Академический Документы

Профессиональный Документы

Культура Документы

SCC Inc. Financial Statement FY 2006 - 2007

Загружено:

L. A. PatersonАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

SCC Inc. Financial Statement FY 2006 - 2007

Загружено:

L. A. PatersonАвторское право:

Доступные форматы

SUNSET CULTURAL CENTER, INC.

FINANCIAL STATEMENTS

FOR THE YEAR ENDED

JUNE 30, 2007

AND INDEPENDENT AUDITORS' REPORT

SUNSET CULTURAL CENTER, INC.

Independent Auditors' Report

Financial Statements:

Statement of Financial Position

Statement of Activities

Statement of Cash Flows

Notes to Financial Statements

Supplemental Schedule:

Table of Contents

Exhibit B Summary Financial Information and Grant Requirements

Notes to Supplemental Schedule

I

Page

2

3

4

5

6-10

11

12

INDEPENDENT AUDITORS' REPORT

To the Board of Directors

Sunset Cultural Center, Inc.

We have audited the accompanying statement of financial position of Sunset Cultural Center,

Inc. (a nonprofit organization) as of June 30, 2007, and the related statement of activities and

cash flows for the year then ended. These financial statements are the responsibility of the

management of Sunset Cultural Center, Inc. Our responsibility is to express an opinion on

these financial statements based on our audit

We conducted our audit in accordance with auditing standards generally accepted in the United

States of America. Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free of material misstatement

An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in

the financial statements An audit also includes assessing the accounting principles used and

significant estimates made by management, as well as evaluating the overall financial statement

presentation. We believe that our audit provides a reasonable basis for our opinion

In our opinion, the accompanying financial statements present fairly, in all material respects, the

financial position of Sunset Cultural Center, Inc. as of June 30, 2007 and the results of its

activities and its cash flows for the year then ended, in conformity with accounting principles

generally accepted in the United States of America.,

Our audit was made for the purpose of forming an opinion on the basic financial statements of

Sunset Cultural Center, Inc. taken as a whole. The supplementary information listed in the

table of contents is presented for purposes of additional analysis and is not a required part of the

basic financial statements. Such information has been subjected to the auditing procedures

applied in the audit of the basic financial statements and, in our opinion, is fairly stated in all

material respects in relation to the basic financial statements taken as a whole ..

September 14,2007

2

ASSETS

Cash

Marketable securities

Accounts receivable- net

Interest receivable

Prepaid expenses

Treasury Bills

SUNSET CULTURAL CENTER, INC.

STATEMENT OF FINANCIAL POSITION

JUNE 30, 2007

Property and equipment -net

TOTAL ASSETS

LIABILITIES AND NET ASSETS

Liabilities:

Accounts payable

Accrued expenses

Deferred revenue

Lease payable

I otalliabilities

Net Assets:

Umestricted

Temporarily restricted

Total net assets

TOTAL LIABILITIES AND NET ASSETS

See Notes to Financial Statements

3

$

$

$

$

31,151

20,098

22,261

4,182

10,376

521,034

50 084

652,186

97,007

78,689

14,080

5 240

195 016

234,230

229 940

464 170

652,186

SUNSET CULTURAL CENTER, INC.

STATEMENT OF ACTIVITIES

FOR THE YEAR ENDED JUNE 30, 2007

Unrestricted

REVENUE AND PUBLIC SUPPORT:

Revenue:

Ticket sales $ 864,155

Theater rental 175,685

Facility use and other fee income 166,429

Reimbursed expenses 151,031

Sponsorship income 50,000

Investment income 20,801

Rental and other income 99 570

Total revenue 1,527,671

Public support:

Enabling grant 713,000

Perfmmance Carmel Venture Fund

Producers Guild

Other grants and donations 1,000

In-kind donation 11,250

Net assets released from restrictions 91 763

Total public support 817 013

Total revenue and public support 2,344,684

EXPENSES:

Theater services 1,713,448

Community services 235,391

Management and general 316,149

I otal expenses 2,264,988

CHANGES IN NET ASSETS 79,696

NET ASSETS, BEGINNING 154 534

NET ASSETS, ENDING $ 234,23Q

See Notes to Financial Statement

4

Temporarily

Restricted

$

3,255

3 255

1,231

129,626

58,838

__{91,763)

97 932

101 187

101,187

128,753

$ 222,24Q

Total

$ 864,155

175,685

166,429

151,031

50,000

24,056

99 570

1,530,926

713,000

1,231

129,626

59,838

11,250

914 945

2,445,871

1,713,448

235,391

316 149

2,264,988

180,883

283,287

$ 464,17Q

SUNSET CULTURAL CENTER, INC.

