Академический Документы

Профессиональный Документы

Культура Документы

Dabur India LTD: Key Financial Indicators

Загружено:

Hardik JaniОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Dabur India LTD: Key Financial Indicators

Загружено:

Hardik JaniАвторское право:

Доступные форматы

GICS Industry : Personal Products l Sub Industry : Personal Products l Website : www.dabur.

com

Dabur India Ltd

Key Stock Indicators

NSE Ticker : Bloomberg Ticker : Face value / Share: Div. Yield (%): DABUR DABUR:IN 1.0 1.9 CMP (as on 17 Feb 2011 Rs/Share): 52-weekrange up to 17 Feb 2011 (rs)(H/L): Market Cap as on 17 Feb 2011 (Rs Mn): Enterprise Value as on 17 Feb 2011 (Rs Mn): Div. Yield (%): 0.0 100.2 215.90/90.75 174,333 174,157 Shares outstanding (mn) : Free Float (%) : Average daily volumes (12 months) : Beta (2 year) : 1740.7 31.3 1,209,376 0.5

Dabur India Limited (DIL) was incorporated in 1975 for manufacture of high-grade edible and industrial guargum powder and its sophisticated derivatives. It is one of the leading FMCG companies in India and the world's largest Ayurvedic and natural healthcare companies. Operations are divided into 3 segments: Consumer care, consumer health and international business

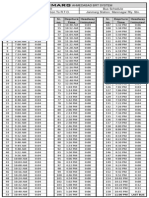

Key Financial Indicators

Revenue (Rs mn) EBITDA ma rgins (%) PAT (Rs mn) PAT ma rgins (%) Gea ring (x) EPS (Rs /s ha re) PE (x) P/BV (x) RoCE (%) RoE (%) EV/EBITDA (x)

n.m. : Not meaningful

KEY HIGHLIGHTS

New plants, acquisitions and new products launched in FY10 In FY10, the company commissioned a manufacturing facility at Baddi in Himachal Pradesh. It also completed the acquisition of Fem Care Pharma Ltd, which added ~3.5% to the top-line. DIL launched a host of new brands and products in FY10, including the Dabur Uveda range of Ayurvedic skin care products. The other major launch of the year was the Ral Burrst range of fruit-based beverages available in 4 variants. The company also introduced 2 new light hair oil brands Vatika Enriched Almond hair oil and Dabur Amla Flower Magic hair oil to expand its presence in the light hair oils category. Strong market presence and brand equity DIL markets products in more than 60 countries. The company has a strong market position, backed by products with good brand appeal, such as Dabur Chyawanprash (61% share in the chyawanprash market), Dabur Lal Danth Manjan and Dabur Red Toothpaste (13% share in oral care), and Dabur Amla, Vatika and Anmol (16% share in hair oils). Dabur is also the market leader in the fruit juice segment with 55% share through its Real and Active brands. In the digestives segment too, it holds 55% market share, with brands like Hajmola. Furthermore, Dabur is one of the largest producers of ayurvedic drugs in India and the world, a niche segment marked by the presence of a few national and numerous unorganised sector players. Wide distribution network DILs overseas business has, over the years, transformed from being a small operation into a multilocation business spanning and marketing its products in 60 countries all over the world, including the US, the Middle East, North and West Africa, South Asia and Europe. The overseas business has been growing at a CAGR of 36% for the past 6 years and today accounts for almost 20% of DILs sales. In India, the company has a wide distribution network covering 2.8 million (mn) retailers across the country and more than 5,000 distributors. For healthcare products, the company has a reach of 200,000 chemists, ~12,000 vaidyas and 12,000 ayurvedic pharmacies.

