Академический Документы

Профессиональный Документы

Культура Документы

Financial Ratio Analysis With Formulas

Загружено:

Lalit Bom MallaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Ratio Analysis With Formulas

Загружено:

Lalit Bom MallaАвторское право:

Доступные форматы

Financial Ratio Analysis with Formulas

Blog, Financial ReportsNo Comments

Financial ratio analysis is the mathematical relationship between two selected numerical values pulled from a companys financial statement. There are many ratios used in business to figure such things out as a companys solvency, profitability, asset turnover, etc. Financial analysts use financial ratios to compare strengths and weaknesses of different entities. Financial ratios compares values between companies, industries, time periods for a particular company and between a single company and its industry average. In order to effectively use ratios, they must be benchmarked against something else such as another company. Financial ratios can be expressed as a decimal value, 0.20 or as an equivalent percent value, 20%. Ratios that are usually less than 1, are normally expressed as a percentage. The values we use in calculating financial ratios come from the income statement, balance sheet, statement of cash flows or statement of retained earnings. Financial ratios results in quantifiable data about a specific aspect of a company. Financial ratios are

categorized based which the ratio measures.

on the financial topic of the business in

Activity ratios: measures how quickly a firm converts non-cash assets within the balance sheet to cash or sales. Liquidity ratios: measures the availability of cash to pay short-debt. Debt ratios: measures the firms ability to repay long-term debt. Profitability ratios: assesses a businesss ability to generate earnings as compared to its expenses and other costs. Market ratios: measures investor response to owning a companys stock and also the cost of issuing stock.

List of Ratios

Activity or Efficiency Ratios

Average Collection Period = Accounts Receivable/(Annual Credit Sales/365 days) Receivables Turnover = Net Credit Sales/Average Net Receivables Degree of Operating Leverage (DOL) = % Change in Net Operating Income/% Change in Sales Average Payment Period = Accounts Payable/(Annual Credit Purchase/365 days) Asset Turnover = Net Sales/Total Assets Stock Turnover Ratio = Cost of Goods Sold/Average Inventory Inventory Conversion = 365 days/Inventory Turnover Inventory Conversion Period = (Inventory/Cost of Goods Sold)/365 Days Receivables Conversion Period = (Receivables/Net Sales)/365 Days Payables Conversion Period = (Accounts Payables/Purchases)/365 Days Cash Conversion Cycle = Inventory Conversion Period + Receivables Conversion Period Payables Conversion Period

Liquidity Ratios

Current Ratio (Working Capital Ratio) = Current Assets/Current Liabilities Cash Ratio = Cash and Marketable Securities/Current Liabilities Operating Cash Flow Ratio = Operating Cash Flow/Total Debts

Debt Ratios

Debt Ratio = Total Liabilities/Total Assets Debt to Equity Ratio = (Long-term Debt + Value of Leases)/Average Shareholders Equity Long-term Debt to Equity = Long-term Debt/Total Assets Times Interest Earned Ratio = Net Income/Annual Interest Expense Debt Service Coverage = Net Operating Income/Total Debt Service

Profitability ratios

Gross Margin, Gross Profit Margin or Gross Profit Rate = Gross Profit/Net Sales or Gross Margin = (Net Sales Cost of Goods Sold)/Net Sales Profit Margin = Net Profit/Net Sales Return on Equity (ROE) = Net Income/Average Shareholders Equity Return on Assets (ROA) = Net Income/Average Total Assets Return on Net Assets (RONA) = Net Income/(Fixed Assets + Working Capital) Return on Capital (ROC) = EBIT (1-Tax Rate)/Invested Capital Efficiency Ratio = Non Interest Expense/Revenue Net Gearing = Net Debt/Equity Basic Earning Power Ratio = EBIT/Total Assets

Market Ratios

Earnings per share (EPS) = Net Earnings/# of Shares Payout Ratio = Dividends/Earnings or EPS P/E Ratio = Market Value per Share/Earnings per Share (EPS) Dividend Yield = Annual Dividends per Share/Price per Share Cash Flow Ratio = Market Price per Share/Present Value of Cash Flow per Share Price to Book Value Ratio = Market Price per Share/Balance Sheet Price per Share Price/Sales Ratio = Market Price per Share/Gross Sales

Financial-Accounting-Ratios Formulas:

This is a collection of financial ratio formulas which can help you calculate financial ratios in a given problem.

