Rs.31,462.50 (b) Rs.25,612.50 (c) Rs.25,785.25 (d) Rs.17,225.00 (e) Rs.15,650.00. (2 marks) 45. Yamini Ltd. has a policy of maintaining a minimum cash balance of Rs.1,00,000 at the end of each month. Any deficit will be financed through bank borrowings and any surplus will be utlised to repay the outstanding bank borrowing and the balance will be invested in short-term securities. For this purpose, the company has an agreement with the bank to borrow in multiples of Rs.10,000 whenever a need arises subject to a maximum of Rs.2,00,000. The rate of interest is 12% per annum payable monthly on the amount borrowed. 50% of the sales are on credit and is expected to be collected in the month following the month of sales. 25% of the purchases are on credit and will be paid in the month following the month of purchases. The salaries and other expenses are to be paid in the month for which they relate. The following is the budgeted information for the quarter ending June 2005: Particulars Sales Purchases Salaries Manufacturing and administrative expenses other April 2005 (Rs.) 40,000 30,000 60,000 25,000 May 2005 (Rs.) 50,000 40,000 70,000 30,000 June 2005 (Rs.) 1,00,000 40,000 50,000 10,000

If the closing cash balance for the month of April 2005 is Rs.1,00,000, the cash balance as on July 01, 2005 will be (a) Rs.1,07,500 (b) Rs.1,01,500 (c) Rs.81,500 (d) Rs.1,02,500 (e) Rs.82,500. (2 marks)

46. Consider the following information pertaining to Akash Ltd.: Particulars Expected sales (units) Estimated wages and other manufacturing expenses (Rs.) April 2005 5,000 1,25,000 May 2005 6,000 1,60,000 June 2005 7,000 1,80,000

Akash Ltd. sells the goods at Rs.50 per unit. 50% of the sales are on cash. The debtors are estimated to be collected the next month. One unit of finished output requires 2 Kg of raw material and is estimated to be purchased for Rs.6 per Kg. The production in a month includes half of that months sales and half of next months sales. The raw material required in a month is purchased in the same month on credit. The creditors are paid in the next month. The wages and other expenses are paid in the month in which they are incurred. The cash surplus in the month of May 2005 will be (a) Rs.49,000 (b) Rs.74,000 (c) Rs.37,000 (d) Rs.62,000 (e) Rs.82,000. (2 marks) 47. A company estimates its direct material requirements for the month of May 2005 to be Rs.2,40,000 and the direct labor to be Rs.1,50,000. It is the policy of the company to absorb overheads as under: Factory overheads 60% of direct wages Administrative overheads 20% of works cost Selling and distribution overheads 25% of works cost It is estimated that the selling and distribution overheads will increase by 15% in May 2005. The company sells goods at a profit of 16.67% on sales. The budgeted sales for the month of May 2005 is (a) Rs.9,21,600 (b) Rs.8,56,800 (c) Rs.9,09,900 (d) Rs.6,87,150 (e) Rs.8,35,200. (2 marks) 48. Consider the following particulars for the month of March 2005: Budgeted fixed production overhead cost Rs.60,000 Budgeted production 6,000 units The fixed overhead cost was under absorbed by Rs.10,000 and the fixed production overhead expenditure variance was Rs.2,500 (Adverse). The number of units produced during the month of March 2005 was (a) 4,750 (b) 5,000 (c) 5,250 (d) 6,750 (e) 7,250. (2 marks) 49. The flexible budget for the month of May 2005 was for 10,000 units with direct material at Rs.24 per unit. Direct labor was budgeted at 45 minutes per unit for a total of Rs.1,02,000. Actual output for the month was 8,500 units with Rs.2,04,000 in direct material and Rs.89,500 in direct labor expenses. The direct labor standard of 45 minutes was maintained throughout the month. The variance analysis of the performance for the month of May 2005 would show a/an (a) (b) (c) (d) (e) Favorable material usage variance of Rs.6,200 Unfavorable material price variance of Rs.5,000 Favorable direct labor efficiency variance of Rs.2,800 Unfavorable direct labor efficiency variance of Rs. 2,800 Unfavorable direct labor rate variance of Rs. 2,800. (2 marks)

50. A1 Ltd. has furnished the following data pertaining to budgeted expenses for 12,000 electrical automatic iron: Particulars Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead (Rs.1,50,000) Selling expenses (20% fixed) Administrative expenses (100% fixed) Distribution expenses (40% fixed) Per unit cost (Rs.) 40 60 20 15 15 5 5 160 The total cost of 8,000 electrical automatic iron is (a) Rs.12,80,000 (b) Rs.16,00,000 (d) Rs.13,50,000 (e) Rs.12,50,000. (c) Rs.13,30,000 (2 marks) 51. Pawan Ltd. manufactures 5,000 units of Product PT at a cost of Rs.120 per unit. Presently, the company is utilizing 50% of the total capacity. The information pertaining to cost per unit of the product is as follows: Material Rs.60 Labor Rs.25 Factory overheads Rs.15 (40% fixed) Administrative overheads Rs.20 (50% fixed) Other information: i. The current selling price of the product is Rs.160 per unit. ii. At 60% capacity level Material cost per unit will increase by 3% and current selling price per unit will reduce by 2%. iii. At 80% capacity level Material cost per unit will increase by 5% and current selling price per unit will reduce by 4%. The profit per unit of the product of the company at 70% and 90% capacity levels will be (a) Rs.39.57 and Rs.37.71 respectively (b) Rs.39.57 and Rs.45.60 respectively (c) Rs.39.57 and Rs.50.50 respectively (d) Rs.50.50 and Rs.40.00 respectively (e) Rs.56.50 and Rs.37.71 respectively. (2 marks) 52. TQM Ltd. has furnished the following data: Particulars Fixed Overheads Output per labor hour Number of working days Labor hours per day Fixed overhead volume variance is (a) Rs.39,750 (favorable) (c) Rs.12,000 (favorable) Budgeted Rs.5,62,000 3 units 25 3,000 Actual Rs.6,02,250 2.6 units 27 3,500

(b) Rs.12,000 (adverse) (d) Rs.51,750 (adverse)

(e) Rs.51,750 (favorable). (2 marks)

53. HP Ltd. produces a commodity by blending two raw materials A and B. The following are the details regarding the raw materials: Material A B Standard mix 40% 60% Standard price per kg. Rs.5 Rs.6

The standard process loss is 15%. During the month of March 2005, the company produced 4,250 kg. of finished product. The position of stock and purchases for the month of March 2005 are as under: Purchases during Material Stock as on Stock as on March 2005 March 01, 2005 March 31, 2005 (Kg.) (Kg.) (Rs.) (Kg.) A B 85 90 40 55 2,400 2,600 13,200 15,080

The material yield variance of the company is (a) Rs.420.20 (adverse) (b) Rs.441.32 (adverse) (c) Rs.519.20 (adverse) (d) Rs.441.32 (favorable)

(e) Rs.519.20 (favorable). (2 marks)

54. Kavya Ltd. is producing three complimentary products. The demand for the products is very much fluctuating. The demand estimates for the products are as below: Product A B C Selling price (Rs.) 16 18 25 Unit Variable cost (Rs.) 10 11 16 Sales units 15,000 20,000 5,000