Mar-08 23,831.3 18.0 2,902.2 12.2 0.2 3.4 33.0 16.8 51.8 58.0 22.3

Mar-09 28,298.8 17.5 3,900.9 13.8 0.3 4.5 22.0 11.0 53.8 57.9 17.5

Mar-10 34,112.2 19.1 4,981.1 14.6 0.2 5.7 17.4 9.6 56.3 59.3 13.3

Shareholding (As on September 30, 2010)

FII 16% DII 8%

Others 7%

Promoter 69%

Indexed price chart

(index) 140 120 100 80 60 ('000) 8000 7000 6000 5000 4000 3000 2000 1000 0 Nov-10 Apr-10 Mar-10 May-10 Dec-10 Aug-10 Sep-10 Oct-10 Jun-10 Jul-10 Jan-11 NIFTY

KEY RISKS

Rising cost of raw material, transport and storage Competitive market conditions and new entrants to the market Inflationary pressures and other factors affecting demand for products

Stock Performances vis--vis market

Returns (%) YTD DABUR NIFTY

Note: 1) YTD returns are since Apr 01, 2010 to Feb 17, 2011. 2) 1-m, 3-m and 12-m returns are up to Feb 17, 2011.

40 20 Feb-10

1-m 1 -3

3-m 4 -10

12-m 19 14

26 4

Volumes (RHS)

DABUR

CRISIL COMPANY REPORT | 1

Dabur India Ltd

BACKGROUND

DIL was established as a private limited company in 1936, even though its founder, Dr S K Burman, laid the foundation with a small shop in Calcutta in 1884. DIL is one of the leading FMCG companies in India and the world's largest Ayurvedic and natural healthcare company; Dabur is today among India's most trusted names. The company's FMCG portfolio includes 5 flagship brands with distinct brand identities, with Dabur as the master brand for natural healthcare products, Vatika for premium personal care products, Anmol for affordable personal care products, Hajmola for digestives and Real for fruit-based drinks. In 2005, DIL acquired 3 companies of the Balsara group for Rs 1.43 billion (bn), along with the brands Promise, Babool, and Meswak in oral care and Odomos, Odonil, and Odopic in home care. In 2009, DIL acquired Fem Care Pharma Ltd for Rs 2.6 bn. DILs business structure is divided into 3 segments: Consumer care, which contributes ~71% to total revenues, consumer health, which contributes ~8% and international business, which accounts for ~20%. DIL has 17 world-class manufacturing plants catering to needs of diverse markets. The company markets its products in more than 60 countries across the world.

COMPETITIVE POSITION

Peer Comparison

Revenue (Rs mn) EBITDA ma rgins (%) PAT (Rs mn) PAT ma rgins (%) Gea ring (x) EPS (Rs /s ha re) PE (x) P/BV (x) RoCE (%) RoE (%) EV/EBITDA (x)

n.m: Not meaningful

Dabur India Ltd Mar-10 34,112.2 19.1 4,981.1 14.6 0.2 5.7 17.4 9.6 56.3 59.3 13.3

Colgate-Palmolive (India) Ltd. Mar-10 20,192.4 24.3 4,232.6 21.0 0.0 29.6 27.9 27.3 183.6 179.8 22.2

Godrej Consumer Products Ltd. Mar-10 12,791.6 22.2 2,481.2 19.4 0.0 11.6 30.3 7.2 35.6 30.1 39.5

Marico Ltd. Mar-10 20,164.2 16.1 2,350.2 11.7 0.7 3.9 31.8 10.4 33.0 44.2 24.6

FINANCIAL PROFILE

Significant increase in top-line and operating margin

Key Financial Indicators Units Revenue Rs mi ll ion Rs mi ll ion Per cent Per cent Per cent Times Per cent Per cent EBITDA ma rgins Per cent PAT PAT ma rgins EBITDA growth PAT growth Gea ring RoCE RoE

Mar-08

23,831.3 18.0 2,902.2 12.2 15.8 21.1 3.3 0.2 51.8 58.0

Mar-09

28,298.8 17.5 3,900.9 13.8 18.7 15.0 34.4 0.3 53.8 57.9

Mar-10

34,112.2 19.1 4,981.1 14.6 20.5 31.7 27.7 0.2 56.3 59.3

Consolidated sales increased by 20.6% to Rs 34.1 bn in FY10, from Rs 28.2 bn in FY09, mainly due to strong double-digit volume growth. The acquisition of Fem Care Pharma Ltd during the year contributed to a 3.5% increase in sales. Operating margin expanded by 160 basis points to 19.1% in FY10 from 17.5% in FY09, due to lower input costs. PAT consequently rose by ~28% to Rs 4.9 bn in FY10 vis--vis Rs 3.9 bn in FY09 principally due to higher operating profits and lower interest expense