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED JUNE 30, 2007

CASH FLOWS FROM OPERATING ACTIVITIES:

Changes in net assets

Aqjustments to reconcile increase in net assets

to net cash provided by operating activities:

Depreciation

Gain on sale of equipment

Donated marketable securities

(Increase) decrease in:

Accounts receivable

Pledges I eceivable

Interest receivable

Prepaid expenses

Increase (decrease) in:

Accounts payable

Accrued expenses

Deferred revenue

NET CASH PROVIDED BY OPERATING

ACTIVITIES

CASH FLOWS FROM INVESTING ACTIVITIES:

Proceeds from sale of equipment

Purchase of Treasury Bills

NET CASH USED BY

INVESTING ACTIVITIES

CASH FLOWS FROM FINANCING ACTIVITIES:

Lease payments

Repayment of working capital advance

NET CASH USED BY FINANCING

ACTIVITIES

NET DECREASE IN CASH

CASH AT BEGINNING OF YEAR

CASH AT END OF YEAR

See Notes to Financial Statement

5

$ 180,883

49,661

(166)

(20,098)

(2,905)

7,686

(4,182)

56,784

37,397

10,404

59,527)

255 937

827

283,762)

282,935)

(2,614)

120,000)

122,614)

(149,612)

180 763

$ 31,151

SUNSET CULTURAL CENTER, INC ..

NOTES TO FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2007

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Operations - Sunset Cultural Center, Inc .. ("SCC") is a California nonprofit

public benefit corporation that was formed to operate and manage the Sunset Community

and Cultural Center ("the Center"), owned by the City of Carmel-by-the-Sea, ("the City"),

for the benefit of the City, its residents and visitors, and the users of the Center.

The Center includes a 718 seat theater with stage, rehearsal rooms, dressing rooms and

related facilities.. The theater is rented to third party presenters and is used for events

produced by SCC. In addition, there are meeting rooms and office space unrelated to the

theater that are used by SCC, tenants and many other outside community groups ..

Basis of Presentation - The accompanying financial statements are presented using the

accrual basis of accounting in accordance with generally accepted accounting principles ..

The net assets, revenues, gains and losses, and other support, expenses and other charges in

the accompanying financial statements are classified based on the existence or absence of

donor-imposed restrictions.. Accordingly, for reporting purposes, net assets of SCC and

changes therein are classified as follows:

Unrestricted Net Assets - Net assets that are not subject to

stipulations.. This includes any amounts designated by the Board for certain purposes.

Temporarily Restricted Net Assets - Net assets subject to

stipulations that may or will be met either by actions of SCC and/or the passage of

time ..

Permanently Restricted Net Assets - Net assets subject to

restrictions that they be maintained permanently by SCC As ofJune 30, 2007, there

were no permanently restricted net assets.

Recognition of Donor Restrictions - Support that is restricted by the donor is reported as

an increase in temporarily or permanently restricted net assets, depending on the nature of

the restriction. When a restriction expires (that is, when a stipulated time restriction ends

or purpose restriction is accomplished), temporarily restricted net assets are reclassified to

unrestricted net assets and reported in the Statement of Activities as "net assets released

from restrictions "

Marketable Securities - Marketable securities represent donated common stock received

in June 2007 and sold on July 3, 2007.. It is the policy of SCC to sell donated securities and

convert the gift to cash.

Accounts Receivable - Accounts receivable are recorded using the allowance method and

are presented net of the allowance for uncollectibility. At June 30, 2007 the allowance is

estimated to be zero..