Fixed cost is Rs.80,000. At the end of the budget period the total sales margin variance is found to be Rs.1,65,000 (Adverse) but same sales mix, cost and price were maintained because of the complimentary nature. If there is no opening and closing inventories of WIP, finished goods and raw materials, and each unit of A, B and C consumes 4 kg, 2 kg and 5 kg of raw material per unit and purchase price of each kg of raw material is Rs.1.50, then the cost of raw materials consumed during the budgeted period is (a) Rs.63,000 (b) Rs.69,720 (c) Rs.86,000 (d) Rs.52,500 (e) Rs.75,000. (2 marks) 55. Sankara Ltd. uses standard process costing method. The standard process cost card per month shows that 2 hours of direct labor is required to produce one kg. of finished product and the fixed overheads, which are recovered on direct labor hours, amount to Rs.200 per kg. of output. The budgeted output is 2,000 kg. per month. Actual production during the month of March 2005 is 1,900 kg. and the direct labor hours utilized during the month were 3,350. The details of opening and closing work-in progress (WIP) are as under: Opening work-in-progress 480 kg.: Degree of completion of labor and overheads 60%. Closing work-in-progress 550 kg.: Degree of completion of labor and overheads 20%. The company uses FIFO method for evaluation of stocks. The fixed overhead efficiency variance is (a) Rs.9,400 (Adverse) (b) Rs.9,400 (Favorable) (c) Rs.10,700 (Adverse) (d) Rs.7,200 (Favorable) (e) Rs.7,200 (Adverse). (2 marks) 56. Consider the following particulars pertaining to Jasmine Ltd. for the month of March 2005: Overheads cost variance Overheads volume variance Budgeted hours for March 2005 Budgeted overheads for March 2005 Actual rate of overheads The overhead capacity variance is (a) Rs.5,200 (Favorable) (b) Rs.1,040 (Favorable) (c) Rs.5,200 (Adverse) (d) Rs.6,240 (Adverse) Rs.3,640 (Adverse) Rs.2,600 (Adverse) 3,120 hours Rs.15,600 Rs.8 per hour.

(e) Rs.8,320 (Adverse). (2 marks)

57. The standard labor component and the actual labor component for a job in a week are given below: Particulars i. Standard number of workers in the gang ii. Standard wage rate per hour (Rs.) iii. Actual number of workers employed in the gang during the week iv. Actual wage rate per hour (Rs.) Skilled workers 32 12 28 14 Semi-skilled workers 12 10 18 8 Unskilled workers 6 8 4 6

During the 40 hours working week, the gang produced 1,800 standard labor hours of work. The labor efficiency variance is (a) Rs.2,048 (A) (b) Rs.2,880 (A) (c) Rs.2,432 (A) (d) Rs.2,016 (F) (e) Rs.2,000 (F). (2 marks) 58. ABM Ltd. has furnished the following production budget pertaining to a single product for the month of March 2005: Production quantity 2,00,000 units Production costs: Material 3,06,000 kg at Rs.4.10 per kg Direct labor 2,16,000 hours at Rs.4.50 per hour Variable overheads Rs. 4,86,000 Fixed overheads Rs.12,28,000 The variable overheads are absorbed at a predetermined direct labor hour rate and the fixed overheads are absorbed at a predetermined rate per unit of output. During the month the actual production was 1,80,000 units and the following costs were incurred : Material 2,83,063 kg at Rs.14,15,300 Direct labor 1,86,000 hours at Rs.8,35,200 Variable overheads Rs.4,05,800 Fixed overheads Rs.12,00,600 The variable overhead efficiency variance and fixed overhead volume variance are (a) Rs.18,900 (F) and Rs.1,22,800 (A) respectively (b) Rs.18,900 (F) and Rs.1,06,440 (A) respectively (c) Rs.18,900 (F) and Rs.1,15,800 (A) respectively (d) Rs.1,06,440 (F) and Rs.18,900 (A) respectively (e) Rs.1,22,800 (A) and Rs.1,26,800 (F) respectively. (2 marks)

59. ABC Ltd. has furnished the following information pertaining to its four products for the month of March 2005: Particulars Output units Cost per unit: Direct material (Rs.) Direct labor (Rs.) Machine hour per unit 40 28 4 50 21 3 30 14 2 60 21 3 A 120 Product B C 100 80 D 120

The four products are similar and are usually produced in production runs of 20 units and sold in batches of 10 units. The production overhead is currently absorbed by using a machine hour rate and the total production overhead for the period has been analyzed as follows: Particulars Machine department costs (rent, rates depreciation and supervision) Set-up costs Stores receiving Inspection / Quality control Material handling and dispatch Rs. 10,430 5,250 3,600 2,100 4,620

The following cost drivers are identified for the absorption of production overhead cost: Cost Setup costs Stores receiving Inspection / Quality control Materials handling and dispatch Cost Driver Number of production runs Requisitions raised Number of production runs Orders executed

The number of requisitions raised on the stores was 20 for each product and number of orders executed was 42, each order being for a batch of 10 of a product. The total costs of products A and D, if the production overheads are absorbed on a machine hour basis, are (a) Rs.17,760 and Rs.16,920 respectively (b) Rs.6,720 and Rs.16,920 respectively (c) Rs.14,800 and Rs.17,760 respectively (d) Rs.17,760 and Rs.6,720 respectively (e) Rs.13,100 and Rs.16,920 respectively. (2 marks) 60. Sarovar Ltd. services washing machines and clothes dryers. It charges customers for the spare materials with markup on cost. The company has five employees, each earning Rs. 7,500 per year and spending 1,000 hours per year on service calls. It sells parts that cost Rs. 37,500 annually. The company has other costs of Rs. 20,000 a year, which is allocated two-thirds to labor and the remainder to material. The amount of markup on parts, if the target profit of the company is Rs.30,000 per annum, is (a) Rs. 25,000 (d) Rs. 45,000 (b) Rs. 75,000 (e) Rs. 27,000. (c) Rs. 30,000 (2 marks) 61. Consider the following data of Product KN of a company for production and sales of 50,000 units: Material Rs.1,00,000 Labor Rs. 80,000 Overheads Rs.3,20,000 The fixed portion of capital employed is Rs.50,000 and the varying portion is 40% of sales turnover. The company desires to earn a profit of 12% on capital employed after payment of tax at 40%. The selling price of the product is (a) Rs.10.28 (b) Rs.11.09 (c) Rs.15.88 (d) Rs.10.00 (e) Rs.12.29. (2 marks)

62. Consider the following data pertaining to the division of a company for the year 2004-05: Investment in working capital Rs.6,60,000 Investment in fixed assets Rs.8,80,000 Total cost Rs.7,70,000 Imputed interest cost 12% If the company desires to achieve a residual income of Rs.2,06,200, the revenue of the division would be (a) Rs.15,40,000 (b) Rs. 9,76,200 (c) Rs.11,02,500 (d) Rs.14,30,000 (e) Rs.11,61,000. (1 mark) 63. Consider the following particulars pertaining to products A and B of a company: Particulars Estimated production Direct labor cost per hour Number of labor hours per unit Fixed costs (Rs.) (units) (Rs.) Total variable costs (other than direct labor) (Rs.) A 4,000 1,60,000 6 3 1,15,000 B 6,000 2,70,000 4.50 4 1,10,000