Revenue growth Per cent

INDUSTRY PROFILE

FMCG Despite the global economic slowdown experienced over the last year, India's Fast Moving Consumer Goods (FMCG) sector has continued to show robust growth. The FMCG segment includes products like soaps, detergents, oral care, hair care and skin care products. India's FMCG market can be divided into two segments - urban and rural. The urban segment is characterized by high penetration levels and high spending propensity of the urban resident. The rural economy is largely agrarian - directly or indirectly dependent on agriculture as a means of livelihood with relatively lower levels of penetration and a large unorganized sector. In the recent past the government has focused upon development in the rural sector. This includes investments in development of infrastructure and schemes for job creation (such as NREGA). This is resulting in a rise in disposable incomes levels in the rural economy and consequently in demand for FMCGs. The demand is increasing by 18% in the rural areas and by 11% in urban areas. Over 300 million people are expected to move up from the category of rural poor to rural lower middle class between 2005 and 2025 and rural consumption levels are expected to rise to the current levels in urban India by 2017. The FMCG environment in India and overseas is competition intensive and companies need to focus on branding, product development, distribution and innovation to ensure their survival. Product innovations help to gain market share while advertising and sales promotions create visibility for the product.

CRISIL COMPANY REPORT | 2

Dabur India Ltd

ANNUAL RESULTS

Income Statement (Rs million ) Net Sales Operating Income EBITDA EBITDA Margin Depreciation Interest Other Income PBT PAT PAT Margin No. of shares (Mn No.) Earnings per share (EPS) Cash flow (Rs million ) Pre-tax profit Total tax paid Depreciation Change in working capital Cash flow from operating activities Capital Expenditure Investments and others Balance sheet (Rs million ) Equity share capital Reserves and surplus Tangible net worth Deferred tax liablity:|asset| Long-term debt Short-term-debt Total debt Current liabilities Total provisions Total liabilities Gross block Net fixed assets Investments Current assets Receivables Inventories Cash Total assets Ratio Mar-08 3,848.0 -499.0 364.3 1,629.3 5,342.6 -1,225.3 -1,230.2 Mar-09 4,470.6 -503.6 448.6 -289.8 4,125.8 -1,387.7 -1,432.5 Mar-10 6,025.2 -989.1 502.7 49.1 5,587.9 -1,678.3 828.6 Revenue growth (%) EBITDA growth(%) PAT growth(%) EBITDA margins(%) Tax rate (%) PAT margins (%) Dividend payout (%) Dividend per share (Rs) BV (Rs) Return on Equity (%) Return on capital employed (%) Gearing (x) Interest coverage (x) Debt/EBITDA (x) Asset turnover (x) Current ratio (x) Gross current assets (days) Mar-08 15.8 21.1 3.3 18.0 15.6 12.2 44.7 1.5 6.6 58.0 51.8 0.2 25.6 0.2 3.9 1.2 99 Mar-09 18.7 15.0 34.4 17.5 12.7 13.8 38.8 1.8 9.0 57.9 53.8 0.3 21.3 0.5 4.1 1.0 101 Mar-10 20.5 31.7 27.7 19.1 15.9 14.6 34.9 2.0 10.4 59.3 56.3 0.2 52.8 0.3 4.1 1.3 92

Mar-08 23,597.1 23,831.3 4,294.3 18.0 364.3 168.0 86.0 3,189.4 2,902.2 12.2 864.0 3.4

Mar-09 28,044.1 28,298.8 4,940.0 17.5 448.6 232.1 211.3 4,441.3 3,900.9 13.8 865.1 4.5