Analysis of Profitability:

General profitability:

Gross profit ratio = (Gross profit / Net sales) 100 Operating ratio = (Operating cost / Net sales) 100 Expense ratio = (Particular expense / Net sales) 100 Operating profit ratio = (Operating profit / Net sales) 100

Overall profitability:

Return on shareholders' investment or net worth = Net profit after interest and tax / Shareholders' funds Return on equity capital = (Net profit after tax Preference dividend) / Paid up equity capital Earnings per share (EPS) ratio = (Net profit after tax Preference dividend) / Number of equity shares Return on gross capital employed = (Adjusted net profit / Gross capital employed) 100 Return on net capital employed = (Adjusted net profit / Net capital employed) 100 Dividend yield ratio = Dividend per share / Market value per share

Dividend payout ratio or pay-out ratio = Dividend per equity share / Earnings per share

Short Term Financial Position or Test of Solvency:

Current ratio = Current assets / Current liabilities Quick or acid test of liquid ratio (for immediate solvency) = Liquid assets / Current liabilities Absolute liquid ratio = Absolute liquid assets / Current liabilities

Current Assets Movement, Efficiency or Activity Ratios:

Inventory / Stock turnover ratio = Cost of goods sold / Average inventory at cost Debtors of receivables turnover ratios = Net credit sales / Average trade debtors Average collection period = (Trade debtors No. of working days) / Net credit sales Creditors or payables turnover ratio = Net credit purchase / Average trade creditors Average payment period = (Trade creditors No. of working days) / Net credit purchase Working capital turnover ratio = Cost of sales / Net working capital

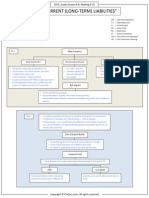

Analysis of Long Term Solvency:

Debt to equity ratio = Outsiders funds / Shareholders funds or External funds / Internal funds Ratio of long term debt to shareholders funds (Debt equity) = Long term debt / Shareholders funds Proprietary of equity ratio = Shareholders funds / Total assets Fixed assets to net worth = Fixed assets after depreciation / Shareholders' funds Fixed assets ratio or fixed assets to long term funds = Fixed assets after depreciation / Total long term funds Ratio of current assets proprietors' funds = Current assets / Shareholders' funds Debt service or interest coverage ratio = Net profit before interest and tax / Fixed interest charges Capital gearing ratio = Equity share capital / Fixed interest bearing funds

Вам также может понравиться

- Activity RatiosДокумент7 страницActivity RatiosSUBIR100% (1)

- AUD Financial RatiosДокумент3 страницыAUD Financial RatiosNick HuynhОценок пока нет

- Financial Ratio Summary SheetДокумент1 страницаFinancial Ratio Summary SheetKeith Tomasson100% (1)

- BEC 1 Outline - 2015 Becker CPA ReviewДокумент4 страницыBEC 1 Outline - 2015 Becker CPA ReviewGabriel100% (1)

- FinQuiz - Smart Summary - Study Session 8 - Reading 26Документ2 страницыFinQuiz - Smart Summary - Study Session 8 - Reading 26RafaelОценок пока нет

- BEC 3 Outline - 2015 Becker CPA ReviewДокумент4 страницыBEC 3 Outline - 2015 Becker CPA ReviewGabrielОценок пока нет

- FinQuiz - Smart Summary - Study Session 7 - Reading 23Документ2 страницыFinQuiz - Smart Summary - Study Session 7 - Reading 23Rafael0% (1)

- Fin Cheat SheetДокумент3 страницыFin Cheat SheetChristina RomanoОценок пока нет

- FinQuiz - Smart Summary - Study Session 9 - Reading 32Документ6 страницFinQuiz - Smart Summary - Study Session 9 - Reading 32RafaelОценок пока нет

- FinQuiz - Smart Summary - Study Session 15 - Reading 52Документ5 страницFinQuiz - Smart Summary - Study Session 15 - Reading 52RafaelОценок пока нет

- FinQuiz - Smart Summary - Study Session 14 - Reading 50Документ4 страницыFinQuiz - Smart Summary - Study Session 14 - Reading 50Rafael100% (1)

