Академический Документы

Профессиональный Документы

Культура Документы

Atul Ltd.

Загружено:

Fast SwiftИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Atul Ltd.

Загружено:

Fast SwiftАвторское право:

Доступные форматы

Daily Corporate News Analysis By KRC Research

Atul Ltd. Initiating Coverage

March 23rd, 2005 CMP Rs.72 March 23rd, 2005 Dyes and Dyestuff ATLP.BO 10/Rs.94.45/28 Rs.240.03 Crs

Key Data

Date Sector Reuters Code Face Value 52 Week H/L Market Cap

Atul Ltd is engaged in the business of manufacturing Colours and specialty chemicals. The company gets around 35% of its sales from Colours (Dyestuff), and the remaining from specialty chemicals like Aromatics, Agrichemicals and Bulk drugs. The core business of the company is witnessing a highly competitive scenario from low cost manufacturers of China. Hence despite the growth in the usage of its core product dyes and dyestuff, it expects the business to remain flat in the near future. However, the company expects growth in its specialty chemicals business, particularly Agrichemicals and Aromatics. The company is currently available at a reasonable price in relation to its size. However, the low price is mainly due to the high competitiveness in its core business and increase in raw material costs which the company is unable to pass on to the consumer, which have resulted in low margins. Hence we recommend a hold on the stock. Key Developments Atul Ltd. to restructure capital High Court of Gujarat granted its approval to Atul Ltd.s scheme of restructuring. As per the scheme, the credit balances in securities premium account and capital redemption reserve account which can be utilized for various write offs. Aggregate write offs would be to the tune of Rs. 75.86 crore of which Rs. 52.86 crore would be utilized for writing off miscellaneous expenditure and Rs. 23 crore against contingencies. This measure will ensure that the future profits of the company will not have to bear the burden of VRS amortization and any unfavorable outcome from past contingencies.

Investment Rationale

KRC RESEARCH

ISIEmergingMarketsPDF in-isb from 202.174.120.2 on 2013-01-31 23:34:17 EST. DownloadPDF. Downloaded by in-isb from 202.174.120.2 at 2013-01-31 23:34:17 EST. ISI Emerging Markets. Unauthorized Distribution Prohibited.

Atul Ltd

March 23rd, 2005

Financials Net Profit up at Rs 8.46 crores The quarter saw a turnaround in the profits as compared with Q3 FY04 with net profit at Rs 8.46 crores from a loss of 1.59 crore earlier in spite of the profit margins being adversely impacted by the rise in the raw material cost front. Valuations Atul currently trades at a EV/EBIDTA of 6.6x its trailing twelve months EBIDTA for quarter ended December 2004.

Contact us at 5696 5555 or mail to customercare@krchoksey.com visit us at www.krchoksey.com

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. While the information contained therein has been obtained from sources believed to be reliable, investors are advised to satisfy themselves before making any investments. Kisan Ratilal Choksey Shares & Sec Pvt Ltd., does not bear any responsibility for the authentication of the information contained in the reports and consequently, is not liable for any decisions taken based on the same. Further, KRC Research Reports only provide information updates and analysis. All opinion for buying and selling are available to investors when they are registered clients of KRC Investment Advisory Services. As a matter of practice, KRC refrains from publishing any individual names with its reports. As per SEBI requirements it is stated that,Kisan Ratilal Choksey Shares & Sec Pvt Ltd., and/or individuals thereof may have positions in securities referred herein and may make purchases or sale thereof while this report is in circulation.

----------------------------------------------------------------

KRC RESEARCH

ISIEmergingMarketsPDF in-isb from 202.174.120.2 on 2013-01-31 23:34:17 EST. DownloadPDF. Downloaded by in-isb from 202.174.120.2 at 2013-01-31 23:34:17 EST. ISI Emerging Markets. Unauthorized Distribution Prohibited.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Atul LTDДокумент27 страницAtul LTDFast SwiftОценок пока нет

- Atul Ltd.Документ4 страницыAtul Ltd.Fast SwiftОценок пока нет

- Atul LTDДокумент4 страницыAtul LTDFast SwiftОценок пока нет

- Abbott Annual Report - WebsiteДокумент96 страницAbbott Annual Report - WebsiteFast SwiftОценок пока нет

- Hawkins Cooker LTD 2002Документ7 страницHawkins Cooker LTD 2002Fast SwiftОценок пока нет

