Академический Документы

Профессиональный Документы

Культура Документы

Aileron Market Balance: Issue 42.2

Загружено:

Dan ShyИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Aileron Market Balance: Issue 42.2

Загружено:

Dan ShyАвторское право:

Доступные форматы

August 23, 2010

Dan Shy

dan.shy@davianletter.com

IN FOCUS:

Trading Outlook for the Week of August 23, 2010

Trading Outlook:

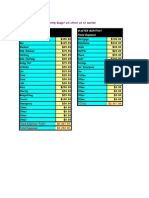

Note: By way of reminder, since the Model Portfolio has only $17,783.01 there will only be 'day trades' at this stage of the game in order to escape the risk of over-leveraged gap opens in the commodity futures markets. As the 'trading sister' model account grows, we will move into 'swing trading'. In addition, I trade according to the methodology outlined in my YouTube series1.

Market #1 October Sugar (SBV0): As I mentioned in the last issue, I was able to find another profitable opportunities to go short within the Sugar market on the 18th. I then mentioned in that update issue ...

Typically, the month of August shows seasonal weakness in Sugar. But we can't say that about the month of August thus far. Even if we were to sink down to .1775 (the present price is .1950) really, all we could say is that Sugar has gone 'channeled', or congested within a broad range in the month of August. Therefore, I'm beginning to back away from my bearish stance. Any short / bearish trades taken in larger accounts would be with a smaller position size if we break lower. - Airelon's Market Tactics 41.5

That eventuality has come to pass. We continued to move higher for the rest of the week closing at .1984, and we never found another profitable opportunity to go short in this market. At this point, the entire bias has broken down, and the seasonal edge has come to an end. So view this as my official 'backing away from the Sugar market' statement. Market #2 October Gold (GCV0, YGV0 for the Mini-Gold or the GLD for the imperfect ETF): I am still hoping to get a pullback in Gold, possibly to the $1,210 region. The reason for this, is that a seasonally strongly bullish

1 Exact Link - http://www.youtube.com/user/AirelonTrading#g/c/61DCBF4BF4E93A0F (Playlist still being created)

August 23, 2010

time is approaching, that typically lasts for a few weeks. So this would provide a wonderful opportunity to massage a 'long bias' as I am apt to do. But I have to see the market pull down to the $1,210 region. I won't chase the market, only to get whipsawed. Either the market conforms to my preestablished trading parameters, or I won't trade it. So at this point, it's just about waiting, watching and observing. There is not a lot in the way of trades at the current time, according to my own methodology. Sometimes, as you've seen throughout the history of this newsletter, it just works out that way. Wheat, Cotton, Coffee and Live Cattle are acting in a completely contra-seasonal manner so that I cannot get a good read on them. Other markets such as Cocoa and Orange Juice I have thoughts regarding, but my methodology is telling me to wait three or four weeks. If you have any questions regarding my personal outlook, or any other comments, please feel free to contact me at dan.shy@davianletter.com. I will say that if you have questions about your own trading and you want to ask for my input? Please include your most recent money management performance statistics in any email correspondence. Until next week, stay safe trade well, and remember that loving other people doesn't cost a dime.

Note: The above statements should not be construed as an investment or trading recommendation. Airelon's Market Tactics is a newsletter that allows subscribers to look 'over my shoulder' as it were, for my own personal specific trading and investing ideas and thoughts for the next week. But they are only thoughts as of the moment of publication, and are subject to change.. Any trades or investments that I discuss within this newsletter are simply my own thoughts regarding my own investing and trading outlook. Remember that entering any market is an individual decision. There is no guarantee that I will enter, or have entered any of the trading or investing ideas that I discuss in this newsletter; as larger accounts may require a different strategy as the ones presented here. This newsletter simply contains my trading and investing thoughts for the next week. I, the author do not grant this work for wide distribution beyond any single individual subscriber as this publication is protected by U.S. And International Copyright laws. All rights reserved. No license is granted to the user except for the user's personal use. No part of this publication or its contents may be copied, downloaded, stored in a retrieval system, further transmitted or otherwise reproduced, stored, disseminated, transferred, or used, in any form or by any means except as permitted under the original subscription agreement or with prior written permission. I personally only enter any market after watching and reading the tape and I trade using money management principles2. The losses in trading can be very real, and depending on the investment vehicle and market, can exceed your initial investment. I am not a licensed trading or investment adviser, or financial planner. But I do have 14 years of experience in trading and investing in these markets. The Model Portfolio accounts are hypothetical accounts,with all of the inherent problems therein, which are used within this newsletter in an attempt to track the results of this newsletter, and is run for the education of other traders who should make their own decisions based off their own research, due diligence, and tolerance for risk. Any pictures used within this newsletter are believed to be public domain. Any charts that are displayed using the ThinkorSwim platform, and other pictures were obtained through Wikipedia's public domain policy.