- Accounting Study Guide PDFДокумент8 страницAccounting Study Guide PDFgetasewОценок пока нет

- Free BEC NotesДокумент6 страницFree BEC Notesxcrunner87Оценок пока нет

- Aicpa 040212far SimДокумент118 страницAicpa 040212far SimHanabusa Kawaii IdouОценок пока нет

- Accounting Ratios FormulasДокумент3 страницыAccounting Ratios FormulasEshan BhattОценок пока нет

- FinQuiz - Smart Summary - Study Session 14 - Reading 49Документ6 страницFinQuiz - Smart Summary - Study Session 14 - Reading 49Rafael100% (1)

- FinQuiz - Smart Summary - Study Session 10 - Reading 34Документ2 страницыFinQuiz - Smart Summary - Study Session 10 - Reading 34RafaelОценок пока нет

- FinQuiz - Smart Summary - Study Session 8 - Reading 28Документ3 страницыFinQuiz - Smart Summary - Study Session 8 - Reading 28RafaelОценок пока нет

- FAR Notes Chapter 3Документ3 страницыFAR Notes Chapter 3jklein2588Оценок пока нет

- CPA Reg Practice Individual TaxationДокумент2 страницыCPA Reg Practice Individual TaxationMatthew AminiОценок пока нет

- BEC Study Guide 4-19-2013Документ220 страницBEC Study Guide 4-19-2013Valerie Readhimer100% (1)

- FAR Review NotesДокумент2 страницыFAR Review NotesFutureMsCPAОценок пока нет

- FinQuiz - Smart Summary - Study Session 4 - Reading 14Документ5 страницFinQuiz - Smart Summary - Study Session 4 - Reading 14RafaelОценок пока нет

- CPA Exam REG - S-Corporation Taxation.Документ2 страницыCPA Exam REG - S-Corporation Taxation.Manny MarroquinОценок пока нет

- BEC 4 Outline - 2015 Becker CPA ReviewДокумент6 страницBEC 4 Outline - 2015 Becker CPA ReviewGabrielОценок пока нет

- FinQuiz - Smart Summary - Study Session 4 - Reading 15Документ7 страницFinQuiz - Smart Summary - Study Session 4 - Reading 15RafaelОценок пока нет

- AUD Notes Chapter 1Документ14 страницAUD Notes Chapter 1janell184100% (1)

- FinQuiz - Smart Summary - Study Session 9 - Reading 30Документ5 страницFinQuiz - Smart Summary - Study Session 9 - Reading 30RafaelОценок пока нет

- REG NotesДокумент41 страницаREG NotesNick Huynh75% (4)

- FinQuiz - Smart Summary - Study Session 1 - Reading 1Документ17 страницFinQuiz - Smart Summary - Study Session 1 - Reading 1RafaelОценок пока нет

- Financial RatiosДокумент21 страницаFinancial RatiosAamir Hussian100% (1)

- BEC MaggieДокумент48 страницBEC MaggieJame NgОценок пока нет

- NINJA Book Reg 1 EthicsДокумент38 страницNINJA Book Reg 1 EthicsJaffery143Оценок пока нет

- Irish Spring ReportДокумент11 страницIrish Spring ReportAri EngberОценок пока нет

- Chapter 7 CPA FAR NotesДокумент5 страницChapter 7 CPA FAR Notesjklein2588Оценок пока нет

- FinQuiz - Smart Summary - Study Session 8 - Reading 25Документ6 страницFinQuiz - Smart Summary - Study Session 8 - Reading 25RafaelОценок пока нет

- Derivatives. ... Syet Derivatives..Документ42 страницыDerivatives. ... Syet Derivatives..Francis Emmanuel TolentinoОценок пока нет

- US Securities Law - Study GuideДокумент14 страницUS Securities Law - Study Guideprof28Оценок пока нет

- CPA Chapter 4 FAR Notes Inventories & CA/CLДокумент5 страницCPA Chapter 4 FAR Notes Inventories & CA/CLjklein2588Оценок пока нет

- Expressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesДокумент3 страницыExpressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDGОценок пока нет

- Wiley CPAexcel - FAR - 13 Disclosure RequirementsДокумент2 страницыWiley CPAexcel - FAR - 13 Disclosure RequirementsAimeeОценок пока нет