Mar-10 33,882.9 34,112.2 6,506.5 19.1 502.7 123.2 144.6 6,007.4 4,981.1 14.6 867.6 5.7

Mar-08 864.0 4,828.1 5,692.1 32.7 106.7 877.9 984.7 4,586.6 1,464.8 12,760.9 6,380.0 4,260.9 2,037.2 6,462.9 1,723.2 3,024.8 765.7 12,761.0

Mar-09 865.1 6,911.4 7,776.5 69.5 44.9 2,219.3 2,264.1 4,828.3 1,609.1 16,547.5 7,500.4 5,220.7 3,469.7 7,857.1 1,778.8 3,754.7 1,484.3 16,547.5

Mar-10 869.0 8,146.2 9,015.2 106.7 151.8 1,595.3 1,747.1 4,715.2 2,113.9 17,698.1 9,341.0 6,418.4 2,641.1 8,638.6 1,198.4 4,262.2 1,923.1 17,698.1

Cash flow from investing activities Equity raised/(repaid) Debt raised/(repaid) Dividend (incl. tax) Others (incl extraordinaries)

-2,455.5 52.2 -608.9 -1,516.3 -655.2

-2,820.2 53.6 1,279.5 -1,771.2 -149.0

-849.7 -136.7 -517.0 -2,031.0 -1,614.5

Cash flow from financing activities Change in cash position Opening cash Closing cash

n.m : Not meaningful;

-2,728.2 158.9 606.7 765.7

-587.1 718.5 765.7 1,484.3

-4,299.2 439.0 1,484.3 1,923.1

QUARTERLY RESULTS

Profit and loss account (Rs million) No of Months Revenue EBITDA Interes t Depreci a tion PBT PAT Dec-10 3 10,888.3 2,189.0 53.7 237.9 1,897.4 1,540.5 100.0 20.1 0.5 2.2 17.4 14.1 % of Rev Dec-09 % of Rev 3 9,321.1 1,832.5 37.2 145.6 1,649.7 1,378.4 100.0 19.7 0.4 1.6 17.7 14.8 Sep-10 3 9,895.1 2,195.8 45.9 189.6 1,960.3 1,604.3 100.0 22.2 0.5 1.9 19.8 16.2 % of Rev Dec-10 % of Rev 9 30,107.2 5,911.0 144.3 572.1 5,194.6 4,218.8 100.0 19.6 0.5 1.9 17.3 14.0 Dec-09 9 25,413.5 4,955.2 106.9 408.3 4,440.0 3,691.3 100.0 19.5 0.4 1.6 17.5 14.5 % of Rev

CRISIL COMPANY REPORT | 3

Dabur India Ltd

FOCUS CHARTS & TABLES

Rs mn 12,000 10,000 8,000 6,000 4,000 2,000 0 Dec-08 Dec-09 Mar-08 Mar-09 Mar-10 Dec-10 Sep-08 Sep-09 Sep-10 Jun-08 Jun-09 Jun-10 10 5 0

Quarterly sales & y-o-y growth

Per cent 25 20 15

Rs mn 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 Jun-08 Mar-08

Quarterly PAT & y-o-y growth

Per cent 35 30 25 20 15 10 5 0

Dec-08

Dec-09

Mar-09

Sales

Sales growth y-o-y (RHS)

Net Profit

Net profit growth y-o-y (RHS)

Rs/share 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 Dec-08

EPS

Per cent 25 20 15 10 5 0

Movement in operating and net margins

Dec-08

Dec-09

Mar-10

Mar-08

Mar-09

Dec-09

Mar-08

Mar-09

Mar-10

Dec-10

Sep-08

Sep-09

Sep-10

Jun-08

Jun-09

Jun-10

OPM

Mar-10

NPM

Shareholding Pattern (Per cent) Mar 2010 Jun 2010 Promoter 69.0 68.9 FII 14.3 14.8 DII 10.0 10.0 Others 6.8 6.3

Sep 2010 68.7 16.2 8.1 7.0

Dec 2010 68.7 16.4 7.8 7.1

B oard of D irectors D irector N am e An a n d Ch a n d B u rm a n (D r.) R a vi n d ra Ch a n d ra B h a rg a va (M r.) Am i t B u rm a n (M r.) M o h i t V i ve k B u rm a n (M r.) Pra d i p B u rm a n (M r.) Aja y D u a (D r.) S u n i l D u g g a l (M r.) Pri ta m D a s N a ra n g (M r.) S u b b a ra m a n N a ra ya n (D r.) Al b e rt W i s e m a n Pa te rs o n (M r.) V i ja y N a ta ra ja s a rm a Pa tta m a d a i (M r.) An a l ji t S i n g h (M r.)

