Академический Документы

Профессиональный Документы

Культура Документы

Aileron Market Balance: Issue 48

Загружено:

Dan ShyАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Aileron Market Balance: Issue 48

Загружено:

Dan ShyАвторское право:

Доступные форматы

September 30, 2012

I have mentioned the possibility of adding Seagate Technologies (STX). Personally, I would like to wait until after Seagate Technologies (STX) earnings release later in October. If Waste Management (WM) gets up near $37 to $41 again, I'll probably sell it off. As I've mentioned, the volatility during simple analyst comments is getting a little annoying. A Seagate (STX) purchase, if it occurs, would nicely replace the yield I'm getting from Waste Management (WM), especially since Seagate (STX) is trading at a better value.

Aileron Market Balance

Issue 48

Visit Us: NoNonsenseTrading.com Email: aileronmarketbalance@gmail.com Twitter: @NoNonsenseTrade

So during the intervening time, I'll be going through the companies that I have on my current watchlist. Investingating them further. I'll even be expanding that list, and looking for new companeis that are trading far below their intrinsic value. After all I have the time to do so. I can probably fit another value dividend company into that section of the portfolio.

Each

newsletter on Sunday that will contain my thoughts for the week ahead will have an audio file that accompanies it. The audio file that is associated with this PDF will contain my detailed thoughts moving forward into the next week. This PDF file is meant to serve as a rough, general outline to the audio file that many subscribers are finding more advantageous.

Trading Outlook:

Note: By way of reminder, since the Model Portfolio has only $10,075.37 in the Commodity Futures and Stock Trading portion of the portfolio, there will only be ' brief day trades' at this stage of the game for Commodity Futures trading in order to escape the risk of over-leveraged gap opens in the commodity futures markets. Stock trades may last more than one day. This is an attempt to demonstrate how account size relates to trading style. As I mention in my methodology series1, as the commodity 'trading sister' approaches $30,000 I will graduate the account into 'swing-trading' and demonstrate how I would go about doing this. The Forex account has $69.44 and is considered a micro-forex account for the purposes of the model portfolio.

Investing Outlook:

Note: As a reminder. the share purchases of the Dividend Investing 'Sister' will be extremely small. It is my intent to demonstrate how to grow the size of these positions from 2 shares, to 300 shares using the three sisters portfolio management style. The Dividend Investing 'Sister' Account will also implement the Permanent Portfolio Method beginning in April 2012 with $1,120.00 of the cash dedicated towards it..

The STX Trade

The STX trade (long 100 STX at $30.45, Sold 1 October 30 Call at 2.115) continues. Options expiration is October 19th. It's not 'sexy' to wait. It may not be exciting. But at the same time, I'm looking at making nearly 2.5% ( if the option was excercised) on my money in 36 days. Considering a one year CD pays currently 0.50% 2.5% isn't too bad for 36 days work. So often, new ones will ask me: What's the exciting

1 Exact Link http://nononsensetrading.com/methodology.html

Although I have been keeping up with the companies that I have investinged with (WM, AFL, MDT and JCI), I have not really had the time to investigate other companies that I would like to invest with. I have the capital. While waiting for the Seagate (STX) trade to complete however, we've seen that we have time. We have until October 19th until the next options expiration.

September 30, 2012

new trade this week?! . and my reply is nothing. Sometimes, there's not a lot to do on the trading front. Although I do not bill this as a trade alerts nesletter, but rather a look over my shoulder I have stated that for the next month or so I'll be looking at income trades. That's 2.5% on a $10,000.00 account for 30 days time, which is nearly $250.00 a month; and the look over my shoulder for $15.00 a month. I'm trying to provide as much value as humanely possible. That does not mean that I'm looking to provide a $4,000.00 trade every single day. It does mean that I am trying to demonstrate the reality of this business. At times, you'll be in a position where you have to look at considering taking only 2% for 30 days work. Now looking forward to the future, I'm looking to do two or three of these income trades, and then trying another commodity or futures trade. In such a case of 2 or 3 profitable options income trades, we really wouldn't be looking at a loss if the futures trade lost, but rather, just risking a portion of our 'wins' to possibly make much more money. It all goes back to rule number one. Control and manage your risk. So I'm making sure that after the drawdown I suffered, my returns from this point stay positive until the end of the year, and trying to pull in 2.5% a month until our next futures trade. It may not be 'sexy' but it's about controling and managing our risk.