- Account ClassificationДокумент3 страницыAccount ClassificationUsama MukhtarОценок пока нет

- Financial Ratio Analysis FormulasДокумент4 страницыFinancial Ratio Analysis FormulasVaishali Jhaveri100% (1)

- CPA REG Entity BasisДокумент4 страницыCPA REG Entity BasisManny MarroquinОценок пока нет

- Chapter 9 & 10 Financial (FAR) NotesДокумент7 страницChapter 9 & 10 Financial (FAR) NotesFutureMsCPAОценок пока нет

- Chapter 11 - Cost of Capital - Text and End of Chapter Questions PDFДокумент63 страницыChapter 11 - Cost of Capital - Text and End of Chapter Questions PDFNbua AhmadОценок пока нет

- CMA FormulaДокумент4 страницыCMA FormulaKanniha SuryavanshiОценок пока нет

- CFALevel1 Sample QuestionsДокумент58 страницCFALevel1 Sample QuestionsManoj UpretiОценок пока нет

- FinQuiz - Smart Summary - Study Session 17 - Reading 57Документ4 страницыFinQuiz - Smart Summary - Study Session 17 - Reading 57RafaelОценок пока нет

- FinQuiz - Smart Summary - Study Session 1 - Reading 4Документ2 страницыFinQuiz - Smart Summary - Study Session 1 - Reading 4RafaelОценок пока нет

- Cheat Sheet For Financial Accounting PDF FreeДокумент1 страницаCheat Sheet For Financial Accounting PDF FreeNahom endОценок пока нет

- BEC Final Review NotesДокумент38 страницBEC Final Review NotessheldonОценок пока нет

- Regulation MyNotesДокумент50 страницRegulation MyNotesaudalogy100% (1)

- MTM 508: Financial Management: Session 1: Time Value of Money (TVM)Документ6 страницMTM 508: Financial Management: Session 1: Time Value of Money (TVM)Chelsea BustamanteОценок пока нет

- CPA BEC 1 - Corporate GovernanceДокумент3 страницыCPA BEC 1 - Corporate GovernanceGabrielОценок пока нет

- Statement of Change in Financial Position-5Документ32 страницыStatement of Change in Financial Position-5Amit SinghОценок пока нет

- CPA Regulation (Reg) Notes 2013Документ7 страницCPA Regulation (Reg) Notes 2013amichalek0820100% (3)

- Inventory Turnover Cost of Sales / Avg Inventory High Is Effective Inv MGMT Days of Inventory On Hand (DOH) 365/inv TurnoverДокумент3 страницыInventory Turnover Cost of Sales / Avg Inventory High Is Effective Inv MGMT Days of Inventory On Hand (DOH) 365/inv Turnoverjoe91bmwОценок пока нет

- RatiosДокумент17 страницRatiositsatulverma100% (1)

- Analysis of Profitability:: Short Term Financial Position or Test of SolvencyДокумент2 страницыAnalysis of Profitability:: Short Term Financial Position or Test of Solvencygauravbhardwaj900Оценок пока нет

- Hand Over Notes SampleДокумент3 страницыHand Over Notes SampleRosa Amri60% (5)

- Al 3257 CTS1 001 R2Документ36 страницAl 3257 CTS1 001 R2Lalit Bom MallaОценок пока нет

- Basics / Terminology: Wheels and Castors GuideДокумент1 страницаBasics / Terminology: Wheels and Castors GuideLetácio OliveiraОценок пока нет

- 12 Samss 007 PDFДокумент30 страниц12 Samss 007 PDFMohammadAseef100% (1)

- 01 Blickle Guide enДокумент2 страницы01 Blickle Guide enLalit Bom MallaОценок пока нет

- Non-Conformity Report: Commercial Aircraft GroupДокумент2 страницыNon-Conformity Report: Commercial Aircraft GroupLalit Bom MallaОценок пока нет

- Hand Over Notes SampleДокумент3 страницыHand Over Notes SampleRosa Amri60% (5)

- F880M-02 (2015) Standard Specification For Stainless Steel Socket Set Screws (Metric)Документ5 страницF880M-02 (2015) Standard Specification For Stainless Steel Socket Set Screws (Metric)Lalit Bom MallaОценок пока нет

