Академический Документы

Профессиональный Документы

Культура Документы

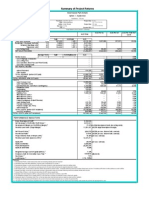

Cash Flow Table For Greenwood Park Estate Option 1 - Subdivision - Subdivision - 179 Lots

Загружено:

Khairuddin IsmailОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cash Flow Table For Greenwood Park Estate Option 1 - Subdivision - Subdivision - 179 Lots

Загружено:

Khairuddin IsmailАвторское право:

Доступные форматы

Cash Flow Table for Greenwood Park Estate

PROJECT CASH FLOW

SALES SUMMARY

Units Sold

Cumulative Units Sold

% Units Sold

SqM Sold

Cumulative SqM Sold

% SqM Sold

AUD Sold

Cumulative AUD Sold

% AUD Sold

HANDOVER SUMMARY

Units Handed Over

Cumulative Units Handed Over

% Units Handed Over

SqM Handed Over

Cumulative SqM Handed Over

% SqM Handed Over

AUD Handed Over

Cumulative AUD Handed Over

% AUD Handed Over

TOTAL

179.00

29,740.00

42,519,199

179.00

29,740.00

42,519,199

0

Jun-07

Option 1 - Subdivision - Subdivision - 179 Lots

1

Jul-07

2

Aug-07

3

Sep-07

4

Oct-07

5

Nov-07

6

Dec-07

7

Jan-08

7.17

7.17

4.0%

716.67

716.67

2.4%

798,127

798,127

1.9%

8

Feb-08

7.17

14.33

8.0%

716.67

1,433.33

4.8%

799,771

1,597,897

3.8%

9

Mar-08

7.17

21.50

12.0%

716.67

2,150.00

7.2%

801,418

2,399,315

5.6%

10

Apr-08

7.17

28.67

16.0%

716.67

2,866.67

9.6%

803,069

3,202,384

7.5%

11

May-08

7.17

35.83

20.0%

716.67

3,583.33

12.0%

804,723

4,007,107

9.4%

12

Jun-08

7.17

43.00

24.0%

716.67

4,300.00

14.5%

806,381

4,813,488

11.3%

13

Jul-08

9.67

52.67

29.4%

1,740.00

6,040.00

20.3%

2,748,708

7,562,196

17.8%

14

Aug-08

9.67

62.33

34.8%

1,740.00

7,780.00

26.2%

2,754,370

10,316,567

24.3%

9.67

72.00

40.2%

1,740.00

9,520.00

32.0%

2,760,044

13,076,610

30.8%

(18,250)

(18,250)

(18,250)

(18,250)

(18,250)

(18,250)

(18,250)

(18,250)

(18,250)

(18,250)

(18,250)

(18,250)

(18,250)

(18,250)

(18,250)

(18,250)

(32,750)

(32,750)

(32,750)

(32,750)

5,252,000

83,650

83,650

2,986,848

5,523

9,025

(14,811)

8,322,234

(8,340,484)

(10,761,107)

19,520

11,151

6,252

2,117

160,355

91,805

64,050

4,500

31,083

(20,837)

190,121

(208,371)

(10,969,478)

25,479

14,581

8,226

2,671

209,689

120,776

84,263

4,650

31,083

(27,182)

239,068

(271,818)

(11,241,296)

30,928

17,037

9,609

4,281

245,006

141,094

98,438

5,475

119,703

31,083

(30,888)

395,832

(428,582)

(11,669,878)

PROJECT CASH FLOW

REVENUE

Gross Sales Revenue

block 1 apartments

block 2 apartments

block 3 townhouses

block 4 townhouses

block 5

block 6

block 7

block 8 houses

block 9

block 10

Capitalised Sales

Selling Costs

Gross Rental Income

Leasing Costs

Other Income

Interest Received*

GST Payments

TOTAL NET REVENUE

COSTS

Land and Acquisition

Professional Fees

pre construction consultants

stage 1 consultants

stage 2 consultants

stage 3 consultants

Development Management

Manual Input

Construction Costs (inc Contingency)

block 1 apartments

block 2

block 3 townhouses

block 4 townhouses

block 5 houses

block 6 houses

block 7 houses

block 8 houses

block 9

block 10

Landscaping Contract

Manual Input

Statutory Fees

Miscellaneous Costs 1

Miscellaneous Costs 2

Miscellaneous Costs 3

Project Contingency (Reserve)

