Академический Документы

Профессиональный Документы

Культура Документы

Jurnal Islam Akuntasi Syariah PDF

Загружено:

Condro TriharyonoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Jurnal Islam Akuntasi Syariah PDF

Загружено:

Condro TriharyonoАвторское право:

Доступные форматы

Journal of Islamic Accounting and Business Research

Emerald Article: Viewpoints: when the Islamisation model doesn't work Razwan Ul-Haq

Article information:

To cite this document: Razwan Ul-Haq, (2012),"Viewpoints: when the Islamisation model doesn't work", Journal of Islamic Accounting and Business Research, Vol. 3 Iss: 1 pp. 57 - 66 Permanent link to this document: http://dx.doi.org/10.1108/17590811211216069 Downloaded on: 12-02-2013 References: This document contains references to 7 other documents To copy this document: permissions@emeraldinsight.com This document has been downloaded 141 times since 2012. *

Users who downloaded this Article also downloaded: *

Razwan Ul-Haq, (2012),"Viewpoints: when the Islamisation model doesn't work", Journal of Islamic Accounting and Business Research, Vol. 3 Iss: 1 pp. 57 - 66 http://dx.doi.org/10.1108/17590811211216069 Razwan Ul-Haq, (2012),"Viewpoints: when the Islamisation model doesn't work", Journal of Islamic Accounting and Business Research, Vol. 3 Iss: 1 pp. 57 - 66 http://dx.doi.org/10.1108/17590811211216069 Razwan Ul-Haq, (2012),"Viewpoints: when the Islamisation model doesn't work", Journal of Islamic Accounting and Business Research, Vol. 3 Iss: 1 pp. 57 - 66 http://dx.doi.org/10.1108/17590811211216069

Access to this document was granted through an Emerald subscription provided by Universitas Muhammadiyah Yogyakarta For Authors: If you would like to write for this, or any other Emerald publication, then please use our Emerald for Authors service. Information about how to choose which publication to write for and submission guidelines are available for all. Please visit www.emeraldinsight.com/authors for more information. About Emerald www.emeraldinsight.com With over forty years' experience, Emerald Group Publishing is a leading independent publisher of global research with impact in business, society, public policy and education. In total, Emerald publishes over 275 journals and more than 130 book series, as well as an extensive range of online products and services. Emerald is both COUNTER 3 and TRANSFER compliant. The organization is a partner of the Committee on Publication Ethics (COPE) and also works with Portico and the LOCKSS initiative for digital archive preservation.

*Related content and download information correct at time of download.

The current issue and full text archive of this journal is available at www.emeraldinsight.com/1759-0817.htm

Viewpoints: when the Islamisation model doesnt work

Razwan Ul-Haq

Al Oblong Books, Bradford, UK

Abstract

Purpose The purpose of the paper is to encourage debate around the issues of the bank and Islamisation. Design/methodology/approach The work is an ideological examination of approaches to Islamisation and includes references to thinkers from Muslim history. Findings The Islamisation model is not wholly appropriate in the banking sector. Practical implications The paper highlights the limitations of the Islamisation approach and puts forward the case for another methodology, Namely the model of Islamication. Social implications The impact of the authors recommendations, if followed would revolutionise the way banking is carried out. Originality/value The conceptualization of Islamication with regard to banking has not yet been academically formulated. This paper provides a platform to do this. Although Muslim societies and Muslims living in the West will be interested in the paper, non Muslim scholars Europe too, faced with a banking crisis may welcome some of the reports recommendations. Keywords Islamisation, Islamication, Banks, Halal, Riba, Interest, Islam Paper type Viewpoint

The Islamisation model

57

Introduction In their editorial piece, Haniffa and Hudaib (2010) show how sacred intentions and positive objectives have, over time, been through much transformation and the current secularisation of Islamic banking. This article is written in very much the spirit of the editorial and offers a view consistent with Haniffa and Hudaib. In this paper I argue that if a bank is to be Islamic, then we must look deeply at its core purpose and cultural environment. Once we do this, I argue, the bank cannot be considered Islamic. Money then should not go through the riba (usury) machinery of the bank. The paper nally presents a practical application of Islamication of money[1] in todays world, in line with the birds eye methodology of Islamication. In order to create an alternative that is exciting, inventive and reminiscent of Islams contribution to the world, there is a rich precedent from Islamic past and present thinkers, scholars and religious gures such as Ibn Khaldun and Suyuti. It is argued that Islam can offer not just Muslims but humanity an alternative economics. Islamisation vs Islamication? Early proponents of Islamisation such as Ismail Raji al-Faruqi and Hosein Nasr are to be commended for their seminal work in seeking Islamic solutions. The well-intentioned mechanism of Islamisation can be, and should be applied as temporary solutions when an environment is not conducive to Muslim life, but not as a permanent solution to societys ills. I would argue that Islamisation[2] in the banking world has not yielded results that have been world transforming, neither has it created a more equitable