- I-03, SV 3, ISB, Hyderabad, India +91 (40) 2300 7000 (Extn: 8389) Mobile: +91 - 809 666 8008Документ1 страницаI-03, SV 3, ISB, Hyderabad, India +91 (40) 2300 7000 (Extn: 8389) Mobile: +91 - 809 666 8008Fast SwiftОценок пока нет

- Gujarat Specilty Chemicals Conclave 2013 Background Paper FinalДокумент74 страницыGujarat Specilty Chemicals Conclave 2013 Background Paper FinalFast SwiftОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Aus Tin 20105575Документ120 страницAus Tin 20105575beawinkОценок пока нет

- Ship Breaking Report Dec 2010Документ105 страницShip Breaking Report Dec 2010rezababakhaniОценок пока нет

- 002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFДокумент7 страниц002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFBenjamin MartinezОценок пока нет

- TCW Act #4 EdoraДокумент5 страницTCW Act #4 EdoraMon RamОценок пока нет

- Bahasa Inggris IIДокумент15 страницBahasa Inggris IIMuhammad Hasby AsshiddiqyОценок пока нет

- Accra Resilience Strategy DocumentДокумент63 страницыAccra Resilience Strategy DocumentKweku Zurek100% (1)

- GL July KoreksiДокумент115 страницGL July KoreksihartiniОценок пока нет

- Factors Affecting SME'sДокумент63 страницыFactors Affecting SME'sMubeen Shaikh50% (2)

- Fiscal Deficit UPSCДокумент3 страницыFiscal Deficit UPSCSubbareddyОценок пока нет

- Coconut Oil Refiners Association, Inc. vs. TorresДокумент38 страницCoconut Oil Refiners Association, Inc. vs. TorresPia SottoОценок пока нет

- Technical Question Overview (Tuesday May 29, 7pm)Документ2 страницыTechnical Question Overview (Tuesday May 29, 7pm)Anna AkopianОценок пока нет

- Company ProfileДокумент13 страницCompany ProfileDauda AdijatОценок пока нет

- Alcor's Impending Npo FailureДокумент11 страницAlcor's Impending Npo FailureadvancedatheistОценок пока нет

- Manufactures Near byДокумент28 страницManufactures Near bykomal LPS0% (1)

- GEARS September 2013Документ128 страницGEARS September 2013Rodger Bland100% (3)

- Introduction - IEC Standards and Their Application V1 PDFДокумент11 страницIntroduction - IEC Standards and Their Application V1 PDFdavidjovisОценок пока нет

- Hard Work and Black Swans - Economists Are Turning To Culture To Explain Wealth and Poverty - Schools Brief - The EconomistДокумент9 страницHard Work and Black Swans - Economists Are Turning To Culture To Explain Wealth and Poverty - Schools Brief - The EconomistMaría Paula ToscanoОценок пока нет

- BIR Form 1707Документ3 страницыBIR Form 1707catherine joy sangilОценок пока нет

- Guide To Accounting For Income Taxes NewДокумент620 страницGuide To Accounting For Income Taxes NewRahul Modi100% (1)

- Vtiger Software For CRMДокумент14 страницVtiger Software For CRMmentolОценок пока нет

- Dog and Cat Food Packaging in ColombiaДокумент4 страницыDog and Cat Food Packaging in ColombiaCamilo CahuanaОценок пока нет

- Nike Pestle AnalysisДокумент10 страницNike Pestle AnalysisAchal GoyalОценок пока нет

- HQ01 - General Principles of TaxationДокумент14 страницHQ01 - General Principles of TaxationJimmyChao100% (1)

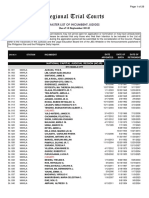

- Regional Trial Courts: Master List of Incumbent JudgesДокумент26 страницRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaОценок пока нет

- Community Development Fund in ThailandДокумент41 страницаCommunity Development Fund in ThailandUnited Nations Human Settlements Programme (UN-HABITAT)100% (1)

- Year 2016Документ15 страницYear 2016fahadullahОценок пока нет

- Forex Fluctuations On Imports and ExportsДокумент33 страницыForex Fluctuations On Imports and Exportskushaal subramonyОценок пока нет

- Contact Details of RTAsДокумент18 страницContact Details of RTAsmugdha janiОценок пока нет

- 4 P'sДокумент49 страниц4 P'sankitpnani50% (2)

- Environment Case Alcoa 2016Документ4 страницыEnvironment Case Alcoa 2016Victor TorresОценок пока нет