Summary of the A.M.B. Model Portfolio

Note: In the beginning of this hypothetical portfolio, the share purchases of the Dividend Investing 'Sister' will be extremely small. It is my intent to demonstrate how to grow the size of these positions from 2 shares, to 300 shares using the three sisters portfolio management style. It is also understood that readers of this newsletter have a firm understanding of my 'three sisters' portfolio management system (See the Special Reference issue of Aileron Market Balance2 for an explanation of this system).

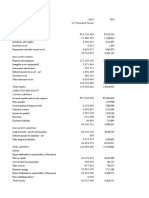

S&P 500 Year to Date: + 14.56 % AMB Total Portfolio Return Year to Date: + 3.903 % Investing Account Balance: $4,210.65 4 Positions have been sold YTD for profit on each ... 0.71 % Yield redistributed to other accounts year to date Return / Yield up + 4.511 % year to date Return / Yield up + 5.266 % since inception 8.081305 shares of WM (DRIP off Current Yield is 4.43 % Yield on Cost is 4.38 % )

8 shares at $32.39 on 12/22/2011 w/ $5.01 Commissions 0.081305 shares DRIP at $34.93 on 3/23/2012 $2.86 in Cash on 6/22/2012 Sent $1.43 to Sav. Side-Pocket $2.86 in Cash on 9/21/2012 Kept entire amount in Account Next Dividend: Not Yet Announced

6 shares of AFL (DRIP off Current Yield is 2.76 % - Yield on Cost is 2.93 % )

6 shares at $45.05 on 8/6/2012 w/ $5.00 Commissions $1.98 in Cash on 9/1/2012 Keeping full amount in Account Next Dividend: Not Yet Announced

6 shares of MDT (DRIP off Current Yield is 2.41 % Yield on Cost is 2.54 % )

6 shares at $40.94 on 8/29/2012 w/ $5.00 Commissions Next Dividend: October 26, 2012 Ex-Dividend Date: October 3, 2012

Micro-Forex Trading

Methodology

Creation

and

9 shares of JCI (DRIP off Current Yield is 2.63 % Yield on Cost is 2.63 % )

9 shares at $27.41 on 9/6/2012 w/ $5.00 Commissions Next Dividend: October 2, 2012 Ex-Dividend Date: September 5, 2012 (Not entitled To Oct Div)

There are no trades at the moment. But I'm examining the possibility of a long in EUR/USD and CAD/JPY. But at this point, I'm only watching it. I have no exact entries at theis point. I will not add in AUD/JPY at the moment, but if I had no carry trade at the moment, I may be interested in starting a carry trade at these levels. Maybe a very, very small add-in at these leves for AUD/JPY.

Permanent Portfolio S $1,120.00 of cash I reserved for Permanent Portfolio Purchases Return from $1082.72 = + 5.00 % from 4/23/12

2 Exact Link http://www.scribd.com/doc/73238645/Aileron-MarketBalance-Special-Reference-Issue-Portfolio-Management

September 30, 2012

- 2 shares @ 156.12 of GLD ( $312.24 ) ( Currently $343.78 ) ( 30.24 % of P.P ) - 2 shares @ 139.58 of SPY ( $279.16 ) ( Currently $287.94 ) ( 25.33 % of P.P ) - 2 shares @ 118.17 of TLT ( $236.34) ( Currently $248.44 ) ( 21.85 % of P.P ) - 3 shares @ 84.45 of SHY ( $253.35) ( Currently $253.50 ) ( 22.30 % of P.P )

Total Trading Balance: $10,144.81 ( Return / Yield up + 4.184 % Year to Date ) Commodity Futures and Stock Balance: $10,075.37 Current Mark Included of Long 100 STX at $30.45 and sold 1 October 30 STX Call at 2.115 Return / Yield up + 4.242 % Year to Date Next Re-Distribution Goal: $10,700.00 Original 3% risk tolerance gives us approximately $282.54 for my drawdown tolerance ALREADY USED $ 286.80 available from Slush Fund The account balance current includes the floating trade we have on with STX ... Futures and Stock 'Sister' Account Year to Date

