Академический Документы

Профессиональный Документы

Культура Документы

2013 Forecast According T Bridgewater

Загружено:

Uzair UmairОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2013 Forecast According T Bridgewater

Загружено:

Uzair UmairАвторское право:

Доступные форматы

http://www.businessinsider.com/bridgewaters-bullish-2013-thesis-2013-2 http://www.bloomberg.com/news/2013-02-12/bridgewater-bets-on-stocks-as-cash-moves-intomarket.

html

Bridgewater Bets on Stocks as Cash Moves Into Market

Bridgewater Associates LP, the $140 billion hedge fund founded by Ray Dalio, is betting on global stocks and oil as it expects money to move into equities and other assets amid increased economic confidence. Bridgewater, the worlds biggest hedge fund, is bullish on stocks, oil, commodities and some currencies as it expects cash to shift to riskier assets, co-chief investment officer Bob Princesaid on a client conference call on Jan. 23.

Enlarge image

Raymond "Ray" Dalio, president and founder of Bridgewater Associates LP. Photographer: Scott Eells/Bloomberg

57:39

Jan. 25 (Bloomberg) -- Deutsche Bank AG Co-Chief Executive Officer Anshu Jain, Bank of America Corp. CEO Brian Moynihan, Bridgewater Associates LP founder Ray Dalio, French Finance Minister Pierre Moscovici, Bank of Italy Governor Ignazio Visco and Jin Liqun, chairman of China Investment Corp.'s supervisory board, participate in a panel discussion at the World Economic Forum's annual meeting in Davos, Switzerland. Bloomberg Television's Francine Lacqua moderates the discussion, entitled "No Growth, Easy Money The New Normal?" (Source: Bloomberg)

You want to be borrowing cash and hold almost anything against it, Prince said, according to a transcript of the call obtained by Bloomberg News. We are at a possible inflection point right now with respect to the pricing of economic conditions in markets and then the actual conditions that are likely to occur. Global stocks have rallied 10 percent in the past six months as the U.S. housing market recovers, European leaders take steps to contain their debt crisis, and reports in China suggest economic growth is accelerating. This year will be a game changer as investors reallocate money after risks such as Europes sovereign-debt crisis recede, Dalio said last month at the World Economic Forum in Davos, Switzerland. Investors from David Tepper, who runs the $15 billion hedge fund Appaloosa Management LP, to Carlyle Group LP co-founder David Rubenstein have said theyre bullish on the U.S. economy. A spokesman for Westport, Connecticut-based Bridgewater declined to comment on the firms conference call.

Bullish Shift

Bridgewater likes oil because of the potential for falling stockpiles at wholesalers and economic growth in the U.S. and China, Prince said. If you get better growth in the U.S., better growth in China, inventories coming down some, and then the incremental supply coming down some -- were seeing some shifts in the supply-demand balance in oil, Prince said, according to the transcript. A bullish shift there for oil. Bridgewater, which is also betting on the price of gold to increase, forecasts U.S. growth of about 2.5 percent, Prince said during the call without citing a time period, according to the transcript. Economists estimate an average increase of 2 percent in 2013 gross domestic product, according to a Bloomberg survey of 82 respondents.

Not Gangbuster

The point is not so much that were going to be in the gangbuster period of growth, Prince said during the call. Its more that growth is likely to be better, particularly in the United States, than it has been. Its more of a movement of capital. The money moving out the risk curve and into risk assets wont take much growth to trigger that kind of shift. Bridgewater is long equities around the world and generally shifting to long commodities positions, Prince said during the call. Hedge funds that make long bets are anticipating the prices of various securities will rise. The firm also has a moderate long position in developed market corporate credit, he said.

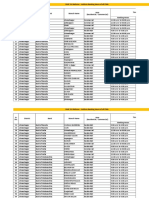

Bridgewater is positive on currencies including the British pound, Korean won, Mexican peso and Russian ruble, according to a chart in the transcript showing the firms current views, which Prince referred to during the call. The firm is bearish on the Japanese yen, Australian dollar and Canadian dollar, the chart shows.

Shorting Yen

The yen has dropped about 20 percent in the past six months, the worst performer of 10 developed-nation currencies tracked by Bloomberg Correlation-Weighted Indexes, in anticipation of the greater stimulus advocated by Prime Minister Shinzo Abe. The Group of Seven nations pledged to avoid devaluing their exchange rates in pursuit of stronger economic growth, to calm concern the world is on the brink of a currency war, officials from G-7 countries said today. Were now short the yen, largely related to the change in their balance of payment circumstances and, subsequent to that, the emphasis on a more aggressive monetary policy, Prince said. We are bullish on sterling, largely related to differences in capital flows and the impacts of monetary policy between the U.K., Europe and United States. The pound is coming off its biggest weekly gain since 2011 versus the euro amid speculation the Bank of England will refrain from extending stimulus, while its European counterpart may cut interest rates further. Sterling rose against all but one of its 16 major counterparts last week after Bank of England Governor-designate Mark Carney suggested current monetary policy may be sufficient to support the economy even as he stands ready to add more stimulus if needed. European Central Bank President Mario Draghi said the recent appreciation of the euro could damp inflation.