Land Holding Costs

Pre-Sale Commissions

Financing Costs (exc Fees)

GST Credits Reclaimed

TOTAL COSTS

Net Cash Flow (before Interest)

Cumulative Cash Flow

Estate Master DF Ver 4.1

42,519,199

4,813,488

3,463,536

3,173,302

1,586,651

4,152,080

4,790,862

2,874,517

9,293,950

2,190,493

6,180,320

(1,266,902)

148,807

(2,683,564)

38,717,541

13,777,490

1,132,572

512,500

102,500

104,201

105,931

307,439

7,370,000

1,505,000

1,050,000

560,000

280,000

585,000

675,000

405,000

1,215,000

270,000

675,000

150,000

7,509,700

412,154

439,376

90,000

(940,986)

29,790,306

8,927,235

1,948,490

19,748

19,748

(2,977)

1,965,261

(1,965,261)

(1,965,261)

12,000

122

122

(1,102)

11,020

(11,020)

(1,976,281)

1,213

1,213

119,703

90,000

(110)

210,806

(210,806)

(2,187,086)

(2,187,086)

818

818

80,661

(74)

81,404

(81,404)

(2,268,491)

56

56

5,523

(1,664)

3,914

(22,164)

(2,290,655)

91

91

9,025

(2,488)

6,629

(24,879)

(2,315,534)

Page 1 of 6 Pages

91

91

9,025

(2,488)

6,629

(24,879)

(2,340,413)

147

147

5,523

9,025

(2,493)

12,202

(30,452)

(2,370,865)

91

91

9,025

(2,488)

6,629

(24,879)

(2,395,744)

91

91

9,025

(2,488)

6,629

(24,879)

(2,420,623)

File: Estate Master DF.xls

Date of Report: 19/05/2009 1:01 PM

Cash Flow Table for Greenwood Park Estate

PROJECT CASH FLOW

TOTAL

FINANCING

Equity

Manual Adjustments (Inject + / Repay -)

Injections

2,000,000

Interest Charged

Equity Repayment

8,184,549

Less Profit Share

(309,227)

Equity Balance

6,184,549

Equity Cash Flow***

5,875,321

Project Cash Account

Surplus Cash Injection

13,835,369

Cash Reserve Drawdown

(14,100,991)

Interest on Surplus Cash

265,622

Surplus Cash Balance

Loan 1 - Lender Name

Manual Adjustments (Drawdown - / Repay +)

Drawdown

(5,159,000)

Loan Interest Rate (%/ann)

Interest Charged

(1,303,976)

Application and Line Fees

(319,337)

Interest Paid by Equity

Loan Repayment

6,782,313

Interest and Fees

1,623,313

Principal

5,159,000

Loan Balance

% of Land Purchase Price.

Profit Share

309,227

Loan 1 Cash Flow

1,932,540

Loan 2 - Lender Name

Manual Adjustments (Drawdown - / Repay +)

Drawdown

Loan Interest Rate (%/ann)

Interest Charged

Application and Line Fees

Interest Paid by Equity

Loan Repayment

Interest and Fees

Principal

Loan Balance

% of Land Purchase Price.

Profit Share

Loan 2 Cash Flow

Loan 3 - Lender Name

Manual Adjustments (Drawdown - / Repay +)

Drawdown

Loan Interest Rate (%/ann)

Interest Charged

Application and Line Fees

Interest Paid by Equity

Loan Repayment

Interest and Fees

Principal

Loan Balance

% of Land Purchase Price.

Profit Share

Loan 3 Cash Flow

Loan 4 - Lender Name

Drawdown

(17,069,077)

Loan Interest Rate (%/ann)

Interest Charged

(1,384,995)

Application and Line Fees

Interest Paid by Equity

Loan Repayment

18,454,072

Interest and Fees

1,384,995

Principal

17,069,077

Loan Balance

% of Land Purchase Price.

Loan 4 Cash Flow

1,384,995

Project Overdraft

% of Land Purchase Price.