Journal of Islamic Accounting and Business Research Vol. 3 No. 1, 2012 pp. 57-66 q Emerald Group Publishing Limited 1759-0817 DOI 10.1108/17590811211216069

JIABR 3,1

58

situation in Muslim societies. I believe that Islamic Banking has, perhaps unwittingly, become a Trojan Horse of secularism rather than an Islamic application to modern nancial issues. Perhaps it is the right time to take a fresh look at the situation and discuss solutions, one of which may be the concept of Islamication[3]. By Islamication, I mean a more contextualised, hierarchically broader approach; one that seeks to contextualise the application of Islam rather than Islamisation[4], which takes a thing x and prepares to Islamise it in isolation of the culture of thing x. Islamication looks beyond thing x and questions the fundamental basis and cultural identity of thing x before proceeding to Islamicate it. Islamication takes into account the religious, spiritual, social and political base of thing x rather than just its economic or singular compartmentalised existence. Islamication is a positive paradigm shift from that of Islamisation; whereas Islamisation is reactive, Islamication is pro-active. Islamisation seeks solutions in modern times while Islamication seeks solutions for the modern world[5]. Islamisation is chiey concerned with ne-tuning institutions and procedures of modern society to t the way Muslims live their lives. Islamication provides solutions for human ills and is not limited to a reducible modern discourse. We need to begin to take on the vision of Islamication as I feel that the Islamisation ` -vis banking seems to have accepted the environment and climate of the process vis-a current economic context and an outcome of this is an analytic approach that centres on specic technicalities, rather than addressing the bigger picture of Islamic life and the impact this would have on what may be a riba ridden global money environment. Debate around Islamisation has centred around specic Shariah applications such as Takaful, Murabaha, Musharaka, Mudaraba, Ijara and other arrangements; an undesirable outcome of which has been an unwitting legitimising of a wider economic eld that is not based on Islamic ethical principles. Though it is without doubt a meritorious aim of Islamisation in that it seeks to offer practical solutions to people living in a non-Islamic global system, the instruments and mechanisms have, over time, become disjointed and atomised to such an extent that they have lost their essential function as originally intended by the Islamic mission, which is to serve God and bring about a just and equitable system for human beings to live by. Islamised applications have become products at banks, but not everything can be made Halal. The nature of the thing to be made Halal has to be considered. Or to put it another way, we could look at the example of swine meat. Would slaughtering and processing a pig through the Islamic method of zabah yield a halal substance? An interesting feature is the standard by which Islamic Fund Managers and Islamic Bankers judge the performance of their holdings: the singular focus on percentage return on investment is more in line with consumerist materialism than ethical responsibility. So we often see an overly materialistic emphasis on statistics that are akin to banks and their twin sisters secular institutions. Whilst there is nothing wrong with trade, as earning prot is halal, one may well ask the question, what is the difference between the day-to-day processes going on in the mind of the Islamic Fund Manager and the non-Islamic Fund manager? Putting aside the parallel nomenclature, are the distinguishing features enough to say that morally, spiritually, politically and religiously, one is at a higher spiritual vibration, as the case should certainly be for Islamic Investments? It is almost as if society now believes that the Muslim population suffers from a constraint imposed by the Shariah, and all that is necessary is to dispense the right type of product hence words such as Shariah Compliant are often

