Академический Документы

Профессиональный Документы

Культура Документы

Assignment CTP Dr. Shipra Jindal

Загружено:

Abhishek AroraИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Assignment CTP Dr. Shipra Jindal

Загружено:

Abhishek AroraАвторское право:

Доступные форматы

Management Programme

ASSIGNMENT

3rd SEMESTER 2012-13

COURSE CODE: MS 223

PAPER NAME: Corporate Tax Planning

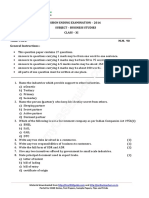

ASSIGNMENT 1 Course Code Paper Name Coverage : : : MS - 223 Corporate Tax Planning

UNIT 1

Answer all the questions Max Marks

Q1. Define the following terms 1X5 i) Income ii) Previous Year iii) Person iv) Agricultural Income v) Non Resident Q2 Short Type Questions (200 Words) 2X5 i) Discuss the concept of Income .Explain Various Sources with Sections. ii) iii) iv) v) Explain Incidence of Income. Comment on Tax Incidence of Agricultural Income Comment Income earned in Previous Year is taxed in assessment year. Explain the term Person according to income tax act?

Q3 Long Type Question (2000 Words) 1X15 Describe Residential Status of an Individual in detail.

ASSIGNMENT 2 Course Code Paper Name Coverage : : : MS - 223 Corporate Tax Planning

UNIT 2

Answer all the questions Max Marks Q1. Define the following terms 1X5 i) Company ii) Salary iii) Capital Gain iv) Cost of Improvement v) Presumptive Taxation Q2 Short Type Questions (200 2X5 i) Explain Perquisites & its Types on basis of Taxability. ii) iii) iv) v) Discuss the essential steps of calculating Capital Gain. Describe expenses allowed for deduction under the head Income from Business & Profession. What is meant by Retirement Benefits Explain Income from House Property Words)

Q3 Long Type Question (2000 Words) 1X15

Explain Allowances under the head Income from Salary & their tax incidence.

ASSIGNMENT 3 Course Code Paper Name Coverage : : : MS - 223 Corporate Tax Planning

UNIT 3

Answer all the questions Max Marks

Q1. Define the following terms 1X5 i) Tax Avoidance ii) Tax Evasion iii) Lease iv) Capital Structure v) Merger Q2 2X5 i) Explain Tax Planning Undertaking with Reference to: Location of Short Type Questions (200 Words)

ii) iii) iv) v)

Explain Tax Planning concepts to be kept in mind at time of mergers of the company. Explain Tax Planning with Reference to type of activity undertaken by any organization. Explain Tax Planning concepts in relation to managerial remuneration. Explain term merger & Demerger according to act.

Q3 Long Type Question (2000 Words) 1X15 Compare & Contrast Tax planning, Evasion & Avoidance.

ASSIGNMENT 4 Course Code : MS - 223

Paper Name Coverage :

Corporate Tax Planning

UNIT 4

Answer all the questions Max Marks Q1. Define the following terms 1X5 i) Returns ii) Assessments iii) TDS iv) Advance Tax v) Appeals Q2 Short Type Questions (200 Words) 2X5 i) Explain various forms available for return filling, ii) Describe the term TDS .Is TDS & Tax collected at source are different or same. iii) Explain various penalties to be imposed under IT act. iv) Explain concept of appeals under IT Act. v) Describe Advance rulings & its applicability.

Q3 Long Type Question (2000 Words) 1X15 Describe provisions of Double Taxation Avoidance Agreement in detail.