Net Cash Flow (after Interest)

6,184,549

Cumulative Cash Flow**

PROJECT IRR & NPV

Cash Flow that includes financing costs but excludes interest and co

Static Discount Rate (per ann. nominal)

20.00%

PV for each Month

(454,978)

NPV of Future Cash Flows

Variable Discount Rate (per ann. nominal)

20.00%

NPV (using weighted avg discount rate)

(454,978)

0

Jun-07

Option 1 - Subdivision - Subdivision - 179 Lots

1

Jul-07

2

Aug-07

3

Sep-07

4

Oct-07

5

Nov-07

6

Dec-07

7

Jan-08

9

Mar-08

10

Apr-08

11

May-08

12

Jun-08

13

Jul-08

0

(2,000,000)

-

14

Aug-08

0

2,000,000

(2,000,000)

(2,000,000)

0

(2,000,000)

-

0

(2,000,000)

-

0

(2,000,000)

-

0

(2,000,000)

-

0

(2,000,000)

-

0

(2,000,000)

-

0

(2,000,000)

-

0

(2,000,000)

-

0

(2,000,000)

-

0

(2,000,000)

-

0

(2,000,000)

-

2,000,000

(1,965,261)

34,739

(11,020)

145

23,864

5,159,000

(210,806)

99

4,972,158

20,717

4,992,875

(81,404)

20,804

4,932,274

(22,164)

20,551

4,930,661

(24,879)

20,544

4,926,327

(24,879)

20,526

4,921,974

(30,452)

20,508

4,912,030

(24,879)

20,467

4,907,618

(24,879)

20,448

4,903,187

(4,923,617)

20,430

-

0

8.00%

-

0

8.00%

-

0

(5,159,000)

8.00%

(1,200)

(5,160,200)

39.7%

(5,159,000)

0

8.00%

(34,401)

(8,598)

(5,203,200)

40.0%

-

0

8.00%

(34,688)

(8,598)

(5,246,486)

40.4%

-

0

8.00%

(34,977)

(8,598)

(5,290,061)

40.7%

-

0

8.00%

(35,267)

(8,598)

(5,333,926)

41.0%

-

0

8.00%

(35,560)

(8,598)

(5,378,084)

41.4%

-

0

8.00%

(35,854)

(8,598)

(5,422,536)

41.7%

-

0

8.00%

(36,150)

(8,598)

(5,467,285)

42.1%

-

0

8.00%

(36,449)

(8,598)

(5,512,332)

42.4%

-

0

8.00%

(36,749)

(8,598)

(5,557,679)

42.8%

-

0

8.00%

(37,051)

(8,598)

(5,603,328)

43.1%

-

0

8.00%

(37,356)

(8,598)

(5,649,282)

43.5%

-

0

8.00%

(37,662)

(8,598)

(5,695,542)

43.8%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

0

0.00%

-

7.50%

-

7.50%

-

7.50%

-

7.50%

-

7.50%

-

7.50%

-

7.50%

-

7.50%

-

7.50%

-

7.50%

-

7.50%

-

0

(2,000,000)

-

(5,203,200)

40.02%

(22,282)

(2,210,325)

(5,246,486)

40.36%

(103,887)

(2,314,212)

(5,290,061)

40.69%

(45,188)

(2,359,400)

(5,333,926)

41.03%

(48,200)

(2,407,600)

(5,378,084)

41.37%

(48,510)

(2,456,110)

(5,422,536)

41.71%

(54,396)

(2,510,506)

(5,467,285)

42.06%

(49,161)

(2,559,667)

0

(2,000,000)

-

(5,512,332)

42.40%

(49,477)

(2,609,144)

(3,416,867)

7.50%

(3,416,867)

26.28%

(3,416,867)

(8,974,545)

69.03%

(8,365,401)

(10,974,545)

(208,371)

7.50%

(21,355)

(3,646,593)

28.05%

(208,371)

(9,249,921)

71.15%

(275,376)

(11,249,921)

(271,818)

7.50%

(22,791)

(3,941,202)

30.32%

(271,818)

(9,590,484)

73.77%

(340,563)

(11,590,484)

(428,582)

7.50%

(24,633)

(4,394,416)

33.80%

(428,582)

(10,089,959)

77.62%

(499,475)

(12,089,959)