used when describing these offerings[6]. Yet, Islamic economics is not just about making a prot without interest. As an essentially religious worldview it is more concerned with injecting a positive sacredness to life[7]. As an aside, I would add that the usage of Islamic to any institute that does not deal in interest is misleading. It is well known that the Prophet (pbuh) was a trader but less well understood that on his deathbed, he had not a single investment in terms of a nancial nature. We need to pause awhile. With such a fragmented view of Islamic banking, it does not seem surprising to me that problems of how to apply Shariah still exist that are very fundamental. For example, in his Critique of Shariah Reports in Selected Islamic Banks, Eddy Yusof (2009) highlighted reporting arrangements that even omit the quintessential Bismillah (In the name of Allah) at the beginning of correspondence, and although he rightly concludes that operational differences between Islamic to non-Islamic banks ought to lead to differing accounting procedures, I do feel that the accounting procedures would have naturally been different if even the micro-culture and character of the Banks were Islamic to begin with[8]. It seems that even good intentions through the wrong approach cannot lead to a lasting full Islamic application[9], and in the case of the Islamic Bank, an over emphasis on the micro-level[10], to give products and institutes an Islamic packaging, has plugged into a wider haram culture. If we are to take a step back and view the current scene through Islamication, the bank and its legitimisation ideology are themselves outside of Islam and thus, Islam does not apply to them. There is a long-running tradition of Muslims applying their faith in a manner that not only enriched their lives but also the lives of others[11]. Muslims are not passive individuals that make up a society but active agents of constructive change. The concept of banking The validity of the premise of this paper is dependent upon how one views the micro-culture of the bank, particularly the cultural environment that encourages it to grow and remain functional. I believe that the contextual situation of the bank is such that the entire banking system is at its core fundamentally riba-based. The basic pillar of the banking system is riba. There is no way round this. A simple glance at the prot and loss accounts and balance sheets of banks show that it is through riba that the core business of a banks nancial gain occurs. The climate and culture that has been formed since Calvins reforms of 1536 has created a riba-nexus around which an entire culture has become entrenched. Four and a half centuries of a massive restructuring worldwide has taken place that has departed from the Judeo-Christian anti-usury tradition. The bank has now become the cornerstone of modern commerce. This was very clearly evident recently, when, in a time of austerity for all major Western countries, the banks were given greater protection than even the education, medical and defence sectors. It is crucial to realise that a support for the bank is a support for the status quo with its gross inequalities in the global market. Riba is condemned in both the Quran and Sunnah. To somehow suggest that the trillions of dollars oating from the riba-powered hegemony of the banking apparatus are clean as soon as they are deposited in an Islamic Bank seems to run against reason as illustrated in the following points: . The bank is based upon interest and therefore not only against the Quran but also the traditional laws of Christianity, Judaism and other codes such as those found in traditional Hinduism.

The Islamisation model

59

JIABR 3,1

60

.

The bank is not a stand-alone institution. It operates in a climate of secular living, which at its core, is consumerist and often criticised for being exploitative. The bank is a shadow institution of monetarist expansion in that it is able to manufacture money out of nowhere and lead to an inated money supply. The important issue here is not just one of customer interest, as a modern bank effectively creates money it does not have, even if it doesnt charge interest to customers. Thus, it is a form of riba, an increase of money without having the money-value in the rst place. The bank encourages hoarding. This is against many of the Hadith as too much savings prevent the circulation of wealth amongst humanity; an established Sunna. The bank legitimises the wider economic system that promotes growth in the form of capital rather than in spiritual values. The bank has effects that are opposite to sadaqa (charity). Instead of the rich helping the poor as advocated in the Quran and by the example of the Prophet (pbuh), by lending money on interest or advancing money on prot, the impoverished poor must pay back a greater sum than they have received[12]. The bank makes vast sums of money through a modern form of indentured slavery. A place to live is the moral right of a human being. Shelter is a basic need like water and food. Human beings must not become enslaved into paying over the value of a necessity. Today it takes almost an entire working lifetime for a man to pay off his mortgage. Prices of goods increase as producers need to make greater prots to offset interest payments. In this process, ination cancels out the real value of money earned by the worker. The bank motivates society to do away with the very important Qard al Hassan. This is the type of loan encouraged in the Quran. To lend a specied amount of money the same of which would be paid back without prot sharing or interest. As this noble loan is clearly mentioned in the Quran, and with full clarity, one should conclude that this in fact is the Islamic loan. As such this is the cornerstone of Islamic nance. A bank, that depends for its existence on prot or interest in this sort of transaction is the very opposite of this Quranic loan.

The conclusion is clear, as the micro-culture of the bank itself is haram and outside of Islam, then one cannot apply Islam to it. To coin an earlier metaphor, it is rather like attempting Islamisation of swine. This may seem to be an extreme statement[13] but not only does it conceptualise the view of this paper but in addition sheds light on the nature of the limitations of the Islamisation process when applied to something that is heavily doubtful as to its halal (lawful) nature. I will now present two examples for the case for Islamication using money as an example. The case for the Islamication of money: a political perspective It is important that services, trade and goods are paid for by a medium of exchange that is fair and just[14]. I would argue, as hinted earlier, that banks deal in money that is expanding and thus losing value constantly. Gold, silver and bi-metallic based

