Академический Документы

Профессиональный Документы

Культура Документы

SBB 50 11

Загружено:

Afework AtnafsegedОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

SBB 50 11

Загружено:

Afework AtnafsegedАвторское право:

Доступные форматы

TELEGRAPHICADRESS NATIONBANK TELLEX21020 CODESUSED PETERSON3rd&4thED. BENTLEY'S2ndPHRASE A.B.C.

6thEDITION

PLEASEADDRESSANYREPLYTO P.O.BOX5550 ADDISABABA

Licensing and Supervision of Banking Business Minimum Capital Requirement for Banks Directives No. SBB/50/2011

WHEREAS, it has become necessary to raise the minimum capital required to establish a new bank so that the newly established bank can compete successfully with existing banks;

WHEREAS, it is known that as banks expand their business they must maintain a level of capital commensurate with the volume of their business to withstand adverse operational results;

NOW, THEREFORE, in accordance with Articles 18(1) and 59(2) of Proclamation No. 592/2008, the National Bank of Ethiopia has issued these directives.

1. Short Title

These directives may be cited as Minimum Capital Requirement for Banks No. SBB/ 50/2011

2. Definitions

For the purpose of these directives, unless the context provides otherwise:

2.1 existing banks refers to banks licensed by the National Bank of Ethiopia before the effective date of these directives; 2.2 a bank under formation means a banking share company under formation which fulfills all of the following as of the effective date of these directives: a) its capital has been fully subscribed, b) collected in cash from its founding shareholders a minimum capital of Birr75 million (Birr seventy five million) and deposited in an existing bank in the name and to the account of the bank under formation, c) held its founding shareholders general meeting which elected board of directors and approved articles and memorandum of associations, and d) submitted final application for banking business to the National Bank of Ethiopia.

3. Scope of Application

These directives shall be applicable to existing banks and applicants for new banking business including those under formation.

4. Minimum Paid-up Capital 4.1 The minimum paid up capital required to obtain a banking business license shall be Birr 500 million (birr five hundred million), which shall be fully paid in cash and deposited in a bank in the name and to the account of the bank under establishment. 4.2 Existing banks whose paid up capital is below Birr 500 million (birr five hundred million) shall raise their paid-up capital to the said amount by June 30, 2016.

Such banks are required to submit action plan for capital increase to the National Bank of Ethiopia within 30 days after the effective date of these directives. 4.3 Banks under formation are required to comply with sub article 1 of this article within five years after commencement of banking operation. 4.4 Notwithstanding the provisions of sub-article 2 of this article, all licensed banks shall at a minimum maintain capital to risk weighted assets ratio of 8% at all times.

5. Sanctions

If a licensed bank fails to comply with the minimum paid up capital requirements specified under article 4 of these directives, the National Bank of Ethiopia may: 5.1 Prohibit such bank from accepting new deposits, underwriting new loans and conducting international banking business until the deficiency in capital is corrected; 5.2 Require such bank to merge with another bank; 5.3 Close such bank; or 5.4 Take any other measures it considers fit.

6. Repeal Minimum paid up capital to be maintained by banks Directives Number SBB/24/99 is hereby repealed and replaced by these Directives.

7. Effective Date These Directives shall enter into force as of 19th day of September 2011.

Вам также может понравиться

- Service Quality Management LectureДокумент36 страницService Quality Management LectureAfework AtnafsegedОценок пока нет

- Seizing Africas Retail OpportunitiesДокумент16 страницSeizing Africas Retail OpportunitiesAfework AtnafsegedОценок пока нет

- Mandatory Exercise For Next ClassДокумент1 страницаMandatory Exercise For Next ClassAfework AtnafsegedОценок пока нет

- RM Guideline RevisedДокумент45 страницRM Guideline RevisedAfework AtnafsegedОценок пока нет

- History of The City of Addis AbabaДокумент14 страницHistory of The City of Addis AbabaAfework AtnafsegedОценок пока нет

- ServiceQualityManagement May3 2016Документ22 страницыServiceQualityManagement May3 2016Afework AtnafsegedОценок пока нет