Treasury Bills- Treasury Bills are recorded at cost and range in maturity from three to six

months at the time of purchase .. Interest is recognized as it is earned

6

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Property and Equipment - The City owns the Center and the related property, plant and

equipment SCC purchases certain tangible assets to support managing the facility. The

City has reversionary rights to any assets purchased by SCC. Property and equipment with

a useful life of more than one year and an acquisition cost of$1 ,000 or more are recognized

at cost. Donated property is recorded at fair market value on the date received.. Such

donations are reported as umestricted support unless the donor has restricted the donated

asset to a specific purpose.. Assets donated with explicit restrictions regarding their use and

contributions of cash that must be used to acquire property and equipment are reported as

restricted support. Absent donor stipulations regarding how long those donated assets must

be maintained, SCC reports expirations of donor restrictions when the donated or acquired

assets are placed in service. Depreciation is computed using the straight-line method over

the estimated useful lives ofthe assets ranging from three to seven years.

Income Taxes- SCC is exempt from federal income tax under Section 50l(c)(3) of the

Internal Revenue Code and from state franchise tax under California Revenue and Taxation

Code 2370l(d) but is subject to taxes on umelated business income when earned

Defened Revenue - Reservation fees are recognized as revenue in the fiscal year which

includes the related performance.. Amounts received in advance are repmted as deferred

revenue .. At June 30,2007, deferred revenue was $14,080

Contributed Services and Facilities - Volunteers contribute services that have not been

recorded in the accompanying financial statements because the criteria for recognition

under SFAS No .. 116 have not been met. SCC receives the use of office space at no cost,

the in-kind donation is recognized at the fair value of rent for similar nonprofit

organizations in the area. The amount recorded for the year ending June 30, 2007 was

$11 ,250, which is reflected in the financial statements as in-kind donation with an

offsetting charge to rent

Functional Allocation of Expenses - The costs of providing program services and other

activities have been presented on a functional basis in the Statement of Activities

Accordingly, certain costs have been allocated among the programs and supporting

services benefited

Use of Estimates - The preparation of financial statements in accordance with generally

accepted accounting principles requires management to make estimates and assumptions

that affect the amounts reported. Actual results are not expected to differ from those

estimates

NOTE 2. CONCENTRATION OF CREDIT RISK

SCC holds cash balances in one financial institution in amounts exceeding the federal

insurance limits.. However, management believes that SCC does not face a significant risk

ofloss on these assets.

7

NOTE 3. TREASURY BILLS

Treasury Bills held at June 30, 2007, have various maturities between August 9 and

December 6, 2007 and amounted to $521,034

The following schedule summarizes the investment return and its classification in the

statement of activities for the year ended June 30, 2007:

Umestricted

Interest/dividends $ 20.801 $

NOTE 4. PROPERTY AND EQUIPMENT

Temporarily

Restricted Total

3 255 !lk$

At June 30, 2007, property and equipment consisted of the following:

Office equipment and software

Building improvements

Theater equipment

Total

Less accumulated depreciation and amortization

Net property and equipment

NOTE 5. LEASING ARRANGEMENTS

$

$

129,494

19,467

18 534

167,495

117411

50.084

SCC leases office equipment under a capital lease.. The economic substance of the lease is

that sec is financing the acquisition of the equipment through the lease and accordingly,

the equipment is recorded as an asset and the lease is recorded as a liability.

Future minimum lease payments under the capital lease as of June 30, 2007 for each of the

remaining years and in the aggregate are as follows:

Year Ended

June 30,

2008

2009

Total

Less: amount representing interest

Present value of minimum lease payments

8

$

Amount

3,356

2 237

5,593

353

5.240

NOTE 5. LEASING ARRANGEMENTS (Continued)

In addition, SCC as lessor, leased office space to eight tenants under operating leases.. The

term of the leases range from two years to two and one half years beginning January 1,

2006 and expiring June 30, 2008.. The monthly rental payments range from $70 to $1,761.

One tenant has an armual rent of $1 for use of library book receipt and storage.. Rental

income for these leases as of June 30, 2007 was $66,670

Minimum future rentals to be received on the operating leases are $59,965 for the year

ending June 30, 2008 ..

NOTE 6. TEMPORARILY RESTRICTED NET ASSETS

As of June 30, 2007, temporarily restricted net assets are composed of cash and cash

equivalents which are restricted for the following purposes:

Performance Carmel

Producers Guild

Facility

Total

$

$

50,071

159,771

20 098

229.940

The City produced a performance series, Performance Carmel, and under the terms of the

Agreement, SCC is to continue producing this series.. The City transferred all funds held

for Performance Crume! to SCC.. The Producers Guild is a fund established to support

events produced by Sunset Center Presents.