The investment in fixed capital is Rs.7,60,000 and working capital requirements amount to Rs.5,00,000. A return of 25% on investment is expected. If the contribution per direct labor hour is expected to be the same for both the products, the selling price of product B is (a) Rs.123 (b) Rs.58 (c) Rs.103 (d) Rs.140 (e) Rs.65. (2 marks) 64. Consider the following data of CT Ltd. for the quarter ending March 2005: Projected sales Raw materials per unit of finished goods Opening stock of finished goods Closing stock of finished goods Opening stock of raw materials Closing stock of raw materials The total quantity of materials purchased during the quarter is (a) 82,500 kg (b) 87,000 kg (c) 1,13,000 kg (d) 1,15,000 kg (e) 1,17,000 kg. (2 marks) 65. Zuari Ltd. manufactures tables for schools, restaurants, hotels and other institutions. The company manufactures table s and purchases four legs for each table from an outside supplier and assembles them. It takes 20 minutes of labor to assemble a table. The company follows a policy of producing enough tables to ensure that 40% of next months sales are in the finished goods inventory. The company also purchases sufficient raw materials to ensure that raw materials inventory is 60% of the following months scheduled production. The sales budget for tables in units for the second quarter is as follows: April 2005 2,300 May 2005 2,500 June 2005 2,100 July 2005 2,000 The closing inventory in units for the month of March 2005 is Finished goods 1,900 Raw materials (table legs) 4,000 The number of table legs to be purchased in the month of May 2005 is (a) 10,000 (b) 11,040 (c) 8,688 (d) 9,200 20,000 units 5 kg 2,500 units 5,500 units 23,000 kg 25,000 kg

(e) 12,940. (2 marks)

66. Consider the following particulars pertaining to 1,000 units of product XLN produced during the month of March 2005: Standard price per kg. of raw material Standard direct labor cost Standard direct labor hours Standard overheads per direct labor hour Total standard cost per unit Material usage variance Rs.6 Rs.16,000 3,200 Re.1 Rs.42 Rs.1,200 (A) (e) 2,400 kg. (2 marks)

The actual quantity of raw material consumed during the month of March 2005 is (a) 8,000 kg (b) 3,600 kg (c) 4,000 kg (d) 3,200 kg 67. The concept of Management by exception refers to managements (a) (b) (c) (d) (e) Consideration of only rare events Lack of predetermined plan Consideration of items selected at random Considering only those items which materially vary from plans Considering all the items except the items under the purview of management.

(1 mark) 68. Costs which can be reduced or removed from the companys cost structure without affecting product or service quality for the customer are referred to as (a) Variable costs (c) Non-value-added costs (b) Indirect costs (d) Avoidable costs (e) Irrelevant costs. (1 mark) 69. Johanson Ltd. has following production costs: Direct wages Direct material Production overheads: Fixed Variable Rs.60,000 Rs.1,00,000 Rs.1,50,000 Rs.2,25,000

Following are the budgeted values for the current year: (a) Labor rate is expected to decrease from Re.1.00 per hour to Re.0.80 per hour. (b) Production efficiency is expected to fall by 10%. (c) Production will increase by 40%. The budgeted cost of production for the year is (a) Rs.6,00,000 (b) Rs.6,59,800 (c) Rs.7,03,600 (d) Rs.7,13,800 (e) Rs.7,23,000. (2 marks) 70. Consider the following data of a company: Quarters Budgeted direct-labor hours Variable overhead rate per hour Fixed manufacturing overhead 1st 60,000 Rs.3.00 Rs.80,000 2nd 80,000 Rs.3.00 Rs.80,000 3rd 75,000 Rs.3.00 Rs.80,000 4th 70,000 Rs.3.00 Rs.80,000

The fixed manufacturing overhead includes depreciation of Rs.35,000 per quarter. Ninety percent of the cash payments for manufacturing overhead for each quarter are made during the quarter, and the remaining 10% is made in the following quarter. How much cash payments are made for overhead costs during the period of 2nd quarter? (a) Rs.2,74,500 (b) Rs.2,79,000 (c) Rs.3,14,000 (d) Rs.3,49,000 (e) Rs.3,54,000. (2 marks)

71. Consider the following information of Subal Ltd. for the quarter ended March 31, 2005: Actual variable overhead is Rs.25,800. Budgeted variable overhead at 25,000 machine hours is Rs.25,000. The variable-overhead efficiency variance is Rs.800 (favorable). How many machine hours were actually used? (a) 22,000 (b) 23,800 (c) 24,200 (d) 26,300 (e) 25,800. (1 mark)

Suggested solutions Management Accounting II

1. : (d) Reason : The cost based transfer pricing is used in the following situations: I No market prices exist II. Difficulties in negotiating market-prices III. Where the product contains a secret ingredient or production process which the management do not wish to disclose to outside customers. Where the transferor division is constrained by capacity limitation, shadow price is the best suited transfer price. Therefore, option (d) is true. : (a) Reason: Particulars Direct material Direct labor Factory overheads Total factory cost Administrative overheads Selling overheads Total cost per unit Total cost 45.00 27.00 27.00 99.00 9.90 9.00 117.90 X Variable cost 45.00 27.00 13.50 85.50 4.50 90.00 Total cost 42.00 18.00 18.00 78.00 7.80 12.00 97.80 Y Variable cost 42.00 18.00 9.00 69.00 6.00 75.00

2.

Total cost = (Rs.117.9 10,000 units) + (Rs. 97.80 20,000 units) =Rs.31,35,000 Particulars Rs. Fixed capital 10,00,000 Working capital (Rs.31,35,000 6/12) 15,67,500 Total capital employed 25,67,500 Expected ROI = 25% Expected return = Rs.25,67,500 25% = Rs.6,41,875. 3. : (d) Rs.2,50,000 = = Rs.4,00,000 Rs.6,50,000 Fixed cost Total cost Reason : Total variable cost 10,000 units Rs.25 =

Estimated profit 100 Total cos ts Mark-up % on total cost =

4.

Rs.1,95,000 Rs = .6,50,000 100 =30%

: (e) Reason : Full cost pricing method is used if a company does not have the basic idea of demand for the product. It is not used to recover only fixed costs or only variable cost. It is not used to recover market price plus mark-up or standard cost plus mark-up. : (d) Reason : If a company charges different prices in different markets for the same products, this is known as discriminatory pricing. It can not be defined as target pricing, standard pricing, full cost pricing and shadow pricing. Therefore, option (d) is correct.

5.

6.

(d) = = = Variable cost Mark-up percentage = = Sales-Variable costs 100 Variable costs 780 units Rs.12 + Rs.5,600 + Rs.7,200 Rs.22,160 Rs.12 780 = Rs.9,360

Rs.22,160-Rs.9,360 100 Rs.9,360 = 136.75%.

Reason : Mark-up percentage Now sales

7.

: (b) Reason : Standard rate of fixed overheads = Rs.1,80,000 / 3,60,000 hours = Re.0.50 per hour Standard rate of variable overheads = Rs.7,20,000 / 3,60,000 hours = Rs.2.00 per hour Total Standard rates = Rs.2.00 + Re.0.50 = Rs.2.50 Overhead efficiency variance = Rs.2.50 (3,70,000 hrs 3,50,000 hrs) =Rs.50,000 (Adverse). : (b) Reason : A flexible budget is a series of budgets prepared for different levels of activity. It allows adjustments of the budget to the actual level of activity before comparing the budgeted activity with actual result. Fixed budget is a budget prepared for one level of activity. Therefore (b) is correct. Other statements mentioned in (a), (c), (d) and (e) are not correct. : (d)

8.

9.

10 .

