Академический Документы

Профессиональный Документы

Культура Документы

Nguttu Auditing

Загружено:

Sifa MtashaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Nguttu Auditing

Загружено:

Sifa MtashaАвторское право:

Доступные форматы

1.

(a) Factors limiting independence of internal audit

Reporting system

The chief internal auditor reports to the finance director. This limits the effectiveness of the internal audit reports as the finance director will also be responsible for some of the financial systems that the internal auditor is reporting on. Similarly, the chief internal auditor may soften or limit criticism in reports to avoid confrontation with the finance director.

To ensure independence, the internal auditor should report to an audit committee.

Scope of work

The scope of work of internal audit is decided by the finance director in discussion with the chief internal auditor. This meansthat the finance director may try and influence the chief internal auditor regarding the areas that the internal audit departmentis auditing, possibly directing attention away from any contentious areas that the director does not want auditing.To ensure independence, the scope of work of the internal audit department should be decided by the chief internal auditor,perhaps with the assistance of an audit committee.

Audit work

The chief internal auditor appears to be auditing the controls which were proposed by that department. This limits independence as the auditor is effectively auditing his own work, and may not therefore identify any mistakes. To ensure independence, the chief internal auditor should not establish control systems in Matalas. However, where controlshave already been established, another member of the internal audit should carry out the audit of petty cash to provide somelimited independence.

Length of service of internal audit staff

All internal audit staff at Matalas have been employed for at least five years. This may limit their effectiveness as they will be very familiar with the systems being reviewed and therefore may not be sufficiently objective to identify errors in those systems. To ensure independence, the existing staff should be rotated into different areas of internal audit work and the chief internal auditor independently review the work carried out.

Appointment of chief internal auditor

The chief internal auditor is appointed by the chief executive officer (CEO) of Matalas. Given that the CEO is responsible for the running of the company, it is possible that there will be bias in the appointment of the chief internal auditor; the CEO may appoint someone who he knows will not criticise his work or the company. To ensure independence, the chief internal auditor should be appointed by an audit committee or at least the appointment agreed by the whole board. (b) Internal control weaknesses petty cash

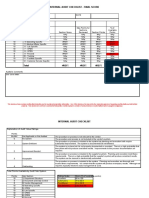

Weakness

The petty cash balance is approximately three months expenditure. This is excessive and will increase the possibility of petty cash being stolen or errors not being identified.

Suggested control

The petty cash balance should be 2,000, being about one months expenditure

The petty cash box it self is not secure,it is placed on a book case where any member of staff could steal it. .

When not in use,the petty cash box should be kept in the branch safe or at least a locked drawer in the accountan ts desk.

Petty cash appears to be used for some larger items of A maximum expenditure limit (e.g. 50) should be expenditure (up to 500). Vouchers are only authorized set before which prior authorization is required. after expenditure is incurred indicating that some significant expenditure can take place without authorization.

Petty cash vouchers are only signed by the person incurring the expenditure, indicating a lack of authorization control for that expenditure.

All vouchers should be signed by an independent official showing that the expenditure has been author Ised.

Petty cash only appears to be counted by the accounts clerk, who is also responsible for the petty cash balance. There is no independent check that the petty cash balance is accurate.

The accounting of petty cash should be checked by The accountant to ensure that the clerk is not stealing the cash.

When the imprest cheque is signed, only the journal entry for petty cash is reviewed, not the petty cash vouchers. The accountant has no evidence that the journal entry actually relates to the petty cash expenditure incurred.

The petty cash vouchers should be available for review to provide evidence of petty cash expenditure.

Petty cash vouchers are not pre-numbered so it is impossible to check the completeness of vouchers; unauthorised expenditure could be blamed on missing vouchers.

Petty cash vouchers should be pre-numbered and the numbering checked in the petty cash book to confirm completeness of recording of expenditure.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Bun DaraДокумент10 страницBun DaraSifa MtashaОценок пока нет

- Management Accounting Assingment OneДокумент15 страницManagement Accounting Assingment OneSifa MtashaОценок пока нет

- Financial AccountsДокумент8 страницFinancial AccountsSifa MtashaОценок пока нет

- Key challenges facing public sector leadersДокумент6 страницKey challenges facing public sector leadersSifa MtashaОценок пока нет

- Management Accounting Assingment OneДокумент15 страницManagement Accounting Assingment OneSifa MtashaОценок пока нет

- Interest Rate OptionsДокумент46 страницInterest Rate OptionsFaridОценок пока нет

- FAДокумент7 страницFASifa MtashaОценок пока нет

- AuditingДокумент5 страницAuditingSifa MtashaОценок пока нет

- f8 June 2009 Question PaperДокумент6 страницf8 June 2009 Question PaperathararainОценок пока нет

- Probate and Administration Ordinance, (Cap. 445)Документ42 страницыProbate and Administration Ordinance, (Cap. 445)Sifa MtashaОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- A Guide To Strategic Human Resource PlanningДокумент12 страницA Guide To Strategic Human Resource PlanningSeipati Phumzy CholotaОценок пока нет

- Lesson: 7 Human Resource Planning: Process, Methods, and TechniquesДокумент36 страницLesson: 7 Human Resource Planning: Process, Methods, and Techniquesranjann349Оценок пока нет

- Question FourДокумент1 страницаQuestion FourSifa MtashaОценок пока нет

- Assignment Number 3 AUDITINGДокумент14 страницAssignment Number 3 AUDITINGSifa MtashaОценок пока нет