Вам также может понравиться

- Max Bupa Premium Reeipt - Parents PDFДокумент1 страницаMax Bupa Premium Reeipt - Parents PDFAnand29% (7)

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers and AcquisitionsОт EverandInvestment Banking: Valuation, Leveraged Buyouts, and Mergers and AcquisitionsРейтинг: 5 из 5 звезд5/5 (2)

- Legal Framework For Business Model QuestionsДокумент11 страницLegal Framework For Business Model QuestionsTitus ClementОценок пока нет

- Paystub 04.30.2019 PDFДокумент1 страницаPaystub 04.30.2019 PDFGanesh RautОценок пока нет

- CT2-PX-0 - QP-x2-x3Документ22 страницыCT2-PX-0 - QP-x2-x3AmitОценок пока нет

- Income Tax IДокумент4 страницыIncome Tax InishatОценок пока нет

- Mefa PDFДокумент4 страницыMefa PDFpadmajasivaОценок пока нет

- HonsДокумент49 страницHonsAASHUTOSH KASHYAPОценок пока нет

- Accountancy Class Xi Grow "N" Grades Chapter 1: Introduction To Accountancy Worksheet Test 1 (Total 20 Marks)Документ2 страницыAccountancy Class Xi Grow "N" Grades Chapter 1: Introduction To Accountancy Worksheet Test 1 (Total 20 Marks)Geetika GoyalОценок пока нет

- Actuarial Society of India: ExaminationsДокумент9 страницActuarial Society of India: ExaminationsAmitОценок пока нет

- (Assignment) : Business OrganizationДокумент14 страниц(Assignment) : Business OrganizationDikshant NehraОценок пока нет

- Certificate in Business Skills / Bachelor's Degree ProgrammeДокумент4 страницыCertificate in Business Skills / Bachelor's Degree ProgrammeTilak Dev AnandОценок пока нет

- 1mba FM 042mbaДокумент3 страницы1mba FM 042mbaAtindra ShahiОценок пока нет

- (Xi) 2023 Target Paper Eco, Poc, Acc & Bmaths by Sir IrfanДокумент17 страниц(Xi) 2023 Target Paper Eco, Poc, Acc & Bmaths by Sir IrfanMosa AbdullahОценок пока нет

- Nov 06Документ24 страницыNov 06Vascilly TerentievОценок пока нет

- Kothapally HarikaДокумент7 страницKothapally HarikaAnonymous ROM9l4xuzОценок пока нет

- Financial Accounting: Actividad IДокумент4 страницыFinancial Accounting: Actividad ILuca DoroОценок пока нет

- (ACC 2022) Xi Target Paper With MCQS by Sir Irfan JanДокумент38 страниц(ACC 2022) Xi Target Paper With MCQS by Sir Irfan Janrubab123Оценок пока нет

- School Tutorials 33Документ1 страницаSchool Tutorials 33Venkat RamОценок пока нет

- Btech 7 Sem Entrepreneurship Development Noe 071 2018 19Документ2 страницыBtech 7 Sem Entrepreneurship Development Noe 071 2018 19127 -ME 54-Sumit SinghОценок пока нет

- ECONOMIC ADMINISTRATION AND FINANCIAL MANAGEMENT First Paper: Business EconomicsДокумент4 страницыECONOMIC ADMINISTRATION AND FINANCIAL MANAGEMENT First Paper: Business EconomicsGuruKPOОценок пока нет

- Mba (Ib) - Ii CP-207 EximДокумент2 страницыMba (Ib) - Ii CP-207 EximShobhit AgrawalОценок пока нет

- Approximately of 400 Words. Each Question Is Followed by Evaluation SchemeДокумент2 страницыApproximately of 400 Words. Each Question Is Followed by Evaluation SchemeBadder DanbadОценок пока нет

- UntitledДокумент98 страницUntitledramu146Оценок пока нет

- Sqp319e PDFДокумент22 страницыSqp319e PDFvichmegaОценок пока нет

- Assignment FmiДокумент2 страницыAssignment Fmibansaluday5Оценок пока нет

- MF0012Документ3 страницыMF0012Rajesh SinghОценок пока нет

- Assignments MAДокумент4 страницыAssignments MAYashi SinghОценок пока нет

- MF0012 - Summer 2014Документ2 страницыMF0012 - Summer 2014Rajesh SinghОценок пока нет

- May 2006 Examinations: Managerial LevelДокумент33 страницыMay 2006 Examinations: Managerial LevelMuhammad Yasir GondalОценок пока нет