Reason : Variance analysis can be used to judge the effectiveness of selling departments. If a firms sales differ from the amount budgeted, the difference may be attributable to either the sales price variance or the sales volume (quantity) variance. Changes in unit selling prices may account for the entire variance if the actual quantity sold is equal to the quantity budgeted. None of the revenue variance is attributed to the sales volume variance because no such variance exists when a flexible budget is used. The flexible budget is based on the level of sales at actual volume. (a) is incorrect because the total flexible budget variance includes items other than revenue. s (b) and (e) are incorrect because the sales volume variance represents the change in contribution margin caused by a difference between actual and budgeted units sold. However, given a flexible budget, there is no difference between budgeted and actual units sold. By definition, a flexible budgets volume is identical to actual volume. (c) is incorrect because the total static budget variance included many items other than revenue. : (e) Reason : Differential cost technique for pricing ignores fixed cost. Differential cost technique is the change of cost for different options. Therefore, fixed cost has no relevancy with these differential cost techniques. Other techniques mentioned in (a), (b), (c) and (d) consider the fixed cost in pricing the goods : (b) Reason : The budget process begins with the sales budget, proceeds to the production and expense budgets and eventually the cash budget. The cash budget cannot be prepared until the end of the process because all other budgets provide inputs to the cash budget. (a) is not correct because budget process begins with the sales budget. (c) is not correct because direct labor budget provides inputs to the cash budget. (d) and (e) are not correct because these budgets provide inputs to the cash budget, which is not prepared until the end of the process. : (d) Reason : If the production is not evenly distributed, quarterly manufacturing cost budget may widely vary. The first financial budget prepared is the budgeted income statement. Hence statement (II) is wrong. The flexible budget is prepared for different level of activity.. Statements (I) and (III) are true. Hence the correct is (d). : (d) Reason : The relationship between the budgeted number of working hours and the maximum possible working hours in a budgeted period is capacity usage ratio. Hence the is (d). The standard hours equivalent to the work produced expressed as a percentage of the actual hours spent in producing that work is efficiency ratio. The activity ratio is the number of standard hours equivalent to the work produced expressed as a percentage of the budgeted standard hours. Calendar ratio is the relationship between the number of working days in a period and the number of working days in the relative budget period. Capacity utilization ratio is the relationship between the actual hours in a budget period and the budgeted working hours in a given period.

11 .

12 .

13 .

14 .

: (a) Reason : Identifying interrelationships between key activities and resources consumed is central to understanding how business activities drive costs. It is part of creating an ABC cost allocation method and usually requires direct input from employees engaged in the process. : (d) Reason : Material price variance arises due to purchase of substitutes at different prices. It does not arise due to pilferage or defective material. Other statements mentioned in (a), (b), (c) and (e) are false. : (e) Reason : Material usage variance = Standard rate (Actual quantity ~ Standard quantity) Material A Material B = = = = Rs.10 (2,050 kgs ~ 1,000 units 2kgs) Rs.10 50 kgs = Rs.20 (2,980 kgs ~ 1,000 units 3 kgs) Rs.20 20 kgs = Rs.500 (Adverse) Rs.400 (Favorable) Rs.100 (Adverse)

15 .

16 .

Material usage variance 17 .

: (b) Reason : The master budget comprises detailed schedules of all prices, costs, and quantities for every organizational function. It is the mechanism through which all activities are coordinated and includes sales forecasts, expenses, cash receipts and disbursements as well as balance sheets. : (b) Reason : Actual overheads cost Less: Applied overhead cost = (Standard hours for actual work standard overhead rate) 4,500 hours Rs.2 Overhead cost variance Other options (a), (c), (d) and (e) are not correct. Rs.11,000 Rs. 9,000

18 .

Rs. 2,000 (Adverse)

19 .

: (b) Reason : As the economist maintains that to maximize income, a firm should produce at the point where the marginal revenue equals marginal cost, in differential cost analysis, the accountant says that the firm should produce at the point where differential costs equal differential income. So differential cost Pricing is related to economic marginal analysis. Hence, statement (b) is false. All other statements are true. : (d) Reason : A balance needs to be kept between divisional autonomy to provide incentives and motivation, and retaining centralized authority to ensure that the organizations divisions are all working towards the same targets, the benefit of the organization as a whole. It ensures the goal congruence, divisional performance in different division and maximize the corporate profit. Therefore (d) is correct. : (e) Reason : A master budget typically begins with the preparation of a sales budget. The next step is to prepare a production budget. Once the production budget has been completed, the next step is to prepare the direct labor, raw material and overhead budgets. Thus, the production budget provides the input necessary for the completion of direct labor budget. Therefore, (e) is correct.

20 .

21 .

22 .

(e) Rs.4,000 4,000 hrs. = Re.1 13,400 units 4 units

Reason : Standard rate per hour =

Standard unit per hour = 16,000 units 4,000 hours = 4 units per hour Standard hours for actual production = = 3,350 hours. Actual hours = 3,500 hours. Variable overhead efficiency variance = Re.1 (3,500 hours ~ 3,350 hours) = Rs.150 (Adverse). 23 . : (d) Reason : Sales volume variance = Standard sale price (Standard sales quantity ~ Actual sales quantity) = Rs.65 (4,000 units ~ 4,200 units) = Rs.65 200 units = Rs.13,000 (favorable). 24 . : (b) Reason : The operating management is responsible for executing various tasks within the framework of plans, programs and schedules defined by executive management. They need the information regarding the overtime payments. The information regarding the changes in government policies, return on investment is required by management and the information regarding the working capital, order bookings, etc. is required by the executive management. : (a) Reason : Maslow set forth a hierarchy of human needs which include Physiological needs, Safety needs, Social needs, Esteem needs and Self-actualisation needs (also called Selffulfillment needs). The psychological needs are not indicated by him. : (c) Reason : Value chain requires an external focus, unlike conventional management accounting in which the focus is internal to the firm i.e., option c is the right option. Options (a), (b), and (d) are the correct statements in relation to value chain analysis. Hence they are not right options. : (e) Reason : Activity based costing deals with the overhead costs. Overhead cost is the cost other than direct cost. It does not segregate variable and fixed costs. It is based on historical costs. It highlights the causes of costs. It is very costly. Therefore (e) is false. : (c) Reason : The major advantage of adopting target costing is that it is deployed during a products design and planning stage so that it can have a maximum impact in determining the level of the locked in costs. Target costing is not deployed at the product selling stage. Therefore (c) is false. : (d) Reason : Target pricing and costing may result in a competitive advantage because it is customeroriented approach that focuses on what products can be sold at what prices. Hence (d) is the . It is also advantageous because it emphasizes control over costs prior to their being locked in during the early links in the value chain. The company sets a target price for a potential product reflecting what it believes consumer will pay and competitors will do. After subtracting the desired profit margin, the long-run target cost is known. If current costs are too high to allow an acceptable profit, cost-cutting measures are implemented or the product is abandoned. The assumption is that target price is the constraint. Option (a) is incorrect because target pricing is used on products that have not yet been developed. Option (b) is incorrect because target pricing includes all costs. Option (c) is incorrect because target pricing can be used in any situation but is most likely to succeed when costs can be well controlled. Option (e) is not correct because it is difficult to use with complex products that require many sub-assemblies such as automobiles. This is because tracking costs becomes too complicated and tedious, and cost analysis must be performed at so many levels.

25 .

26 .

27 .

28 .

29 .

30 .