currency coins retain more intrinsic value than the numbers and paper backed currencies in banks. If a worker earned $100 in gold in 1960 and he retained this (even after paying zakat), the uctuations in gold price on this $100 of gold would still be worth a lot today. Contrast this with the decrease of $100 in a bank account. The following comparison from the USA is interesting: . On average, cost of a new house: $16,500 or 471.33 ounces of gold in 1960. . On average, cost of new house: $203,000 or 145.52 ounces of gold in 2010. It could be argued that Imam Ibn Hanbal[15] allowed the use of non-metallic currency, but I would say that in todays world, paper currency has become intrinsically linked to usury and one way forward, is to return to precious metallic currency as argued by many scholars. Precious metals retain value and then there is the question of fulus for smaller amounts. Another historic Muslim personality, Imam As-Suyuti[16] noted the fact that copper currency can become devalued over time. In his lifetime, it devalued 17 percent. I want to afrm here Suyutis insistence on trying to keep currency stable. If a currency were to become unstable or lose value, then Suyuti suggests its abolishment and the usage of another and I tend to agree with it, as paper money today falls in value at a very sharp rate, far more steeply than the 17 percent recorded by Imam Suyuti, then it is not ideal to be used as a medium of exchange. If governments do not, then people should instinctively change the currency. Let us take the example of modern day Islamic Republic of Pakistan, which like all other countries including Saudi Arabia, Iran and Malaysia has fully aligned itself with the secular monetary regime. The currency of Pakistan is the Rupiah. The Rupiah was issued and introduced by the pioneering Muslim Leader, Sher Shah Suri in 1540 and began life as a silver coin of 175 grains troy (about 11.34 grams)[17]. If this silver weighted Rupiah was still being minted today, then the Rupiahs silver value itself would be $10.32[18]. This contrasts sharply with the Pakistani Rupiah (singular of Rupee) which is today worth much less than a single dollar at 85.50 Rupees[19] to a $1. I would argue that had the Pakistani Government used silver currency, then the purchasing power of the Pakistani nation would be much greater. When the money base itself is worthless, no amount of Islamic banks can undo damage of an unstable devalued money in an economy. Imam Suyuti is quite right in holding a medium of exchange to be only a mithal in the sense that even gold, silver and rare metals do not possess a permanent store of value and change over time. Currency is always going to have a virtual existence. Hence, it would be wrong to say that gold or silver itself will apply Islam to money. And there are further issues of conducting transactions through the internet[20] for example. However, I feel that in the present day climate, Muslims need to hold wealth in stable currency. Against the background of a world suffering from a banking crisis, sky high property prices, unrestricted consumerism, had Muslims kept an alternative system going, they could have been able to impact positively and offer humanity some solutions if their money should remain resilience and have greater stability. The underdeveloped countries could be offered solutions to have greater purchasing power too. But let us not think in the past tense, as the application of Islam to the economy can still set an example for the world to follow. If money itself had value, it would not require people to invest in bank accounts offering interest rates, as money would be a store of value. Governments of poor

The Islamisation model

61

JIABR 3,1

62

countries would not be subject to buying worthless so-called foreign exchange and it would mean forcing the moneys of the rich people back into society. However, this is not the whole story. A classic monetarist argument needs to be mentioned; this would afrm that depending on gold and other nite resources would not allow an economy to grow. It is therefore often believed that central to the growth of money within an economy is the monetarist approach based on pumping cash through lending at interest. However, this presents a conict as the application of Islam (Islamication) in a given economy through interest cannot occur. Therefore, one cannot Islamicate the growth of society through monetarist methodology. But there are other ways of growth. An economy may easily grow if it can add value and through exporting more than it imports as Imam Suyuti noted. However, Islam itself is less concerned with the pursuit of riches than it is with social justice, providing shelter for the poor, education and spiritual well being. All of these do not require an economy to grow exponentially. The pursuit of betterment in technology and in human endeavour can occur without an outrageous quest for shareholder increase. Prosperity does not lie in a bank balance; even material human happiness devoid of religion is not linked to money. The case for the Islamication of money, a person perspective[21] It is not just the responsibility of government to Islamicate money. If Islam does not apply fully to the free market, it cannot be applied to a socialist order too. Islamication should take place on an individual and family level. One way to Islamicate money would be for the individual to withdraw money from the bank account, and keep only the absolute minimum that is a necessity[22], as wealth created by someone should not become a source for another to create interest. Store of the value could be in the form of precious metals, property, land or better still on Islamic projects, to help call non-Muslims to Islam and to create projects that help civilsation. Interestingly, Ibn Khaldun[23] writes that wealth is not a store of commodities. I will address wealth later on. It is regrettable that Muslim scholars have by and large favoured the Islamisation approach over an overarching Islamication. Though most Islamic scholars would agree that instead of investing in a bank, whether Islamic or not, it would be better to invest money: . on education for the children; . their own health and spiritual well being; . businesses that are run on ethical lines and employ others, thus helping people feed, clothe and give security to their families; . lm, books, promoting publicity material to invite others to Islam; . research and development to better civilisation; and . And of course on charitable concerns and the giving of Qard al Hassan. If the choice is between Islamic products that will make a man become closer to his Creator or on money in the bank, then obviously it should be the former. Often the simple solutions seem to be allusive. This brings us to the issue of wealth. The Islamication of money for the individual is related to moneys purpose, not money itself. If money is there to make one wealthy, then what is the religious, spiritual, political and moral test of wealth? There would be many