Remaining Cash: $2,025.14 ( 48.1 % )

Percentages of that Cash -$1,722.14 of this Remaining Cash I reserve for Hedging and New Purchases ( 85.04 % ) -$63.00 ( 3.658 % ) of this Hedging and New Purchases Cash I reserve to Dollar Cost WM further in the future DCA Price w/ no fundamental changes on WM $28.00 -$85.00 ( 4.936 % ) of this Hedging and New Purchases Cash I reserve to Dollar Cost AFL further in the future DCA Price w/ no fundamental changes on AFL $40 to $38 region -$80.00 ( 4.645 % ) of this Hedging and New Purchases Cash I reserve to Dollar Cost MDT further in the future DCA Price w/ no fundamental changes on MDT $37 to $35 region -$75.00 ( 4.355 % )of this Hedging and New Purchases Cash I reserve to Dollar Cost JCI further in the future DCA Price w/ no fundamental changes on JCI $22 to $24 region

$ 286.80 ( 6.811 % of this account ) available from Slush Fund Dividend Investing Sister Year to Date

Until that STX trade completes, the Money Management Statistics remains the same for that account

September 30, 2012

There was one small Forex trade last week ...

Long 10 USD/CHF @ 0.9335(9) on 9/23/2012 Exit 10 @ 0.9354(1) PROFIT 18.2 Pips $0.0195

PIPS FOR PREVIOUS WEEKS OF 9/24/2012 to 9/28/2012: 18.2 PIPS GAINED (Pips Gained do not

necessarily Reflect Differing Position Sizes)

CARRY TRADE POSTIONS AUD/JPY current mark at 81.34(1) 4 Units AUD/JPY at 83.35(3) on 8/16/2012 3 Units AUD/JPY at 81.95(0) on 8/23/2012 3 Units AUD/JPY at 80.34(0) on 9/3/2012 NZD/JPY current mark at 63.55(9) 4 Units NZD/JPY at 63.81(3) on 8/23/2012 2 Units NZD/JPY at 62.55(7) on 9/3/2012 INTEREST ADDED LAST WEEK: $0.0110

Micro Forex Account Year to Date

Micro-Forex Balance: $69.45 The totals for the Forex account do not include the unrealized gain / loss from the Carry Trades. It does count the interest earned from those trades. Capital up from January 1, 2012: + 3.502 % Return / Yield - 3.675 % Year to Date Return / Yield - 0.180 % in Phase 3 $ 286.80 available from Slush Fund

September 30, 2012

As well as the Capital Graph for the Forex Account in Phase 3. Remember that the following graph does not include the unrealized gain / loss on the unfinished Carry Trades Savings Side-Pocket Account Balance: $1,822.71 Capital is - 10.14 % Year to Date. Yield Return on Capital + 1.028 % Added $1.30 of Interest to the Slush fund / Drawdown Kill Switch fund bringing total to $286.80 ($218.34 owed to this Fund) $1,010.29 for a Base Savings

Percentages of that Cash: $814.29 of this cash reserved for Long Term Variable Capital PP - ( 80.60 % ) $120.00 of this cash reserved for CD Ladder creation ( 11.88 % ) - One $10.00 One Year CD purchased on 11/21/2011 at 0.60% - One $10.00 One Year CD Purchase on 12/21/2011 at 0.50% - One $10.00 One Year CD Purchase on 1/21/2012 at 0.50% - One $10.00 One Year CD Purchase on 2/21/2012 at 0.50% - One $10.00 One Year CD Purchase on 3/21/2012 at 0.50% - One $10.00 One Year CD Purchase on 4/21/2012 at 0.50% - One $10.00 One Year CD Purchase on 5/21/2012 at 0.50% - One $10.00 One Year CD Purchase on 6/21/2012 at 0.50% - One $10.00 One Year CD Purchase on 7/21/2012 at 0.50% - One $10.00 One Year CD Purchase on 8/21/2012 at 0.50% - One $10.00 One Year CD Purchase on 9/21/2012 at 0.50% $20.00 of this cash reserved for the first side-pocket purchase ( 1.98 % ) $20.00 of this cash I reserve for the second sidepocket purchase ( 1.98 % ) $36.00 of this cash I reserve for the hedging account ( 3.563 % )