During the year ended June 30, 2007 net assets were released from donor restrictions when

expenses satisfying the restricted purpose were incurred, or by occurrence of other events

specified by donors, These assets are shown in the Statement of Activities as "Items

released from restriction"

Purpose restriction accomplished:

Performance Crume!

Producers Guild

Facility

Sunset Center Presents

Total

$

$

9

29,745

23,278

23,145

15 595

91.763

NOTE 7. RETIREMENT PLAN

During 2005, the Board of Trustees approved the creation of the Sunset Cultural Center,

Inc .. 403(b) Plan (the Plan), a defined contribution plan. Employees voluntarily make

contributions to the Plan in amounts based upon the limits established by Sections 402(g)

and 414(v) of the Internal Revenue Code .. The Plan's assets are invested in certain self-

directed income, money market and mutual funds.

The Board of Trustees may approve a discretionary employer contribution to be allocated

in proportion to the participants' total armual compensation. The Board of Trustees has not

approved a contribution for the period ended June 30, 2007.

NOTE 8. MANAGEMENT AGREEMENT

A management agreement ("the Agreement") was signed by SCC and the City and

accepted by the City Council on June 8, 2004.. Responsibility for management of the

Center was transferred to SCC on July I, 2004 for a term of3 years ending June 30, 2007.

SCC has the option to extend the term for two additional three-year terms. The renewal

option has been exercised for the period July 1, 2007 through June 30, 2010. The

Agreement sets performance criteria and provides remedies in the event SCC fails to meet

such criteria, including early termination of the Agreement The City is committed to

providing an Enabling Grant of $750,000 for the fiscal year ending June 30, 2008.. SCC is

economically dependent on the Enabling Grant received from the City

NOTE 9. COMMITMENTS AND CONTINGENCIES

SCC has entered into various contracts for services.. The contracts range from a period of

three years to five years and total $284,568. At June 30, 2007, the remaining commitments

were $90, 170 ..

10

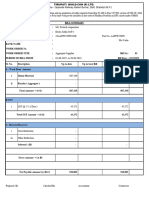

SUPPLEMENTAL SCHEDULE

SUNSET CULTURAL CENTER, INC.

SUPPLEMENTAL SCHEDULE

EXHIBIT B SUMMARY FINANCIAL INFORMATION AND GRANT REQUIREMENTS

FOR THE YEAR ENDED JUNE 30, 2007

REVENUE:

Rentals:

Theater

Rooms

Offices

Other

Facility fees

Grants/sponsorships

Total revenue

Performance Carmel - net

Sunset Center Presents -net

Box Office - net

Adjusted revenue

COSTS:

Direct costs:

All personnel

All other

Total direct costs

Indirect costs

Total costs

SHORTFALL

ENABLING GRANT

EXCESS OF REVENUE AND GRANTS OVER COSTS

11

$ 163,091

27,718

66,670

53,769

93,723

74145

479,116

13,680

21,654

37,542)

476 908

594,778

218 317

813,095

275 994

1,089,089

(612,181)

713 000

$ 1QQ,812

SUNSET CULTURAL CENTER, INC.

NOTES TO SUPPLEMENTAL SCHEDULE

EXHIBIT B- SUMMARY FINANCIAL INFORMATION AND GRANT REQUIREMENTS

FOR THE YEAR ENDED JUNE 30, 2007

NOTE 1. The supplemental schedule presents the results of operations as defined in the Agreement

in Article 4 Expenses, Section 4.2, for the year ended June 30, 2007. The financial results

shown in Exhibit B Summary Financial Information and Grant Requirements differ from

the preceding financial statements as follows:

1) The supplemental schedule does not reflect the in-kind donation and expense

related to Sunset Cultural Center's use of administrative offices owned by the City

2) The supplemental schedule shows as expenditures the costs of acquired assets with

useful lives in excess of one year.. In the accompanying financial statements these

assets have been capitalized and depreciation and amortization expense has been

recorded for the period

3) The supplemental schedule shows as expenditures certain lease payments related to

a capital lease. In the accompanying financial statements this asset has been

capitalized and future lease payments have been recorded as a liability, and

depreciation expense has been recorded for the period

4) The supplemental schedule does not include donations of temporarily restricted net

assets for Producers Guild and facilities which remain restricted as of June 30,

2007..