questions that an individual would ask in this respect, but I want to centre the questions on how wealth has made a change to the life and culture of the person, who could well ask: . When I meet the Creator, how do I account for where I spent the earnings He gave me? . If there was a natural catastrophe what would that leave my family and me? Without the material possessions do I have the resilience to psychologically survive tough times? . Have I used wealth in my lifetime to decrease the load of worldly stress and opened up free time and avenues to pursue my own spiritual progress? . Would people in my neighbourhood have the moral ethics to help each other should money be unavailable? Have I inuenced those close to me and those around me so that they understand reality? The above I feel, will create more security and peace than a bigger bank balance, not only for the Muslim individual but indeed for anyone with any religious bent of mind. There is no absolute assurance in paper money. If having wealth is important, it is also crucial to build up wealth through halal means. It is important for Muslims not to buy houses using interest or any other form of increase in loan repayments. Many argue that this will lead to impoverished Muslims who live off rent. But if Muslims buy a house, however small and in whatever deprived area, they would attract the baraka (blessing) of Allah. In addition, they could bring the deen of Islam into deprived areas and nancially the areas would improve too over time. Islam does not believe that humanity is deprived. All human beings have the capacity to change and mobility is granted through gifts given by Allah. And furthermore, Muslims are by nature change-agents. The Sunna of the Prophet is a pattern of changing societys ideology and life. To do this, movement is vital. And positive, peaceful transformation of money would be a wonderful example for others who feel lost in repaying off a huge mortgage. In addition, Muslims in the West need to understand how they are viewed and what needs to be done to counteract stereotypes. In fact, a society where immigrants are seen as well off would only lead to resentment by the host community and many of the European and American urban poor may see Muslims as hypocrites and no different to the bankers they blame for the rise in taxes and cuts in public spending. Instead of the Islamic Bank promising to increase the size of personal homes and bank accounts, it is crucial that Muslim investment is geared towards the values the culture of Islam represents. It is sad that the wealth of many Muslim businesses is tied up in banks. I would say they are not beneting humanity in any way whatsoever. And the time for Islamication is long overdue. If post-Islamisation is to succeed at all, then a shift in approach is vital. Conclusion During the course of this paper I have presented Islamication as an alternative to Islamisation. I have made some assertions during the course of the paper which I feel should not be fully afrmed in tablets of stone as an end piece here they are perhaps at best temporal conclusions, but most importantly, I hope that they spark a debate to where we go from here. Islamication, like the concept of Islamisation, is not the nal word but I really do think that it is a way forward. If this paper encourages reection, then it has achieved its purpose.