D esig nation N o n -Exe cu ti ve Ch a i rm a n , Pro m o te rD i re cto r, N o n -Exe cu ti ve D i re cto r N o n -Exe cu ti ve D i re cto r N o n -Exe cu ti ve D i re cto r, Pro m o te rD i re cto r N o n -Exe cu ti ve D i re cto r, Pro m o te rD i re cto r Pro m o te r-D i re cto r N o n -Exe cu ti ve D i re cto r W h o l e ti m e D i re cto r W h o l e ti m e D i re cto r N o n -Exe cu ti ve D i re cto r N o n -Exe cu ti ve D i re cto r N o n -Exe cu ti ve D i re cto r N o n -Exe cu ti ve D i re cto r

Additional Disclosure This report has been sponsored by NSE - Investor Protection Fund Trust (NSEIPFT). Disclaimer This report is based on data publicly available or from sources considered reliable. CRISIL Ltd. (CRISIL) does not represent that it is accurate or complete and hence, it should not be relied upon as such. The data / report is subject to change without any prior notice. Opinions expressed herein are our current opinions as on the date of this report. Nothing in this report constitutes investment, legal, accounting or tax advice or any solicitation, whatsoever. The subscriber / user assume the entire risk of any use made of this data / report. CRISIL especially states that, it has no financial liability whatsoever, to the subscribers / users of this report. This report is for the personal information only of the authorised recipient in India only. This report should not be reproduced or redistributed or communicated directly or indirectly in any form to any other person especially outside India or published or copied in whole or in part, for any purpose. CRISIL is not responsible for any errors and especially states that it has no financial liability whatsoever to the subscribers / users / transmitters / distributors of this report. For information please contact 'Client Servicing' at +91-22-33423561, or via e-mail: clientservicing@crisil.com.

CRISIL COMPANY REPORT | 4

Dec-10

Sep-08

Sep-09

Sep-10

Jun-08

Jun-09

Jun-10

Dec-10

Sep-08

Sep-09

Sep-10

Jun-09

Jun-10

Вам также может понравиться

- Hindustan Unilever LTD: Key Financial IndicatorsДокумент4 страницыHindustan Unilever LTD: Key Financial Indicatorssoft.mayank6348Оценок пока нет

- MS Investor Presentation Jun 2011 v1Документ26 страницMS Investor Presentation Jun 2011 v1gautam_s_kОценок пока нет

- DIL Inv - Presentation May 12Документ38 страницDIL Inv - Presentation May 12Yatin SehgalОценок пока нет

- Diwakar SharmaДокумент28 страницDiwakar SharmaDiwakar sharmaОценок пока нет

- DIL India InvConf May 2010Документ33 страницыDIL India InvConf May 2010Puneet KumarОценок пока нет

- WFH: Project Study On Industry and Organization: Sec A: Industry Report Sec B: Organisation Report Sec C: Major ProcessДокумент50 страницWFH: Project Study On Industry and Organization: Sec A: Industry Report Sec B: Organisation Report Sec C: Major ProcessNandini AgarwalОценок пока нет

- Equity Research On FMCG SectorДокумент41 страницаEquity Research On FMCG SectorRahul Tilak0% (1)

- Monika Sritharan Murali PurnimaДокумент28 страницMonika Sritharan Murali PurnimaSridhar KousalyaОценок пока нет

- Ratio Analysis On Dabur India LTDДокумент58 страницRatio Analysis On Dabur India LTDhoney08priya1Оценок пока нет