: (b) Reason : TQC is a management process based on the belief that quality costs are minimized with zero defects. The phrase Quality is free is commonly advocated by the proponents of TQC. Hence statement (b) is incorrect and all other statements (a), (c), (d) and (e) are correct. : (d) Reason : Return on investment (ROI) equals to income divided by invested capital. If a firm is already profitable, increasing sales and expenses by the same percentage will increase the ROI. Other options given in (a), (b), (c) and (e) are not correct. : (e) Reason : Sales Less variable costs Rs.5,00,000 Rs.3,00,000 Rs.2,00,000 Less fixed costs (traced) Rs. 50,000 Rs.1,50,000 Less interest (26% of Rs.1,00,000) Rs. 26,000 Residual income = Rs.1,24,000.

31 .

32 .

33 .

: (d) Reason : RI is the net operating income which a division is able to earn above the minimum rate of return on operating assets. It is in absolute terms and not a ratio. Hence (d) is false. As RI is the income above the minimum rate of return, there is a problem of defining the minimum required rate of return associated with various investment opportunities. ROI can be readily employed for inter-divisional comparisons as it is a ratio. A project will be rejected under ROI method and accepted under RI method if the rate of return from such project is more than the minimum required rate of return but less than the current ROI. Under RI approach, the larger divisions will be expected to have more RI than the smaller divisions, not necessarily because they are better managed but because of the bigger numbers involved. : (b) Reason : Residual income is the excess of the return on an investment over a targeted amount equal to an imputed interest charge on invested capital. The rate used is ordinarily set as a target return by management but is often equal to the weighted average cost of capital. Some enterprises prefer to measure managerial performance in terms of the amount of residual income rather than the percentage of ROI because the firm will benefit from expansion as long as residual income is earned. Therefore, (b) is correct. : (b) Reason : A profit center is a segment of a company responsible for both revenues and expenses. A profit center has the authority to make decisions concerning markets (revenues) and sources of supply (costs).Option (a) is not correct because a revenue center is responsible for developing markets and selling the firms products. Option (c) is not correct because a cost center combines labor, materials, and other factors of production into a final output. Option (d) is not correct because a service center provides specialized support to other units of the organization. Option (e) is incorrect because an investment center is responsible for revenues, expenses, and the amount of invested capital. : (a) Reason : Zero-Based Budgeting is a method of budgeting whereby all activities are re-evaluated each time a budget is set. In zero-based budgeting no reference is made to previous level of expenditure and thus each activity is analyzed and questioned afresh. Alternative (a) is false as the concept of incrementalization is not used in case of Zero-based budgeting. : (d) = 600 hours 700 hours = 0.86. Reason : Capacity usage ratio = Budgeted hours Maximum possible hours in the budget period

34 .

35 .

36 .

37 .

38 .

: (b) Reason : Normal costing charges production for the actual prime costs, but budgeted costs for variable and fixed factory overhead. Any combination, which includes direct costs like Direct Material and Direct Labour, is wrong.

39 .

: (b) Reason : Standard cost are predetermined, attainable unit costs. Standard cost systems isolate deviations of actual from expected costs. One advantage of standard costs is that they facilitate flexible budgeting. Accordingly, standard and budgeted costs should not differ when standards are currently attainable. However, in practice, budgeted (estimated actual) costs may differ from standard costs when operating conditions are not expected to reflect those anticipated when the standards were developed. (a) is incorrect because standard costs are determined independently of the budget. (c) is incorrect because budgeted costs are expected future costs, not historical cost. (d) is incorrect because budgeted and standard costs should in principle be the same, but in practice they will differ when standard costs are not expected to be currently attainable. (e) is not correct. Therefore (b) is the . : (b) Reason : The number of standard hours equivalent to the work produced expressed as a percentage of the budgeted standard hours is known as activity ratio. : (c) Reason : Contribution of division A Sales 2,400 Rs.264 = Less : Variable cost: Purchase cost (2,400 Rs.228) = Contribution of division B Sales 2400 Rs.480 Less : Variable cost Division A: Rs.6,33,600 Own cost 2,400 Rs.180 Rs. 4,32,000 Total Contribution : (e) Reason : Fixed costs Return on capital employed (Rs.75,00,000 x 12%) Residual income desired Total desired contribution 8,00,000 9,00,000 10,00,000 27,00,000 6,33,600 5,47,200 86,400 11,52,000 Rs.

40 . 41 .

10,65,600 86,400 1,72,800

42 .

Contribution per unit from outside sales = Rs.180 Rs.160 = Rs.20 per unit Total contribution from outside sales = Rs.20 per unit x 1,20,000 units = 24,00,000 Minimum contribution to be earned from supply to division B = Rs.27,00,00 Rs.24,00,000 = Rs. 3,00,000

Rs. 3,00,000 30,000 units = Rs.10 per unit Contribution per unit on additional 30,000 units = Variable cost for minor modification = Rs.5 per unit Minimum transfer price per unit to be quoted = Rs.160 + Rs.10 + Rs.5 = Rs.175.

43 .

: (b) Reason : Computation of prime cost Rs. Sales (8,000 units) Less: Profit margin 25% Cost of sales (75% of Rs.6,40,000) Less: Variable overheads Rs.40,000 Semi-variable overheads Rs.88,000 Fixed overheads Rs.1,50,000 Prime cost Semi-variable overheads: Variable cost = Rs.12, 000 2, 000 units Change in cos t Change in units = Rs.1,00,000-Rs.88,000 10,000 units-8,000 units 6,40,000 1,60,000 4,80,000

2,78,000 2,02,000

= = Rs.6per unit At 8,000 units: Fixed cost = Total semi-variable cost Variable cost = Rs.88,000 8,000 units Rs.6 = Rs.40,000 At 9,000 units: Total cost = 9,000 units Rs.6 + Rs.40,000 = Rs. 94,000 Computation of differential cost of production of 1,000 additional units (i.e. 10% of normal capacity): Element of cost Prime cost Variable overhead Semi variable overhead Fixed overhead 8,000 Units (Rs.) 2,02,000 40,000 88,000 1,50,000 4,80,000 9,000 units (Rs.) 2,27,250 45,000 94,000 1,50,000 5,16,250 Differential cost for 1000 units (Rs.) 25,250 5,000 6,000 36,250

Rs.36, 250 Cost per unit of new order = 1, 000 = Rs.36.25 Profit margin 33.33% (25% on sale = 33.33% on cost) = Rs. 12.08 Minimum selling price per unit = Rs.48.33

44 . : (b) Reason : Cash sales for June 2005 (Rs.5,85,000 x 0.4) Cash flows for the credit sales in the month of April 2005 (Rs.4,25,000 x 0.6 x 0.35) Cash flows for the credit sales in the month of May 2005 (Rs.5,25,000x 0.6 x 0.6) Rs.2,34,000 Rs.89,250 Rs.1,89,000 Rs.5,12,250 Total commission payable to salesmen = Rs. 5,12,250x 5% = Rs.25,612.50

45 .

: (b) Reason : Particulars May June Opening cash balance 1,00,000 1,07,500 Cash sales 25,000 50,000 Collection of credit sales 20,000 25,000 Cash inflows 1,45,000 1,82,500 Cash purchases 30,000 30,000 Payment to creditors 7,500 10,000 Salaries 70,000 50,000 Expenses 30,000 10,000 Interest (Rs.1,00,000 12% 1/12) 1,000 Cash outflows 1,37,500 1,01,000 Closing balance before borrowings 7,500 81,500 Borrowings * 1,00,000 20,000 Surplus Closing balance 1,07,500 1,01,500 *As the closing balance before borrowings in May 2005 is Rs.7,500, it needs to borrow Rs.92,500 to make the cash balance to Rs.1,00,000. However as the agreement with the bank provides to borrow in multiples of Rs.10,000, the company should borrow Rs.1,00,000 at the end of May 2005. Similarly, for the month of June 2005, the company is required to borrow Rs.20,000.