(1,965,261)

(1,965,261)

(10,875)

(1,976,136)

(5,160,200)

39.69%

(211,906)

(2,188,042)

(1,965,261)

(11,020)

(212,006)

(8,598)

(90,003)

(30,763)

(33,477)

(33,477)

(39,051)

(33,477)

(33,477)

(8,349,082)

(216,969)

(280,416)

(437,180)

(1,965,261)

(454,978)

20.00%

(10,839)

1,535,455

20.00%

(205,112)

1,572,249

20.00%

(8,182)

1,813,992

20.00%

(84,244)

1,852,967

20.00%

(28,323)

1,975,353

20.00%

(30,316)

2,039,551

20.00%

(29,819)

2,107,578

20.00%

(34,214)

2,176,740

20.00%

(28,850)

2,252,720

20.00%

(28,377)

2,324,301

20.00%

(6,961,043)

2,397,074

20.00%

(177,932)

10,925,259

20.00%

(226,194)

11,327,932

20.00%

(346,865)

11,801,821

20.00%

* Includes half interest from deposit for land acquisition plus Interest received from pre-sale deposits

** Cumulative Cash Flow After Interest is revenue less costs (including interest on overdraft)

*** Includes equity injection, interest expense, loan re-payments and share of profit as outflows. Revenue and money borrowed as inflows.

Estate Master DF Ver 4.1

8

Feb-08

Estate Master for Excel Licensed to: Unlicensed

Page 2 of 6 Pages

File: Estate Master DF.xls

Date of Report: 19/05/2009 1:01 PM

Вам также может понравиться

- Sample Cash Flow Construction ProjectsДокумент6 страницSample Cash Flow Construction ProjectsRoshan de Silva89% (9)

- Toll Road Financial Model v1-0Документ52 страницыToll Road Financial Model v1-0siby13172100% (3)

- Sample Needs StatementДокумент66 страницSample Needs StatementKhairuddin Ismail100% (6)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)От EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Рейтинг: 3.5 из 5 звезд3.5/5 (17)

- MQL4 ProgrammingДокумент12 страницMQL4 ProgrammingKhairuddin Ismail100% (2)

- Millions of Dollars Except Per-Share DataДокумент14 страницMillions of Dollars Except Per-Share DataVishal VermaОценок пока нет

- Need Statement Guide JKRДокумент89 страницNeed Statement Guide JKRKhairuddin Ismail67% (12)

- CIA Triangle Review QuestionsДокумент11 страницCIA Triangle Review QuestionsLisa Keaton100% (1)

- Scourge of The Sword Coast BookДокумент85 страницScourge of The Sword Coast BookDaniel Yasar86% (7)

- TCO Assignment StudentДокумент6 страницTCO Assignment StudentPablo EstebanОценок пока нет

- Soldier PilesДокумент41 страницаSoldier PilesGan Chin Phang100% (5)

- Grievance Machinery ReportДокумент16 страницGrievance Machinery ReportRoseMantuparОценок пока нет

- Meaford Haven Proforma Sept 2013Документ7 страницMeaford Haven Proforma Sept 2013api-204895087Оценок пока нет

- Financial Study LunaДокумент9 страницFinancial Study LunaNia LunaОценок пока нет

- Sherrard Developments ProformaДокумент4 страницыSherrard Developments ProformaBrook SherrardОценок пока нет

- DLF PRIMUS PSE APPROVEDДокумент68 страницDLF PRIMUS PSE APPROVEDnawazkhan23Оценок пока нет

- Manajemen Keuangan 2Документ22 страницыManajemen Keuangan 2syhrnsypОценок пока нет

- Contractual Innovation in The UK Energy MarketsДокумент8 страницContractual Innovation in The UK Energy MarketsRahul YadavОценок пока нет

- Mayfield PlazaДокумент9 страницMayfield PlazaPuran SarnaОценок пока нет

- New Landscapes EstimatesДокумент13 страницNew Landscapes EstimatesMathew YoyakkyОценок пока нет

- Lease Income NarrativeДокумент14 страницLease Income Narrativegreg_jkОценок пока нет

- Pro Forma Financial Statements4Документ50 страницPro Forma Financial Statements4SakibMDShafiuddinОценок пока нет