2 Exact Link - http://www.youtube.com/user/AirelonTrading#grid/user/D41865A5A41F4283

Вам также может понравиться

- Aileron Market Balance: Issue 52Документ8 страницAileron Market Balance: Issue 52Dan ShyОценок пока нет

- Aileron Market Balance: Issue 51Документ9 страницAileron Market Balance: Issue 51Dan ShyОценок пока нет

- Aileron Market Balance: Issue 45Документ7 страницAileron Market Balance: Issue 45Dan ShyОценок пока нет

- Aileron Market Balance: Issue 42Документ6 страницAileron Market Balance: Issue 42Dan ShyОценок пока нет

- Aileron Market Balance: Issue 49Документ6 страницAileron Market Balance: Issue 49Dan ShyОценок пока нет

- Aileron Market Balance: Issue 41Документ6 страницAileron Market Balance: Issue 41Dan ShyОценок пока нет

- Aileron Market Balance: Issue 47Документ7 страницAileron Market Balance: Issue 47Dan ShyОценок пока нет

- Aileron Market Balance: Issue 50Документ8 страницAileron Market Balance: Issue 50Dan ShyОценок пока нет

- Aileron Market Balance: Issue 48Документ6 страницAileron Market Balance: Issue 48Dan ShyОценок пока нет

- Aileron Market Balance: Issue 46Документ9 страницAileron Market Balance: Issue 46Dan ShyОценок пока нет

- Aileron Market Balance: Issue 44Документ7 страницAileron Market Balance: Issue 44Dan ShyОценок пока нет

- Aileron Market Balance: Issue 43Документ8 страницAileron Market Balance: Issue 43Dan ShyОценок пока нет

- Aileron Market Balance: Issue 39Документ6 страницAileron Market Balance: Issue 39Dan ShyОценок пока нет

- Aileron Market Balance: Issue 40Документ6 страницAileron Market Balance: Issue 40Dan ShyОценок пока нет

- Aileron Market Balance: Issue 36Документ6 страницAileron Market Balance: Issue 36Dan ShyОценок пока нет

- Aileron Market Balance: Issue 37Документ7 страницAileron Market Balance: Issue 37Dan ShyОценок пока нет

- Aileron Market Balance: Issue 35.5Документ3 страницыAileron Market Balance: Issue 35.5Dan ShyОценок пока нет

- Aileron Market Balance: Issue 38Документ7 страницAileron Market Balance: Issue 38Dan ShyОценок пока нет

- Aileron Market Balance: Issue 35Документ7 страницAileron Market Balance: Issue 35Dan ShyОценок пока нет

- Aileron Market Balance: Issue 34Документ6 страницAileron Market Balance: Issue 34Dan ShyОценок пока нет

- Aileron Market Balance: Issue 30Документ6 страницAileron Market Balance: Issue 30Dan ShyОценок пока нет

- Aileron Market Balance: Issue 33Документ6 страницAileron Market Balance: Issue 33Dan ShyОценок пока нет

- Aileron Market Balance: Issue 29Документ6 страницAileron Market Balance: Issue 29Dan ShyОценок пока нет

- Aileron Market Balance: Issue 32Документ5 страницAileron Market Balance: Issue 32Dan ShyОценок пока нет

- Aileron Newsletter Special Reference Issue: 12 Months of Aileron Market BalanceДокумент7 страницAileron Newsletter Special Reference Issue: 12 Months of Aileron Market BalanceDan ShyОценок пока нет

- Aileron Market Balance: Issue 26Документ5 страницAileron Market Balance: Issue 26Dan ShyОценок пока нет

- Aileron Market Balance: Issue 31Документ5 страницAileron Market Balance: Issue 31Dan ShyОценок пока нет

- Aileron Market Balance: Issue 28Документ5 страницAileron Market Balance: Issue 28Dan ShyОценок пока нет

- Aileron Market Balance: Issue 27Документ6 страницAileron Market Balance: Issue 27Dan ShyОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Axial DCF Business Valuation Calculator GuideДокумент4 страницыAxial DCF Business Valuation Calculator GuideUdit AgrawalОценок пока нет