The Islamisation model

63

JIABR 3,1

Notes 1. Money is intrinsically linked to the banking system. It is not enough to assert the bank is haram (unlawful), the issue of how to cope with a practical economic life needs to be looked at. And this was surely the original aim of Islamisation. In one sense then, we have come full circle to the debating table of the early 1970s as to how best to deal with the challenge of modern economics from an Islamic perspective. 2. Today a new approach is necessary; we have schools and banks that are neither Islamic nor Modern; a confusion exists in the man on the street so much so that a recent scholar from Nadva tul Ulama, at the Islamic Centre at the University of Oxford declared that all banks are haram, yet out of necessity Muslims should use Western non-Muslim banks and never Muslim banks, whilst bearing in mind that taking a Mortgage is haram. I feel such proclamations have come about as Muslim Scholars have lost sight of the bigger picture of applying Islam. If Islamisation is the rst step, then Islamication can be seen as a natural second step as well as an alternative. This paper is not a blanket negation of Islamisation. In fact the Islamication approach can build on much of what Islamisation has achieved. 3. Islamication is perhaps more interesting to members of other faiths than its Islamisation counterpart. Islamisation specialised in providing Islamic solutions the structural framework of the world as-it-is, whilst Islamication goes beyond and asks deeper, more probing questions that strike a chord with the scriptures of faith members outside of Islam. 4. Of course, there are many views of Islamisation. And I accept the validity of those who have outlined an Islamisation approach that is identical to the one I term Islamication. Though I strongly feel that today we need to begin to differentiate between Islamisation as it is generally understood and taking place and offer another perspective. 5. Islamisation seems to deal solely with the modern world. It does not take into account other cultures and civilisations that are on this globe. In the time of Muslim dominancy over the world (though many Muslim scientist-philosophers of that period have rightly been accused of being similarly mono (often Greek) in their approach), polymaths such as Ibn Sina synthesised a variety of cultures through an Islamic matrix. He included Chinese, Indian as well as Greek methodologies. It can even be argued that a great failing of current ` -vis Western modernity and its reluctance to journey Islamisation is its inferior position vis-a seeking knowledge to China and beyond. 6. An unpleasant offspring has been the commercialisation of Muslim morality. It is almost as if bankers (including some Muslim business people) now believe that in order to attract Muslim money and Muslim investment, shariah compliant products are marketed. 7. It may be argued that Islamic products at banks are carefully created to undertake investments in places where they are free from interest and furthermore, that sometimes prot is shared in socially conducive causes. Even if this is accepted on a micro-level, the macro-picture of the bank may cause the products emanating from it to be unworthy of an Islamic label. 8. To take another example outside of the banking world, I was once with a school inspector who is one of the leading lights in Islamisation of modern education, and he showed me a tool, which was a checklist of criteria a good Islamic school should have as observed by an outside inspector. The whole approach was borrowed from British OFSTED and it struck me as odd that whole scale unquestioning adoption of a structural view of doing things should seem to be. It is not that tools created in modern times cannot be used to judge the effectiveness of Islamic organisations, but that the tools need to be thoroughly investigated and meta-judged beforehand. If all there is to an Islamic application is a borrowing and not a synthesis leading to better tools themselves, that not only Muslims but others could use too, then the whole

64

enterprise does not add value to the tool itself. It should be said here that both Islamisation and Islamication has the capacity to do this. 9. According to a quite well known hadith derived view, the jurist who makes a mistake in ijtihad still gets a reward; intentions are all important. In this holistic cosmology, it would be a disservice to the Islamisation project thus far to locate it as a total wrong way. 10. By this I mean the pragmatic interaction level between client and banker, whether it be face-to-face or structural. 11. In their analysis of Muslims trade with medieval Europe, economic historians acknowledged the groundbreaking role of mudarabah-nanced trade in acquainting Western Europe with a powerful instrument of corporate nance, hence opening up immense opportunities of protable trade across the Mediterranean. Mudarabah came to be known in the Italian cities as commendo, marking thereafter an important historical phase of corporate growth in Western Europe which culminated through time into the modern corporate structure (Taj el-Din, 2007). 12. Many Islamic Banks offer Halal mortgages where the recipient has to pay more than if he or she was to take out a loan on interest at a non Islamic Bank. 13. I feel this is an important analogy. We can compare this with the case of Islamisation of schools. Whilst the mainstream modern school has a secular curriculum, there is still some debate as to Islamic legitimacy, it often does not be deal directly with a haram element: hence it would not be appropriate to compare schools to swine or gambling, whilst the bank can be. 14. Ubida b. al-Simit (Allah be pleased with him) reported Allahs Messenger (may peace be upon him) as saying: Gold is to be paid for by gold, silver by silver, wheat by wheat, barley by barley, dates by dates, and salt by salt, like for like and equal for equal, payment being made hand to hand. If these classes differ, then sell as you wish if payment is made hand to hand. Hadith 3853 The Book of Transactions (Kitaab Al Buyu) of Sahih Muslim and the following Hadith. Abu Said al-Khudri (Allah be pleased with him) reported Allahs Messenger (may peace be upon him) as saying: Gold is to be paid for by gold, silver by silver, wheat by wheat, barley by barley, dates by dates, salt by salt, like by like, payment being made hand to hand. He who made an addition to it, or asked for an addition, in fact dealt in usury. The receiver and the giver are equally guilty. 15. Ibn Qudamah (1972). 16. Abdul Azim Islahi (2006, revised 2008). 17. Subodh Kapoor (2002). 18. As at 18 December 2010. 19. As at 18 December 2010: 45.17 Indian Rupees to $1. 20. Electronic payment is not inconsistent with Suyutis observation of mithal however it is a responsibility of a government that wishes to apply Islam to create an infrastructure that does not lead to an articial increase in money supply. Application of Islam does not lead to a free consumerist culture nor a totally free market. In any case, every market and currency in the West and East of today has checks and regulations. 21. I have refrained from using the word consumer. A human being is a wonderful creature that has been made Khalifa (vice-regent). The dunya (present life) is a testing ground and not the nal end and thus the individual is hardly a consumer. The Quran posits humanity as a loftier kind of being. 22. For instance, to buy and sell through the internet or to pay for goods and services through the bank only as long as there is no other option.