Bond Bets

Bridgewater is wagering on European bonds and betting against those in the U.S., Japan, U.K. and Australia, the firms chart shows. Its bearish on emerging sovereign credit. The move from cash to riskier holdings would support an increase in the value of assets and improve balance sheets, credit and economic growth, Prince said. That cycle will continue only until the U.S. Federal Reserve moves toward tighter policy, he said. Youre likely to do reasonably well until you hit the tail end of that cycle, where you get the central banks pulling back on liquidity, Prince said. That can continue for some time until the Fed no longer continues to inject liquidity. That would end that cycle and push all yields up which would, of course, hurt asset returns. Bridgewater Pure Alpha rose 0.8 percent last year, according to a table in the transcript. The fund has posted an annual return of 14 percent since inception in 1991. Bridgewater

All Weather posted a 15 percent gain in 2012 and 9.4 percent annual return since inception in 1996, according to another table. To contact the reporter on this story: Kelly Bit in New York at kbit@bloomberg.net To contact the editor responsible for this story: Christian Baumgaertel at

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- How To Look After Your Mental HealthДокумент15 страницHow To Look After Your Mental HealthUzair UmairОценок пока нет

- PMEX CommodityДокумент6 страницPMEX CommodityUzair UmairОценок пока нет

- dbCurrencyReturns March2009Документ8 страницdbCurrencyReturns March2009Uzair UmairОценок пока нет

- Arif Habib Commodity CommissionSheetДокумент1 страницаArif Habib Commodity CommissionSheetUzair UmairОценок пока нет

- 237 227 1 PBДокумент2 страницы237 227 1 PBUzair UmairОценок пока нет

- Fit For Free Forever2cДокумент48 страницFit For Free Forever2cUzair UmairОценок пока нет

- Managing Complexity 30 Methods ExcerptДокумент166 страницManaging Complexity 30 Methods ExcerptUzair UmairОценок пока нет

- SpanishДокумент1 страницаSpanishUzair UmairОценок пока нет

- Kauffman Foundation We Have Met The Enemy and He Is UsДокумент52 страницыKauffman Foundation We Have Met The Enemy and He Is UsUzair UmairОценок пока нет

- Discomfort Zone: How To Master The Universe: Leo BabautaДокумент15 страницDiscomfort Zone: How To Master The Universe: Leo BabautaUzair UmairОценок пока нет

- Benjamin Graham InterviewДокумент4 страницыBenjamin Graham InterviewUzair UmairОценок пока нет

- 000000-HOW I Internalize KNowledge-Uni and NOWДокумент2 страницы000000-HOW I Internalize KNowledge-Uni and NOWUzair UmairОценок пока нет

- Pakistan SummaryДокумент2 страницыPakistan SummaryUzair UmairОценок пока нет

- AEB 3.2 Perry WeinstockДокумент4 страницыAEB 3.2 Perry WeinstockUzair UmairОценок пока нет

- CoverДокумент1 страницаCoverUzair UmairОценок пока нет

- Little Black Book of Investment SecretsДокумент113 страницLittle Black Book of Investment SecretsUzair Umair100% (3)

- Cover LetterДокумент1 страницаCover LetterUzair UmairОценок пока нет

- Battle Mind An OverviewДокумент7 страницBattle Mind An OverviewUzair UmairОценок пока нет

- Affirmation InterviewДокумент30 страницAffirmation InterviewUzair UmairОценок пока нет

- Alibaba Double Margin of Apple-18th July 2013Документ2 страницыAlibaba Double Margin of Apple-18th July 2013Uzair UmairОценок пока нет

- Letter To PCMEA For Joint BothДокумент1 страницаLetter To PCMEA For Joint BothUzair UmairОценок пока нет

- Bill Gates Reclaims Billionaire TitlesДокумент3 страницыBill Gates Reclaims Billionaire TitlesUzair UmairОценок пока нет

- Ambani's Private Defence CompanyДокумент9 страницAmbani's Private Defence CompanyUzair UmairОценок пока нет

- Umair ColorsДокумент1 страницаUmair ColorsUzair UmairОценок пока нет

- Calorie Restriction Causing ANOREXIAДокумент14 страницCalorie Restriction Causing ANOREXIAUzair UmairОценок пока нет

- Hedge Funds Squeezed With Shorts Beating S&P 500Документ4 страницыHedge Funds Squeezed With Shorts Beating S&P 500Uzair UmairОценок пока нет

- 10 Ways To Reform SchoolsДокумент2 страницы10 Ways To Reform SchoolsUzair UmairОценок пока нет

- 5 Steps To Learning AnythingДокумент1 страница5 Steps To Learning AnythingUzair UmairОценок пока нет

- The Essential Wall St. Summer Reading ListДокумент3 страницыThe Essential Wall St. Summer Reading ListUzair UmairОценок пока нет

