Академический Документы

Профессиональный Документы

Культура Документы

Section B, Question 2

Загружено:

Divyen PatelАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Section B, Question 2

Загружено:

Divyen PatelАвторское право:

Доступные форматы

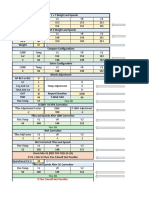

SECTION B - ANSWER ONE QUESTION FROM THIS SECTION Question 2 The following models were fitted to data from

50 firms: Model 1 Model 2 where y = rate of return on equity for the firm, x = market share, x = measure of

2 3

firm size, x = industrial growth rate, x = level of world trade in industrial products.

4 5

Numbers in parentheses are coefficient standard errors. The following results were obtained: (a) Use Model (1) to test the null hypothesis, that the industrial growth rate is statistically insignificant in explaining the rate of return on equity. You should use a 5% level of significance. STATE HYPOTHESES AND FORMULAE for Parts (a) (c). Test stat = 0.66 and Critical = 2.0086, therefore the do not reject the null hypothesis, suggesting that the industrial growth is insignificant in explaining the rate of return on equity. [2 marks] (b) Use Model (1) to test the null hypothesis that world trade in industrial products has no effect on the rate of return on equity. Test stat = 0.822 and Critical = 2.0086, therefore the do not reject the null hypothesis, suggesting that the world trade in industrial products has no effect in explaining the rate of return on equity. [2 marks] (c) Based on models 1 and 2, examine the joint hypothesis that the coefficients on x and x are both equal to zero. The 5% critical value for F(2,45)=3.23.

5 4

[8 marks] Test Stat = 3.75 and Critical = 3.23, therefore we reject the null hypothesis suggesting that both variables (industrial growth and world trade in industrial products) are significant in explaining the rate of return on equity.

(d) Explain the difference between the outcomes in (a) and (b) compared with (c). [8 marks]

With outcomes of (a) and (b) we did not rejected the null hypothesis that beta 4 and beta 5 are equal to 0, suggesting that they are insignificant when explaining the rate of return on equity; however outcome (c) suggests that when both of the variables are considered together, they have an effect on explaining the rate of return on equity. This means that the industrial growth and the world trade in industrial products are linked together and one variable cannot explain the rate of return on equity without using the other variable.

(e) Why do these results suggest collinearity between the industrial growth rate and world trade in industrial products? [10 marks] DEFINE COLINEARITY Individually they are not significant and together they are significant, that indicates that some level of collinearity occurs as one variable cannot explain the returns without the other present. Slide 135-137 [Total - 30 marks]

Вам также может понравиться

- Hybrid Bond Issuance 2009 To 2014Документ39 страницHybrid Bond Issuance 2009 To 2014Divyen PatelОценок пока нет

- Bookrunner Parent RankingsДокумент4 страницыBookrunner Parent RankingsDivyen PatelОценок пока нет

- Bookrunner Parent Rankings (EUR)Документ4 страницыBookrunner Parent Rankings (EUR)Divyen PatelОценок пока нет

- The Four Factors that Heightened the Financial Crisis CollapseДокумент5 страницThe Four Factors that Heightened the Financial Crisis CollapseDivyen PatelОценок пока нет

- Hunter-Worth Question 1Документ2 страницыHunter-Worth Question 1Divyen Patel100% (1)

- BondsДокумент19 страницBondsDivyen PatelОценок пока нет

- With Regards To The Vicente IssueДокумент1 страницаWith Regards To The Vicente IssueDivyen PatelОценок пока нет

- Section AДокумент5 страницSection ADivyen PatelОценок пока нет

- Section C, Question 5Документ5 страницSection C, Question 5Divyen PatelОценок пока нет

- C4 AДокумент4 страницыC4 Ashah143Оценок пока нет

- NCXZДокумент5 страницNCXZNoraLambОценок пока нет

- Derivatives FuturesДокумент98 страницDerivatives FuturesDivyen Patel100% (2)

- C4 Jan 11 MSДокумент8 страницC4 Jan 11 MSasmashaОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Grade 3 Unit 3 (English)Документ1 страницаGrade 3 Unit 3 (English)Basma KhedrОценок пока нет

- Chapter 6 THE SECOND LAW OF THERMODYNAMICS5704685Документ29 страницChapter 6 THE SECOND LAW OF THERMODYNAMICS5704685bensonОценок пока нет