- Report On FMCG SectorДокумент29 страницReport On FMCG SectoradityaintouchОценок пока нет

- FMCGДокумент53 страницыFMCGAditi AggarwalОценок пока нет

- FMCG Companies in IndiaДокумент7 страницFMCG Companies in IndiaAnuj KumarОценок пока нет

- Dabur India LTD.: Presented By: Deepak Section - A ROLL NO. - 2379Документ22 страницыDabur India LTD.: Presented By: Deepak Section - A ROLL NO. - 2379'Uday RanaОценок пока нет

- A Study On Capital Structure: With Reference To FMCG CompaniesДокумент36 страницA Study On Capital Structure: With Reference To FMCG CompaniesArpit KulshreshthaОценок пока нет

- Dabur India Limited Corporate Profile: August, 2009Документ37 страницDabur India Limited Corporate Profile: August, 2009Shabaaz ShaikhОценок пока нет

- Dissertation On DaburДокумент99 страницDissertation On Dabursona2791100% (1)

- Report On FMCG SectorДокумент29 страницReport On FMCG Sectoraqas_khanОценок пока нет

- Dabur India LTD.: Equity Research ReportДокумент40 страницDabur India LTD.: Equity Research ReportshakeDОценок пока нет

- FMCG Industry Analysis - DoperzДокумент10 страницFMCG Industry Analysis - DoperzSidd123Оценок пока нет

- Dabur Iindia Limited - FinalДокумент37 страницDabur Iindia Limited - FinalKaashvi HiranandaniОценок пока нет

- FMCGДокумент11 страницFMCGShivank SharmaОценок пока нет

- G CF MMTTy MFQo 1582661818084Документ6 страницG CF MMTTy MFQo 1582661818084Dev ShahОценок пока нет

- Ratio Analysis On Dabur India Ltd.Документ62 страницыRatio Analysis On Dabur India Ltd.dheeraj dawar50% (2)

- Company Review Session On: Submitted byДокумент45 страницCompany Review Session On: Submitted bySukumar ReddyОценок пока нет

- DIL Investor Presentation March 11Документ37 страницDIL Investor Presentation March 11Suresh AketiОценок пока нет

- Aniket DDabur. SMДокумент9 страницAniket DDabur. SMBushalОценок пока нет

- P&G Company Financial AnalysisДокумент42 страницыP&G Company Financial Analysisramki07303375% (4)

- FMCG Sector AnalysisДокумент7 страницFMCG Sector AnalysisKrutika AbitkarОценок пока нет

- 13 Chapter 2Документ64 страницы13 Chapter 2Nitin SengarОценок пока нет

- ColgateДокумент21 страницаColgateABHISHEK KHURANAОценок пока нет

- Dabur's Growth Strategy in IndiaДокумент2 страницыDabur's Growth Strategy in Indiagscentury27Оценок пока нет

- INTRODUCTION The Fast Moving Consumer Goods (FMCG)Документ22 страницыINTRODUCTION The Fast Moving Consumer Goods (FMCG)vaidehi_39883252100% (3)

- Final Copy of HulДокумент50 страницFinal Copy of HulNilesh AhujaОценок пока нет

- Dabur India HapurДокумент93 страницыDabur India Hapurtariquewali11Оценок пока нет

- Fast Moving Consumer GoodsДокумент25 страницFast Moving Consumer GoodsPinky AgarwalОценок пока нет

- Dabur Annual Report 2011 12Документ140 страницDabur Annual Report 2011 12Vipul BhatiaОценок пока нет

- Assignment On HUL LTDДокумент8 страницAssignment On HUL LTDIshwar RajputОценок пока нет

- Capital Strutur of FMCG &automobile SectorДокумент39 страницCapital Strutur of FMCG &automobile SectorJithin PonathilОценок пока нет

- Boroline Brand StrategyДокумент25 страницBoroline Brand StrategyDigvijay Singh100% (2)