12

INDEPENDENT AUDITORS' REPORT

To the Board of Directors

Sunset Cultural Center, Inc.

We have audited the accompanying statement of financial position of Sunset Cultural Center,

Inc. (a nonprofit organization) as of June 30, 2007, and the related statement of activities and

cash flows for the year then ended These financial statements are the responsibility of the

management of Sunset Cultural Center, Inc. Our responsibility is to express an opinion on

these financial statements based on our audit

We conducted our audit in accordance with auditing standards generally accepted in the United

States of America Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free of material misstatement

An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in

the financial statements An audit also includes assessing the accounting principles used and

significant estimates made by management, as well as evaluating the overall financial statement

presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the accompanying financial statements present fairly, in all material respects, the

financial position of Sunset Cultural Center, Inc. as of Tune 30, 2007 and the results of its

activities and its cash flows for the year then ended, in conformity with accounting principles

generally accepted in the United States of America ..

Our audit was made for the purpose of forming an opinion on the basic financial statements of

Sunset Cultural Center, Inc. taken as a whole. The supplementary information listed in the

table of contents is presented for purposes of additional analysis and is not a required part of the

basic financial statements Such information has been subjected to the auditing procedures

applied in the audit of the basic financial statements and, in our opinion, is fairly stated in all

material respects in relation to the basic financial statements taken as a whole.

September 14, 2007

2

Вам также может понравиться

- Agenda City Council Special Meeting 12-03-18Документ3 страницыAgenda City Council Special Meeting 12-03-18L. A. PatersonОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- City of Carmel-By-The-Sea City Council AgendaДокумент5 страницCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byДокумент5 страницCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byДокумент2 страницыCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Councilmember Announcements 12-03-18Документ1 страницаCouncilmember Announcements 12-03-18L. A. PatersonОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Agenda City Council 03-21-18Документ2 страницыAgenda City Council 03-21-18L. A. PatersonОценок пока нет

- Minutes City Council Special Meeting November 5, 2018 12-03-18Документ1 страницаMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonОценок пока нет

- Appointments Monterey-Salinas Transit Board 12-03-18Документ2 страницыAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Appointments FORA 12-03-18Документ2 страницыAppointments FORA 12-03-18L. A. PatersonОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byДокумент2 страницыCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Destruction of Certain Records 11-05-18Документ41 страницаDestruction of Certain Records 11-05-18L. A. PatersonОценок пока нет

- Monthly Reports September 2018 11-05-18Документ55 страницMonthly Reports September 2018 11-05-18L. A. PatersonОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- MPRWA Agenda Packet 11-08-18Документ18 страницMPRWA Agenda Packet 11-08-18L. A. PatersonОценок пока нет

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Документ2 страницыProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonОценок пока нет

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byДокумент4 страницыCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byДокумент5 страницCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byДокумент3 страницыCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectДокумент2 страницыCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonОценок пока нет

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectДокумент4 страницыCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonОценок пока нет

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byДокумент4 страницыCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectДокумент8 страницCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- Special Meeting Minutes October 1, 2018 11-05-18Документ1 страницаSpecial Meeting Minutes October 1, 2018 11-05-18L. A. PatersonОценок пока нет

- MPRWA Agenda Packet 10-25-18Документ6 страницMPRWA Agenda Packet 10-25-18L. A. PatersonОценок пока нет

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byДокумент7 страницCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonОценок пока нет

- City Council Agenda 10-02-18Документ3 страницыCity Council Agenda 10-02-18L. A. PatersonОценок пока нет

- MPRWA Agenda Closed Session 10-25-18Документ1 страницаMPRWA Agenda Closed Session 10-25-18L. A. PatersonОценок пока нет

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byДокумент4 страницыCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonОценок пока нет

- Minutes Mprwa September 27, 2018Документ2 страницыMinutes Mprwa September 27, 2018L. A. PatersonОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Monthly Reports August 10-02-18Документ48 страницMonthly Reports August 10-02-18L. A. PatersonОценок пока нет

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byДокумент30 страницCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonОценок пока нет

- S3 The PTH of A Finaal MoДокумент18 страницS3 The PTH of A Finaal Mosuhasshinde88Оценок пока нет

- Puyat and Sons Vs City of ManilaДокумент4 страницыPuyat and Sons Vs City of ManilaJohn Jeffrey L. Ramirez100% (1)