- BEFA Important QuestionsДокумент8 страницBEFA Important QuestionsAnush Varma KakarlapudiОценок пока нет

- 2015 11 Lyp Business Studies 01Документ2 страницы2015 11 Lyp Business Studies 01gmuthu2000Оценок пока нет

- Mba Programme (3 Year) Ii Year Assignment Question Papers 2010-2011 201: Human Resource ManagementДокумент9 страницMba Programme (3 Year) Ii Year Assignment Question Papers 2010-2011 201: Human Resource ManagementDeep Narayan RamОценок пока нет

- Cge101 2020 01 Tl1 Summ AssДокумент8 страницCge101 2020 01 Tl1 Summ AssKurt BrockerhoffОценок пока нет

- Bba 2Документ119 страницBba 2Rajan SinghОценок пока нет

- Afm - AДокумент2 страницыAfm - Asunru24Оценок пока нет

- 001 1-1gbr 2002 Dec QДокумент14 страниц001 1-1gbr 2002 Dec QArun KarthikОценок пока нет

- 17E00102-Business Environment & LawДокумент11 страниц17E00102-Business Environment & LawSuman Naveen JaiswalОценок пока нет

- Assignment and Seminar TopicsДокумент13 страницAssignment and Seminar TopicsSeenaОценок пока нет

- Departmental AccountДокумент9 страницDepartmental AccountDele AremoОценок пока нет

- Training Content CTP W-O FeeДокумент13 страницTraining Content CTP W-O FeeRizwan MalikОценок пока нет

- Managerial Economics and Financial AnalysisДокумент4 страницыManagerial Economics and Financial Analysissrihari100% (1)

- Bachelor'S Degree Programme 0 Term-End Examination June, 2018 Elective Course: Commerce Eco-001: Business OrganisationДокумент2 страницыBachelor'S Degree Programme 0 Term-End Examination June, 2018 Elective Course: Commerce Eco-001: Business OrganisationHrishikesh RayОценок пока нет

- Mba 1 Sem 14 DecДокумент2 страницыMba 1 Sem 14 DecrohanОценок пока нет

- Corporate Accounting 1 AssignmentДокумент3 страницыCorporate Accounting 1 AssignmentAfnan AlbОценок пока нет

- Business Laws (70) : Summer Exam-2013Документ21 страницаBusiness Laws (70) : Summer Exam-2013Khalid MahmoodОценок пока нет

- F1 Mock1 Quest PDFДокумент15 страницF1 Mock1 Quest PDFMoiez Ali33% (3)

- G/L Accounts - Individual Processing - in Company CodeДокумент6 страницG/L Accounts - Individual Processing - in Company CodeIrfan Putra SulaemanОценок пока нет

- Master of Commerce: 1 YearДокумент8 страницMaster of Commerce: 1 YearAston Rahul PintoОценок пока нет

- Basic FICO For MM & SDДокумент45 страницBasic FICO For MM & SDKristian SanchezchavezОценок пока нет

- Equivalent Subjects of Mcom Part I Old Syllabus To Mcom Part I New Syllabus Mcom Part I Old Syllabus Mcom Part I New SyllabusДокумент8 страницEquivalent Subjects of Mcom Part I Old Syllabus To Mcom Part I New Syllabus Mcom Part I Old Syllabus Mcom Part I New SyllabusDeepraj SinghОценок пока нет

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Документ4 страницыPart - A (: Time Allowed: 3 Hours Maximum Marks: 90Anonymous VaYaLmoX4Оценок пока нет

- Second Paper: Elements of Financial ManagementДокумент5 страницSecond Paper: Elements of Financial ManagementGuruKPOОценок пока нет

- Distance Learning 1st Year January BatchДокумент9 страницDistance Learning 1st Year January BatchChandan KumarОценок пока нет

- PGDT Assignment 2019-20 - 26092019Документ6 страницPGDT Assignment 2019-20 - 26092019abhishekchavda20Оценок пока нет

- MB0041 MQP Answer KeysДокумент21 страницаMB0041 MQP Answer Keysajeet100% (1)