46 .

: (a) Reason : Particulars Expected sales Kg. Production (units) Raw material required for production (kg) Amount to be paid for raw material (Rs.) Payment to creditors Particulars Expected sales (units) Sales (in Rs.) Cash sales Collection from debtors April 2005 5,000 2,50,000 1,25,000 April 2005 5,000 2,500 + 3,000 = 5,500 11,000 66,000 May 2005 6,000 3,000 + 3,500 = 6,500 13,000 78,000 66,000 June 2005 7,000 3,50,000 1,75,000 1,50,000

May 2005 6,000 3,00,000 1,50,000 1,25,000

Particulars Cash sales Collection from debtors Less: Payment to creditors Other expenses Cash surplus 47 . : (b) Reason :

May 2005 1,50,000 1,25,000 66,000 1,60,000 49,000

Rs. Direct material Direct labor Factory overheads (60% of direct labor) Works cost Administrative overheads (20% of works cost) Selling and distribution expenses (25% of works cost + 15%) (4,80,000 25% 115%) Profit 16.67% on sales (i.e. 20% on cost) Sales 2,40,000 1,50,000 90,000 4,80,000 96,000 1,38,000 7,14,000 1,42,800 8,56,800

48 .

: (c) Reason : Fixed overhead recovery rate = Particulars Budgeted fixed overhead Add: Fixed overhead expenditure variance Actual fixed overhead Fixed overhead cost Rs.60,000 = =Rs.10 per unit Production (Units) 6,000 units Rs. 60,000 2,500 62,500

Absorbed overhead = Actual fixed overhead under-absorbed overhead = Rs.62,500 10,000 = Rs.52,500

Overhead absorbed Rs.52,500 = =Rs.5,250 Rs.10 Actual production = Fixed overhead rate units

49 .

: (e) Reason : The standard cost of materials for 8,500 units is Rs.2,04,000 (i.e. 8,500 Rs.24). Thus, no variance arose with respect to materials. Because labor for 10,000 units was budgeted at Rs.1,02,000, the unit labor cost is Rs.10.20. Thus, the labor budget for 8,500 units is Rs.86,700 and total labor variance is Rs.2,800 (i.e. Rs.89,500 Rs.86,700). Because the actual cost is greater than the budgeted amount, Rs.2,800 variance is unfavorable. Given that the actual time per unit (45 minutes) was the same as that budgeted, no labor efficiency variance was incurred. Hence, the entire Rs.2,800 unfavorable variance must be attributable to labor rate variance. : (d) Reason : Particulars Variable cost: Direct materials Direct labor Manufacturing overheads Selling expenses Distribution expenses Total variable cost Fixed cost: Manufacturing overheads Selling expenses Administrative expenses Distribution expenses Rs. 40 60 20 12 3 135 1,50,000 36,000 60,000 24,000 2,70,000

50 .

Total cost of 8,000 units = 8,000 units Rs.135 + Rs.2,70,000 = 10,80,000 + Rs.2,70,000 = Rs.13,50,000

51 .

: (a) Reason : Capacity Production (units) Material Labor Variable overheads Factory Administrative Total variable cost Fixed overheads Factory Administrative 50% 5,000 (Rs.) 60 25 9 10 104 5,20,00 0 30,000 50,000 6,00,00 0 160 8,00,00 0 2,00,00 0 40.00 70% 7,000 (Rs.) 61.80 25.00 9.00 10.00 105.80 7,40,600 30,000 50,000 8,20,600 156.80 10,97,60 0 2,77,000 39.57 90% 9,000 (Rs.) 63.00 25.00 9.00 10.00 107.00 9,63,000 30,000 50,000 10,43,000 153.60 13,82,400 3,39,400 37.71

Sale price per unit Sales value Profit Profit per unit 52 . : (e) Reason:

Standard output = Standard Number of working days x Standard Labor hours per day x Standard Output per labor hour = 25 x 3000 x 3 = 2,25,000 units Standard fixed overhead rate per unit = Rs. 5,62,500 / 2,25,000 = Rs.2.50 Actual output = Actual Number of working days x Actual Labor hours per day x Actual Output per labor hour = 27 x 3,500 x 2.60 = 2,45,700 units Fixed overhead volume variance = Actual output x standard rate Budgeted fixed overheads =2,45,700 units x Rs.2.50 Rs.5,62,500 =Rs.6,14,250 Rs5,62,500 = Rs.51,750 (favorable).

53 .

: (b) Reason:

Actual material consumption: Particulars Stock as on March 01, 2005 Add: Purchases during the month of March 2005 Less: Stock as on March 31, 2005 Material consumed during the month of March 2005 Total material consumption = 2,445+ 2,635= 5,080 kg. Materials input = 4,250 0.85 = 5000 kg Standard cost: A B Loss: Output Quantity (kg.) 2,400 2,600 5,000 750 4,250 Price (Rs.) 5 6 Amount (Rs.) 12,000 15,600 A 85 2,400 2,485 40 2,445 B 90 2,600 2,690 55 2,635

27,600

Standard yield = Material yield variance = Standard rate of output (Actual yield Standard yield) = Rs.27,600 (4,250 kg. ~ 4,318 kg.) 4,250 = Rs.6.49 x 68kg. = Rs. 441.32 (Adverse) 54 . : (e) Reason : Here the total sales margin variance is Rs.1,65,000 (Adverse ) implies the actual sales margin (contribution) = Budgeted sales margin Rs.1,65,000 = [15,000 x Rs.6+20,000 x Rs.7+5,000 x Rs.9] Rs.1,65,000 = Rs.2,75,000-Rs.1,65,000 = Rs.1,10,000. Here sales mix ratio is 3:4:1.Let us assume a composite unit has 3 units of product A,4units of product B and 1 unit of product C. So , contribution from composite unit = 3 x Rs.6+4 x Rs.7+1 x Rs.9=Rs.55. Number of composite units to be sold = Contribution of Rs.1,10,000 / Rs.55 = 2,000 units.i.e. A-2,000 x 3=6,000 units B-2000 x 4=8,000 units C-2000 x 1=2,000 units. So, the consumption of raw materials = 6,000 x 4 + 8,000 x 2 + 2,000 x 5 = 50,000 kg. The cost of raw materials is = 50,000 x Rs.1.50 =Rs.75,000. : (b) Reason: Completed stock: From opening work-inprogress Closing work-inprogress Current production Total Units 480 550 1,42 0 Degree of completion 40 % 20 % 100 % Overheads 192 110 1,420 1,722

Actual standard output 85 kg. Actual input = 5,080kg.= 4,318kg. Standard input 100 kg.

55 .

Budgeted rate per unit = Rs.200 No. of direct labor hours per unit = 2 Budgeted rate per hour = Rs.100 Standard hours for actual production = 1,722 x 2 = 3,444 hours Fixed overhead efficiency variance = (Standard hours for actual production Actual hours) x budgeted rate per hour = (3,444 hours 3,350 hours ) x Rs.100 = Rs.9,400 (F)

56 .