- A Project Report On: Marketing Strategy of Dabur Vatika Hair Oil & Dabur ChyawanprashДокумент88 страницA Project Report On: Marketing Strategy of Dabur Vatika Hair Oil & Dabur Chyawanprashvkumar_34528750% (2)

- MM Final ProjectДокумент24 страницыMM Final ProjectNishan ShettyОценок пока нет

- PROJECT - REPORT On AdidasДокумент49 страницPROJECT - REPORT On AdidasChetan SharmaОценок пока нет

- Dabur India (DABIND) : Safe Bet On Natural' Consumer BusinessДокумент11 страницDabur India (DABIND) : Safe Bet On Natural' Consumer Businessarun_algoОценок пока нет

- Financial Ratio Analysis of HULДокумент28 страницFinancial Ratio Analysis of HULRakesh Balani80% (5)

- Channel Management of DaburДокумент15 страницChannel Management of DaburMonangshu MallickОценок пока нет

- ACI LimitedДокумент6 страницACI Limitedtanvir616Оценок пока нет

- MAC Project - Group 6Документ26 страницMAC Project - Group 6Vatsal SharmaОценок пока нет

- Investment TДокумент4 страницыInvestment TRohit GuptaОценок пока нет

- Final Sa Project FinalДокумент25 страницFinal Sa Project FinalPratik PurohitОценок пока нет

- Upload Login SignupДокумент48 страницUpload Login SignupsimpyishraОценок пока нет

- C C !"!# !"" # $ % % &C% ' +, (KДокумент4 страницыC C !"!# !"" # $ % % &C% ' +, (KnithindnnОценок пока нет

- Competition Law AssignmentДокумент14 страницCompetition Law AssignmentKshitij KatiyarОценок пока нет

- India Personal Care Market - Case Study - Sakshi GuptaДокумент7 страницIndia Personal Care Market - Case Study - Sakshi GuptaSakshi GuptaОценок пока нет

- Legal ManagementДокумент47 страницLegal ManagementBhavya BhartiОценок пока нет

- Market Share of Major FMCG Companies: Revenues in Crores INRДокумент4 страницыMarket Share of Major FMCG Companies: Revenues in Crores INRabhijeetОценок пока нет

- Group 19 - Case - 21PGDM077 - PraptiДокумент22 страницыGroup 19 - Case - 21PGDM077 - PraptiPRAPTI TIWARIОценок пока нет

- A Comprehensive Report On Consumer Research On FMCG Sector With Reference To Packed FoodДокумент60 страницA Comprehensive Report On Consumer Research On FMCG Sector With Reference To Packed FoodAKANKSHAОценок пока нет

- Soaps & Detergents World Summary: Market Values & Financials by CountryОт EverandSoaps & Detergents World Summary: Market Values & Financials by CountryОценок пока нет

- Building Manufacturing Competitiveness: The TOC WayОт EverandBuilding Manufacturing Competitiveness: The TOC WayРейтинг: 3 из 5 звезд3/5 (1)

- Model Answer: E-Commerce store launch by Unilever in Sri LankaОт EverandModel Answer: E-Commerce store launch by Unilever in Sri LankaОценок пока нет

- Maninagar To Rto Bus Schedule 01072010Документ1 страницаManinagar To Rto Bus Schedule 01072010Hardik JaniОценок пока нет

- Dabur India LimitedДокумент3 страницыDabur India LimitedHardik JaniОценок пока нет

- E-Commerce: Assignment OnДокумент5 страницE-Commerce: Assignment OnHardik JaniОценок пока нет

- Distributor Channel OptimizationДокумент14 страницDistributor Channel OptimizationMinh Hoàng Nguyễn HữuОценок пока нет

- THE Winter Project ON Organisatonal Studies AT Saber Flexipack PVT LTDДокумент45 страницTHE Winter Project ON Organisatonal Studies AT Saber Flexipack PVT LTDHardik JaniОценок пока нет

- Dupont Analysis of Asian PaintsДокумент4 страницыDupont Analysis of Asian Paintsdeepaksg787Оценок пока нет