From the very small trade last week, the money management stats, which does not include the additions from the carry trade (yet) are as follows

$505.14 for Emergency Savings Getting Paid Fund: $20.48 Total Portfolio Breakdown Return Graph

September 30, 2012

Total Portfolio Balance: $16,178.17 - Total AMB November 2011 Inception to Date Return: + 7.854 % Return / Yield up + 3.903 % year to date) S&P 500 Year to Date: + 14.56 %

If you have any questions regarding my personal outlook, or any other comments, please feel free to contact us at aileronmarketbalance@gmail.com. Our twitter account is @NoNonsenseTrade. I will say that if you have questions about your own trading and you want to ask for my input? Please include your most recent money management performance statistics in any email correspondence.

Until next time, stay safe trade well, and remember that loving other people doesn't cost a dime.

Note: I, the author do not grant this work for wide distribution beyond any single individual subscriber as this publication is protected by U.S. And International Copyright laws. All rights reserved. No license is granted to the user except for the user's personal use. No part of this publication or its contents may be copied, downloaded, stored in a retrieval system, further transmitted or otherwise reproduced, stored, disseminated, transferred, or used, in any form or by any means except as permitted under the original subscription agreement or with prior written permission. The above statements should not be construed as an investment or trading recommendation. Aileron Market Balance is a newsletter that allows subscribers to look 'over my shoulder' as it were, for my own personal specific trading and investing ideas and thoughts for the next week. But they are only thoughts as of the moment of publication, and are subject to change. There is no guarantee that I will enter, or have entered any of the trading or investing ideas that I discuss in this newsletter; as larger accounts may require a different strategy as the ones presented here. Any trades or investments that I discuss within this newsletter are simply my own thoughts regarding my own investing and trading outlook. I discuss which trades I take and do not take on the No Nonsense Trading Forums, as well as the Ventrilo Voice Server. Remember that entering any market is an individual decision. This newsletter simply contains my trading and investing thoughts for the next week. I personally only enter any market after watching and reading the tape and I trade using money management principles3. The losses in trading can be very real, and depending on the investment vehicle and market, can exceed your initial investment. I am not a licensed trading or investment adviser, or financial planner. But I do have 16 years of experience in trading and investing in these markets. The Model Portfolio accounts are hypothetical accounts,with all of the inherent problems therein, which are used within this newsletter in an attempt to track the results of this newsletter, and is run for the education of other traders who should make their own decisions based off their own research, due diligence, and tolerance for risk. Any pictures used within this newsletter are believed to be public domain. Any charts that are displayed using the ThinkorSwim platform, and other pictures were obtained through Wikipedia's public domain policy.

Exact Link - http://nononsensetrading.com/MoneyManagement.html

Вам также может понравиться

- Aileron Market Balance: Issue 31Документ5 страницAileron Market Balance: Issue 31Dan ShyОценок пока нет

- Aileron Market Balance: Issue 25Документ5 страницAileron Market Balance: Issue 25Dan ShyОценок пока нет

- Aileron Market Balance: Issue 23Документ6 страницAileron Market Balance: Issue 23Dan ShyОценок пока нет

- Aileron Market Balance: Issue 22Документ6 страницAileron Market Balance: Issue 22Dan ShyОценок пока нет

- Aileron Market Balance: Issue 21Документ8 страницAileron Market Balance: Issue 21Dan ShyОценок пока нет

- Aileron Market Balance: Issue 16Документ8 страницAileron Market Balance: Issue 16Dan ShyОценок пока нет

- Aileron Market Balance: Issue 18Документ6 страницAileron Market Balance: Issue 18Dan ShyОценок пока нет

- Aileron Market Balance: Issue 15Документ9 страницAileron Market Balance: Issue 15Dan ShyОценок пока нет

- Aileron Market Balance: Issue 15.1Документ1 страницаAileron Market Balance: Issue 15.1Dan ShyОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- AA Chapter6Документ8 страницAA Chapter6Nikki GarciaОценок пока нет