The Islamisation model

65

JIABR 3,1

23. He notes that Sudan has more gold than the more prosperous countries of the east. Further, he argues that the prosperous eastern nations export much merchandise. If they possessed ready property in abundance, they would not export their merchandise in search of money [. . .] (Ibn Khaldun, II, p. 282). Ibn Khaldun seems to understand that a surplus of money would result in a cash outow, and is arguing that a high level of (net) exports argues against this being the situation (Ahmad, 1995). References Ahmad, I.ud.-D. (1995), Islam and the medieval progenitors of Austrian economics, paper presented at the Durell Institute Fall Conference, Minaret of Freedom Institute, Rosedale Avenue Bethesda, MD, USA. Eddy Yusof, E.F. (2009), A Critique of Shariah Reports in Selected Islamic Banks, available at: www.scribd.com/doc/21952717/A-Critique-of-Shariah-Reports-in-Selected-Islamic-Banks Haniffa, R. and Hudaib, M. (2010), Islamic nance: from sacred intentions to secular goals? (editorial), Journal of Islamic Accounting & Business Research, Vol. 1 No. 2, pp. 85-91. Kapoor, S. (2002), The Indian Encyclopaedia: Biographical, Historical, Religious, Administrative, Ethnological, Commercial and Scientic, Vol. 6, Cosmo Publications, Coimbatore,, Coimbatore District-Dewala Devi. Qudamah, I. (1972), al-Mughni, Dar al-Kitab al-Arabi, Beirut. Taj el-Din, S.I. (2007), Islamic economics: theoretical and practical perspectives in a global context capital and money markets: the emerging experience in theory and practice, Kyoto Bulletin of Islamic Area Studies, Vol. 1-2, pp. 54-71. Further reading Islahi, A.A. (2006), Monetary thought of the sixteenth century Muslim scholars, MPRA Paper, No. 18346, University Library of Munich, Munich, available at: http://ideas.repec.org/p/ pra/mprapa/18346.html (accessed 22 February 2008). About the author Razwan Ul-Haq is a Freelance Consultant based in Bradford, UK. Razwan Ul-Haq can be contacted at: razwan@live.com

66

To purchase reprints of this article please e-mail: reprints@emeraldinsight.com Or visit our web site for further details: www.emeraldinsight.com/reprints

Вам также может понравиться

- CH 3 - The Problems With Conventional AccountingДокумент52 страницыCH 3 - The Problems With Conventional AccountingCondro TriharyonoОценок пока нет

- CH 3 - The Problems With Conventional AccountingДокумент52 страницыCH 3 - The Problems With Conventional AccountingCondro TriharyonoОценок пока нет

- ACC 6810 Lesson 2Документ20 страницACC 6810 Lesson 2Condro TriharyonoОценок пока нет

- Need For Islamic AccountingДокумент57 страницNeed For Islamic AccountingCondro TriharyonoОценок пока нет

- Jurnal Islam AkuntaniДокумент16 страницJurnal Islam AkuntaniCondro TriharyonoОценок пока нет

- Jurnal Islam Akuntasi Syariah PDFДокумент11 страницJurnal Islam Akuntasi Syariah PDFCondro TriharyonoОценок пока нет

- Jurnal Akuntansi Syariah IndonesiaДокумент4 страницыJurnal Akuntansi Syariah IndonesiaCondro TriharyonoОценок пока нет

- CH 3 - The Problems With Conventional AccountingДокумент52 страницыCH 3 - The Problems With Conventional AccountingCondro TriharyonoОценок пока нет

- Jurnal Akuntansi IslamДокумент19 страницJurnal Akuntansi IslamCondro TriharyonoОценок пока нет

- Jurnal Islam Akuntansi 2Документ23 страницыJurnal Islam Akuntansi 2Condro TriharyonoОценок пока нет

- Jurnal Islam IndnesiaДокумент16 страницJurnal Islam IndnesiaCondro TriharyonoОценок пока нет

- Jurnal Islam AkuntansiДокумент15 страницJurnal Islam AkuntansiCondro TriharyonoОценок пока нет

- Jurnl Islam IndonesiaДокумент6 страницJurnl Islam IndonesiaCondro TriharyonoОценок пока нет

- GiantsДокумент17 страницGiantsCondro TriharyonoОценок пока нет

- UntitledДокумент1 страницаUntitledCondro TriharyonoОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Fiscal Theory and Public PolicyДокумент41 страницаFiscal Theory and Public PolicyClint RamosОценок пока нет