: (c) Reason:

Overhead expenditure variance = Overhead cost variance ~ Overhead volume variance = Rs.3,640 (A) ~ Rs.2,600 (A) = Rs.1,040(A) Actual overheads incurred = budgeted overheads ~ overheads expenditure variance = Rs.15,600 ~ Rs.1,040(A) = Rs.16,640 Actual hours = Overheads capacity variance = Standard rate (Actual hours budgeted hours) Actual overheads incurred Rs.16,640 = =2,080 hours Actual rate of recovery 8

Rs.15,600 = 3,120 (2,080 hours 3,120 hours) = 5,200 (Adverse)

57 . : (a) Reason: Actual hours = 40 (28 + 18 + 4) = 2,000 hrs Total standard = 40 (32 + 12 + 6) = 2,000 hrs Standard time for actual output

1, 800 40 32 Skilled = 2, 000 = 1,152 hrs 1, 800 40 12 Semi-skilled = 2, 000 = 432 hrs 1, 800 40 6 Unskilled = 2, 000 = 216 hrs Efficiency variance:

Skilled = Rs.12 (40 28 1152) = Rs.384 (F) Semi-skilled = Rs.10 (40 18 432) = Rs.2,880 (A) Unskilled = Rs.8 (40 4 216) = Rs. 448 (F) Rs.2,048 (A) 58 . : (a) Standard variable overhead rate=Rs.4,86,0002,16,000 hrs = Rs.2.25 per hour Standard hours per unit = 2,16,000 hours2,00,000 units= 1.08 hours Fixed overhead rate per unit = Rs.12,28,0002,00,000 units= Rs.6.14 Variable overhead efficiency variance: =(Standard hours for actual production- Actual hours) x Standard rate per hour =(1,80,000 units x 1.08 hours 1,86,000) x Rs.2.25 = (1,94,400 ~ 1,86,000) x Rs. 2.25 = Rs.8,400 x Rs. 2.25 = Rs. 18,900(F) Fixed overhead volume variance =(Actual output Budgeted output) x Standard rate =1,80,000 units 2,00,000 units) x Rs.6.14= 20,000 units x Rs.6.14= Rs.1,22,800 (A). 59 . : (a) Reason: Total machine hours = = Machine hour rate = 120 4 + 100 3 + 80 2 + 120 3 480 + 300 + 160 + 360 = 1300 hrs. Rs.10, 430 + Rs.5, 250 + Rs.3, 600 + Rs.2,100 + Rs.4, 620 1300 hrs Reason:

Rs.26, 000 = 1300hrs = Rs.20 per machine hour.

Particulars Direct material Direct labor Production overhead Total units Total cost

A (Rs.) 40 28 80 148 120 units Rs.17,760

D (Rs.) 60 21 60 141 120 units Rs.16,920

60 .

: (a) Reason:

Total labor cost 5 x Rs. 7,500 Cost of parts Total variable cost Target profit Fixed cost Mark up % Mark up on parts

= Rs. 37,500 = Rs. 37,500 Rs.75,000 = Rs. 30,000 = Rs. 20,000 = Rs. 50,000 = Rs. 50,000 Rs. 75,000 = 66.67% = 66.67% of Rs. 37,500 = Rs. 25,000.

61 .

: (b) Reason : Let the sale price = x

12%

50,000x = Rs.1,00,000 + Rs.80,000 + Rs.3,20,000 + 1 .4 50,000x = Rs.5,00,000 + 0.2 (50,000 + 20,000x) 50,000x = Rs.5,00,000 + Rs.10,000 + 4000x 46,000x = Rs.5,10,000 x = 11.09. 62 . : (e) Reason:

[ Rs.50, 000 + .4(50, 000x) ]

Revenue = Total cost + Target profit = Total cost + Imputed interest cost + Residual income = Rs.7,70,000 + 12% on (Rs.6,60,000 + Rs.8,80,000) + Rs.2,06,200 = Rs.7,70,000 + Rs.1,84,800 + Rs.2,06,200 = Rs.11,61,000.

63 .

: (a) Reason: Particulars Fixed cost (Rs. Rs.1,15,000 + Rs.1,10,000) Add: expected return (Rs.7,60,000 + Rs.5,00,000) 25% Contribution Total labor hours: Product A: (3 4,000 units) Product B: (4 6,000 units) Total labor hours 12,000 24,000 36,000 Rs. 2,25,000 3,15,000 5,40,000

Rs.5,40,000 Contribution per labor hour = 36,000 hours = Rs.15 per labor hour. Calculation of selling price: Particulars Rs. Variable cost other than labor (Rs.2,70,000 / 6,000 units) 45 Direct labor (Rs.4.50 4 hours) 18 Contribution (Rs.15 4) 60 Selling price 123

64 . : (e) Reason: Closing finished goods Add: Budgeted sales Total requirement of sales Less: Opening finished goods Required production of finished goods Raw material per unit Material usage Add: Closing raw material Less: Opening raw material Required purchases 5,500 units 20,000 units 25,500 units 2,500 units 23,000 units x 5 kg 1,15,000 kg 25,000 kg 1,40,000 kg 23,000 kg 1,17,000 kg

65 .

: (c) Reason: Production of tables for the month of May 2005: 2,500 + 40% of 2,100 = 2500 + 840 = Less: Opening stock (40% of 2,500) Production Production of tables for the month of June 2005 : 2,100 + 40% of 2,000 = 2100 + 800 = Less: Opening stock Production Legs for May 2005: 4 2340 + 60% of 2060 4 = 9360 + 4944 Less: Opening stock 60% of 2340 4 = 14,304 5,616 8,688 2,900 840 2,060 3,340 1,000 2,340

66 .

: (c) Reason: Particulars Total standard cost of XLN (1,000 units @ Rs.42) Less: Standard direct labor cost Standard overhead cost (3,200 hours @ Re.1) Standard cost of raw material Total standard quantity of raw material required Standard cost of raw material used Rs.22,800 = Standard rate per kg. of raw material Rs.6 Rs. 42,000 16,000 3,200 22,800

= = 3,800 kg. Material usage variance = Standard rate (standard quantity actual quantity) i.e. Rs.1,200 (A) = Rs.6 x (3,800 kg. actual quantity)

(Rs.6 3,800 kg.) + 1,200 =4,000 kg. 6 Actual quantity =

67 .

: (d) Reason: The concept of Management by exception refers to managements considering only those items which materially vary from plans. So option (d) is correct. All other options are incorrect and no other option is giving similar meaning. : (c) Reason: A value added activity contributes to customer satisfaction or meets a need of the entity. A non-value adding activity does not make such a contribution. It can be eliminated, reduced or redesigned without impairing quantity, quality or responsiveness of the product or service desired by customers or entity. For example, raw materials storage may be greatly reduced or eliminated in just-in-time (JIT) production system without affecting the customer value. Variable costs are the costs, which vary with volume. Indirect costs lack an obvious connection with products produced or services provided. Value-added costs cannot be reduced or taken away without changing the customers perceived value of the organizations service or product. Irrelevant costs are the costs which are irrelevant for decision making. Avoidable costs are the costs which can be avoided with dropping of a decision.

68 .

69 .