- IBO - English Assign.Документ8 страницIBO - English Assign.Browse PurposeОценок пока нет

- REGULATIONS & SYLLABUS B-ComДокумент65 страницREGULATIONS & SYLLABUS B-ComRAMESHKUMAR.S MCE-LECT/MECHОценок пока нет

- Assignment BBA I Year 2017-18Документ13 страницAssignment BBA I Year 2017-18Jatin Pahuja0% (1)

- Question Papers Supplementary Exam 2007Документ24 страницыQuestion Papers Supplementary Exam 2007ce1978Оценок пока нет

- FINAL STRДокумент42 страницыFINAL STRAbhishek AroraОценок пока нет

- Axis 2013Документ212 страницAxis 2013Abhishek AroraОценок пока нет

- To Whomsoever It May ConcernДокумент1 страницаTo Whomsoever It May ConcernAbhishek AroraОценок пока нет

- Lightroom 5Документ57 страницLightroom 5Ree DexterОценок пока нет

- To Whomsoever It May ConcernДокумент1 страницаTo Whomsoever It May ConcernAbhishek AroraОценок пока нет

- Project On Toothpaste - Image Profile Analysis of Leading Brand ToothpastesДокумент47 страницProject On Toothpaste - Image Profile Analysis of Leading Brand Toothpastesshah faisal68% (37)

- IPO Project ReportДокумент36 страницIPO Project Reportkamdica94% (51)

- To Whomsoever It May ConcernДокумент1 страницаTo Whomsoever It May ConcernAbhishek AroraОценок пока нет

- FINAL STRДокумент42 страницыFINAL STRAbhishek AroraОценок пока нет

- MBA Full ProjectДокумент123 страницыMBA Full Projectdinesh877783% (18)

- Ethical Decision Making and Ethical LeadershipДокумент11 страницEthical Decision Making and Ethical LeadershipAbhishek AroraОценок пока нет

- 05 Chap003Документ61 страница05 Chap003Abhishek AroraОценок пока нет

- To Whomsoever It May ConcernДокумент1 страницаTo Whomsoever It May ConcernAbhishek AroraОценок пока нет

- 4.1 Kinds of TakeoverДокумент2 страницы4.1 Kinds of TakeoverAbhishek AroraОценок пока нет

- Current Affairjkjs 2012125125316880Документ1 страницаCurrent Affairjkjs 2012125125316880Abhishek AroraОценок пока нет

- 6137 Chap01Документ11 страниц6137 Chap01Abhishek AroraОценок пока нет

- Swot-Fdi in RetailДокумент12 страницSwot-Fdi in RetailShubha Brota RahaОценок пока нет

- CSRДокумент11 страницCSRAbhishek AroraОценок пока нет

- 4.1 Kinds of TakeoverДокумент2 страницы4.1 Kinds of TakeoverAbhishek AroraОценок пока нет

- 3 BV in Mergers and AcquisitionsДокумент27 страниц3 BV in Mergers and AcquisitionsZeko BekoОценок пока нет

- Roll Nos. of Candidates Shortlisted For The Interview For The Post of Assistants For Which Written Examination Was Held On April 29, 2012Документ38 страницRoll Nos. of Candidates Shortlisted For The Interview For The Post of Assistants For Which Written Examination Was Held On April 29, 2012Thomas SebastianОценок пока нет

- Bank Po Exam Model Question Papers ReleasedДокумент1 страницаBank Po Exam Model Question Papers ReleasedAbhishek AroraОценок пока нет

- Company ProfilelkДокумент4 страницыCompany ProfilelkAbhishek AroraОценок пока нет

- 47 MBA Project ListДокумент2 страницы47 MBA Project ListShamilee DhilОценок пока нет

- 05 Chap003Документ61 страница05 Chap003Abhishek AroraОценок пока нет

- Frankfinn Travel Assignment 1224668268202097 8Документ151 страницаFrankfinn Travel Assignment 1224668268202097 8Abhishek Arora50% (2)