- 2009 24446 ArДокумент60 страниц2009 24446 ArnnasikerabuОценок пока нет

- Raheja Developers - Installment Payment PlanДокумент6 страницRaheja Developers - Installment Payment PlanNishit GargОценок пока нет

- Chap 015Документ18 страницChap 015dbjnОценок пока нет

- AFE - Flow MetersДокумент13 страницAFE - Flow MetersMichael Adu-boahenОценок пока нет

- Bharat Petroleum Corporation Limited - Oil & Gas: CMP-'728.1 "Hold" TP-'794.0Документ4 страницыBharat Petroleum Corporation Limited - Oil & Gas: CMP-'728.1 "Hold" TP-'794.0sakiv1Оценок пока нет

- Calculating commission, rates, and net proceedsДокумент7 страницCalculating commission, rates, and net proceedsjm laqueОценок пока нет

- Q1 FY2013 InvestorsДокумент28 страницQ1 FY2013 InvestorsRajesh NaiduОценок пока нет

- APL International's 2005 Manufacturing and Financial ReportДокумент12 страницAPL International's 2005 Manufacturing and Financial ReportphunguyenframasОценок пока нет

- Financial StatementДокумент120 страницFinancial StatementRodalyn OlivaОценок пока нет

- MFGPro MenuListДокумент266 страницMFGPro MenuListJay TracewellОценок пока нет

- 2013-5-22 First Resources CIMBДокумент27 страниц2013-5-22 First Resources CIMBphuawlОценок пока нет

- 4 Year Mechanical Power: Dr. Mohamed Hammam 2020Документ9 страниц4 Year Mechanical Power: Dr. Mohamed Hammam 2020Mohamed HammamОценок пока нет

- Horngrens Accounting 10Th Edition Nobles Solutions Manual Full Chapter PDFДокумент36 страницHorngrens Accounting 10Th Edition Nobles Solutions Manual Full Chapter PDFelizabeth.hayes136100% (9)

- Q2FY2013 InvestorsДокумент31 страницаQ2FY2013 InvestorsRajesh NaiduОценок пока нет

- Fixed Assets and Intangible Assets: AccountingДокумент73 страницыFixed Assets and Intangible Assets: AccountingYustamar Ramatsuy0% (1)

- Stafford CaseДокумент31 страницаStafford CaseJennineОценок пока нет

- Maximizing revenue and reducing costs for MPI projectsДокумент31 страницаMaximizing revenue and reducing costs for MPI projectsSovik KumarОценок пока нет

- Balance Sheet StatementДокумент8 страницBalance Sheet StatementsantasantitaОценок пока нет

- Revenue: Revenue & Net Profit/ (Loss) - 9 Months Ended 31st DecemberДокумент2 страницыRevenue: Revenue & Net Profit/ (Loss) - 9 Months Ended 31st DecemberMihiri de SilvaОценок пока нет

- DPR Financial Model Final 30.07.10Документ194 страницыDPR Financial Model Final 30.07.10deshmukhvaibhav2009Оценок пока нет

- Statements of Expenditure Review - Not ReviewДокумент2 страницыStatements of Expenditure Review - Not ReviewMheshimiwa SabarehОценок пока нет

- Ho Beefs Announcement 3 Q 2014Документ10 страницHo Beefs Announcement 3 Q 2014mmccОценок пока нет

- ENGR 3360U Winter 2014 Unit 11: Cash Flow and DepreciationДокумент40 страницENGR 3360U Winter 2014 Unit 11: Cash Flow and DepreciationsunnyopgОценок пока нет

- Exchange Summary Volume and Open Interest Equity Index FuturesДокумент2 страницыExchange Summary Volume and Open Interest Equity Index FuturesavadcsОценок пока нет

- Zipcar FishboneДокумент24 страницыZipcar FishboneKrishna Srikumar0% (3)

- Exchange Summary Volume and Open Interest Equity Index FuturesДокумент2 страницыExchange Summary Volume and Open Interest Equity Index FuturesavadcsОценок пока нет

- DepreciationДокумент27 страницDepreciationraj10420Оценок пока нет

- Benn Hi - Financial AnalysisДокумент9 страницBenn Hi - Financial AnalysisJoey KulkinОценок пока нет