- Harshil Singhal - Niharika Jain - Prem Sagar - Shuchit KhuranaДокумент15 страницHarshil Singhal - Niharika Jain - Prem Sagar - Shuchit KhuranaHarshil SinghalОценок пока нет

- Amore Pacific Corp Introduction 2010Документ13 страницAmore Pacific Corp Introduction 2010rtrinoОценок пока нет

- Reverse Stock SplitДокумент3 страницыReverse Stock SplitEvie Liu0% (1)

- Important Banking Financial Terms For RBI Grade B Phase II NABARD DA Mains IBPS PO Mains PDFДокумент21 страницаImportant Banking Financial Terms For RBI Grade B Phase II NABARD DA Mains IBPS PO Mains PDFk vinayОценок пока нет

- Capital Budgeting TechniquesДокумент57 страницCapital Budgeting TechniquesAlethea DsОценок пока нет

- 2 Lim Tay Vs CAДокумент19 страниц2 Lim Tay Vs CAMark Ebenezer BernardoОценок пока нет

- Newco Inc.: Pro Forma Cap TableДокумент5 страницNewco Inc.: Pro Forma Cap Tablebeebac2009Оценок пока нет

- What Is Property, Plant, and Equipment - PP&E?: EquityДокумент2 страницыWhat Is Property, Plant, and Equipment - PP&E?: EquityDarlene SarcinoОценок пока нет

- Globe PLDT 2014 Financial RatiosДокумент6 страницGlobe PLDT 2014 Financial RatiosSamОценок пока нет

- Private Placement Memo PDFДокумент14 страницPrivate Placement Memo PDFKurt BogdonovitchОценок пока нет

- Accounting Acc106Документ23 страницыAccounting Acc106zary100% (3)

- Interim Order Cum Show Cause Notice in The Matter of BNP Real Estate and Allied LimitedДокумент18 страницInterim Order Cum Show Cause Notice in The Matter of BNP Real Estate and Allied LimitedShyam SunderОценок пока нет

- Subject: SAPM Name: Rucha Sem: 3 Roll No.:15Документ18 страницSubject: SAPM Name: Rucha Sem: 3 Roll No.:15niraliОценок пока нет

- CCFДокумент19 страницCCFDeepak JainОценок пока нет

- Western Money Management IncДокумент8 страницWestern Money Management IncNavid Al Galib50% (2)

- Acct 3101 Chapter 05Документ13 страницAcct 3101 Chapter 05Arief RachmanОценок пока нет

- The Healthcare Diagnostics Value GameДокумент28 страницThe Healthcare Diagnostics Value Gamekoolyogesh1Оценок пока нет

- Credit Appraisal System of PUNJAB NATIONAL BANKДокумент36 страницCredit Appraisal System of PUNJAB NATIONAL BANKManish Kanwar78% (9)

- Hull-White Model 2Документ12 страницHull-White Model 2meko1986Оценок пока нет

- List of Instruments in Demeter - April 2018Документ23 страницыList of Instruments in Demeter - April 2018speedenquiryОценок пока нет

- Online Trading - ProjectДокумент69 страницOnline Trading - Projectvenkatdevraj100% (3)

- Joint Ventures and StrategicAlliancesДокумент17 страницJoint Ventures and StrategicAlliancesnikunj1990Оценок пока нет

- Exercise For Mid TestДокумент11 страницExercise For Mid TestNadia NathaniaОценок пока нет

- Revised SCH VIДокумент8 страницRevised SCH VIParas ShahОценок пока нет

- Term SheetДокумент9 страницTerm SheetDongare RahulОценок пока нет

- The Trouble With Value PDFДокумент6 страницThe Trouble With Value PDFjwod_chick0% (1)

- Current Ratio Quick Ratio: LT-Debt To Total Debt Long Term Debt / Total DebtДокумент2 страницыCurrent Ratio Quick Ratio: LT-Debt To Total Debt Long Term Debt / Total Debtankit kumarОценок пока нет

- Irctc LTD.: Retail Equity ResearchДокумент8 страницIrctc LTD.: Retail Equity ResearchPaul AlappattОценок пока нет