- Check List For Structural ReviewДокумент6 страницCheck List For Structural ReviewAvinaash VeeramahОценок пока нет

- Design Process Checklist v1-0Документ4 страницыDesign Process Checklist v1-0hdaamirОценок пока нет

- A536-84 R14 Ductile Iron CastingsДокумент6 страницA536-84 R14 Ductile Iron CastingsLalit Bom MallaОценок пока нет

- ASME U & R Certification CostДокумент2 страницыASME U & R Certification CostLalit Bom Malla0% (1)

- Ameron PN220GДокумент4 страницыAmeron PN220GLalit Bom MallaОценок пока нет

- Available CodesДокумент14 страницAvailable CodesPankaj MunjalОценок пока нет

- Lenovo Ideapad 310Документ51 страницаLenovo Ideapad 310Lalit Bom MallaОценок пока нет

- Check List For Structural ReviewДокумент6 страницCheck List For Structural ReviewAvinaash VeeramahОценок пока нет

- Amercoat 400AL PDFДокумент4 страницыAmercoat 400AL PDFLalit Bom MallaОценок пока нет

- AutoCad 2007 Keyboard ShortcutsДокумент9 страницAutoCad 2007 Keyboard ShortcutsoomagooliesОценок пока нет

- Ajor InternationalДокумент5 страницAjor InternationalLalit Bom MallaОценок пока нет

- Ameron PN220GДокумент4 страницыAmeron PN220GLalit Bom MallaОценок пока нет

- Amercoat 400ALДокумент4 страницыAmercoat 400ALLalit Bom MallaОценок пока нет

- Pins & Keys: Spring Cotters of A Bolt - Steel Zinc Plated, Yellow PassivatedДокумент1 страницаPins & Keys: Spring Cotters of A Bolt - Steel Zinc Plated, Yellow PassivatedLalit Bom MallaОценок пока нет

- 1257 - Spring Hinges PDFДокумент1 страница1257 - Spring Hinges PDFLalit Bom MallaОценок пока нет

- SaudiCertificate 20171016 PDFДокумент1 страницаSaudiCertificate 20171016 PDFLalit Bom MallaОценок пока нет

- EM SRC 0003 Non Destructive Test NDT and Non Destructive Evaluation NDE RequirementsДокумент20 страницEM SRC 0003 Non Destructive Test NDT and Non Destructive Evaluation NDE RequirementsAhmed Shaban KotbОценок пока нет

- CSWIP Vision Certificate FormДокумент1 страницаCSWIP Vision Certificate FormLalit Bom MallaОценок пока нет

- Incident Report FormДокумент9 страницIncident Report FormLalit Bom MallaОценок пока нет

- Comparison Between Astm A 36 and Astm A 283 Grade C 1. Material ScopeДокумент1 страницаComparison Between Astm A 36 and Astm A 283 Grade C 1. Material ScopeLalit Bom MallaОценок пока нет

- Asme Section II A Sa-283 Sa-283mДокумент4 страницыAsme Section II A Sa-283 Sa-283mAnonymous GhPzn1xОценок пока нет

- Amerlock 400CДокумент4 страницыAmerlock 400CLalit Bom MallaОценок пока нет

- Entrenamiento 3412HTДокумент1 092 страницыEntrenamiento 3412HTWuagner Montoya100% (5)

- Soal Bahasa Inggris Sastra Semester Genap KLS Xi 2023Документ3 страницыSoal Bahasa Inggris Sastra Semester Genap KLS Xi 2023Ika Endah MadyasariОценок пока нет

- Logo DesignДокумент4 страницыLogo Designdarshan kabraОценок пока нет

- A Professional Ethical Analysis - Mumleyr 022817 0344cst 1Документ40 страницA Professional Ethical Analysis - Mumleyr 022817 0344cst 1Syed Aquib AbbasОценок пока нет

- 15.597 B CAT en AccessoriesДокумент60 страниц15.597 B CAT en AccessoriesMohamed Choukri Azzoula100% (1)

- Alice (Alice's Adventures in Wonderland)Документ11 страницAlice (Alice's Adventures in Wonderland)Oğuz KarayemişОценок пока нет