- Eric Schdmit Invests in BG Data Company Finding Small Trends - VERY IMPROTANTДокумент3 страницыEric Schdmit Invests in BG Data Company Finding Small Trends - VERY IMPROTANTUzair UmairОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Behind The Scenes of Central Bank Digital Currency - Emerging Trends, Insights, and Policy LessonsДокумент35 страницBehind The Scenes of Central Bank Digital Currency - Emerging Trends, Insights, and Policy LessonsEnlilОценок пока нет

- Explanation of The Raw Material/metal Surcharges: Surcharge Calculation Weight MethodДокумент3 страницыExplanation of The Raw Material/metal Surcharges: Surcharge Calculation Weight MethodRafid A. Jassem AlashorОценок пока нет

- History of Central Bank of JordanДокумент8 страницHistory of Central Bank of JordanFarah KurdiОценок пока нет

- Genting Plantations: 9M21 In-Line With ExpectationsДокумент10 страницGenting Plantations: 9M21 In-Line With ExpectationsCatherine TorresОценок пока нет

- Exchange Rate Management SystemsДокумент3 страницыExchange Rate Management SystemsMonalisa PadhyОценок пока нет

- Ayush PPT DemonetizationДокумент15 страницAyush PPT DemonetizationAYUSH MAHAJANОценок пока нет

- TD Economics: The Weekly Bottom LineДокумент8 страницTD Economics: The Weekly Bottom LineInternational Business TimesОценок пока нет

- National Institute of Economic and Social Research: DR Garry YoungДокумент23 страницыNational Institute of Economic and Social Research: DR Garry YoungBenedikt HorvatОценок пока нет

- Mishkin CH 15Документ22 страницыMishkin CH 15Ana Maria SpasovskaОценок пока нет

- Important Banking Awareness QuestionsДокумент9 страницImportant Banking Awareness QuestionsJagriti AryanОценок пока нет

- A Comparison of Financial Performance in The Banking SectorДокумент12 страницA Comparison of Financial Performance in The Banking SectorandoraphОценок пока нет

- Feenstra Taylor Lecture 12Документ15 страницFeenstra Taylor Lecture 12Alex KaraОценок пока нет

- Graph of The Cash Rate. Graph: Long DescriptionДокумент17 страницGraph of The Cash Rate. Graph: Long DescriptionSyed KunmirОценок пока нет

- EUROPA - European Central BankДокумент3 страницыEUROPA - European Central BankSusan MihaiОценок пока нет

- Bank For International Settlements - How The Rothschilds Control and Rule The WorldДокумент9 страницBank For International Settlements - How The Rothschilds Control and Rule The WorldBrian DavisОценок пока нет

- Protect Your Hard - Earned Money From Unlawful Investment SchemesДокумент1 страницаProtect Your Hard - Earned Money From Unlawful Investment Schemesnuwany2kОценок пока нет

- Minutes of The 40th Council Meeting (Clean)Документ18 страницMinutes of The 40th Council Meeting (Clean)msis09Оценок пока нет

- 100 Most Important Banking Awareness One Liners Day-9Документ9 страниц100 Most Important Banking Awareness One Liners Day-9Lakshmi NarasaiahОценок пока нет

- The Financial New World Order: Towards A Global Currency and World GovernmentДокумент28 страницThe Financial New World Order: Towards A Global Currency and World GovernmentsuperjagdishОценок пока нет

- h1-b Petitions 2021 - 0Документ2 704 страницыh1-b Petitions 2021 - 0JAGUAR GAMINGОценок пока нет

- 1 - Slides6 - 3 - Asset Markets PDFДокумент6 страниц1 - Slides6 - 3 - Asset Markets PDFHenry TianОценок пока нет

- A House Built On Sand? The ECB and The Hidden Cost of Saving The EuroДокумент20 страницA House Built On Sand? The ECB and The Hidden Cost of Saving The EuroAzhar HeetunОценок пока нет

- Article Summary Worksheet: Directions: Complete One Article Summary Worksheet For Each Article Read. Remember ToДокумент4 страницыArticle Summary Worksheet: Directions: Complete One Article Summary Worksheet For Each Article Read. Remember ToThahtia RahmaОценок пока нет

- AP Macroeconomics: Sample Student Responses and Scoring CommentaryДокумент6 страницAP Macroeconomics: Sample Student Responses and Scoring CommentaryDion Masayon BanquiaoОценок пока нет

- Previous Paper Economics Paper-IIIДокумент24 страницыPrevious Paper Economics Paper-IIIugcnetworkОценок пока нет

- Branch Timings From 01.11.19Документ964 страницыBranch Timings From 01.11.19Sawan YadavОценок пока нет

- Financial Times Asia June 8 2019 PDFДокумент60 страницFinancial Times Asia June 8 2019 PDFHai AnhОценок пока нет

- RbiДокумент23 страницыRbiAnkitha TheresОценок пока нет

- Statistics PPT Yes BankДокумент4 страницыStatistics PPT Yes BankMBA VCETОценок пока нет

- What Does International Fisher EffectДокумент3 страницыWhat Does International Fisher EffectGauri JainОценок пока нет