- SUCHANA EANV SANCHAR PRAUDYOGIK (I.C.T.) AADHARIT SHIKSHAN ADHIGAM VYUV RACHANA KA MADHYAMIK STAR PAR ADHYAYANRAT GRAMIN EANV SHAHARI PARIVESH KE VIDHYARTHITON KI GANIT UPLABDHI PAR PRABHAV KA ADHYAYANДокумент9 страницSUCHANA EANV SANCHAR PRAUDYOGIK (I.C.T.) AADHARIT SHIKSHAN ADHIGAM VYUV RACHANA KA MADHYAMIK STAR PAR ADHYAYANRAT GRAMIN EANV SHAHARI PARIVESH KE VIDHYARTHITON KI GANIT UPLABDHI PAR PRABHAV KA ADHYAYANAnonymous CwJeBCAXpОценок пока нет

- 942 FullДокумент9 страниц942 FullZulfah MidahОценок пока нет

- Reliance - Formulas & Calculations PDFДокумент5 страницReliance - Formulas & Calculations PDFkrishbistОценок пока нет

- 3 - Big Data CharacteristicsДокумент32 страницы3 - Big Data CharacteristicsWong pi wenОценок пока нет

- Cities Words and Images From Poe To ScorseseДокумент266 страницCities Words and Images From Poe To Scorsesejcbezerra100% (2)

- Fc6a Plus (MQTT)Документ44 страницыFc6a Plus (MQTT)black boxОценок пока нет

- Trip WireДокумент19 страницTrip Wirepinky065558100% (2)

- Cop Y: Queueing TheoryДокумент7 страницCop Y: Queueing TheoryDiego VásquezОценок пока нет

- Spe 143287 MS PДокумент11 страницSpe 143287 MS PbvkvijaiОценок пока нет

- Caso de Estudio 14.1, 14.2 y 14.3Документ6 страницCaso de Estudio 14.1, 14.2 y 14.3Rodolfo G. Espinosa RodriguezОценок пока нет

- Textbook List for Sri Kanchi Mahaswami Vidya Mandir 2020-21Документ13 страницTextbook List for Sri Kanchi Mahaswami Vidya Mandir 2020-21drsubramanianОценок пока нет

- Presentation of Mind and AwarenessДокумент6 страницPresentation of Mind and AwarenessLia PribadiОценок пока нет

- Independent University, Bangladesh: Term Paper (Group Assignment)Документ16 страницIndependent University, Bangladesh: Term Paper (Group Assignment)Johan Tausifur RahmanОценок пока нет

- GITAM Guidelines For MBA Project Work - 2018Документ6 страницGITAM Guidelines For MBA Project Work - 2018Telika RamuОценок пока нет

- 1.4 Solved ProblemsДокумент2 страницы1.4 Solved ProblemsMohammad Hussain Raza ShaikОценок пока нет

- 38-13-10 Rev 2Документ128 страниц38-13-10 Rev 2Gdb HasseneОценок пока нет

- Hydraulic System Trainer AS-10Документ13 страницHydraulic System Trainer AS-10Tanlets Gery100% (1)

- Real Time Braille To Speech Using PythonДокумент10 страницReal Time Braille To Speech Using PythonKali LinuxОценок пока нет

- Animated Film Techniques for Phrasing Action and DialogueДокумент10 страницAnimated Film Techniques for Phrasing Action and Dialoguevall-eОценок пока нет

- BF 00571142Документ1 страницаBF 00571142Tymoteusz DziedzicОценок пока нет

- USTHB Master's Program Technical English Lesson on Reflexive Pronouns and Antenna FundamentalsДокумент4 страницыUSTHB Master's Program Technical English Lesson on Reflexive Pronouns and Antenna Fundamentalsmartin23Оценок пока нет

- 桌球比賽裁判自動系統Документ69 страниц桌球比賽裁判自動系統ErikОценок пока нет

- A320 Flex CalculationДокумент10 страницA320 Flex CalculationMansour TaoualiОценок пока нет

- Rules of the Occult UndergroundДокумент247 страницRules of the Occult UndergroundIsaak HillОценок пока нет

- Universal Chargers and GaugesДокумент2 страницыUniversal Chargers and GaugesFaizal JamalОценок пока нет

- Follow The Directions - GR 1 - 3 PDFДокумент80 страницFollow The Directions - GR 1 - 3 PDFUmmiIndia100% (2)

- Ticket SunilДокумент2 страницыTicket SunilDURGA PRASAD TRIPATHYОценок пока нет

- Katsina Polytechnic Lecture Notes on History and Philosophy of Science, Technology and MathematicsДокумент33 страницыKatsina Polytechnic Lecture Notes on History and Philosophy of Science, Technology and MathematicsHamisu TafashiyaОценок пока нет