- What Is E-Business and Does It Matter?Документ34 страницыWhat Is E-Business and Does It Matter?dhayal_sweet2005Оценок пока нет

- Oral Health Survey 2002: Appendix 1Документ3 страницыOral Health Survey 2002: Appendix 1Abhishek AroraОценок пока нет

- QuestinnairesДокумент1 страницаQuestinnairesAbhishek AroraОценок пока нет

- Tax Profile - FORMULARIO PARA MONETIZARДокумент3 страницыTax Profile - FORMULARIO PARA MONETIZARSANDRA MILENA RODRIGUEZ CARRILLOОценок пока нет

- E-Way BillДокумент1 страницаE-Way BillPEDAPUDI SIVAОценок пока нет

- Reliance Retail Limited Tax Invoice: Original For RecipientДокумент1 страницаReliance Retail Limited Tax Invoice: Original For RecipientalokОценок пока нет

- Exercise CorporationДокумент3 страницыExercise CorporationJefferson MañaleОценок пока нет

- GHFHДокумент8 страницGHFHnicahОценок пока нет

- Elan Epic Cost Sheet - LGF07-1292sqftДокумент4 страницыElan Epic Cost Sheet - LGF07-1292sqftAmit GolaОценок пока нет

- ITR AcknowledgementДокумент8 страницITR AcknowledgementVinod PatelОценок пока нет

- Chapter 26 Practice-notes-SALES-IGSTДокумент4 страницыChapter 26 Practice-notes-SALES-IGSTTEJA SINGH67% (3)

- CombinepdfДокумент19 страницCombinepdfYashodhaОценок пока нет

- BIR Ruling No. 009-90Документ2 страницыBIR Ruling No. 009-90Jessmar InsigneОценок пока нет

- Form 3251BДокумент2 страницыForm 3251BHarish ChandОценок пока нет

- Tax Quiz 2Документ5 страницTax Quiz 2Garcia Alizsandra L.Оценок пока нет

- Accounting Voucher 1Документ1 страницаAccounting Voucher 1Sadiq SultanОценок пока нет

- Alfseike Douglas AДокумент2 страницыAlfseike Douglas ADouglas AlfseikeОценок пока нет

- 0605 2018 - MP PDFДокумент1 страница0605 2018 - MP PDFAnonymous DohqBW7g0% (1)

- Donation ReceiptДокумент1 страницаDonation Receiptshiva krishnaОценок пока нет

- 0605 Certification FeeДокумент1 страница0605 Certification FeePAULA TVОценок пока нет

- Bemis Co Check Date Check Number: VOID - This Is Not A CheckДокумент1 страницаBemis Co Check Date Check Number: VOID - This Is Not A Checkfreeman p. donОценок пока нет

- CE Luzon v. CIRДокумент2 страницыCE Luzon v. CIRSab Amantillo Borromeo100% (1)

- Recipt of BWSSBДокумент1 страницаRecipt of BWSSBMahmood VdnОценок пока нет

- GST Aftab 2.0Документ76 страницGST Aftab 2.0AFTAB PIRJADEОценок пока нет

- Tally Erp 9 Exercise With GSTДокумент2 страницыTally Erp 9 Exercise With GSTSatyabarta73% (52)

- Answer SEVEN (7) Questions: Part A: Structured Questions (60 MARKS)Документ4 страницыAnswer SEVEN (7) Questions: Part A: Structured Questions (60 MARKS)navimala85Оценок пока нет

- TNTC Form 75CДокумент2 страницыTNTC Form 75Cjaiinfo84Оценок пока нет

- Threads (India) Limited: Particulars Credit DebitДокумент3 страницыThreads (India) Limited: Particulars Credit DebitRahul TekchandaniОценок пока нет

- Taxation 101 Amendment ActДокумент6 страницTaxation 101 Amendment Actnikitha chowdaryОценок пока нет

- Chartered ClubДокумент3 страницыChartered ClubkajshdiОценок пока нет

- May PurchasesДокумент1 страницаMay Purchasessrinivasa annamayyaОценок пока нет