- Primary Objective (RA 11211) : Salient AmendmentsДокумент25 страницPrimary Objective (RA 11211) : Salient AmendmentsSam OneОценок пока нет

- Transtrend PresentationДокумент28 страницTranstrend Presentationsf_freeman5645Оценок пока нет

- Real Estate MortgageДокумент2 страницыReal Estate MortgageLia LBОценок пока нет

- Standard BI Content Extractors & Queries ListДокумент151 страницаStandard BI Content Extractors & Queries Listnira505033% (3)

- Weber Meadowview Corporation Bylaws May 31, 2014 Approved FinalДокумент18 страницWeber Meadowview Corporation Bylaws May 31, 2014 Approved FinalMattGordonОценок пока нет

- Company Valuation & Ratio Analysis (Tata Motors) 2021Документ25 страницCompany Valuation & Ratio Analysis (Tata Motors) 2021Manveet SinghОценок пока нет

- Icahn Letter To AppleДокумент14 страницIcahn Letter To Applejmurrell4037Оценок пока нет

- ACCOUNTING 101 - No.4 - Theories - QuestionsДокумент3 страницыACCOUNTING 101 - No.4 - Theories - QuestionslemerleОценок пока нет

- CFA Program Exam Results: Your Performance On The ExamДокумент2 страницыCFA Program Exam Results: Your Performance On The ExamVaibhav BhatiaОценок пока нет

- Chapter 2 Comprehensive IncomeДокумент34 страницыChapter 2 Comprehensive IncomeKyla DizonОценок пока нет

- Quit Your JobДокумент30 страницQuit Your JobNoah Navarro100% (2)

- Trutech Stone Crusher KubariДокумент7 страницTrutech Stone Crusher Kubarigolu23_1988Оценок пока нет

- Competitive Strategy Notes at MBAДокумент26 страницCompetitive Strategy Notes at MBABabasab Patil (Karrisatte)Оценок пока нет

- Registered Address Contact Details: Seller BuyerДокумент10 страницRegistered Address Contact Details: Seller BuyerAzim AhmedОценок пока нет

- General Oil and GasДокумент10 страницGeneral Oil and GasRizqullah RamadhanОценок пока нет

- Book-Tax Income Differences and Major Determining FactorsДокумент11 страницBook-Tax Income Differences and Major Determining FactorsFbsdf SdvsОценок пока нет

- Brand Valuation - Event StudiesДокумент59 страницBrand Valuation - Event StudiesCamelia VechiuОценок пока нет

- 2023 CFAMM Chairs Brief - Draft 06.03.2023Документ22 страницы2023 CFAMM Chairs Brief - Draft 06.03.2023Bo BilkoОценок пока нет

- What Is CapitalismДокумент15 страницWhat Is Capitalismkingfund7823Оценок пока нет

- Lecture 9 TVM (Practical Applications)Документ22 страницыLecture 9 TVM (Practical Applications)Devyansh GuptaОценок пока нет

- Sma4802 - Learning Unit 2Документ14 страницSma4802 - Learning Unit 2Kgatli MazibukoОценок пока нет

- Vijay Kumar: GuptaДокумент63 страницыVijay Kumar: GuptaContra Value BetsОценок пока нет

- SecciДокумент4 страницыSecciMelcescuIriОценок пока нет

- GSK Annual Report 2013 PDFДокумент62 страницыGSK Annual Report 2013 PDFsahilОценок пока нет

- 10000000830Документ181 страница10000000830Chapter 11 DocketsОценок пока нет

- Mergers and Acquisitions of Financial Institutions: A Review of The Post-2000 LiteratureДокумент24 страницыMergers and Acquisitions of Financial Institutions: A Review of The Post-2000 LiteratureImran AliОценок пока нет

- Bitcoin Halving, Explained: Mar 24, 2020updated Apr 6, 2020Документ11 страницBitcoin Halving, Explained: Mar 24, 2020updated Apr 6, 2020Pieter SteenkampОценок пока нет

- TVS TyresДокумент84 страницыTVS TyresNitinAgnihotriОценок пока нет

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОт EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОценок пока нет

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОценок пока нет

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistОт EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistРейтинг: 4.5 из 5 звезд4.5/5 (73)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceОт EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceРейтинг: 4 из 5 звезд4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)