: (d) Reason: Labor hours = 1,50,000/1.00 = 1,50,000 hours. Increase in labour hours due to decrease in production efficiency by 10% and 40% increase in production = 1,50,000 x (1 + 0.10) x (1 + 0.40) = 2,31,000 hours. Hence, budgeted wages = 2,31,000 x 0.80 = Rs.1,84,800. Direct material when production increases by 40% = 2,25,000 x (1+0.40) = Rs.3,15,000. Fixed overhead cost = Rs.60,000. Variable cost after decrease in production efficiency by 10% and 40% increase in Production = Rs.1,00,000 x (1 + 0.10) x (1+ 0.40) = Rs.1,54,000. Cost of production = Direct material + Direct labour + Variable overhead + Fixed overhead =Rs.(3,15,000 + 1,84,800 +1,54,000 + 60,000) =Rs.7,13,800. : (b) Reason: Total planned overhead costs for the first quarter = (60,000x3 + 80,000) = Rs.260,000 1st quarter cash payments = 90% x (260,000 35,000), (depreciation is excluded) = Rs.202,500 Total planned overhead costs for the second quarter = (80,000x3 + 80,000) = Rs.320,000. 2ndst quarter cash payments = {90% x (320,000 35,000} + {10% x (Rs.260,000 Rs.35,000)} = (2,56,500 + 22,500) = Rs.2,79,000. : (c) Reason: Variable-overhead efficiency variance = Standard variable-overhead rate x (actual hours standard hours). The standard variable-overhead rate is Rs.25,000 / 25,000 = Re.1. Substituting: Re.1(AH 25,000) = Rs.800(F); Re.1(AH) Rs.25,000 = (Rs.800); Re.1(AH) = Rs.24,200; AH = Rs.24,200 / Re.1; AH = 24,200 machine hours.

70 .

71 .

OF THE DOCUMENT

Вам также может понравиться

- Financial Policies & Procedures Manual For CSOsДокумент55 страницFinancial Policies & Procedures Manual For CSOsahsanlrk75% (4)

- Setting Performance TargetsДокумент12 страницSetting Performance TargetsBusiness Expert Press100% (2)

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsОт EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsОценок пока нет

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosОт EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosОценок пока нет

- 2022 School Operational WorkplanДокумент12 страниц2022 School Operational WorkplanDorothy Otieno100% (3)

- Basic Cost Accounting Notes TermsДокумент89 страницBasic Cost Accounting Notes TermsAbdulWahab100% (7)

- 8508 QuestionsДокумент3 страницы8508 QuestionsHassan MalikОценок пока нет

- Sample Paper Cost & Management Accounting Question BankДокумент17 страницSample Paper Cost & Management Accounting Question BankAnsh Sharma100% (1)

- Ma 6Документ32 страницыMa 6Tausif Narmawala0% (1)

- Ma2 Specimen j14Документ16 страницMa2 Specimen j14talha100% (3)

- Economic Insights from Input–Output Tables for Asia and the PacificОт EverandEconomic Insights from Input–Output Tables for Asia and the PacificОценок пока нет

- Group 3 - Case Study For Monolith ProductionДокумент4 страницыGroup 3 - Case Study For Monolith ProductionRuth Joy R. ParedesОценок пока нет

- Swot AnalysisДокумент5 страницSwot AnalysisTausif Narmawala0% (1)

- Managerial Akuntansi Hansen MowenДокумент22 страницыManagerial Akuntansi Hansen Mowenria susanti100% (2)

- Economic Indicators for Eastern Asia: Input–Output TablesОт EverandEconomic Indicators for Eastern Asia: Input–Output TablesОценок пока нет

- MKN Property Estates Biz Plan 27.03.2019 PDFДокумент89 страницMKN Property Estates Biz Plan 27.03.2019 PDFHerbert Bushara100% (3)

- Project On DoveДокумент60 страницProject On DoveTausif Narmawala67% (6)

- BACC3115-Cost Accounting Midterm Exam PRДокумент6 страницBACC3115-Cost Accounting Midterm Exam PRVahia Ralliza Dotarot0% (1)

- Group II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksДокумент23 страницыGroup II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksMahesh BabuОценок пока нет

- Tma 2 - Q4 - Mcis - July - 2005Документ19 страницTma 2 - Q4 - Mcis - July - 2005Prince SeedatОценок пока нет

- F2 Mock 2Документ12 страницF2 Mock 2Areeba alyОценок пока нет

- Management Accounting II 0405Документ29 страницManagement Accounting II 0405api-26541915Оценок пока нет

- Revalidation Test Paper Intermediate Group II: Revised Syllabus 2008Документ6 страницRevalidation Test Paper Intermediate Group II: Revised Syllabus 2008sureka1234Оценок пока нет

- Cost Accounting V1Документ12 страницCost Accounting V1solvedcare100% (1)

- F 5 Progressssjune 2016 SOLNДокумент12 страницF 5 Progressssjune 2016 SOLNAnisahMahmoodОценок пока нет

- MAS UTd Practice Exam 1Документ4 страницыMAS UTd Practice Exam 1JEP WalwalОценок пока нет

- MCS Practical For StudentsДокумент10 страницMCS Practical For StudentsrohitkoliОценок пока нет

- t4 2008 Dec QДокумент8 страницt4 2008 Dec QShimera RamoutarОценок пока нет

- F5 QuestionsДокумент10 страницF5 QuestionsDeanОценок пока нет

- Paper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsДокумент47 страницPaper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionspranllОценок пока нет

- Cost AccountingДокумент10 страницCost AccountingAlex BaptistaОценок пока нет

- Paper 8Документ63 страницыPaper 8Richa SinghОценок пока нет

- Management Accounting II 0105Документ33 страницыManagement Accounting II 0105api-265419150% (1)

- Adl 56 - Cost Managerial Accounting AssignmentДокумент11 страницAdl 56 - Cost Managerial Accounting AssignmentVincent Keys100% (1)

- Test 1Документ13 страницTest 1Moon JeeОценок пока нет

- Midsemester Practice QuestionsДокумент6 страницMidsemester Practice Questionsoshane126Оценок пока нет

- AY 201 2013 EXAMINATION: 1. This Paper Consists of 6 Pages (Excluding Cover Page)Документ8 страницAY 201 2013 EXAMINATION: 1. This Paper Consists of 6 Pages (Excluding Cover Page)Chew Hong KaiОценок пока нет

- Gls University'S Faculty of Commerce Semester - Iv Cost Accounting - 2 Objective Questions 2017-2018Документ12 страницGls University'S Faculty of Commerce Semester - Iv Cost Accounting - 2 Objective Questions 2017-2018Archana0% (1)

- Suggested Answer - Syl08 - Dec13 - Paper 8 Intermediate ExaminationДокумент13 страницSuggested Answer - Syl08 - Dec13 - Paper 8 Intermediate ExaminationBalaji RajagopalОценок пока нет

- Set: A: Instructions For CandidatesДокумент10 страницSet: A: Instructions For CandidatessaurabhОценок пока нет

- MGMT Acts PaperДокумент27 страницMGMT Acts PaperAbhishek JainОценок пока нет

- Financial Management - IIДокумент7 страницFinancial Management - IIR SheeОценок пока нет

- Management AccountingДокумент54 страницыManagement AccountingArap Rono LeonardОценок пока нет

- Cost AccountingДокумент54 страницыCost AccountingAlankar SharmaОценок пока нет

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionДокумент9 страницMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionCHAU Nguyen Ngoc BaoОценок пока нет

- MB2D2Документ15 страницMB2D2Praghathi PaiОценок пока нет

- Wef2012 Pilot MAFДокумент9 страницWef2012 Pilot MAFdileepank14Оценок пока нет