- SR No Particulars Amt (Rs in Lacs)Документ20 страницSR No Particulars Amt (Rs in Lacs)Payal PatelОценок пока нет

- Full Assignment Tax RPGTДокумент19 страницFull Assignment Tax RPGTVasant SriudomОценок пока нет

- Formula 546Документ9 страницFormula 546Muhammad Zahid FareedОценок пока нет

- Completed - FMДокумент13 страницCompleted - FM122592Оценок пока нет

- BUS 230A Exam 1 Spreadsheets-2Документ40 страницBUS 230A Exam 1 Spreadsheets-2fasanoj5211Оценок пока нет

- For Proyectolisina: 1. Executive Summary (2012 Prices)Документ12 страницFor Proyectolisina: 1. Executive Summary (2012 Prices)Moy GonzálezОценок пока нет

- AFM RevisionДокумент8 страницAFM RevisionSomabhizinisi MazibukoОценок пока нет

- Lansdowne Partnership PlanДокумент18 страницLansdowne Partnership PlancbcottawaОценок пока нет

- Input Form: Input For Venture Guidance AppraisalДокумент7 страницInput Form: Input For Venture Guidance AppraisalgenergiaОценок пока нет

- Capital InvestmentДокумент38 страницCapital InvestmentSameerbaskarОценок пока нет

- Project FeasibilityДокумент7 страницProject FeasibilitychengadОценок пока нет

- PPE PPT - Ch10Документ81 страницаPPE PPT - Ch10ssreya80Оценок пока нет

- Pamsimas Q4-2009Документ86 страницPamsimas Q4-2009datakuОценок пока нет

- SPLK LatestДокумент1 страницаSPLK Latestmbm_rajaОценок пока нет

- Projected Financials of Maize Processing PlantДокумент13 страницProjected Financials of Maize Processing PlantRahul RankaОценок пока нет

- Value SpreadsheetДокумент58 страницValue SpreadsheetJitendra SutarОценок пока нет

- MT4-2 - Part 2Документ3 страницыMT4-2 - Part 2Khairuddin IsmailОценок пока нет

- MT4 3Документ9 страницMT4 3Khairuddin IsmailОценок пока нет

- Creep PDFДокумент236 страницCreep PDFoshadhivОценок пока нет

- Recent Advances in Repair and Rehabilitation of RCC Structures With Nonmetallic FibersДокумент12 страницRecent Advances in Repair and Rehabilitation of RCC Structures With Nonmetallic FibersWasim KhanОценок пока нет

- MT4-2 - Part 2Документ3 страницыMT4-2 - Part 2Khairuddin IsmailОценок пока нет

- MT4-2 - Part 2Документ3 страницыMT4-2 - Part 2Khairuddin IsmailОценок пока нет

- MT4 1Документ10 страницMT4 1Khairuddin IsmailОценок пока нет

- A2 Sewer Report SaqmpleДокумент2 страницыA2 Sewer Report SaqmpleKhairuddin IsmailОценок пока нет

- Detailing of Reinforcement in Concrete StructuresДокумент82 страницыDetailing of Reinforcement in Concrete StructuresLiu JianqiОценок пока нет

- Code-Compliant Installation Manual 227.3: U.S. Des. Patent No. D496,248S, D496,249S. Other Patents PendingДокумент26 страницCode-Compliant Installation Manual 227.3: U.S. Des. Patent No. D496,248S, D496,249S. Other Patents Pendingrmm99rmm99Оценок пока нет

- Recent Advances in Repair and Rehabilitation of RCC Structures With Nonmetallic FibersДокумент12 страницRecent Advances in Repair and Rehabilitation of RCC Structures With Nonmetallic FibersWasim KhanОценок пока нет

- Summary Project ReturnsДокумент2 страницыSummary Project ReturnsKhairuddin IsmailОценок пока нет

- GB2-1 Tie BeamДокумент1 страницаGB2-1 Tie BeamKhairuddin IsmailОценок пока нет

- CRB Jan 08 EarleyДокумент4 страницыCRB Jan 08 EarleyKhairuddin IsmailОценок пока нет

- Intoduction To Small Hydropower SystemsДокумент8 страницIntoduction To Small Hydropower SystemsmiccassОценок пока нет