- OrganДокумент4 страницыOrganAfework AtnafsegedОценок пока нет

- Exercises On Risk and ReturnДокумент2 страницыExercises On Risk and ReturnAfework AtnafsegedОценок пока нет

- SBB/43/08Документ14 страницSBB/43/08Afework AtnafsegedОценок пока нет

- SBB 40 06Документ2 страницыSBB 40 06Afework AtnafsegedОценок пока нет

- Licensing and Supervision of Banking Business Directives To Authorize The Business of Interest Free Banking Directives Number SBB/51/2011Документ3 страницыLicensing and Supervision of Banking Business Directives To Authorize The Business of Interest Free Banking Directives Number SBB/51/2011Afework AtnafsegedОценок пока нет

- Licensing and Supervision of Banking BusinessДокумент3 страницыLicensing and Supervision of Banking BusinessAfework AtnafsegedОценок пока нет

- Issuing Authority: Licensing and Supervision of Banking Business Directive No. SBB/3/95 Contribution in KindДокумент1 страницаIssuing Authority: Licensing and Supervision of Banking Business Directive No. SBB/3/95 Contribution in KindAfework AtnafsegedОценок пока нет

- Manner of Reporting Financial Information: 2. Issuing AuthorityДокумент1 страницаManner of Reporting Financial Information: 2. Issuing AuthorityAfework AtnafsegedОценок пока нет

- SBB 48 10Документ13 страницSBB 48 10Afework AtnafsegedОценок пока нет

- SBB 29 02Документ5 страницSBB 29 02Afework AtnafsegedОценок пока нет

- SBB 29 02Документ5 страницSBB 29 02Afework AtnafsegedОценок пока нет

- SBB 31 02Документ4 страницыSBB 31 02Afework AtnafsegedОценок пока нет

- Minimum Paid Up Capital To Be Maintained by Banks: Licensing and Supervision of Banking Business Directive No. SBB/24/99Документ1 страницаMinimum Paid Up Capital To Be Maintained by Banks: Licensing and Supervision of Banking Business Directive No. SBB/24/99Afework AtnafsegedОценок пока нет

- SBB 26 01Документ4 страницыSBB 26 01Afework AtnafsegedОценок пока нет

- SBB 36 04Документ6 страницSBB 36 04Afework AtnafsegedОценок пока нет

- SBB 31 02Документ4 страницыSBB 31 02Afework AtnafsegedОценок пока нет

- SBB 40 06Документ2 страницыSBB 40 06Afework AtnafsegedОценок пока нет

- Licensing and Supervision of Banking Business Directive No. SBB/12/1996 Limitation On Investment of BanksДокумент2 страницыLicensing and Supervision of Banking Business Directive No. SBB/12/1996 Limitation On Investment of BanksAfework AtnafsegedОценок пока нет

- NBE DirectivesДокумент7 страницNBE DirectivesAfework Atnafseged100% (3)

- Amend The National Bank of Ethiopia Establishment 591Документ20 страницAmend The National Bank of Ethiopia Establishment 591Afework AtnafsegedОценок пока нет

- Issuing Authority: Licensing and Supervision of Banking Business Directive No. SBB/3/95 Contribution in KindДокумент1 страницаIssuing Authority: Licensing and Supervision of Banking Business Directive No. SBB/3/95 Contribution in KindAfework AtnafsegedОценок пока нет

- Issuing Authority: Licensing and Supervision of Banking Business Directive No. SBB/10/95 Limitation On AccommodationДокумент1 страницаIssuing Authority: Licensing and Supervision of Banking Business Directive No. SBB/10/95 Limitation On AccommodationAfework AtnafsegedОценок пока нет

- NBE Directive39 45Документ51 страницаNBE Directive39 45Afework Atnafseged100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Acct Statement XX7809 31032023Документ6 страницAcct Statement XX7809 31032023harshal jagtapОценок пока нет

- Quiz On Audit of CashДокумент11 страницQuiz On Audit of CashY JОценок пока нет

- Chapter Two Financial Institutions in The Financial SystemДокумент75 страницChapter Two Financial Institutions in The Financial Systemhasenabdi30Оценок пока нет