- Books On Africa and Related Issues Published by The UNU: Library@hq - Unu.eduДокумент29 страницBooks On Africa and Related Issues Published by The UNU: Library@hq - Unu.eduPawar SachinОценок пока нет

- Solution: International Inance SsignmentДокумент7 страницSolution: International Inance SsignmentJamshidОценок пока нет

- Jan 24Документ2 страницыJan 24charnold miolОценок пока нет

- Modify Monthly Budget TemplateДокумент32 страницыModify Monthly Budget TemplateMohammed TetteyОценок пока нет

- Group 12 - Gender and Diversity - RITTER SPORT BIOДокумент40 страницGroup 12 - Gender and Diversity - RITTER SPORT BIOIsabel HillenbrandОценок пока нет

- Accountant / Student Resume SampleДокумент2 страницыAccountant / Student Resume Sampleresume7.com100% (6)

- Audio Book - Brian Tracy - The Psychology of Selling (Index)Документ2 страницыAudio Book - Brian Tracy - The Psychology of Selling (Index)Wanga SailiОценок пока нет

- Planning Commission and NITI AayogДокумент5 страницPlanning Commission and NITI AayogsuprithОценок пока нет

- Mini CaseДокумент18 страницMini CaseZeeshan Iqbal0% (1)

- 403Документ12 страниц403al hikmahОценок пока нет

- Climate Change & Disaster Risk Management: Razon, Lovelyn Rivera, Meg Anne Sta. Ines, MaricrisДокумент56 страницClimate Change & Disaster Risk Management: Razon, Lovelyn Rivera, Meg Anne Sta. Ines, MaricrisMeg Anne Legaspi RiveraОценок пока нет

- Strama Paper FinalДокумент31 страницаStrama Paper FinalLauren Refugio50% (4)

- What Dubai Silicon Oasis DSO Free Zone OffersДокумент3 страницыWhat Dubai Silicon Oasis DSO Free Zone OffersKommu RohithОценок пока нет

- TD Sequential Best PDFДокумент23 страницыTD Sequential Best PDFancutzica2000100% (4)

- Tài Liệu Tham Khảo Chương 2 KTQTNC- UpdatedДокумент43 страницыTài Liệu Tham Khảo Chương 2 KTQTNC- UpdatedMai TuấnОценок пока нет

- Urban Economics Problem Set #2 Due Thursday, Oct 15, 11pm, ONLY ONLINE at NYU ClassesДокумент4 страницыUrban Economics Problem Set #2 Due Thursday, Oct 15, 11pm, ONLY ONLINE at NYU ClassesBhavik ModyОценок пока нет

- FinanceanswersДокумент24 страницыFinanceanswersAditi ToshniwalОценок пока нет

- Using APV: Advantages Over WACCДокумент2 страницыUsing APV: Advantages Over WACCMortal_AqОценок пока нет

- Msq01 Overview of The Ms Practice by The CpaДокумент9 страницMsq01 Overview of The Ms Practice by The CpaAnna Marie75% (8)

- Retail Technology Management: Presented by Kumar Gaurav Harshit KumarДокумент19 страницRetail Technology Management: Presented by Kumar Gaurav Harshit KumarKumar GauravОценок пока нет

- TARLAC STATE UNIVERSITY - TAX 3 SPECIAL TAXATIONДокумент1 страницаTARLAC STATE UNIVERSITY - TAX 3 SPECIAL TAXATIONKezОценок пока нет

- Staff WelfareДокумент2 страницыStaff Welfaremalikiamcdonald23Оценок пока нет

- Traders CodeДокумент7 страницTraders CodeHarshal Kumar ShahОценок пока нет

- Excel Case 6Документ2 страницыExcel Case 6Huế ThùyОценок пока нет

- Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Документ10 страницCapital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Aditya Anshuman DashОценок пока нет

- IRV Banikanta Mishra: Practice Assignment - 1Документ9 страницIRV Banikanta Mishra: Practice Assignment - 1SANCHITA PATIОценок пока нет

- Sap SCM Features Functions Modules List - 6389aba9Документ16 страницSap SCM Features Functions Modules List - 6389aba9Mohd AbideenОценок пока нет

- IFRS Lease Accounting HSBC 2.19.2019 PDFДокумент76 страницIFRS Lease Accounting HSBC 2.19.2019 PDFmdorneanuОценок пока нет

- NMIMS TRIMESTER VI - BRAND MANAGEMENT HISTORYДокумент46 страницNMIMS TRIMESTER VI - BRAND MANAGEMENT HISTORYPayal AroraОценок пока нет