- Nzingula Swali La 3Документ3 страницыNzingula Swali La 3Sifa MtashaОценок пока нет

- Question TwoДокумент1 страницаQuestion TwoSifa MtashaОценок пока нет

- Question ThreeДокумент1 страницаQuestion ThreeSifa MtashaОценок пока нет

- Matalas Co internal audit independence issues and recommendations (38 charactersДокумент1 страницаMatalas Co internal audit independence issues and recommendations (38 charactersSifa MtashaОценок пока нет

- Answer 3Документ4 страницыAnswer 3Sifa MtashaОценок пока нет

- Answer. 4. Benefits of Audit Committee in Conoy Co - LTD.: Assistance With Financial Reporting (No Finance Expertise)Документ2 страницыAnswer. 4. Benefits of Audit Committee in Conoy Co - LTD.: Assistance With Financial Reporting (No Finance Expertise)Sifa MtashaОценок пока нет

- Answer 2Документ2 страницыAnswer 2Sifa MtashaОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Dissertation On HR AuditДокумент6 страницDissertation On HR AuditBuyAPhilosophyPaperUK100% (1)

- Financial Regulations 2010 - 2Документ7 страницFinancial Regulations 2010 - 2stthomasiowОценок пока нет

- Runaya Refining LLLP IMS Internal Audit Checklist ReviewДокумент2 страницыRunaya Refining LLLP IMS Internal Audit Checklist Reviewdeep maliОценок пока нет

- Ohsas 18001 2007Документ29 страницOhsas 18001 2007не мораОценок пока нет

- Acca - Case StudyДокумент11 страницAcca - Case Studyseda198573% (11)

- Good Corporate Governance Manual: PT Apexindo Pratama Duta, Tbk. Dan Seluruh Unit-Unit UsahaДокумент66 страницGood Corporate Governance Manual: PT Apexindo Pratama Duta, Tbk. Dan Seluruh Unit-Unit UsahaapingОценок пока нет

- External Audit ChecklistДокумент15 страницExternal Audit ChecklistJeff Drew100% (1)

- BCM Diagnostic Tool 1Документ7 страницBCM Diagnostic Tool 1JulioIglesiasОценок пока нет

- Agenda Ordinary Meeting of CouncilДокумент329 страницAgenda Ordinary Meeting of CouncilAlexander DarlingОценок пока нет

- C-TPAT Membership Security Model Summary: Report Generated By: Hugo MedranoДокумент33 страницыC-TPAT Membership Security Model Summary: Report Generated By: Hugo MedranoaLBERTOОценок пока нет

- ISO14001-EMS Self-Assessment Checklist PDFДокумент21 страницаISO14001-EMS Self-Assessment Checklist PDFshujad77100% (1)

- Servalakshmi Paper LTD 5334010315Документ86 страницServalakshmi Paper LTD 5334010315earnrockzОценок пока нет

- CA Fresher Interview Questions for Internal AuditДокумент3 страницыCA Fresher Interview Questions for Internal AuditNIMESH BHATTОценок пока нет

- Auditing Theory Test BankДокумент32 страницыAuditing Theory Test BankJane Estrada100% (2)

- Adidas Audit Manual enДокумент16 страницAdidas Audit Manual enAkashdeep MukherjeeОценок пока нет

- Chapter 14 - Comparative International Auditing and Corporate GovernanceДокумент11 страницChapter 14 - Comparative International Auditing and Corporate GovernanceLoretta SuryadiОценок пока нет

- BAKER TILLY MKM DIRECTORYДокумент14 страницBAKER TILLY MKM DIRECTORYklamsОценок пока нет

- Business ProcessesДокумент30 страницBusiness ProcessesMarisol AunorОценок пока нет

- Auditing Notes by Rehan Farhat ISA 300Документ21 страницаAuditing Notes by Rehan Farhat ISA 300Omar SiddiquiОценок пока нет

- Case Study DohДокумент9 страницCase Study DohQueenie QuisidoОценок пока нет

- Assurance engagements and auditing standardsДокумент16 страницAssurance engagements and auditing standardsnerissa belloОценок пока нет

- Presentation NABL 091214Документ51 страницаPresentation NABL 091214Nak's PОценок пока нет

- ADWEA's Sustainability Journey BeginsДокумент66 страницADWEA's Sustainability Journey Beginsepurice5022100% (1)

- Guilford County AuditДокумент5 страницGuilford County AuditWfmy TegnaОценок пока нет

- ISO 9001 & ISO 140001 2015 VersionДокумент40 страницISO 9001 & ISO 140001 2015 VersionIsmail toro75% (4)

- Session 7 Dashboard ControlsДокумент30 страницSession 7 Dashboard ControlsSheikh Ahmer HameedОценок пока нет

- Audit and Corporate Governance Unit IДокумент23 страницыAudit and Corporate Governance Unit IAbhishek JhaОценок пока нет

- Effectiveness of The Operation.: AuditsДокумент4 страницыEffectiveness of The Operation.: AuditsAllia AntalanОценок пока нет

- LLL Case Study PDFДокумент159 страницLLL Case Study PDFRakesh JangraОценок пока нет

- Final Thesis - Biruk TesfayeДокумент101 страницаFinal Thesis - Biruk TesfayeNaod MekonnenОценок пока нет