- Scope of Work ExhibitДокумент22 страницыScope of Work ExhibitKhairuddin IsmailОценок пока нет

- 1.statement of Financial Position (SFP)Документ29 страниц1.statement of Financial Position (SFP)Efrelyn Grethel Baraya Alejandro100% (4)

- Mandhana SD BBP-mumbai2Документ75 страницMandhana SD BBP-mumbai2Mukeshila2010Оценок пока нет

- GP Fund Form AДокумент2 страницыGP Fund Form Aihsan ul haqОценок пока нет

- Cornell Notes Financial AidДокумент3 страницыCornell Notes Financial AidMireille TatroОценок пока нет

- Types of RoomДокумент2 страницыTypes of RoomAran TxaОценок пока нет

- Terminals & Connectors: Delphi Packard Metri-Pack 150 Series Sealed ConnectorsДокумент1 страницаTerminals & Connectors: Delphi Packard Metri-Pack 150 Series Sealed ConnectorsTrần Long VũОценок пока нет

- People vs Solayao ruling on admission of homemade firearm evidenceДокумент1 страницаPeople vs Solayao ruling on admission of homemade firearm evidenceMaria Victoria Dela TorreОценок пока нет

- Form 6a PDFДокумент3 страницыForm 6a PDFNeet SandhuОценок пока нет

- HHRG 118 IF00 Wstate ChewS 20230323Документ10 страницHHRG 118 IF00 Wstate ChewS 20230323Jillian SmithОценок пока нет

- KCIC's Capital Goods Duty ExemptionДокумент3 страницыKCIC's Capital Goods Duty ExemptionRian Rizki YantamaОценок пока нет

- Eltek FP2 IndoorДокумент1 страницаEltek FP2 IndoorDmiОценок пока нет

- Compassion and Choices Fall 2015Документ27 страницCompassion and Choices Fall 2015Kathleen JaneschekОценок пока нет

- 2020 Dee - v. - Dee Reyes20210424 14 mjb83kДокумент4 страницы2020 Dee - v. - Dee Reyes20210424 14 mjb83kLynielle CrisologoОценок пока нет

- Application Form For Aviation Security Personnel Certification - InstructorДокумент4 страницыApplication Form For Aviation Security Personnel Certification - InstructorMoatasem MahmoudОценок пока нет

- DRS Rev.0 C 051 390 MCC TR2!01!0001 - Condensate StablizationДокумент4 страницыDRS Rev.0 C 051 390 MCC TR2!01!0001 - Condensate StablizationBalasubramanianОценок пока нет

- DeclarationДокумент6 страницDeclarationzdvdfvsdvsОценок пока нет

- Understanding ASEAN: Its Systems & StructuresДокумент59 страницUnderstanding ASEAN: Its Systems & StructureskaiaceegeesОценок пока нет

- Cma End Game NotesДокумент75 страницCma End Game NotesManish BabuОценок пока нет

- 90 Cameron Granville V ChuaДокумент1 страница90 Cameron Granville V ChuaKrisha Marie CarlosОценок пока нет

- Evidence Drop: Hawaii DOH Apparently Gave Obama Stig Waidelich's Birth Certificate Number - 3/27/2013Документ62 страницыEvidence Drop: Hawaii DOH Apparently Gave Obama Stig Waidelich's Birth Certificate Number - 3/27/2013ObamaRelease YourRecords100% (3)

- Why Some Like The New Jim Crow So Much - A Critique (4!30!12)Документ14 страницWhy Some Like The New Jim Crow So Much - A Critique (4!30!12)peerlesspalmer100% (1)

- Election of 2000 WorksheetДокумент3 страницыElection of 2000 Worksheetvasanthi sambaОценок пока нет

- DV Consulting Inc Summary of ServicesДокумент5 страницDV Consulting Inc Summary of ServicesDv AccountingОценок пока нет

- PNP Ethical Doctrine Core ValuesДокумент10 страницPNP Ethical Doctrine Core Valuesunknown botОценок пока нет

- Digital Forensic Tools - AimigosДокумент12 страницDigital Forensic Tools - AimigosKingОценок пока нет

- Traffic CitationsДокумент1 страницаTraffic Citationssavannahnow.comОценок пока нет