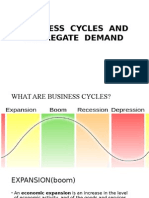

- Understanding Business Cycles and Aggregate DemandДокумент40 страницUnderstanding Business Cycles and Aggregate DemandSnehal Joshi100% (1)

- Impact of Monetary Policy On Economic Growth - A Case Study of South AfricaДокумент9 страницImpact of Monetary Policy On Economic Growth - A Case Study of South AfricaAbdulkabirОценок пока нет

- The 28 Great Ideas That Changed The World ShowДокумент69 страницThe 28 Great Ideas That Changed The World ShowJeff AkinОценок пока нет

- Question and Answer - 5Документ30 страницQuestion and Answer - 5acc-expertОценок пока нет

- An Abridged History of Labour MovementДокумент32 страницыAn Abridged History of Labour Movementximena.torresОценок пока нет

- ECON 3008: History of Economic Thought: SEMESTER 2-2016 Keynesians and MonetaristsДокумент22 страницыECON 3008: History of Economic Thought: SEMESTER 2-2016 Keynesians and MonetaristsKishawn SmithОценок пока нет

- Economic School of ThoughtДокумент199 страницEconomic School of ThoughtMinakshi Barman100% (1)

- Introduction To Economics - Class NotesДокумент33 страницыIntroduction To Economics - Class NotesEliot PrimoОценок пока нет

- Keynesian Economics Explained: How Government Spending Boosts GrowthДокумент14 страницKeynesian Economics Explained: How Government Spending Boosts GrowthMisha KosiakovОценок пока нет

- The Fall of The House of Credit PDFДокумент382 страницыThe Fall of The House of Credit PDFRichard JohnОценок пока нет

- Starting Over Again - The Covid-19 Pandemic Is Forcing A Rethink in Macroeconomics - Briefing - The EconomistДокумент20 страницStarting Over Again - The Covid-19 Pandemic Is Forcing A Rethink in Macroeconomics - Briefing - The EconomistblacksmithMGОценок пока нет

- Fatal Couplings of Power and DifferenceДокумент10 страницFatal Couplings of Power and DifferenceJoohyun KimОценок пока нет

- Monetary Policy Notes PDFДокумент18 страницMonetary Policy Notes PDFOptimistic Khan50% (2)

- Lecture Notes On Inflation: Meaning, Theories, and Costs/EffectsДокумент39 страницLecture Notes On Inflation: Meaning, Theories, and Costs/EffectsAnonymous yy8In96j0rОценок пока нет

- H3 Economics PapersДокумент21 страницаH3 Economics Papersdavidboh100% (1)

- MacroExam2SelfTest AnswersДокумент9 страницMacroExam2SelfTest AnswersIves LeeОценок пока нет

- Principles of Economics Business Banking Finance and Your Everyday Life Peter NavarroДокумент81 страницаPrinciples of Economics Business Banking Finance and Your Everyday Life Peter NavarroWaris Awais100% (2)

- Settling the Accounts of Revolutionary Democracy in EthiopiaДокумент31 страницаSettling the Accounts of Revolutionary Democracy in EthiopiaKaleb Berhanu100% (1)

- Modern Macroeconomics QuizДокумент115 страницModern Macroeconomics Quizimmoenix0% (1)

- 2008-2009 Keynesian Resurgence: Navigation SearchДокумент19 страниц2008-2009 Keynesian Resurgence: Navigation SearchAppan Kandala VasudevacharyОценок пока нет

- Inflation in India: An Analytical Survey: The TheДокумент1 страницаInflation in India: An Analytical Survey: The TheTio KumowalОценок пока нет

- Economic Terms Glossary PDFДокумент12 страницEconomic Terms Glossary PDFannayaОценок пока нет

- Money, Bank Credit, Economic CyclesДокумент906 страницMoney, Bank Credit, Economic CyclesBot Psalmerna100% (3)

- Monetary Reform and The Bellagio GroupДокумент4 страницыMonetary Reform and The Bellagio GroupPickering and ChattoОценок пока нет

- NullДокумент22 страницыNullapi-28191758100% (1)

- Economics: DR P James Daniel Paul Professor VIT BSДокумент29 страницEconomics: DR P James Daniel Paul Professor VIT BSAntony JohnОценок пока нет

- What is the Quantity Theory of Money? (39Документ4 страницыWhat is the Quantity Theory of Money? (39Nazmun BegamОценок пока нет

- Ace Institute of Management: Assignment: Inflation in NepalДокумент7 страницAce Institute of Management: Assignment: Inflation in NepalRupesh ShahОценок пока нет

- Jun18l1-S02pm QaДокумент22 страницыJun18l1-S02pm QajuanОценок пока нет