- Philippine Financial SystemДокумент14 страницPhilippine Financial SystemMarie Sheryl FernandezОценок пока нет

- Swaps - Interest Rate and Currency PDFДокумент64 страницыSwaps - Interest Rate and Currency PDFKarishma MittalОценок пока нет

- Banco Filipino v. YbañezДокумент2 страницыBanco Filipino v. YbañezAlexis Von TeОценок пока нет

- Assignment - Bank ConfirmationДокумент1 страницаAssignment - Bank ConfirmationAldrienne Dela CruzОценок пока нет

- Fcra Summary of RightsДокумент8 страницFcra Summary of RightsSpamchurchОценок пока нет

- SsssssssssssssssssssssssssssssssssssДокумент13 страницSsssssssssssssssssssssssssssssssssssRizza RegaladoОценок пока нет

- SC Predatory Lending BrochureДокумент2 страницыSC Predatory Lending BrochureSC AppleseedОценок пока нет

- RBI Vs SEBIДокумент5 страницRBI Vs SEBIMANASI SHARMAОценок пока нет

- SP 1400392394Документ4 страницыSP 1400392394RitaОценок пока нет

- Classification of MoneyДокумент8 страницClassification of MoneyRajat KumarОценок пока нет

- Barclays Bank PLC Annual Report 2008Документ159 страницBarclays Bank PLC Annual Report 2008Kay ChenОценок пока нет

- SbiДокумент5 страницSbiAbhishek KumarОценок пока нет

- Indemnity Letter For Idbi Bank Debit CardДокумент1 страницаIndemnity Letter For Idbi Bank Debit CardFebin PaulОценок пока нет

- System Enabled Emp DetailsДокумент6 страницSystem Enabled Emp DetailsAshish PorechaОценок пока нет

- Sajjan Bank (Private) Ltd. V. Reserve Bank of India AIR 1961 Mad. 8Документ52 страницыSajjan Bank (Private) Ltd. V. Reserve Bank of India AIR 1961 Mad. 8Lakkaraju Ashok Kumar100% (2)

- Banking System of India: Presented By-Sohini MukherjeeДокумент31 страницаBanking System of India: Presented By-Sohini MukherjeeShivam AgarwalITF43Оценок пока нет

- Merchant Banking: Prepared By: Suraj DasДокумент17 страницMerchant Banking: Prepared By: Suraj DasSuraj DasОценок пока нет

- Appendix 35 RCIДокумент6 страницAppendix 35 RCIJan Mikel RiparipОценок пока нет

- Multiple Choice: Tomas Claudio CollegesДокумент5 страницMultiple Choice: Tomas Claudio CollegesRouise GagalacОценок пока нет

- Indian Banks and Their HeadquartersДокумент5 страницIndian Banks and Their HeadquartersRanobir ChowdhuryОценок пока нет

- Turning India Into A Cashless Economy The Challenges To OvercomeДокумент19 страницTurning India Into A Cashless Economy The Challenges To OvercomeAkshay SwamiОценок пока нет

- Statement Summary: Run24.mx Sapi de CV Statement Date: Statement Period: Billing MethodДокумент6 страницStatement Summary: Run24.mx Sapi de CV Statement Date: Statement Period: Billing MethodnovelОценок пока нет

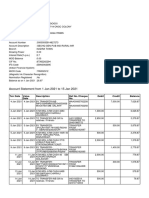

- Account Statement From 1 Jan 2021 To 15 Jan 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент2 страницыAccount Statement From 1 Jan 2021 To 15 Jan 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balanceabhijit gogoiОценок пока нет

- 2013 UCPB Annual ReportДокумент116 страниц2013 UCPB Annual ReportPat Dela CruzОценок пока нет

- Proof of CashДокумент6 страницProof of CashAlexander OОценок пока нет

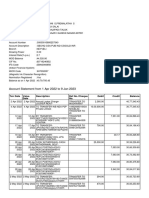

- Account Statement From 1 Apr 2022 To 9 Jan 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент8 страницAccount Statement From 1 Apr 2022 To 9 Jan 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSelva maniОценок пока нет