- Written Recitation - AnswerДокумент2 страницыWritten Recitation - AnswerJoovs JoovhoОценок пока нет

- Annual Report FY15 16 PDFДокумент256 страницAnnual Report FY15 16 PDFRAMОценок пока нет

- CadburryДокумент8 страницCadburryEunice FloresОценок пока нет

- Ch. 3 HW ExplanationДокумент7 страницCh. 3 HW ExplanationJalaj GuptaОценок пока нет

- 7 Ways To Shortlist The Right StocksДокумент10 страниц7 Ways To Shortlist The Right Stockskrana26Оценок пока нет

- Primary Purpose - RetailДокумент1 страницаPrimary Purpose - RetailAngelo Labios50% (2)

- Sustainability Busness ModelДокумент16 страницSustainability Busness ModelKhoulita Cherif100% (1)

- Corporate VeilДокумент11 страницCorporate VeiltullaramОценок пока нет

- AL Malkawi 2007Документ28 страницAL Malkawi 2007Yolla Monica Angelia ThenuОценок пока нет

- VL EXAM Set AДокумент6 страницVL EXAM Set ADavid GodiaОценок пока нет

- Adverse Reporting On AuditДокумент2 страницыAdverse Reporting On AuditRIZA LUMAADОценок пока нет

- 3.13 Concept Map - Shareholders' Equity Part IДокумент2 страницы3.13 Concept Map - Shareholders' Equity Part IShawn Cassidy F. GarciaОценок пока нет

- Oil & Gas Project FinanceДокумент22 страницыOil & Gas Project Finance78arthurОценок пока нет

- Ghoshal - Bad Management Theories Are Destroying Good Management Practi PDFДокумент17 страницGhoshal - Bad Management Theories Are Destroying Good Management Practi PDFCarlos SantiagoОценок пока нет

- Audit BoyntonДокумент27 страницAudit BoyntonMasdarR.MochJetrezzОценок пока нет

- BIR Ruling (DA - (C-066) 228-09) - Capital Infusion in The Form of APIC Not Subject To Donor's TaxДокумент8 страницBIR Ruling (DA - (C-066) 228-09) - Capital Infusion in The Form of APIC Not Subject To Donor's TaxJerwin Dave100% (1)

- TP 1 Financial ModellingДокумент9 страницTP 1 Financial ModellingChristina Yunita Intan100% (1)

- Corporation Law ReviewerДокумент3 страницыCorporation Law ReviewerJada WilliamsОценок пока нет

- Equity SecuritiesДокумент25 страницEquity Securitieslana del reyОценок пока нет

- Ceylon Beverage Holdings PLC - Notice & Form of Proxy - 6108338117833530-8Документ4 страницыCeylon Beverage Holdings PLC - Notice & Form of Proxy - 6108338117833530-8safdfefОценок пока нет

- Sole ProprietorshipДокумент3 страницыSole ProprietorshipjeromeencioОценок пока нет

- Slides Higgins 11e CH 1Документ18 страницSlides Higgins 11e CH 1Huy NguyễnОценок пока нет

- Corpo Digested IncompleteДокумент28 страницCorpo Digested IncompleteERWINLAV2000Оценок пока нет

- Preview of Chapter 16: ACCT2110 Intermediate Accounting II Weeks 6 and 7Документ111 страницPreview of Chapter 16: ACCT2110 Intermediate Accounting II Weeks 6 and 7Chi Iuvianamo100% (1)

- SegmentДокумент11 страницSegmentSiva SankariОценок пока нет

- Fine 707Документ6 страницFine 707Anonymous NOSL188B0% (1)

- DuluxGroup Annual Report November 2017Документ136 страницDuluxGroup Annual Report November 2017Farah SafrinaОценок пока нет

- Ch18-11 Worksheet Syed Qamar Osama Raheel Shahrukh MughalДокумент2 страницыCh18-11 Worksheet Syed Qamar Osama Raheel Shahrukh MughalSyed Qamar100% (2)

- Business CombinationДокумент6 страницBusiness CombinationJalieha Mahmod0% (1)