- Rele A Gas BuchholtsДокумент18 страницRele A Gas BuchholtsMarco GiraldoОценок пока нет

- Session Guide - Ramil BellenДокумент6 страницSession Guide - Ramil BellenRamilОценок пока нет

- DLL LayoutДокумент4 страницыDLL LayoutMarife GuadalupeОценок пока нет

- Alcatraz Analysis (With Explanations)Документ16 страницAlcatraz Analysis (With Explanations)Raul Dolo Quinones100% (1)

- Pon Vidyashram Group of Cbse Schools STD 8 SCIENCE NOTES (2020-2021)Документ3 страницыPon Vidyashram Group of Cbse Schools STD 8 SCIENCE NOTES (2020-2021)Bharath Kumar 041Оценок пока нет

- Curriculum Vitae: Personal InformationДокумент3 страницыCurriculum Vitae: Personal InformationMira ChenОценок пока нет

- Xavier High SchoolДокумент1 страницаXavier High SchoolHelen BennettОценок пока нет

- MSC in Healthcare Management (Top-Up) Degree From ARU - Delivered Online by LSBR, UKДокумент19 страницMSC in Healthcare Management (Top-Up) Degree From ARU - Delivered Online by LSBR, UKLSBRОценок пока нет

- Government College of Engineering Jalgaon (M.S) : Examination Form (Approved)Документ2 страницыGovernment College of Engineering Jalgaon (M.S) : Examination Form (Approved)Sachin Yadorao BisenОценок пока нет

- Contoh RPH Ts 25 Engish (Ppki)Документ1 страницаContoh RPH Ts 25 Engish (Ppki)muhariz78Оценок пока нет

- Roberts, Donaldson. Ante-Nicene Christian Library: Translations of The Writings of The Fathers Down To A. D. 325. 1867. Volume 15.Документ564 страницыRoberts, Donaldson. Ante-Nicene Christian Library: Translations of The Writings of The Fathers Down To A. D. 325. 1867. Volume 15.Patrologia Latina, Graeca et OrientalisОценок пока нет

- Chapin Columbus DayДокумент15 страницChapin Columbus Dayaspj13Оценок пока нет

- Matthew DeCossas SuitДокумент31 страницаMatthew DeCossas SuitJeff NowakОценок пока нет

- Sarcini: Caiet de PracticaДокумент3 страницыSarcini: Caiet de PracticaGeorgian CristinaОценок пока нет

- A Comprehensive Guide To HR Best Practices You Need To Know This Year (Infographic)Документ42 страницыA Comprehensive Guide To HR Best Practices You Need To Know This Year (Infographic)MALATHI MОценок пока нет

- Motion Exhibit 4 - Declaration of Kelley Lynch - 03.16.15 FINALДокумент157 страницMotion Exhibit 4 - Declaration of Kelley Lynch - 03.16.15 FINALOdzer ChenmaОценок пока нет

- Wwe SVR 2006 07 08 09 10 11 IdsДокумент10 страницWwe SVR 2006 07 08 09 10 11 IdsAXELL ENRIQUE CLAUDIO MENDIETAОценок пока нет

- National Bank Act A/k/a Currency Act, Public Law 38, Volume 13 Stat 99-118Документ21 страницаNational Bank Act A/k/a Currency Act, Public Law 38, Volume 13 Stat 99-118glaxayiii100% (1)

- Lesson 73 Creating Problems Involving The Volume of A Rectangular PrismДокумент17 страницLesson 73 Creating Problems Involving The Volume of A Rectangular PrismJessy James CardinalОценок пока нет

- Magnetism 1Документ4 страницыMagnetism 1krichenkyandex.ruОценок пока нет

- Deadlands - Dime Novel 02 - Independence Day PDFДокумент35 страницDeadlands - Dime Novel 02 - Independence Day PDFDavid CastelliОценок пока нет

- DLP No. 10 - Literary and Academic WritingДокумент2 страницыDLP No. 10 - Literary and Academic WritingPam Lordan83% (12)

- Engineering Graphics and Desing P1 Memo 2021Документ5 страницEngineering Graphics and Desing P1 Memo 2021dubethemba488Оценок пока нет

- LiverДокумент6 страницLiverMiguel Cuevas DolotОценок пока нет