Академический Документы

Профессиональный Документы

Культура Документы

Fundamentals of Financial Manaigham & Houston - 12th Edition 83

Загружено:

Man ManИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Fundamentals of Financial Manaigham & Houston - 12th Edition 83

Загружено:

Man ManАвторское право:

Доступные форматы

58

Part 2 Fundamental Concepts in Financial Management

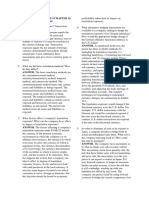

Table 3-1

Allied Food Products: December 31 Balance Sheets (Millions of Dollars)

2008 Assets Current assets: Cash and equivalents Accounts receivable Inventories Total current assets Net fixed assets: Net plant and equipment (cost minus depreciation) Other assets expected to last more than a year Total assets Liabilities and Equity Current liabilities: Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total debt Common equity: Common stock (50,000,000 shares) Retained earnings Total common equity Total liabilities and equity 2007

10 375 615 $1,000 1,000 0 $2,000

80 315 415 $ 810 870 0 $1,680

60 140 110 $ 310 750 $1,060 $ 130 810 $ 940 $2,000

30 130 60 $ 220 580 $ 800 $ 130 750 $ 880 $1,680

Notes: 1. Inventories can be valued by several different methods, and the method chosen can affect both the balance sheet value and the cost of goods sold, and thus net income, as reported on the income statement. Similarly, companies can use different depreciation methods. The methods used must be reported in the notes to the financial statements, and security analysts can make adjustments when they compare companies if they think the differences are material. 2. Book value per share: Total common equity/Shares outstanding $940/50 $18.80. 3. Also note that a relatively few firms use preferred stock, which we discuss in Chapter 9. Preferred stock can take several different forms, but it is generally like debt because it pays a fixed amount each year. However, it is like common stock because a failure to pay the preferred dividend does not expose the firm to bankruptcy. If a firm does use preferred stock, it is shown on the balance sheet between Total debt and Common stock. There is no set rule on how preferred stock should be treated when financial ratios are calculatedit could be considered as debt or as equity. Bondholders often think of it as equity, while stockholders think of it as debt because it is a fixed charge. In truth, it is a hybrid, somewhere between debt and common equity.

Working Capital Current assets.

2. 3.

Working capital. Current assets are often called working capital because these assets turn over; that is, they are used and then replaced throughout the year.4 Net working capital. When Allied buys inventory items on credit, its suppliers, in effect, lend it the money used to finance the inventory items. Allied could have borrowed from its bank or sold stock to obtain the money, but it received the funds from its suppliers. These loans are shown as accounts payable, and they typically are free in the sense that they do not bear interest. Similarly, Allied pays its workers every two weeks and it pays taxes quarterly; so

4 Any current assets not used in normal operations, such as excess cash held to pay for a plant under construction, are deducted and thus not included in working capital. Allied requires all of its current assets for operations.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- How To Write A Business Plan CAP 1Документ6 страницHow To Write A Business Plan CAP 1Man ManОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Escalas de BluesДокумент1 страницаEscalas de BluesMan ManОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Fundamentals of Financial Manaigham & Houston - 12th Edition 86Документ1 страницаFundamentals of Financial Manaigham & Houston - 12th Edition 86Man ManОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Fundamentals of Financial Manaigham & Houston - 12th Edition 86Документ1 страницаFundamentals of Financial Manaigham & Houston - 12th Edition 86Man ManОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Real Estate Finance Lecture - 3 - 2021Документ14 страницReal Estate Finance Lecture - 3 - 2021Zigma NetworkОценок пока нет

- Managing Financial Resources in The GovernmentДокумент93 страницыManaging Financial Resources in The GovernmentBarney's Gaming Squad100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Aberfoyle Plantations LTD V Khaw Bian ChengДокумент7 страницAberfoyle Plantations LTD V Khaw Bian ChengshaherawafiОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Chapter 11 Bonds PayableДокумент27 страницChapter 11 Bonds PayableNicho Deven HamawiОценок пока нет

- Cash Balances Quantity Theory of MoneyДокумент8 страницCash Balances Quantity Theory of MoneyAppan Kandala VasudevacharyОценок пока нет

- CF Assignment Draft 1Документ3 страницыCF Assignment Draft 138Nguyễn Ngọc Bảo TrânОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Negotiable Instruments Act Notes Part 1Документ12 страницNegotiable Instruments Act Notes Part 1zombiesunami007Оценок пока нет

- Test Bank For Macroeconomics 11th Edition David ColanderДокумент15 страницTest Bank For Macroeconomics 11th Edition David ColanderDeborahMartingabed100% (23)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Internal Rate of ReturnДокумент16 страницInternal Rate of ReturnAnnalie Alsado BustilloОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Customer Satisfaction Canara BankДокумент53 страницыCustomer Satisfaction Canara BankAsrar70% (10)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Chapter 6 - Cash Management: Learning ObjectivesДокумент5 страницChapter 6 - Cash Management: Learning Objectives132345usdfghjОценок пока нет

- S Bica 20221226000911705529Документ20 страницS Bica 20221226000911705529Mr. RajkumarОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Umme Zainab Accounting AssighnmentДокумент2 страницыUmme Zainab Accounting Assighnmentzm65012Оценок пока нет

- Spmunit 2 UpeerДокумент36 страницSpmunit 2 UpeerMayank TutejaОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Concentrix Services India Private Limited Payslip For The Month of July - 2023Документ1 страницаConcentrix Services India Private Limited Payslip For The Month of July - 2023Bujji BabuОценок пока нет

- Questions CH 10Документ4 страницыQuestions CH 10Maria DevinaОценок пока нет

- Capital Asset Pricing ModelДокумент11 страницCapital Asset Pricing ModelrichaОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Capital Budegting - Project and Risk AnalysisДокумент46 страницCapital Budegting - Project and Risk AnalysisUpasana Thakur100% (1)

- Engineering EconomyДокумент53 страницыEngineering EconomyPaulo Emmanuele BetitaОценок пока нет

- Yes Bank CrisisДокумент2 страницыYes Bank CrisisAnkit ChoudhuryОценок пока нет

- Banglore Hotel Bill - 08 JAN 2023Документ1 страницаBanglore Hotel Bill - 08 JAN 2023Devendar UradiОценок пока нет

- Michael Burry Write Ups From 2000Документ27 страницMichael Burry Write Ups From 2000Patrick LangstromОценок пока нет

- Report APOL Konsol - Des 2018 PDFДокумент138 страницReport APOL Konsol - Des 2018 PDFCitra DianaОценок пока нет

- Marketing Mix of Bank Al Habib PakistanДокумент6 страницMarketing Mix of Bank Al Habib Pakistankhalid100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Annual Report 2012 3Документ263 страницыAnnual Report 2012 3Ali Asghar0% (1)

- Accounting IntroductionДокумент24 страницыAccounting IntroductionUshmikaОценок пока нет

- MCom - Accounts Ch-3 Topic7Документ20 страницMCom - Accounts Ch-3 Topic7Sameer GoyalОценок пока нет

- Fdnacct Chap 24 & 2Документ8 страницFdnacct Chap 24 & 2Leanne AnguloОценок пока нет

- Chapter 2: The Role of Marketing in The FinancialservicesДокумент56 страницChapter 2: The Role of Marketing in The Financialservicestrevorsum123Оценок пока нет

- FinMan Report On FS Analysis RATIOДокумент31 страницаFinMan Report On FS Analysis RATIOMara LacsamanaОценок пока нет